Wabag SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wabag Bundle

Wabag's strong presence in water treatment and wastewater management presents significant opportunities for growth, especially with increasing global demand for sustainable solutions. Their technological expertise and established project execution capabilities are key strengths, positioning them well in a competitive market. However, understanding the nuances of their operational efficiencies and potential market saturation requires a deeper dive.

Want the full story behind Wabag's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

VA Tech Wabag's technological prowess is a significant strength, positioning it as a frontrunner in water treatment. The company boasts an impressive portfolio of over 125 intellectual property rights, a testament to its commitment to developing proprietary solutions. This deep well of innovation is further reinforced by its three dedicated global R&D centers, driving the creation of advanced water management technologies.

The company’s strategic investment in cutting-edge technologies, such as IoT and AI-driven water management systems, directly addresses the evolving and complex needs of the global water sector. This forward-thinking approach ensures Wabag remains at the forefront of the industry, capable of delivering sophisticated and efficient solutions for diverse water challenges.

Wabag's comprehensive service portfolio is a major strength, covering the entire water cycle from initial planning and design through to construction and ongoing operation. This includes specialized areas like desalination, water reuse, and sludge treatment, offering clients a complete end-to-end solution.

The company's significant global presence is another key advantage, with operations spanning over 25 countries. This extensive reach is backed by a robust track record of successfully executing more than 1,500 projects globally, underscoring their capability to manage diverse and large-scale water infrastructure developments.

Specifically, Wabag's experience includes the completion of over 450 sewage treatment plants and more than 320 water treatment plants. This extensive project history demonstrates deep technical expertise and a proven ability to deliver critical water solutions across various geographies and project types.

VA Tech Wabag boasts a significantly robust and well-diversified order book, offering exceptional revenue visibility for the foreseeable future. As of the close of March 2025, the company's order book had swelled to an impressive Rs 125 billion. This substantial backlog translates directly into over three years of secured revenue, demonstrating remarkable stability and a clear path for growth.

Focus on High-Margin O&M and Industrial Projects

Wabag is strategically shifting its focus towards the Operation and Maintenance (O&M) segment, a move designed to bolster profitability. This segment historically offers healthier profit margins when contrasted with the more capital-intensive Engineering, Procurement, and Construction (EPC) projects. By prioritizing O&M, Wabag aims to secure a more stable and higher-margin revenue stream.

The company is also actively pursuing international industrial projects, which are anticipated to further enhance its operating margins. For example, in fiscal year 2023-24, Wabag's order book saw a significant contribution from its O&M segment, indicating a successful execution of this strategy. This focus on higher-margin work is crucial for improving overall profitability and financial resilience.

- Focus on O&M: Wabag is increasing its share in the O&M business, which offers better margins than EPC.

- International Industrial Projects: The company is targeting international industrial orders, also expected to boost profitability.

- Improved Profitability: This strategic shift is aimed at driving higher operating margins and overall financial performance.

- FY23-24 Order Book: O&M projects contributed significantly to Wabag's order intake during the fiscal year 2023-24.

Strong Financial Performance and Asset-Light Model

VA Tech Wabag has showcased robust financial health, characterized by consistent positive cash flows and a prudent approach to debt. As of the fiscal year ending March 2024, the company maintained a net cash position, underscoring its efficient financial management and ability to generate surplus funds. This financial strength provides a solid foundation for future growth and operational stability.

The company's strategic adoption of an asset-light model is a significant strength. By collaborating with financial, construction, and technology partners, Wabag minimizes its direct capital expenditure requirements. This approach allows for greater financial flexibility, enabling the company to undertake a larger number of projects without being constrained by substantial upfront investments in physical assets.

- Consistent Cash Flow Positivity: Wabag has a proven track record of generating positive cash flows, which is crucial for sustainable operations and reinvestment.

- Efficient Debt Management: Maintaining a net cash position indicates effective control over liabilities and a healthy balance sheet.

