Volkswagen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volkswagen Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Volkswagen's destiny. Our comprehensive PESTLE analysis provides actionable insights into how these external forces influence the automotive giant's strategy and future growth. Don't get left behind; understand the landscape that matters most.

Gain a competitive advantage by delving into the intricate external environment impacting Volkswagen. From evolving consumer preferences to stringent environmental regulations, this analysis offers a clear roadmap for navigating challenges and capitalizing on opportunities. Make informed decisions with data-driven intelligence.

Ready to sharpen your strategic planning for Volkswagen? Our expertly crafted PESTLE analysis delivers the essential market intelligence you need. Understand the dynamic interplay of global trends and their direct effect on one of the world's leading automakers. Download the full version now and empower your business foresight.

Political factors

Stricter global emissions standards, such as the Euro 7 regulations in Europe, are a major political factor impacting Volkswagen. These regulations, along with evolving rules in China and North America, are compelling the company to accelerate its transition to electric vehicles and adopt more sustainable manufacturing processes. For instance, the EU's CO2 emission standards for cars and vans require a 55% reduction by 2030 compared to 2021 levels, with a full ban on new combustion engine car sales from 2035. This regulatory push directly influences Volkswagen's product development pipeline and overall market strategy, as non-compliance can result in substantial fines, while adherence unlocks access to significant incentives for green technologies.

Volkswagen's global operations are significantly shaped by international trade policies and tariffs. For instance, the EU's trade agreements, such as those with Canada and Japan, can reduce barriers for vehicle exports, boosting sales. Conversely, the potential for tariffs, like those considered by the US on imported vehicles or parts in past years, directly increases production costs and can impact pricing strategies in key markets. The EU's automotive sector relies heavily on these trade frameworks, with exports of vehicles and parts valued in the tens of billions of euros annually, making policy shifts a critical consideration.

Political stability in Volkswagen's core markets like Germany, the EU, China, and North America directly influences its investment strategies and operational stability. For instance, Germany's consistent pro-industry policies and commitment to the automotive sector in 2024 provided a stable foundation, contrasting with potential shifts in other regions.

Sudden policy changes, such as alterations in emissions standards or trade tariffs, pose significant risks. In 2024, the EU's continued focus on the Green Deal, while generally supportive of electric vehicle (EV) development, introduced regulatory complexities that Volkswagen had to navigate, impacting its product development timelines and supply chain strategies.

Political unrest in any of these key markets can disrupt production and sales, affecting consumer confidence. While major disruptions were not a dominant theme for Volkswagen in its primary markets through early 2025, geopolitical tensions in Eastern Europe continued to be a background risk, influencing energy costs and component sourcing.

Government incentives, particularly for electric vehicles, play a vital role in market demand. In 2024, countries like China and various EU member states offered substantial subsidies for EV purchases, directly boosting sales for Volkswagen's ID. series vehicles and impacting its market share in these crucial segments.

Government Subsidies for EVs

Governments globally are actively promoting electric vehicle (EV) adoption through substantial financial incentives. These often include direct purchase subsidies, tax credits, and reduced registration fees, making EVs more attractive to consumers. For instance, the German government extended its EV subsidy program into 2024, aiming to boost domestic sales. These policies are a critical driver for Volkswagen's EV strategy, directly influencing sales volumes and the company's investment decisions in battery production and charging networks.

The impact of these government incentives on Volkswagen's market performance is significant. By lowering the upfront cost of EVs, these programs encourage wider consumer uptake, which in turn fuels demand for Volkswagen's electric models like the ID.4 and ID. Buzz. Furthermore, incentives for charging infrastructure development are crucial for addressing range anxiety, a key barrier to EV adoption. As of late 2024, many European nations continue to offer attractive grants for installing home and public charging points, a trend Volkswagen actively supports through partnerships.

- Government incentives directly boost EV sales, impacting Volkswagen's revenue streams.

- Tax breaks and subsidies reduce the effective price of EVs for consumers, increasing market penetration.

- Investment in charging infrastructure, often government-backed, is vital for consumer confidence and EV adoption.

- Policy changes in key markets like China and the US can dramatically shift demand for electric vehicles.

Geopolitical Tensions and Supply Chains

Geopolitical tensions worldwide are a significant concern for Volkswagen. For instance, ongoing conflicts and trade disputes can directly impact the availability and cost of crucial components like semiconductors. In 2024, the automotive industry continued to grapple with these issues, with some analysts projecting that chip shortages, exacerbated by geopolitical instability in key manufacturing regions, could still cause production delays and increased costs for major automakers like Volkswagen.

These disruptions directly affect Volkswagen's global supply chains, leading to longer lead times for vehicle production and higher manufacturing expenses. The company's ability to secure stable access to raw materials, such as lithium and cobalt essential for electric vehicle batteries, is also vulnerable to international political dynamics. Navigating these complex global relations is paramount for maintaining operational stability and mitigating financial risks.

- Semiconductor Availability: Persistent geopolitical issues in East Asia continue to create uncertainty around the consistent supply of essential semiconductors, impacting automotive production schedules globally.

