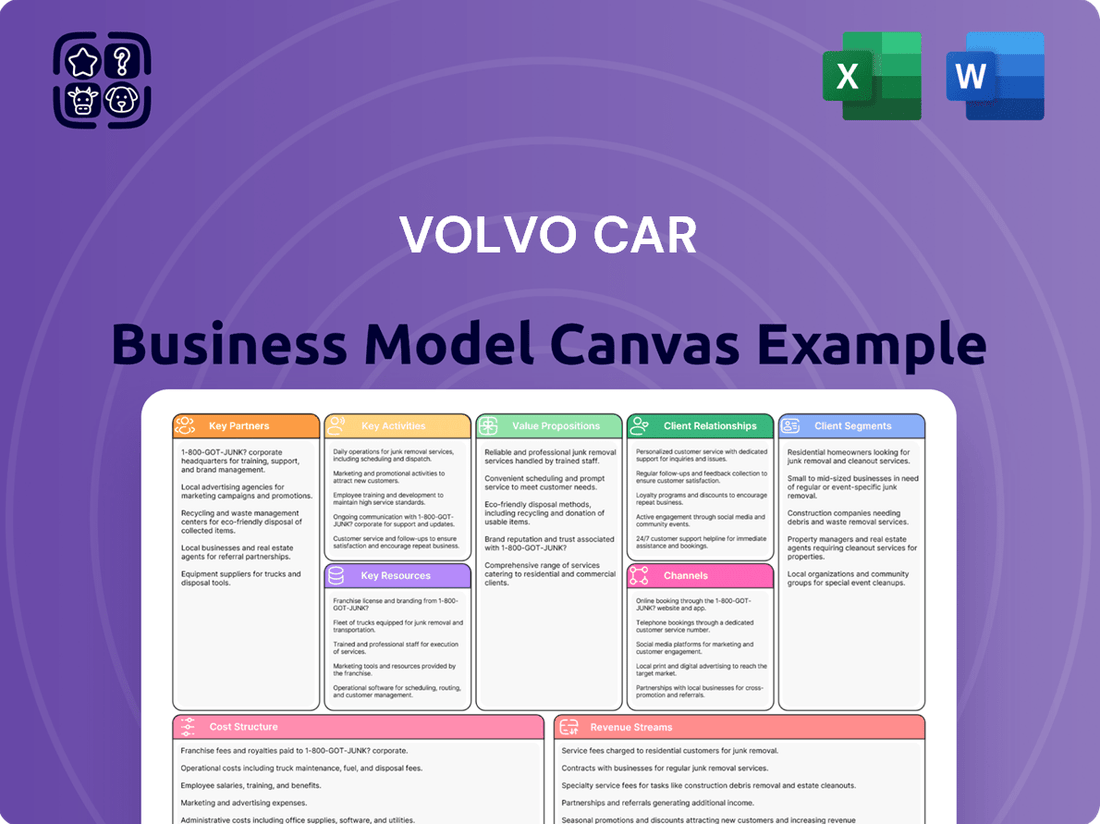

Volvo Car Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volvo Car Bundle

Unlock the full strategic blueprint behind Volvo Car's business model. This in-depth Business Model Canvas reveals how the company drives value through its focus on safety and sustainability, captures market share with premium offerings, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a resilient automotive giant.

Dive deeper into Volvo Car’s real-world strategy with the complete Business Model Canvas. From innovative value propositions like electrification and autonomous driving to key partnerships and revenue streams, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its future opportunities lie.

See how the pieces fit together in Volvo Car’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more, showcasing their commitment to a premium, safe, and sustainable driving experience. Download the full version to accelerate your own business thinking and strategic planning.

Partnerships

Volvo Car Company actively pursues strategic technology collaborations, focusing on areas critical to modern vehicle development. These partnerships are vital for advancing capabilities in areas like advanced driver-assistance systems (ADAS) and the burgeoning software-defined vehicle (SDV) platforms that are reshaping the automotive landscape. By engaging with tech firms, Volvo aims to deliver intelligent and seamless in-car experiences for its customers.

Key technology partners play a crucial role in Volvo's innovation pipeline. For instance, GlobalLogic and Tata Technologies serve as strategic suppliers, contributing essential engineering services. Their expertise is particularly focused on driving advancements in vehicle electrification and the complex embedded software solutions that power these sophisticated systems.

These collaborations are not just about acquiring technology; they are fundamental to Volvo's strategy for maintaining a competitive edge. By working with specialized firms, Volvo can accelerate the development of cutting-edge features and ensure its vehicles remain at the forefront of innovation in an automotive industry that is evolving at an unprecedented pace.

Volvo relies on a strong network of suppliers for essential components, especially batteries for its growing electric vehicle lineup, and various raw materials. These partnerships are critical for maintaining production flow. For example, in 2023, the automotive industry continued to navigate complex global supply chains, making reliable supplier relationships paramount for companies like Volvo.

Maintaining these supplier relationships helps ensure a steady flow of parts, even amidst global trade tensions and disruptions. Such stability is key to meeting production targets and customer demand for Volvo's vehicles.

Volvo's strategic decisions, like exploring localized EV production, underscore the significance of these supplier connections. Having strong ties with battery manufacturers and raw material providers geographically closer can mitigate risks and improve efficiency.

Volvo Car's global dealership network is a cornerstone of its business model, acting as the primary channel for vehicle sales and vital after-sales services. These dealerships are where customers experience the brand firsthand, test drive vehicles, and receive crucial maintenance and support, directly impacting customer satisfaction and loyalty.

This extensive network not only drives significant revenue through car sales but also through ongoing service and parts, reinforcing Volvo's market presence. For instance, in 2024, the expansion and modernization of dealerships, particularly in emerging markets, were key strategic initiatives to enhance customer touchpoints and capture greater market share, contributing to a robust revenue stream from service operations.

The strength of this network allows Volvo to maintain strong competitive positions in key global markets, offering localized sales and service solutions tailored to regional demands. The ability to provide consistent, high-quality customer experiences across diverse geographies is a critical factor in Volvo's brand reputation and its continued success in the automotive industry.

Charging Infrastructure Providers

Volvo's strategic alliances with charging infrastructure providers are crucial as the company accelerates its all-electric vehicle strategy. These partnerships are designed to ensure Volvo EV owners have seamless access to charging, a vital component for widespread EV adoption. By collaborating with established charging networks, Volvo enhances the convenience and usability of its electric models, directly addressing a key consumer concern.

These collaborations are fundamental to supporting Volvo's commitment to sustainable mobility and meeting the escalating demand for electric vehicles. For instance, in 2024, the global EV charging market was projected to reach hundreds of billions of dollars, underscoring the scale of this ecosystem. Volvo’s partnerships aim to capture a significant portion of this growth by offering integrated charging solutions.

