Volvo Car Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volvo Car Bundle

Curious about Volvo's product portfolio strength? Our preview offers a glimpse into how their vehicles might stack up as Stars, Cash Cows, Dogs, or Question Marks in the competitive automotive landscape.

Understanding this positioning is crucial for strategic decision-making, whether you're an investor, a competitor, or a Volvo enthusiast. Where does the popular XC90 sit? Is the emerging EV line a budding Star or a risky Question Mark?

Don't be left in the dark about Volvo's market performance. This limited insight is just the beginning of a comprehensive analysis.

Purchase the full BCG Matrix report to unlock detailed quadrant placements, data-driven insights into market share and growth, and actionable recommendations for future product development and investment.

Gain a complete strategic roadmap for Volvo's product lineup and navigate the automotive market with confidence. Your competitive clarity awaits!

Stars

The Volvo EX30 electric SUV is a prime example of a Star in the BCG matrix for Volvo Car. Launched in 2023, this compact all-electric vehicle entered a high-growth global EV market. Its impressive initial sales, especially in Europe, where it became one of the best-selling EVs in several markets during its debut year, highlights its strong market share capture. The EX30 is significantly contributing to Volvo's overall EV sales volume, solidifying its position as a leading product in the company's electrification strategy.

Volvo's fully electric vehicle segment is a clear star in its BCG matrix. In 2024, these sales saw a remarkable 54% increase, making up 23% of Volvo's total global sales. This is the leading percentage among established premium automakers, underscoring Volvo's strong position in a rapidly expanding market.

The Volvo EX90, a premium large electric SUV, is positioned to capture a significant share of the rapidly expanding electric vehicle market. While initial production challenges might temper immediate market share, its role as a technological showcase for Volvo and its commitment to electrification strongly suggests its potential as a Star. This vehicle embodies a substantial investment in a segment poised for considerable future expansion, with the global EV market projected to reach over $800 billion by 2027.

Electrified Models in Europe

In 2024, Volvo's electrified models, encompassing both fully electric and plug-in hybrids, captured a significant 65% of its European sales. This strong performance is further underscored by a 25% increase in overall Volvo sales across the region during the same year. Europe is clearly a pivotal market for Volvo's strategic shift towards electrification.

This trend indicates that Volvo's electrified offerings are not only meeting but exceeding market demand in Europe, a continent at the forefront of vehicle electrification adoption. The high market share signifies robust current performance for these models.

- Electrified Share: 65% of Volvo's 2024 European sales were electrified.

- Sales Growth: Overall Volvo sales in Europe grew by 25% in 2024.

- Market Position: Europe is a key market demonstrating strong adoption of Volvo's electrified future.

Software-defined Vehicle Technologies

Volvo's commitment to software-defined vehicle technologies, particularly in advanced safety, positions it strongly in a high-growth market. The EX90's Driver Understanding System, for instance, showcases this innovation, aiming to reduce traffic fatalities by identifying driver impairment. This focus directly addresses consumer demand for safer, more intelligent vehicles.

These technological advancements are a key differentiator, boosting the appeal and competitiveness of new Volvo models. In 2024, the automotive industry saw continued investment in ADAS (Advanced Driver-Assistance Systems), with the global market projected to reach over $100 billion by 2030, highlighting the significant growth potential. Volvo's strategic investments here are crucial for capturing market share.

- Software-Defined Vehicle Growth: The global market for software-defined vehicles is expanding rapidly, with analysts predicting significant revenue growth in the coming years, driven by features like autonomous driving and enhanced connectivity.

- Safety Feature Adoption: Consumer willingness to pay for advanced safety features continues to rise, with studies indicating a strong preference for vehicles equipped with sophisticated driver assistance systems.

- R&D Investment: Volvo's ongoing investment in software and AI development is critical for staying ahead of competitors in this rapidly evolving technological landscape.

- Competitive Advantage: By leading in software-defined capabilities, Volvo can command premium pricing and build stronger brand loyalty among tech-savvy consumers.

