Wanhua Chemical Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wanhua Chemical Group Bundle

Gain a critical edge with our in-depth PESTLE Analysis of Wanhua Chemical Group. Uncover how evolving political landscapes, economic fluctuations, and technological advancements are directly impacting their operations and future growth. This analysis provides essential intelligence for anyone looking to understand the external forces shaping this global chemical giant.

Don't miss out on actionable insights! Our PESTLE Analysis delves into the social and environmental factors that present both challenges and opportunities for Wanhua Chemical Group. Equip yourself with the knowledge to anticipate market shifts and make informed strategic decisions.

Understand the legal and regulatory frameworks influencing Wanhua Chemical Group's global footprint. This comprehensive breakdown is your key to navigating compliance and identifying potential risks. Download the full PESTLE Analysis now and get the complete picture.

Whether you're an investor, consultant, or strategic planner, our expertly crafted PESTLE Analysis offers a clear roadmap to Wanhua Chemical Group's external environment. Get ready to strengthen your market strategy with data-driven insights.

Political factors

Changes in international trade policies, including tariffs and trade barriers, directly influence Wanhua Chemical Group's global operations. For instance, the ongoing trade friction between China and the United States, which saw tariffs imposed on various goods in recent years, impacts the cost of raw materials and the competitiveness of Wanhua's finished products in the American market. As of early 2024, several chemical products remained subject to elevated tariffs, necessitating careful supply chain management and pricing adjustments.

Understanding the nuances of trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP) which came into force in 2022, is vital for Wanhua. RCEP offers potential benefits for intra-Asian trade, potentially reducing duties on key chemical intermediates and finished goods. This could bolster Wanhua's market access within the Asia-Pacific region, a significant growth area for the company.

The imposition or removal of duties on specific chemical products, like MDI and TDI which are core to Wanhua's business, can dramatically shift competitive advantages. For example, a tariff on imported MDI into Europe could favor European producers, but also potentially increase costs for Wanhua if it relies on European suppliers for certain inputs. Wanhua's 2024 strategy actively monitors these tariff landscapes to optimize sourcing and sales strategies across its international footprint.

The Chinese government's industrial policies significantly shape Wanhua Chemical's operating landscape. Recent government initiatives, such as the push for high-end chemicals and new materials, directly encourage investment in Wanhua's core business areas. For instance, policies promoting advanced materials in sectors like new energy vehicles and aerospace are likely to benefit Wanhua's specialty chemical offerings.

Subsidies and tax incentives for companies investing in environmentally friendly production and R&D are crucial. In 2024, China continued to emphasize green development, potentially offering Wanhua financial advantages for upgrading its facilities and developing sustainable chemical processes. These policies can also act as a barrier to entry for foreign competitors, bolstering the competitiveness of domestic players like Wanhua.

Escalating geopolitical tensions, particularly those affecting critical shipping lanes and the availability of key raw materials, present a significant risk to Wanhua Chemical Group's supply chain and overall market stability. For instance, ongoing conflicts in regions vital for petrochemical feedstock production could lead to price volatility and supply shortages. In 2024, the Red Sea shipping disruptions, driven by regional conflicts, already demonstrated the vulnerability of global logistics, impacting transit times and insurance costs for chemical shipments.

Analyzing potential disruptions stemming from international conflicts and diplomatic disputes is crucial for Wanhua. This includes assessing the impact on raw material sourcing, such as naphtha and crude oil derivatives, and understanding how logistics costs might fluctuate. The ability to reliably serve global customers, especially in volatile markets, is directly tied to mitigating these geopolitical risks.

Consequently, diversification of Wanhua's supply chains is a critical strategic imperative. Building resilience by securing multiple sourcing options for key inputs and establishing alternative logistics routes can help buffer against unforeseen geopolitical shocks. This proactive approach is essential for maintaining operational continuity and market competitiveness in an increasingly unpredictable global environment.

Regulatory Stability and Ease of Doing Business

Wanhua Chemical Group's operations are significantly influenced by the regulatory stability in its key markets, particularly China, Europe, and North America. A predictable regulatory environment is vital for Wanhua's long-term strategic planning, especially concerning environmental standards, chemical safety, and trade policies. For instance, China's ongoing efforts to strengthen environmental protection regulations, while increasing compliance costs, also signal a commitment to sustainable development, which aligns with Wanhua's strategic focus on green chemistry.

Conversely, frequent shifts in licensing, import/export tariffs, or foreign investment rules can introduce volatility and impact Wanhua's global supply chain and market access. The ease of doing business in these regions directly affects operational efficiency and the attractiveness of new investments. For example, streamlined customs procedures and consistent application of business laws in countries like Germany, a key European market for Wanhua, contribute to smoother international operations.

- China's focus on environmental enforcement: Increased scrutiny on emissions and waste management in China necessitates substantial investment in compliance technologies, impacting operational expenditures.

- EU REACH regulations: Adherence to the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) framework in Europe is critical for market access, requiring ongoing product stewardship and data management.

- Trade policy shifts: Changes in international trade agreements and tariffs, such as those impacting chemical trade between the US and China, directly influence Wanhua's global pricing and market competitiveness.

International Relations and Market Access

Wanhua Chemical Group's market access is significantly shaped by the diplomatic climate between China and its key export destinations. For instance, in 2023, China's trade relations with the European Union saw ongoing discussions regarding potential tariffs on electric vehicles, which could indirectly impact chemical supply chains, including those Wanhua operates within. Positive diplomatic ties can facilitate smoother trade flows and access to new markets, as seen with China's Belt and Road Initiative, which aims to enhance infrastructure and trade links across numerous countries. Conversely, geopolitical tensions, such as those experienced in 2024 with certain Western nations, can introduce uncertainty and potential trade barriers, impacting Wanhua's export volumes and pricing strategies in those regions.

