Wanhua Chemical Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wanhua Chemical Group Bundle

Curious about Wanhua Chemical Group's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these dynamics is crucial for any investor or competitor looking to navigate the chemical industry.

This initial overview is just the tip of the iceberg. To truly grasp Wanhua Chemical Group's competitive landscape and identify actionable strategies, you need the complete BCG Matrix.

Unlock detailed quadrant placements, data-backed insights into market share and growth rates, and expert recommendations tailored to each product category. This comprehensive analysis will equip you with the knowledge to make informed investment decisions and refine your own strategic approach.

Don't settle for a partial view. Purchase the full BCG Matrix report today and gain a clear, actionable roadmap to understanding and capitalizing on Wanhua Chemical Group's market performance.

Stars

Wanhua Chemical is strategically targeting the specialty polyolefins, particularly polyolefin elastomers (POE), a segment showing robust growth. The company launched a 200,000 tonnes per year (t/yr) POE unit in June 2024. This significant investment is bolstered by plans for a further 400,000 t/yr expansion by the end of 2025.

This aggressive capacity expansion underscores Wanhua Chemical's commitment to becoming a dominant player in the POE market. The demand for POE is primarily fueled by its critical role in high-growth sectors such as new energy applications, including solar films, and the automotive industry. By scaling up production, Wanhua aims to capture substantial market share in this burgeoning field.

Given the substantial investments and the high-growth trajectory of the POE market, driven by factors like the renewable energy transition and automotive electrification, Wanhua Chemical's specialty polyolefins business, particularly POE, is positioned as a Star in their BCG Matrix. This classification reflects its strong market position and high growth potential.

Wanhua Chemical Group is significantly expanding its high-end aliphatic isocyanates capacity, with plans to double production in 2024. This expansion includes the introduction of new products like XDI and H6XDI, catering to the increasing demand for advanced materials in sectors such as flooring, adhesives, and thermoplastic polyurethanes (TPUs). These specialty chemicals are vital for applications requiring enhanced durability and performance, aligning with market trends towards high-value solutions.

Wanhua Chemical is heavily investing in battery materials, specifically Lithium Iron Phosphate (LFP) and PVDF, as part of its 2025 strategic plan. This focus signals a deliberate move into a high-growth sector expected to drive future revenue. The company's acquisitions throughout 2024 across the battery materials supply chain underscore this commitment. This strategic pivot positions battery materials as a key Star in Wanhua's portfolio.

Bio-based and Sustainable Materials

Wanhua Chemical Group is significantly increasing its investment in bio-based and sustainable materials. This strategic focus includes the development and large-scale production of bio-based polyols, recyclable thermoplastic polyurethane (TPU), and recycled polycarbonate (rPC). These initiatives are directly responding to a growing worldwide need for environmentally friendly products.

The company's dedication to these green materials is a cornerstone of its commitment to achieving carbon neutrality. By prioritizing sustainability and innovation, Wanhua is targeting market segments that are experiencing rapid expansion due to stricter environmental regulations and shifting consumer preferences. For instance, the global market for bio-based chemicals is projected to reach $150 billion by 2027, underscoring the significant growth potential.

- Bio-based Polyols: Essential components for polyurethane production, offering a lower carbon footprint.

- Recyclable TPU: Enhances the circular economy by allowing for material reuse in various applications.

- Recycled Polycarbonate (rPC): Provides a sustainable alternative for plastics used in electronics and automotive industries.

- Green Additives: Supporting the eco-friendly transformation of a wide range of chemical products.

Advanced Performance Chemicals

Wanhua Chemical Group's Advanced Performance Chemicals segment is a key growth driver, showcasing significant advancements in high-end optical materials like XDI and polysulfone. The company is also actively developing new products, including Nylon-12 elastomers, targeting sectors that demand exceptional performance and specialized properties. This focus on innovation and the successful commercialization of proprietary technologies solidify Wanhua's strong position in these lucrative, high-value markets, indicating robust future growth potential.

In 2024, Wanhua Chemical Group continued to invest heavily in research and development, with a notable emphasis on advanced materials. For instance, their XDI-based optical materials are finding applications in high-resolution displays and lenses, sectors experiencing rapid technological evolution. The group's commitment to expanding its portfolio in specialized chemicals, such as the newly developed Nylon-12 elastomers, positions them to capture emerging market opportunities demanding superior durability and flexibility.

