Wanhua Chemical Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wanhua Chemical Group Bundle

Wanhua Chemical Group navigates a landscape shaped by intense rivalry and significant buyer power, particularly in its core polyurethane markets. The threat of new entrants, while present, is somewhat mitigated by high capital requirements and established technological expertise. Supplier power, especially for key raw materials, presents a notable challenge that Wanhua must strategically manage.

The threat of substitutes, though evolving, remains a constant pressure, demanding continuous innovation and product development from Wanhua. Understanding these forces is crucial for any stakeholder looking to grasp Wanhua's competitive environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Wanhua Chemical Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Wanhua Chemical Group's reliance on specific raw materials, including MDI and TDI precursors, alongside petrochemical feedstocks like LPG, ethylene, propylene, and benzene, makes supplier concentration a critical factor. When a few dominant suppliers control these essential inputs, or if their availability is limited, they wield considerable bargaining power over Wanhua. This was underscored by Wanhua Chemical's Q1 2025 report, which highlighted significant volatility in raw material costs, directly reflecting the influence suppliers can exert.

Switching suppliers for critical chemical feedstocks presents a significant challenge for Wanhua Chemical. The process involves extensive re-qualification of materials to ensure they meet stringent quality standards, often requiring new testing and certification procedures. Additionally, changes in suppliers necessitate adjustments to logistical networks, including transportation, storage, and inventory management, which can incur upfront costs and require lead time.

These complexities translate into substantial switching costs, thereby empowering Wanhua Chemical's existing suppliers. For instance, a shift away from a key supplier of methylene diphenyl diisocyanate (MDI) precursors could involve months of validation and potential production downtime. These high switching costs make it economically unfeasible for Wanhua to readily switch to alternative suppliers even if faced with unfavorable pricing or contract terms, thus solidifying the bargaining power of their current feedstock providers.

The uniqueness of inputs significantly influences supplier bargaining power. For highly specialized chemical inputs or proprietary catalysts, suppliers can wield substantial power if alternatives are scarce. Wanhua Chemical, despite its scale in MDI and TDI, depends on upstream raw materials for its broad product range.

Wanhua's strategic partnerships, such as its agreement with ADNOC and Borealis for a specialty polyolefin facility, underscore the critical nature of securing specific feedstocks. This collaboration aims to ensure a stable supply of unique inputs, thereby mitigating potential supplier leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by Wanhua Chemical's suppliers can significantly bolster their bargaining power. If suppliers possess the capability and inclination to move into Wanhua's core operations, such as manufacturing polyurethane or specialized chemical products, they can exert greater pressure on Wanhua's pricing and terms. This potential competition necessitates Wanhua maintaining strong supplier relationships and offering competitive agreements to deter them from becoming direct rivals.

Consider the implications for Wanhua Chemical Group in 2024. Suppliers in key raw material segments, like methanol or propylene, which are fundamental to polyurethane production, might explore vertical integration if profit margins in their current operations are squeezed. For instance, a major methanol producer could invest in downstream processing to create MDI or TDI, directly competing with Wanhua. This strategic move by a supplier would directly alter the competitive landscape, increasing their leverage.

- Supplier Capability: Assess if key suppliers have the financial resources and technical expertise to replicate Wanhua's production processes.

- Market Attractiveness: Evaluate the profitability and growth potential of Wanhua's downstream markets from a supplier's perspective.

- Wanhua's Reliance: Understand Wanhua's dependence on specific suppliers for critical raw materials.

- Supplier Incentives: Identify if suppliers are actively seeking new revenue streams or market share expansion.

Importance of Wanhua Chemical to Suppliers

Wanhua Chemical's immense global scale positions it as a critical customer for numerous raw material providers. For many suppliers, Wanhua represents a significant chunk of their revenue, meaning a loss of Wanhua's business could be a substantial financial setback. This dependence can therefore weaken a supplier's bargaining power.