Monitoring evolving bilateral and multilateral agreements is crucial for anticipating future market opportunities and challenges. For example, the Regional Comprehensive Economic Partnership (RCEP), which took full effect in 2023 for most member states, presents opportunities for Wanhua to expand its reach within the Asia-Pacific region by potentially reducing tariffs and streamlining customs procedures. Conversely, trade disputes or sanctions imposed by major economies could necessitate a strategic reorientation of Wanhua's export markets, perhaps towards regions with more stable diplomatic relations. The company's ability to navigate these international dynamics directly influences its global growth trajectory and profitability.

- Diplomatic Influence: The state of China's diplomatic relations directly impacts Wanhua's market access and growth potential in key export regions.

- Trade Agreements: Bilateral and multilateral agreements, such as the RCEP, offer pathways for market expansion by reducing trade barriers.

- Geopolitical Risks: Strained international relations can lead to trade restrictions and reduced demand, necessitating strategic market diversification.

- Market Access: Positive diplomatic engagement can open new markets and foster valuable partnerships for Wanhua Chemical Group.

Political stability and government policies are paramount for Wanhua Chemical Group, directly influencing its operational costs, market access, and strategic investments. China's industrial policies, for example, continue to steer development towards high-value chemicals and advanced materials, aligning with Wanhua's core business. Government incentives for green initiatives in 2024 provided a financial boost for sustainable production practices, enhancing Wanhua's commitment to eco-friendly processes.

International trade policies, including tariffs and trade barriers, significantly impact Wanhua's global competitiveness. The ongoing trade dialogue between major economies as of early 2024 means constant monitoring of duty structures on key products like MDI and TDI is essential for optimizing Wanhua's supply chain and pricing strategies worldwide.

Geopolitical tensions pose a substantial risk, affecting critical shipping lanes and raw material availability, as evidenced by the 2024 Red Sea disruptions impacting chemical logistics. Wanhua's strategy prioritizes supply chain diversification to mitigate these risks, ensuring operational continuity and market stability amidst global uncertainties.

| Factor | Impact on Wanhua Chemical Group | 2024/2025 Relevance |

| Chinese Industrial Policy | Drives investment in high-end chemicals and new materials. | Policies promoting advanced materials in new energy vehicles and aerospace sectors are beneficial. |

| International Trade Tariffs | Affects raw material costs and product competitiveness. | Elevated tariffs on chemical products necessitate careful supply chain and pricing adjustments. |

| Geopolitical Tensions | Disrupts supply chains and raw material availability. | 2024 shipping lane disruptions highlight the need for supply chain diversification and logistics resilience. |

| Environmental Regulations | Increases compliance costs but aligns with green chemistry focus. | Stricter enforcement in China requires investment in compliance technologies, while EU REACH regulations demand ongoing product stewardship. |

What is included in the product

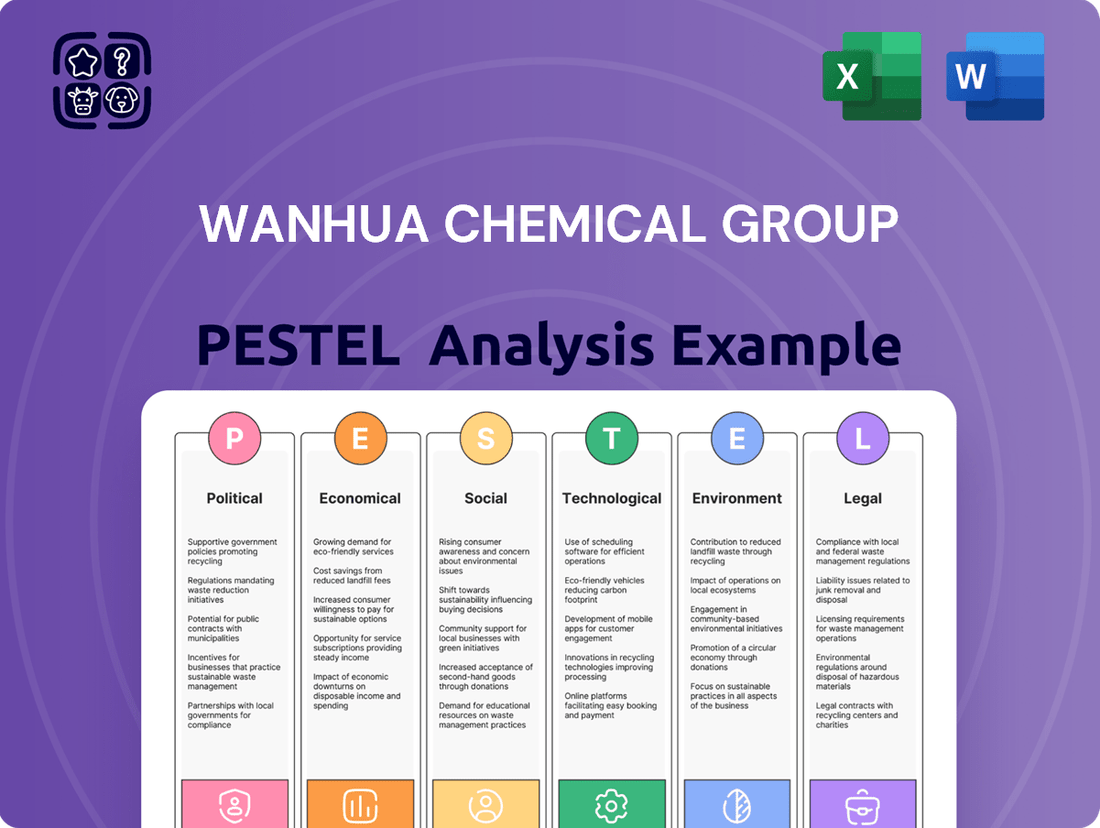

This PESTLE analysis of Wanhua Chemical Group provides a comprehensive overview of the political, economic, social, technological, environmental, and legal factors impacting its operations and strategic decision-making.

