Wabag Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wabag Bundle

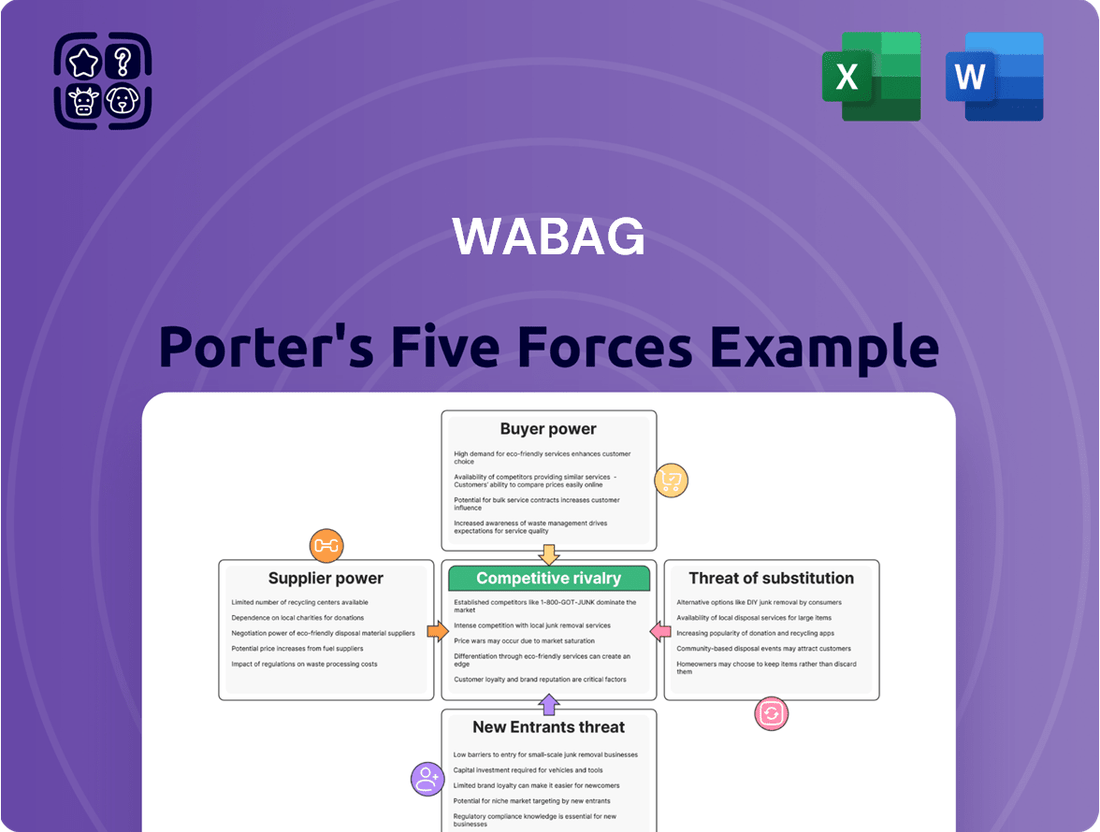

Wabag's industry is shaped by intense competition, with the threat of new entrants and the bargaining power of buyers being significant factors. The availability of substitutes and the power of suppliers also play crucial roles in defining Wabag's strategic landscape. Understanding these forces is vital for navigating the complexities of the water and wastewater treatment sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Wabag’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for VA Tech Wabag is significantly shaped by the concentration and specialization within its supply chain. When a limited number of providers offer essential, highly specialized components, such as advanced membranes for water treatment or specific proprietary chemicals, these suppliers gain considerable leverage. This allows them to dictate terms and potentially increase prices, impacting Wabag's cost structure.

Wabag's reliance on unique technologies, particularly in areas like desalination and advanced water reuse, further amplifies the bargaining power of its specialized suppliers. For instance, if only a handful of companies globally can produce the highly efficient pumps or critical filtration systems required for these complex processes, those suppliers are in a strong position. This reliance means Wabag has fewer alternatives, giving these specialized providers more influence over pricing and supply availability.

The bargaining power of suppliers for Wabag is significantly influenced by switching costs. If Wabag needs to replace a supplier for critical components or specialized services, the expense and effort involved in making that change directly translate into increased supplier leverage.

