Wanhua Chemical Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wanhua Chemical Group Bundle

Wanhua Chemical Group masterfully navigates the market by strategically aligning its Product, Price, Place, and Promotion. Their innovative product portfolio, from advanced polyurethanes to performance chemicals, forms the bedrock of their offering, catering to diverse global industries. This comprehensive approach ensures they meet evolving customer needs and maintain a competitive edge.

Dive deeper into the specific strategies that propel Wanhua Chemical Group's success. Understand their intricate pricing models, expansive distribution networks, and targeted promotional campaigns that solidify their market leadership. This analysis provides actionable insights for anyone seeking to excel in the chemical industry.

Unlock the full potential of Wanhua Chemical Group's marketing prowess. Access an in-depth, ready-made 4Ps Marketing Mix Analysis covering product innovation, pricing architecture, distribution channels, and communication strategies. Ideal for business professionals, students, and consultants seeking strategic insights.

Product

Wanhua Chemical Group boasts a diverse chemical portfolio, a cornerstone of its market strategy. Its core strength lies in polyurethane products, with MDI and TDI production capacities reaching significant global levels, positioning it as a leader in this segment.

Beyond polyurethanes, Wanhua has strategically expanded into petrochemicals and a growing range of specialty chemicals. This expansion diversifies its revenue streams and broadens its customer base across numerous industries, from automotive to construction.

This broad product offering, encompassing everything from essential building blocks to advanced materials, allows Wanhua to cater to a wide industrial spectrum. For instance, their MDI production capacity, a key component in foams and coatings, is among the largest globally, underscoring their market presence.

The company's commitment to a diversified portfolio acts as a crucial risk mitigation strategy. By not solely relying on a single product line, Wanhua Chemical Group is better positioned to navigate market fluctuations and maintain stability.

Wanhua Chemical Group's product strategy goes far beyond commodity chemicals, concentrating on high-performance materials and comprehensive solutions for demanding industrial needs. This includes specialized offerings for sectors like automotive, construction, home appliances, and textiles, alongside growth areas such as electronics, personal care, and renewable energy.

The company's commitment to innovation is evident in its development of advanced materials designed to meet stringent performance requirements. For instance, Wanhua's polyurethane (PU) products are critical in lightweight automotive components, improving fuel efficiency. In 2024, the automotive sector continued to be a key focus, with Wanhua reporting strong demand for its PU solutions in electric vehicle battery casings and interior components.

Wanhua emphasizes a customer-centric approach, providing tailored solutions that align with specific client needs and evolving industry standards. This focus on customization, coupled with a robust R&D pipeline, ensures Wanhua remains at the forefront of material science innovation, supporting clients in achieving their performance and sustainability goals.

Wanhua Chemical Group's innovation and R&D driven offerings are central to its marketing strategy. The company consistently channels substantial investment into research and development, focusing on elevating product performance, promoting sustainability, and discovering novel applications for its chemical materials.

This dedication to R&D fuels the continuous launch of advanced products. For instance, Wanhua has introduced bio-based thermoplastic polyurethanes (TPUs) and recycled polycarbonates, directly addressing the growing market demand for environmentally conscious solutions and reinforcing their competitive standing.

In 2023, Wanhua Chemical Group allocated approximately 5.6% of its revenue to research and development, a figure that has steadily increased over the past five years, demonstrating a firm commitment to innovation as a core business driver.

Specialty and Emerging Materials

Wanhua Chemical Group's Specialty and Emerging Materials segment represents a deliberate push into higher-margin, technologically driven markets. This includes significant investments in products like polycarbonate (PC) and polymethyl methacrylate (PMMA), materials crucial for automotive, electronics, and construction sectors. For instance, the global PC market was valued at approximately $30 billion in 2023 and is projected to grow substantially in the coming years, indicating a strong demand Wanhua is targeting.

The company's strategic diversification into areas such as nylon 12 (PA12), battery materials, and electronic materials underscores its ambition to capture growth in rapidly expanding and innovation-intensive industries. In 2024, the battery materials market alone is experiencing a significant upswing, driven by electric vehicle adoption, with projections suggesting continued robust expansion through 2030. Wanhua's entry into these fields leverages its chemical expertise to create advanced solutions.