- Expanded Network Access: Volvo EV owners gain access to a wider range of public charging stations through these partnerships, improving range confidence.

- Integrated Payment & Billing: Collaborations often lead to simplified payment processes, allowing owners to charge and pay seamlessly via Volvo's app or vehicle interface.

- Fast Charging Availability: Key partnerships focus on ensuring access to DC fast charging, significantly reducing charging times and making longer journeys more feasible.

- Home Charging Solutions: Some alliances extend to offering preferred home charging installation services, adding further convenience for new EV buyers.

Financial Service Providers

Volvo Car Company actively partners with financial institutions to offer a diverse suite of financing and insurance solutions. These collaborations are crucial for making vehicle ownership more accessible, covering options like loans, leases, and comprehensive insurance packages. By providing these essential services, Volvo enhances the customer purchasing journey and fosters long-term loyalty.

These financial partnerships are not just about facilitating sales; they represent a strategic pillar for Volvo's business. The company prioritizes its service revenue streams, including financing, to create a more stable and predictable income, especially when new car sales might experience market-driven fluctuations. This strategy helps to smooth out revenue volatility.

- Partnerships with banks and leasing companies: Volvo collaborates with major financial institutions to provide customers with flexible vehicle financing options, including loans and leasing agreements.

- Insurance product offerings: Through partnerships, Volvo offers integrated insurance solutions, such as comprehensive car insurance and extended warranties, enhancing customer peace of mind.

- Revenue diversification: The financing and insurance segments are key to balancing the cyclical nature of new vehicle sales, contributing a significant portion to Volvo's overall service revenue. For example, in 2024, the automotive industry saw a continued emphasis on recurring revenue models, with financial services playing a pivotal role in customer retention and profitability.

Volvo's key partnerships extend to technology providers, ensuring they are at the forefront of automotive innovation. Collaborations with companies like GlobalLogic and Tata Technologies bolster their engineering and software development capabilities, especially for electric and software-defined vehicles. These alliances are vital for accelerating the development of advanced features and maintaining a competitive edge in a rapidly evolving market.

These partnerships are crucial for securing essential components, particularly batteries and raw materials for their expanding electric vehicle range. Reliable supplier relationships are paramount for maintaining production flow, a challenge underscored by global supply chain complexities experienced in 2023. Proximity of suppliers, like battery manufacturers, is increasingly important for efficiency and risk mitigation.

Volvo's extensive global dealership network acts as its primary sales and after-sales service channel, directly influencing customer satisfaction and brand loyalty. In 2024, efforts to modernize and expand dealerships, particularly in growth markets, were key initiatives to enhance customer engagement and market penetration. This network is critical for generating revenue from both vehicle sales and ongoing service operations.

Strategic alliances with charging infrastructure providers are essential for Volvo's all-electric strategy, aiming to provide seamless charging access for EV owners. By partnering with established charging networks, Volvo enhances the convenience of its electric models, addressing a significant consumer concern. The global EV charging market's substantial growth, projected to reach hundreds of billions of dollars by 2024, highlights the importance of these collaborations for capturing market share through integrated charging solutions.

What is included in the product

A detailed Volvo Car Business Model Canvas, meticulously crafted to align with their premium, safety-focused, and increasingly electrified vehicle strategy.

It comprehensively outlines Volvo's customer segments, channels, and value propositions, reflecting their commitment to sustainability and innovation.

Provides a structured framework to identify and address customer pains, streamlining Volvo's product development and marketing efforts.

Activities

Volvo Car Company places a strong emphasis on Research and Development, dedicating substantial resources to pioneering advancements in automotive technology. This commitment is clearly demonstrated through their focus on safety, autonomous driving capabilities, and the ongoing electrification of their vehicle lineup.

Key R&D efforts include the development of sophisticated Advanced Driver Assistance Systems (ADAS), often incorporating cutting-edge LiDAR sensors for enhanced perception. Furthermore, Volvo is actively innovating in new infotainment systems and the integration of sustainable materials throughout their vehicle designs.

The company's investment in these critical areas is substantial. In 2024, Volvo allocated a significant percentage of its revenue directly to R&D, a clear signal of its strategic priority to remain at the forefront of automotive innovation and deliver future-ready solutions to consumers.

Volvo Car's core activity revolves around the meticulous manufacturing and assembly of a diverse range of luxury vehicles. This includes their well-known sedans, versatile station wagons, and popular sport utility vehicles, all brought to life in their global network of state-of-the-art manufacturing plants.

The company's production strategy is notably agile, designed to adapt swiftly to evolving market conditions. A prime example of this is their proactive approach to regionalizing operations; for instance, Volvo has been strategically shifting electric vehicle (EV) production to different locations to effectively mitigate the impact of tariffs, ensuring continued competitiveness and market access.

This strategic adaptation not only enhances manufacturing efficiency but also fosters a more responsive supply chain. By regionalizing production, Volvo can more effectively meet fluctuating global demand for its vehicles, ensuring timely delivery and maintaining customer satisfaction in a dynamic automotive landscape.

Volvo's marketing and sales activities are deeply rooted in reinforcing its core brand pillars: safety, luxury, and sustainability. Global campaigns are meticulously crafted to resonate with these values, aiming to attract a broad audience. For instance, in 2024, Volvo continued its strong digital push, with a significant portion of its marketing budget allocated to online channels to engage with younger, tech-savvy demographics and those prioritizing environmental responsibility.

The sales strategy involves a dual approach: direct engagement through digital platforms and robust support for its extensive global dealership network. This integrated model ensures a consistent brand experience whether a customer is researching online or visiting a showroom. Volvo's focus in 2024 remained on enhancing the customer journey, making it seamless and personalized.

Targeting diverse customer segments is paramount. Volvo actively courts millennials and environmentally conscious consumers by highlighting its electric vehicle offerings and commitment to carbon neutrality. This strategic positioning through digital marketing tactics, including influencer collaborations and targeted social media campaigns, proved effective in 2024 for building brand affinity.

After-Sales Service and Support

Volvo Car's commitment to after-sales service is a cornerstone of its business model. This involves offering a full suite of maintenance, repair, and spare parts services, all underpinned by robust warranty programs. These activities are vital for fostering customer loyalty and generating recurring revenue streams from the service sector.

Prioritizing world-class service ensures that Volvo vehicles remain operational, thereby maximizing uptime and productivity for its customers. This focus on reliability directly translates into a positive ownership experience.