- Raw Material Access: Tensions in regions rich with critical minerals like lithium and nickel pose a risk to Volkswagen's EV battery supply chain, potentially driving up component costs.

- Trade Policy Volatility: Shifting trade policies and tariffs between major economic blocs can create unpredictable cost structures and logistical challenges for Volkswagen's international manufacturing and sales operations.

- Regional Conflicts: Escalating conflicts in various parts of the world can disrupt transportation routes and increase insurance premiums for global logistics, affecting Volkswagen's ability to move parts and finished vehicles efficiently.

Political stability remains a cornerstone for Volkswagen's strategic planning, with governments in its key markets like Germany, China, and the United States continuing to shape the automotive landscape through policy. For example, Germany's commitment to the automotive industry through 2024 provided a predictable environment, while evolving regulations in China directly influenced production targets for electric vehicles.

What is included in the product

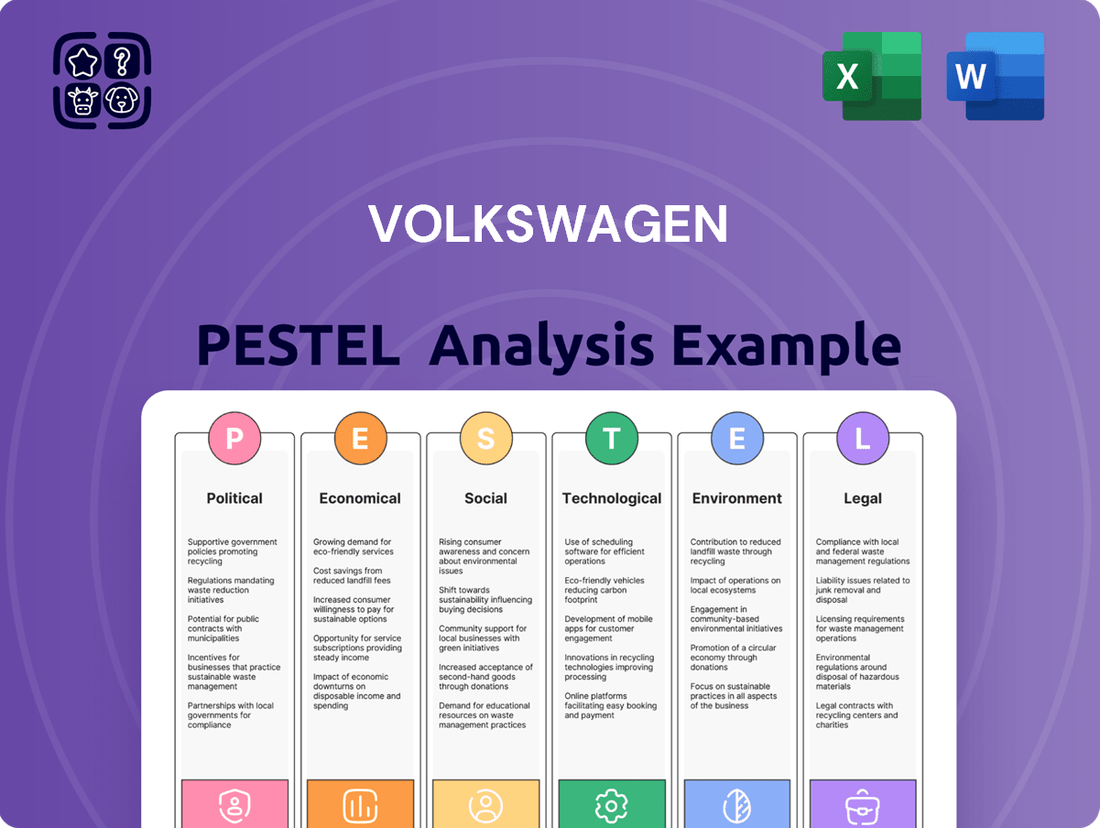

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors influencing Volkswagen's global operations and strategic decisions.

Provides a clear, actionable framework to identify and mitigate external threats and opportunities, thereby relieving the pain of uncertainty in strategic decision-making for Volkswagen.

Economic factors

Global economic health, marked by projected GDP growth of around 2.7% for 2024 and an anticipated slight acceleration in 2025, directly impacts Volkswagen's sales. Consumer disposable income levels are a critical determinant of demand for new vehicles. When economies are robust, consumers tend to have more money to spend on discretionary items like cars, boosting sales for manufacturers like Volkswagen.

Conversely, economic slowdowns or recessions can significantly dampen consumer confidence and discretionary spending. For instance, a substantial dip in consumer spending, as seen during periods of high inflation or job insecurity, directly translates to fewer car purchases, negatively affecting Volkswagen's revenue and market share. The automotive sector is particularly sensitive to these shifts.