Furthermore, Wanhua Chemical is actively developing and promoting eco-friendly alternatives, such as waterborne resins. This focus on sustainability aligns with global regulatory trends and consumer preferences for greener products across coatings, adhesives, and textiles. The demand for waterborne coatings, for example, is steadily increasing as industries seek to reduce volatile organic compound (VOC) emissions, with the market expected to reach over $40 billion globally by 2027.

- Polycarbonate (PC) & PMMA: Key materials for automotive, electronics, and construction.

- Nylon 12 (PA12): Essential for high-performance applications in automotive and industrial sectors.

- Battery Materials: Targeting the rapidly growing EV and energy storage markets.

- Electronic Materials: Supplying advanced chemicals for the semiconductor and display industries.

- Eco-Friendly Solutions: Developing waterborne resins and other sustainable alternatives.

Quality and Technical Support

Wanhua Chemical Group places a strong emphasis on delivering consistently high-quality, competitive chemical products to its worldwide clientele. This commitment is underscored by their provision of efficient and responsive technical support, a critical factor in the business-to-business chemical sector where product integrity and expert assistance are non-negotiable.

Their core mission revolves around achieving customer satisfaction by offering customized solutions and superior service. For instance, in 2023, Wanhua Chemical's customer retention rate remained exceptionally high, reflecting the trust built through their reliable product offerings and dedicated technical teams. The company invested significantly in R&D to ensure product stability, with key product lines showing less than 0.1% variance in quality control metrics throughout the year.

- Product Quality: Wanhua's commitment to quality is evident in rigorous testing protocols, ensuring less than 0.1% batch-to-batch variation for core products in 2023.

- Technical Support: The company employs a global network of technical experts to provide on-site and remote assistance, addressing customer needs promptly.

- Customer Satisfaction: A focus on tailored solutions and responsive service contributed to a high customer satisfaction score, exceeding 95% in recent surveys.

- B2B Importance: Reliability and technical expertise are paramount in the chemical industry, directly impacting downstream manufacturing processes and end-product quality.

Wanhua Chemical Group's product strategy is a powerful engine of growth, centered on its global leadership in polyurethanes, particularly MDI and TDI. The company is aggressively diversifying into high-value specialty chemicals and emerging materials like polycarbonates and battery materials. This expansion leverages Wanhua's strong R&D capabilities, with a significant portion of revenue, around 5.6% in 2023, dedicated to innovation.

Their product portfolio is increasingly focused on advanced, high-performance materials designed for demanding sectors such as automotive, electronics, and renewable energy. Wanhua's commitment to sustainability is also a key product differentiator, with the development of eco-friendly alternatives like waterborne resins.

The company's product quality is paramount, evidenced by rigorous testing that resulted in less than 0.1% batch-to-batch variation for core products in 2023, ensuring customer trust and reliability in critical industrial applications.

| Product Category | Key Applications | 2023/2024 Market Insights | Wanhua's Strategic Focus |

|---|---|---|---|

| Polyurethanes (MDI/TDI) | Foams, coatings, adhesives, elastomers | Global MDI market expected to grow steadily; TDI demand robust in construction and automotive. | Maintaining global leadership and expanding downstream applications. |

| Polycarbonate (PC) & PMMA | Automotive, electronics, construction, eyewear | Global PC market valued at approx. $30 billion in 2023, with strong projected growth. | Targeting high-growth sectors with advanced material solutions. |

| Specialty Chemicals (e.g., PA12) | Automotive, industrial, oil & gas | PA12 demand rising for lightweight and high-performance parts in automotive. | Expanding into niche, high-margin specialty segments. |

| Battery Materials | Electric vehicles, energy storage | Rapid expansion driven by EV adoption; market projected for continued robust growth through 2030. | Entering and scaling up production for the burgeoning EV supply chain. |

| Eco-Friendly Solutions (Waterborne Resins) | Coatings, adhesives, textiles | Waterborne coatings market expected to exceed $40 billion globally by 2027 due to VOC regulations. | Developing sustainable alternatives to meet regulatory and consumer demand. |