- Comprehensive Service Offerings: Volvo provides extensive maintenance, repair, and genuine spare parts availability, ensuring vehicles remain in optimal condition.

- Customer Satisfaction and Loyalty: High-quality after-sales support is key to building long-term customer relationships and encouraging repeat business.

- Revenue Generation: The service business, including parts and labor, represents a significant and consistent revenue stream for Volvo.

- Uptime and Productivity: Volvo aims to keep customer vehicles running smoothly, minimizing downtime and supporting their daily activities.

Software Development and Integration

Developing and integrating sophisticated software for infotainment, connectivity, and autonomous driving is a core function for Volvo. As vehicles become more like connected devices, this requires significant investment in software engineering.

Volvo's strategic partnerships, such as those with GlobalLogic and Tata Technologies, underscore their commitment to building software-defined vehicles. These collaborations are crucial for delivering intelligent in-car experiences and advanced driver-assistance systems.

The company's focus on software development is driven by the rapidly evolving automotive landscape, where digital features are increasingly important for customer appeal and competitive advantage. This includes over-the-air updates and personalized user interfaces.

- Software Development: Creating and refining the operating systems, applications, and algorithms that power in-car functions.

- System Integration: Ensuring seamless communication and operation between various hardware and software components.

- Technology Partnerships: Collaborating with external experts to accelerate innovation and access specialized skills in areas like AI and cybersecurity.

- Data Management: Handling the vast amounts of data generated by connected vehicles for analytics and feature improvement.

Volvo Car's key activities encompass robust research and development, focusing on safety, autonomous driving, and electrification. Their manufacturing process is agile, with strategic regionalization to optimize production and mitigate trade impacts.

Marketing and sales efforts highlight safety, luxury, and sustainability, leveraging digital channels and a strong dealership network. After-sales service is critical for customer retention and revenue, ensuring vehicle reliability and customer satisfaction.

Furthermore, Volvo invests heavily in software development for connected car features and autonomous driving, often through strategic partnerships to accelerate innovation.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Research & Development | Pioneering automotive technology (safety, autonomous, electrification) | Significant R&D investment as a percentage of revenue, focusing on LiDAR and sustainable materials. |

| Manufacturing & Assembly | Producing sedans, wagons, SUVs with agile, regionalized operations. | Strategic shift of EV production to various locations to manage tariffs and demand. |

| Marketing & Sales | Reinforcing brand pillars (safety, luxury, sustainability) via digital and dealership channels. | Increased digital marketing spend targeting tech-savvy and environmentally conscious consumers. |

| After-Sales Service | Providing maintenance, repair, and spare parts to ensure vehicle uptime and loyalty. | Focus on high-quality service to enhance customer experience and generate recurring revenue. |

| Software Development | Creating and integrating software for infotainment, connectivity, and autonomous driving. | Partnerships with tech firms to accelerate development of software-defined vehicles and over-the-air updates. |

Delivered as Displayed

Business Model Canvas

The Volvo Car Business Model Canvas you are currently viewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct preview of the complete, professionally formatted file. Once your order is processed, you will gain full access to this comprehensive analysis, ready for immediate use and customization.

Resources

Volvo's brand, built on a bedrock of safety, quality, and distinctive Scandinavian luxury, stands as a crucial intangible asset. This reputation, honed over decades, allows Volvo to command premium pricing and foster customer loyalty.

Intellectual property, particularly patents for groundbreaking safety innovations like the three-point seatbelt and advanced driver-assistance systems, forms a core competitive advantage. These proprietary technologies not only enhance vehicle safety but also differentiate Volvo in a crowded automotive market.

The legacy of safety innovation continues, with significant investments in electrified powertrains and autonomous driving technologies. For instance, in 2024, Volvo Cars announced further development of its AI-powered driver assistance systems, underscoring its commitment to future safety advancements.

Volvo's manufacturing footprint is a critical resource, encompassing global production plants in Sweden, Belgium, the US, and China. These state-of-the-art facilities are equipped with advanced manufacturing machinery, forming the backbone of their vehicle production capabilities.

These physical assets are vital for producing Volvo's diverse vehicle portfolio, from sedans to SUVs, and allow for agile adaptation to varying regional market demands. For instance, their Ghent, Belgium plant is a key hub for electric vehicle production, supporting Volvo's electrification goals.

The strategic placement of these plants also enhances their ability to navigate supply chain complexities and optimize logistics. In 2023, Volvo Cars continued to invest in its manufacturing network, focusing on increasing capacity for its growing range of electrified models.

Volvo's human capital is a cornerstone of its business model, encompassing a diverse and skilled global workforce. This team, numbering around 42,600 full-time employees as of recent reports, includes vital engineers, creative designers, efficient production staff, and customer-focused sales professionals.

The company's dedication to innovation is visibly concentrated in its R&D and design centers, where these skilled individuals are instrumental. Their collective expertise is the driving force behind Volvo's ability to develop cutting-edge products, maintain high-quality manufacturing standards, and deliver exceptional customer experiences.

Financial Capital

Financial capital is the lifeblood for Volvo Car, enabling significant investments in research and development for new technologies like electrification and autonomous driving. It also underpins the substantial costs associated with manufacturing, maintaining a global supply chain, and executing strategic acquisitions that bolster its market position.

Volvo Car Group demonstrated robust financial performance in 2024, achieving record revenues and a strong core operating profit. This financial strength is crucial as the company navigates its ambitious transformation into a fully electric vehicle manufacturer, requiring continuous capital allocation.

- Research & Development: Funding advancements in battery technology, software, and safety systems.

- Manufacturing & Production: Investing in state-of-the-art electric vehicle production facilities.

- Global Operations: Supporting a widespread sales, service, and distribution network.

- Strategic Investments: Allocating capital for acquisitions, partnerships, and joint ventures to accelerate growth and technological integration.

Technology and R&D Centers

Volvo Car's commitment to innovation is anchored in its dedicated R&D and design centers, notably in Gothenburg, Sweden, and Shanghai, China. These hubs are crucial for pushing the boundaries in automotive technology.

The focus is on developing cutting-edge safety features, advancing electric vehicle (EV) powertrain technology, and refining advanced driver-assistance systems (ADAS). This strategic investment ensures Volvo consistently delivers leading-edge automotive solutions.

In 2023, Volvo Car Group invested approximately SEK 10.4 billion (around $1 billion USD) in research and development, underscoring the significant resources allocated to these centers. This investment fuels their ability to stay ahead in a rapidly evolving automotive landscape.

- Global R&D Footprint: Centers in Sweden, China, and other key locations foster international collaboration and diverse perspectives.