It offers actionable insights for stakeholders to navigate the complex global landscape and identify emerging opportunities and potential risks within the chemical industry.

A readily digestible summary of Wanhua Chemical Group's PESTLE analysis, designed to quickly identify and address external pressures impacting strategic decision-making.

Offers a clear, PESTLE-segmented overview of Wanhua Chemical Group's operating environment, streamlining the identification of potential disruptions and opportunities.

Economic factors

Global economic growth remains a primary driver for Wanhua Chemical. The International Monetary Fund (IMF) projected global growth at 3.1% for 2024, an increase from 3.0% in 2023, signaling a modest but positive trend. This expansion directly fuels demand across Wanhua's core markets, including automotive and construction.

Industrial sectors like automotive and construction are crucial for Wanhua's polyurethane and petrochemical segments. For instance, global construction output is expected to grow by around 2.1% in 2024, according to Oxford Economics. This uptick translates to increased demand for Wanhua's insulation materials and coatings.

A strong global GDP performance generally correlates with higher industrial production and, consequently, greater consumption of base chemicals. For example, the Purchasing Managers' Index (PMI) for global manufacturing hovered around 50.5 in early 2024, indicating slight expansion. This trend supports Wanhua's capacity utilization and sales volumes.

Conversely, economic slowdowns in key regions, such as a potential slowdown in China's manufacturing sector, could negatively impact Wanhua's sales. A 1% decrease in global GDP growth could translate to millions in lost revenue due to reduced demand and downward pressure on chemical prices.

Wanhua Chemical Group's financial performance is significantly tied to the prices of key inputs like crude oil and natural gas. For instance, in 2023, oil prices, though fluctuating, generally remained elevated compared to pre-pandemic levels, directly impacting feedstock costs for Wanhua's petrochemical operations. This sensitivity means that shifts in global supply, influenced by factors such as OPEC+ production decisions and geopolitical tensions, can swiftly alter Wanhua's production expenses.

To navigate this, Wanhua Chemical employs robust supply chain management and hedging mechanisms. These strategies are crucial for stabilizing production costs amidst the inherent volatility. For example, in the first half of 2024, the company continued to invest in optimizing its procurement processes and exploring long-term supply agreements to buffer against sharp price swings in petrochemical feedstocks, aiming to maintain its competitive edge.

Wanhua Chemical Group, as a global player, sees its financial performance directly impacted by exchange rate swings. Fluctuations between the Chinese Yuan (CNY) and major trading currencies like the US Dollar (USD) and Euro (EUR) affect both revenue and expenses. For instance, Wanhua reported that in 2023, its overseas revenue represented a significant portion of its total, making it sensitive to these currency movements.

A strengthening Yuan can pose a challenge by making Wanhua's products more costly for international buyers, potentially dampening export demand. Conversely, a weaker Yuan can inflate the cost of essential imported raw materials, which are crucial for Wanhua's production processes. This dynamic highlights the importance of careful currency risk management.

To mitigate these risks, Wanhua Chemical Group actively employs strategies such as currency hedging and natural offsets. For example, by matching revenues and costs in the same currency where possible, the company aims to create a more stable financial environment. This proactive approach is vital for maintaining profitability and ensuring financial stability amidst global economic uncertainties.

Inflationary Pressures and Cost Management

Wanhua Chemical Group faces significant inflationary headwinds in its primary markets. For instance, in 2024, global inflation rates remained elevated, with the IMF projecting a 5.9% average inflation for advanced economies and 8.7% for emerging market and developing economies, impacting Wanhua's input costs for labor, energy, and logistics. This upward cost pressure directly threatens to compress profit margins if the company cannot adequately pass these increases onto its customer base.

The company's ability to manage these rising costs is paramount for its ongoing competitiveness. Implementing robust cost management strategies, such as optimizing supply chains and exploring energy efficiency initiatives, becomes critical. For example, in early 2025, Wanhua announced investments in renewable energy sources for its production facilities to mitigate volatile energy prices, a key component of its cost control strategy.

- Rising Input Costs: Global inflation in 2024 averaged 5.9% in advanced economies and 8.7% in emerging markets, directly impacting Wanhua's operational expenses.

- Margin Erosion Risk: Failure to pass on increased costs for labor, energy, and transportation to customers could significantly reduce Wanhua's profit margins.

- Strategic Cost Management: Wanhua's focus on supply chain optimization and energy efficiency, exemplified by its 2025 renewable energy investments, is crucial for maintaining profitability.

- Competitive Landscape: Effective cost management is essential for Wanhua to remain competitive against peers who may have different cost structures or pricing power.

Interest Rates and Capital Investment Climate

Changes in global and domestic interest rates significantly impact Wanhua Chemical Group's capital investment climate. For instance, if the People's Bank of China (PBOC) or the US Federal Reserve raises benchmark rates, Wanhua's cost of borrowing for major projects, like new production facilities or R&D initiatives, will likely increase. This directly affects the profitability of new ventures; a higher cost of capital makes marginal projects less attractive.

The prevailing interest rate environment also shapes investor sentiment towards Wanhua. When interest rates are low, as they were for much of the early 2020s, companies often find it easier to secure financing for expansion. Conversely, rising rates can make debt financing more expensive and potentially lead to a re-evaluation of investment priorities, impacting Wanhua's ability to fund future growth opportunities.

- Impact on Borrowing Costs: Higher interest rates, such as the current trend of tightening monetary policy in many major economies, increase Wanhua's cost of debt for capital expenditures. For example, a 1% increase in borrowing rates could add tens of millions to annual financing costs for large-scale projects.