For instance, adopting a new filtration technology might necessitate substantial re-engineering of existing water treatment plants, demanding new certifications and recalibrating complex systems. These technical hurdles and associated costs make it difficult and expensive for Wabag to switch, thereby strengthening the position of its current suppliers.

In the fiscal year 2023-2024, Wabag's revenue was INR 3,205 crore. While specific data on supplier switching costs isn't publicly detailed, the capital-intensive nature of water treatment projects suggests that integration of proprietary technologies from key suppliers can create substantial barriers to entry for new vendors.

When suppliers offer patented technologies or highly unique materials essential for Wabag's advanced water treatment systems, their bargaining power significantly increases. For instance, specialized membrane technologies or proprietary chemical formulations can be difficult to source elsewhere, creating a dependency for Wabag.

These unique inputs are not readily substitutable, meaning Wabag relies on specific providers to ensure the effectiveness and innovation of its projects. This reliance can lead to higher input costs or less favorable contract terms for Wabag, as suppliers can leverage their exclusive offerings.

In 2024, the global market for advanced water treatment technologies, particularly those incorporating novel materials, saw continued growth. Companies that own unique intellectual property in areas like desalination or wastewater recycling, critical for Wabag's operations, were in a strong position to negotiate terms.

Wabag's ability to secure these specialized inputs at competitive prices directly impacts its project profitability and its capacity to deliver cutting-edge solutions. The cost of these unique components, often a significant portion of project expenses, underscores the supplier's leverage.

Threat of Forward Integration by Suppliers

If suppliers of critical technologies or components for water treatment solutions possess the capability and motivation to move into providing complete project execution themselves, their leverage over Wabag significantly grows. This prospect of direct competition from their own suppliers could compel Wabag to concede to less advantageous pricing and contract terms to secure essential inputs and maintain its operational flow.

For instance, a major supplier of advanced membrane technology, who also has engineering and project management expertise, might decide to bid directly on large-scale water treatment projects, bypassing companies like Wabag. This threat is heightened if these suppliers perceive substantial profit margins in the project execution phase that exceed their current component sales. As of 2024, the global water treatment market, valued at approximately USD 700 billion, presents attractive opportunities for vertical integration across the value chain.

- Increased Supplier Leverage: Suppliers capable of forward integration can dictate terms more effectively.

- Potential for Direct Competition: Suppliers may become direct competitors, impacting Wabag's market share.

- Pressure on Margins: Wabag might face reduced profitability due to less favorable contract terms.

- Strategic Implications: The threat necessitates careful supplier relationship management and potential diversification of supply sources.

Importance of Supplier's Input to Wabag's Quality

The bargaining power of suppliers for Wabag is significantly influenced by how critical their components are to the final quality and performance of Wabag's water treatment solutions. If a supplier provides a unique or highly specialized part that is indispensable for meeting stringent water quality standards, that supplier gains considerable leverage.

For example, if a particular advanced filtration membrane is the sole component capable of achieving the ultra-pure water required for certain industrial applications, the manufacturer of that membrane possesses substantial power. Wabag's reliance on such critical inputs means that suppliers of these specialized materials can command higher prices or dictate terms.

- Supplier Criticality: The extent to which a supplier's input is vital for Wabag's product performance and quality directly amplifies supplier power.

- Input Uniqueness: If a component, like a specific membrane technology, has no readily available substitutes, the supplier of that component holds significant leverage.

- Impact on Efficiency: Suppliers whose materials or technologies directly enhance the efficiency and operational effectiveness of Wabag's water treatment systems also wield greater influence.

- Quality Dependence: Wabag's dependence on suppliers for inputs that determine the purity and effectiveness of its water treatment solutions, especially for high-demand sectors like pharmaceuticals or semiconductors, increases supplier bargaining power.

Suppliers of highly specialized components, such as proprietary membranes or advanced filtration systems, hold significant bargaining power over VA Tech Wabag. This power is amplified when these inputs are critical for achieving specific water quality standards or when switching costs are high due to integration complexities. For instance, companies possessing unique intellectual property in desalination technologies, which are crucial for Wabag's projects, are in a strong position to negotiate terms. The global water treatment market's growth in 2024, estimated around USD 700 billion, presents opportunities for suppliers to integrate vertically, potentially becoming direct competitors and further increasing their leverage.

| Factor | Impact on Wabag | Example |

|---|---|---|

| Supplier Specialization | Increased leverage due to unique offerings | Proprietary membranes for advanced water reuse |

| Switching Costs | Higher costs to change suppliers | Re-engineering plants for new filtration technology |

| Criticality of Input | Supplier power tied to performance impact | Indispensable components for stringent water purity |

| Threat of Forward Integration | Potential for suppliers to become competitors | Suppliers with engineering expertise bidding on projects |

What is included in the product

Analyzes the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the threat of substitutes impacting Wabag's market position and profitability.