- Focus Areas: Prioritizing electrification, autonomous driving technology, and sustainable materials for future vehicles.

- Investment in Innovation: Significant annual R&D expenditure, with 2023 seeing approximately SEK 10.4 billion invested, highlights their dedication.

- Talent Acquisition: Attracting top engineering and design talent globally to drive technological advancements.

Volvo's key resources also include its robust global sales, service, and distribution network, ensuring widespread market reach and customer support. This network is essential for delivering Volvo vehicles and maintaining customer satisfaction post-purchase. The company's strong brand partnerships and collaborations also represent significant intangible assets, enhancing its market presence and technological development.

Value Propositions

Volvo's unwavering dedication to safety is central to its brand, evident in its advanced driver-assistance systems like LiDAR sensors and City Safety. This commitment ensures drivers feel secure, a key value for customers prioritizing protection.

The 2025 Volvo EX90 exemplifies this, being recognized as the safest vehicle in the company's history. This reinforces Volvo's reputation and appeals directly to consumers who seek the highest levels of safety in their vehicles.

Volvo vehicles are at the forefront of automotive innovation, boasting integrated cutting-edge technology. A prime example is the Android Automotive Infotainment System, featuring Google built-in, which offers a seamless and intuitive user experience. This commitment to advanced connectivity, including features like over-the-air updates and robust mobile app integration, directly addresses the desires of today's tech-savvy consumers.

The incorporation of semi-autonomous driving capabilities, such as Pilot Assist, further enhances Volvo's value proposition. This system, which combines adaptive cruise control with lane-keeping assist, provides a safer and more relaxed driving experience. In 2024, Volvo continued to refine these systems, aiming to deliver sophisticated driver assistance that appeals to a broad customer base seeking both convenience and enhanced safety.

Volvo’s value proposition centers on its distinctive Scandinavian luxury and design. This aesthetic translates into minimalist interiors, featuring high-quality, sustainably sourced materials like reclaimed wood and recycled textiles, emphasizing functionality and comfort. This focus creates a serene driving experience, distinguishing Volvo in the competitive luxury automotive segment.

In 2024, this commitment to design and sustainability is a key differentiator. Volvo reported a 24% increase in global sales for its Recharge models, which embody this Scandinavian ethos, highlighting consumer demand for premium, eco-conscious vehicles.

Commitment to Sustainability and Electrification

Volvo's dedication to sustainability is a core element of its business model, focusing on reducing CO2 emissions and embracing electrification. This commitment resonates strongly with a growing segment of environmentally aware consumers. By 2024, a remarkable 46% of Volvo's global sales were from electrified models, demonstrating significant market traction.

This focus on sustainability extends beyond powertrain technology. Volvo actively incorporates recycled materials into its vehicles and employs eco-friendly production methods. These practices not only minimize environmental impact but also enhance brand perception and appeal to a conscientious customer base.

- Environmental Responsibility: Volvo is actively working to minimize its carbon footprint.

- Electrification Drive: A significant portion of sales, 46% in 2024, are now electrified models.

- Material Innovation: The company utilizes recycled and sustainable materials in its manufacturing processes.

- Consumer Appeal: These efforts directly target and attract environmentally conscious buyers.

Comprehensive Ownership Experience

Beyond the initial purchase, Volvo cultivates a comprehensive ownership experience. This extends to integrated financing and insurance solutions designed to simplify the customer journey. Volvo's commitment is further demonstrated through its robust after-sales network, offering service agreements and readily available spare parts.

This focus on a complete ecosystem ensures customer uptime and supports their productivity. For instance, in 2024, Volvo continued to emphasize digital service booking and proactive maintenance alerts to minimize disruptions. These offerings are crucial for fostering long-term customer satisfaction and building loyalty.

- Financing and Insurance: Integrated financial products to streamline vehicle acquisition.

- After-Sales Support: Comprehensive service agreements, spare parts availability, and roadside assistance.

- Customer Uptime: Proactive maintenance and efficient service to keep vehicles operational.

- Loyalty Building: Holistic experience designed to foster long-term customer relationships and repeat business.

Volvo's value proposition is anchored in its unparalleled commitment to safety, offering advanced driver-assistance systems and a reputation for creating secure vehicles. This focus is exemplified by models like the 2025 EX90, recognized as the safest in Volvo's history, directly appealing to customers who prioritize protection above all else.

The brand also excels in technological innovation, integrating features like the Android Automotive Infotainment System with Google built-in for a seamless user experience. Furthermore, semi-autonomous driving capabilities, such as Pilot Assist, enhance both safety and convenience, with continuous refinements made throughout 2024 to provide a superior driving experience.

Volvo's Scandinavian design ethos, emphasizing minimalist interiors and sustainable, high-quality materials, creates a unique sense of luxury and comfort. This aesthetic, coupled with a strong push towards electrification, saw 46% of Volvo's global sales being electrified models in 2024, demonstrating a clear appeal to environmentally conscious consumers.

The company ensures a holistic ownership experience through integrated financing and insurance, alongside robust after-sales support. Initiatives like digital service booking and proactive maintenance alerts in 2024 aim to maximize customer uptime and foster long-term loyalty.

Customer Relationships

Volvo places a strong emphasis on customer relationships by offering personalized service and support through its extensive dealership network and dedicated customer service centers. This commitment translates into tailored assistance designed to build enduring connections with their clientele.

This focus on bespoke support directly impacts customer satisfaction, and Volvo's efforts have yielded positive results, with customer satisfaction scores showing an improvement in 2024. This growth indicates that their strategy of building strong, personal bonds is resonating effectively with their customer base.

Volvo Cars is significantly enhancing its customer relationships through robust digital engagement and online platforms. Customers can explore Volvo's full vehicle lineup, customize their desired models with various options, and even complete purchases directly online. This direct digital channel streamlines the customer journey, making it more convenient and personalized.

In 2024, Volvo reported a continued strong performance in its online sales channels, with a notable increase in vehicle configurations completed via their website. This digital interaction allows Volvo to gather valuable data, enabling them to tailor specific offers and marketing efforts to different customer segments, thereby deepening engagement and improving customer satisfaction.

Volvo actively cultivates a brand community through owner events and digital platforms, reinforcing its reputation for safety and quality. This strategy aims to build lasting customer loyalty and drive repeat purchases.

Loyalty programs, such as exclusive service offers and early access to new models, are key to retaining Volvo's customer base. These initiatives leverage the brand's strong identity, encouraging continued engagement and advocacy.

In 2024, customer retention is paramount. Companies like Volvo, known for their strong brand equity, often see loyalty programs contribute significantly to their revenue streams, with some studies indicating that a 5% increase in retention can boost profits by 25% to 95%.