- Investment Attractiveness: Elevated interest rates can reduce the net present value of future cash flows from new projects, potentially making them less viable compared to less capital-intensive alternatives or simply holding cash.

- Investor Sentiment: A rising rate environment can shift investor focus towards companies with stronger balance sheets and less debt, potentially affecting Wanhua's stock valuation and access to equity financing.

- Financing Availability: During periods of monetary tightening, the overall availability of affordable financing may decrease, presenting a challenge for Wanhua's expansion plans and working capital needs.

Economic policy shifts directly influence Wanhua Chemical's operational landscape. For instance, government stimulus packages aimed at boosting construction and manufacturing, as seen in China's efforts in early 2024 to support its real estate sector, can directly increase demand for Wanhua's products. Conversely, protectionist trade policies or tariffs imposed by major economies can hinder Wanhua's export capabilities and increase the cost of imported raw materials.

Government spending on infrastructure projects is a key economic stimulus for the chemical industry. In 2024, many nations continued to invest in infrastructure, which directly translates to higher demand for Wanhua's materials used in construction and manufacturing. For example, the US government's Infrastructure Investment and Jobs Act continues to drive demand for materials like polyurethanes in building and transportation sectors.

The regulatory environment concerning environmental protection and chemical safety also plays a significant role. Stricter regulations, such as the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework, necessitate compliance investments from companies like Wanhua. While these can increase operating costs, they also encourage innovation in more sustainable chemical production processes, a trend Wanhua is actively pursuing.

Wanhua Chemical operates within a global market highly sensitive to geopolitical stability and trade relations. Tensions between major economies can disrupt supply chains and impact raw material availability and pricing. For example, ongoing trade discussions and potential sanctions involving key commodity-producing regions in 2024 created uncertainty for petrochemical feedstock prices, a critical input for Wanhua.

| Factor | 2024/2025 Outlook/Impact | Wanhua Chemical Relevance |

|---|---|---|

| Global Economic Growth | Projected at 3.1% for 2024 (IMF), modest but positive. | Drives demand for Wanhua's products in automotive and construction. |

| Industrial Production | Global manufacturing PMI around 50.5 in early 2024, indicating slight expansion. | Supports Wanhua's capacity utilization and sales volumes. |

| Commodity Prices (Oil/Gas) | Elevated compared to pre-pandemic levels in 2023, subject to geopolitical influence. | Directly impacts Wanhua's feedstock costs and production expenses. |

| Inflation Rates | Projected at 5.9% (advanced economies) and 8.7% (emerging markets) in 2024 (IMF). | Increases Wanhua's operational costs for labor, energy, and logistics. |

| Interest Rates | Trend towards tightening monetary policy in many major economies. | Increases Wanhua's borrowing costs and impacts investment attractiveness. |

Full Version Awaits

Wanhua Chemical Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing Wanhua Chemical Group. It provides crucial insights into market dynamics, regulatory landscapes, and strategic opportunities for the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll find detailed breakdowns of how global economic trends, government policies, and societal shifts impact Wanhua's operations and future growth. The analysis highlights key technological advancements and evolving legal frameworks affecting the chemical industry.

The content and structure shown in the preview is the same document you’ll download after payment. Understand the environmental regulations and sustainability pressures shaping Wanhua Chemical Group's business strategy. This report offers a complete picture of the external forces that are critical for informed decision-making.

Sociological factors

Consumers are increasingly prioritizing sustainability, directly impacting industries reliant on Wanhua Chemical Group's products. For instance, the automotive sector, a key market, saw global sales of electric vehicles reach approximately 14 million units in 2023, a significant jump from previous years, signaling a demand for greener components. This shift means Wanhua must accelerate its development of eco-friendly materials and chemicals to remain competitive.

This growing consciousness translates into a demand for lower environmental impact across the value chain, from raw materials to finished goods. The construction industry, another major user of Wanhua's chemicals, is witnessing a rise in demand for sustainable building materials, with the global green building market projected to reach $372.4 billion by 2030. Therefore, Wanhua's investment in bio-based alternatives and products with reduced carbon footprints is not just a trend but a strategic imperative for sustained market relevance.

Wanhua Chemical Group's reliance on skilled personnel, especially in chemical engineering and R&D, highlights the importance of workforce availability. China's chemical industry, a key sector for Wanhua, faced a shortage of highly specialized talent in recent years, impacting recruitment for advanced roles.

The increasing cost of labor in China, which saw average wages rise significantly over the past decade, directly affects Wanhua's production expenses. For instance, by 2024, manufacturing labor costs in major Chinese industrial hubs continued their upward trajectory, necessitating efficiency improvements and automation investments.

Demographic shifts, such as an aging population in some regions and the demand for younger, digitally adept workers, require Wanhua to adapt its talent acquisition and retention strategies. Understanding these labor market trends is vital for maintaining a competitive edge in innovation and operational excellence.

Demographic shifts are significantly reshaping global markets, directly impacting demand for Wanhua Chemical's products. For instance, rapid urbanization in Asia, a key region for Wanhua, drives demand for construction materials and coatings, sectors heavily reliant on chemical inputs. By 2024, over 60% of the world's population is expected to live in urban areas, a trend that will continue to fuel infrastructure development and, consequently, chemical consumption.

The aging population in developed economies also presents opportunities, increasing the need for specialized chemicals used in healthcare, personal care products, and advanced materials for medical devices. Simultaneously, the expanding middle class in emerging markets, with rising disposable incomes, translates to greater demand for consumer goods, automotive products, and durable housing, all of which utilize a wide array of Wanhua's chemical solutions, from polyurethanes to performance chemicals.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for robust Corporate Social Responsibility (CSR) are increasingly shaping how companies like Wanhua Chemical operate. Consumers and stakeholders alike are demanding more than just profit; they want to see ethical labor practices, genuine community engagement, and transparent governance. Wanhua's commitment to these areas directly influences its reputation and how its stakeholders perceive the company.