Volvo's fully electric vehicle lineup, particularly models like the EX30 and EX90, represents Stars within the BCG matrix. These vehicles operate in the high-growth electric vehicle market, a sector experiencing rapid expansion and significant consumer interest. The EX30, a compact EV, has demonstrated strong initial sales, especially in Europe, contributing substantially to Volvo's overall EV volume. The EX90, a larger premium EV, is positioned to capitalize on future market growth, despite potential initial production hurdles.

The company's strategic focus on electrification, exemplified by the strong performance of its electrified models in Europe, where they accounted for 65% of sales in 2024, further solidifies the Star status of its EV segment. This regional success, coupled with a 25% increase in overall European sales in 2024, highlights a robust market position in a key electrification market.

| Product/Segment | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Volvo's Fully Electric Vehicles | High | High | Star |

| Volvo EX30 | High | High (early indicator) | Star |

| Volvo EX90 | High | Potential High (projected) | Star |

What is included in the product

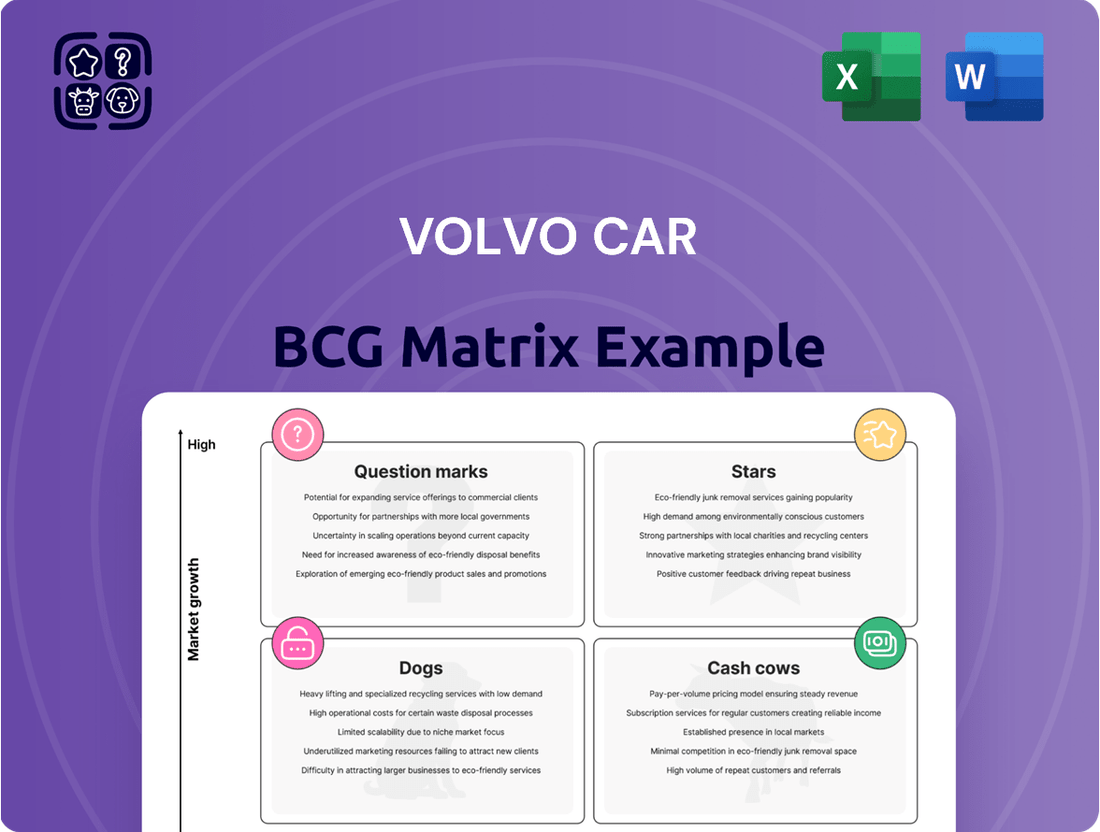

This BCG Matrix overview analyzes Volvo's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment and divestment decisions.

A clear Volvo Car BCG Matrix overview that visualizes each business unit's position, alleviating the pain of strategic ambiguity.

Cash Cows

The Volvo XC60, across all its powertrain options, firmly sits in the Cash Cows category of Volvo Car's BCG Matrix. Its position is solidified by its status as Volvo's leading global seller, commanding a substantial market share within the highly competitive mid-size SUV market.