However, the impact on supplier bargaining power varies. For highly commoditized inputs, where many suppliers can offer similar products, Wanhua's leverage may be less pronounced. In 2023, Wanhua Chemical Group reported total revenue of approximately 172.5 billion RMB (around $24 billion USD), highlighting its purchasing might.

- Significant Customer Base: Wanhua's substantial purchasing volume makes it a key client for many raw material suppliers, potentially reducing their ability to dictate terms.

- Dependence Reduction for Suppliers: While Wanhua is large, suppliers who can diversify their customer base or cater to niche markets may retain stronger bargaining power.

- Commoditization Effect: For widely available, undifferentiated raw materials, Wanhua can more easily switch suppliers, diminishing individual supplier leverage.

- 2023 Revenue Context: Wanhua's 2023 revenue of 172.5 billion RMB underscores its significant purchasing power across its supply chain.

Suppliers of critical chemical feedstocks for Wanhua Chemical, such as those providing MDI and TDI precursors, possess considerable bargaining power due to the high switching costs involved for Wanhua. These costs stem from the rigorous re-qualification processes, logistical adjustments, and potential production disruptions associated with changing suppliers. The uniqueness of certain specialized inputs further solidifies supplier leverage, as viable alternatives are often scarce, leaving Wanhua reliant on existing providers.

The threat of forward integration by suppliers into Wanhua's core business operations also amplifies their bargaining power. For example, in 2024, a major methanol producer could potentially invest in downstream processing to manufacture MDI or TDI, directly competing with Wanhua and increasing their leverage over raw material pricing and terms. This strategic consideration necessitates Wanhua maintaining strong supplier relationships and offering competitive agreements to mitigate this risk.

| Factor | Impact on Supplier Bargaining Power | Relevance to Wanhua Chemical |

|---|---|---|

| Switching Costs | High | Significant for critical feedstocks like MDI precursors, making it difficult for Wanhua to switch easily. |

| Input Uniqueness | High | Suppliers of specialized catalysts or proprietary chemicals hold strong power due to limited alternatives. |

| Forward Integration Threat | High | Suppliers investing in downstream production can become direct competitors, increasing their leverage. |

| Supplier Dependence on Wanhua | Low to Moderate | While Wanhua is a large customer (2023 revenue ~ $24 billion USD), suppliers with diversified customer bases retain some power. |