Direct-to-Consumer Initiatives

Volvo is actively pursuing direct-to-consumer (DTC) initiatives, aiming to build closer relationships with millions of customers globally. This strategic pivot involves transitioning many markets towards a direct sales model.

This direct approach, while presenting operational challenges, is designed to foster a more personalized and efficient customer journey. By cutting out traditional intermediaries, Volvo can better control the brand experience and gather direct customer feedback.

For instance, in 2024, Volvo continued to expand its online sales capabilities and company-owned retail stores in key markets, aiming to streamline the purchasing process. This strategy supports the company's goal of increasing customer loyalty and understanding their evolving needs.

- Direct Sales Expansion: Volvo is increasingly adopting a direct sales model in numerous countries, aiming to connect directly with a vast customer base.

- Enhanced Customer Experience: This shift allows for more tailored interactions and a more efficient purchasing and ownership journey.

- Market Presence: By 2024, the company had expanded its online sales platforms and company-owned retail locations to strengthen its direct customer engagement.

- Customer Insight: The DTC model facilitates direct feedback loops, enabling Volvo to better understand and respond to customer preferences.

Continuous Improvement through Feedback

Volvo Cars prioritizes continuous improvement by actively seeking and integrating customer feedback into its product and service development. This data-driven approach ensures that Volvo remains responsive to evolving consumer needs and preferences, enhancing the overall customer experience.

For instance, in 2024, Volvo continued to refine its in-car technology and digital services based on user insights gathered through surveys, app usage data, and direct customer interactions. This feedback loop allows Volvo to make tangible adjustments, such as improving the intuitiveness of its infotainment system or enhancing the reliability of its connected services.

- Data-Driven Refinements: Feedback mechanisms in 2024 focused on areas like user interface design and connectivity features, leading to specific software updates.

- Customer Satisfaction Metrics: Volvo closely monitors customer satisfaction scores, aiming for year-over-year increases attributed to improvements informed by feedback.

- Product Evolution: Insights from customer feedback directly influence future model updates and the introduction of new features, ensuring relevance.

- Service Enhancements: Customer input also guides improvements in dealership services and after-sales support, fostering loyalty.

Volvo's customer relationships are built on personalized service, digital engagement, and direct sales initiatives. By enhancing online customization and leveraging customer feedback, Volvo aims to foster loyalty and adapt to evolving consumer preferences.

| Aspect | 2024 Focus | Impact |

|---|---|---|

| Personalization | Tailored support via dealerships and service centers. | Improved customer satisfaction scores. |

| Digital Engagement | Online configuration and purchase options. | Increased website vehicle configurations. |

| Direct-to-Consumer (DTC) | Expansion of online sales and company-owned stores. | Streamlined customer journey and direct feedback. |

| Customer Feedback | Integration of user insights into product development. | Refinement of in-car technology and services. |

Channels

Volvo's global dealership network is the core channel for both new vehicle sales and essential after-sales services. These physical locations are crucial for customers to interact with Volvo vehicles, offering test drives and personalized guidance. In 2024, Volvo continued to leverage this extensive network to drive market presence and revenue, with thousands of dealerships worldwide ensuring broad customer accessibility.

Volvo leverages online sales platforms allowing customers to research models, customize their cars, and complete purchases directly through digital channels. This approach significantly enhances customer convenience and broadens Volvo's market penetration among digitally adept consumers.

In 2023, online car sales continued to gain traction, with a significant portion of car buyers indicating a preference for online research and purchase options. Volvo's digital strategy aligns with this trend, aiming to capture a larger share of this evolving market by offering a seamless online customer journey.

These platforms provide a transparent and efficient way for customers to configure their desired Volvo, from selecting powertrains and interior finishes to adding optional features, streamlining the traditional dealership experience.

By embracing these digital channels, Volvo is not only adapting to changing consumer behaviors but also investing in a future where direct-to-consumer online sales are increasingly the norm, potentially reducing overhead and improving customer data insights.

Volvo's brand experience centers and showrooms act as crucial touchpoints, offering potential customers immersive environments to connect with the brand's core values and latest innovations. These strategically located physical spaces are designed to highlight Volvo's commitment to design, cutting-edge technology, and sustainability, thereby elevating brand perception and fostering deeper customer engagement.

These centers go beyond traditional car sales, focusing on creating memorable experiences that showcase Volvo's Scandinavian heritage and forward-thinking approach. By allowing customers to interact directly with vehicles and learn about the underlying philosophy, Volvo aims to build stronger emotional connections, a key differentiator in the competitive automotive market.

In 2024, Volvo continued to invest in these experiential retail formats. For instance, their flagship locations often feature interactive displays detailing electric vehicle technology and sustainable material sourcing, directly addressing growing consumer interest in eco-friendly transportation solutions and aligning with the company's ambitious electrification goals.

Marketing and Advertising Campaigns

Volvo Car utilizes extensive marketing and advertising campaigns across both traditional and digital platforms to connect with its target consumers. These efforts are designed to build brand recognition and generate interest in their vehicle offerings.

The core messaging in these campaigns consistently highlights Volvo's key brand pillars: safety, luxury, and sustainability. This strategic focus aims to resonate with consumers who prioritize these attributes in their vehicle purchases, reinforcing Volvo's market positioning.

In 2024, Volvo's marketing spend reflected a continued emphasis on digital channels, with significant investment in social media, programmatic advertising, and content marketing to reach a broad audience. This digital-first approach allows for precise targeting and measurable campaign effectiveness.

- Digital Reach: Volvo's digital marketing efforts in 2024 saw a substantial increase in engagement across platforms like YouTube and Instagram, showcasing new models and sustainability initiatives.

- Brand Messaging: Campaigns consistently featured Volvo's renowned safety innovations, alongside its premium interior design and commitment to electrification, aiming to attract affluent, environmentally conscious buyers.

- Partnerships: Strategic collaborations with influencers and lifestyle brands amplified Volvo's message, extending its reach into diverse consumer segments.

- Lead Generation: Through targeted online advertising and compelling content, Volvo successfully drove qualified leads to dealerships and its online sales platforms.

After-Sales Service Centers

Volvo's after-sales service centers form a critical component of its customer value proposition, ensuring vehicle longevity and owner satisfaction. These dedicated facilities provide authorized maintenance, repairs, and access to genuine Volvo parts, reinforcing the brand's commitment to quality and safety. In 2024, Volvo continued to invest in its service network, aiming to enhance customer experience through faster turnaround times and specialized technician training.