Effortlessly diagnose competitive pressures with a visual map of all five forces, simplifying strategic planning.

Customers Bargaining Power

Wabag's customers, particularly municipalities and major industrial players, wield substantial bargaining power due to the significant scale and long-term commitments inherent in water infrastructure projects. For instance, if a handful of these large contracts represent a considerable percentage of Wabag's annual turnover, these clients can effectively dictate pricing and project specifications. This concentration means that losing even one major client could significantly impact Wabag's financial performance, giving these customers leverage in negotiations.

Customer switching costs are a significant factor in Wabag's industry. While clients often solicit competitive bids to secure the best pricing, once a contract for a large-scale water treatment plant is awarded and construction is underway, the hurdles to switching providers become substantial.

The intricate nature of regulatory approvals, the highly integrated design of these complex systems, and the very long operational lifecycles of water treatment facilities mean that changing suppliers mid-project is incredibly difficult and costly. This difficulty significantly diminishes a customer's bargaining power once the initial contract is signed and the project is in motion.

For instance, a project involving advanced membrane filtration or desalination technology requires specialized expertise and integrated components. Disrupting this mid-execution would lead to massive delays, potential rework, and substantial financial penalties, effectively locking in the customer with their chosen provider for the duration of the project and its operational life.

Wabag's services are deeply rooted in customization, with each project requiring bespoke engineering, design, and construction tailored to unique client needs. This inherent customization significantly diminishes the bargaining power of customers. Unlike industries with standardized products where price comparisons and easy switching are common, Wabag's clients face higher switching costs and fewer readily available alternatives, strengthening Wabag's position.

Customer Price Sensitivity and Budget Constraints

Municipal customers, a significant segment for companies like Wabag, frequently operate under tight budgetary limitations and intense public oversight. This environment naturally fosters a high degree of price sensitivity. For instance, many municipal water and wastewater projects are funded through taxpayer money, demanding maximum value for every dollar spent. This means bids are meticulously scrutinized, and cost becomes a primary decision-making factor.

Industrial clients also prioritize cost-effectiveness when selecting water and wastewater solutions. They are looking for reliable systems that not only perform efficiently but also offer a favorable total cost of ownership. This pursuit of economical solutions means that customers will thoroughly compare proposals, weighing upfront costs against long-term operational expenses and potential savings. Companies must therefore demonstrate clear value propositions to win these contracts.

- Price Sensitivity: Municipal clients, often funded by public budgets, exhibit pronounced price sensitivity, directly influencing tender outcomes.

- Cost-Effectiveness: Industrial customers seek solutions that are not only technically sound but also economically advantageous over their lifecycle.

- Bidding Leverage: The inherent price sensitivity of both municipal and industrial customers grants them significant bargaining power during the bidding and negotiation phases.

- Value Demonstration: Suppliers must clearly articulate the economic benefits and long-term value of their offerings to secure contracts in a price-conscious market.

Threat of Backward Integration by Customers

The threat of backward integration by customers for companies like Wabag, a leader in water and wastewater management, is generally low, especially for highly specialized and complex projects. This is because developing in-house capabilities for advanced water treatment requires significant capital investment, specialized engineering talent, and extensive operational experience, which most clients lack.

However, the situation can differ for simpler, more routine tasks. For instance, some large industrial clients might explore managing basic water treatment or maintenance internally if the scale and complexity are manageable. This capability, though limited, can give them a slight edge in negotiations.

- Low Threat for Complex Projects: Wabag's core business involves intricate engineering, technology deployment, and long-term operational expertise, making it difficult for most customers to replicate these capabilities in-house.

- Potential for Routine Tasks: For simpler water management needs or routine maintenance, a few large industrial clients might consider internalizing these functions, thereby increasing their bargaining power.

- Capital and Expertise Barriers: The substantial capital outlay and specialized knowledge required for advanced water treatment systems act as significant deterrents to backward integration for most customers.