What is included in the product

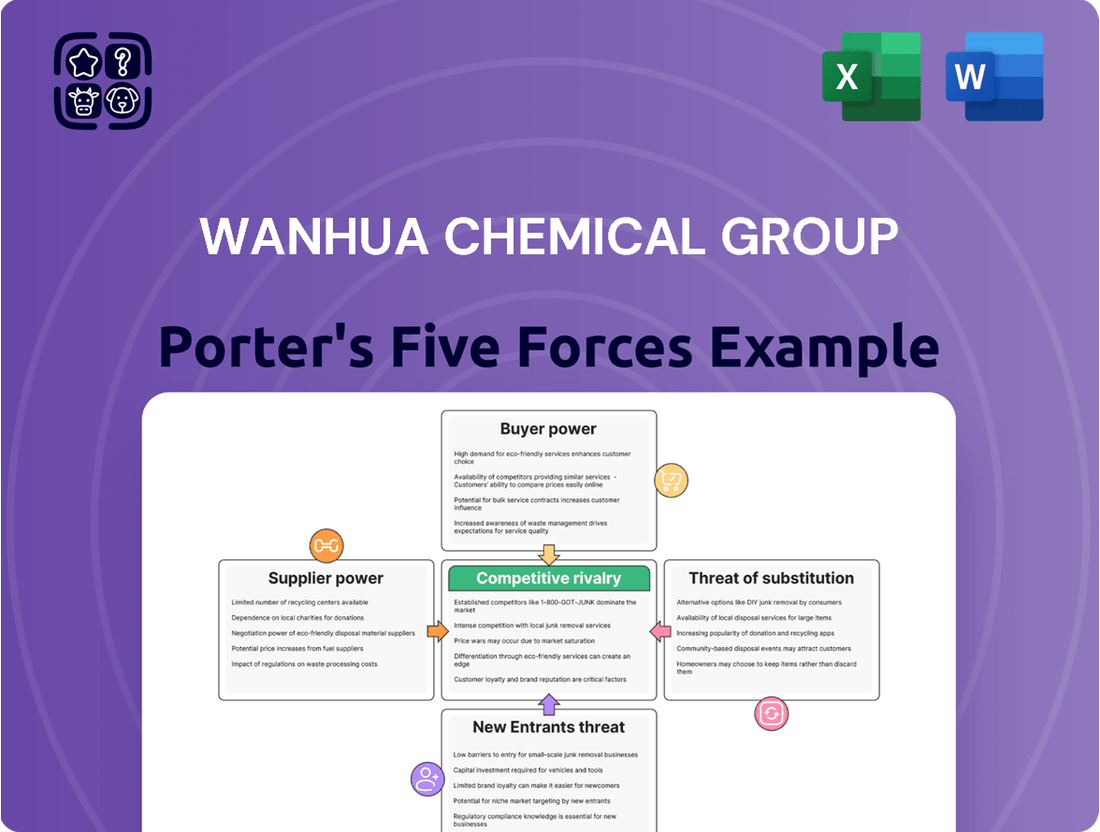

Wanhua Chemical Group's Porter's Five Forces analysis reveals the intense industry rivalry and the significant bargaining power of buyers, while also highlighting moderate threats from new entrants and substitutes, and a strong bargaining power of suppliers due to specialized raw materials.

Understand Wanhua Chemical Group's competitive landscape with an intuitive Porter's Five Forces analysis, instantly highlighting potential threats and opportunities to inform strategic responses.

Customers Bargaining Power

Wanhua Chemical's diverse customer base across construction, automotive, home appliances, and textiles generally dilutes customer concentration. This broad reach means no single customer typically holds excessive sway over pricing or terms.

However, within specialized, high-volume segments, a few major industrial clients could emerge as significant buyers. For instance, a large automotive manufacturer purchasing substantial quantities of specific polyurethane raw materials might negotiate more aggressively, leveraging their order size for better pricing or customized supply agreements.

In 2024, Wanhua Chemical reported that its top ten customers accounted for approximately 25% of its total revenue, indicating a moderate level of customer concentration. This figure suggests that while individual customers are important, the majority of sales are distributed across a wider network.

The bargaining power of these larger customers is further influenced by the availability of substitute products and the switching costs involved. If alternative suppliers can readily meet specific chemical requirements, customers gain leverage to demand concessions from Wanhua Chemical.

For Wanhua Chemical's customers, especially manufacturers relying on key inputs like MDI, the cost and complexity of switching suppliers are substantial. These costs can encompass reconfiguring production lines, rigorous quality assurance testing, and obtaining necessary regulatory approvals, all of which represent significant hurdles. This effectively entrenches Wanhua's position, as customers face considerable disruption and expense to move elsewhere.

Wanhua Chemical actively reduces customer bargaining power through significant product differentiation. By focusing on innovation, the company offers specialized solutions, such as high-performance and eco-friendly products, including bio-based polyols. This strategic approach transforms products from mere commodities into valued, specialized offerings.

This differentiation directly impacts customer price sensitivity. When customers perceive Wanhua's products as unique and offering distinct advantages, their ability to demand lower prices diminishes. The emphasis on advanced materials and sustainable solutions further solidifies this position, making customers less inclined to switch based on price alone.

Threat of Backward Integration by Customers

The bargaining power of customers is a key consideration for Wanhua Chemical. A significant threat arises from the potential for customers to integrate backward, meaning they could start producing the chemicals Wanhua supplies themselves. This is particularly relevant for large-scale customers in industries like automotive or construction, who might consider manufacturing certain basic chemical inputs if it proves economically or strategically advantageous. For instance, a major automotive manufacturer might evaluate producing specific polyurethane precursors if the volume is substantial enough to justify the investment and technical challenges.