- Asset-Light Strategy: This model reduces the need for heavy capital investment, enhancing agility and reducing financial risk.

- Partnership Leverage: Collaboration with diverse partners allows Wabag to access specialized expertise and resources, optimizing project execution.

Wabag's technological leadership is a core strength, evidenced by its over 125 intellectual property rights and three global R&D centers that drive innovation in water treatment. The company’s strategic embrace of IoT and AI in water management solutions positions it to address complex global water challenges effectively.

The company's comprehensive service offering, spanning the entire water cycle from design to operation, including specialized areas like desalination and water reuse, provides clients with complete end-to-end solutions. This broad capability is complemented by a significant global footprint, with over 1,500 projects successfully completed in more than 25 countries, including 450+ sewage and 320+ water treatment plants.

A robust order book of Rs 125 billion as of March 2025 provides over three years of revenue visibility, ensuring financial stability and growth. Wabag's strategic pivot towards higher-margin Operation and Maintenance (O&M) projects, which significantly contributed to its order intake in FY23-24, is enhancing profitability.

Financially, Wabag demonstrates strength through consistent positive cash flows and a net cash position as of FY24, indicating prudent debt management. Its asset-light model, leveraging partnerships, enhances financial flexibility and reduces capital expenditure risk.

| Metric | FY23-24 (or latest available) | Significance |

| Order Book Value | Rs 125 billion (as of March 2025) | Over 3 years of revenue visibility |

| Global Projects Completed | 1,500+ | Demonstrates extensive execution capability |

| Sewage Treatment Plants | 450+ | Deep technical expertise in a key segment |

| Water Treatment Plants | 320+ | Proven track record in diverse water solutions |

| Intellectual Property Rights | 125+ | Underpins technological leadership and proprietary solutions |

What is included in the product

Offers a full breakdown of Wabag’s strategic business environment by examining its internal strengths and weaknesses alongside external opportunities and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

A significant vulnerability for VA Tech Wabag lies in its substantial dependence on municipal and governmental orders, which represented roughly 87-91% of its order book as of June 2024. This concentration means that any slowdowns or shifts in public sector spending directly impact Wabag's revenue streams and project pipelines.

This heavy reliance on government clients often translates into slower project execution and a more protracted revenue recognition cycle. Public sector entities can have lengthy approval processes, leading to delays in project commencement and completion, which in turn affects Wabag's ability to convert its large order book into timely financial results.

Furthermore, the company faces increased risks related to receivables. Government bodies may have slower payment cycles compared to private sector clients, potentially leading to extended collection periods. This can strain Wabag's working capital and impact its cash flow management, especially when a large percentage of its business is tied to these public sector entities.

VA Tech Wabag's significant reliance on international markets, which accounted for approximately 44% of its revenue and 60-67% of its order intake in the first nine months of FY24 and the full FY24 respectively, presents a notable weakness. This global footprint inherently exposes the company to the volatile nature of foreign exchange rates.

Unfavorable shifts in currency values can directly erode the profitability of its overseas projects. For instance, if a project is contracted in a foreign currency that depreciates against the Indian Rupee, the realized revenue in INR will be lower, impacting the company's bottom line.

This currency exposure means that even strong operational performance can be overshadowed by adverse currency movements, creating a layer of financial uncertainty that is outside of direct operational control.

Wabag's business model is inherently capital-intensive, demanding substantial upfront investments for water infrastructure projects. This reliance on significant capital expenditure means the company often needs to secure external financing, potentially increasing debt levels and associated interest expenses. For instance, the large-scale nature of water treatment plants and desalination facilities necessitates considerable financial resources, impacting the company's balance sheet.

The company also grapples with a prolonged working capital cycle, a common challenge in project-based industries. This extended cycle, from initial project outlay to final payment receipt, can tie up substantial amounts of cash, thereby increasing the need for working capital financing. Managing this efficiently is crucial, as delays in project payments or extended inventory holding periods can strain financial liquidity and increase borrowing costs, potentially affecting profitability and operational flexibility.