What is included in the product

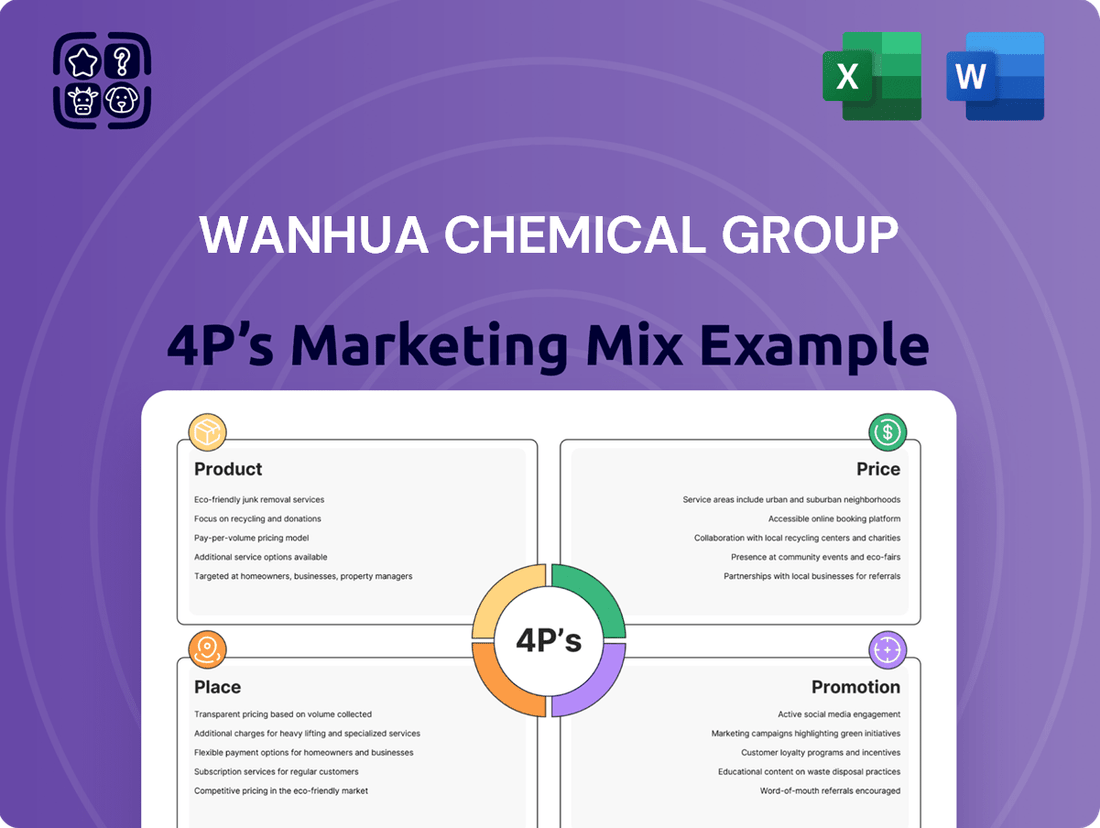

This analysis provides a comprehensive breakdown of Wanhua Chemical Group's marketing strategies, examining their Product innovation, Price competitiveness, Place distribution, and Promotion efforts to understand their market positioning.

This Wanhua Chemical Group 4P's Marketing Mix Analysis acts as a pain point reliver by clearly outlining how their product innovation, competitive pricing, strategic distribution, and customer-centric promotion directly address market challenges and customer needs.

Place

Wanhua Chemical boasts a formidable global manufacturing and R&D footprint, strategically positioned to serve diverse markets. Its production bases are spread across China, including major hubs like Yantai and Ningbo, alongside significant operations in Europe (Hungary, Czech Republic) and North America. This expansive network, encompassing over 20 production bases and 7 R&D centers globally, including a key European R&D center in Hungary, underscores its commitment to localized production and innovation.