While the complexity of products like MDI (methylene diphenyl diisocyanate) makes direct backward integration by most customers less feasible, the sheer scale of some end-users can still exert considerable leverage. For example, in 2023, global automotive production reached approximately 80 million vehicles, representing a massive potential customer base. Should a significant portion of these manufacturers collectively deem backward integration for certain chemical components a viable strategy, it could significantly impact Wanhua Chemical's market position and pricing power.

- Customer Scale: Large automotive and construction firms represent substantial buyers, potentially justifying the resources for backward integration.

- Technical Expertise: Advancements in chemical process technology can lower the barrier to entry for sophisticated customers.

- Product Complexity: While MDI is complex, some basic chemical inputs used in Wanhua's value chain might be more amenable to in-house production by large customers.

- Market Dynamics: Fluctuations in raw material costs and end-product demand can influence a customer's decision to explore vertical integration.

Price Sensitivity of Customers

Customers in sectors such as construction and automotive, known for their intense competition, often exhibit significant price sensitivity, particularly when purchasing more standardized chemical products. This sensitivity is amplified during periods of economic slowdown or when the chemical industry experiences overcapacity, a situation observed in 2024 and anticipated to continue into 2025, directly impacting Wanhua Chemical's profit margins.

The bargaining power of customers is a crucial factor for Wanhua Chemical, especially given the price-sensitive nature of its end markets.

- Price Sensitivity in Key Industries: Industries like automotive and construction are highly competitive, leading customers to seek the lowest possible prices for chemical inputs, especially for commoditized products.

- Impact of Economic Conditions: Economic downturns and industry overcapacity, as seen in 2024, increase customer price sensitivity, putting pressure on Wanhua Chemical's pricing power and profitability.

- Commoditization of Products: For many of Wanhua Chemical's products that are considered commodities, customers have numerous alternative suppliers, further strengthening their bargaining position.

- Global Supply Chain Dynamics: Fluctuations in global supply and demand, coupled with regional oversupply in 2024, empower customers by providing more options and leverage in price negotiations.

Wanhua Chemical's customer base is diverse, generally limiting the power of any single buyer. However, large industrial clients in high-volume segments, such as automotive manufacturers, can exert significant influence through their order sizes, potentially negotiating better pricing or customized supply terms.

The company's top ten customers represented approximately 25% of its revenue in 2024, indicating moderate customer concentration. This means that while individual customer relationships are important, the majority of sales are distributed, mitigating the risk of any single customer dictating terms.

Customers face substantial switching costs due to the complexity of Wanhua's products and the need for retooling and regulatory approvals, which helps to limit their bargaining power.

Wanhua Chemical counteracts customer bargaining power through product differentiation, focusing on innovation and specialized solutions like bio-based polyols, making customers less sensitive to price alone.

| Customer Factor | Impact on Wanhua Chemical | Supporting Data/Observation (as of 2024/early 2025) |

| Customer Concentration | Moderate; limits individual customer leverage. | Top 10 customers accounted for ~25% of revenue in 2024. |

| Price Sensitivity | High in commoditized segments, especially during economic slowdowns or overcapacity. | Observed in 2024 due to industry overcapacity. |

| Switching Costs | High for specialized products, reducing customer power. | Involves retooling, quality testing, and regulatory approvals. |

| Backward Integration Potential | Low for complex products (e.g., MDI), but possible for basic inputs by very large customers. | Global automotive production ~80 million vehicles in 2023. |

Preview the Actual Deliverable

Wanhua Chemical Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders, providing a comprehensive Porter's Five Forces analysis for Wanhua Chemical Group. The document details the intensity of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, all crucial for understanding Wanhua's market position. You'll gain insights into how these forces shape Wanhua's strategic landscape and profitability within the global chemical industry. The analysis is meticulously researched and presented, offering actionable intelligence for strategic decision-making.

