Volvo Car PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volvo Car Bundle

Unlock the strategic advantages shaping Volvo Car's future with our comprehensive PESTLE analysis. From evolving environmental regulations to shifting economic landscapes and rapid technological advancements, understand the external forces influencing their market position. This in-depth report provides actionable intelligence to navigate these complexities and identify growth opportunities. Download the full version now to gain a critical edge in your market strategy.

Political factors

Governments worldwide are actively promoting electric vehicle (EV) adoption through various policies and incentives. These include substantial tax credits, direct purchase subsidies, and investments in charging infrastructure. For instance, the Inflation Reduction Act in the United States offers tax credits of up to $7,500 for qualifying new EVs purchased in 2024. Such initiatives directly impact consumer affordability and buying preferences, aligning with Volvo's strategic pivot to an all-electric lineup.

Regulatory frameworks are a significant driver for this electrification trend, primarily focused on reducing carbon emissions and fostering sustainable technologies. Many regions are setting ambitious targets for EV sales and phasing out internal combustion engine vehicles. The European Union, for example, has mandated that all new cars sold from 2035 must be zero-emission, a policy that strongly supports companies like Volvo committed to electrification.

International trade agreements and tariffs directly influence Volvo's global operations. For example, the European Union's trade pacts facilitate smoother movement of vehicles and parts, but potential tariffs on components could increase costs. The U.S. government's consideration of higher tariffs on electric vehicles from China, a market where Volvo sources some components and sells vehicles, presents a significant challenge for 2024 and beyond, potentially impacting pricing and market access.

Global geopolitical stability is paramount for Volvo's supply chain, especially given the intricate nature of automotive manufacturing. Political conflicts and trade disputes directly impact raw material costs and component availability. For instance, the ongoing semiconductor shortage, exacerbated by geopolitical tensions in 2023, significantly affected global automotive production, including Volvo's.

Disruptions can lead to shortages and logistical hurdles, directly affecting Volvo's production volumes and, consequently, its profitability. In 2024, continued geopolitical uncertainties in key sourcing regions could further inflate costs for critical materials like lithium and cobalt, essential for EV battery production.

To counter these risks, Volvo is actively pursuing supply chain resilience through strategies like diversification and regionalization. By shifting some sourcing and manufacturing closer to its key markets, Volvo aims to mitigate the impact of distant geopolitical events and reduce lead times, a strategy that gained significant traction throughout 2023 and into 2024.

Regulatory Environment for Autonomous Driving

The regulatory environment for autonomous driving is a critical political factor for Volvo. Different nations and regional blocs are establishing unique rules for testing, deploying, and assigning liability for self-driving vehicles. This patchwork of regulations directly impacts Volvo's development schedules and how quickly their advanced autonomous features can reach various markets.

For instance, the European Union's proposed framework for automated vehicles aims for a more harmonized approach, but individual member states still retain significant influence over implementation. In the United States, the National Highway Traffic Safety Administration (NHTSA) has provided guidelines, yet state-level regulations vary widely, creating a complex compliance landscape for a global automaker like Volvo.

Volvo's investment in autonomous driving technology, a key area of innovation for the company, is therefore heavily influenced by these evolving political and legal frameworks. Successful market entry and widespread adoption hinge on navigating these diverse and often stringent requirements. The ongoing development of 5G infrastructure, crucial for vehicle-to-everything (V2X) communication essential for advanced autonomous systems, is also subject to government policy and spectrum allocation decisions.

Key considerations for Volvo include:

- Varying Safety Standards: Different regions have distinct safety validation requirements for autonomous systems, potentially extending development and testing cycles.

- Data Privacy Laws: Regulations concerning the collection and use of data generated by autonomous vehicles, such as GDPR in Europe, impact how Volvo can leverage this information for system improvement.

- Liability Frameworks: Clear legal definitions of responsibility in case of accidents involving autonomous vehicles are still being established globally, creating uncertainty for manufacturers.

Political Influence on Consumer Behavior

Government policies and political narratives significantly shape consumer choices, particularly in the automotive sector. For instance, political campaigns championing sustainability or favoring electric vehicles directly influence consumer perception and purchasing decisions. Volvo, with its strong focus on electrification, is well-positioned to capitalize on this trend.

Public discourse on climate change, often amplified by political agendas, is accelerating the adoption of eco-friendly transportation. As of early 2024, many governments worldwide have set ambitious targets for EV adoption, with some countries aiming for 100% new car sales to be electric by 2035. This political push creates a favorable market environment for companies like Volvo, which have committed to becoming fully electric by 2030.

Government incentives, such as tax credits and subsidies for electric vehicles, play a crucial role in making these cars more accessible to consumers. For example, the Inflation Reduction Act in the United States, enacted in 2022, provides significant tax credits for qualifying electric vehicles, directly boosting demand. Such political interventions directly impact consumer willingness to invest in sustainable mobility solutions.

- Government Mandates: Many nations are implementing stricter emissions standards for internal combustion engine vehicles, making them less attractive and more expensive over time.

- EV Subsidies: Financial incentives like purchase grants and tax rebates for electric vehicles continue to be a major driver of consumer adoption in key markets like Europe and North America.