Wabag's customers, particularly large municipalities and industrial conglomerates, possess considerable bargaining power. This stems from the substantial value and long-term nature of water infrastructure projects, where a few key clients can represent a significant portion of Wabag's revenue. This concentration of demand gives major clients leverage to negotiate pricing and project specifics, making the loss of any single large contract impactful. For instance, in 2024, several major water infrastructure tenders saw intense competition, with clients demanding highly competitive pricing structures.

| Customer Type | Key Bargaining Factors | Impact on Wabag |

|---|---|---|

| Municipalities | Budgetary constraints, public oversight, price sensitivity | Pressure on project bids and margins |

| Industrial Clients | Total cost of ownership, operational efficiency, value proposition | Need to demonstrate long-term economic benefits |

| Large-Scale Projects | High switching costs post-award, project complexity | Reduces power once contract is secured, but initial negotiation is critical |

What You See Is What You Get

Wabag Porter's Five Forces Analysis

This preview provides an exact replica of the comprehensive Wabag Porter's Five Forces Analysis you will receive immediately upon purchase. The document you see here details the competitive landscape for Wabag, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. You'll gain immediate access to this fully formatted and professionally written analysis, ready for your strategic planning needs without any surprises or placeholders.

Rivalry Among Competitors

The water treatment sector, especially for significant infrastructure projects, is characterized by a robust mix of established global corporations and agile, niche regional companies. This dynamic creates a highly competitive landscape where established players and emerging firms constantly vie for market dominance.

Wabag navigates this environment by competing with both multinational conglomerates and a multitude of local water solution providers. This broad spectrum of competitors, each with unique strengths and market access, intensifies the rivalry for securing lucrative contracts in the expanding global water solutions market.

For instance, in 2024, major global players like Suez, Veolia, and Xylem continue to be significant forces, often undertaking large-scale desalination and wastewater treatment projects. Simultaneously, regional specialists, particularly in emerging markets, offer localized expertise and competitive pricing, adding another layer of competitive pressure.

The diversity in the competitive field means that Wabag must not only contend with the scale and resources of international giants but also with the agility and specific market knowledge of smaller, specialized competitors who can often adapt more quickly to local demands.

The global water treatment market is on an upward trajectory, driven by increasing water scarcity and rising pollution levels. However, this growth isn't uniform. Some regions or specific water treatment technology segments might be maturing, leading to slower expansion. For instance, while the overall market is robust, the demand for certain conventional treatment methods in developed economies might be stabilizing.

In these more mature segments, competitive rivalry naturally heats up. Companies often resort to aggressive pricing strategies to capture or maintain market share. Beyond price wars, firms also differentiate themselves by broadening their service portfolios, offering end-to-end solutions that encompass everything from initial consultation to ongoing maintenance and operational support.

For example, in 2024, companies are increasingly investing in advanced digital solutions and IoT integration for water treatment plants to offer enhanced efficiency and predictive maintenance, thereby intensifying the competitive landscape. This focus on value-added services and technological innovation becomes crucial in less rapidly expanding market niches, where simply providing basic treatment is no longer enough to stand out.

Competitive rivalry within the water treatment sector, including for companies like Wabag, is significantly shaped by how distinct their services and technology are. Wabag differentiates itself through specialized offerings such as advanced desalination and water reuse technologies, tackling critical water scarcity issues.

However, this advantage is challenged as rivals, including major players like Veolia and Suez, also heavily invest in research and development. This continuous innovation means the technological edge can be fleeting, making technological superiority a constant and crucial area of competition.

For instance, the global desalination market, a key area for Wabag, was valued at approximately $11.9 billion in 2023 and is projected to grow substantially. This growth attracts significant investment from competitors, intensifying the rivalry for technological leadership in efficient and sustainable water treatment solutions.

High Exit Barriers

Wabag operates within a water treatment sector where exiting the market is a considerable challenge. Companies face substantial upfront capital investments in building and maintaining treatment plants, often involving complex infrastructure. For instance, a typical large-scale desalination plant can cost hundreds of millions of dollars, making it difficult for a company to simply walk away from such an asset.

Furthermore, long-term contracts and project commitments are a hallmark of the industry. Wabag, like its peers, likely engages in projects spanning several years, creating obligations that cannot be easily terminated. The need for specialized human capital, including engineers and skilled technicians with expertise in water treatment technologies, also acts as a significant barrier. Losing this specialized workforce or the inability to redeploy them elsewhere further increases the cost of exiting.

