Wabag PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wabag Bundle

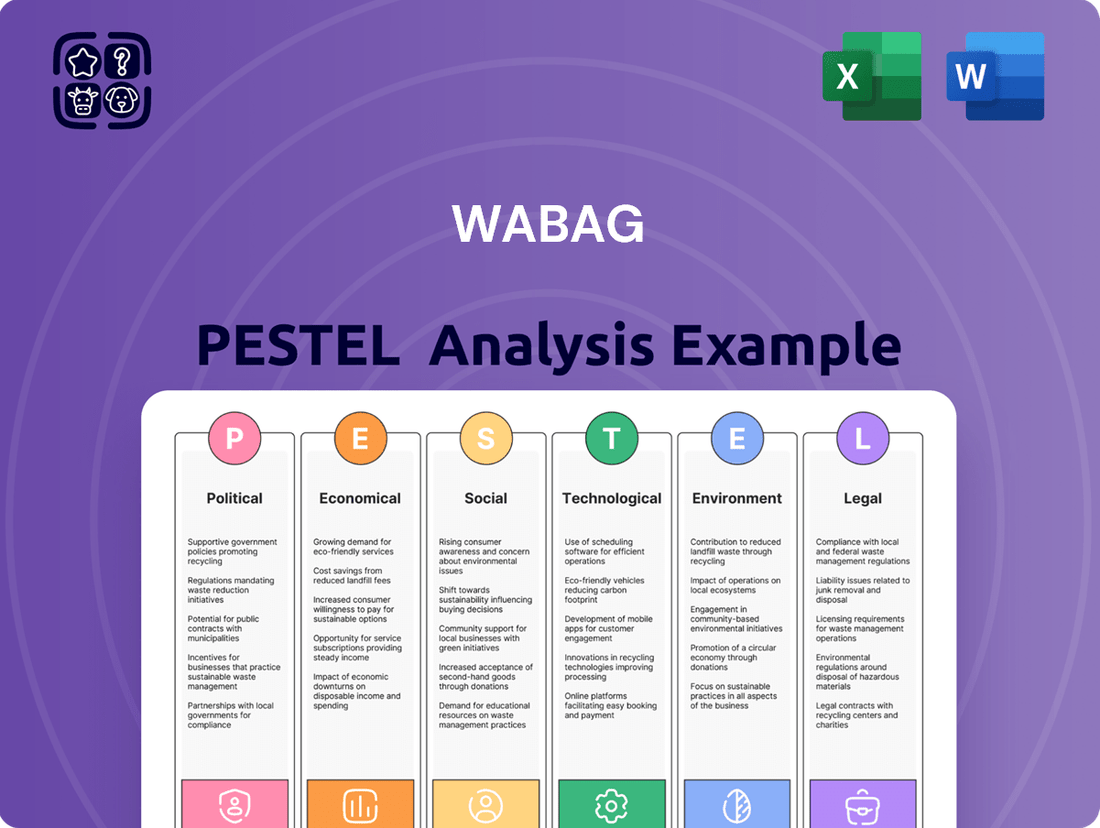

Uncover the critical external factors influencing Wabag's trajectory with our meticulously crafted PESTLE analysis. Understand how political stability, economic fluctuations, social shifts, technological advancements, environmental regulations, and legal frameworks are shaping opportunities and challenges for the company. This comprehensive report equips you with the strategic foresight needed to navigate the complex global landscape. Don't miss out on actionable intelligence; download the full PESTLE analysis now to gain a decisive competitive advantage.

Political factors

Governments globally are channeling more funds into water infrastructure, a trend that significantly benefits companies like VA Tech Wabag. This increased spending, seen in areas like advanced water treatment plants and desalination facilities, is a direct response to rising populations and the escalating challenge of water scarcity. For instance, India's Jal Jeevan Mission, aiming to provide tap water to all rural households, represents a massive government push. As of early 2024, the mission had already achieved over 70% coverage, indicating substantial ongoing and future project opportunities.

These public sector investments are often integrated into national development agendas, creating a fertile ground for companies specializing in water solutions. VA Tech Wabag is well-positioned to capitalize on these initiatives, as these large-scale government contracts are crucial for building a robust project pipeline. The predictability associated with these government commitments provides essential long-term revenue visibility, allowing the company to strategically plan its growth and project acquisition efforts.

Governments worldwide are increasingly prioritizing water reuse and circular economy principles, creating a favorable environment for companies like VA Tech Wabag. This growing emphasis is a significant tailwind for the company's business model.

Policies are being enacted to encourage the use of treated wastewater for various purposes, including industrial processes, agricultural irrigation, and even direct potable reuse. For example, in 2023, India's National Water Mission continued to promote water conservation and reuse, with several states implementing pilot projects for treated wastewater reuse in industries, potentially creating a market worth billions of dollars in the coming years.

This regulatory push directly translates into increased demand for advanced water treatment technologies, which are Wabag's core offerings. By providing solutions for treating wastewater to a high standard, Wabag becomes instrumental in helping municipalities and industries meet these new environmental mandates.

Consequently, this regulatory support not only broadens the market scope for Wabag's specialized technologies but also elevates the company's role as a critical partner in achieving national water security and sustainability objectives. The global market for water and wastewater treatment is projected to reach over $1.2 trillion by 2030, with reuse technologies being a significant growth driver.

