Wabag Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wabag Bundle

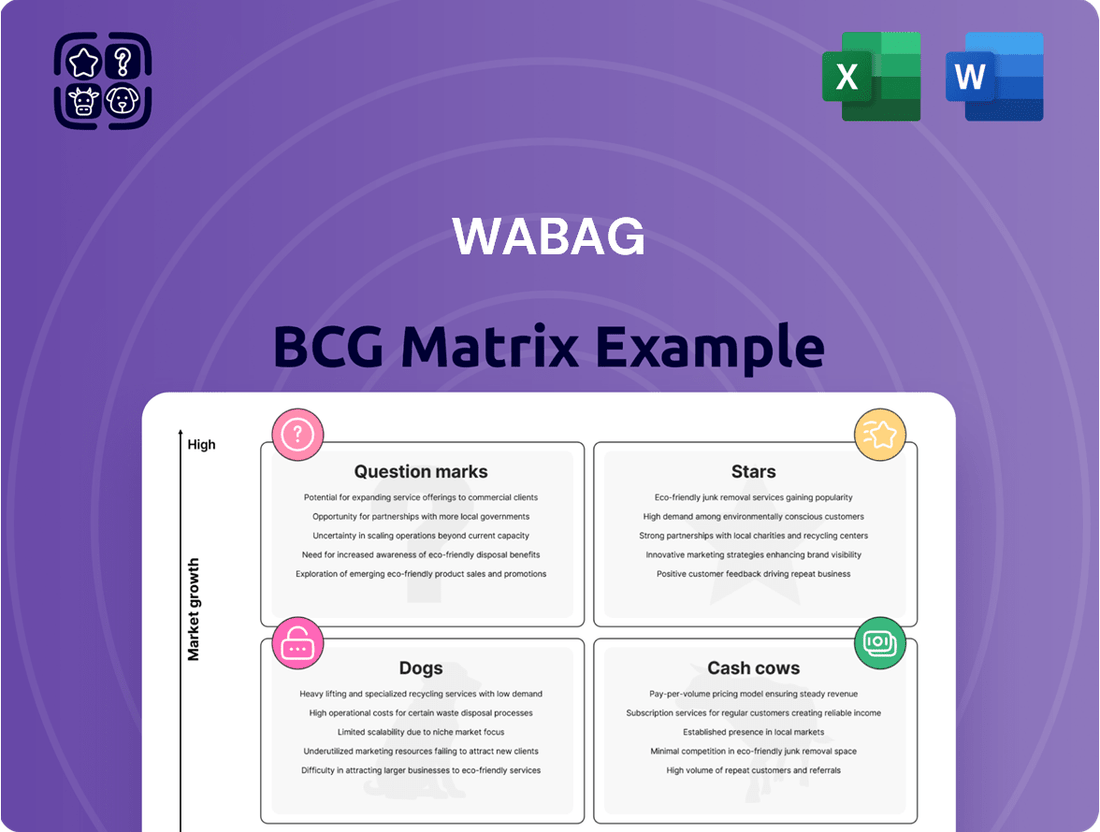

This Wabag BCG Matrix preview offers a glimpse into their strategic product portfolio, categorizing offerings into Stars, Cash Cows, Dogs, and Question Marks. Understanding these classifications is crucial for any business aiming for sustained growth and efficient resource allocation. See which of Wabag's ventures are leading the pack and which require a closer look.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. You'll receive detailed quadrant placements, enabling you to pinpoint exactly where Wabag is excelling and where strategic adjustments might be necessary. This comprehensive view is essential for informed decision-making.

Don't just see the categories; understand the strategy. The full BCG Matrix provides actionable insights and data-backed recommendations tailored to Wabag's specific market position. This empowers you to develop a robust roadmap for future investments and product development.

Gain a competitive edge by diving deep into Wabag's strategic positioning. The complete report offers a quadrant-by-quadrant breakdown, revealing the dynamics of their product lifecycle and market share. Equip yourself with the clarity needed to navigate the evolving industry landscape.

Ready to transform insights into action? Purchase the full BCG Matrix and receive not only detailed analysis but also ready-to-use formats in both Word and Excel. This is your shortcut to presenting and strategizing with confidence, making smart, data-driven decisions for your own business.