- Infrastructure Investment: Government funding for charging infrastructure development influences consumer confidence in the practicality of owning an EV.

- Trade Policies: Tariffs and trade agreements can impact the cost of imported vehicles and components, affecting pricing and consumer affordability.

Government policies promoting electric vehicle (EV) adoption, such as tax credits and charging infrastructure investment, directly influence consumer purchasing decisions and support Volvo's electrification strategy. For instance, the US Inflation Reduction Act offers up to $7,500 in tax credits for new EVs in 2024, while the EU's 2035 zero-emission mandate strongly favors companies like Volvo. Political narratives around climate change and sustainability further accelerate EV demand, with many nations aiming for all-electric new car sales by 2035, aligning with Volvo's 2030 all-electric goal.

What is included in the product

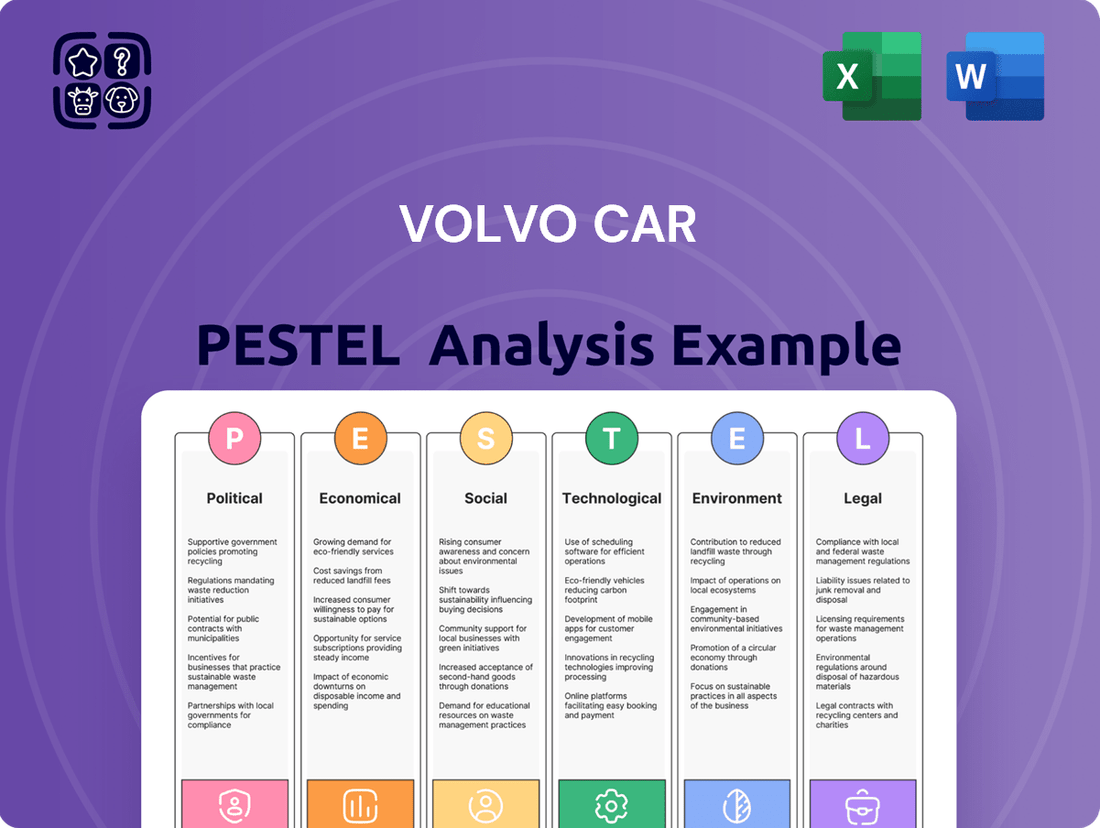

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Volvo Car across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within the global automotive industry.

This Volvo Car PESTLE analysis provides a clean, summarized version of external factors for easy referencing during strategic planning, alleviating the pain of sifting through complex data.

Economic factors

Global economic growth is a critical driver for Volvo's sales, as consumer spending power directly impacts demand for premium vehicles. A robust economy with increasing disposable income typically translates to higher sales volumes for luxury brands.

Conversely, economic slowdowns or recessions can significantly curb consumer spending on big-ticket items like cars. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight slowdown from previous years, which could moderate demand for luxury goods.

Consumer confidence surveys also offer insight; a decline in confidence often precedes a drop in discretionary spending, affecting sectors like automotive. In 2023, while many developed economies showed resilience, inflation and interest rate hikes continued to pressure household budgets, impacting purchasing decisions.

Volvo's performance is therefore closely tied to the health of key markets and the purchasing sentiment within them. A stable global economic environment with sustained consumer spending is essential for Volvo to achieve its sales and profitability targets.

Rising inflation poses a significant challenge for Volvo, directly increasing its operational costs. For instance, the cost of essential raw materials like steel and lithium, crucial for electric vehicle batteries, saw considerable volatility in 2024. This upward pressure on inputs, coupled with higher labor and energy expenses, can squeeze Volvo's profit margins if not effectively managed through pricing strategies or cost efficiencies.