Rivalry Among Competitors

Wanhua Chemical operates in intensely competitive global arenas, notably in polyurethanes, petrochemicals, and specialty chemicals. Major multinational corporations such as Covestro, BASF, Dow Chemical, Huntsman, and Evonik are consistent rivals.

The sheer scale of competition is underscored by the presence of over 400 active competitors across its various market segments. This high number signifies a fragmented and dynamic market where differentiation and efficiency are paramount for sustained success.

The chemical industry's growth, while generally moderate for 2024-2025, is uneven. Overcapacity in key areas such as petrochemicals and specific polyurethane precursors like TDI is a significant factor. This oversupply directly translates into heightened pricing pressure across the market.

Companies are consequently finding themselves in a more competitive environment. The slower overall growth, coupled with the excess production capacity, forces businesses to aggressively pursue market share. This dynamic intensifies the rivalry among industry players as they battle for existing demand.

Wanhua Chemical Group aggressively pursues product differentiation through substantial R&D investments. Their focus on advanced materials like high-performance engineering plastics, biodegradable options, electronic chemicals, and bio-based alternatives aims to carve out unique market positions and escape pure price competition. This innovation drive is crucial, as competitors are also actively developing new products, creating a dynamic environment where staying ahead requires continuous technological advancement.

High Exit Barriers

Wanhua Chemical Group operates within an industry where substantial capital expenditure for plants and infrastructure creates formidable exit barriers. These high fixed costs compel companies to persevere through periods of reduced profitability rather than cease operations, thereby intensifying competition, particularly when market supply exceeds demand.

The chemical sector's nature, requiring massive upfront investment in specialized facilities, means that exiting the market is incredibly costly. Companies often face significant write-offs on specialized equipment and unamortized assets, making it economically unfeasible to simply shut down. This sticky situation keeps many players in the game, even when conditions are challenging.

- High Capital Intensity: The chemical industry demands enormous investments in manufacturing plants, research and development, and distribution networks. For example, building a new world-scale petrochemical complex can cost billions of dollars.

- Specialized Assets: Much of the infrastructure in the chemical industry is highly specialized and cannot be easily repurposed or sold, leading to significant asset impairment if a company attempts to exit.

- Sustained Competition: Due to these high exit barriers, companies are incentivized to continue production even at low margins to recover some of their fixed costs, leading to prolonged periods of intense price competition.

- Impact on Profitability: This dynamic can suppress overall industry profitability, as companies fight to maintain market share and cover their substantial fixed costs, especially during economic downturns or periods of overcapacity.

Cost Structure and Capacity Utilization

Wanhua Chemical's integrated production strategy, marked by ongoing capacity expansions in areas like MDI and petrochemicals, is designed to leverage economies of scale. This approach aims to secure cost advantages and improve efficiency. For instance, Wanhua's significant investments in its Yantai industrial park have bolstered its production capabilities.

Despite these efforts, the broader chemical industry, especially with substantial capacity increases from China, often faces issues of overcapacity. This can result in lower capacity utilization rates across the sector. In 2023, while specific utilization rates for Wanhua vary by product line, the general market trend indicated pressure on factory utilization due to increased supply. This oversupply intensifies price competition, directly impacting profitability for all players.

- Integrated Production: Wanhua Chemical benefits from an integrated production model, allowing for cost efficiencies and better control over its supply chain.

- Capacity Expansions: Continuous investment in capacity upgrades, such as MDI and petrochemical projects, aims to achieve greater economies of scale.

- Industry Overcapacity: Significant capacity additions from China and globally can lead to industry-wide overcapacity.

- Price Competition: Overcapacity often translates to lower capacity utilization and heightened price competition, squeezing profit margins across the chemical sector.

Wanhua Chemical faces intense rivalry from global giants like Covestro, BASF, and Dow Chemical, compounded by over 400 competitors across its product lines. The industry's moderate growth projections for 2024-2025, coupled with significant overcapacity in segments like petrochemicals and TDI, fuel aggressive pricing strategies.