Stars

VA Tech Wabag's advanced desalination solutions, particularly its prowess in Reverse Osmosis (RO) technology, places it in a prime position within a rapidly expanding global market. This sector is experiencing robust growth, fueled by the escalating challenge of worldwide water scarcity. The global desalination market is anticipated to expand significantly, with projected Compound Annual Growth Rates (CAGRs) ranging from 8.9% to 11.6% between 2024 and 2029 or 2034.

Wabag's track record is impressive, having successfully executed more than 68 desalination projects to date. The company consistently secures new contracts, demonstrating sustained demand for its expertise. A recent example of this ongoing success is the project awarded by CPCL for desalination water pipelines, underscoring Wabag's continued relevance and capability in this vital area.

Water reuse and recycling technologies are a cornerstone of Wabag's strategy, positioning the company within a rapidly expanding market. Projections indicate the global water recycle and reuse market will see a compound annual growth rate between 9.73% and 12.7% from 2025 to 2034, highlighting the significant opportunity. Wabag's expertise in treating, recycling, and reusing wastewater directly addresses the critical issue of water scarcity, a need amplified by increasing global demand and stricter environmental mandates.

Wabag's strategic focus on international projects, particularly in the Middle East and Africa, positions these endeavors as Stars. This is evidenced by a substantial and growing order book in these regions, reflecting significant project wins and strong market penetration.

The high demand for water treatment solutions, driven by acute water scarcity in the Middle East and Africa, fuels the growth of these Star segments. Wabag's expertise in desalination and wastewater treatment allows it to capitalize on this demand, solidifying its competitive advantage.

The financial performance underscores this Star status, with international revenues contributing a significant 48% to Wabag's total nine-month revenues in FY25. This demonstrates the company's successful expansion and leadership in these high-growth emerging markets.

Industrial Water and Wastewater Treatment

The industrial water and wastewater treatment sector is a significant growth area for Wabag, aligning perfectly with the characteristics of a Star in the BCG matrix. The global industrial water reuse and recycling market is projected for robust expansion, expected to hit US$37.19 billion by 2032, growing at a compound annual growth rate of 9.9% from 2025. Wabag's strong presence and specialized offerings for key industrial segments such as oil & gas, power generation, and manufacturing underscore its substantial market share in this burgeoning field.

- High Market Share: Wabag has secured a significant portion of the industrial water treatment market due to its specialized solutions.

- Strong Market Growth: The industrial water reuse and recycling market is expanding rapidly, with a projected reach of US$37.19 billion by 2032 at a 9.9% CAGR from 2025.

- Industry Demand: The increasing need for consistent water quality and high-purity water across diverse industrial applications fuels this segment's growth.

- Strategic Importance: This sector represents a key area of focus and investment for Wabag, leveraging its expertise to capitalize on market opportunities.

Digital Water Management and IoT Solutions

Wabag’s commitment to research and development, especially in areas like IoT and AI for water management, is a significant strength. This focus places them at the forefront of a market that is just beginning to expand but shows immense promise for the future.

While precise market share figures for these specialized digital solutions are still developing, the global push for smart water systems and digital upgrades in the water industry signals substantial future growth potential. For example, the global smart water management market was valued at approximately USD 17.5 billion in 2023 and is projected to reach over USD 50 billion by 2030, growing at a CAGR of around 16%.

These advanced digital solutions are designed to boost operational efficiency and deliver significant cost reductions for both municipal and industrial clients. This value proposition makes them highly appealing and suggests they could evolve into major revenue generators, or cash cows, for Wabag in the coming years.

- R&D Investment: Wabag actively invests in cutting-edge technologies like IoT and AI for water management.

- Market Potential: The smart water management market is experiencing rapid growth, with projections indicating a significant expansion in the coming years.

- Client Benefits: Digital solutions offer enhanced efficiency and cost savings, making them attractive to clients.

- Future Outlook: These innovations are well-positioned to become future cash cows for the company.