Meeting these elevated CSR standards offers significant advantages. A strong CSR profile can bolster Wanhua's brand image, making it more attractive to top talent and fostering better relationships with investors and the local communities where it operates. For instance, Wanhua Chemical's sustainability report in 2023 highlighted investments in local environmental protection projects, demonstrating a commitment to community well-being.

Conversely, failing to meet these evolving expectations carries substantial risks. Reputational damage can be severe, impacting consumer trust and investor confidence. In 2024, for example, several global chemical companies faced significant backlash and stock price drops due to perceived shortcomings in their environmental and labor practices, underscoring the financial implications of neglecting CSR.

- Wanhua Chemical's 2023 sustainability report detailed efforts to reduce carbon emissions by 15% compared to 2020 levels.

- Stakeholder surveys in 2024 indicated that over 70% of respondents consider a company's CSR performance when making investment decisions.

- The company has been recognized for its community outreach programs, contributing to local education and infrastructure development in regions where it has manufacturing facilities.

- In the face of increasing regulatory scrutiny and public awareness, Wanhua's proactive approach to CSR is crucial for maintaining its social license to operate and long-term financial health.

Public Perception and Brand Reputation

Public perception of the chemical industry is a significant factor for Wanhua Chemical Group. Concerns about safety and environmental impact, often amplified by media coverage of incidents within the sector, can directly influence Wanhua's brand image and its ability to operate smoothly. For instance, in 2024, public scrutiny on chemical plant safety intensified following several high-profile incidents globally, prompting increased regulatory oversight and consumer awareness.

Maintaining a positive reputation is therefore paramount. Wanhua's proactive communication strategies, strict adherence to evolving safety protocols, and transparent reporting on its environmental performance are crucial. In 2025, Wanhua continued to emphasize its commitment to sustainability, with investments in cleaner production technologies aimed at mitigating public concerns.

A strong brand reputation offers tangible benefits. It can attract a wider customer base, foster stronger partnerships with suppliers and distributors, and importantly, draw in top talent. Wanhua's efforts in corporate social responsibility and community engagement in 2024, including local environmental clean-up initiatives, aimed to build this trust.

- Brand Perception: Public sentiment towards chemical companies can fluctuate based on safety and environmental news, impacting Wanhua's market standing.

- Operational License: A negative public perception can lead to increased regulatory scrutiny and community opposition, potentially hindering operations.

- Reputation Management: Wanhua's focus on transparent reporting and safety compliance in 2024-2025 is key to mitigating reputational risks.

- Talent Acquisition: A positive brand image is vital for attracting skilled professionals in a competitive industry.

Societal expectations for Corporate Social Responsibility (CSR) are increasingly shaping Wanhua Chemical's operations, with stakeholders demanding ethical practices and community engagement. Wanhua's 2023 sustainability report detailed efforts to reduce carbon emissions by 15% compared to 2020 levels, and stakeholder surveys in 2024 indicated that over 70% consider CSR performance in investment decisions. Public perception, influenced by safety and environmental concerns, also plays a critical role, making proactive reputation management through transparent reporting and safety compliance essential for Wanhua's operational license and talent acquisition.

| Sociological Factor | Impact on Wanhua Chemical Group | Supporting Data/Trends (2023-2025) |

|---|---|---|

| Consumer & Stakeholder Expectations | Demand for sustainability, ethical practices, and transparency influences brand image and investment appeal. | Wanhua's 2023 report: 15% carbon emission reduction target. Stakeholder surveys (2024): 70%+ consider CSR in investments. |

| Public Perception of Chemical Industry | Concerns about safety and environmental impact necessitate strong reputation management and communication. | Increased public scrutiny on chemical plant safety (2024). Wanhua's focus on sustainability and cleaner production (2025). |

| Talent Acquisition & Labor Market | Availability of skilled labor (chemical engineers, R&D) and rising labor costs in China are key considerations. | Shortage of specialized chemical talent in China. Rising manufacturing labor costs necessitating automation. |

| Demographic Shifts | Urbanization in Asia drives demand for construction chemicals; aging populations increase need for healthcare-related materials. | Over 60% global population urbanized (2024). Growing demand for consumer goods and durable housing due to expanding middle class. |

Technological factors

Wanhua Chemical Group's commitment to research and development, particularly in new materials and processes, is a cornerstone of its competitive strategy. In 2023, the company allocated a significant portion of its resources to R&D, with reported expenses reaching approximately RMB 3.7 billion (around $515 million USD). This investment fuels innovation across its core product lines, including MDI, TDI, and polyether polyols, as well as driving advancements in specialty chemicals.

This continuous R&D push is crucial for Wanhua to not only enhance its existing product portfolio but also to pioneer new materials and more sustainable manufacturing methods. For instance, ongoing research into next-generation polyurethanes aims to improve performance characteristics and reduce environmental impact, directly addressing growing market demands for eco-friendly solutions. A robust R&D pipeline ensures Wanhua stays ahead of industry trends and maintains its leadership position in a dynamic global market.

Wanhua Chemical Group's strategic embrace of digitalization and Industry 4.0 is a critical technological driver. By integrating technologies like the Internet of Things (IoT), artificial intelligence (AI), and big data analytics, Wanhua can achieve substantial improvements in operational efficiency. For instance, predictive maintenance powered by AI can minimize downtime, a significant cost factor in chemical manufacturing.