Volkswagen faces significant headwinds from rising global inflation, which directly impacts its operational expenses. For instance, the cost of crucial raw materials like lithium and nickel, essential for EV batteries, saw substantial increases throughout 2023 and into early 2024. This upward pressure on input prices forces the company to absorb higher costs or pass them onto consumers, potentially impacting sales volume.

Simultaneously, elevated interest rates present a dual challenge. For consumers, higher financing costs can make purchasing new vehicles, especially expensive electric models, less attractive, thereby reducing demand. For Volkswagen itself, increased borrowing costs for capital expenditures, such as expanding production capacity or investing in new technologies, can squeeze profit margins and hinder strategic growth initiatives.

As a global automotive giant, Volkswagen's financial performance is significantly shaped by exchange rate fluctuations. The company operates in numerous markets, meaning the value of the Euro against currencies like the US Dollar, Chinese Yuan, and British Pound directly impacts its bottom line.

For instance, a stronger Euro can make Volkswagen's exports more expensive for international buyers, potentially dampening sales volumes. Conversely, a weaker Euro could make imports of raw materials and components, like semiconductors, more costly for the company's European manufacturing facilities.

In 2023, Volkswagen reported that currency effects had a negative impact on its operating result. While specific figures for 2024 and 2025 are still unfolding, the trend suggests continued sensitivity. For example, if the Euro strengthens by 5% against the US Dollar in 2024, it could lead to a reduction in the value of profits repatriated from its significant US operations.

Furthermore, the company's strategy to localize production in key markets, such as China and North America, aims to mitigate some of these currency risks by matching revenues and costs within those regions. However, the overall exposure remains substantial, requiring constant monitoring and strategic hedging to protect profitability.

Supply Chain Disruptions and Raw Material Costs

Volkswagen continues to grapple with persistent supply chain vulnerabilities, a key economic factor affecting its operations. The shortage of crucial components, especially semiconductors, significantly hampered production throughout 2024. For instance, in Q1 2024, Volkswagen Group delivered approximately 1.8 million vehicles, a slight decrease compared to the previous year, partly attributable to these supply constraints.

Volatile raw material prices present another considerable economic challenge. The cost of essential materials for electric vehicle batteries, such as lithium and nickel, has seen significant fluctuations. In early 2025, lithium prices, while stabilizing from previous peaks, remained a key consideration for battery production costs, impacting the overall profitability of VW's EV strategy.

- Semiconductor Shortages: Continued impact on production volumes, with recovery expected to be gradual through 2025.

- Raw Material Volatility: Fluctuating prices for lithium and nickel directly influence EV manufacturing costs.

- Logistics Costs: Elevated shipping and transportation expenses add to the overall cost of goods sold.

- Energy Prices: While showing signs of easing, energy costs in key manufacturing regions remain a factor in operational expenses.

Competition and Pricing Pressures

The automotive sector remains a battleground, with established giants and emerging players, especially from China, intensifying price competition. Volkswagen faces the constant challenge of maintaining market share while safeguarding profitability. This dynamic necessitates a keen focus on operational efficiencies and innovative pricing models.

For instance, in early 2024, Chinese EV manufacturers continued their aggressive market entry, often undercutting established Western brands. This trend put pressure on traditional automakers like Volkswagen to re-evaluate their pricing strategies, particularly in key markets like Europe and Asia. Volkswagen's response has included optimizing production costs and emphasizing the value proposition of its technology and brand.

- Intensified Competition: Chinese automakers are increasingly competitive on price, particularly in the electric vehicle (EV) segment, impacting global market dynamics.

- Pricing Pressure: Volkswagen must navigate a landscape where pricing is a critical differentiator, balancing volume goals with margin preservation.

- Cost Efficiency Focus: To counter pricing pressures, Volkswagen continues to emphasize cost reduction initiatives across its manufacturing and supply chain operations.

- Technological Differentiation: Investing in advanced technology and software is crucial for Volkswagen to create a distinct value proposition beyond price.

Global economic health directly influences Volkswagen's sales, with projected GDP growth around 2.7% for 2024 and a slight acceleration anticipated for 2025. Rising inflation in 2023 and early 2024 increased raw material costs, impacting production expenses, while higher interest rates made vehicle financing less attractive for consumers and borrowing more costly for the company. Exchange rate fluctuations also pose a risk, as demonstrated by the negative impact of currency effects on Volkswagen's operating results in 2023, with a strengthening Euro potentially reducing profits from its US operations.

| Economic Factor | Impact on Volkswagen | Supporting Data/Trend (2023-2025) |

| Global GDP Growth | Affects consumer spending and vehicle demand. | Projected 2.7% in 2024, slight acceleration in 2025. |

| Inflation & Raw Material Costs | Increases operational expenses, particularly for EV batteries. | Significant price increases for lithium and nickel noted through 2023-early 2024. |

| Interest Rates | Reduces consumer demand due to higher financing costs; increases company borrowing costs. | Elevated rates persist, impacting affordability and investment. |

| Exchange Rate Fluctuations | Impacts the value of international sales and import costs. | Currency effects negatively impacted operating results in 2023; continued sensitivity expected. |

Preview the Actual Deliverable

Volkswagen PESTLE Analysis

The preview you see here is the exact Volkswagen PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Volkswagen's operations and strategy.