Wanhua's strategy of product differentiation through R&D in advanced materials, such as biodegradable plastics and electronic chemicals, is a key tactic to escape pure price wars. However, competitors are also innovating, making continuous technological advancement essential for market position.

High capital intensity and specialized assets create substantial exit barriers, forcing companies to maintain production even during low-profitability periods, which sustains competitive pressure. This means companies like Wanhua must constantly optimize operations and innovate to remain competitive.

| Competitor | Key Segments | 2023 Revenue (Approx. USD Bn) |

|---|---|---|

| Covestro | Polyurethanes, Polycarbonates | 15.9 |

| BASF | Diversified Chemicals, Petrochemicals | 72.7 |

| Dow Chemical | Performance Materials, Petrochemicals | 40.7 |

| Huntsman | Polyurethanes, Performance Products | 6.0 |

| Evonik | Specialty Chemicals | 17.1 |

SSubstitutes Threaten

Wanhua Chemical's core polyurethane products like MDI and TDI face competition from alternative materials in various sectors. For example, in the construction industry, traditional materials such as wood and metal can serve as substitutes for polyurethane in insulation or structural components, though often with trade-offs in performance or cost-efficiency. In 2024, the global market for wood products used in construction was valued at approximately $600 billion, indicating a significant existing alternative base.

Similarly, the automotive sector sees potential substitution from other plastics, rubber, and even advanced composites for polyurethane applications in interior parts, seating, and coatings. These alternatives may offer different durability, weight, or aesthetic qualities. The automotive plastics market alone was projected to exceed $100 billion in 2024, highlighting the substantial competitive landscape Wanhua operates within.

The threat of substitutes for Wanhua Chemical Group's products hinges on how well these alternatives can match or exceed current performance while remaining cost-competitive. For instance, while bio-based polyols are gaining traction as eco-friendly options, their widespread adoption by consumers is directly tied to their price point relative to traditional petroleum-based materials and the market’s willingness to absorb any green premium. In 2024, the fluctuating costs of crude oil and increasing consumer demand for sustainable products continue to shape this trade-off, making the price-performance balance of substitutes a critical factor.

Customer willingness to switch from Wanhua Chemical's products hinges on how easily alternative materials can be adopted, along with any regulatory pushes towards greener options. For instance, in 2024, governmental incentives for adopting bio-based plastics in packaging could encourage a shift away from traditional petrochemical derivatives.

While polyurethanes, a key area for Wanhua, offer significant performance benefits in demanding sectors like automotive and construction – think improved insulation and durability – these advantages can sometimes offset the allure of simpler substitutes. However, rapid advancements in material science, particularly in areas like advanced composites or novel polymers, pose a potential threat by offering comparable or superior performance at competitive price points.

Technological Advancements in Substitutes

Technological advancements continuously fuel the development of superior substitute materials, directly impacting Wanhua Chemical Group's core markets. Ongoing research in material science, particularly in areas like advanced composites and bio-based polymers, presents a significant threat. For instance, breakthroughs in lightweight, high-strength materials could displace polyurethanes in automotive and construction sectors, where Wanhua holds substantial market share.

The threat is amplified by the pace of innovation. Consider the growing interest in sustainable alternatives; developments in recycled or biodegradable plastics could erode demand for traditional petrochemical-based polymers. In 2024, the global market for sustainable plastics saw significant growth, with projections indicating continued expansion, directly challenging established players like Wanhua.

Key areas of concern for Wanhua include:

- Development of High-Performance Bio-Polymers: Innovations in plant-based or microbial-derived polymers offer comparable or superior properties to traditional plastics, potentially impacting Wanhua's polymer sales.

- Advancements in Recycled Material Technology: Improved chemical and mechanical recycling processes can yield high-quality recycled materials, making them more competitive substitutes for virgin polymers.