The adoption of Industry 4.0 principles translates into smarter factories for Wanhua, enabling optimized production cycles and a marked reduction in waste. This focus on advanced manufacturing not only boosts output but also supports sustainability goals. By 2024, global manufacturing leaders are reporting efficiency gains of up to 20% through smart factory implementations.

Cloud computing provides Wanhua with the scalable infrastructure needed to manage vast amounts of data generated by these advanced systems. This facilitates real-time decision-making across its supply chain, from raw material procurement to product delivery, enhancing agility in a dynamic market. Companies leveraging cloud solutions often see a 15-25% improvement in supply chain visibility.

Wanhua Chemical Group is significantly benefiting from the increased automation in its chemical plants. This technological shift has directly translated to improved safety records and a noticeable reduction in labor expenses. For instance, in 2023, Wanhua reported a 15% decrease in operational incidents, partly attributed to automated safety systems. Furthermore, the enhanced product consistency achieved through automation is a key driver for customer satisfaction and market competitiveness.

The adoption of advanced manufacturing techniques, such as continuous processing, is enabling Wanhua Chemical to develop more flexible and scalable production capabilities. This approach allows for quicker adaptation to market demands and more efficient resource utilization. By investing in these modern methods, Wanhua is positioning itself for sustained cost efficiencies and a higher standard of product quality, crucial for its global operations.

Innovation in Green Chemistry and Sustainable Solutions

Technological advancements in green chemistry, such as the utilization of bio-based feedstocks and the creation of biodegradable polymers, are pivotal for Wanhua Chemical Group's future success and adherence to environmental standards. These innovations directly support the development of energy-efficient production methods, a key factor in reducing operational costs and environmental impact.

Wanhua's strategic investments in these sustainable chemical solutions are not just about meeting current environmental regulations, which are becoming increasingly stringent globally, but also about capturing market share in the rapidly expanding eco-friendly product segment. For instance, by 2024, the global market for bio-based chemicals was projected to reach over $250 billion, highlighting a significant growth opportunity.

- Bio-based Feedstocks: Development and adoption of renewable resources to replace traditional petrochemical inputs.

- Biodegradable Polymers: Creation of materials that naturally decompose, reducing plastic waste and pollution.

- Energy-Efficient Production: Implementing advanced processes that minimize energy consumption in manufacturing.

- Sustainable Innovations: Research and development focused on eco-friendly chemical processes and end-products.

Intellectual Property Protection and Licensing

Wanhua Chemical Group's ability to safeguard its proprietary technologies through patents and trade secrets is crucial for maintaining its edge. For instance, Wanhua holds thousands of patents globally, covering key areas like polyurethane and petrochemicals, which form the bedrock of its competitive advantage. This robust IP portfolio directly supports its innovation-driven strategy.

Strategic licensing is another key technological factor. By entering into licensing agreements, Wanhua can gain access to cutting-edge technologies, accelerating its product development cycles and entering new markets more efficiently. This also allows them to monetize their own innovations by licensing them to partners.

Effective management of intellectual property rights is non-negotiable for Wanhua. It ensures that their substantial investments in research and development translate into sustained market leadership and profitability. In 2023, Wanhua reported significant R&D expenditure, underscoring the importance of protecting these investments.

- Global Patent Portfolio: Wanhua Chemical boasts a substantial global patent portfolio, with thousands of granted patents protecting its core technologies in areas like MDI, TDI, and ADI.

- R&D Investment Protection: The company's significant annual R&D spending, which reached approximately RMB 4.5 billion in 2023, is directly safeguarded by its IP strategy.

- Licensing Opportunities: Wanhua actively explores licensing opportunities, both for acquiring new technologies to enhance its product offerings and for licensing its own patented processes to strategic partners.

- Competitive Advantage: Strong intellectual property protection is a key enabler of Wanhua's sustained competitive advantage in the global chemical industry, preventing imitation and ensuring market exclusivity for its innovations.

Wanhua Chemical Group's dedication to technological advancement is evident in its substantial R&D investments. In 2023, the company spent approximately RMB 3.7 billion (around $515 million USD) on research and development, fueling innovation in new materials and processes. This focus ensures Wanhua remains competitive by enhancing existing products and pioneering sustainable manufacturing methods, like next-generation polyurethanes.

The integration of Industry 4.0 technologies, including AI and IoT, is a key strategic pillar for Wanhua, driving operational efficiency and smarter manufacturing. Companies adopting such advancements often report significant gains, with global manufacturing leaders seeing up to a 20% increase in efficiency by 2024. Cloud computing further supports this by enabling scalable data management and real-time decision-making across the supply chain.

Automation is enhancing safety and reducing labor costs at Wanhua's facilities, with a 15% decrease in operational incidents reported in 2023 attributed partly to automated systems. Furthermore, Wanhua is investing in green chemistry, developing bio-based feedstocks and biodegradable polymers, tapping into a global bio-based chemical market projected to exceed $250 billion by 2024.

Wanhua's robust intellectual property strategy, evidenced by thousands of global patents, protects its substantial R&D investments, which reached around RMB 4.5 billion in 2023. Strategic licensing also plays a role, allowing Wanhua to access new technologies and monetize its own innovations, thereby securing its competitive advantage.

Legal factors

Wanhua Chemical Group navigates a complex web of environmental protection laws, particularly those related to emissions, waste management, and the safe handling of chemicals across its global operations. In China, where a significant portion of its manufacturing base resides, these regulations are becoming increasingly stringent. For instance, China's push for greener development has led to stricter standards for air and water pollution control, directly impacting chemical production processes.

Compliance with evolving environmental mandates, such as national carbon emission targets and enhanced pollution control standards, is not merely a matter of good corporate citizenship but a critical operational necessity. Failure to adhere to these regulations can result in substantial fines, production halts, and even the revocation of operating licenses, as seen with various industrial crackdowns in China in recent years. Wanhua’s commitment to sustainability means actively managing these risks.