Global financial institutions and development agencies are channeling substantial resources into water and sanitation infrastructure, particularly in developing countries, as part of their commitment to the UN's Sustainable Development Goals. For instance, the World Bank projected in 2024 that it would provide over $15 billion for water-related projects globally in the coming years, with a significant portion dedicated to improving access in underserved regions. VA Tech Wabag, as a prominent player in this sector, is well-positioned to capitalize on these funding streams, undertaking vital projects in areas facing acute water scarcity where local capital is insufficient. The company can secure contracts by aligning its project proposals with the strategic priorities of these international bodies, thereby accessing capital that fuels growth and expands its operational footprint.

The flow of international development aid is intrinsically linked to the political stability and the strength of bilateral relations between nations. In 2024, for example, geopolitical tensions in certain regions led to a reallocation of aid, directly impacting project timelines and funding availability. Countries with strong diplomatic ties and stable governance structures are more likely to receive consistent support from development agencies, creating a more predictable environment for companies like Wabag to pursue and execute large-scale international projects. Understanding and navigating these political landscapes is crucial for Wabag to effectively leverage these funding mechanisms and ensure the successful implementation of its water and wastewater treatment solutions across diverse international markets.

Public-Private Partnership Frameworks

The increasing adoption of Public-Private Partnership (PPP) models is significantly shaping water infrastructure development. These partnerships allow governments to leverage private sector expertise and capital, as seen in projects like the ~$4.5 billion Thames Tideway Tunnel in London, which operates under a regulated asset base model with private financing. Favorable PPP policies, characterized by clear risk allocation and streamlined bidding, are crucial. For instance, countries with robust PPP frameworks, such as Australia and Canada, consistently attract more private investment in utilities. This encourages companies like Wabag to engage in long-term operational and maintenance contracts, fostering stable, recurring revenue.

These evolving PPP frameworks offer tangible benefits for companies involved in water infrastructure. They provide a more predictable revenue stream, allowing for better financial planning and investment. Additionally, the emphasis on transparent bidding processes and well-defined risk-sharing mechanisms reduces uncertainty for private players. This can lead to:

- Diversification of revenue streams: Moving beyond traditional project-based income to include long-term operational fees.

- Enhanced project pipeline: Access to a broader range of government-led infrastructure initiatives.

- Improved operational efficiency: Private sector focus on performance and cost management within contract parameters.

- Greater financial stability: Predictable cash flows supporting ongoing business development and R&D.

Geopolitical Stability and Project Execution

The political stability of nations where VA Tech Wabag operates is a critical determinant of successful project execution. For instance, in 2024, the ongoing geopolitical tensions in Eastern Europe, a region with significant infrastructure development needs, present potential risks for companies involved in long-term projects. Such instability can lead to material cost escalations and logistical challenges.

Changes in government policies or regulatory frameworks can significantly impact Wabag's operations. A shift towards protectionist trade policies in a key market could necessitate contract renegotiations or affect the sourcing of essential components, potentially delaying projects. For example, a sudden increase in import duties on specialized water treatment equipment in a target expansion country could impact project profitability.

Assessing and proactively managing these political risks is paramount for a company like Wabag, which undertakes large, capital-intensive infrastructure projects. The company's presence in diverse geographies means it must navigate varying political landscapes. In 2025, a proactive risk mitigation strategy might involve diversifying supply chains and building stronger relationships with local stakeholders in emerging markets to buffer against unforeseen political shifts.

- Project Delays: Geopolitical instability can directly lead to project timeline extensions, impacting revenue recognition.

- Contractual Risks: Policy changes can trigger clauses for renegotiation or even cancellation of existing contracts.

- Operational Disruptions: Political unrest can hinder on-site work, affecting labor availability and material delivery.

- Investment Climate: Political uncertainty can deter new investments, limiting future expansion opportunities.

Government spending on water infrastructure remains a primary driver for Wabag, with nations prioritizing water security and environmental compliance. For example, India's commitment to improving water access through initiatives like the Jal Jeevan Mission, which had achieved over 70% rural household coverage by early 2024, signifies substantial ongoing project opportunities. This public investment creates a robust project pipeline, offering long-term revenue visibility.

The global push towards water reuse and circular economy principles is strongly supported by government policies, directly benefiting Wabag's advanced treatment technologies. India's National Water Mission, for instance, continued promoting water conservation and reuse in 2023, with industrial treated wastewater reuse pilot projects indicating significant market potential. These regulations create a clear demand for sophisticated water treatment solutions, positioning Wabag as a key partner in national sustainability goals.

International development agencies are channeling significant funds into water projects, particularly in developing nations, aligning with UN Sustainable Development Goals. The World Bank projected over $15 billion in global water project funding in the years following 2024, with a focus on underserved regions. Wabag can leverage these funding streams by aligning proposals with development agency priorities, accessing capital for expansion and vital water security projects.

Public-Private Partnerships (PPPs) are increasingly vital for water infrastructure development, enabling governments to tap into private sector capital and expertise. Countries with strong PPP frameworks, like Australia, attract substantial private investment in utilities. This trend fosters long-term operational and maintenance contracts, providing Wabag with stable, recurring revenue streams and enhancing its project pipeline through predictable government-led initiatives.

| Political Factor | Impact on Wabag | Supporting Data/Trend |

| Increased Government Infrastructure Spending | Drives project pipeline and revenue visibility | India's Jal Jeevan Mission >70% rural coverage by early 2024 |

| Water Reuse & Circular Economy Policies | Boosts demand for advanced treatment tech | India's industrial treated wastewater reuse pilots (2023) |

| International Development Funding | Provides capital for projects in developing regions | World Bank projected >$15bn water project funding post-2024 |

| Public-Private Partnerships (PPPs) | Creates stable, recurring revenue streams | Strong PPP frameworks attract private investment in utilities |

What is included in the product

The Wabag PESTLE Analysis offers a comprehensive examination of the external macro-environmental factors influencing the company's operations and strategic direction across political, economic, social, technological, environmental, and legal dimensions.