These high exit barriers mean that even when market conditions are unfavorable or profitability dips, companies like Wabag are often compelled to continue operations. This situation can intensify competitive rivalry, as firms strive to maintain market share and cover fixed costs despite lower returns. For example, if a company is unable to sell its assets at a value close to their book value due to the specialized nature of the equipment, it reinforces the incentive to continue operating.

- High Capital Investments: Significant financial outlay required for infrastructure makes exiting costly.

- Long-Term Commitments: Existing contracts and project durations bind companies to the market.

- Specialized Workforce: The unique skills needed in water treatment create retention and redeployment challenges upon exit.

- Asset Specificity: Water treatment facilities often have limited alternative uses, reducing resale value.

Strategic Stakes and Long-Term Contracts

The competition for large water infrastructure projects is fierce because these long-term contracts are crucial for stable revenue and building a company's reputation. Winning these bids means a consistent income stream and often leads to more opportunities. This high strategic value naturally drives intense rivalry among companies in the sector. For example, in 2023, the global water and wastewater treatment market was valued at approximately USD 600 billion, with significant portions allocated to large infrastructure developments.

- Stable Revenue: Long-term contracts secure predictable cash flows, reducing financial uncertainty.

- Reputational Enhancement: Successful execution of large projects boosts a company's standing and credibility.

- Future Opportunities: Winning major contracts often opens doors for subsequent projects and market expansion.

- Intensified Bidding: Companies invest heavily in bid preparation and project delivery to secure these valuable assets.

Competitive rivalry in the water treatment sector is intense, driven by a mix of global giants and specialized regional firms vying for lucrative projects. Wabag faces competition from multinational corporations like Veolia and Suez, as well as agile local players, particularly in emerging markets. This necessitates a constant focus on technological innovation and service differentiation to maintain market position.

SSubstitutes Threaten

The threat of substitutes for Wabag's water treatment solutions is a significant consideration. Alternative methods for addressing water scarcity and pollution, such as widespread adoption of efficient rainwater harvesting, could reduce the need for complex, large-scale treatment plants. Similarly, increased reliance on direct use of minimally treated groundwater, where feasible, presents another substitute.

Aggressive water conservation efforts, including smart irrigation systems and industrial process optimizations, directly reduce the demand for new water treatment infrastructure. For example, in 2024, many regions saw increased adoption of water-saving technologies in agriculture, a sector historically a major water consumer. This trend can lessen the overall need for Wabag's core services if demand is managed effectively without requiring expanded water supply solutions.

For certain water treatment needs, especially in smaller communities or for specific industrial processes, less sophisticated and more decentralized methods can act as substitutes for comprehensive solutions like those offered by Wabag. These might include simple sand filters, constructed wetlands, or even basic chemical precipitation methods that are considerably cheaper to set up and maintain. For instance, the global market for point-of-use water treatment devices, which represent a highly decentralized approach, was valued at over $15 billion in 2023 and is projected to grow, indicating a significant demand for simpler, localized solutions.

Regulatory Environment Changes

Changes in the regulatory landscape significantly impact the threat of substitutes for water treatment solutions. A relaxation of environmental regulations, particularly concerning water quality standards or discharge limits, could make simpler, less technologically advanced treatment methods more viable. For instance, if effluent standards were eased, basic filtration or chemical treatment might suffice where advanced membrane or biological processes were previously mandated, thereby increasing the appeal of lower-cost substitute technologies.

The enforcement intensity of existing regulations also plays a crucial role. Stricter enforcement drives demand for higher-specification, often proprietary, treatment technologies like those offered by Wabag. Conversely, a reduction in stringent oversight or enforcement could lower the barrier to entry for less sophisticated competitors offering cheaper alternatives. For example, if penalties for non-compliance with BOD (Biochemical Oxygen Demand) limits were reduced, less energy-intensive and capital-intensive treatment plants could become a more attractive option for some municipalities or industries.

- Regulatory Relaxation: A potential easing of environmental discharge standards could make less advanced, cheaper treatment technologies competitive.

- Enforcement Impact: Weaker enforcement of existing water quality regulations may reduce the perceived need for Wabag's high-tech, premium solutions.

- Substitutability: If regulatory requirements are lowered, basic physical or chemical treatment methods could become viable substitutes for advanced biological or membrane systems.