- High-End Optical Materials: Wanhua is pushing boundaries in XDI and polysulfone, crucial for advanced displays and lenses.

- New Product Development: The introduction of Nylon-12 elastomers addresses growing demand for high-performance polymers in automotive and industrial applications.

- Innovation & Industrialization: Successful commercialization of proprietary technologies underscores Wanhua's competitive edge in specialty chemicals.

- Market Position: These advancements solidify Wanhua's presence in high-value segments with substantial growth prospects.

Wanhua Chemical's specialty polyolefins, particularly POE, are a clear Star. The company launched a 200,000 t/yr POE unit in June 2024 and plans a further 400,000 t/yr expansion by the end of 2025. This aggressive move into a high-growth market, driven by new energy and automotive applications, positions POE for significant market share capture.

The company's strategic focus on battery materials, including LFP and PVDF, also marks them as a Star. Acquisitions in 2024 across the battery supply chain reinforce this commitment. This segment is poised for substantial revenue growth in the coming years.

Wanhua's investment in bio-based and sustainable materials, such as bio-polyols and recyclable TPU, represents another Star. The global bio-based chemicals market is projected to reach $150 billion by 2027, highlighting the immense growth potential in this environmentally conscious segment.

Advanced Performance Chemicals, featuring XDI optical materials and Nylon-12 elastomers, also fall into the Star category. These high-value products serve rapidly evolving sectors like advanced displays and automotive, solidifying Wanhua's position in lucrative markets with strong future growth prospects.

What is included in the product

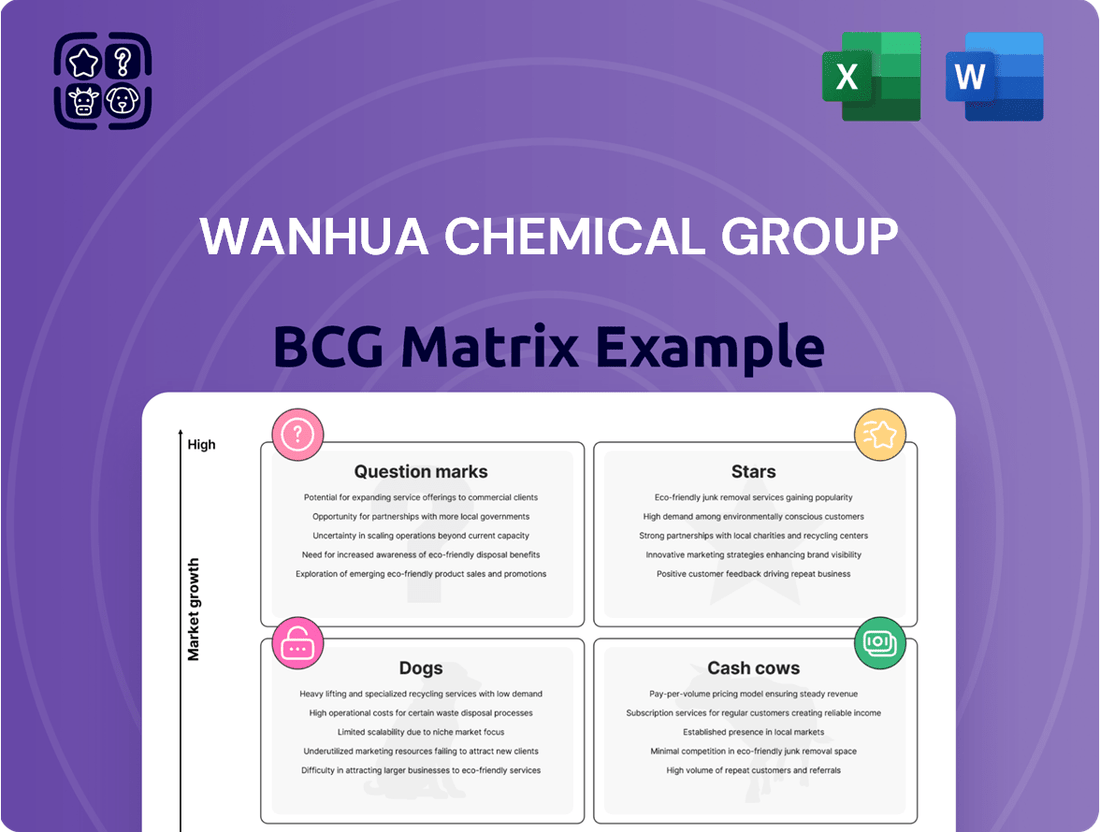

Wanhua Chemical Group's BCG Matrix analysis categorizes its business units as Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

The Wanhua Chemical Group BCG Matrix provides a clear, one-page overview, relieving the pain point of complex portfolio analysis.