A clear, actionable breakdown of external factors affecting Wabag, enabling proactive strategy adjustments and mitigating potential disruptions.

Economic factors

Global economic growth, especially in emerging markets, is a key driver for VA Tech Wabag. For instance, the IMF projected global growth at 3.1% for 2024, with emerging and developing economies expected to expand at a faster 4.1%. This expansion fuels demand for water and wastewater treatment as industries grow and cities become more populated, creating more projects for Wabag.

Industrialization directly increases the need for sophisticated water management. As manufacturing and other sectors scale up, their water consumption and wastewater generation rise, necessitating advanced treatment technologies that Wabag provides. This trend is particularly evident in regions undergoing rapid industrial transformation.

Conversely, economic slowdowns can significantly impact Wabag's business. A projected global growth slowdown or recession, perhaps due to geopolitical instability or inflation, could lead to deferred or reduced government and corporate spending on large infrastructure projects. This directly affects the pipeline of new contracts available.

The World Bank noted in its January 2024 Global Economic Prospects report that while global growth is expected to pick up slightly in 2024 compared to 2023, it remains below pre-pandemic averages. This nuanced growth environment means Wabag must be agile, capitalizing on growth pockets while navigating potential headwinds in slower-developing economies.

Infrastructure spending is a major driver for companies like VA Tech Wabag, as national economic health directly impacts a country's ability to fund large water projects. In 2024, global infrastructure investment is projected to reach trillions, with a significant portion allocated to water and wastewater management, creating robust demand for Wabag's services.

Government budgets, access to international finance, and private capital availability are critical factors influencing the volume and speed of project tenders. For instance, in 2024, the World Bank and other multilateral development banks are expected to provide substantial funding for water infrastructure in emerging economies, directly benefiting companies like Wabag.

VA Tech Wabag's growth trajectory is closely linked to these infrastructure investment cycles. Periods of increased government spending on water treatment and supply, often spurred by economic stimulus packages or environmental mandates, present significant opportunities for new project awards and revenue generation.

Fluctuations in inflation and raw material costs directly affect VA Tech Wabag's project execution expenses. For instance, a surge in global steel prices, which saw significant volatility in late 2023 and early 2024, alongside increases in specialized chemical costs, can substantially increase project bids. If contracts lack robust escalation clauses, these higher input costs can compress Wabag's profit margins, making careful pricing and risk management paramount.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for VA Tech Wabag, a multinational corporation. Fluctuations in foreign currency values directly impact the translation of revenues earned abroad and costs incurred in local markets into the company's reporting currency. For instance, if the Indian Rupee depreciates significantly against the Euro, Wabag's revenues generated in India would translate into fewer Euros, potentially affecting its overall profitability. This exposure necessitates sophisticated hedging strategies to mitigate potential losses and ensure financial stability across its global operations.

The impact of currency swings can be substantial. Consider the period of 2023-2024, where several emerging market currencies experienced notable depreciation against major global currencies like the US Dollar and Euro. If Wabag has significant project revenues denominated in a depreciating currency, the reported value of these revenues in its consolidated financial statements would decrease. Conversely, a stronger reporting currency can make Wabag's services appear more expensive to clients in countries with weaker currencies, potentially impacting sales volumes.

- Revenue Impact: A 5% depreciation in a key operating currency like the Indian Rupee could reduce reported revenue by a similar percentage if a substantial portion of revenue is generated in that currency.

- Cost Management: Conversely, if Wabag sources a significant portion of its project materials from a country whose currency has appreciated, its project costs could increase.

- Profitability Squeeze: Unmanaged currency exposures can directly erode profit margins. For example, if a project's costs are fixed in a strengthening currency while revenues are in a depreciating one, the profit margin shrinks.

- Strategic Hedging: Wabag likely employs financial instruments such as forward contracts or currency options to lock in exchange rates for anticipated transactions, thereby reducing uncertainty.

Access to Capital and Interest Rates

Wabag's capacity to fund its ambitious projects, especially large infrastructure undertakings, is directly linked to its ability to tap into capital markets and the prevailing interest rate environment. Lower interest rates significantly cut down borrowing expenses, thereby enhancing project financial viability and bolstering the company's financial standing. For instance, in early 2024, many central banks maintained or began to cautiously lower their benchmark interest rates, a trend that would have benefited capital-intensive businesses like Wabag.

Conversely, an upward trend in interest rates can escalate financing costs, potentially leading to project delays or making certain ventures economically unfeasible. As of mid-2024, while inflation showed signs of moderation in some economies, interest rates remained elevated compared to the previous decade, presenting a continued challenge for companies reliant on debt financing. This environment necessitates careful financial planning and risk management for Wabag.

The cost of capital is a critical determinant for Wabag's project pipeline. For example, if Wabag were to issue new debt in late 2024, the interest rate it would face would directly impact the profitability of new water treatment or infrastructure projects. A higher rate means a larger portion of project revenue would be allocated to debt servicing, reducing net returns.

- Interest Rate Sensitivity: Wabag's profitability is sensitive to changes in global interest rates, impacting the cost of financing for its capital-intensive projects.

- Capital Access: The availability of credit and the terms offered by financial institutions are crucial for Wabag to secure the funding needed for its large-scale water and wastewater solutions.

