WildBrain Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WildBrain Bundle

WildBrain navigates a dynamic entertainment landscape, facing intense competition and evolving consumer demands.

Understanding the bargaining power of buyers and suppliers is crucial for WildBrain's profitability and strategic positioning.

The threat of substitute products and new entrants constantly challenges WildBrain's market share and innovation.

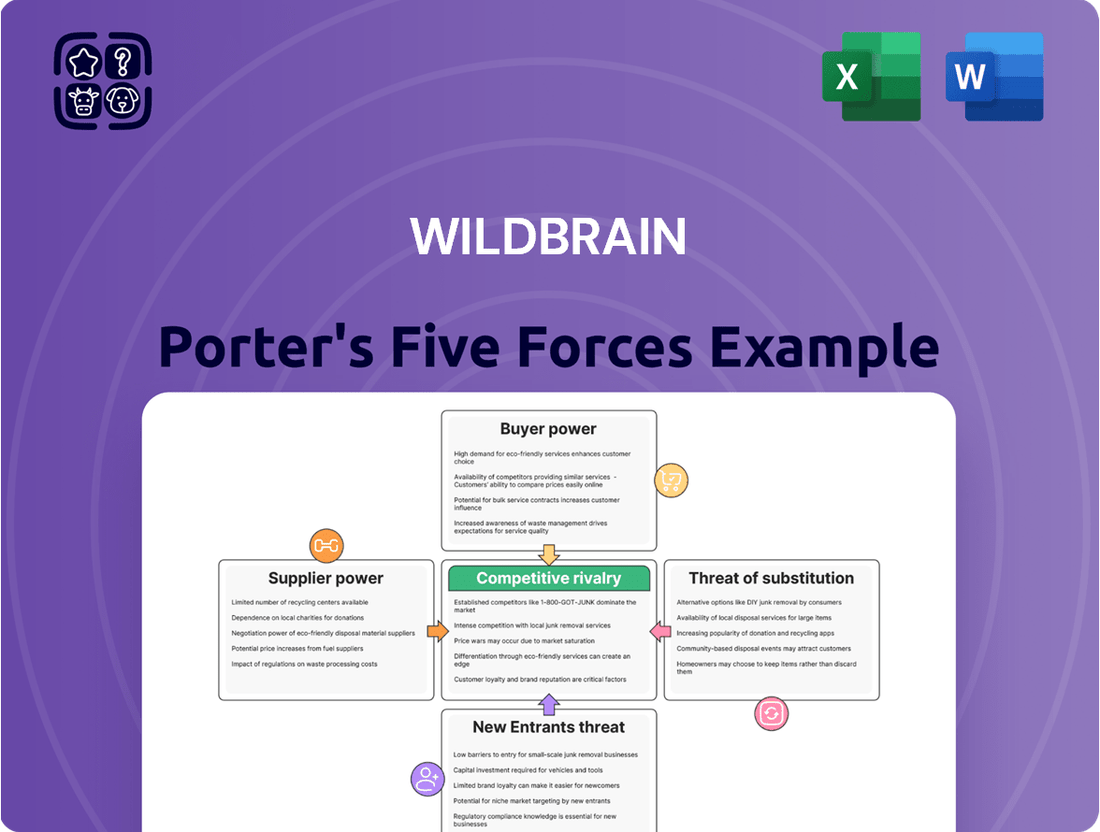

The full Porter's Five Forces Analysis reveals the strength and intensity of each market force affecting WildBrain, complete with visuals and summaries for fast, clear interpretation.

Unlock key insights into WildBrain’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

The bargaining power of top-tier animation talent, including sought-after voice actors and specialized production studios, is significant. High-demand creators with successful track records can command higher fees and more favorable terms, reflecting market demand for quality content. For WildBrain, attracting and retaining this talent is crucial for maintaining content quality and innovation, especially as the animation market remains competitive in 2024. The ability to secure key creative partnerships directly impacts production costs and the appeal of new series.

When WildBrain licenses popular third-party intellectual property, the owners hold substantial bargaining power. These IP holders can dictate high licensing fees, royalties, and creative control over their content. For instance, securing rights to major franchises involves significant negotiation for favorable terms. However, WildBrain's extensive library of owned IP, including iconic brands like Peanuts and Teletubbies, considerably reduces its reliance on external content. This robust internal portfolio helps mitigate the power of external IP suppliers, strengthening WildBrain's position.