The reliability and performance of Volvo vehicles are directly supported by this network. Customers can trust that their cars are being serviced by trained professionals using manufacturer-approved components. This focus on quality after-sales care helps maintain the resale value of Volvo vehicles and fosters long-term customer loyalty. For instance, customer satisfaction surveys from late 2023 indicated that access to convenient and expert service was a significant driver of repeat purchases.

- Global Network Reach: Volvo maintains a widespread network of service centers across key markets, ensuring accessibility for its global customer base.

- Genuine Parts Availability: The centers guarantee the use of genuine Volvo parts, crucial for maintaining vehicle performance and safety standards.

- Technician Expertise: Volvo invests heavily in training its service technicians on the latest vehicle technologies, including electric and hybrid powertrains.

- Customer Service Focus: Beyond repairs, these centers offer a comprehensive customer service experience, including vehicle diagnostics and preventative maintenance advice.

Volvo's channels extend beyond physical dealerships to encompass a robust digital presence, including online sales platforms and brand experience centers. These digital avenues cater to evolving consumer preferences for research, customization, and direct purchase, enhancing convenience and market reach. In 2024, Volvo’s investment in online configurators and direct sales capabilities continued to grow, reflecting a strategic shift towards a more seamless, omnichannel customer journey.

The brand experience centers offer immersive encounters with Volvo's design, technology, and sustainability ethos, fostering deeper emotional connections. These physical touchpoints complement digital efforts by providing tangible brand engagement. For example, in early 2024, Volvo launched new experiential retail concepts in key urban areas, focusing on electric vehicle technology showcases.

Marketing and advertising campaigns, heavily weighted towards digital in 2024, utilize social media and targeted advertising to communicate Volvo's core values of safety, luxury, and sustainability. This multi-channel approach aims to build brand awareness and generate qualified leads for both online and dealership sales.

Customer Segments

Safety-conscious individuals and families form a cornerstone of Volvo's customer base. This segment is deeply invested in vehicle reliability and the practical space needed for family life, often seeking larger SUVs or wagons. Volvo's unwavering commitment to safety, a brand pillar for decades, resonates powerfully with these buyers who prioritize peace of mind above all else.

In 2024, Volvo Cars continued to emphasize its advanced driver-assistance systems, such as emergency braking and lane-keeping assist, which are critical selling points for this demographic. For instance, the XC90, a popular family SUV, consistently receives high safety ratings, reinforcing its appeal to parents and guardians. This segment’s purchasing decisions are heavily influenced by Volvo’s consistent safety accolades and its historical role in introducing groundbreaking safety technologies.

Environmentally Conscious Consumers represent a rapidly expanding market segment for Volvo. This group is drawn to Volvo's demonstrable dedication to sustainability, a commitment increasingly reflected in their product development, particularly the growing range of electric and plug-in hybrid vehicles. In 2023, Volvo Cars reported that pure electric vehicles accounted for 16% of its global sales, a significant jump from previous years, underscoring this trend. These consumers prioritize minimizing their ecological footprint and actively seek out luxury transportation solutions that align with their eco-friendly values.

Volvo is making significant strides in attracting tech-savvy millennials and younger demographics, recognizing their influence on automotive trends. This segment prioritizes vehicles that offer advanced technology, seamless digital integration, and contemporary design aesthetics.

Millennials, in particular, are a crucial part of Volvo's current customer base, with their purchasing power and preference for innovative features driving sales. As of 2024, this demographic continues to represent a substantial portion of Volvo's market, underscoring the brand's successful pivot towards younger consumers.

The company's commitment to electrification, exemplified by models like the XC40 Recharge and C40 Recharge, directly appeals to younger buyers who often prioritize sustainability and forward-thinking mobility solutions. These electric vehicles are equipped with advanced infotainment systems and over-the-air update capabilities, aligning perfectly with the digital expectations of this audience.

Luxury and Premium Vehicle Buyers

Volvo's luxury and premium vehicle buyers are discerning individuals who prioritize exceptional quality, refined design, and an elevated driving experience. This segment is attracted to Volvo's distinctive Scandinavian luxury, characterized by its minimalist elegance, premium materials, and meticulous craftsmanship. For instance, in 2024, a significant portion of Volvo's sales volume continues to be driven by these customers who value the brand's commitment to safety and sustainability alongside its luxurious appointments.

These customers are often affluent professionals and families who seek a vehicle that reflects their status and lifestyle. They appreciate the sophisticated yet understated aesthetic that Volvo offers, setting it apart from more ostentatious luxury brands. The emphasis on natural materials, intuitive technology, and a calm, comfortable cabin environment directly appeals to this demographic's desire for a premium sanctuary on the road.

- Target Demographic: Affluent individuals and families, typically aged 35-60, with high disposable incomes.

- Key Motivations: Desire for premium quality, sophisticated design, advanced safety features, and a comfortable, quiet driving experience.

- Brand Perception: Volvo is perceived as a brand offering understated luxury, Scandinavian elegance, and a strong commitment to ethical practices.

- Purchase Drivers: High-quality interiors, advanced technology integration, superior safety ratings, and a reputation for reliability.

Fleet and Corporate Customers

Volvo targets businesses and organizations that need dependable, safe, and efficient vehicles for their operations. These fleet and corporate customers often prioritize total cost of ownership, including fuel efficiency, maintenance, and residual value.

Volvo provides a range of models suitable for corporate fleets, from compact sedans to larger SUVs, with options that can be customized to meet specific business requirements. The company’s commitment to sustainability also resonates strongly with corporations aiming to meet their environmental, social, and governance (ESG) targets.

In 2024, the automotive industry saw a continued focus on electrification and fleet sustainability. For example, many large corporations are setting ambitious goals for electrifying their vehicle fleets. By 2025, a significant portion of new vehicle sales to fleets are expected to be electric or plug-in hybrid, a trend Volvo is well-positioned to capitalize on with its growing range of Recharge models.

Volvo's fleet solutions often include flexible leasing options, dedicated account management, and specialized services designed to minimize downtime and maximize productivity for business users.

- Targeting Businesses: Businesses requiring reliable, safe, and efficient vehicles for their fleets.

- Tailored Solutions: Volvo offers various models and services specifically adapted for corporate needs.

- Sustainability Focus: Emphasis on meeting corporate sustainability targets for vehicle procurement, including a growing demand for electric and plug-in hybrid vehicles.

- Fleet Benefits: Access to flexible leasing, dedicated support, and services aimed at enhancing operational efficiency and reducing total cost of ownership.