You'll gain insights into market dynamics, regulatory landscapes, and consumer trends crucial for understanding Volkswagen's competitive position.

The content and structure shown in this preview is the same document you’ll download after payment, providing a complete and actionable report.

Sociological factors

Global consumer demand for electric vehicles (EVs) is on a significant upward trajectory. This surge is fueled by heightened environmental consciousness, the appeal of reduced running expenses, and considerable improvements in battery range and the availability of charging stations. For instance, in 2023, global EV sales surpassed 13.5 million units, a substantial increase from previous years.

Volkswagen needs to ensure its vehicle offerings and promotional strategies effectively cater to these shifting consumer tastes. The company's ID. family of electric vehicles is a key part of this alignment, aiming to meet the growing market segment for sustainable transportation solutions.

By 2024, projections indicate continued strong growth in the EV market, with some analysts forecasting sales to reach over 17 million units globally. This trend underscores the critical importance for Volkswagen to remain agile and responsive to evolving consumer preferences for greener mobility options.

Urbanization is a significant driver of change for Volkswagen. As more people flock to cities, the demand for personal vehicles is shifting. In 2024, it's estimated that over 60% of the world's population lives in urban areas, a figure projected to reach nearly 70% by 2050. This trend means cities are becoming hubs for diverse mobility solutions, moving beyond just private car ownership.

Volkswagen must recognize this shift. We're seeing a surge in ride-sharing services, car-sharing platforms, and the growing popularity of micro-mobility like e-scooters and e-bikes. For instance, the global ride-sharing market was valued at over $100 billion in 2023 and is expected to grow substantially. Adapting its business model to integrate or offer these alternative transportation services is crucial for Volkswagen's future relevance and success in these evolving urban landscapes.

Consumers are increasingly prioritizing brands that show a genuine commitment to environmental and social responsibility. This trend means that Volkswagen's efforts in areas like ethical sourcing, reduced emissions, and fair labor practices directly impact how people view the company and whether they choose its vehicles. For instance, a significant majority of consumers, around 70% according to some 2024 surveys, are willing to pay more for products from companies with strong sustainability credentials.

Volkswagen's focus on Environmental, Social, and Governance (ESG) principles is therefore a critical factor in shaping its brand image and influencing purchasing decisions. In 2024, Volkswagen continued to invest heavily in electric vehicle technology and sustainable manufacturing processes, aiming to meet growing consumer demand for greener mobility solutions. This strategic alignment with societal values is crucial for maintaining and enhancing customer loyalty in the current market.

Demographic Shifts and Generational Preferences

Global demographics are undergoing significant changes, impacting consumer behavior and preferences within the automotive sector. Mature markets, such as Europe and Japan, are experiencing an aging population, leading to a potential shift in demand towards vehicles prioritizing comfort, ease of use, and advanced safety features. Volkswagen needs to adapt its product portfolio to meet the needs of this growing senior demographic.

Concurrently, younger generations, including Gen Z and Millennials, represent a powerful and evolving consumer base with distinct expectations. These demographics prioritize seamless connectivity, immersive digital experiences, and a strong commitment to sustainability. For instance, a significant percentage of Gen Z consumers consider a brand's environmental impact when making purchasing decisions, with some studies indicating over 70% are willing to pay more for sustainable products. Volkswagen's marketing and vehicle development must resonate with these values, integrating cutting-edge infotainment systems and emphasizing eco-friendly manufacturing processes and electric vehicle (EV) offerings.

Volkswagen's strategic approach must therefore be multi-faceted, catering to the differing needs and desires across these generational cohorts. This includes:

- Developing vehicles with advanced driver-assistance systems (ADAS) and user-friendly interfaces appealing to older drivers.

- Enhancing in-car digital connectivity and offering over-the-air software updates that satisfy tech-savvy younger consumers.

- Expanding and promoting its range of electric vehicles and sustainable mobility solutions to align with the environmental consciousness of Millennials and Gen Z.

- Tailoring marketing campaigns to highlight specific features and brand values relevant to each demographic segment.

Brand Image and Reputation Management

Volkswagen's brand image, significantly impacted by the 2015 diesel emissions scandal, continues to be a critical factor in consumer perception and purchasing decisions. Rebuilding trust requires consistent demonstration of ethical practices and environmental responsibility.

In 2024, Volkswagen has been actively communicating its commitment to sustainability, investing heavily in electric vehicle (EV) technology and aiming for a carbon-neutral future. This proactive stance is essential for regaining consumer confidence and loyalty in key markets like Europe and North America.

The company's reputation management efforts focus on transparency regarding its environmental, social, and governance (ESG) performance. For instance, reporting on the lifecycle emissions of its vehicles and supply chain practices is becoming increasingly important for stakeholders.

- Brand Perception: Surveys in early 2024 indicated that while progress has been made, lingering skepticism about Volkswagen's environmental claims persists in some consumer segments.