WildBrain, like other animation and digital content creators, significantly relies on specialized software for production, animation, and visual effects. While industry-standard software from providers like Adobe and Autodesk creates a degree of dependency, the bargaining power of these suppliers is moderate. Both companies reported strong fiscal years, with Adobe's Creative Cloud revenue reaching approximately $14.5 billion in 2023, and Autodesk's Media & Entertainment segment contributing to its $5.5 billion net revenue in fiscal year 2024, yet competition among them keeps their leverage in check.

Distribution Platforms

WildBrain leverages its robust WildBrain Spark network on YouTube, which remains a cornerstone for content distribution. However, the company also relies on major streaming services and broadcasters like Netflix, Disney+, and Apple TV+ to reach broader audiences. These external platforms possess significant bargaining power due to their control over content discovery algorithms and direct access to subscribers. WildBrain's strategic multi-platform approach, coupled with its own network's substantial global reach, helps to mitigate this supplier power, fostering a more balanced relationship in 2024.

- WildBrain Spark viewership exceeded 1.3 trillion lifetime views by early 2024.

- Major platforms like Netflix reported over 269 million global paid memberships in Q1 2024.

- WildBrain's content is present across over 150 platforms globally, diversifying its distribution risk.

Merchandise and Toy Manufacturers

WildBrain partners with merchandise and toy manufacturers for its extensive licensing business, making them key suppliers. The bargaining power of these manufacturers varies significantly based on their scale and market reach within the global toy industry. Large, established companies like Mattel or Hasbro, which reported net sales of $5.44 billion and $5.86 billion respectively for the full year 2023, possess substantial leverage in negotiations due to their market dominance and production capabilities. Conversely, smaller, specialized manufacturers typically have less power.

- Major toy manufacturers control significant market share, impacting negotiation terms.

- WildBrain relies on these partnerships to monetize its intellectual property.

- Access to diverse manufacturing capabilities is crucial for WildBrain's product variety.

- The global toy market's projected value for 2024 underscores the scale of these suppliers.

WildBrain faces varying supplier power, with top-tier animation talent and third-party IP owners holding significant leverage due to their unique offerings. Major distribution platforms like Netflix, with over 269 million Q1 2024 global memberships, also wield substantial influence over content reach. However, WildBrain's extensive owned IP and strategic multi-platform distribution across over 150 platforms globally help mitigate these pressures. The company's WildBrain Spark network, exceeding 1.3 trillion lifetime views by early 2024, further balances supplier dynamics.

| Supplier Type | Bargaining Power | Key 2024 Data |

|---|---|---|

| Animation Talent | High | High demand for top creators in competitive market. |

| Distribution Platforms | Significant | Netflix: 269M+ Q1 2024 global paid memberships. |

| Software Providers | Moderate | Adobe Creative Cloud: ~$14.5B 2023 revenue; Autodesk: $5.5B FY2024 net revenue. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to WildBrain's entertainment and media landscape.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, providing a clear roadmap to navigate WildBrain's market landscape.

Customers Bargaining Power

Major global streaming platforms and broadcasters, including industry giants like Netflix and Apple TV+, exert substantial bargaining power over content providers such as WildBrain. These platforms, collectively holding a dominant share of the global streaming market with Netflix alone surpassing 270 million subscribers in Q1 2024, possess extensive reach and can be highly selective about content acquisition. Their vast subscriber bases allow them to dictate terms, often negotiating for favorable pricing and exclusive content rights. The high concentration of these powerful buyers significantly limits WildBrain's leverage in securing optimal distribution deals.

Viewers and end consumers, primarily children and families, possess significant bargaining power over WildBrain. This is due to the immense breadth of entertainment options available across various platforms in 2024, from streaming services to gaming. Their viewing habits and engagement directly dictate content success and its value to advertisers and distribution partners. The low cost of switching between platforms, such as moving from one streaming app to another, further empowers these consumers.

For WildBrain's ad-supported video on demand services like WildBrain Spark, advertisers are crucial customers. Their bargaining power is influenced by the availability of alternative advertising platforms that target similar demographics, such as YouTube Kids or other children-focused digital content providers, which saw global digital ad spending reach over $660 billion in 2024. WildBrain must demonstrate high engagement and a large, targeted audience to maintain pricing power with these advertisers. The ability to deliver strong campaign performance and precise audience reach is essential for WildBrain to secure favorable advertising rates and sustain its AVOD revenue streams.

Retailers and Distributors of Consumer Products

Retailers and distributors in the consumer products segment wield substantial bargaining power over WildBrain. These major buyers, including large chains, significantly influence wholesale prices and dictate product placement for licensed merchandise. Securing prime shelf space in competitive retail environments, such as the 2024 landscape where digital sales also play a major role, further amplifies their leverage.