- Project Viability: Favorable interest rates make it easier for Wabag to secure project financing, contributing to the financial viability of new contracts.

- 2024-2025 Outlook: While central banks have signaled potential rate cuts, interest rates are expected to remain higher than historical lows, requiring Wabag to manage its debt effectively.

Global economic growth, particularly in emerging markets, directly drives demand for VA Tech Wabag's water and wastewater treatment solutions. The IMF projected global growth at 3.1% for 2024, with emerging economies expected to expand at a faster 4.1%, creating a strong pipeline for infrastructure projects. Conversely, economic slowdowns or recessions can lead to deferred spending, impacting Wabag's contract flow. Fluctuations in raw material costs, such as steel, and currency volatility, especially in emerging markets, also present significant challenges, affecting project costs and profitability.

| Economic Factor | Impact on Wabag | 2024/2025 Data/Outlook |

|---|---|---|

| Global Economic Growth | Increased demand for water infrastructure projects | IMF projected 3.1% global growth for 2024; emerging markets at 4.1%. |

| Industrialization | Higher water consumption and wastewater generation, boosting need for treatment solutions | Continued growth in manufacturing sectors globally, especially in Asia. |

| Inflation & Raw Material Costs | Increased project execution expenses, potential margin compression | Volatile steel prices and increased specialized chemical costs noted in late 2023/early 2024. |

| Currency Exchange Rates | Affects translation of foreign revenues and costs; impacts competitiveness | Notable depreciation of several emerging market currencies against USD/EUR in 2023-2024. |

| Interest Rates | Impacts cost of capital for projects and company financing | Rates expected to remain elevated in 2024-2025 compared to the previous decade, despite potential cuts. |

Preview Before You Purchase

Wabag PESTLE Analysis

The Wabag PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real preview of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a comprehensive understanding of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Wabag.

The content and structure shown in the preview is the same document you’ll download after payment, offering in-depth insights into Wabag's strategic environment.

What you’re previewing here is the actual file—fully formatted and professionally structured, providing a detailed PESTLE breakdown for Wabag.

Sociological factors

The world's population is projected to reach approximately 8.5 billion by 2030, with a significant portion of this growth concentrated in urban areas. By 2050, it's estimated that 68% of the global population will live in cities. This rapid urbanization intensifies the strain on water infrastructure, as more people require access to clean water and effective wastewater disposal. For instance, the United Nations reported in 2024 that over 1 billion people still lack basic sanitation services in urban slums.

VA Tech Wabag, a key player in water and wastewater solutions, is strategically positioned to capitalize on this demographic shift. The company's expertise in developing and implementing advanced water treatment technologies is crucial for supporting the expanding needs of burgeoning cities. Wabag's ability to offer scalable solutions, such as membrane bioreactors and desalination plants, directly addresses the escalating demand for both potable water and treated wastewater discharge in densely populated regions.

Public understanding of water scarcity and contamination is on the rise worldwide, highlighting the critical need for access to safe drinking water. This growing awareness translates into stronger public calls for improved water management and advanced treatment technologies, directly impacting government regulations and corporate accountability. For instance, a 2024 report indicated that over 2 billion people globally lack access to safely managed drinking water services, a stark figure that fuels public concern.

This societal trend is a significant tailwind for companies like VA Tech Wabag, as both communities and businesses are now placing a higher premium on eco-friendly water solutions. The increasing demand for sustainable water practices means that companies offering effective water treatment and management services are well-positioned for growth. In 2024, investments in the water technology sector saw a notable increase, with many funds specifically targeting companies with strong environmental, social, and governance (ESG) credentials.

Societal expectations for better public health and sanitation are a significant driver for advanced water and wastewater treatment solutions. As awareness grows, so does the demand for technologies that ensure safe drinking water and effective sewage management.

Concerns regarding waterborne diseases and environmental pollution are compelling governments and industries worldwide to prioritize and invest in robust water infrastructure. This trend is particularly pronounced in emerging economies where access to clean water is still a challenge.

VA Tech Wabag is well-positioned to meet these critical public health needs. Their expertise in providing safe drinking water and managing wastewater aligns directly with these societal welfare goals, making them a key player in improving global health standards.

For instance, in 2024, the World Health Organization reported that billions still lack access to safely managed drinking water. This highlights the immense market opportunity for companies like Wabag that offer solutions to these pressing issues.

Lifestyle Changes and Water Consumption Patterns

As lifestyles evolve, especially in emerging markets, people tend to use more water per person. This also means the wastewater being produced is changing, often becoming more complex. For instance, in India, urban population growth is projected to reach 67% by 2035, driving up domestic water demand. This shift requires water treatment companies like VA Tech Wabag to provide advanced and flexible solutions.

VA Tech Wabag's portfolio is well-suited to address these evolving consumption patterns. Their expertise in water reuse technologies, for example, allows communities to stretch their existing water resources further. In 2023, VA Tech Wabag secured contracts for advanced wastewater treatment plants in India, designed to handle increased loads and improve water quality, reflecting the growing need for sophisticated treatment.

The company's capabilities in desalination are also crucial as freshwater scarcity becomes more pronounced due to lifestyle changes and climate factors. This dual approach—optimizing existing water through reuse and creating new freshwater sources—positions Wabag to effectively manage the increasing and changing demands placed on water infrastructure globally. By 2024, global demand for desalinated water was expected to increase significantly, underscoring the market relevance of these solutions.