- EV Transition: Volkswagen invested approximately €180 billion in digitalization and electrification by 2026, signaling a clear strategic shift to enhance its image as an innovative and sustainable automotive manufacturer.

- Consumer Trust: Initiatives like extended warranties on EV batteries and transparent communication about charging infrastructure development aim to bolster consumer trust in the brand's long-term vision.

- Global Reputation: Maintaining a positive global image is paramount, with varying consumer expectations and regulatory environments across different regions influencing how brand reputation is perceived and managed.

Societal values are increasingly shaped by environmental consciousness, driving demand for sustainable products. Volkswagen's investment in electric vehicles (EVs), projected to reach over 17 million global sales in 2024, directly addresses this trend. Consumers are willing to pay more for eco-friendly brands, with roughly 70% of surveyed individuals in 2024 indicating this preference.

Urbanization is reshaping transportation needs, with over 60% of the global population residing in cities in 2024. This rise in urban living fuels demand for alternative mobility solutions beyond traditional car ownership, impacting how Volkswagen designs and markets its vehicles, as seen in the booming ride-sharing market valued at over $100 billion in 2023.

Demographic shifts present varied consumer needs. Aging populations in mature markets prioritize comfort and safety, while younger generations seek connectivity and sustainability. Volkswagen's strategy, including a significant €180 billion investment by 2026 in digitalization and electrification, aims to capture these diverse preferences.

Technological factors

Volkswagen's competitive edge hinges on rapid advancements in electric vehicle technology, particularly in battery energy density and charging speeds. For instance, by early 2025, industry analysts project battery costs to fall below $100 per kilowatt-hour, a significant driver for EV affordability. Improvements in electric powertrain efficiency and motor design directly impact vehicle range and performance, areas where Volkswagen is investing heavily to meet consumer demand for longer-distance travel and quicker refueling.

The automotive sector is undergoing a seismic shift driven by the intense competition to develop and implement robust autonomous driving systems. This technological race is fundamentally reshaping how vehicles are conceived and manufactured.

Volkswagen is making substantial investments in crucial areas like artificial intelligence, sophisticated sensor technology, precise mapping, and the intricate software required for self-driving vehicles. These advancements are not just about innovation; they are critical for establishing a competitive advantage and setting future safety benchmarks for the company.

By 2024, the global autonomous vehicle market was projected to reach over $30 billion, with significant growth expected in the coming years. Volkswagen's commitment to these technologies positions it to capture a substantial share of this expanding market.

The success of Volkswagen's autonomous driving initiatives will directly impact its brand perception and its ability to meet evolving customer expectations for safety and convenience, making these technological factors a paramount concern for its strategic planning.

Volkswagen is navigating a landscape where sophisticated infotainment systems, over-the-air (OTA) updates, and vehicle-to-everything (V2X) communication are no longer novelties but core customer demands. This digital integration is crucial for enhancing the driving experience and unlocking new revenue streams through digital services. For instance, in 2024, the automotive industry saw a significant uptick in connected car services, with projections indicating a substantial increase in subscription-based software features.

The company must strategically embrace digitalization to offer personalized user experiences and innovative digital services, ranging from advanced navigation to predictive maintenance alerts. Simultaneously, ensuring robust cybersecurity measures is paramount to protect sensitive vehicle and customer data. Volkswagen’s investment in software development, including its CARIZMA subsidiary, highlights its commitment to this digital transformation. By 2025, it's anticipated that a significant portion of new vehicle sales will include advanced connectivity features, making Volkswagen's digital strategy a key differentiator.

Industry 4.0 and Smart Manufacturing

Volkswagen is heavily investing in Industry 4.0 technologies to modernize its production. This includes the integration of artificial intelligence, robotics, and the Internet of Things (IoT) across its manufacturing facilities. For instance, by 2025, Volkswagen aims to have its main plants equipped with advanced digital solutions, enhancing operational efficiency. These advancements are crucial for achieving greater flexibility and driving down production costs.

The implementation of smart manufacturing is directly boosting Volkswagen's productivity and quality. Data analytics plays a key role in optimizing assembly lines and predictive maintenance, reducing downtime. This technological push also strengthens the resilience of Volkswagen's supply chain, a critical factor in today's volatile global market.

- AI-powered quality checks: Reduced defect rates by up to 20% in pilot programs.

- Robotic automation: Increased assembly line speed by 15%.

- IoT sensor deployment: Improved real-time monitoring of machine performance, leading to a 10% reduction in unplanned maintenance.

- Data analytics for optimization: Enhanced energy efficiency in production by 8%.

New Mobility Solutions and Software Integration

The automotive sector is rapidly transforming into a software-centric industry. Vehicle capabilities and emerging mobility services are now fundamentally dependent on advanced software platforms. Volkswagen's success hinges on its prowess in developing, integrating, and generating revenue from sophisticated software for offerings such as ride-sharing, tailored driving experiences, and data insights.