Wabag's international projects, particularly in water-scarce regions like the Middle East and Africa, represent its Stars. These segments benefit from high demand due to severe water scarcity, a factor driving significant growth. Wabag's strong order book in these areas, coupled with international revenues forming 48% of its FY25 nine-month income, highlights its leadership and successful expansion in these lucrative, high-growth markets.

The industrial water and wastewater treatment sector is another key Star for Wabag. With the global industrial water reuse and recycling market projected to reach US$37.19 billion by 2032, growing at a 9.9% CAGR from 2025, Wabag's specialized solutions for industries like oil & gas and power generation are well-positioned. This strong market share and the increasing demand for consistent water quality underscore its Star status.

| Segment | Market Growth | Wabag's Position | Key Drivers |

| International Desalination & Water Reuse (ME & Africa) | 8.9% - 11.6% CAGR (2024-2029/2034) for Desalination; 9.73% - 12.7% CAGR (2025-2034) for Water Reuse | Strong market penetration, significant order book, 48% of FY25 9-month international revenue | Acute water scarcity, increasing global demand, stricter environmental mandates |

| Industrial Water Treatment | 9.9% CAGR (2025-2032), reaching US$37.19 billion by 2032 | Substantial market share with specialized solutions for key industries | Need for consistent water quality, high-purity water in manufacturing, power generation, and oil & gas |

What is included in the product

The Wabag BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

The Wabag BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for decisive action.

Cash Cows

VA Tech Wabag's traditional municipal wastewater treatment operations, particularly its operation and maintenance (O&M) contracts, are prime examples of Cash Cows within its business portfolio. These segments are characterized by a dominant market share, especially in India, and a history of stable, recurring revenue streams. For fiscal year 2025, O&M contracts represented a substantial 39% of Wabag's order book, demonstrating their ongoing importance and future revenue potential.

These mature business areas require minimal new investment for growth promotion, as their market position is already well-established. Instead, the focus is on efficient execution and operational excellence, which directly translates into consistent profitability. This consistent profit generation allows Wabag to leverage these Cash Cows as a reliable source of funds to support other areas of the business, such as investing in growth opportunities or research and development.

The strategic aim is to maintain O&M contracts at around 20% of overall revenues, a target that underscores their role as a foundational and dependable income generator. This stable cash flow is crucial for the company's financial health, providing a predictable income stream that can absorb market fluctuations and fund strategic initiatives.

Wabag's drinking water treatment plants, covering both EPC and O&M, are a foundational "Cash Cow" in its BCG matrix. This segment boasts a significant market share within a mature and stable industry, evidenced by their extensive project portfolio. For instance, Wabag's involvement in India's largest seawater RO plant in Chennai highlights their established expertise and capacity in this critical infrastructure area.

These established operations provide a consistent and reliable stream of revenue and profit for Wabag. Unlike emerging technologies, the growth investment needed for these water treatment solutions is relatively lower, allowing the company to leverage its existing infrastructure and expertise effectively. This stability makes the drinking water treatment segment a vital contributor to the company's overall financial health.

Wabag's EPC projects in established markets are clearly cash cows. The company boasts an impressive order book, reaching around ₹13,667 crore as of FY25, with a substantial 72% of that stemming from EPC orders. This translates to excellent revenue visibility and a steady, reliable cash flow from its core, mature markets.

Despite the capital-intensive nature of EPC projects, Wabag's strategic emphasis on an asset-light approach and efficient project execution in these established regions allows for high profit margins. This operational efficiency is key to generating strong returns from these mature business segments.

The consistent success in securing large EPC contracts within its traditional areas of strength underscores Wabag's dominant market position. This track record speaks volumes about their expertise and competitive edge in these established markets.

Sludge Treatment Solutions

Sludge treatment solutions represent a mature segment within the broader water and wastewater management industry, and Wabag has established a strong presence here. This area is characterized by consistent demand, making it a reliable revenue generator for the company. Wabag’s comprehensive offerings in sludge treatment underscore its significant market share in this essential, though not rapidly expanding, niche.

These specialized services are crucial for the efficient operation of water and wastewater infrastructure. They contribute substantially to the overall value of larger projects and ensure steady income streams for Wabag. The mature nature of this market means that while growth potential might be moderate, the established demand provides a stable foundation.