In 2024, the XC60 achieved impressive sales figures, with 230,853 units sold. This consistent high volume translates directly into a stable and significant revenue stream for Volvo, underscoring its role as a reliable cash generator.

The established market presence of the XC60 means it requires less intensive marketing and promotional investment to maintain its sales momentum. This efficiency further contributes to its strong cash flow generation, making it a cornerstone of Volvo's financial stability.

The Volvo XC90, especially its plug-in hybrid and mild hybrid versions, stands as a prime example of a Cash Cow for Volvo Cars. This large premium SUV boasts a sustained strong market share in a well-established segment, consistently ranking as one of Volvo's top three sellers. Its profitability contribution is substantial, reflecting its enduring appeal and value to customers.

Volvo’s strategic choice to continue production of the XC90, even with the introduction of the newer EX90 electric SUV, highlights the XC90's established role as a reliable profit driver. This decision acknowledges the XC90's proven ability to generate consistent revenue and cash flow for the company, reinforcing its Cash Cow status within the BCG matrix.

The Volvo XC40, particularly its plug-in hybrid (PHEV) and mild hybrid variants, stands as a significant Cash Cow for Volvo Cars. It consistently holds a strong market share within the competitive compact SUV segment.

In 2023, the XC40 family, including its electrified options, contributed substantially to Volvo's global sales volume, underscoring its role as a reliable revenue generator. Its ongoing popularity in key markets like Europe and North America ensures a steady cash flow, supporting the company's broader strategic investments.

The established brand reputation of Volvo, coupled with the XC40's appeal as a stylish and practical compact SUV, allows it to maintain its strong market position even as the automotive landscape evolves. This consistent performance solidifies its Cash Cow status.

Global Plug-in Hybrid (PHEV) Portfolio

Volvo's global plug-in hybrid electric vehicle (PHEV) portfolio is a prime example of a Cash Cow within its product lineup. In 2024, this segment experienced a robust 16% growth, securing a substantial market share in the mature yet still highly relevant electrified vehicle market. These vehicles act as a crucial, profitable pathway for consumers moving towards full electrification, ensuring a steady stream of cash flow due to consistent demand and their balanced appeal to a wide range of buyers.

- Significant Market Share: Volvo's PHEVs hold a commanding position in a growing, albeit established, electrified market segment.

- Consistent Cash Flow: The profitability of these models is driven by stable consumer demand and their role as an intermediate step to full EV adoption.

- Broad Customer Appeal: Offering a compromise between traditional and electric powertrains, Volvo's PHEVs attract a diverse customer base.

- 2024 Performance: Demonstrating strong momentum with 16% year-over-year growth, these vehicles underscore their importance to Volvo's financial health.

After-sales Services and Spare Parts

Volvo's after-sales services and spare parts represent a significant cash cow, leveraging its substantial global installed vehicle base. This segment provides a stable and high-margin revenue stream, driven by the ongoing need for maintenance and genuine Volvo parts. The loyalty of Volvo owners ensures consistent demand, making this business less reliant on new vehicle sales cycles.

In 2024, the automotive aftermarket, including parts and services, continued to be a robust sector. For instance, the global automotive aftermarket was projected to reach over $500 billion by 2024, with services and parts forming the backbone of this revenue. Volvo benefits from this trend by offering specialized knowledge and OEM-certified components.

- High Profit Margins: Genuine Volvo parts and authorized service typically command higher margins than independent alternatives.

- Customer Retention: Comprehensive after-sales care fosters loyalty, encouraging customers to return for future service needs and new vehicle purchases.

- Predictable Revenue: The necessity of vehicle maintenance provides a consistent and predictable cash flow, independent of new car sales fluctuations.

- Brand Value Enhancement: Quality after-sales support reinforces Volvo's reputation for reliability and safety, further solidifying its brand image.

The established Volvo C40 Recharge, particularly its twin-motor all-wheel-drive variant, is a strong contender in Volvo's Cash Cow portfolio. It holds a significant market share within the premium compact electric SUV segment, a market that is maturing but still shows consistent demand.

Its consistent sales performance, coupled with the growing consumer preference for electric vehicles, ensures a steady revenue stream. The C40 Recharge benefits from Volvo's established brand reputation for safety and quality, appealing to a broad customer base seeking a practical and stylish EV.