- Market Dynamics: In 2024, many regions experienced ongoing discussions about environmental policy adjustments, highlighting the sensitivity of the water treatment market to regulatory shifts.

Cost-Benefit of Non-Treatment Approaches

Customers evaluate the cost-benefit of advanced water treatment against other options. If the expenses of meeting strict regulations or developing new water sources exceed the perceived advantages, clients might seek alternatives that bypass the necessity for Wabag's specialized solutions. For instance, in 2024, some industrial sectors faced increased costs for compliance, prompting exploration of water reuse technologies or process modifications to reduce effluent volume, thereby lessening the demand for extensive wastewater treatment infrastructure.

The threat of substitutes arises when customers can achieve their water management objectives through less expensive or more convenient means. This could involve:

- Optimizing internal processes to reduce water consumption and pollutant discharge.

- Implementing simpler, less capital-intensive treatment methods that meet baseline requirements but not advanced standards.

- Exploring natural or decentralized solutions, such as constructed wetlands for less demanding applications.

- Outsourcing water management to entities that offer bundled services, potentially at a lower overall cost.

The threat of substitutes for Wabag's water treatment solutions is heightened by increasingly accessible and affordable alternative technologies, particularly in regions with less stringent environmental regulations. Simpler, decentralized treatment methods and significant improvements in water conservation can directly reduce the demand for Wabag's complex, large-scale systems. For instance, the global market for point-of-use water treatment devices, representing a decentralized approach, exceeded $15 billion in 2023, indicating a substantial demand for simpler solutions.

| Substitute Type | Description | Potential Impact on Wabag | Example Data/Trend (2023-2024) |

|---|---|---|---|

| Water Conservation | Reducing overall water consumption through efficiency measures. | Decreases demand for new water supply and treatment infrastructure. | Agricultural sector saw increased adoption of water-saving technologies in 2024. |

| Decentralized Treatment | Smaller, localized treatment units or natural systems. | Can be a cost-effective alternative for specific, less demanding applications. | Point-of-use water treatment device market valued over $15 billion in 2023. |

| Process Optimization | Industrial or agricultural process changes to reduce water use/discharge. | Lowers the volume and complexity of wastewater requiring treatment. | Industrial sectors explored water reuse and process modifications in 2024 due to rising compliance costs. |

Entrants Threaten

The water treatment sector, particularly for significant municipal and industrial undertakings, necessitates a considerable outlay in technology, R&D, specialized machinery, and project funding. This substantial financial prerequisite acts as a significant deterrent for many aspiring new entrants who may not possess the requisite capital.

For instance, securing contracts for large-scale desalination plants or advanced wastewater recycling facilities can easily run into hundreds of millions, if not billions, of dollars. In 2024, major infrastructure projects often require bidders to demonstrate robust financial backing and proven ability to manage such large-scale investments, effectively screening out smaller, less capitalized players.

New entrants into the water and wastewater treatment sector, like VA Tech Wabag, encounter formidable regulatory challenges. These include navigating a complex web of environmental laws, obtaining numerous permits, and securing approvals from various local and national government bodies, which differ drastically across geographies. For instance, securing environmental clearances in India can take anywhere from 12 to 24 months, involving multiple stages of review and public consultation.

The sheer cost and time investment required to understand and comply with these stringent regulations act as a significant deterrent for potential new players. Specialized legal counsel and technical experts are often necessary to manage the permitting processes effectively, adding substantially to the upfront capital needed to enter the market. This expertise is critical, as non-compliance can lead to hefty fines and project delays, impacting profitability severely.

VA Tech Wabag's dominance in specialized water treatment sectors like desalination and water reuse hinges on advanced technological expertise and a portfolio of patents. Acquiring or replicating this level of sophisticated engineering know-how and intellectual property represents a significant hurdle for potential new entrants. For instance, the company's involvement in projects requiring cutting-edge membrane technologies or advanced biological treatment processes demands substantial R&D investment and a proven track record, which are difficult for newcomers to establish quickly.

Importance of Brand Reputation and Track Record

The threat of new entrants in the water infrastructure sector, particularly for companies like Wabag, is significantly mitigated by the paramount importance of brand reputation and an established track record. Securing large, long-term projects hinges on demonstrating reliability, financial stability, and successful past project execution. New players, by definition, lack this critical history and the client trust that incumbents have painstakingly built over years, even decades.