Cash Cows

MDI (Methylene Diphenyl Diisocyanate) stands as a robust cash cow for Wanhua Chemical Group. Wanhua’s global leadership in MDI is undeniable, evidenced by its production capacity reaching an impressive 3.8 million tons/year by the close of 2024. This dominant position ensures substantial and consistent cash flow, underpinning the company's financial strength.

Despite being a mature market, the global MDI sector is expected to see continued growth. Projections indicate a Compound Annual Growth Rate (CAGR) between 4.6% and 9.0% for the period of 2024-2031, with the Asia Pacific region anticipated to be the primary driver of this expansion. Wanhua's strategic advantage within this growing, yet established, market solidifies MDI's role as its leading profit contributor.

Wanhua Chemical Group's Toluene Diisocyanate (TDI) operations are a prime example of a Cash Cow within its business portfolio. As one of the world's largest TDI producers, Wanhua's significant capacity, reaching 1.11 million tons per year with further expansions underway, solidifies its dominant position in this mature but consistently profitable market.

The polyurethane sector, heavily reliant on TDI, represents Wanhua's largest profit segment. This strong market share, coupled with established demand from crucial industries such as automotive manufacturing and construction, ensures a reliable and substantial cash flow generation for the group.

Wanhua Chemical Group's Standard Polyether Polyols business is a prime example of a Cash Cow within its portfolio. With a substantial production capacity of 1.59 million tons, the company is a crucial supplier to vital sectors including home appliances, automotive, and coatings.

This segment benefits from strong integration with Wanhua's core MDI/TDI production, allowing for efficient operations and a dominant market position in a mature industry. Its established presence ensures a steady and predictable inflow of cash, a hallmark of a successful Cash Cow.

The mature nature of the polyether polyols market means that growth opportunities are limited, but the business consistently generates robust profits. This stability allows Wanhua to allocate fewer resources to marketing and promotional activities compared to its high-growth segments.

In 2024, Wanhua Chemical reported significant revenue from its polyurethanes segment, which includes polyether polyols, highlighting the segment's consistent contribution to the group's overall financial performance.

Core Polyurethane Business Segment

Wanhua Chemical's core polyurethane business, including MDI, TDI, and polyether polyols, stands as its primary profit engine, contributing over 60% of its gross profit. This dominance is fueled by Wanhua's integrated production capabilities and its status as a global leader in these key chemical intermediates. The segment's substantial market share translates into consistently strong and stable cash flows for the company.

This established leadership in the polyurethane market positions Wanhua Chemical's core segment firmly in the Cash Cows quadrant of the BCG Matrix.

- Dominant Market Share: Wanhua Chemical holds a leading global position in MDI and TDI production, essential components for polyurethanes.

- High Profitability: The segment consistently generates over 60% of the company's gross profit, demonstrating its strong earnings power.

- Stable Cash Generation: Its integrated production and market leadership ensure a reliable and substantial inflow of cash for the business.

- Mature Market: While the polyurethane market is mature, Wanhua's efficiency and scale allow it to maintain profitability and cash generation.

Established Petrochemical Commodity Products

Wanhua Chemical Group’s established petrochemical commodity products, particularly those within its C2/C3/C4 value chains, function as its Cash Cows. These include significant operations in high-density and linear low-density polyethylene (HDPE/LLDPE) and polypropylene. Despite potential market volatility and oversupply concerns in the broader petrochemical sector, Wanhua's substantial scale and integrated production model for these fundamental chemicals are designed to generate consistent and substantial cash flow.

The company’s strategic advantage lies in its economies of scale and established market position, which allow it to maintain profitability even during market downturns. For instance, in 2023, Wanhua Chemical reported robust performance in its polyolefins segment, contributing significantly to its overall financial stability. The sheer volume of production for these essential building blocks of the chemical industry ensures a steady demand and reliable revenue stream.

- Significant Market Share: Wanhua holds a dominant position in key polyolefin markets, leveraging its large production capacities.

- Integrated Value Chain: Its upstream integration provides cost advantages and supply chain security for its commodity products.

- Consistent Profitability: Despite market cycles, these products consistently deliver strong earnings, fueling investment in other business segments.