The profitability of the C40 Recharge is further enhanced by its operational efficiencies as an electric vehicle, contributing to its reliable cash flow generation for Volvo Cars.

| Product | Category | 2024 Sales (Units) | Market Position | Cash Flow Contribution |

| Volvo XC60 | Cash Cow | 230,853 | Leading global seller, strong market share in mid-size SUV | High and stable revenue generator |

| Volvo XC90 (PHEV/Mild Hybrid) | Cash Cow | N/A (Top 3 seller) | Sustained strong market share in large premium SUV | Substantial profitability |

| Volvo XC40 (PHEV/Mild Hybrid) | Cash Cow | N/A (Significant contributor) | Strong market share in compact SUV | Reliable revenue generator |

| Volvo PHEV Portfolio | Cash Cow | 16% Growth (2024) | Substantial market share in mature electrified segment | Crucial, profitable pathway to EVs |

| After-sales Services & Parts | Cash Cow | N/A (Robust sector) | Leverages large installed base | Stable, high-margin revenue stream |

What You’re Viewing Is Included

Volvo Car BCG Matrix

The Volvo Car BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, detailing Volvo's strategic product portfolio positioning, is ready for immediate use without any watermarks or demo content. You are seeing the final, analysis-ready file designed for strategic clarity and professional application.

Dogs

Volvo's S60 and S90 sedans are positioned in a market segment that's experiencing a decline. This is largely due to a significant consumer shift towards SUVs, which has impacted overall sedan sales.

While the S60 experienced a brief sales increase in the United States, its global sales figures are modest, suggesting a small and potentially shrinking market share for these traditional models.

For instance, in 2023, Volvo sold approximately 25,000 S60 units globally, a figure that represents a small fraction of their total vehicle sales.

These sedans often demand considerable investment for what are typically limited returns, and they are not considered key drivers for Volvo's future expansion plans.

Volvo's traditional wagon models, such as the V60 and V90 Cross Country, occupy a niche in a market that is largely declining, much like sedans. These vehicles face challenges in capturing significant market share due to evolving consumer preferences leaning towards SUVs.

Recent sales figures for the V60, for instance, have shown a noticeable downturn, underscoring their limited growth potential and reduced market presence. Continued investment to boost mass-market appeal for these wagons is often an inefficient strategy given their struggle against the popularity of SUVs.

Older, non-electrified vehicle variants, primarily pure internal combustion engine (ICE) models without any form of hybridization, would be classified as Dogs in Volvo's BCG Matrix. These models represent Volvo's legacy offerings that are being systematically phased out to align with global sustainability goals and evolving consumer preferences.

In 2024, the market for purely ICE vehicles is experiencing a significant contraction. For instance, in many key European markets, the market share of new car registrations for purely ICE vehicles has fallen below 20%, with many countries implementing or planning outright bans on their sale in the coming years. This declining demand directly translates to very limited growth potential for these Volvo variants.

These older models possess a minimal market share within Volvo's overall sales portfolio. Their primary role is to serve a niche segment of the market or to clear existing inventory. Consequently, they generate low returns and require significant investment for compliance with increasingly stringent emissions standards, making them unattractive from a growth and profitability standpoint.

Underperforming Regional Markets (e.g., China overall sales)

Despite a notable increase in electrified model sales, Volvo's performance in the vast Chinese market presented a significant challenge in 2024. Overall sales in China saw a contraction of 8% compared to the previous year, signaling a difficult operating landscape and a potentially shrinking market share within this crucial region.

This underperformance in China positions it as a 'Dog' within Volvo's broader portfolio, a segment characterized by low growth and market share. The decline is largely attributed to intensified competition from aggressive local manufacturers and rapid shifts in consumer preferences, necessitating a thorough strategic review.

- Market Decline: Volvo's overall sales in China fell by 8% in 2024, indicating a struggling regional market.

- Competitive Pressure: Intense competition from domestic brands is a primary factor contributing to this underperformance.

- Strategic Reassessment: The 'Dog' status necessitates a deep dive into market strategies and product positioning for China.

- Electrified Growth Offset: While electrified models showed growth, it wasn't enough to counteract the overall sales dip.