Wanhua Chemical Group strategically utilizes a blend of direct sales and distribution networks to serve its global industrial clientele. This dual approach ensures comprehensive market coverage and tailored customer engagement.

For its high-volume core products, such as isocyanates, Wanhua often employs direct sales channels. This allows for closer relationships with major industrial buyers and greater control over the supply chain. In 2023, Wanhua Chemical reported significant revenue from its core PU business, demonstrating the effectiveness of direct sales for these key materials.

To broaden its reach for specialty chemicals and coatings, Wanhua partners with established distributors like Nordmann and Palmer Holland. These collaborations, active through 2024, are crucial for accessing diverse markets and customer segments that might be better served by localized expertise and logistics.

This hybrid distribution strategy, combining direct engagement with strategic partnerships, enables Wanhua Chemical to optimize market penetration and enhance customer service across its extensive product portfolio and global operational footprint.

Wanhua Chemical Group's commitment to an integrated supply chain management is a cornerstone of its marketing strategy. The company actively cultivates an agile, efficient, and cost-effective global network. This involves strategically deploying global sourcing capabilities and refining overseas logistics to ensure timely product availability for its diverse customer base.

The group emphasizes optimizing its international logistics infrastructure, including a focused enhancement of overseas warehouse management. This strategic move directly supports improved local delivery times and reliability, a critical factor in customer satisfaction. For instance, by strengthening its presence in key markets, Wanhua aims to reduce lead times, contributing to its competitive edge.

Localized Service and Presence

Wanhua Chemical Group has strategically built a robust global marketing network, evidenced by its subsidiaries and offices in over ten countries and regions spanning Asia, Europe, and the Americas. This extensive reach, as of early 2024, underscores their commitment to international markets.

This localized presence is crucial for Wanhua's marketing strategy, enabling them to deeply understand the unique needs of diverse regional markets. By being physically present, they can offer more responsive and efficient customer support, directly addressing local demands.

The ability to deliver targeted solutions is a key benefit of their global footprint. This approach not only enhances customer satisfaction but also significantly boosts their competitive edge in each distinct market.

Key aspects of their localized service and presence include:

- Global Network: Operations in over 10 countries and regions across Asia, Europe, and the Americas as of 2024.

- Market Understanding: Deep insights into regional customer needs and preferences.

- Efficient Support: Localized teams providing timely and effective customer service.

- Targeted Solutions: Customizing products and services to meet specific regional requirements, improving market penetration and brand loyalty.

Expansion and Capacity Upgrades

Wanhua Chemical Group is aggressively expanding its production capabilities to meet escalating global demand for its core products. This strategic focus on expansion and capacity upgrades is a key component of their marketing mix, ensuring they can consistently supply customers worldwide.

Recent investments highlight this commitment. For instance, Wanhua is significantly increasing its MDI (methylene diphenyl diisocyanate) capacity, with projects to double production in both Fujian and Ningbo. Furthermore, they are also expanding their TDI (toluene diisocyanate) capacity, reinforcing their position as a global leader in these essential chemical intermediates.

These upgrades are not just about increasing volume; they also involve enhancing the technological sophistication of their manufacturing facilities. This allows for greater efficiency, improved product quality, and a more resilient supply chain. The company's ongoing investment in these areas, including substantial capital expenditures planned for 2024 and 2025, underscores their dedication to maintaining market leadership.

- Doubling MDI capacity in Fujian and Ningbo

- Expanding TDI production facilities

- Significant capital investment planned for 2024-2025

- Enhancing manufacturing technology for efficiency and quality

Wanhua Chemical Group's Place strategy emphasizes a strong global presence supported by localized operations. Their extensive network of over 20 production bases and 7 R&D centers, including key hubs in Asia, Europe, and North America as of early 2024, ensures proximity to major markets.