Furthermore, the prevailing interest rate environment heavily influences consumer purchasing power. As of mid-2025, many central banks maintained relatively high interest rates to combat persistent inflation. This makes car loans more expensive for consumers, potentially deterring purchases of new vehicles, including Volvo's premium and electric models. A slowdown in demand due to financing costs directly impacts sales volumes and revenue streams for the company.

Volvo's financial planning must therefore be agile, adapting to these macroeconomic shifts. The company needs to carefully balance passing on increased costs to consumers with maintaining competitive pricing to avoid losing market share. Strategic financial management, including hedging against commodity price fluctuations and optimizing financing structures, becomes paramount in navigating this complex economic landscape.

The cost of essential raw materials like lithium, cobalt, and nickel for electric vehicle batteries is a major concern for Volvo. For instance, lithium carbonate prices saw significant volatility, with spot prices in early 2024 ranging from $13,000 to $15,000 per metric ton, a considerable drop from their 2022 peaks, but still subject to market shifts. Similarly, semiconductor shortages, though easing compared to recent years, continue to influence component costs, impacting the overall manufacturing expenses for vehicles like the popular Volvo XC40 Recharge.

Currency Exchange Rate Volatility

Currency exchange rate volatility significantly impacts Volvo Cars, a global entity with operations spanning many nations. Fluctuations in currency values can directly affect the company's financial results, influencing both revenue earned in foreign markets and the cost of components sourced internationally. For instance, a stronger Swedish Krona (SEK) against currencies like the Euro or US Dollar could make Volvo's vehicles more expensive for overseas buyers, potentially dampening sales volumes.

In 2024, the automotive industry, including Volvo, continues to navigate a complex global economic landscape where currency swings are a persistent factor. Hedging strategies are crucial for mitigating these risks. These financial instruments, such as forward contracts or options, allow Volvo to lock in exchange rates for future transactions, providing a degree of predictability in its financial planning and protecting profit margins from adverse currency movements.

- Impact on Revenue: A weaker Euro against the SEK would reduce the value of sales made in the Eurozone when translated back into Volvo's reporting currency.

- Impact on Costs: Conversely, if the SEK strengthens significantly, the cost of imported parts and materials priced in foreign currencies would decrease.

- Financial Performance: The net effect of these currency movements can lead to substantial swings in reported profits and losses, even if underlying sales volumes remain consistent.

- Hedging Necessity: Volvo's reliance on global supply chains and diverse sales markets necessitates active currency risk management to stabilize financial performance.

Competition and Pricing Pressure in EV Market

The electric vehicle (EV) sector is experiencing a surge in competition, with both legacy automakers and new EV startups aggressively expanding their offerings. This heightened rivalry is forcing companies like Volvo to navigate significant pricing pressures. For instance, by early 2024, average EV transaction prices in the US saw a notable decline compared to previous years as manufacturers introduced more budget-friendly models and offered incentives to attract buyers in a crowded market.

This competitive landscape directly impacts Volvo's profitability. To remain competitive, Volvo may need to adjust its pricing strategies, potentially reducing margins on its EVs. The company's ability to differentiate through technology, brand, and charging infrastructure will be crucial in mitigating the effects of this price war. For example, in 2023, several major EV manufacturers engaged in price cuts, a trend expected to continue into 2024 as inventory levels adjusted and competition intensified.

- Intensified Competition: The EV market saw a significant increase in new models and manufacturers entering the fray throughout 2023 and early 2024.

- Pricing Pressure: Average EV prices have been under pressure, with some segments experiencing year-over-year declines in transaction prices as of early 2024.

- Margin Impact: Reduced pricing power can directly affect Volvo's profit margins on its electric vehicle sales.

- Strategic Differentiation: Volvo's success will depend on its ability to stand out beyond price, emphasizing innovation and customer experience.

Global economic conditions significantly shape Volvo's sales trajectory, with consumer purchasing power directly influencing demand for premium automobiles. Economic downturns or recessions can curtail spending on high-value items like cars, as seen in the IMF's 2024 global growth projection of 3.2%, a slight moderation impacting luxury goods demand.

Inflationary pressures raise Volvo's operational costs, particularly for raw materials like lithium and steel, and also increase consumer financing costs due to higher interest rates. This necessitates agile financial planning to balance cost absorption with competitive pricing, as exemplified by the ongoing efforts to manage input expenses and borrowing costs in 2024-2025.

Currency exchange rate volatility directly affects Volvo's global revenue and costs, making hedging strategies essential for financial stability. For instance, fluctuations between the Swedish Krona and major currencies like the Euro and USD can impact sales attractiveness and the cost of imported components.

The intensifying competition in the electric vehicle (EV) market, with new entrants and aggressive pricing by established players, puts pressure on Volvo's margins. By early 2024, average EV transaction prices saw a decline, highlighting the need for Volvo to differentiate through technology and brand rather than solely relying on price competition.

What You See Is What You Get

Volvo Car PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Volvo Car PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the automotive giant. You’ll gain insights into market trends, regulatory landscapes, and consumer behavior that shape Volvo's strategic decisions and future growth.

Sociological factors

Consumers are increasingly factoring environmental impact into their buying choices, fueling demand for electric and hybrid vehicles. Surveys in 2024 indicate that over 60% of new car buyers consider sustainability a key factor. This widespread societal shift directly benefits automakers like Volvo, which has committed to being a fully electric brand by 2030.