Volvo Cars effectively caters to a diverse customer base by segmenting its market. Key segments include safety-conscious individuals and families who prioritize vehicle reliability and space. Environmentally aware consumers are drawn to Volvo's expanding range of electric and plug-in hybrid vehicles, with pure electrics making up 16% of global sales in 2023. Additionally, tech-savvy millennials and younger demographics are targeted for their preference for advanced technology and contemporary design, with these groups representing a substantial portion of Volvo's market in 2024.

Cost Structure

Volvo Car’s commitment to future mobility solutions is clearly reflected in its significant investment in Research and Development. These costs are crucial for developing new technologies, particularly in the electric vehicle (EV) space, and for advancing vehicle platforms and safety innovations. In 2024, Volvo's R&D expenses saw an increase, underscoring its dedication to staying at the forefront of automotive innovation.

Volvo's manufacturing and production costs are a significant component of its business model, encompassing expenses for raw materials like steel and aluminum, as well as intricate components sourced globally. In 2024, the automotive industry continued to grapple with supply chain volatility, directly impacting these material costs for manufacturers like Volvo.

Labor costs for its skilled workforce across various production facilities, from Sweden to China and the United States, also represent a substantial outlay. Furthermore, the operational expenses of maintaining and upgrading these global production plants, including energy, maintenance, and automation investments, contribute heavily to the overall cost structure.

Supply chain management, ensuring the efficient flow of parts and finished vehicles, is another area of considerable expense. This also includes the rigorous quality control processes essential for maintaining Volvo's reputation for safety and reliability, a critical factor in its brand value and customer retention.

Adapting to evolving trade policies and potential tariffs can also introduce unexpected production cost shifts. For instance, in 2024, ongoing geopolitical considerations continued to influence global trade dynamics, necessitating flexibility and strategic planning in Volvo's manufacturing footprint and sourcing strategies to mitigate potential cost increases.

Volvo Car's marketing, sales, and distribution costs are substantial, reflecting its global reach and premium positioning. These expenses encompass major global marketing campaigns, crucial for building brand awareness and customer acquisition. For instance, in 2023, Volvo Cars reported a marketing and administrative expense of SEK 20.3 billion, a significant portion of which is dedicated to these efforts.

Maintaining an extensive dealership network worldwide also represents a considerable cost. This includes investments in showroom upkeep, staff training, and ensuring a consistent customer experience across all touchpoints. Furthermore, the development and upkeep of online sales platforms and robust distribution logistics are vital for reaching customers efficiently and managing the complex supply chain of automotive manufacturing.

These expenditures are strategically allocated to reinforce Volvo's brand image, emphasizing safety, sustainability, and Scandinavian design. Customer acquisition costs are also a key component, driven by the competitive automotive market. Volvo's focus on electrification also introduces new marketing and sales strategies, requiring investment in educating consumers and adapting sales processes for electric vehicles.

Personnel and Labor Costs

Volvo Car Group's personnel and labor costs are a major component of its expense structure, encompassing salaries, benefits, and ongoing training for a vast global workforce. This includes everyone from assembly line workers and engineers in research and development to sales teams and administrative staff. These costs represent a significant portion of Volvo's fixed expenses, meaning they don't fluctuate much with production volume.

In 2024, it's estimated that personnel and labor costs will continue to be a substantial outlay. For instance, in 2023, Volvo Car Group reported total employee-related expenses, which would include these personnel costs, as a significant part of their operating expenses, reflecting the global nature of their operations and workforce.

- Salaries and Wages: Compensation for a diverse global workforce across manufacturing, R&D, sales, and administration.

- Employee Benefits: Healthcare, retirement plans, and other benefits provided to Volvo employees worldwide.

- Training and Development: Investment in skill enhancement and professional development for continuous improvement.

- Fixed Cost Component: Personnel costs are largely fixed, contributing to operational stability but also requiring careful management.

Fixed Costs (e.g., Depreciation, Infrastructure)

Volvo's fixed costs are significantly influenced by the depreciation of its extensive manufacturing facilities, advanced machinery, and critical IT infrastructure. These assets represent a substantial capital investment that the company amortizes over time, impacting its profitability.

Volvo is strategically focused on optimizing both its fixed and variable costs. This includes a concerted effort to reduce its overall cost structure, particularly in response to market volatility. By freeing up cash through cost efficiencies, Volvo aims to enhance its financial resilience and flexibility.

For instance, in 2024, global automotive manufacturers, including Volvo, are navigating pressures on fixed asset utilization. Companies are evaluating their capital expenditures and depreciation schedules to find areas for optimization. Volvo's commitment to electrification also involves significant upfront investment in new production lines and battery technology, which will contribute to future depreciation charges.

- Depreciation of Manufacturing Assets: Includes the cost allocation of factories and assembly plants.

- Machinery and Equipment Amortization: Covers the gradual expensing of production tools and robotics.

- IT Infrastructure Costs: Encompasses depreciation on servers, software licenses, and network systems.

- Strategic Cost Reduction Initiatives: Ongoing efforts to lower overheads for improved financial performance.

Volvo Car's cost structure is heavily influenced by its investment in cutting-edge technology and manufacturing. In 2024, significant expenditures are allocated to Research and Development for electric vehicle advancements and autonomous driving features. Manufacturing expenses, including raw materials and global supply chain logistics, are also substantial, with companies like Volvo facing ongoing material cost pressures in 2024 due to market volatility.

Personnel and operational costs form another core part of Volvo's expenses. This includes a global workforce's salaries and benefits, alongside maintaining and upgrading its manufacturing plants, which are crucial for producing its range of vehicles. Marketing and sales efforts, including a global dealership network and digital platforms, also represent a considerable financial commitment to maintain its premium brand image.

Fixed costs, such as the depreciation of manufacturing assets and IT infrastructure, are also significant. Volvo is actively pursuing cost optimization strategies across its operations in 2024 to enhance financial resilience, especially as it invests heavily in electrification and new production capabilities.

| Cost Category | Key Components | 2024 Focus/Impact |

| Research & Development | EV technology, autonomous driving, safety innovations | Increased investment to maintain technological leadership |

| Manufacturing & Production | Raw materials (steel, aluminum), components, supply chain logistics | Managing material cost volatility and supply chain disruptions |

| Personnel & Labor | Salaries, benefits, training for global workforce | Significant fixed cost; managing workforce efficiency |

| Marketing, Sales & Distribution | Global campaigns, dealership network, online platforms | Brand building, customer acquisition, EV sales strategy adaptation |

| Fixed Costs | Depreciation of assets (plants, machinery, IT) | Capital expenditure for electrification impacting depreciation |

Revenue Streams

Volvo Car's core revenue generation stems from the sale of new vehicles, encompassing their well-known luxury sedans, versatile station wagons, and popular SUVs. A significant and increasing portion of these sales now comprises fully electric and plug-in hybrid models, reflecting a strategic shift towards electrification.