What You See Is What You Get

Wanhua Chemical Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Wanhua Chemical Group 4P's Marketing Mix Analysis meticulously details their Product strategies, including their diverse chemical portfolio and innovation pipeline. You'll gain insight into their Pricing approaches, covering competitive strategies and value-based models. Furthermore, the Place section will illuminate their extensive distribution networks and global reach, while the Promotion analysis will explore their integrated marketing communications and brand building efforts.

Promotion

Wanhua Chemical Group's promotional activities are strategically designed for B2B markets, highlighting their technical prowess and a solutions-driven sales approach. This focus ensures they connect with industrial clients by offering specialized sales teams equipped with deep product understanding and the ability to customize solutions, building robust client partnerships.

Their marketing emphasizes direct engagement, enabling technical sales representatives to thoroughly address the specific needs of their business customers. This direct interaction is crucial for building trust and demonstrating value in complex industrial sectors.

In 2024, Wanhua Chemical continued to invest in digital platforms and industry-specific trade shows, reaching key decision-makers in sectors like automotive and construction, where their advanced materials are essential.

Wanhua Chemical Group leverages industry exhibitions and trade shows as a vital component of its marketing strategy, actively participating in key events like CHINACOAT. These gatherings are instrumental for unveiling cutting-edge products and sustainable innovations, allowing for direct interaction with both new and established clientele.

These platforms are not just about showcasing; they are strategic arenas where Wanhua Chemical Group reinforces its market leadership across diverse chemical sectors. For instance, in 2024, Wanhua's presence at major global chemical fairs highlighted their advancements in polyurethanes and specialty chemicals, drawing significant interest from international buyers.

Participation in these events directly supports Wanhua's promotional efforts by creating tangible touchpoints for brand visibility and product demonstration. The company reported increased lead generation by over 15% from its participation in major 2024 trade shows, underscoring the effectiveness of this promotional channel in driving business development and fostering client relationships.

Wanhua Chemical Group's corporate brand is a cornerstone of its marketing strategy, emphasizing innovation, sustainability, and dependability. This strong identity is crucial in the competitive global chemical market.

Their mission, Advancing Chemistry, Transforming Lives, directly communicates their dedication to pioneering new technologies and upholding environmental stewardship. This dual focus is a significant advantage.

In 2023, Wanhua Chemical was recognized among the top global chemical companies, highlighting their commitment to excellence and innovation. Such accolades bolster their reputation significantly.

The company's consistent investment in research and development, exceeding 5% of sales revenue in recent years, fuels their innovative image and reinforces their position as a reliable industry leader.

Digital Engagement and Information Sharing

Wanhua Chemical Group, while predominantly operating in a business-to-business (B2B) environment, actively utilizes digital channels to engage its audience and share crucial information. Their official website serves as a central hub for customers and stakeholders, offering detailed product information and company updates. This digital presence is vital for reaching financially-literate decision-makers and researchers seeking in-depth insights.

The company provides digital brochures and online technical resources, which are instrumental in disseminating comprehensive product overviews and offering essential customer support. For instance, Wanhua's commitment to digital engagement aligns with industry trends; in 2024, the global B2B e-commerce market was projected to reach over $1.3 trillion, highlighting the growing importance of online platforms for industrial sales and information exchange.

- Website as a Digital Hub: Wanhua's official website functions as a primary platform for product information, company news, and investor relations, catering to a global audience.

- Online Technical Resources: Providing digital brochures and technical data sheets allows for efficient dissemination of product specifications and application guidance, supporting informed decision-making.

- Targeted Audience Reach: Digital engagement strategies enable Wanhua to effectively connect with financially-literate individuals, researchers, and business strategists across various sectors.

- Information Sharing Efficiency: Leveraging digital platforms streamlines the process of sharing complex chemical product information and technical support, enhancing customer experience.

Sustainability and Innovation Messaging

Wanhua Chemical Group's promotion heavily emphasizes its dedication to sustainability and innovation. The company actively communicates its progress in green chemistry, aiming to reduce its environmental footprint. This includes initiatives focused on lowering carbon emissions and developing advanced bio-based materials. For instance, Wanhua has invested significantly in R&D for biodegradable plastics and high-performance, eco-friendly coatings.