Project Delays and Cost Overruns

VA Tech Wabag's involvement in large-scale water infrastructure projects inherently exposes it to the risk of project delays and cost overruns. These challenges are common in the sector due to the complexity of engineering, procurement, and construction (EPC) activities. For instance, in the fiscal year ending March 2023, Wabag secured orders worth INR 10,530 crore, indicating the substantial scale of its projects. Unforeseen site conditions or supply chain disruptions can significantly extend project timelines and inflate budgets, directly impacting profitability and cash flow.

Such delays can lead to financial strain for VA Tech Wabag, as extended project durations often mean increased overheads and potential penalties. In 2023, the company reported an order backlog of INR 17,000 crore, underscoring the importance of efficient project execution. Any slippage in these projects can erode margins and affect the company's ability to take on new, profitable ventures.

- Susceptibility to Project Delays: The inherent complexity of water infrastructure projects makes them prone to scheduling slippages.

- Risk of Cost Overruns: Unforeseen challenges can escalate project expenses beyond initial estimates.

- Impact on Profitability: Delays and overruns directly reduce profit margins and can lead to financial strain.

- Operational Efficiency Concerns: Extended timelines can tie up resources, affecting the company's capacity and efficiency.

Intense Competition in the Water Management Sector

The water management industry is a crowded space, with many companies, both large and small, competing for projects. This means Wabag often faces pressure to keep its prices competitive to win business, which can squeeze profit margins even when it has a strong track record and advanced technology.

For example, in fiscal year 2023-24, the global water and wastewater treatment market was valued at approximately USD 75 billion and is projected to grow, but this growth also attracts more competition. Companies like Veolia, Suez, and Xylem are significant players, alongside numerous regional competitors, all vying for contracts in key markets. This competitive landscape can make securing lucrative deals more challenging and impact overall profitability.

- Intense Rivalry: The sector includes established multinational corporations and nimble local players, creating a highly competitive environment.

- Price Sensitivity: To win bids, pricing often becomes a critical factor, potentially impacting Wabag's margins on projects.

- Market Share Battles: Despite technological advantages, Wabag must continually strategize to maintain and grow its market share against aggressive competitors.

VA Tech Wabag's heavy reliance on municipal and governmental orders, representing approximately 87-91% of its order book as of June 2024, makes it vulnerable to shifts in public sector spending and can lead to slower project execution and extended revenue recognition cycles due to lengthy approval processes.

The company's significant exposure to international markets, contributing 44% to revenue and 60-67% to order intake in FY24, exposes it to foreign exchange rate volatility, which can negatively impact profitability and create financial uncertainty.

Wabag's capital-intensive business model necessitates substantial upfront investments in water infrastructure, leading to potential increases in debt levels and interest expenses, impacting its balance sheet and financial flexibility.

The company faces risks associated with prolonged working capital cycles, tying up significant cash and increasing the need for financing, which can strain liquidity and borrowing costs if project payments are delayed or inventory holding periods are extended.

Intense competition in the water management industry, with players like Veolia and Suez, pressures Wabag to maintain competitive pricing, potentially squeezing profit margins despite technological strengths.