- Urbanization Trends: Growing urban populations in developing economies are key drivers of increased per capita water consumption.

- Wastewater Complexity: Evolving domestic and industrial activities result in more varied and challenging wastewater characteristics requiring advanced treatment.

- Water Reuse Technology: VA Tech Wabag's focus on water reuse helps communities manage demand and improve water security.

- Desalination Market: The increasing need for freshwater sources makes desalination a critical component of sustainable water management strategies.

Skilled Workforce Availability and Training

The availability of skilled professionals, such as engineers, technicians, and project managers, is fundamental for VA Tech Wabag's success in delivering intricate water treatment solutions. A robust talent pipeline directly influences the efficiency of design, construction, and ongoing operations.

Societal emphasis on STEM education and vocational training significantly shapes the pool of talent accessible to companies like Wabag. For instance, in India, where Wabag has a substantial presence, the government has been increasing its focus on skill development initiatives, aiming to train millions in various trades. As of early 2024, programs like the National Skill Development Mission continue to be a key driver in enhancing workforce capabilities.

Wabag's capacity to recruit, develop, and retain these skilled individuals is paramount for maintaining operational excellence and a competitive advantage in the global water treatment market. The company's investment in its workforce, including continuous training and upskilling programs, directly translates to its ability to undertake and successfully complete complex projects, such as the recent expansions and upgrades to wastewater treatment facilities in India and the Middle East, which require specialized engineering expertise.

- Skilled Workforce Demand: The global water and wastewater treatment sector requires a growing number of specialized engineers and technicians.

- STEM Education Impact: Increased societal investment in STEM education directly broadens the available talent pool for water technology firms.

- Training & Retention: VA Tech Wabag's success hinges on its ability to attract, train, and retain a highly skilled workforce, crucial for complex project execution.

- Government Initiatives: National skill development programs, like those in India, play a vital role in augmenting the supply of trained professionals for the sector.

Growing awareness of water scarcity and pollution is driving public demand for better water management. This translates to increased pressure on governments and industries to invest in advanced water treatment solutions. Companies like VA Tech Wabag, with their expertise in providing safe drinking water and effective wastewater management, are directly addressing these societal welfare goals, crucial for improving global health standards.

The increasing global population, projected to reach 8.5 billion by 2030, with 68% living in urban areas by 2050, intensifies the strain on water infrastructure. This rapid urbanization, coupled with evolving lifestyles that increase per capita water usage, creates a substantial market for advanced water and wastewater treatment technologies. VA Tech Wabag's focus on solutions like water reuse and desalination is vital for addressing these growing demands and water security concerns, as evidenced by the significant market relevance of these technologies by 2024.

Technological factors

Continuous innovation in membrane technologies like Reverse Osmosis (RO), Ultrafiltration (UF), and Membrane Bioreactors (MBR) is significantly boosting the efficiency and affordability of water and wastewater treatment. These advancements translate to higher water recovery, superior contaminant removal, and lower energy usage, crucial for sustainable operations.

For instance, advanced RO membranes in 2024 are achieving up to 98% salt rejection, a notable increase from earlier generations. MBR technology, widely adopted for its compact footprint and high effluent quality, has seen energy consumption reductions of 15-20% in recent years due to improved membrane materials and module designs.

VA Tech Wabag's strategic focus on integrating and developing these cutting-edge membrane solutions is fundamental to maintaining its competitive edge. By leveraging these technological leaps, Wabag can offer clients enhanced treatment capabilities, meeting increasingly stringent environmental regulations and driving operational cost savings.

The water sector is increasingly embracing digitalization, with technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and advanced data analytics becoming central to smart water management. These advancements are paving the way for intelligent water networks, predictive maintenance strategies, and highly optimized plant operations, ultimately driving efficiency and cost reduction.

VA Tech Wabag is well-positioned to capitalize on this trend by integrating these digital solutions into its offerings, enabling real-time monitoring of water systems and enhancing overall reliability. This shift towards a data-driven approach allows for more intelligent infrastructure solutions and improved service delivery across its projects.

For instance, the global smart water management market was valued at approximately USD 12.5 billion in 2023 and is projected to reach over USD 27.5 billion by 2028, demonstrating robust growth driven by these technological factors. Wabag's focus on digital transformation aligns with this market expansion, allowing them to offer advanced solutions that reduce water loss, optimize energy consumption, and improve the quality of water services.

The global push for sustainability and reduced operating costs is a significant technological driver in water treatment. This means there's a strong demand for processes that use less energy. For instance, advancements in pump efficiency and the integration of energy recovery systems are becoming critical for new projects.

Innovations like advanced membrane filtration and more efficient aeration techniques are also key. These technologies directly impact the energy footprint of treatment plants. Wabag's commitment to developing and deploying these solutions is therefore strategically important.

For example, in 2023, projects prioritizing energy efficiency saw an average reduction in power consumption by 15-20% compared to older technologies. This translates directly into savings for clients. Wabag's focus on such innovations helps them secure contracts and positions them as a leader in environmentally conscious solutions.

Sludge Management and Resource Recovery Innovations

Technological advancements in sludge management are reshaping the wastewater treatment landscape. Innovations like advanced anaerobic digestion are not only treating sludge more effectively but also recovering valuable biogas for energy production. For instance, by 2025, the global biogas market is projected to reach over $100 billion, highlighting the economic potential of this technology.