- Mature Market: Sludge treatment is a well-established part of water management, offering predictable demand.

- High Market Share: Wabag's specialized solutions indicate a strong position in this segment.

- Steady Revenue: These services provide consistent income without the need for extensive new market exploration.

- Project Value Addition: Sludge treatment capabilities enhance the overall value of Wabag's water and wastewater projects.

Long-Term Operation & Maintenance (O&M) Services

Wabag's strategic push towards increasing its revenue share from Operations & Maintenance (O&M) services, with a target of 20% of its total income, firmly positions this segment as a cash cow within its business model. This focus highlights a mature, stable, and highly profitable area of operation.

These long-term O&M contracts offer a predictable revenue stream, which is crucial for financial stability. Once the initial capital investment in infrastructure is made, the ongoing investment requirements for O&M are relatively low, leading to high profit margins. For instance, in the fiscal year 2023, Wabag reported a robust order book, with a significant portion attributed to O&M projects, underscoring the segment's consistent contribution.

- Stable Revenue: Long-term O&M contracts provide a predictable and consistent income flow.

- High Profitability: Lower ongoing capital expenditure after initial setup results in strong profit margins.

- Repeat Business: Strong client relationships and the essential nature of O&M foster repeat business.

- Financial Foundation: This segment offers a solid financial base, supporting other strategic initiatives.

Wabag's municipal wastewater treatment operations, particularly its Operations and Maintenance (O&M) contracts, are quintessential Cash Cows. These segments, especially in India, command a significant market share and generate stable, recurring revenues. For FY25, O&M contracts represented a substantial 39% of Wabag's order book, highlighting their ongoing importance and future revenue potential.

These mature business areas require minimal new investment for growth, focusing instead on operational excellence to ensure consistent profitability. This allows Wabag to leverage these Cash Cows for funding other business segments or R&D initiatives. The company strategically aims to maintain O&M contracts at around 20% of total revenues, reinforcing their role as a dependable income generator.

Wabag's drinking water treatment plants, encompassing both EPC and O&M, are foundational Cash Cows. With a substantial market share in a mature and stable industry, these operations provide consistent revenue and profit. For example, Wabag's involvement in India's largest seawater RO plant in Chennai showcases their established expertise. The relatively lower growth investment needed for these established solutions allows the company to leverage existing infrastructure effectively, contributing significantly to its financial health.

| Segment | BCG Classification | Key Characteristics | FY25 Order Book Contribution |

| Municipal Wastewater (O&M) | Cash Cow | Stable, recurring revenue, dominant market share, low investment needs | 39% |

| Drinking Water Treatment (EPC & O&M) | Cash Cow | Mature market, consistent demand, established expertise, reliable income | N/A (Integral part of overall order book) |

What You See Is What You Get

Wabag BCG Matrix

The preview you see is the identical Wabag BCG Matrix document you will receive upon purchase, offering an unwatermarked and fully formatted strategic planning tool. This comprehensive report, meticulously designed for clarity, will be immediately available for your use without any demo content or hidden surprises. What you're currently viewing is the complete, ready-to-deploy BCG Matrix analysis, ensuring you get precisely what you need for informed business decisions. Once purchased, this professional document becomes yours, perfect for editing, presenting, or integrating into your strategic initiatives.

Dogs

Projects with significant cancellation risks or delays, like the $317 million (₹2,700 crore) Saudi desalination plant order that was canceled in December 2024, represent a high-risk, low-return segment for Wabag. Even though Wabag was a preferred bidder, the cancellation demonstrates the inherent volatility.

These types of projects can act as cash traps, consuming valuable resources and management attention without generating immediate revenue. The uncertainty surrounding their eventual realization, even after rebidding, impacts short-term financial performance and operational efficiency.

While Wabag is known for its innovation, certain older water treatment technologies that haven't been upgraded or retired could be considered in the Dogs quadrant. These might include legacy systems that are energy-intensive or require significant ongoing maintenance. For instance, if a particular desalination process uses substantially more power than newer membrane technologies, its operational costs would be higher, impacting profitability.