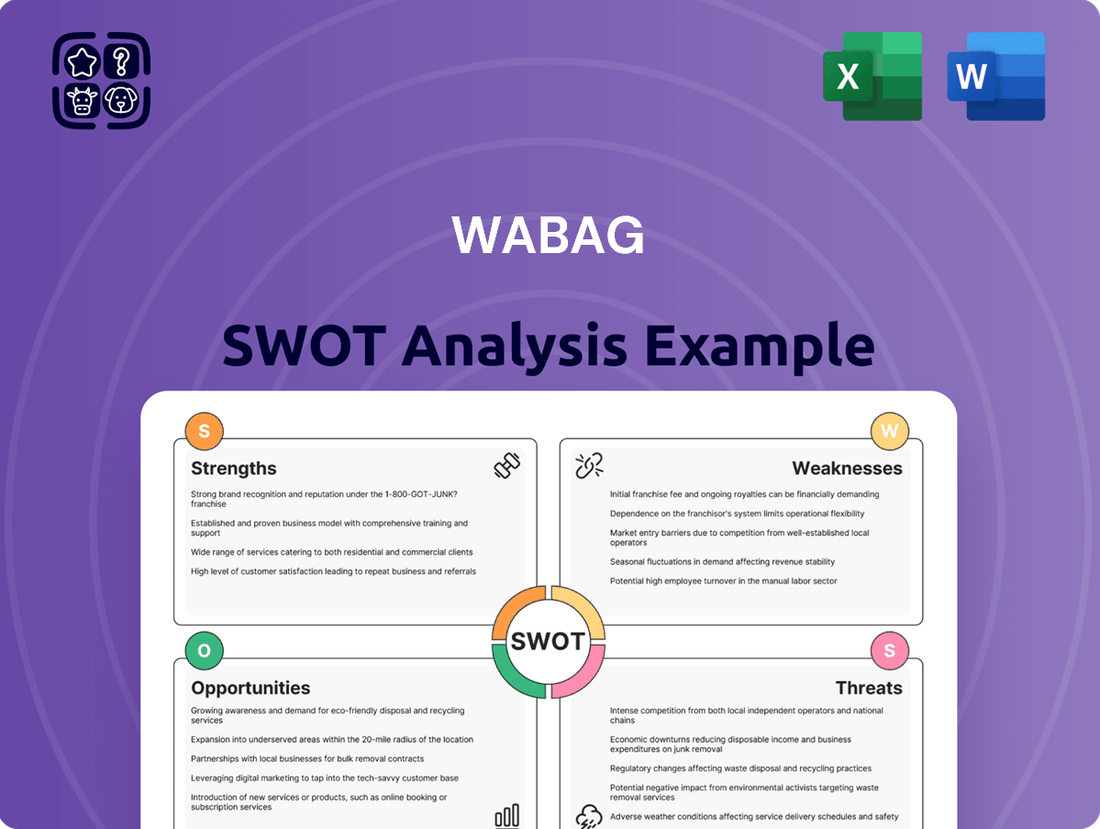

Preview Before You Purchase

Wabag SWOT Analysis

The file shown below is not a sample—it’s the real Wabag SWOT analysis you'll download post-purchase, in full detail. You can see the comprehensive breakdown of Wabag's Strengths, Weaknesses, Opportunities, and Threats. This preview reflects the actual document you'll receive, ensuring professional quality and structure. Purchase now to unlock the complete, in-depth analysis ready for your strategic planning.

Opportunities

The intensifying global water crisis, fueled by a growing population, expanding cities, and the impacts of climate change, creates significant opportunities for companies like Wabag that offer water management solutions. Projections indicate that by 2030, global demand for freshwater could exceed supply by a substantial 40%, highlighting an urgent need for advanced water treatment, recycling, and desalination technologies.

Governments globally, especially in India, are channeling substantial funds into water infrastructure. Programs like the Jal Jeevan Mission and AMRUT highlight this commitment, aiming to ensure access to safe drinking water and enhance wastewater management. This focus creates a fertile ground for companies like VA Tech Wabag, offering significant opportunities for securing major contracts and participating in vital national projects.

For instance, India's Jal Jeevan Mission, launched in 2019, has a target to provide tap water connections to all rural households. By early 2024, over 14 crore rural households had received functional tap water connections, demonstrating the scale of investment and execution. Similarly, the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) 2.0, launched in 2021, aims to provide universal coverage of water supply to all households in urban areas and increase the number of water bodies being rejuvenated. These government-led initiatives translate directly into substantial project pipelines for water technology and infrastructure providers.