C40 Recharge (Pre-EX40 Rebranding)

The Volvo C40 Recharge, before its rebranding to the EX40, faced considerable headwinds in the market. A notable example is the significant decline in sales in key regions. For instance, US EV sales, which would encompass the C40, saw a substantial drop, and Australia experienced a 49.2% decrease in sales for the model. These figures strongly suggest a low market share and stagnant or declining growth.

This performance firmly places the C40 Recharge in the 'Dog' category of the BCG matrix. This classification means the model had a low relative market share in a slow-growing industry. Such a position typically indicates that the product is not a significant contributor to overall profits and may even be a drain on resources.

- Low Market Share: The C40 Recharge demonstrated a weak position relative to its competitors in the electric vehicle segment.

- Struggling Growth: Significant sales declines, like the 49.2% drop in Australia, highlight a lack of market expansion.

- Strategic Repositioning Needed: The rebranding to EX40 signifies Volvo's attempt to revitalize the model and improve its market standing.

- Resource Allocation Considerations: As a 'Dog', the C40 Recharge's future required careful evaluation regarding continued investment versus divestment.

Older, non-electrified vehicle variants, particularly pure internal combustion engine (ICE) models, are categorized as Dogs in Volvo's BCG Matrix. These represent legacy offerings being phased out due to sustainability goals and evolving consumer preferences towards electrification.

In 2024, the market for purely ICE vehicles is shrinking significantly, with market share in many European markets falling below 20%. This declining demand offers very limited growth potential for these Volvo variants, which possess minimal market share and generate low returns.

The Volvo C40 Recharge, now rebranded as the EX40, also exemplifies a Dog. It faced considerable market headwinds, including significant sales declines in key regions, such as a 49.2% drop in Australia, indicating a low market share and stagnant growth.

This underperformance, coupled with intense competition, particularly in the Chinese market where overall sales contracted by 8% in 2024, positions these segments for a strategic reassessment and potential divestment.

| Model/Segment | BCG Category | Market Trend | Key Challenges | 2024 Data Point |

| Pure ICE Variants | Dog | Declining | Sustainability goals, consumer shift to EVs | ICE market share < 20% in key European markets |

| Volvo S60/S90 Sedans | Dog | Declining | Shift to SUVs | Global sales ~25,000 units (2023) |

| Volvo V60/V90 Wagons | Dog | Declining | Competition from SUVs | Noticeable sales downturn |

| Volvo C40 Recharge (EX40) | Dog | Mature/Slowing | EV market competition, sales declines | 49.2% sales decrease in Australia |

| Volvo China Operations | Dog | Contraction | Intensified competition, shifting preferences | 8% sales contraction in 2024 |

Question Marks

The Volvo ES90, an anticipated entry into the premium electric sedan segment, faces a dynamic market characterized by rapid growth but also intense competition from established players. Volvo's current market share in this specific niche is minimal, indicating it's a new frontier for the brand.

Significant capital is being allocated to the ES90's development and launch, reflecting a strategic bet on its future success. However, the vehicle's ability to capture substantial market share against strong rivals like the Tesla Model S or Mercedes-Benz EQS is yet to be proven.

This positioning places the ES90 in a potential question mark category within the BCG Matrix. Its substantial investment suggests high growth potential, but its unproven market acceptance means it could either become a future Star or require further strategic evaluation if initial sales fall short.

The Volvo EX60, slated for its global debut in 2026, is positioned as a future entrant into the mid-size battery-electric SUV market. This segment is characterized by intense competition but also significant growth potential, making the EX60 a potential Star in the BCG Matrix.

As a product yet to launch, the EX60 currently has zero market share, but its strategic placement in a high-growth electric SUV sector suggests a strong future revenue opportunity for Volvo. The company needs to secure substantial market share quickly to justify its investment.

Significant investment in launch and marketing is crucial for the EX60's success. Without this, it risks falling into the Dog category, failing to capture market share in a crowded and fast-evolving segment.

Volvo is introducing a new long-range plug-in hybrid electric vehicle (PHEV) tailored for the Chinese market, a region experiencing robust growth in hybrid vehicle demand. This strategic move targets a specific, expanding niche within a key global automotive market. China's new energy vehicle (NEV) sales, which include PHEVs, reached approximately 9.5 million units in 2023, a significant increase year-over-year, underscoring the market's potential.