These less efficient technologies often yield lower profit margins and consume capital without contributing to significant market growth or providing a distinct competitive edge. In 2023, for example, the global water treatment market saw significant investment in advanced technologies like IoT-enabled monitoring and AI-driven process optimization, highlighting the increasing obsolescence of purely mechanical or older chemical treatment methods if not modernized.

Small-scale, highly competitive local projects often characterize the "Dogs" quadrant of the BCG matrix. These ventures typically operate in fragmented markets where price is a major differentiator, leading to thin profit margins. For a company like Wabag, which operates in the water and wastewater management sector, these could be smaller municipal projects in localized regions with numerous smaller competitors.

In 2024, the global water and wastewater treatment market, while substantial, is characterized by both large-scale infrastructure projects and smaller, localized service contracts. While specific figures for Wabag's "Dog" segments are not publicly disclosed, industry analysis suggests that smaller, highly competitive local projects often represent a significant portion of the market's overall volume but contribute less to overall profitability. For instance, reports from early 2024 indicated that while the broader water treatment market was valued in the hundreds of billions of dollars globally, the profit margins on smaller, highly localized projects could be as low as 5-10%, compared to 15-20% or higher for large, integrated solutions.

Segments with High Regulatory Compliance Costs

Certain older municipal wastewater treatment facilities often fall into segments with high regulatory compliance costs. These facilities, particularly those needing substantial upgrades to meet evolving environmental standards, can become cash traps.

The significant capital expenditure required for compliance, coupled with potentially unfavorable contract structures that limit returns, can lead to unprofitable resource allocation. For instance, in 2024, the global wastewater treatment market saw continued investment, but projects facing stringent EPA or equivalent international standards can see cost overruns of 15-20% due to unforeseen regulatory requirements.

- High Capital Expenditure: Upgrading aging infrastructure to meet new discharge limits can cost millions, even billions, for large municipalities.

- Uncertain Returns: Contracts for municipal upgrades may have fixed pricing, leaving little room for unexpected compliance cost increases.

- Resource Tie-up: Significant financial and managerial resources are committed to compliance, diverting them from potentially more profitable ventures.

- Regulatory Uncertainty: Constantly changing environmental regulations can necessitate further, unplanned investments.

Geographical Regions with Limited Growth Potential and Low Market Share

Geographical regions where VA Tech Wabag has a minimal market presence and where the overall water treatment market growth is stagnant or declining would be classified as Dogs in the BCG Matrix. These areas present limited avenues for expansion or establishing a dominant market position, resulting in diminished returns on any capital deployed. For instance, while Wabag has a strong presence in India and the Middle East, certain smaller, less developed markets in Africa or parts of Eastern Europe might fit this description if their water infrastructure investment is low and competitive intensity is high with little differentiation potential.

These "Dog" regions are characterized by several factors that hinder profitable growth:

- Stagnant Market Growth: The overall demand for water treatment solutions in these regions is not expanding, perhaps due to economic slowdowns or a lack of new industrial development.

- Low Market Share: VA Tech Wabag’s existing footprint and revenue generated from these specific geographies are insignificant compared to its global operations. For example, if a particular African nation contributes less than 0.5% to Wabag's total revenue and the national water treatment market is projected to grow at less than 2% annually, it might be categorized as a Dog.

- Limited Scalability: The economic or regulatory environment in these Dog regions may not support significant scaling of operations or investments in new, large-scale projects.

- Low Return on Investment: Resources allocated to these markets are unlikely to yield substantial returns, making them candidates for divestment or minimal resource allocation.

The "Dogs" in Wabag's BCG Matrix represent segments with low growth and low market share, often characterized by intense competition and thin profit margins. These can include older, less efficient technologies, or small-scale projects in highly fragmented markets. For instance, legacy water treatment systems that are energy-intensive or require extensive maintenance might fall into this category, yielding lower returns compared to advanced, modernized solutions.

Projects with high cancellation risks, like the $317 million Saudi desalination plant order canceled in December 2024, also exemplify the "Dogs" quadrant due to their low return potential despite initial investment. These ventures can become cash traps, consuming resources without generating immediate revenue, impacting overall financial performance and operational efficiency.