- Economies of Scale: Large-scale production facilities reduce per-unit costs, enhancing competitiveness and margins.

Wanhua Chemical Group's core polyurethane business, encompassing MDI, TDI, and polyether polyols, functions as its primary profit engine. This segment consistently contributes over 60% of the company's gross profit, a testament to its global leadership and integrated production capabilities in these essential chemical intermediates. The substantial market share in these mature yet vital markets translates into robust and stable cash flows, firmly positioning this segment within the Cash Cows quadrant of the BCG Matrix.

| Key Cash Cow Segments | 2024 Production Capacity (Estimated/Reported) | Estimated Contribution to Gross Profit | Market Position |

| MDI | 3.8 million tons/year | Significant | Global Leader |

| TDI | 1.11 million tons/year (with expansions) | Significant | One of the World's Largest Producers |

| Polyether Polyols | 1.59 million tons | Significant | Crucial Supplier |

What You’re Viewing Is Included

Wanhua Chemical Group BCG Matrix

The preview you're seeing is the definitive Wanhua Chemical Group BCG Matrix report you'll receive after your purchase. This comprehensive analysis, including all strategic insights and visual representations, is exactly as it will be delivered, ready for immediate application in your business planning. No further edits or enhancements are required; you'll get the complete, polished document designed for strategic decision-making and competitive advantage.

Dogs

Wanhua Chemical Group's undifferentiated commodity petrochemicals segment likely faces challenges in today's market. Despite ongoing investments in new projects, some existing facilities may be struggling with low growth and oversupply, especially in older or less efficient units.

This pressure is evident in Wanhua's 2024 financial results, where net profit saw a decline. This downturn was attributed to fluctuating prices and increasing raw material costs, directly impacting the profitability of these commodity-focused operations.

These segments, if they haven't undergone significant upgrades or strategic diversification, could be characterized as having low market share within highly competitive and slow-growing markets.

Legacy products with declining relevance in Wanhua Chemical Group's portfolio, while not explicitly segmented, would represent those facing obsolescence. These might include older formulations or technologies that are being supplanted by more environmentally friendly or technologically advanced alternatives. Such offerings would likely exhibit low market share and minimal, if any, future growth potential, representing a drain on resources.

For instance, if Wanhua were to retain any legacy petrochemical derivatives that are now facing intense competition from bio-based or recycled materials, these would fit this category. The market's increasing focus on sustainability means that products with a high carbon footprint or those reliant on non-renewable resources are naturally losing appeal. This shift directly impacts demand and, consequently, market share for any such legacy items.

In 2023, global demand for certain traditional plastics saw slower growth compared to advanced polymers, indicating a broader market trend. Companies like Wanhua, with their strong R&D, are likely to be phasing out or repurposing older product lines that no longer align with market needs or sustainability goals. This strategic pruning is essential for efficient capital allocation and focusing on high-growth areas.

Wanhua Chemical Group's strategic redirection towards battery materials and specialty chemicals in 2025 naturally casts a spotlight on its less central offerings. Products that don't fit this new, more focused vision, and consequently receive limited resources or strategic emphasis, fall into the non-strategic niche category. These might be legacy products or smaller ventures that, while potentially profitable, do not drive the company's future growth or competitive advantage.

These non-strategic niche products are characterized by their low investment levels and minimal market impact, often generating modest returns. For instance, if Wanhua were to divest a small line of industrial coatings that historically served a specific, but shrinking, market segment, these would represent non-strategic niche products. In 2024, Wanhua’s reported revenue was approximately RMB 177.7 billion (USD 24.5 billion), and a significant portion of this revenue likely came from its core polyurethane and petrochemical businesses, highlighting the relative scale of any non-strategic niche segments.

Underperforming Acquired Assets

Underperforming acquired assets within Wanhua Chemical Group's portfolio, particularly those categorized as Dogs in a BCG Matrix analysis, represent significant challenges. In 2024, the company recorded provisions for asset impairments and write-offs, which notably impacted net profits. These write-downs are indicative of investments that have not met anticipated market penetration or growth objectives.

These underperforming ventures are essentially capital drains, consuming resources without generating adequate returns. They may include product lines or business units acquired that are now struggling in their respective markets, facing intense competition or declining demand.

- 2024 Impairment Provisions: Wanhua Chemical Group's financial reports for 2024 detailed specific provisions for asset impairments, directly affecting profitability. While exact figures for specific underperforming acquired assets are not publicly itemized in this context, these provisions contributed to a decline in the company's overall net profit compared to previous periods.