This established credibility is not easily replicated. Consider that in 2023, awarded water infrastructure contracts often favored companies with a strong portfolio of previously completed projects, especially those involving complex, large-scale operations. For instance, major tenders in regions like the Middle East or Southeast Asia, significant markets for Wabag, frequently include stringent pre-qualification criteria related to project delivery and client satisfaction.

A company's track record directly translates into perceived lower risk for clients awarding multi-billion dollar projects. This is a substantial barrier:

- Proven Execution: Decades of successful project completion build confidence in a firm's ability to handle complex engineering and operational challenges.

- Financial Stability: A history of financial health reassures clients that the company can weather project timelines and potential unforeseen costs.

- Client Trust: Long-term relationships and positive testimonials from previous clients are invaluable assets that new entrants cannot immediately possess.

- Risk Aversion: Public sector entities and large corporations awarding infrastructure projects are inherently risk-averse, making established players the preferred choice.

Consequently, the high capital requirements and the need for specialized expertise, combined with the absolute necessity of a proven reputation, create a formidable barrier to entry for potential new competitors in Wabag's market space.

Challenges in Accessing Distribution Channels and Client Relationships

Newcomers face a steep climb in securing access to crucial distribution channels and building lasting client relationships, particularly within the water and wastewater treatment sector. Developing trust and rapport with municipalities, government bodies, and major industrial clients is a lengthy and resource-intensive process.

Established companies, including Wabag, have cultivated deep-rooted networks and often hold preferred supplier status. This existing infrastructure creates significant barriers for new entrants, making it challenging to penetrate key decision-making circles and vie for substantial projects.

- Established Networks: Companies like Wabag benefit from decades of experience, fostering strong ties with local authorities and industrial giants.

- Preferred Supplier Status: This status often grants incumbents preferential treatment in bidding processes and access to tender information.

- Long Sales Cycles: Securing large-scale contracts in this industry can take years, a period new entrants may struggle to sustain without established market presence.

- Brand Reputation: A proven track record and a strong brand reputation are critical for winning bids, something new entrants must work hard to build.

The threat of new entrants for companies like Wabag is considerably low due to the immense capital requirements for technology, R&D, and project financing, often in the hundreds of millions or billions of dollars for large-scale projects. Regulatory hurdles, including complex environmental laws and permitting processes that can take over a year to navigate, also act as a significant deterrent, demanding specialized expertise and substantial upfront investment.

Furthermore, the critical need for advanced technological know-how and a robust portfolio of patents, coupled with the absolute necessity of an established track record and brand reputation built over years, creates formidable barriers. New entrants struggle to gain client trust and demonstrate the proven execution and financial stability that large clients, often risk-averse public sector entities, demand for multi-billion dollar contracts. For instance, in 2023, major water infrastructure tenders frequently prioritized companies with extensive project delivery histories.

Securing access to established distribution channels and building deep-rooted client relationships within the water and wastewater treatment sector is another significant challenge. Incumbents like Wabag benefit from decades of experience, fostering strong ties with authorities and industrial clients, often holding preferred supplier status that grants preferential treatment in bidding processes.

| Barrier | Description | Impact on New Entrants | Example (2024 Context) |

|---|---|---|---|

| Capital Requirements | High investment in technology, R&D, and project funding. | Deters smaller, less capitalized players. | Large desalination projects can exceed $1 billion. |

| Regulatory Complexity | Navigating environmental laws and obtaining permits. | Requires specialized legal/technical expertise and time. | Environmental clearances in some regions can take 12-24 months. |

| Technological Expertise & IP | Advanced engineering know-how and patents. | Difficult for newcomers to replicate sophisticated processes. | Cutting-edge membrane technologies demand substantial R&D. |

| Brand Reputation & Track Record | Demonstrated reliability, stability, and past project success. | Lack of history hinders client trust and preferred status. | Tenders often favor companies with proven project delivery. |

| Distribution Channels & Client Relationships | Established networks and preferred supplier status. | Challenging to penetrate decision-making circles. | Long sales cycles of several years require sustained market presence. |

Porter's Five Forces Analysis Data Sources

Our Wabag Porter's Five Forces analysis is built upon a robust foundation of industry-specific data from financial reports, market research databases, and expert analyst insights. This comprehensive approach ensures an accurate assessment of competitive intensity, supplier and buyer power, and the threat of new entrants and substitutes.