Geographical regions with stagnant market growth and minimal market presence for Wabag, such as certain less developed markets in Africa or Eastern Europe with low water infrastructure investment, also fit the "Dogs" profile. These areas offer limited avenues for expansion and are unlikely to yield substantial returns on deployed capital.

Several factors contribute to these segments being classified as Dogs: stagnant market growth, low market share (e.g., a region contributing less than 0.5% to total revenue with sub-2% annual market growth), limited scalability due to economic or regulatory environments, and consequently, a low return on investment, making them candidates for minimal resource allocation.

| Segment Characteristic | Examples for Wabag | Market Reality (2024) | Impact on Wabag |

|---|---|---|---|

| Low Market Share & Low Growth | Small, highly competitive local projects; Geographies with minimal presence and stagnant water treatment market growth (e.g., certain African or Eastern European markets). | Smaller projects often have profit margins of 5-10%. Stagnant markets offer limited expansion opportunities. | Consumes resources with little prospect of significant returns, potentially acting as cash traps. |

| Underperforming Technologies | Older, energy-intensive water treatment technologies; Legacy systems requiring significant maintenance. | Global market increasingly favors IoT-enabled monitoring and AI-driven optimization, making older methods less competitive. | Yields lower profit margins and requires capital investment without a distinct competitive edge. |

| High Risk, Low Return Projects | Projects with significant cancellation risks (e.g., $317 million Saudi desalination plant order canceled December 2024). | Project cancellations highlight inherent market volatility and the risk of unrealized revenue. | Drains financial and managerial resources, impacting short-term financial performance and operational efficiency. |

| Regulatory Compliance Burdens | Older municipal wastewater treatment facilities requiring substantial upgrades for evolving environmental standards. | Projects facing stringent regulations can see cost overruns of 15-20% due to unforeseen compliance needs. | Requires significant capital expenditure and may have unfavorable contract structures, leading to unprofitable resource allocation. |

Question Marks

Wabag's strategic investments in smart water management systems, leveraging AI and IoT, position it in a high-growth, albeit currently low-share, segment. This area is characterized by rapid technological advancement and burgeoning demand.

The market for these integrated solutions is still maturing, meaning Wabag's current market penetration is modest, reflecting the nascent stage of both the technology and its widespread adoption. Continued investment is crucial to solidify its position.

Significant capital expenditure is necessary to translate these innovative, emerging technologies into dominant market players, or "Stars," in the future. For instance, global spending on IoT in water management was projected to reach billions of dollars by 2024, highlighting the substantial growth runway.

Wabag's approach to municipal Public-Private Partnership (PPP) projects, particularly those requiring significant equity from partners, positions them as Question Marks within the BCG framework. This strategy leverages external investment to fuel expansion in a sector with substantial growth potential, such as the global water and wastewater treatment market which was valued at approximately USD 62.3 billion in 2023 and is projected to grow.

While these PPPs offer considerable upside in terms of scale and market penetration, Wabag's established market share in this specific partnership model is still developing. This necessitates a careful balance between the potential for large-scale projects and the upfront capital commitment required to secure and implement them effectively.

New market entries in untapped regions for Wabag would fall under the Question Marks category of the BCG Matrix. These are ventures into geographies with high potential for water solutions but where Wabag currently has little to no footprint.

Consider the emerging markets in Southeast Asia or parts of Africa where rapid industrialization and population growth are driving significant water demand, yet established water treatment infrastructure is limited. These regions often present a high growth opportunity for companies like Wabag.

For example, while specific 2024 data is still emerging, market analysis indicates that sub-Saharan Africa's water treatment market is projected to grow at a CAGR of over 6% in the coming years, presenting a prime example of an untapped region with high demand.

These ventures require substantial initial investment for market understanding, establishing local partnerships, and navigating regulatory landscapes, making their short-term profitability uncertain but offering significant long-term upside should Wabag successfully capture market share.

Specialized Industrial Niche Applications

In the Wabag BCG Matrix, specialized industrial niche applications represent areas like advanced treatment for PFAS (per- and polyfluoroalkyl substances) or highly customized solutions for complex pharmaceutical effluents. These sectors demand substantial research and development, positioning them as potential question marks.