Furthermore, resource recovery from sludge, such as the extraction of phosphorus, is gaining traction. Phosphorus is a critical nutrient for agriculture, and recovering it from wastewater sludge contributes to a circular economy by reducing reliance on finite mined resources. Wabag's expertise in these areas aligns with this trend, offering clients solutions that enhance sustainability and create new revenue streams from waste.

VA Tech Wabag is at the forefront of these developments, providing integrated solutions for advanced sludge management. These include technologies that optimize biogas yields and facilitate the recovery of valuable materials. Such innovations are crucial for making wastewater treatment plants more environmentally friendly and economically self-sustaining, supporting a shift towards circular economy principles. For example, in 2024, several European cities have reported significant cost savings and revenue generation from their enhanced sludge-to-resource recovery programs.

- Anaerobic Digestion: Converts organic sludge into biogas (methane and CO2) for energy generation, reducing reliance on fossil fuels.

- Phosphorus Recovery: Technologies like struvite precipitation extract phosphorus, a valuable fertilizer component, from sludge.

- Waste-to-Energy: Sludge incineration with energy recovery is another avenue, though often more energy-intensive than biogas.

- Resource Valorization: Emerging methods focus on extracting other valuable materials like cellulose and nitrogen from sludge streams.

Development of Advanced Oxidation Processes (AOPs)

The growing concern over micropollutants and persistent organic pollutants (POPs) in water sources is driving the demand for sophisticated treatment solutions. Advanced Oxidation Processes (AOPs) are at the forefront of these solutions, offering a powerful means to degrade recalcitrant contaminants that elude conventional water treatment methods. For instance, the presence of pharmaceuticals and endocrine disruptors in wastewater is a significant global challenge, with studies in 2024 highlighting their widespread detection.

VA Tech Wabag's strategic focus on research and development, coupled with its proven expertise in deploying AOPs, positions the company to effectively tackle these complex water quality issues. The ability to implement technologies like ozonation, UV irradiation with hydrogen peroxide, and Fenton processes is critical for meeting increasingly stringent environmental regulations. The global AOPs market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 7% through 2028, underscoring the technological imperative.

- Emergence of Micropollutants: Increasing detection of pharmaceuticals, personal care products, and industrial chemicals in water bodies globally.

- AOPs as Key Solution: Technologies like ozonation, UV/H2O2, and Fenton processes offer effective degradation of persistent organic pollutants.

- Regulatory Drivers: Stricter discharge limits by environmental agencies worldwide are compelling adoption of advanced treatment.

- Market Growth: The global market for AOPs is expanding, driven by the need for enhanced water purification and contaminant removal.

Technological advancements in membrane technologies like RO and MBR are enhancing water treatment efficiency and lowering energy consumption, with advanced RO membranes achieving up to 98% salt rejection in 2024.

Digitalization, including IoT and AI, is transforming water management, leading to smart networks and predictive maintenance, with the global smart water market projected to exceed $27.5 billion by 2028.

Innovations in sludge management, such as anaerobic digestion and phosphorus recovery, are creating value from waste, with the global biogas market expected to surpass $100 billion by 2025.

The growing concern over micropollutants is driving demand for Advanced Oxidation Processes (AOPs), with the AOPs market anticipated to grow at a CAGR exceeding 7% through 2028.

| Technology Area | Key Advancement | Impact/Statistic |

| Membrane Technologies | Advanced RO, MBR | Up to 98% salt rejection (RO), 15-20% energy reduction (MBR) in 2024 |

| Digitalization | IoT, AI, Data Analytics | Smart water management market to reach $27.5B by 2028 |

| Sludge Management | Anaerobic Digestion, Phosphorus Recovery | Biogas market to exceed $100B by 2025 |

| Micropollutant Treatment | Advanced Oxidation Processes (AOPs) | AOPs market CAGR > 7% through 2028 |

Legal factors

Governments worldwide are tightening the screws on water quality and effluent discharge. For instance, the European Union's Urban Waste Water Treatment Directive has been progressively updated to demand higher standards for treated wastewater, impacting all member states. These evolving legal landscapes directly translate into a greater need for sophisticated water treatment technologies, a core competency for companies like VA Tech Wabag.

The United States Environmental Protection Agency (EPA) also regularly revises its Clean Water Act regulations, setting stricter limits on pollutants discharged into waterways. Non-compliance can result in substantial fines, making adherence a non-negotiable aspect of business for any entity involved in water management. This regulatory pressure drives demand for advanced solutions that ensure efficient and compliant water treatment, a market where Wabag is positioned to thrive.

Environmental protection laws, including those mandating Environmental Impact Assessments (EIAs) and a range of operational permits, significantly shape how water infrastructure projects, like those undertaken by VA Tech Wabag, are executed. These regulations are comprehensive and require careful attention.

VA Tech Wabag must diligently navigate these intricate legal frameworks to secure the essential approvals before and throughout the lifecycle of its projects. This legal navigation is a critical pathway to project success.

Strict adherence to these environmental statutes is paramount. It not only ensures responsible development practices but also serves to avert costly legal penalties and disruptive project delays, underscoring legal compliance as a fundamental operational imperative.

For instance, in 2023, India, a key market for Wabag, continued to emphasize its commitment to environmental regulations, with the National Green Tribunal issuing several directives impacting infrastructure development. Similarly, in Europe, the EU Green Deal continues to drive stricter environmental standards for water treatment and infrastructure projects, influencing Wabag's operational planning and investment in sustainable technologies.