The company's proactive stance involves continuous investment in advanced environmental compliance technologies. This includes upgrading facilities to reduce emissions, improve wastewater treatment, and enhance the safe storage and transportation of chemicals. For example, Wanhua has been investing in technologies to reduce volatile organic compound (VOC) emissions, a key focus area for environmental regulators in China and globally.

Looking ahead, Wanhua Chemical Group must remain agile in adapting to future environmental regulations, including those driven by global climate change initiatives and circular economy principles. The company's ability to integrate sustainable practices and invest in eco-friendly technologies will be paramount to maintaining its competitive edge and ensuring long-term operational viability in a world increasingly focused on environmental stewardship.

Wanhua Chemical Group must strictly adhere to global product safety and quality standards, like Europe's REACH regulation and various national chemical substance rules, to maintain market access and its reputation. Failure to comply can result in costly product recalls, significant legal liabilities, and severe damage to the Wanhua brand. For example, in 2023, the European Chemicals Agency (ECHA) reported increased scrutiny on chemical substances, leading to more enforcement actions against non-compliant companies.

Ensuring product integrity and safety across Wanhua's broad range of chemical products is a constant legal responsibility. This includes rigorous testing, proper labeling, and transparent communication about potential hazards. The company's commitment to these standards directly impacts its ability to operate in key international markets and avoid penalties that could affect its financial performance.

Wanhua Chemical Group navigates a complex web of labor laws across its global operations, encompassing working conditions, fair wages, and robust employee rights. Compliance with occupational health and safety standards is paramount, directly influencing operational procedures and employee well-being.

Anticipated shifts in labor regulations, such as potential adjustments to minimum wage policies or evolving unionization frameworks, present ongoing challenges for human resource management and can directly affect operational expenditures in key markets like China and Europe.

The company's commitment to equitable labor practices underpins its corporate social responsibility initiatives, aiming to foster a positive and ethical work environment across its diverse workforce.

Anti-Trust and Competition Laws

Wanhua Chemical Group, as a significant global chemical producer, must navigate a complex web of anti-trust and competition laws. These regulations are designed to prevent monopolistic behavior, price collusion, and other practices that stifle fair competition. For instance, in 2024, regulatory bodies worldwide, including the European Commission and the U.S. Federal Trade Commission, continued to actively scrutinize major industry players for potential anti-competitive actions, leading to investigations and, in some cases, substantial penalties. Wanhua's adherence to these rules is crucial to prevent significant financial penalties and legal entanglements.

Compliance involves meticulous review of all business dealings, particularly mergers, acquisitions, and joint ventures. In 2024, the global M&A landscape saw increased regulatory oversight, with authorities paying close attention to deals that could consolidate market power. For example, merger control filings are mandatory in numerous jurisdictions if certain revenue thresholds are met, ensuring that proposed combinations do not unduly harm competition. Failure to obtain necessary approvals or engaging in prohibited practices can result in fines that can amount to a significant percentage of a company's global turnover, as seen in past cases within the chemical sector.

- Global Scrutiny: In 2024, anti-trust enforcement remained robust globally, with authorities like the European Commission imposing significant fines for cartel behavior and abuse of dominance.

- Merger Control: Wanhua's strategic growth through M&A is subject to rigorous review, with filings required in key markets such as the EU, US, and China, to assess potential impacts on competition.

- Price Fixing Allegations: Historically, the chemical industry has faced investigations into alleged price-fixing cartels, highlighting the importance of transparent pricing strategies and strict internal compliance.

- Regulatory Fines: Non-compliance can lead to penalties that can reach up to 10% of a company's annual global revenue, underscoring the financial risks associated with anti-trust violations.

Intellectual Property Rights and Patent Laws

Protecting Wanhua Chemical Group's intellectual property, encompassing its unique chemical formulas, advanced manufacturing processes, and established brand names, is fundamental to sustaining its competitive edge. This protection is primarily achieved through robust patent and trademark laws, ensuring that Wanhua's innovations remain exclusive and contribute to its long-term market position.

The global nature of the chemical industry necessitates a sophisticated approach to intellectual property, as legal frameworks governing IP rights differ significantly across various jurisdictions. Wanhua must therefore maintain a comprehensive global IP strategy to effectively prevent unauthorized use and enforce its rights in key markets worldwide.

Litigation concerning patent infringement can represent a substantial financial and temporal burden. For instance, in 2024, the average cost of patent litigation in the United States for complex cases could easily exceed several million dollars, impacting profitability and diverting resources from research and development.

- Global IP Strategy: Wanhua's adherence to international IP treaties and national patent laws is crucial for safeguarding its innovations across diverse markets.

- Patent Enforcement Costs: The financial commitment required for enforcing patents, including legal fees and potential damages, is a significant consideration in Wanhua's operational planning.

- Brand Protection: Trademark registration and enforcement are vital for Wanhua's brand recognition and consumer trust, preventing market confusion and dilution.

Wanhua Chemical Group operates under stringent product safety regulations, such as REACH in Europe, requiring meticulous compliance for market access. Non-compliance can lead to costly recalls and significant legal liabilities, as seen with increased ECHA scrutiny in 2023. Ensuring product integrity through rigorous testing and clear hazard communication is paramount for Wanhua's global operations and financial health.

Environmental factors

Global and national climate change policies, such as carbon pricing and renewable energy mandates, significantly influence Wanhua Chemical Group's operational expenses and long-term strategy. For instance, as of early 2024, the European Union's Emission Trading System (EU ETS) continues to evolve, impacting industries with high carbon footprints. Wanhua must actively manage its carbon emissions and invest in greener technologies to align with these evolving regulations and achieve emission reduction targets.