While these niche markets offer significant growth potential, Wabag's initial market share would likely be low, necessitating strategic investment to build expertise and market presence. For instance, the global market for PFAS remediation technologies was projected to reach over $1.5 billion by 2024, indicating a substantial opportunity for those with specialized capabilities.

- Emerging Contaminants: Addressing advanced treatment needs for substances like microplastics or endocrine disruptors, requiring significant R&D investment.

- High-Value Industrial Effluents: Developing bespoke water treatment solutions for industries such as electronics manufacturing or advanced materials, which have unique and stringent discharge requirements.

- Market Development Costs: These applications often involve longer sales cycles and higher initial costs for technology validation and customer acquisition.

- Strategic Partnerships: Collaborating with research institutions or key industrial players could be crucial for accelerating market entry and technology refinement in these specialized areas.

Hybrid Desalination Technologies

Hybrid desalination technologies, combining methods like reverse osmosis with thermal processes or membrane distillation, are a significant innovation area. These advancements are driven by the urgent need to lower energy consumption and environmental impact, making them high-growth segments. For instance, advancements in renewable energy integration with desalination are a key focus, with projects increasingly incorporating solar or wind power.

While Wabag holds a strong position in traditional desalination, its market share in these emerging hybrid technologies might be currently modest as they are still maturing. The global desalination market was valued at approximately $10 billion in 2023 and is projected to grow, with hybrid systems expected to capture a larger portion of this growth in the coming years. Continued strategic investment in research and development, alongside successful project execution in these innovative areas, will be crucial for Wabag to cement a leading role.

- Innovation Focus: Hybrid desalination technologies are rapidly evolving, aiming for reduced carbon footprints and improved water quality.

- Market Position: While Wabag is a leader in desalination, its specific market share in newer hybrid approaches may still be developing.

- Growth Potential: These technologies represent a high-growth area within the broader desalination market, driven by sustainability demands.

- Strategic Imperative: Continued investment in R&D and project execution is vital for Wabag to establish a leading position in hybrid desalination.

Wabag's participation in novel water recycling and reuse projects, particularly those involving advanced membrane technologies or complex industrial wastewater treatment for resource recovery, positions them as Question Marks. These projects are in high-growth sectors but require substantial upfront investment and market development.

The company's strategic focus on developing and implementing digital water solutions, including smart metering and predictive analytics for water networks, also falls into the Question Mark category. While the potential for efficiency gains and cost savings is significant, the market adoption and Wabag's current penetration are still evolving.

These ventures require significant capital for research, development, and initial market penetration. For example, the global market for digital water solutions was projected to reach tens of billions of dollars by 2024, underscoring the growth opportunity.

| Strategic Area | BCG Category | Rationale | Market Growth Potential | Wabag's Current Share |

|---|---|---|---|---|

| Smart Water Management Systems (AI/IoT) | Question Mark | High growth, low share due to nascent market | High | Low |

| Municipal PPP Projects (Equity-heavy) | Question Mark | High potential scale, but requires significant upfront capital and developing market share | High (Global water/wastewater market valued ~USD 62.3 billion in 2023) | Developing |

| New Geographic Market Entries | Question Mark | Untapped regions with high demand but no existing footprint | High (e.g., Sub-Saharan Africa market projected CAGR > 6%) | Negligible |

| Specialized Industrial Niche Applications (e.g., PFAS, Pharma) | Question Mark | High growth potential, but requires specialized R&D and market development | High (e.g., PFAS remediation market projected > $1.5 billion by 2024) | Low |

| Hybrid Desalination Technologies | Question Mark | Innovative, high-growth segment within a mature market, requiring R&D investment | High (part of ~USD 10 billion global desalination market in 2023) | Developing |

| Water Recycling & Reuse Projects (Advanced) | Question Mark | High-growth sectors needing substantial upfront investment and market development | High | Developing |

| Digital Water Solutions (Smart Metering/Analytics) | Question Mark | Evolving market adoption and penetration requiring strategic investment | High (Tens of billions of dollars projected by 2024) | Developing |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.