- Major retailers globally control significant market share, increasing their negotiation power.

- Product placement and promotional support are often tied to sales volume commitments.

- The highly competitive retail environment makes shelf space a premium asset.

- WildBrain's ability to secure favorable terms is directly impacted by buyer consolidation.

Educational Institutions and Content Curators

Educational institutions and content curators represent a smaller yet vital customer segment for WildBrain, licensing content primarily for learning. These customers often face specific content requirements and budget constraints, which grants them moderate bargaining power. For instance, the global education technology market is projected to reach over $400 billion by 2024, highlighting a significant demand for quality digital content. If WildBrain's offerings align with these high-quality, educational needs, it can significantly strengthen its market position, attracting long-term partnerships.

- Educational customers seek specific, curriculum-aligned content.

- Budget limitations often influence licensing negotiations.

- WildBrain's ability to provide high-quality educational material enhances its leverage.

- Demand for digital learning content continues to grow in 2024.

WildBrain encounters significant customer bargaining power across its diverse segments. Major streaming platforms, with Netflix exceeding 270 million subscribers in Q1 2024, dictate terms for content acquisition. Consumers and advertisers leverage a vast array of alternatives, including over $660 billion in global digital ad spending for 2024, influencing content value and ad rates. Retailers also wield substantial power over licensed merchandise pricing and placement in the competitive 2024 retail landscape.

| Customer Segment | Bargaining Power | 2024 Data Insight |

|---|---|---|

| Streaming Platforms | High | Netflix 270M+ Q1 2024 subscribers |

| End Consumers/Advertisers | High | $660B+ global digital ad spending 2024 |

| Retailers/Distributors | Substantial | Competitive 2024 retail landscape |

| Educational Institutions | Moderate | $400B+ global ed-tech market 2024 |

Preview the Actual Deliverable

WildBrain Porter's Five Forces Analysis

This preview displays the complete WildBrain Porter's Five Forces Analysis you will receive upon purchase. You're examining the actual document, ensuring there are no generic placeholders or missing information. This professionally formatted analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the entertainment industry. What you see here is precisely the ready-to-use document that will be instantly available to you after completing your transaction.

Rivalry Among Competitors

WildBrain confronts fierce rivalry from global entertainment giants like Disney, Warner Bros. Discovery, and Paramount Global. These conglomerates command immense financial resources; for instance, Disney’s Q2 FY2024 revenue was $22.08 billion, showcasing vast capital. They possess extensive content libraries and established global distribution networks, reaching billions through platforms like Disney+ and Max. Their powerful brand recognition and integrated operations create a highly competitive landscape, forcing WildBrain to innovate and specialize to maintain market share.

WildBrain faces intense competitive rivalry from numerous specialized animation studios. Major players like DreamWorks Animation, part of NBCUniversal, which saw its 2024 film *Kung Fu Panda 4* gross over $540 million globally, and Sony Pictures Animation constantly vie for audience attention and lucrative distribution deals. Independent studios also contribute to this crowded market. This fierce competition for production contracts and original content makes securing projects challenging for WildBrain, particularly as the global animation market is projected to reach approximately $426.6 billion in 2024.

The proliferation of platforms like YouTube and TikTok has intensified competitive rivalry for WildBrain, ushering in a wave of independent creators and digital-first media companies. These agile competitors often produce content at lower costs, enabling rapid responses to emerging trends. This strategy effectively captures significant viewership, particularly among younger demographics, with TikTok reportedly exceeding 1.7 billion global monthly active users in 2024. This rise fragments the audience and escalates the battle for valuable viewing time.

Other Children's Content and Licensing Companies

WildBrain faces significant competitive rivalry from other children's content and licensing companies. Firms such as Hasbro, through its entertainment division, and Mattel directly compete by creating content around their toy brands, intensifying the battle for audience attention and consumer product sales. Hasbro's entertainment segment, for instance, generated substantial revenue in 2023, reflecting its strong market presence.

- Hasbro's total net revenues were approximately $5.0 billion in 2023, with its entertainment segment contributing significantly.

- Mattel reported net sales of around $5.4 billion in 2023, leveraging its brands across content and products.

- This competition extends to digital platforms and streaming services for content distribution.

- WildBrain's direct competitors also include diverse media conglomerates with children's divisions.