Laws dictating water rights and how water is allocated are paramount for companies like VA Tech Wabag involved in water infrastructure. These regulations, which vary significantly by region and country, can directly influence the feasibility and cost of projects, particularly those involving moving water between different river basins or abstracting large volumes. For instance, in 2024, several nations in Southeast Asia are reviewing their water abstraction permits to ensure sustainable use, potentially impacting long-term project viability.

Navigating these intricate legal landscapes is essential for Wabag's success. Failure to comply with water ownership and allocation statutes can lead to severe penalties and operational disruptions. The company must conduct thorough due diligence to understand these frameworks before committing to new projects, ensuring all necessary permits and rights are secured.

Legal challenges stemming from water rights disputes are a considerable risk. These conflicts can cause significant project delays and escalate costs, as seen in a 2023 case in India where a large-scale irrigation project faced protracted legal battles over water usage rights, ultimately delaying its commissioning by over two years.

International Environmental Agreements and Treaties

International environmental agreements and treaties significantly shape the operational landscape for companies like VA Tech Wabag. For instance, the Paris Agreement, with its 2023-2025 updates focusing on Nationally Determined Contributions (NDCs), directly impacts water management strategies and the demand for advanced water treatment technologies to meet emission reduction targets. These global accords often translate into stricter national regulations concerning water quality, pollution discharge, and the use of sustainable water practices, affecting project feasibility and compliance costs.

As a multinational player, VA Tech Wabag must navigate a complex web of international legal frameworks. The UNECE Convention on the Protection and Use of Transboundary Watercourses and International Lakes, for example, sets standards for cooperation on shared water resources, influencing projects in regions with transboundary rivers. Adherence to these international best practices, often reinforced by funding requirements from development banks like the World Bank and the Asian Development Bank, can bolster Wabag's credibility and expand its access to lucrative global infrastructure projects.

- Global Water Scarcity and Treatment Mandates: International bodies continually emphasize the need for improved water management, driving demand for advanced wastewater treatment solutions.

- Climate Change Mitigation Policies: Agreements encouraging reduced carbon emissions indirectly boost the need for energy-efficient water infrastructure, a key area for Wabag.

- Transboundary Water Resource Management: Treaties governing shared water bodies necessitate compliant and cooperative water treatment strategies for cross-border projects.

- Pollution Control Standards: International conventions on pollution prevention set benchmarks that influence national environmental legislation and require sophisticated treatment technologies.

Contractual and Procurement Laws

Contractual and procurement laws form the backbone of VA Tech Wabag's project acquisition and execution. These legal frameworks dictate everything from transparent bidding processes for government contracts to the intricacies of private project agreements and how disputes are resolved. For instance, in 2023, Wabag secured significant orders under frameworks that emphasize strict adherence to procurement regulations, reflecting the critical nature of compliance.

The company's ability to secure and profitably deliver projects hinges on its mastery of these laws. This includes meticulous contract drafting to mitigate risks and the strategic use of legal counsel for effective dispute resolution. Changes in contract law or public procurement policies, such as evolving tender requirements or new anti-corruption legislation, could directly influence Wabag's competitive edge and profitability in securing future projects.

- Transparency in Bidding: Adherence to open and fair bidding processes is paramount, especially for public sector projects, which constituted a significant portion of Wabag's order book in FY24.

- Robust Contract Drafting: Ensuring contracts clearly define scope, timelines, payment terms, and dispute resolution mechanisms is crucial for project success and risk management.

- Legal Counsel for Disputes: Access to expert legal advice is vital for navigating and resolving contractual disagreements efficiently, minimizing financial and operational disruptions.

- Policy Impact: Shifts in government procurement policies or international contract law can necessitate adjustments in Wabag's bidding strategies and operational frameworks.

Stricter environmental regulations globally, including those from the EU and US EPA, necessitate advanced water treatment technologies, a core area for VA Tech Wabag. For example, India, a key market, continued to bolster its environmental regulations in 2023, influencing infrastructure development, while the EU Green Deal drives sustainable water practices. Wabag's success hinges on navigating these evolving legal frameworks, ensuring compliance to avoid penalties and project delays, especially as international agreements like the Paris Agreement influence national water management strategies.

Environmental factors

Water scarcity is becoming a major global challenge. Factors like climate change, a growing population, and inefficient water use are intensifying this issue, leading to an increased need for smart water management and new water sources. For instance, by 2025, it's estimated that two-thirds of the world's population could face water shortages, according to the UN.

This growing environmental pressure creates a significant market opportunity for companies like VA Tech Wabag, which specialize in advanced water treatment technologies. Their expertise in areas such as desalination and wastewater recycling directly addresses the urgent demand for sustainable water solutions.

VA Tech Wabag's focus on these critical competencies positions them as a key contributor to solving this fundamental environmental crisis. The company's solutions are essential for regions struggling with water stress, making them a vital player in the global water sector.

Climate change is significantly altering global water cycles, manifesting in increasingly erratic rainfall, prolonged droughts, and more severe flooding events. These shifts place immense pressure on existing water infrastructure, demanding innovative and robust solutions. For instance, by 2023, the World Meteorological Organization reported a 15% increase in extreme weather events over the past decade, directly impacting water availability and quality.

These environmental transformations underscore the critical need for adaptable and resilient water treatment technologies. Water scarcity and contamination risks are escalating, requiring systems that can efficiently manage fluctuating water sources and varying impurity levels. The ability to cope with these dynamic conditions is paramount for ensuring reliable water supplies for both communities and industries.

VA Tech Wabag, with its broad technological portfolio, is well-positioned to address these climate-induced challenges. The company's expertise spans advanced membrane technologies, biological treatment processes, and desalination, enabling the development of climate-resilient water systems. By offering diverse solutions, Wabag supports the creation of infrastructure capable of withstanding the unpredictable nature of future water resources.