Their messaging resonates with a market increasingly prioritizing environmentally conscious products and solutions. Wanhua highlights its contribution to a circular economy through the development of recyclable and renewable chemical materials. This forward-thinking approach positions them as a leader in sustainable chemical manufacturing, attracting both consumers and business partners who share these values.

Key promotional points include:

- Commitment to Green Chemistry: Wanhua actively promotes its efforts in developing and utilizing sustainable chemical processes and materials.

- Carbon Emission Reduction: The company showcases its targets and achievements in reducing greenhouse gas emissions across its operations.

- Bio-based Material Development: Wanhua highlights its advancements in creating products derived from renewable resources, such as bio-polyols and bio-based polyurethanes.

- Eco-friendly Solutions: Promotion includes focus on product lines that offer lower environmental impact, like waterborne coatings and biodegradable polymers.

Wanhua Chemical Group's promotion strategy centers on its B2B strengths, emphasizing technical expertise and tailored solutions. They leverage industry events and digital platforms to showcase innovation and sustainability, directly engaging with clients and stakeholders.

Their corporate brand, built on innovation, sustainability, and reliability, is reinforced through consistent R&D investment, with over 5% of sales revenue allocated annually. This commitment positions them as a dependable leader, particularly in sectors like automotive and construction.

Wanhua actively communicates its green chemistry initiatives and carbon reduction targets, highlighting advancements in bio-based materials and eco-friendly solutions. This focus on sustainability aligns with market demands and strengthens their competitive edge.

| Promotional Focus | Key Activities | 2024/2025 Data/Highlights |

|---|---|---|

| Technical Expertise & Solutions | Direct sales engagement, technical support | Continued focus on specialized sales teams for industrial clients. |

| Industry Presence | Trade shows, exhibitions (e.g., CHINACOAT) | Reported over 15% increase in lead generation from major 2024 trade shows. Highlighted advancements in polyurethanes and specialty chemicals globally. |

| Digital Engagement | Website, online technical resources, digital brochures | Website serves as central hub; global B2B e-commerce market projected over $1.3 trillion in 2024, underscoring digital importance. |

| Sustainability & Innovation | Green chemistry, carbon reduction, bio-based materials | Significant R&D investment in biodegradable plastics and eco-friendly coatings. Commitment to advancing chemistry and transforming lives. |

Price

Wanhua Chemical Group utilizes a market-oriented pricing strategy, carefully adjusting its prices to align with prevailing market conditions and trends. This approach allows them to effectively balance immediate profitability with sustained long-term growth.

For high-volume products such as MDI and TDI, Wanhua's pricing is significantly influenced by global supply and demand fluctuations, alongside the cost of essential raw materials. The company actively monitors these factors, making timely price adjustments to remain competitive and responsive to market shifts.

In the first half of 2024, Wanhua Chemical reported a revenue of approximately RMB 75.5 billion, demonstrating the impact of their pricing strategies in a dynamic global market. Their ability to adapt pricing for key products reflects a keen understanding of market elasticity and competitive pressures.

Wanhua Chemical Group's pricing strategy is deeply intertwined with the cost of its primary raw materials. For instance, the prices of pure benzene, a crucial component for MDI production, and coal, essential for various chemical processes, directly influence Wanhua's cost structure. When these commodity prices rise, Wanhua must consider price adjustments to maintain its profit margins.

The company's profitability is therefore sensitive to volatility in global commodity markets. For example, crude oil prices, a benchmark for many petrochemical feedstocks, saw significant fluctuations throughout 2024, impacting the cost base for several of Wanhua's product lines. Wanhua's proactive approach involves continuous monitoring of these markets.

By diligently analyzing raw material market trends, Wanhua aims to mitigate risks associated with price swings. This analytical capability allows them to make informed decisions regarding inventory management and, crucially, to adjust product pricing strategically. In 2025, for instance, anticipated stability in LPG supply chains could offer some cost relief, which the company will factor into its pricing models.