Volvo's strategic pivot towards electrification, including significant investments in battery technology and charging infrastructure, directly addresses this growing consumer preference. By 2025, Volvo aims for at least 50% of its global sales to be pure electric. This proactive approach positions Volvo favorably within a market increasingly driven by eco-conscious consumers.

Volvo's deep-rooted legacy of prioritizing safety is a significant sociological factor influencing its market position. This core brand value, which has consistently resonated with consumers, is further amplified by a societal shift towards greater safety consciousness. For instance, in 2024, global road safety organizations continued to highlight the impact of advanced driver-assistance systems (ADAS) in reducing accident fatalities, a trend that directly supports Volvo's long-standing emphasis on such innovations.

The increasing public awareness surrounding vehicle safety, often fueled by readily available accident statistics and media coverage, reinforces the value proposition of brands like Volvo. This heightened societal demand for secure transportation makes Volvo's commitment to developing and integrating cutting-edge safety technologies a powerful market differentiator. By consistently investing in areas like pedestrian detection and autonomous emergency braking, Volvo aligns with and capitalizes on this growing societal expectation.

Urbanization continues to reshape how people move, with cities becoming denser and more crowded. This surge in urban living, particularly evident in major global centers, brings with it significant challenges like escalating traffic congestion and a persistent shortage of parking spaces. For example, by 2025, it’s projected that over 60% of the world’s population will reside in urban areas, a trend that directly impacts transportation needs and preferences.

These urban realities are driving a noticeable move away from the traditional model of individual car ownership. Instead, there's a growing embrace of shared mobility services, including ride-sharing, car-sharing platforms, and subscription-based vehicle access. This shift suggests a future where access to mobility is prioritized over outright ownership, particularly in densely populated environments.

Volvo is well-positioned to adapt to these evolving urban mobility patterns. By expanding its existing service offerings and exploring strategic partnerships within the car-sharing and vehicle subscription sectors, the company can cater to this changing consumer demand. This necessitates a strategic re-evaluation of traditional sales channels and a proactive exploration of new, service-oriented business models to remain competitive.

Demographic Shifts and Lifestyle Changes

Demographic shifts significantly impact car manufacturers like Volvo. For instance, the aging population in many developed nations, including Europe and North America, means a growing demand for vehicles with enhanced accessibility features and advanced driver-assistance systems. Conversely, the burgeoning Gen Z population, with its distinct preferences, is increasingly prioritizing sustainability and digital integration in their purchasing decisions. By 2025, it's projected that over 50% of the global population will be under 30, a demographic that highly values technology and environmental consciousness.

Lifestyle changes are also playing a crucial role. The increasing emphasis on work-life balance and the rise of remote or hybrid work models are altering commuting patterns and the need for spacious, comfortable interiors that can serve as mobile offices. Consumers are also seeking greater digital connectivity within their vehicles, expecting seamless integration with personal devices and access to advanced infotainment systems. This is evidenced by the fact that in 2024, over 70% of new car buyers considered advanced connectivity features as a key deciding factor.

- Aging Population: In 2024, the median age in the EU was around 44 years, driving demand for comfort and safety features.

- Younger Generations: Gen Z and Millennials, representing a substantial portion of car buyers by 2025, prioritize electric vehicles and in-car technology.

- Digital Connectivity: Over 80% of new vehicle sales in 2024 included some form of advanced connectivity or infotainment system.

- Urbanization: Increased urban living, especially among younger demographics, fuels demand for smaller, more efficient, and potentially shared mobility solutions.

Brand Perception and Ethical Consumerism

Consumers are increasingly scrutinizing a company's ethical footprint, from how its workers are treated to the transparency of its supply chains and its overall commitment to corporate social responsibility. This growing awareness significantly influences purchasing choices. For instance, in 2023, a Nielsen report indicated that 73% of global consumers would change their consumption habits to reduce their impact on the environment, highlighting a strong demand for sustainable and ethically produced goods.

Volvo has strategically cultivated a brand image deeply rooted in safety and sustainability. This perception is further bolstered by its active pursuit of responsible business practices, such as its ambition to be a fully electric car maker by 2030 and its efforts to ensure ethical sourcing in its battery supply chains. This alignment with ethical consumerism directly appeals to a growing segment of the market that prioritizes these values.

Volvo’s commitment to ethical operations can translate into a competitive advantage. The company’s focus on sustainability, for example, aligns with major global trends. By 2025, it's projected that electric vehicles will account for a significant portion of new car sales in many key markets, a trend that Volvo is well-positioned to capitalize on due to its brand perception.

- Ethical Consumerism Growth: Studies show a significant rise in consumer willingness to pay more for products from brands with strong ethical and sustainability credentials.

- Volvo's Brand Pillars: Safety and sustainability remain core to Volvo's identity, attracting consumers who value these attributes.

- Supply Chain Focus: Volvo's efforts towards supply chain transparency, particularly concerning battery materials, resonate with ethically-minded buyers.

- Market Alignment: Volvo's proactive stance on electrification and responsible manufacturing aligns with evolving market demands and regulatory pressures.