Industrial discharges, agricultural runoff, and untreated municipal wastewater are major contributors to escalating water pollution worldwide, posing significant threats to ecosystems and human health. For instance, the World Health Organization reported in 2023 that over 2 billion people use drinking water sources contaminated with feces. This environmental degradation creates a critical demand for advanced wastewater treatment and industrial effluent treatment solutions.

VA Tech Wabag's specialized technologies, such as advanced oxidation processes and membrane bioreactors, are directly relevant to mitigating this widespread environmental problem. These solutions are designed to remove complex pollutants that conventional methods struggle with, aligning with the growing global imperative to improve water quality. In 2024, the global wastewater treatment market was valued at approximately $250 billion, with a projected compound annual growth rate of over 5% through 2030, underscoring the market opportunity for companies like Wabag.

Focus on Circular Economy and Resource Recovery

The global push towards a circular economy significantly influences the environmental landscape, prioritizing waste reduction and efficient resource recovery from wastewater. This paradigm shift fuels demand for advanced water treatment technologies capable of water reuse, sludge-to-energy conversion, and nutrient reclamation.

VA Tech Wabag's expertise in developing solutions for resource recovery directly addresses these growing environmental imperatives. Their technologies, such as advanced sludge digestion for biogas production and nutrient removal systems, are well-positioned to capitalize on this trend. For instance, by 2025, the global wastewater treatment market is projected to reach over $200 billion, with a substantial portion driven by resource recovery initiatives.

- Growing Demand: The circular economy model necessitates technologies that recover valuable resources from wastewater streams, like water, energy, and nutrients.

- Wabag's Alignment: VA Tech Wabag's portfolio, including advanced sludge treatment for biogas and nutrient recovery systems, directly supports these circular economy principles.

- Market Growth: The global wastewater treatment market is expanding, with resource recovery technologies being a key growth driver, expected to see significant investment in the coming years.

- Sustainability Focus: Companies and governments are increasingly investing in sustainable practices, making Wabag's resource-efficient solutions highly attractive.

Corporate Sustainability and ESG Mandates

Corporations and public bodies are increasingly bound by regulations to enhance their environmental impact and conform to Environmental, Social, and Governance (ESG) standards. This trend necessitates significant investment in advanced water treatment technologies and a concerted effort to minimize water usage and ensure responsible wastewater management. Wabag's expertise directly aids clients in meeting these environmental objectives and satisfying rigorous ESG reporting obligations, positioning them for continued success in a sustainability-focused market.

The global push for sustainability is accelerating, with many regions implementing stricter environmental regulations. For instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting water-intensive industries. Companies are responding by seeking solutions that reduce their water footprint. In 2024, many businesses are prioritizing water reuse and desalination technologies to meet these evolving demands and improve their ESG scores.

- Growing ESG Investment: Global ESG assets reached an estimated $37.8 trillion in early 2024, underscoring the financial imperative for companies to demonstrate strong environmental performance.

- Water Scarcity Concerns: By 2025, it's projected that two-thirds of the world's population could face water shortages, driving demand for efficient water management solutions.

- Regulatory Compliance: Stricter discharge limits for industrial wastewater are being implemented worldwide, requiring advanced treatment processes.

- Client Demand for Sustainability: Many Wabag clients are actively seeking to improve their water-related ESG metrics, often driven by investor pressure and corporate social responsibility goals.

Environmental factors are a significant driver for VA Tech Wabag. Increasing water scarcity, projected to affect two-thirds of the world's population by 2025, creates a substantial market for advanced water treatment solutions. Climate change exacerbates this by causing erratic weather patterns, increasing the need for resilient water infrastructure.

The growing problem of water pollution from industrial, agricultural, and municipal sources demands sophisticated treatment technologies. Furthermore, the global shift towards a circular economy emphasizes resource recovery from wastewater, a key area for Wabag's expertise.

Stricter environmental regulations and a greater focus on ESG performance are compelling companies to invest in sustainable water management. This regulatory and market pressure directly benefits companies like Wabag, offering solutions for water reuse, pollution control, and resource efficiency.

| Factor | Description | Impact on Wabag | Data Point (2024/2025 Est.) |

|---|---|---|---|

| Water Scarcity | Global population facing water stress. | Increased demand for water treatment and recycling. | Two-thirds of world population potentially facing water shortages by 2025. |

| Climate Change | Erratic weather, droughts, floods. | Need for resilient and adaptable water infrastructure. | 15% increase in extreme weather events over the past decade (WMO). |

| Water Pollution | Industrial, agricultural, and municipal discharge. | Demand for advanced wastewater and effluent treatment. | Over 2 billion people use faecal-contaminated drinking water sources (WHO, 2023). |

| Circular Economy | Resource recovery from wastewater (water, energy, nutrients). | Growth in market for reuse and resource efficiency technologies. | Global wastewater treatment market valued at ~$250 billion in 2024. |

| ESG & Regulations | Stricter environmental laws and ESG compliance. | Clients seeking solutions for sustainability and regulatory adherence. | Global ESG assets estimated at $37.8 trillion (early 2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Wabag is meticulously constructed using data from reputable international organizations like the World Bank and IMF, alongside government reports and leading industry publications. We integrate insights on water resource management policies, economic development trends, technological advancements in water treatment, socio-cultural attitudes towards water conservation, and environmental regulations to provide a comprehensive view.