This shift presents a significant competitive challenge. For instance, Volkswagen's CARIAD software division faced considerable delays and restructuring in 2023, impacting its ability to deliver next-generation vehicle software on schedule. The company aims to significantly increase its software development capabilities, targeting a substantial portion of its vehicle's value to be derived from software by 2025.

- Software-Defined Vehicles: The industry trend towards vehicles where functionality is increasingly controlled and enhanced by software.

- New Mobility Services: The development of platforms for ride-hailing, car-sharing, and subscription-based mobility, all powered by integrated software.

- Data Monetization: Leveraging vehicle and user data through software to create new revenue streams, such as predictive maintenance or personalized infotainment.

- CARIAD's Role: Volkswagen's dedicated software unit, tasked with unifying the group's software architecture and developing digital services.

Technological advancement is central to Volkswagen's strategy, particularly in electric vehicle (EV) and autonomous driving capabilities. By early 2025, industry analysts anticipate battery costs to drop below $100 per kilowatt-hour, making EVs more accessible and driving Volkswagen's investment in longer range and faster charging solutions.

The company is also heavily investing in AI, sensors, and software for autonomous driving, a market projected to exceed $30 billion by 2024. Furthermore, Volkswagen is embracing digitalization for connected car services and over-the-air updates, with a significant portion of new vehicles expected to feature advanced connectivity by 2025.

Volkswagen is also modernizing production with Industry 4.0 technologies like AI and IoT, aiming for advanced digital solutions in its main plants by 2025 to boost efficiency and reduce costs. The automotive sector's shift to software-defined vehicles presents a challenge and opportunity, with Volkswagen's CARIAD unit focused on developing integrated software platforms and new mobility services.

Legal factors

Volkswagen faces increasing pressure from evolving emissions and fuel economy regulations worldwide. For instance, the upcoming Euro 7 standards in Europe, expected to be finalized in 2024/2025, will impose even tighter limits on pollutants from internal combustion engines, pushing for further electrification and advanced exhaust aftertreatment systems. Similarly, the Corporate Average Fuel Economy (CAFE) standards in the United States continue to mandate higher efficiency, influencing powertrain development and vehicle design.

These regulations necessitate substantial capital expenditure for Volkswagen to develop and implement cleaner technologies, including electric vehicle (EV) platforms and improved internal combustion engine efficiency. Failure to comply with these stringent standards, such as exceeding permitted CO2 emissions thresholds, can lead to significant financial penalties. For example, in 2023, the European Union fined several automakers for non-compliance with fleet CO2 targets, highlighting the financial risks involved.

Beyond direct fines, non-compliance can also trigger reputational damage, impacting consumer trust and market share, especially as environmental consciousness grows among buyers. Volkswagen's ongoing transition towards electric mobility is a direct response to these regulatory shifts, aiming to meet future standards and maintain its competitive edge in a rapidly changing automotive landscape.

Global vehicle safety standards are constantly evolving, demanding significant investment in research and development for Volkswagen. For instance, countries are increasingly mandating advanced driver-assistance systems (ADAS) like automatic emergency braking and lane-keeping assist. This means Volkswagen must integrate these technologies seamlessly into new models to meet regulatory requirements and enhance safety.

Adherence to stringent crash test protocols, such as those from Euro NCAP and IIHS, is paramount. Failure to meet these standards can result in models being disqualified from key markets or receiving poor consumer ratings. Volkswagen's commitment to rigorous testing ensures their vehicles offer robust protection, a critical factor for consumer purchasing decisions.

Product recalls represent a significant legal and financial risk. In 2023, the automotive industry saw a notable number of recalls globally, impacting various manufacturers. Volkswagen, like its peers, must have robust systems in place to identify potential safety defects early and manage recalls efficiently to minimize damage to its reputation and avoid substantial fines or lawsuits.

Volkswagen faces increasing scrutiny under data privacy and cybersecurity laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). As connected vehicles generate substantial driver and vehicle data, compliance with these regulations is paramount. In 2023, data privacy fines globally reached billions of dollars, highlighting the significant financial risks of non-compliance.

Protecting this sensitive information requires robust cybersecurity infrastructure to guard against evolving cyber threats. The automotive industry, in particular, is a growing target for cyberattacks, with incidents impacting vehicle functionality and user data. By investing in advanced cybersecurity, Volkswagen aims to maintain customer trust and avoid costly breaches.

Antitrust and Competition Laws

Volkswagen navigates a landscape shaped by stringent antitrust and competition laws across its global operations. These regulations are designed to foster fair competition by preventing monopolistic practices, cartels, and other anti-competitive behaviors. For instance, in 2023, the European Commission continued its scrutiny of various industries, including automotive, for potential cartel activities, though specific investigations directly impacting Volkswagen's core operations in that year remain part of ongoing regulatory processes.

Adherence to these laws is not merely a legal obligation but a critical business imperative. Non-compliance can result in substantial financial penalties; for example, the European Union has imposed multi-billion euro fines on companies for antitrust violations in the past. Volkswagen must also contend with potential legal challenges and investigations from national competition authorities, which can disrupt business and damage its reputation.