Emerging technologies are revolutionizing water treatment. Innovations like the Internet of Things (IoT) and Artificial Intelligence (AI) are boosting efficiency, while advanced membrane filtration and Zero Liquid Discharge (ZLD) systems are enabling more sustainable water management. Biotechnological solutions also offer new avenues for effective treatment.

VA Tech Wabag is strategically positioned to capitalize on these technological shifts. The company's commitment to research and development allows it to integrate these advancements, improving its operational performance and broadening its service portfolio. This focus on innovation is key to developing environmentally friendly water solutions.

For instance, the global advanced water treatment market was valued at approximately USD 30 billion in 2023 and is projected to grow significantly. Wabag's ability to adopt and implement technologies like AI-driven process optimization can lead to substantial cost savings and improved water quality for clients, enhancing its competitive edge.

Expansion into New Geographies and Industrial Segments

Wabag's strategic vision strongly emphasizes geographic expansion, aiming to bolster its international revenue streams by targeting new markets with significant demand, especially within the Middle East and Africa. This push is crucial for diversifying its revenue base and tapping into regions experiencing rapid development and infrastructure needs.

The company is also actively exploring lucrative opportunities in emerging industrial sectors that require high-purity water. The semiconductor manufacturing industry, for instance, presents a substantial growth avenue due to its stringent water quality requirements. Expanding its reach within this segment and broadening its industrial client portfolio across various sectors will be key drivers for sustained growth.

- Geographic Focus: Targeting Middle East and Africa for increased international revenue.

- Emerging Industries: Exploring semiconductor manufacturing and other ultra-pure water-dependent sectors.

- Client Base Expansion: Broadening reach within the industrial segment.

Growing Demand for Water Reuse and Circular Economy Solutions

The global push for water sustainability is a significant opportunity. There's a growing focus on water reuse and circular economy principles, aiming to make the most of every drop and reduce wastewater. This trend is driving demand for advanced solutions that can efficiently treat and recycle water.

Technologies like Zero Liquid Discharge (ZLD) are becoming increasingly important. ZLD systems are crucial for industries that need to minimize their water footprint, often mandated by stricter environmental regulations. Companies offering these eco-friendly wastewater management approaches are well-positioned to benefit.

For instance, the global water and wastewater treatment market was valued at approximately USD 672.3 billion in 2023 and is projected to grow. Specifically, the ZLD market is experiencing robust expansion, with estimates suggesting it could reach over USD 4.8 billion by 2028, growing at a compound annual growth rate of around 7.5%.

- Increasing global emphasis on water reuse and recycling

- Growing market for Zero Liquid Discharge (ZLD) systems

- Demand for sustainable and eco-friendly wastewater solutions

- Potential for market expansion in water-stressed regions

Wabag is well-positioned to benefit from the increasing global focus on water sustainability and the circular economy, driving demand for water reuse and recycling technologies. The company can also capitalize on the growing market for Zero Liquid Discharge (ZLD) systems, essential for industries facing stringent environmental regulations, with the ZLD market projected to exceed USD 4.8 billion by 2028.

Threats

Changes in environmental and safety regulations present a significant threat to VA Tech Wabag. For instance, stricter effluent discharge standards, like those being considered or implemented in various regions for industrial wastewater, could necessitate substantial capital expenditure on advanced treatment technologies. This would directly impact operational costs and potentially reduce profit margins if these costs cannot be fully passed on to clients.

Global economic slowdowns can directly impact water infrastructure spending, a core market for Wabag. For instance, if major economies experience recessions in 2024 or 2025, government budgets allocated to new water projects might be slashed, potentially delaying or canceling awards. This economic uncertainty presents a significant threat to Wabag's order intake and future revenue streams, especially given its reliance on these types of public sector contracts.

Operating in diverse international markets means VA Tech Wabag is susceptible to geopolitical instability, which can unfortunately lead to project cancellations. This exposure creates a significant threat, impacting revenue streams and project pipelines. For instance, the cancellation of a major desalination project in Saudi Arabia, a key market for water solutions, highlights the potential for substantial financial repercussions and operational disruptions.