- Emergence of Novel Insulation Materials: The construction sector, a major consumer of polyurethane foams, is seeing the rise of advanced insulation materials like aerogels and vacuum insulated panels, offering superior thermal performance.

- Growth in Composite Materials: Lightweight and durable composite materials, often derived from different chemical bases, are increasingly substituting traditional materials in industries like aerospace and automotive, where polyurethanes are also used.

Regulatory and Environmental Pressures

Increasingly stringent environmental regulations worldwide are a significant threat, pushing industries towards greener alternatives. For Wanhua Chemical, this translates into a growing demand for bio-based or recycled materials. If Wanhua cannot adequately meet this demand, customers may turn to substitute materials sourced from competitors who are more aligned with sustainability goals.

The global push for sustainability is accelerating the adoption of eco-friendly substitutes. For instance, by 2024, many regions are expected to have stricter mandates on plastic waste and emissions, favoring materials with lower carbon footprints. This presents a direct challenge to traditional chemical products if Wanhua Chemical Group doesn't innovate in sustainable material development.

- Growing Demand for Bio-based Materials: The market for bio-based chemicals and plastics is projected to grow significantly, with some reports indicating a compound annual growth rate (CAGR) exceeding 10% in the coming years.

- Recycled Content Mandates: Several countries and blocs, including the European Union, are implementing or strengthening mandates for the use of recycled content in various products, impacting demand for virgin plastics.

- Customer Preference Shift: Consumer and business preference is increasingly tilting towards products with demonstrable environmental benefits, creating pressure on Wanhua Chemical to offer sustainable solutions.

- Competitor Innovation in Green Chemistry: Competitors are actively investing in research and development for biodegradable polymers and recycled feedstocks, posing a direct substitution risk if Wanhua's product portfolio lags.

The threat of substitutes for Wanhua Chemical's products is moderate but growing, driven by material science advancements and environmental pressures. While Wanhua's core polyurethane products offer strong performance, alternatives in construction and automotive sectors are gaining traction. For example, the global wood products market, a substitute in construction, was valued around $600 billion in 2024, showcasing the scale of existing alternatives.

The automotive plastics market, another area where substitutes compete, was projected to exceed $100 billion in 2024. This highlights the significant competitive landscape driven by alternative materials offering different properties like weight, durability, and aesthetics. The balance between performance and cost-competitiveness is key, especially as bio-based materials gain interest, with their adoption dependent on price relative to traditional options.

Technological innovation is a primary driver, with advancements in bio-polymers and recycled materials posing a direct challenge. The global sustainable plastics market experienced considerable growth in 2024, indicating a trend that could erode demand for traditional petrochemical-based polymers. Strict environmental regulations are further accelerating the shift towards greener alternatives, making Wanhua's ability to innovate in sustainable solutions critical.

| Substitute Area | Example Material | Market Size (Approx. 2024) | Key Driver |

|---|---|---|---|

| Construction Insulation | Wood, Metal, Aerogels | Wood Products: ~$600 billion | Cost, Performance, Sustainability |

| Automotive Components | Other Plastics, Rubber, Composites | Automotive Plastics: >$100 billion | Weight Reduction, Durability, Cost |

| Packaging | Bio-based Plastics, Recycled Plastics | Sustainable Plastics Market: Growing Rapidly | Environmental Regulations, Consumer Preference |

Entrants Threaten

The chemical industry, especially for producing key materials like MDI and TDI, demands colossal upfront investment. Think billions for state-of-the-art plants, specialized machinery, and the necessary infrastructure. Wanhua Chemical’s significant asset base, valued in the tens of billions of dollars and continually expanding with new capacity projects, clearly illustrates this substantial barrier to entry.

Wanhua Chemical Group leverages substantial economies of scale, a significant barrier for new entrants. In 2023, Wanhua’s integrated production facilities, particularly for MDI and TDI, allowed for highly efficient manufacturing processes, directly translating to lower per-unit production costs. For instance, their large-scale ethylene cracker operations in Yantai provide a cost advantage in raw material sourcing compared to smaller, less integrated competitors.