The company's strategic decisions, from pricing strategies to joint ventures and acquisitions, are constantly evaluated through the lens of competition law. This includes ensuring that its collaborations and market positioning do not stifle innovation or harm consumer choice.

- Global Scrutiny: Volkswagen operates in markets subject to varying antitrust frameworks, including those of the EU, US, and China, each with distinct enforcement priorities and penalties.

- Fines and Penalties: Historically, automotive companies have faced significant fines for competition law breaches, underscoring the financial risks of non-compliance.

- Merger Control: Any future mergers, acquisitions, or significant joint ventures undertaken by Volkswagen will undergo rigorous review by competition authorities to assess their impact on market competition.

- Unfair Practices: Volkswagen must ensure its sales practices, pricing, and distribution agreements do not constitute unfair competition or abuse of a dominant market position.

Labor Laws and Employment Regulations

Volkswagen, as a massive global employer, navigates a complex web of labor laws and employment regulations across its numerous operating countries. These regulations dictate everything from fair working conditions and collective bargaining rights to minimum wages and protections against discrimination. For instance, in Germany, Volkswagen's home turf, strong works councils and co-determination laws significantly influence employment practices. Failure to comply can lead to substantial fines and damage to the company's reputation.

The company's adherence to these legal frameworks is not just about avoiding penalties; it's fundamental to fostering a stable and motivated workforce. In 2024, the automotive industry, including Volkswagen, faced ongoing scrutiny regarding fair labor practices, particularly concerning supply chain workers and the transition to electric vehicle production. Maintaining compliance ensures operational continuity and avoids costly legal battles that could disrupt production or financial performance.

- Global Compliance Burden: Volkswagen must adhere to differing labor standards in over 150 countries, impacting wage structures, working hours, and employee benefits.

- Collective Bargaining Impact: In regions like Europe, strong unions and works councils, such as those at Volkswagen, influence decisions on job security, training, and operational changes, as seen in ongoing discussions about EV plant retooling.

- Discrimination Laws: Strict anti-discrimination laws in key markets like the US and EU require Volkswagen to implement robust diversity and inclusion policies and training programs.

- Wage and Hour Regulations: Compliance with minimum wage laws, overtime rules, and pay equity requirements across its global workforce is a continuous operational focus for Volkswagen.

Volkswagen faces stringent environmental regulations globally, necessitating significant investment in cleaner technologies and compliance. For example, upcoming Euro 7 standards in Europe and CAFE standards in the US push for further electrification and efficiency, with non-compliance risks including substantial fines, as seen in past EU CO2 target breaches. These legal mandates directly influence Volkswagen's R&D priorities and capital allocation, driving its transition to electric mobility to meet future standards and avoid penalties.

Safety regulations are a critical legal factor, requiring continuous investment in advanced driver-assistance systems and adherence to rigorous crash test protocols like Euro NCAP. Non-compliance can lead to market disqualification or poor consumer ratings, impacting sales. Volkswagen must also manage the legal and financial risks associated with product recalls, a common occurrence in the automotive industry, as evidenced by numerous global recalls in 2023.

Data privacy and cybersecurity laws, such as GDPR and CCPA, impose strict requirements on handling the vast amounts of data generated by connected vehicles. In 2023, data privacy fines globally reached billions, underscoring the financial ramifications of breaches. Volkswagen must maintain robust cybersecurity to protect sensitive information, uphold customer trust, and avoid costly legal challenges.

Antitrust and competition laws are vital, preventing monopolistic practices and ensuring fair market behavior across Volkswagen's operations. Violations can result in significant fines, as demonstrated by past multi-billion euro penalties in the EU. Volkswagen's strategic decisions, including pricing and collaborations, are scrutinized to ensure they do not stifle competition or harm consumers.

Environmental factors

Global pressure to address climate change is compelling automakers like Volkswagen to commit to ambitious carbon neutrality goals throughout their operations. This includes everything from manufacturing processes to the energy consumption of their vehicles. For instance, Volkswagen has pledged to become net CO2 neutral by 2050, with interim targets to reduce emissions by 30% by 2030 compared to 2018 levels.

These targets necessitate significant investments in sustainable practices. Volkswagen is directing substantial capital towards renewable energy sources for its production facilities and exploring more eco-friendly materials for vehicle construction. A key component of this strategy is the accelerated transition towards a fully electric vehicle lineup, aiming for 50% of its global sales to be battery-electric vehicles by 2030.

Volkswagen faces increasing pressure due to the scarcity of vital materials like lithium, cobalt, and nickel, essential for its electric vehicle batteries. This drives the company to embrace circular economy models, focusing on recycling, component reuse, and more sustainable sourcing strategies to mitigate supply chain risks and environmental impact. For instance, Volkswagen is investing in battery recycling technologies, aiming to recover up to 95% of valuable materials from end-of-life batteries by 2025.