Intensifying Competition from Local and International Players

The water management sector is indeed a crowded space, with both local and global companies vying for projects. This means VA Tech Wabag faces constant pressure on pricing. For instance, in 2023, the global water and wastewater treatment market was valued at approximately USD 64.3 billion, with significant growth anticipated.

This intense competition can squeeze profit margins, making it harder for Wabag to secure profitable contracts. When bidding for new projects, companies often engage in aggressive pricing strategies to win mandates. This dynamic is particularly evident in large-scale infrastructure projects where multiple players compete for limited opportunities.

The increasing number of international players entering emerging markets, often backed by strong financial resources, further intensifies this challenge. These competitors can bring new technologies and more competitive cost structures to the table.

- Increased Pricing Pressure: Competitors' aggressive pricing can force Wabag to lower its bid prices, potentially impacting profitability.

- Market Share Erosion: A crowded market makes it difficult to grow or even maintain existing market share without strategic differentiation.

- Technological Advancements: New entrants may offer cutting-edge technologies that require significant investment from Wabag to match.

- Global Reach of Competitors: International players often have established supply chains and operational efficiencies that can be leveraged in bids.

Execution Risks and Supply Chain Disruptions

Large infrastructure projects, which are central to Wabag's business, are inherently exposed to execution risks. These can manifest as difficulties in sticking to project timelines, maintaining stringent quality standards, and navigating the complexities of global supply chains. For instance, a delay in a major desalination plant project could significantly impact revenue recognition.

Supply chain disruptions pose a significant threat, particularly given the reliance on specialized equipment and materials for water treatment solutions. In 2024, global supply chain volatility, exacerbated by geopolitical tensions, could lead to increased lead times for critical components, potentially impacting project schedules. This could translate to higher material costs and delayed project completion.

- Project Delays: Missed deadlines can lead to penalties and reduced profitability.

- Cost Overruns: Unexpected increases in material or labor costs can erode margins.

- Reputational Damage: Failure to deliver on time or to specified quality can harm future business prospects.

- Supply Chain Volatility: Geopolitical events or natural disasters can interrupt the flow of essential materials and equipment.

Intensifying competition from both established international players and emerging local entities presents a significant challenge for VA Tech Wabag. This crowded market, valued at approximately USD 64.3 billion in 2023, often leads to aggressive pricing strategies, potentially squeezing profit margins and impacting the company's ability to secure lucrative contracts.

Economic slowdowns, particularly in 2024 and 2025, pose a threat to infrastructure spending, a critical revenue driver for Wabag. Reduced government budgets could lead to project delays or cancellations, impacting order intake and future revenue streams.

Geopolitical instability and evolving environmental regulations are also key threats. Project cancellations due to political unrest, as seen in some key markets, and the need for substantial capital expenditure to meet stricter effluent discharge standards can negatively affect financial performance.

| Threat Category | Specific Risk | Potential Impact | Mitigation Consideration |

| Competition | Aggressive pricing by rivals | Reduced profit margins, market share erosion | Focus on value-added services, technological differentiation |

| Economic Factors | Global economic slowdown (2024-2025) | Decreased infrastructure spending, delayed project awards | Diversification of geographic markets, focus on essential water services |

| Geopolitical & Regulatory | Political instability, project cancellations | Revenue loss, operational disruption | Robust risk assessment for new markets, strong local partnerships |

| Regulatory Changes | Stricter environmental standards | Increased capital expenditure, higher operational costs | Investment in R&D for compliant technologies, proactive engagement with regulators |

SWOT Analysis Data Sources

This Wabag SWOT analysis is built upon a robust foundation of data, drawing from Wabag's official financial reports, comprehensive market intelligence, and expert industry analyses to provide a thorough and accurate strategic overview.