Societal expectations around vehicle safety continue to be a cornerstone for Volvo. As of 2024, global road safety organizations consistently report the life-saving impact of advanced driver-assistance systems (ADAS), reinforcing Volvo's long-standing commitment. This heightened consumer demand for secure transportation makes Volvo's focus on innovations like pedestrian detection and autonomous emergency braking a powerful differentiator.

The increasing global urbanization, with over 60% of the world's population projected to live in urban areas by 2025, is reshaping mobility preferences. This trend fuels a move towards shared mobility services and subscription models, influencing how consumers access transportation. Volvo's expansion into car-sharing and vehicle subscription services directly addresses this shift, requiring adaptation of traditional sales models.

Demographic shifts, including an aging population in developed nations and the growing influence of younger generations like Gen Z, are significantly impacting the automotive market. While older demographics seek enhanced accessibility and safety, younger consumers prioritize sustainability and digital integration. By 2025, over 50% of the global population will be under 30, a key demographic valuing technology and environmental consciousness.

Ethical consumerism is on the rise, with a significant percentage of consumers, over 70% in 2024 reports, willing to alter purchasing habits for sustainability and ethical production. Volvo's brand pillars of safety and sustainability, coupled with its 2030 all-electric ambition and focus on supply chain transparency, directly appeal to this growing market segment, positioning the company favorably.

| Sociological Factor | Trend/Observation (2024/2025 Data) | Volvo's Strategic Alignment |

|---|---|---|

| Safety Consciousness | Global road safety organizations highlight ADAS impact; 2024 data shows continued demand for safety features. | Core brand value, reinforced by investment in ADAS and safety innovations. |

| Urbanization & Mobility | Over 60% global population in urban areas by 2025; increased preference for shared/subscription mobility. | Expansion into car-sharing and subscription services to meet evolving urban needs. |

| Demographic Shifts | Over 50% global population under 30 by 2025; aging populations seek accessibility; younger generations prioritize EVs and tech. | Developing accessible features and advanced digital integration; strong EV portfolio. |

| Ethical Consumerism | 73% of global consumers in 2023 reported changing habits for sustainability; strong demand for ethical sourcing. | Brand commitment to sustainability and transparent supply chains resonates with ethically-minded buyers. |

Technological factors

Rapid advancements in battery technology are a major technological factor impacting Volvo. Increased energy density, faster charging, and improved longevity are crucial for the EV market's expansion. For instance, by early 2024, battery energy density has seen significant jumps, with some manufacturers achieving over 300 Wh/kg in lab settings, a substantial leap from earlier technologies.

Volvo's strategic pivot to an all-electric future hinges on its ability to integrate these innovations effectively. This means ensuring its vehicles offer competitive driving ranges, comparable to or exceeding gasoline counterparts, and robust performance. The company is investing heavily in R&D to achieve this, aiming to offer vehicles with ranges exceeding 500 km (WLTP) by 2025 on many models.

Looking ahead, the development of solid-state batteries and the exploration of diversified battery chemistries represent key trends to monitor. Solid-state batteries promise higher energy density and faster charging, potentially revolutionizing EV capabilities. Companies like QuantumScape, a partner for several automakers, are making progress, with pilot production lines expected to begin in 2024-2025, signaling a shift towards more advanced battery solutions.

Volvo Car is heavily invested in the advancement of autonomous driving systems. Recent years have seen significant breakthroughs in areas like sensor fusion, artificial intelligence for decision-making, and vehicle-to-everything (V2X) communication, all of which are reshaping the automotive landscape. These technological leaps are critical for enhancing vehicle safety and passenger convenience, areas where Volvo has traditionally excelled.

Volvo's strategic direction includes the development and implementation of increasingly sophisticated Advanced Driver-Assistance Systems (ADAS). The company's long-term vision extends to achieving full autonomous driving capabilities. This commitment is evidenced by their ongoing research and development, aiming to integrate these cutting-edge technologies seamlessly into their vehicle offerings to provide a superior and safer driving experience.

The global market for autonomous driving technology is projected for substantial growth. Analysts anticipate the market to reach hundreds of billions of dollars by the early 2030s, with significant investments being poured into AI and sensor development. For instance, in 2024, major automakers and tech companies collectively invested over $50 billion globally in AV R&D, highlighting the intense focus on this transformative technology.

The automotive industry's rapid digitalization is a key technological driver, with vehicles increasingly becoming connected platforms. Features like over-the-air (OTA) updates, advanced infotainment systems, and seamless smartphone integration are now standard consumer expectations.

Volvo's strategic focus on these digital and connectivity features is paramount for maintaining competitiveness. For example, by 2024, the automotive industry saw a significant increase in connected car services, with a projected 75% of vehicles sold globally featuring some form of connectivity by 2025.

Innovating in this space allows Volvo to offer a personalized and enhanced in-car experience. This includes developing sophisticated driver-assistance systems and intuitive user interfaces, directly addressing consumer demand for smart, integrated mobility solutions.