- Market Share and Growth Deficiencies: The assets in question likely represent acquisitions where the projected market share and growth rates have not materialized. This could be due to misjudged market potential, integration challenges post-acquisition, or shifts in industry dynamics that rendered the acquired business less viable.

- Capital Consumption Without Returns: These Dog assets consume capital for operations, research, and development, yet fail to generate sufficient revenue or profit to justify the ongoing investment. This directly hinders Wanhua's ability to allocate capital to more promising Stars or Cash Cows.

Highly Competitive, Low-Margin Segments

Wanhua Chemical Group may face challenges in highly competitive, low-margin chemical segments. These are often characterized by intense rivalry and oversupply, which can significantly squeeze profitability. For instance, bulk chemicals like ethylene, a foundational petrochemical, frequently experience such market conditions, impacting producers’ ability to achieve healthy margins.

If Wanhua Chemical Group operates within these highly commoditized sectors without a distinct competitive advantage or unique product differentiation, these business units could be classified as Dogs in the BCG matrix. Such segments typically exhibit low growth and low market share, often operating at or near break-even points, demanding careful strategic consideration.

- Low Margins: Intense competition in segments like bulk chemicals can suppress profit margins, making it difficult to generate substantial returns.

- Oversupply Risk: Overcapacity in certain chemical markets, such as ethylene production, can further depress prices and profitability for all players.

- Lack of Differentiation: Segments where Wanhua lacks a competitive edge or unique selling proposition are most vulnerable to being classified as Dogs.

- Strategic Review: These low-growth, low-share units require a strategic assessment to determine if divestment, restructuring, or a niche focus is the most appropriate path forward.

Wanhua Chemical Group's "Dogs" likely represent legacy petrochemical operations or acquired businesses that are underperforming. These are characterized by low market share in slow-growing or declining markets, consuming resources without significant returns. For example, certain older commodity chemical lines, if they haven't been modernized or diversified, would fit this description, facing challenges from new technologies and sustainability demands.

In 2024, Wanhua Chemical Group reported a decline in net profit, partly due to fluctuating market prices and rising raw material costs impacting its commodity segments. This financial pressure on lower-margin businesses reinforces the potential for certain product lines or acquired units to be classified as Dogs, requiring careful strategic evaluation.

These underperforming segments, particularly acquired assets that failed to meet growth projections, represent capital drains. Provisions for asset impairments noted in Wanhua's 2024 financial statements directly reflect investments that have not yielded expected market penetration or returns, a common characteristic of Dog assets.

The company's strategic shift towards battery materials and specialty chemicals by 2025 implies a de-emphasis on offerings that do not align with future growth drivers. Products or smaller ventures that receive minimal strategic focus or investment, despite potentially generating modest returns, are likely candidates for classification as Dogs.

| BCG Category | Characteristics | Wanhua Chemical Group Context (Illustrative) | 2024 Financial Impact | Strategic Implication |

| Dogs | Low Market Share, Low Growth | Legacy commodity petrochemicals, underperforming acquired assets, non-strategic niche products | Contributed to overall net profit decline; potential asset impairment provisions | Divestment, restructuring, or minimal investment focus |

Question Marks

Wanhua Chemical Group is making substantial investments in ethylene production, with a 1-million-ton/year ethylene revamp and a new 1.2-million-ton/year ethylene plant scheduled to commence operations in Q1 2025. These expansions are poised to significantly boost Wanhua's capacity in a sector known for its consistent demand.

Alongside ethylene, Wanhua is also introducing high-end alpha-olefins projects, specifically focusing on 1-octene and 1-hexene. These specialized chemicals are crucial for producing advanced polymers like linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE), indicating a move towards higher-value product offerings. The global alpha-olefins market is projected for robust growth, driven by demand for performance plastics in packaging, automotive, and construction sectors.

These new ventures represent significant opportunities in high-growth markets, positioning Wanhua to capture a larger share of the global chemical supply chain. However, the success of these projects hinges on Wanhua's ability to establish a dominant market presence and achieve economies of scale quickly, especially given the competitive landscape for both ethylene and alpha-olefins.

Wanhua Chemical's new 400,000 mt/year PVC plant, slated for a Q1 2025 startup, positions it as a new entrant in a substantial global market. Despite the considerable demand, particularly from the construction sector, Wanhua's current market share in large-scale PVC production is expected to be low as it establishes its presence.