International and Regional Content Producers

WildBrain faces intense competitive rivalry from a diverse array of international and regional content producers, especially in the global market. The rise of anime from Japan, which saw its market size reach an estimated USD 28.6 billion in 2023, along with content from other regions, significantly broadens consumer choices and distribution options. This global content influx intensifies the battle for market share and audience attention, compelling companies like WildBrain to innovate constantly.

- Global animation market size reached approximately USD 394 billion in 2023.

- Japanese anime market estimated at USD 28.6 billion in 2023, showcasing significant international competition.

- Emergence of diverse regional content challenges established players in 2024.

- Increased consumer choice from global content producers intensifies competition for distribution and viewership.

WildBrain faces intense competitive rivalry from global entertainment giants like Disney, specialized animation studios, and agile digital-first creators. This crowded market, projected to reach approximately $426.6 billion in 2024, forces constant innovation. Competition from other children's content and licensing companies, alongside a surge of diverse international content, further intensifies the battle for audience attention and market share.

| Competitor Type | Key Player | 2024 Data Point |

|---|---|---|

| Global Conglomerates | Disney | Q2 FY2024 Revenue: $22.08 Billion |

| Digital Platforms | TikTok | Global Monthly Users: >1.7 Billion |

| Animation Studios | DreamWorks Animation | Kung Fu Panda 4 Global Gross (2024): >$540 Million |

SSubstitutes Threaten

Live-action movies and television series for families and children act as strong substitutes for animated productions, directly competing for audience attention. These live-action shows, like those readily available on platforms such as Disney+ or Netflix, offer distinct storytelling approaches that may appeal more to certain age groups or genre preferences. The significant investment in live-action family content, with major studios continuing to produce new series and films in 2024, presents a persistent threat to animated content providers.

Video games, spanning mobile, console, and online platforms like Roblox, pose a significant threat as a substitute for WildBrain's passive content. The interactive and immersive nature of gaming captures a substantial portion of children's entertainment time and discretionary spending. For instance, the global gaming market is projected to reach approximately 346 billion USD in 2024, reflecting its immense draw. This direct competition for attention impacts viewership for television and video content, as children often prioritize engaging gameplay over linear media consumption.

Platforms like TikTok, YouTube Shorts, and Instagram Reels present a significant substitute threat to WildBrain's professionally produced content. These services, with TikTok alone boasting over 1.5 billion global monthly active users in 2024, offer endless streams of short-form, user-generated content. Younger audiences, in particular, are drawn to the constant novelty and trend-driven nature of these platforms. This high engagement makes user-generated content a compelling alternative to traditional long-form shows, impacting viewership and advertising revenue potential for media companies.

Books, Comics, and Traditional Play

Traditional entertainment like books, comics, and imaginative play remains a significant substitute for WildBrain's digital content. Despite high digital media consumption, these activities are still fundamental to many children's development and are actively encouraged by parents as alternatives to screen time. In 2024, the global traditional toys and games market continued to show resilience, with projected revenues indicating ongoing consumer interest. Parents often prioritize non-screen activities, leading to sustained demand for physical playthings and reading materials.

- Global toy industry revenue was projected at over 110 billion U.S. dollars in 2024.

- A 2024 survey indicated over 70% of parents limit children's screen time.

- Children's book sales remain robust, with consistent demand in 2024.

- Play-based learning is increasingly emphasized in early childhood education.

Other Leisure Activities

A broad array of alternative leisure activities, such as organized sports, outdoor recreation, and family visits to entertainment centers, directly compete for children's limited time and attention. These tangible, real-world experiences serve as significant substitutes for all forms of media consumption, including WildBrain's digital content. For instance, participation in youth sports remains robust, with millions of children actively engaged in 2024, diverting time from screens. Family outings to theme parks or museums also represent substantial spending, with the U.S. family entertainment market projected to exceed $35 billion in 2024.

- Youth sports involvement often takes precedence over screen time.

- Outdoor play and family excursions offer direct real-world alternatives.

- The experiential economy continues to draw significant household spending.

- WildBrain must differentiate against non-digital engagement.