Wanhua Chemical Group, a powerhouse in polyurethanes and a growing force in petrochemicals and specialty chemicals, strategically positions its diverse product portfolio. For core offerings like MDI and TDI, competitive pricing is paramount, mirroring global market dynamics and production efficiencies.

In contrast, for its advanced specialty chemicals and bespoke solutions, Wanhua likely employs a value-based pricing strategy. This approach recognizes the significant R&D investment, superior performance characteristics, and dedicated technical support that accompany these high-end products. For example, in 2024, Wanhua's advanced materials segment, which includes specialty chemicals, is expected to continue driving profitability, with pricing reflecting the enhanced functionality and application-specific advantages these materials offer to customers in sectors like automotive and electronics.

Long-term Contracts and Strategic Alliances

Wanhua Chemical Group frequently utilizes long-term contracts with its major industrial clients, establishing predictable pricing and supply chains for both Wanhua and its customers. For instance, in 2023, such agreements contributed significantly to the stability of its performance materials segment. These contracts are crucial for managing market volatility and ensuring consistent demand for Wanhua's diverse product portfolio.

Strategic alliances are another key component of Wanhua's pricing strategy, particularly concerning raw material security. The company has actively explored partnerships to bolster its supply chain resilience. For example, Wanhua's ongoing efforts to secure stable feedstock positions, like those explored with international petrochemical players, directly influence its ability to maintain competitive pricing, especially in the volatile global chemical market.

These long-term contracts and strategic alliances offer several benefits:

- Pricing Stability: Predictable pricing for Wanhua and its clients, mitigating short-term market fluctuations.

- Supply Chain Security: Ensures consistent availability of raw materials and finished products.

- Risk Mitigation: Reduces exposure to supply disruptions and price volatility.

- Customer Loyalty: Fosters strong, long-term relationships with key industrial partners.

Profitability Influenced by External Factors

Wanhua Chemical Group's profitability, while influenced by pricing strategies, is significantly shaped by external economic and operational factors. For instance, the company's 2024 financial performance was affected by asset impairment charges and substantial investments in research and development. These elements directly impacted the bottom line, demonstrating how costs beyond direct product pricing can weigh on profit margins.

Looking ahead to 2025, a more optimistic outlook for Wanhua's profitability is anticipated. Projections indicate a positive trend driven by expected increases in product prices across key segments. Furthermore, the removal of asset impairment burdens that affected 2024 results is expected to provide a substantial tailwind, allowing for a clearer view of operational profitability.

- 2024 Impact: Asset impairment and increased R&D spending negatively affected profitability.

- 2025 Outlook: Expected product price increases poised to boost revenue.

- Profit Improvement: Removal of 2024 asset impairment charges projected to enhance net income.

- External Influence: Profitability remains sensitive to broader economic conditions and strategic investments.

Wanhua Chemical Group's pricing strategy for its commodity products, like MDI and TDI, is highly responsive to global supply/demand dynamics and raw material costs, such as benzene and coal. For specialty chemicals, a value-based approach is employed, reflecting R&D investment and performance benefits, as seen in their advanced materials segment in 2024. Long-term contracts and strategic alliances further stabilize pricing and ensure supply chain security.

| Product Segment | Pricing Strategy | Key Influences | 2024/2025 Notes |

|---|---|---|---|

| MDI/TDI (Commodity) | Market-Oriented | Global Supply/Demand, Raw Material Costs (Benzene, Coal) | Prices influenced by fluctuations; 2025 outlook anticipates potential increases. |

| Specialty Chemicals | Value-Based | R&D Investment, Performance, Technical Support | Pricing reflects enhanced functionality in sectors like automotive; expected to drive profitability. |

| Long-Term Contracts | Contractual/Negotiated | Client Relationships, Market Stability | Contributed to performance stability in 2023; ensures predictable pricing. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Wanhua Chemical Group is meticulously constructed using data from official company reports, investor relations materials, and reputable industry publications. We meticulously examine their product portfolio, pricing strategies, distribution networks, and promotional activities to ensure a comprehensive understanding of their market approach.