While this new PHEV addresses a high-growth segment, its ultimate market penetration and profitability remain uncertain, placing it in a speculative position within Volvo's product portfolio. The company is investing heavily in localizing the development, marketing, and distribution of this vehicle to secure a competitive edge in China's dynamic automotive landscape.

Advanced Autonomous Driving Features

Volvo's advanced autonomous driving features, like the developing 'Ride Pilot,' are positioned as a future growth driver, tapping into a high-potential technological segment. While the long-term vision is strong, current market penetration is nascent, meaning these innovations are in a high-investment, low-return phase. This places them squarely in the question mark category of the BCG matrix, requiring significant capital for R&D without immediate, assured market dominance.

The automotive industry's autonomous driving market is projected for substantial growth, with estimates suggesting it could reach hundreds of billions of dollars by the late 2020s and early 2030s. For instance, some analyses in 2024 indicated the market could surpass $200 billion by 2030. Volvo's investment in this area, though currently yielding minimal direct revenue, is strategic for future competitiveness.

- High Growth Potential: The autonomous driving sector is anticipated to expand exponentially in the coming years.

- Significant R&D Investment: Developing and perfecting these advanced systems demands continuous and substantial financial commitment.

- Low Current Market Share: Widespread adoption and revenue generation from these specific features are still in their early stages.

- Uncertainty of Immediate Returns: The path to profitability and market leadership in this evolving technology is not yet guaranteed.

Emerging Mobility Solutions and Subscription Services

Volvo is actively venturing into emerging mobility solutions and subscription services, representing a significant strategic pivot beyond traditional car sales. These new ownership models, like Care by Volvo, are positioned as potential high-growth areas within the evolving transportation landscape.

While these subscription services tap into a growing consumer preference for flexible access over outright ownership, their current contribution to Volvo's overall market share and profitability is likely minimal. The company is investing heavily in developing these platforms, which often involve substantial upfront capital for technology, operations, and marketing.

To transition these nascent ventures into successful 'Stars' within the BCG matrix, Volvo needs to demonstrate a clear scalability strategy and forge key strategic partnerships. For instance, in 2023, Volvo's subscription services continued to expand their reach, aiming to capture a larger segment of the urban mobility market, though specific profitability figures for these new segments remain proprietary.

- Low Current Market Share: Subscription services are a small fraction of Volvo's total vehicle sales and revenue.

- High Investment Needs: Significant capital is required for platform development, fleet management, and customer acquisition.

- Growth Potential: The mobility-as-a-service market is expanding rapidly, offering long-term revenue opportunities.

- Strategic Partnerships: Collaborations are crucial for expanding service offerings and geographic reach.

The Volvo ES90, though poised for a premium electric sedan segment, faces a market where its current share is virtually non-existent, marking it as a question mark. Significant investment is poured into its development, betting on future growth, but its ability to capture market share against established rivals like Tesla remains unproven, requiring careful monitoring.

Volvo's new long-range plug-in hybrid electric vehicle (PHEV) for China is strategically placed in a high-growth market, yet its ultimate success and profitability are uncertain, classifying it as a question mark. China's NEV market, including PHEVs, saw approximately 9.5 million units sold in 2023, highlighting the potential but also the competitive intensity for this new Volvo offering.

Volvo's advanced autonomous driving features, such as 'Ride Pilot,' represent a high-potential technological segment but are currently in an early R&D phase with minimal market penetration, placing them firmly in the question mark category. The autonomous driving market is projected to exceed $200 billion by 2030, underscoring the strategic importance of Volvo's investment despite immediate low returns.

Emerging mobility solutions and subscription services, like Care by Volvo, are new ventures with uncertain current market share and profitability, marking them as question marks. While the mobility-as-a-service market is expanding, these services require substantial capital for platform development and customer acquisition, with success hinging on scalability and strategic partnerships.

BCG Matrix Data Sources

Our Volvo Car BCG Matrix is built on a foundation of robust data, integrating internal sales figures, market research reports, and industry growth forecasts to accurately assess product portfolio performance.