WildBrain faces a substantial threat from a wide array of substitutes that compete for children's time and attention. Live-action content, the interactive global gaming market projected at $346 billion in 2024, and short-form user-generated content like TikTok are strong digital alternatives. Furthermore, traditional entertainment such as books and imaginative play, alongside real-world activities like sports and family outings, significantly divert audience engagement. This broad competitive landscape, where over 70% of parents limit screen time in 2024, constantly pressures WildBrain's content viewership and revenue potential.

| Substitute Category | 2024 Market Data / Trend | Impact on WildBrain |

|---|---|---|

| Live-action Content | Major studios continue significant investment. | Direct competition for screen time. |

| Video Games | Global market projected $346 billion. | High interactive engagement, diverting attention. |

| User-Generated Content | TikTok: 1.5+ billion global users. | Short-form content preferred by younger audiences. |

| Traditional Play/Books | Parents limit screen time (70%+). | Prioritized non-digital engagement. |

Entrants Threaten

The cost of producing high-quality animated content is a substantial barrier, with a typical 22-minute episode costing upwards of $300,000 for top-tier animation in 2024. Furthermore, building global brand awareness requires significant marketing and distribution investments, often millions annually for established brands. These high capital requirements make it exceptionally difficult for new entrants to effectively compete with companies like WildBrain, which leverages its extensive content library and global distribution network.

Established companies like WildBrain benefit immensely from their extensive library of well-known intellectual property and strong brand recognition. New entrants typically lack this deep portfolio of beloved characters and stories, making it exceptionally challenging to attract widespread audiences and secure lucrative licensing deals in 2024. Building a comparable IP library, akin to WildBrain's portfolio which includes Peanuts and Teletubbies, demands many years and substantial financial investment. This creates a formidable barrier, as new players cannot easily replicate decades of brand development and audience loyalty, impacting their ability to compete effectively in the market.

Gaining access to established global distribution channels, including major streaming services like Netflix and Disney+, is a significant hurdle for new entrants in the children's content space. WildBrain, for instance, leverages its long-standing relationships with broadcasters and retailers worldwide, securing prime placement for franchises such as Peanuts and Teletubbies. For new companies, the cost and effort of building such extensive networks from scratch are prohibitive, as evidenced by the high upfront investment required for content licensing in 2024. This makes it difficult for newcomers to compete effectively for audience reach and retail shelf space.

Economies of Scale

Large, established media and entertainment companies, such as Disney or Netflix, benefit significantly from economies of scale in content production, global distribution, and expansive marketing efforts. This allows them to achieve a lower cost per unit for their animated series and films, making it challenging for new entrants to compete effectively on price or scale. For instance, a major streaming service might allocate over $15 billion annually to content, a scale new players cannot easily match. This substantial investment capability creates a formidable barrier, impacting WildBrain by limiting market entry for smaller, less capitalized competitors.

- Major studios leverage vast content libraries and global distribution networks for cost efficiencies.

- High production budgets of established players, like Netflix's estimated $17 billion for content in 2024, create a significant entry barrier.

- Marketing reach of incumbents allows for lower customer acquisition costs per viewer.

- New entrants face higher per-unit costs due to smaller production volumes and limited distribution channels.

Lower Barriers in Digital Niche Markets

While the overall threat of new entrants to WildBrain at a large scale remains moderate to low, the barrier for entry into niche digital markets is considerably lower. Individual creators and smaller production houses can achieve success on platforms like YouTube by targeting specific audiences, as evidenced by the creator economy's growth reaching an estimated $250 billion in 2023. However, scaling operations to directly compete with a diversified company such as WildBrain, with its extensive content library and global distribution, presents a significant challenge.

- The digital landscape allows new entrants to emerge with lower initial capital requirements.

- Platforms like YouTube facilitate niche content creation, attracting specific viewer segments.

- Despite this, the infrastructure and market reach of established players like WildBrain create high barriers to direct competition.

- WildBrain's diverse portfolio, including Peanuts and Teletubbies, provides a competitive moat against smaller, specialized entrants.

New entrants face significant hurdles in children's content, primarily due to the high capital costs for quality animation, often over $300,000 per 22-minute episode in 2024. Building a competitive intellectual property library and securing global distribution channels, like WildBrain's, demands extensive time and financial investment. Large incumbents leverage vast economies of scale, with major studios spending billions annually on content, making direct competition challenging for newcomers. While niche digital platforms offer lower entry points, scaling to WildBrain's diversified market presence remains difficult.

| Barrier Type | Description | 2024 Data |

|---|---|---|

| Capital Costs | High production budget for quality content | $300,000+ per 22-min episode |

| Economies of Scale | Incumbent content spending | Netflix: $17 Billion/year |

| IP & Brand | Time/cost to build extensive library | Decades of development |

Porter's Five Forces Analysis Data Sources

Our WildBrain Porter's Five Forces analysis leverages data from company annual reports, investor presentations, and industry-specific market research reports to assess competitive dynamics.

We also incorporate insights from trade publications, news archives, and public financial databases to provide a comprehensive view of the entertainment and media landscape.