This strategic move into PVC production represents a significant investment for Wanhua Chemical. The company's entry into this large, competitive market necessitates substantial capital outlay to build brand recognition and capture market share, characteristic of a question mark in the BCG matrix.

Wanhua Chemical Group is actively investing in promising, high-growth areas like synthetic biology and electrochemistry. In 2024, the company's research institute initiated its first AI for Science projects, signaling a commitment to these advanced technologies. These fields represent significant long-term potential, though their current market impact and revenue contribution are still developing.

The significant R&D expenditure required for synthetic biology and electrochemistry places these ventures in the question mark category of the BCG matrix. While these innovative areas offer substantial future growth prospects, their commercial viability and ability to capture market share are yet to be fully realized. Wanhua's strategic focus on these cutting-edge sectors underscores its dedication to future innovation and market leadership.

Specific Green Additives & Nutritional Ingredients

Wanhua Chemical Group is strategically investing in the industrialization of specific green additives and nutritional ingredients as part of its broader fine chemicals expansion. These segments are experiencing robust growth, fueled by increasing consumer demand for healthier, eco-friendly products and stricter environmental regulations. For instance, the global market for food additives, which includes many nutritional ingredients, was valued at approximately $64.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% through 2030, according to Grand View Research. Similarly, the green chemicals market, encompassing sustainable additives, is also on a strong upward trajectory.

Despite this promising outlook, Wanhua is in the process of establishing and expanding its market share within these specialized and often fragmented niches. The company's efforts are aimed at capturing a significant portion of this burgeoning market. Wanhua's commitment to these areas reflects a forward-looking strategy to align with evolving market needs and sustainability imperatives, positioning itself for future gains in high-value chemical segments.

- High Growth Potential: Driven by consumer demand for sustainable and healthy products, the market for green additives and nutritional ingredients offers significant expansion opportunities.

- Investment Focus: Wanhua Chemical is channeling substantial resources into the industrialization of these specialized chemical sectors.

- Market Building Phase: The company is actively working to build its market presence and increase its share in these diverse, niche markets.

- Regulatory Tailwinds: Increasingly stringent environmental regulations globally are creating a favorable environment for the adoption of green additives.

International Joint Ventures in Emerging Markets

Wanhua Chemical Group's international joint ventures in emerging markets, like the 50:50 venture with an unnamed partner to build a specialty polyolefin facility in Fuzhou, exemplify strategic moves into potential high-growth areas. These partnerships are designed to tap into specific regional market demands or emerging product segments, offering significant upside potential.

While these ventures are positioned for growth, they often begin with Wanhua holding a relatively low initial market share within the newly established entity. This necessitates considerable investment and focused strategic execution to cultivate these nascent operations into future market leaders, often categorized as Stars in a BCG Matrix framework.

- Fuzhou Joint Venture: A 50:50 agreement in July 2024 to develop a specialty polyolefin facility, highlighting a commitment to emerging market infrastructure and product development.

- High Growth Prospect: These ventures are targeted at regions or product categories exhibiting strong potential for future expansion and market penetration.

- Initial Low Market Share: Wanhua's stake in these new joint ventures starts with a limited market position, requiring dedicated resources to foster growth.

- Capital and Strategy Intensive: Significant financial commitment and strategic planning are essential to transform these ventures from question marks into market-dominating Stars.

Wanhua Chemical's ventures into synthetic biology and electrochemistry, supported by AI for Science projects initiated in 2024, represent strategic bets on future growth. These cutting-edge fields demand substantial R&D investment and are in early stages of commercialization, indicating a question mark status in the BCG matrix.

The company's entry into the PVC market with a new 400,000 mt/year plant, scheduled for Q1 2025, also places it in the question mark category. Despite the large market size, Wanhua's initial market share will be low as it establishes its presence.

Similarly, Wanhua's investments in green additives and nutritional ingredients, while targeting high-growth segments, require market building efforts to gain traction. These specialized niches, though promising, necessitate significant capital and strategic focus to achieve substantial market share.

These question mark businesses require ongoing investment and strategic focus to potentially transition into stars. Their success hinges on Wanhua's ability to navigate competitive landscapes and capitalize on emerging market trends.

BCG Matrix Data Sources

Our Wanhua Chemical Group BCG Matrix is informed by comprehensive market research, company financial statements, and industry growth forecasts to provide strategic insights.