Designing vehicles with end-of-life recyclability in mind and actively working to minimize manufacturing waste are becoming critical environmental responsibilities for Volkswagen. The company's 2024 sustainability report highlights a goal to increase the proportion of recycled materials in new vehicles to 25% by 2030, a significant step towards reducing its overall resource footprint.

Volkswagen faces stringent environmental regulations globally, particularly concerning emissions and waste. For instance, in 2024, the European Union continued to enforce strict CO2 emission standards for new vehicles, pushing manufacturers like VW to accelerate their transition to electric mobility. Failure to comply can result in significant fines, as seen in past penalties levied against automakers for exceeding emission limits.

The company's commitment to pollution control necessitates substantial investment in advanced manufacturing technologies and sustainable practices. Volkswagen has been investing billions in developing cleaner production methods and improving energy efficiency at its plants. In 2024, reports indicated ongoing efforts to reduce water consumption and improve wastewater treatment across its European facilities, aligning with directives like the EU Water Framework Directive.

Efficient waste management is also a critical operational factor. Volkswagen aims to minimize production waste and maximize recycling rates, particularly for battery components in its growing electric vehicle fleet. By 2025, the company plans to have closed-loop systems for battery recycling at several key locations, a move supported by growing global demand for sustainable resource management and circular economy principles.

Biodiversity Protection and Land Use

Volkswagen faces growing pressure to address the environmental impact of its manufacturing plants and supply chains on local ecosystems. This scrutiny demands responsible land use, minimizing habitat disruption, and actively protecting biodiversity across its operational sites and sourcing areas.

The company's commitment to sustainability extends to its supply chain, where sourcing raw materials can have significant effects on biodiversity. For instance, the extraction of materials like lithium for batteries requires careful land management to prevent ecosystem damage.

Volkswagen's 2023 sustainability report highlighted initiatives such as habitat restoration projects at several of its European production sites. The company aims to increase the share of recycled materials in its vehicles, which indirectly reduces the demand for virgin resources and associated land use impacts.

- Biodiversity Impact: Volkswagen acknowledges the need to assess and mitigate the impact of its operations on local flora and fauna.

- Land Use Management: Implementing strategies for responsible land use at manufacturing facilities and supply chain nodes is a key focus.

- Supply Chain Scrutiny: The company is increasing its oversight of suppliers to ensure they adhere to biodiversity protection standards.

- Conservation Efforts: Volkswagen is investing in projects that aim to restore or protect natural habitats within its sphere of influence.

Sustainable Supply Chain Practices

Volkswagen faces increasing scrutiny to embed sustainability across its entire supply chain. This pressure extends from the initial sourcing of raw materials, such as cobalt and lithium for batteries, to the final assembly of vehicles, demanding a focus on ethical practices. For example, in 2024, Volkswagen announced its commitment to responsible sourcing for critical battery raw materials, aiming to trace 100% of its cobalt supply by 2025.

Addressing human rights and responsible mining is paramount. The company is working to ensure that suppliers adhere to strict labor standards and environmental regulations, mitigating risks associated with resource extraction. This involves rigorous supplier audits and collaborative initiatives to improve conditions in mining regions.

Reducing the environmental footprint of its suppliers is another key focus. Volkswagen is encouraging its partners to adopt cleaner production methods, increase energy efficiency, and minimize waste generation. By 2030, the company aims for its suppliers to reduce their CO2 emissions by 30% compared to 2018 levels.

- Ethical Sourcing: Volkswagen is enhancing its due diligence processes for raw materials, particularly for battery components.

- Human Rights Compliance: The company is implementing stricter supplier codes of conduct to ensure fair labor practices throughout the value chain.

- Responsible Mining: Efforts are underway to promote transparency and sustainability in the mining of critical minerals essential for electric vehicle production.

- Supplier Environmental Goals: Volkswagen has set targets for its suppliers to reduce their carbon emissions and improve resource efficiency.

Volkswagen faces significant regulatory pressure globally to reduce its environmental impact, particularly concerning vehicle emissions and manufacturing waste. For instance, the European Union's stringent CO2 emission standards in 2024 continue to drive the company's accelerated shift towards electric vehicles, with non-compliance potentially leading to substantial financial penalties.

The company is investing heavily in cleaner production technologies and operational efficiencies to meet these demands, focusing on reducing water consumption and improving wastewater treatment, as evidenced by its ongoing efforts in European facilities. Efficient waste management, especially for battery components, is also a priority, with plans for closed-loop recycling systems by 2025.

Volkswagen is also addressing the environmental impact of its supply chain, including responsible sourcing of battery materials like lithium and cobalt, and promoting sustainable practices among its suppliers. Initiatives like habitat restoration projects at production sites and increasing recycled materials in vehicles are part of its broader strategy to minimize its ecological footprint.

PESTLE Analysis Data Sources

Our Volkswagen PESTLE analysis is grounded in comprehensive data from official government publications, international economic organizations like the IMF and World Bank, and reputable industry-specific market research firms. These sources provide the authoritative insights needed to understand the political, economic, social, technological, legal, and environmental forces shaping the automotive sector.