Manufacturing Process Innovations

Technological advancements in manufacturing are fundamentally reshaping how companies like Volvo produce vehicles. Innovations such as increased automation, the use of sophisticated robotics, and the burgeoning field of additive manufacturing (3D printing) are key drivers for improving efficiency and driving down production costs. These technologies also play a crucial role in enhancing the overall quality and precision of the vehicles produced. For instance, Volvo is investing heavily in advanced robotics for its assembly lines to improve worker safety and production speed.

These manufacturing process innovations are particularly vital for Volvo's strategic shift towards electric vehicle (EV) production. Scaling up EV manufacturing requires highly efficient, flexible, and precise production methods. Automation and robotics allow for the consistent and rapid assembly of complex EV components, such as battery packs and electric powertrains. Volvo aims to significantly increase its EV output, and these technological upgrades are essential to meet those ambitious scaling targets and sustainability goals.

Volvo's commitment to these advancements is evident in its operational strategies. By integrating more intelligent automation, the company can achieve greater consistency in its manufacturing output, leading to fewer defects and a higher quality end product. This focus on technological integration is not just about efficiency; it's about building a more resilient and future-proof manufacturing base, capable of adapting to the rapidly evolving automotive landscape.

Key technological factors impacting Volvo's manufacturing processes include:

- Increased Automation and Robotics: Volvo continues to implement advanced robotic systems on its production lines to handle repetitive or strenuous tasks, improving speed and precision.

- Additive Manufacturing (3D Printing): Exploration and adoption of 3D printing for prototyping and producing specialized or complex parts, potentially reducing lead times and material waste.

- Smart Factory Integration: Connecting manufacturing processes with digital technologies for real-time monitoring, data analysis, and predictive maintenance, optimizing overall equipment effectiveness.

- Advanced Assembly Techniques: Development of new methods for assembling EV components, like battery modules and electric motors, to ensure safety, efficiency, and quality at scale.

Data Analytics and AI Integration

The increasing connectivity of vehicles means Volvo is swimming in data. This data, when analyzed using advanced techniques and artificial intelligence, unlocks significant potential. For instance, AI can predict when a car might need maintenance before a problem even arises, reducing unexpected breakdowns and improving customer satisfaction. Volvo's focus on safety can be further enhanced by AI analyzing driving patterns to offer real-time assistance or even prevent accidents. By mid-2025, it's estimated that over 90% of new cars sold globally will be connected, providing a massive dataset for Volvo to exploit.

Leveraging these technological advancements allows Volvo to significantly enhance the customer experience. Imagine personalized infotainment systems that learn your preferences or proactive service alerts tailored to your driving habits. Beyond customer-facing benefits, data analytics can optimize Volvo's manufacturing processes, supply chain management, and even the development of new vehicle features. This data-driven approach is crucial for staying competitive in the rapidly evolving automotive landscape, with many automakers investing billions into AI research and development.

- Predictive Maintenance: AI algorithms analyze sensor data to anticipate component failures, reducing downtime and repair costs.

- Personalized Services: Connected car data enables customized infotainment, navigation, and driver assistance features.

- Operational Efficiency: Data analytics optimizes manufacturing, supply chain logistics, and energy consumption in vehicles.

- New Revenue Streams: Opportunities exist for subscription-based services, data insights, and advanced driver-assistance features powered by AI.

Technological advancements are a critical driver for Volvo, especially in battery technology and autonomous driving. Innovations in battery energy density, exceeding 300 Wh/kg in lab settings by early 2024, and the promise of solid-state batteries by 2024-2025, are crucial for Volvo's all-electric future, aiming for ranges over 500 km (WLTP) by 2025.

The company is heavily invested in autonomous driving systems, leveraging AI and V2X communication. The autonomous driving market is projected for substantial growth, with over $50 billion invested globally in AV R&D in 2024 alone, highlighting its transformative potential for safety and convenience.

Digitalization and connectivity are reshaping the automotive industry, with over 75% of vehicles expected to be connected by 2025. Volvo's focus on over-the-air updates and advanced infotainment systems enhances customer experience and competitiveness.

Manufacturing innovations, including automation and 3D printing, are vital for Volvo's EV production scalability and efficiency. Smart factory integration and advanced assembly techniques ensure quality and adapt to evolving automotive demands.

Legal factors

Vehicle emission standards are increasingly stringent, with regulators like the European Union and the US Environmental Protection Agency (EPA) mandating significant reductions in CO2 output. For instance, the EU's target for 2025 aims for an average of 93.6g/km of CO2, a 15% decrease from 2021 levels. These regulations directly impact automakers, including Volvo, compelling them to innovate and adapt their product lines to avoid substantial financial penalties for non-compliance.

Volvo's strategic commitment to becoming a fully electric vehicle manufacturer by 2030 is a direct response to these evolving legal requirements. This ambitious goal ensures the company remains ahead of the curve and avoids potential fines associated with exceeding emission limits. The shift to electric vehicles is not merely an environmental choice but a legal necessity to operate successfully within the global automotive market.

Global vehicle safety regulations are a constant moving target, pushing manufacturers like Volvo to integrate more sophisticated safety systems and excel in rigorous crash testing. For instance, in 2024, the European Union's General Safety Regulation 2 (GSR2) mandates advanced driver-assistance systems (ADAS) such as intelligent speed assistance and emergency lane keeping, impacting new vehicle designs.