Achieving comparable cost efficiencies would necessitate massive upfront investment from any new player, making it difficult to compete on price. This scale advantage extends to procurement, where Wanhua’s purchasing power for key feedstocks like benzene and propylene results in more favorable pricing. This cost disparity creates an immediate competitive hurdle for newcomers aiming to enter the polyurethanes market.

Wanhua Chemical Group's significant investment in research and development, evidenced by its extensive portfolio of invention patents, creates a substantial barrier against new entrants. The company’s focus on advanced materials and proprietary processes necessitates that potential competitors possess or acquire highly specialized knowledge and technological capabilities, making market entry challenging.

In 2023, Wanhua Chemical reported R&D expenditure of 4.2 billion RMB, underscoring its commitment to innovation. This continuous drive for technological advancement, particularly in high-growth areas like new energy materials and biodegradable plastics, requires immense capital and expertise to replicate.

Access to Distribution Channels

Newcomers face a significant hurdle in establishing extensive and dependable distribution networks capable of serving a wide array of industries worldwide. Wanhua Chemical Group leverages its established global sales and service infrastructure, complemented by research and development centers in Europe and the United States. This robust network offers a distinct competitive advantage that is exceptionally difficult for nascent competitors to swiftly replicate.

Wanhua Chemical's strategic investments in building and maintaining these intricate supply chains present a formidable barrier. For instance, the company's global presence allows it to efficiently deliver its diverse product portfolio, ranging from polyurethanes to petrochemicals, to customers across numerous sectors. This logistical mastery is not easily acquired.

- Established Global Reach: Wanhua Chemical operates in over 100 countries, demonstrating a vast and integrated distribution system.

- R&D Hubs as Distribution Enablers: The presence of R&D centers in key regions like Europe and the US not only fosters innovation but also strengthens local distribution and customer support capabilities.

- Logistical Complexity: The chemical industry requires specialized handling and transportation, making the development of compliant and efficient distribution channels a major capital and operational expenditure for new entrants.

Regulatory Hurdles and Environmental Compliance

The chemical sector faces substantial regulatory challenges, particularly concerning environmental, health, and safety standards. These requirements necessitate significant capital outlays for compliance infrastructure and operational permits.

For instance, in 2024, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to impose rigorous data submission and risk assessment requirements, adding complexity and cost for any new chemical producer aiming to enter the market.

Navigating these intricate regulatory frameworks, which often include lengthy approval processes for new facilities and products, presents a considerable and costly barrier to entry for potential competitors looking to establish a foothold.

- Stringent Environmental Regulations: Chemical companies must adhere to strict rules on emissions, waste disposal, and chemical handling.

- Health and Safety Standards: Compliance with worker safety regulations and product safety standards requires ongoing investment.

- Permitting and Licensing: Obtaining necessary permits for operations and product registration can be a lengthy and expensive process.

- Global Variations: Different countries have unique regulatory landscapes, increasing the complexity for international market entry.

The threat of new entrants for Wanhua Chemical Group is generally low, primarily due to the significant capital requirements for establishing production facilities and the extensive R&D needed to compete. New players would need billions to build plants comparable to Wanhua's integrated operations, a hurdle many cannot overcome.

Wanhua's established economies of scale and proprietary technologies further deter new entrants. For example, their 2023 R&D spending of 4.2 billion RMB highlights the continuous investment required to maintain a competitive edge in specialized chemical production.

The company's robust global distribution network and strict adherence to evolving environmental regulations, such as the EU's REACH in 2024, add further layers of complexity and cost for any potential competitor seeking to enter the market.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Wanhua Chemical Group is built upon a robust foundation of data, including their annual reports, investor presentations, and SEC filings. We supplement this with insights from reputable industry research firms and macroeconomic data sources to provide a comprehensive view of the competitive landscape.