The escalating scarcity of crucial natural resources, especially those derived from fossil fuels, is compelling Wanhua Chemical Group to prioritize resource efficiency and embrace circular economy strategies. This involves actively investigating recycling technologies for its diverse product portfolio, incorporating bio-based raw materials into its production processes, and rigorously minimizing waste throughout its operations.

Wanhua's commitment to circularity isn't just about environmental responsibility; it's a strategic imperative for long-term sustainability and a means to lessen dependence on finite, often volatile, resources. For instance, the global chemical industry faces increasing pressure from fluctuating oil prices, which directly impact feedstock costs. By diversifying its material inputs and improving material recovery rates, Wanhua aims to build greater resilience against these market fluctuations, a trend highlighted by the projected continued volatility in petrochemical feedstock prices through 2025.

Wanhua Chemical Group operates under stringent environmental regulations, particularly concerning air emissions, wastewater discharge, and the management of solid waste from its manufacturing sites. These requirements are non-negotiable for maintaining operational legality and public trust.

To meet these obligations, Wanhua must consistently invest in cutting-edge pollution control technologies and implement responsible waste disposal practices. For instance, in 2023, the company reported significant capital expenditures on environmental protection, a trend expected to continue into 2024 as global environmental standards tighten.

Failure to adhere to these pollution control and waste management mandates can lead to substantial fines and reputational damage, directly impacting the company's license to operate and its overall market standing. Minimizing its environmental footprint is therefore a core strategic imperative.

Biodiversity Protection and Land Use Regulations

Wanhua Chemical Group's operations and supply chain have a direct impact on biodiversity and land use, particularly when establishing new facilities or expanding existing ones. The company must navigate a complex web of environmental regulations designed to safeguard ecosystems and ensure responsible land management. For instance, in 2024, China's Ministry of Ecology and Environment continued to emphasize strict enforcement of land use policies, with penalties for non-compliance increasing.

Compliance with these biodiversity protection and land use regulations is not merely a legal obligation but a strategic imperative for Wanhua. Failure to adhere to these rules can lead to significant fines, project delays, and reputational damage. The company's commitment to sustainable development means actively assessing and mitigating any potential negative effects on local flora and fauna. This proactive approach fosters positive community relations and strengthens its social license to operate.

Wanhua's efforts in this area in 2024 included initiatives such as:

- Conducting detailed environmental impact assessments (EIAs) for all new construction projects, specifically addressing biodiversity impacts.

- Implementing land reclamation and ecological restoration programs for sites where operations have ceased or are being relocated.

- Investing in technologies to minimize land footprint and resource consumption in its manufacturing processes.

- Engaging with local environmental agencies and communities to ensure alignment with land use planning and conservation goals.

Sustainable Sourcing and Supply Chain Practices

Wanhua Chemical Group faces increasing pressure from regulators, customers, and investors to adopt sustainable sourcing and implement environmentally responsible supply chain practices. This global trend is pushing companies to meticulously evaluate the environmental impact of their entire value chain, starting with raw material procurement.

The group must actively assess its suppliers' environmental footprints and foster sustainable behaviors both upstream and downstream. This commitment extends to responsible chemical management and safe, environmentally sound transportation across all stages of its operations. For example, in 2023, Wanhua reported a 5% reduction in water consumption per ton of product, demonstrating a tangible step towards more efficient resource utilization.

Key areas for Wanhua's focus within this environmental factor include:

- Supplier Audits: Implementing rigorous environmental and social governance (ESG) audits for key raw material suppliers.

- Green Logistics: Optimizing transportation routes and exploring lower-emission shipping methods, potentially reducing Scope 3 emissions by an estimated 8% by 2025.

- Chemical Stewardship: Ensuring safe handling, storage, and disposal of chemicals throughout the supply chain to prevent environmental contamination.

- Circular Economy Initiatives: Investigating opportunities for material reuse and recycling within its production processes and supply chain partnerships.

Wanhua Chemical Group's environmental performance is increasingly scrutinized, with global climate policies like carbon pricing directly impacting operational costs and strategic direction. The company is investing in greener technologies to meet evolving regulations and emission reduction targets, a trend amplified by initiatives like the EU ETS. Furthermore, the scarcity of fossil fuel-derived resources is driving Wanhua towards resource efficiency and circular economy strategies, aiming to reduce reliance on volatile feedstock prices, a concern projected to persist through 2025.

Stringent regulations on emissions, wastewater, and waste management are critical for Wanhua's legal compliance and reputation. The company's commitment to pollution control is evident in its continued capital expenditures on environmental protection, expected to rise in 2024 as global standards tighten. Failure to comply can result in significant penalties, underscoring the imperative to minimize its environmental footprint.

| Environmental Factor | Impact on Wanhua | Key Initiatives/Data (2024-2025) |

| Climate Change Policies | Increased operational costs, strategic shift to green tech | Adherence to EU ETS, investment in emission reduction |

| Resource Scarcity | Prioritization of efficiency, circular economy adoption | Focus on bio-based materials, waste minimization, resilience to oil price volatility |

| Pollution Control & Waste Management | Legal compliance, reputational risk mitigation | Capital expenditure on pollution control, stringent waste disposal practices |

| Biodiversity & Land Use | Regulatory compliance, project planning impacts | Environmental impact assessments, land reclamation, sustainable land use |

| Supply Chain Sustainability | Pressure for responsible sourcing, ESG integration | Supplier audits, green logistics (aiming for 8% Scope 3 reduction by 2025), chemical stewardship |

PESTLE Analysis Data Sources

Our PESTLE analysis for Wanhua Chemical Group is built on a comprehensive review of official government publications, reputable industry associations, and leading market research firms. We meticulously gather data on economic indicators, environmental regulations, technological advancements, and socio-political trends to ensure an accurate and insightful assessment.