Volvo, with its longstanding commitment to safety, must continually refine its vehicle engineering and technological innovations to adhere to these evolving legal mandates across diverse international markets. This includes meeting updated standards from bodies like the NHTSA in the US, which in 2025 is expected to finalize new guidelines for Autonomous Vehicle safety, requiring substantial R&D investment.

The evolving landscape of data privacy and cybersecurity presents significant legal challenges for Volvo. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) mandate stringent controls over personal data collection, processing, and storage. With connected car technology generating vast amounts of vehicle and driver information, Volvo must adhere to these laws to avoid substantial fines, which under GDPR can reach up to 4% of global annual turnover.

New legislation, such as the EU Data Act, further complicates compliance by defining rules for data sharing and access, particularly for data generated by connected products. Volvo's commitment to robust cybersecurity measures is paramount not only for legal compliance but also for safeguarding sensitive customer information and maintaining brand reputation. Failure to meet these evolving legal standards could result in significant penalties and erode consumer trust in Volvo's connected vehicle offerings.

Product Liability and Consumer Protection Laws

Product liability and consumer protection laws are paramount for automotive manufacturers like Volvo. These regulations mandate rigorous quality control to prevent defects and ensure consumer safety, with non-compliance leading to severe financial and reputational consequences. For instance, in 2024, the automotive industry continued to grapple with recalls, with billions spent globally on addressing safety concerns.

Volvo's commitment to safety, a cornerstone of its brand, directly addresses these legal demands. Any perceived failure in product integrity, such as a safety flaw in a new electric vehicle model launched in late 2024, could trigger extensive recalls and legal challenges. Such events can significantly impact consumer trust and market share, underscoring the critical need for robust legal adherence.

- Global automotive recalls in 2024 are estimated to cost manufacturers billions of dollars.

- Consumer protection laws empower buyers with rights regarding faulty products, including repair, replacement, or refund.

- Product liability lawsuits can result in substantial damages, including compensatory and punitive awards.

- Volvo's brand reputation hinges on its ability to meet and exceed safety standards mandated by these laws.

Labor Laws and Employment Regulations

Operating a global network means Volvo must navigate a patchwork of labor laws. For instance, in 2024, minimum wage laws in European countries like Germany saw increases, directly affecting labor costs. Similarly, regulations around working hours and overtime vary significantly, impacting scheduling and potential staffing needs across its international operations.

These regulations extend to employee rights, including those concerning trade unions and collective bargaining. In Sweden, Volvo's home country, strong union presence influences wage negotiations and employment terms. Globally, companies like Volvo must ensure compliance with laws protecting against unfair dismissal and mandating equal opportunities, which adds layers of complexity to human resource management and can influence hiring and severance costs.

- Varying Minimum Wage Laws: In 2024, many European nations, including Sweden and Germany, adjusted minimum wage rates, impacting direct labor expenses for Volvo.

- Trade Union Influence: Strong collective bargaining agreements in key markets like Sweden can dictate wage increases and working condition standards.

- Employee Rights and Protections: Compliance with regulations on working hours, paid leave, and anti-discrimination laws is critical across all operational regions.

- Impact on Operational Flexibility: Diverse employment laws can restrict the ability to quickly adjust staffing levels or work schedules in response to market demand fluctuations.

Volvo must navigate evolving environmental regulations, such as the EU's 2025 CO2 emission targets of 93.6g/km, requiring significant investment in electric vehicle technology. The company’s commitment to be fully electric by 2030 is a direct legal and strategic imperative to avoid penalties. Furthermore, safety standards are tightening globally, with the EU's GSR2 (2024) mandating advanced driver-assistance systems, necessitating continuous R&D for compliance and market competitiveness.

Environmental factors

Global climate change targets are significantly reshaping the automotive sector, pushing manufacturers towards substantial reductions in carbon emissions. Many nations have set ambitious goals for carbon neutrality, directly influencing vehicle design, manufacturing processes, and the entire supply chain.

Volvo Car has positioned itself at the forefront of this transition with an aggressive climate strategy. The company aims to cut CO2 emissions per vehicle by 40 percent by 2025 compared to 2018 levels and has a bold target of achieving net-zero greenhouse gas emissions across its entire business by 2040. This commitment is not merely aspirational; it dictates investment in electric vehicle technology and sustainable manufacturing practices.

These decarbonization efforts are not without financial implications. For instance, the shift to electric vehicles requires significant capital expenditure in battery production and charging infrastructure development. As of early 2024, the automotive industry is investing billions globally in EV technology, a trend that Volvo's strategy directly aligns with, expecting these investments to yield long-term market share and brand value.

Growing global awareness of resource scarcity, especially concerning materials critical for electric vehicle batteries like rare earth metals, is driving a significant shift towards circular economy principles. This trend directly impacts automotive manufacturers like Volvo.

Volvo Car is actively integrating circular economy strategies into its operations, with a stated goal of achieving an average of 30 percent recycled content across its vehicles by 2030. This commitment extends to ensuring sustainable sourcing of raw materials and developing robust systems for the recycling and reuse of components at the end of a vehicle's life cycle.