Beyond new car transactions, the company also benefits from sales of used vehicles, often enhanced by certified pre-owned programs that add value and consumer confidence. This dual approach to vehicle sales provides a robust revenue base.

Volvo Car demonstrated strong performance in 2024, reporting record sales figures. This achievement underscores the continued demand for their product portfolio and the success of their evolving strategy, particularly in the electrified segment.

Volvo Car generates revenue through financing and leasing services, making vehicle ownership more attainable for customers. These offerings are provided either in-house or through partnerships with financial institutions. For example, in 2023, Volvo Cars’ financial services segment reported operating income of SEK 3,599 million, demonstrating a significant contribution to the company's bottom line.

Volvo Car's after-sales services and parts represent a significant revenue stream, encompassing income from maintenance, repairs, genuine spare parts, and extended warranty programs. This segment is a strategic priority for Volvo, helping to smooth out the cyclical nature of vehicle sales and bolster overall profitability.

The service business demonstrates resilience, contributing to a more stable financial performance. For instance, in 2023, Volvo Cars reported a strong performance in its aftermarket business, with service revenue growing alongside vehicle sales, underscoring its importance in balancing sales fluctuations.

Subscription Services (e.g., Care by Volvo)

Volvo's foray into subscription services like Care by Volvo represented a strategic pivot towards recurring revenue streams, aiming to capture consistent income beyond traditional vehicle sales. This model offered customers a fixed monthly payment that typically bundled vehicle access, insurance, maintenance, and roadside assistance, simplifying car ownership. While Volvo paused the Care by Volvo program in the U.S. in late 2024 to streamline operations and concentrate on core business efficiencies, the underlying concept of subscription-based mobility remains a significant trend in the automotive industry.

The suspension of Care by Volvo in the U.S. market in late 2024 highlights the complexities of managing such programs, particularly in balancing customer value with operational profitability. Despite this pause, the automotive sector continues to explore and refine subscription models. Market analysts suggest that as the industry matures in its understanding of flexible ownership and mobility-as-a-service, subscription offerings could see a resurgence, potentially adapted to better suit evolving consumer preferences and economic conditions. For instance, companies are experimenting with tiered subscription levels and shorter commitment periods to enhance flexibility.

The potential for future iterations of subscription services by Volvo or competitors is substantial. These models are designed to foster customer loyalty and provide predictable revenue. By analyzing the performance data and customer feedback from earlier programs, automakers can develop more robust and appealing subscription packages. The goal is to offer a compelling alternative to traditional ownership that aligns with a growing demand for seamless, integrated digital experiences and flexible access to transportation.

- Recurring Revenue Potential: Subscription services aim to create a stable, predictable income stream, reducing reliance on the cyclical nature of new car sales.

- Customer Acquisition and Retention: These models can attract new customer segments and foster long-term relationships through bundled services and enhanced convenience.

- Operational Adjustments: Volvo's decision to suspend Care by Volvo in late 2024 demonstrates a strategic focus on optimizing business efficiency and core operations.

- Future Market Adaptability: The automotive industry's ongoing exploration of subscription models suggests that future offerings may be re-introduced, potentially with refined structures and value propositions.

Software and Connectivity Services

Volvo is increasingly tapping into revenue streams from software and connectivity services, reflecting the industry's shift towards software-defined vehicles. This includes potential future income from subscription-based features that enhance vehicle functionality or user experience, offering a recurring revenue model. The company’s strategy involves delivering value through over-the-air (OTA) updates, which can add new capabilities or improve existing ones, thereby extending the car's lifecycle and customer engagement. Connected car services, such as advanced navigation, remote diagnostics, and in-car entertainment, also represent a significant growth area, generating revenue through subscriptions and data utilization. For instance, by 2024, many automakers are seeing substantial growth in their connected services segments, with projections indicating continued expansion as vehicle connectivity becomes standard.

- Subscription Services: Offering premium features like advanced driver-assistance systems or enhanced infotainment through monthly or annual subscriptions.

- Over-the-Air (OTA) Updates: Monetizing software upgrades that improve performance, add new functionalities, or fix issues, potentially as part of a service package.

- Connected Car Services: Generating revenue from services like remote vehicle management, predictive maintenance alerts, and integrated third-party applications.

- Data Monetization: Leveraging anonymized vehicle data for insights, traffic management, or partnerships, while ensuring user privacy.

Volvo Car's revenue streams are diverse, anchored by new vehicle sales, which in 2024 saw record figures, especially for their electrified models. Beyond this, used car sales, including certified pre-owned programs, contribute significantly. The company also generates income through financing and leasing services, as evidenced by Volvo Cars’ financial services reporting SEK 3,599 million in operating income in 2023.

After-sales services, encompassing parts, maintenance, and extended warranties, provide a stable and growing revenue stream, as seen in 2023 where service revenue increased alongside vehicle sales. While Volvo paused its Care by Volvo subscription service in the U.S. in late 2024 to streamline operations, the automotive industry continues to explore recurring revenue from subscription-based mobility.

Software and connectivity services are emerging as key revenue drivers, with potential for subscription-based features and monetization of anonymized vehicle data. Over-the-air updates and connected car services, like advanced navigation and remote diagnostics, are projected for substantial growth by 2024 as vehicle connectivity becomes standard.

| Revenue Stream | Description | 2023 Data/2024 Trend | Strategic Importance |

|---|---|---|---|

| New Vehicle Sales | Sale of sedans, wagons, SUVs (including EVs and PHEVs) | Record sales in 2024, strong electrification growth | Core business, market presence |

| Used Vehicle Sales | Sales of pre-owned vehicles, CPO programs | Consistent contributor | Maximizing asset value, customer reach |

| Financing & Leasing | In-house or partnered financial services for vehicle acquisition | SEK 3,599 million operating income (2023) | Accessibility, customer loyalty |

| After-Sales & Parts | Maintenance, repairs, genuine parts, extended warranties | Service revenue grew alongside vehicle sales (2023) | Stable income, customer retention |

| Subscription Services | Bundled vehicle access, insurance, maintenance (e.g., Care by Volvo) | Care by Volvo suspended in U.S. late 2024; industry trend persists | Recurring revenue, customer relationship |

| Software & Connectivity | Subscription features, OTA updates, connected car services | Significant growth projected by 2024 for connected services | Future revenue growth, value-added services |

Business Model Canvas Data Sources

The Volvo Car Business Model Canvas is built using a combination of internal financial data, global market research reports, and extensive competitive analysis. These data sources ensure a comprehensive understanding of Volvo's strategic positioning and operational realities.