The company's efforts include exploring innovative battery recycling technologies and designing vehicles with greater recyclability in mind. For instance, by 2025, Volvo aims to have 25% recycled plastic in new cars, a tangible step towards its broader circularity ambitions.

Beyond the exhaust pipe, Volvo is facing increased scrutiny regarding emissions from its manufacturing plants and the broader supply chain. This encompasses everything from the energy used in production facilities to the waste generated throughout its network. For instance, in 2023, Volvo Cars reported a 19% reduction in CO2 emissions from its manufacturing operations compared to 2018, reaching 4.2 tonnes of CO2 per car produced.

Volvo is actively working to curb carbon emissions across its manufacturing sites, wider operations, and supply chain to meet its ambitious climate goals. A key part of this strategy involves transitioning to renewable energy sources for its factories. In 2024, Volvo announced plans to power its Torslanda, Sweden, plant entirely with renewable electricity by 2025, a significant step in reducing its operational footprint.

Reducing production waste is another critical area of focus for Volvo. The company aims to achieve a circular economy within its manufacturing processes, minimizing material discarded. By 2023, Volvo had already implemented programs that led to a 15% reduction in production waste per vehicle compared to 2019 levels.

Consumer Demand for Eco-Friendly Vehicles

Consumer demand for eco-friendly vehicles is a significant environmental factor impacting Volvo. Growing awareness of climate change and environmental pollution is directly shaping purchasing decisions. This heightened consciousness translates into a robust demand for vehicles with lower emissions and sustainable manufacturing processes. For instance, a 2024 report indicated that over 60% of car buyers consider environmental impact when making a purchase, a figure expected to rise.

Volvo's strategic focus on electrification and sustainability aligns perfectly with this market shift. The company's brand identity is deeply intertwined with environmental responsibility, allowing it to capitalize on this trend. Consumers are increasingly willing to invest more in vehicles that reflect their commitment to a greener future, a premium Volvo is well-positioned to capture. Indeed, Volvo aims for 50% of its global sales to be fully electric by 2025, demonstrating its commitment to meeting this demand.

- Growing environmental consciousness drives demand for electric and hybrid vehicles.

- Consumers are increasingly willing to pay a premium for sustainable automotive options.

- Volvo's strong brand association with sustainability positions it favorably in this market.

- Government regulations and incentives further bolster the market for eco-friendly cars.

Biodiversity and Environmental Stewardship

Volvo Cars is enhancing its sustainability focus to encompass biodiversity and environmental stewardship, recognizing growing societal expectations for companies to manage their ecological impact. This expansion means going beyond carbon emissions to actively reduce its biodiversity footprint. For instance, by 2025, Volvo aims to have nature-positive supply chains for key materials. This proactive stance signals a commitment to restorative actions and a more comprehensive approach to environmental responsibility.

The company's strategy includes several key initiatives:

- Biodiversity Impact Assessment: Volvo is developing methods to measure and understand its direct and indirect impacts on biodiversity across its value chain.

- Nature-Positive Supply Chains: A target is set to ensure that by 2025, the sourcing of critical materials will actively contribute to or at least not negatively impact biodiversity.

- Restorative Actions: Volvo is exploring and implementing projects that aim to restore degraded ecosystems in areas relevant to its operations or supply chain.

- Stakeholder Engagement: The company is increasing dialogue with conservation organizations and local communities to better integrate biodiversity considerations into its business practices.

Global climate targets are a significant driver for Volvo Car, pushing for substantial CO2 emission reductions across its operations and products. The company's commitment to becoming climate neutral by 2040 necessitates substantial investments in electric vehicle technology and sustainable manufacturing, aligning with industry-wide shifts and billions in global EV investments as of early 2024.

Volvo is actively embracing circular economy principles, aiming for 30 percent recycled content in its vehicles by 2030 and 25 percent recycled plastic in new cars by 2025, addressing concerns about resource scarcity, particularly for battery materials.

Consumer demand for eco-friendly vehicles is robust, with over 60% of car buyers in a 2024 survey considering environmental impact, a trend Volvo's electrification strategy and brand identity are well-positioned to capitalize on, targeting 50% of global sales to be fully electric by 2025.

Volvo is also intensifying its focus on biodiversity and nature-positive supply chains, aiming for key material sourcing to not negatively impact biodiversity by 2025, reflecting growing societal expectations for comprehensive environmental stewardship.

| Environmental Factor | Volvo's Target/Action | Key Data/Year |

| CO2 Emissions Reduction | Reduce CO2 per vehicle by 40% | By 2025 (vs. 2018) |

| Climate Neutrality | Net-zero greenhouse gas emissions | By 2040 |

| Recycled Content | 30% recycled content across vehicles | By 2030 |

| Recycled Plastic | 25% recycled plastic in new cars | By 2025 |

| Manufacturing Emissions | 19% reduction in CO2 from manufacturing | 2023 (vs. 2018) |

| Electric Vehicle Sales | 50% of global sales to be fully electric | By 2025 |

| Nature-Positive Supply Chains | Key materials to not negatively impact biodiversity | By 2025 |

PESTLE Analysis Data Sources

Our Volvo Car PESTLE analysis is meticulously constructed using data from reputable sources, including official government publications, international economic bodies, and leading automotive industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting Volvo.