Volkswagen Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volkswagen Bundle

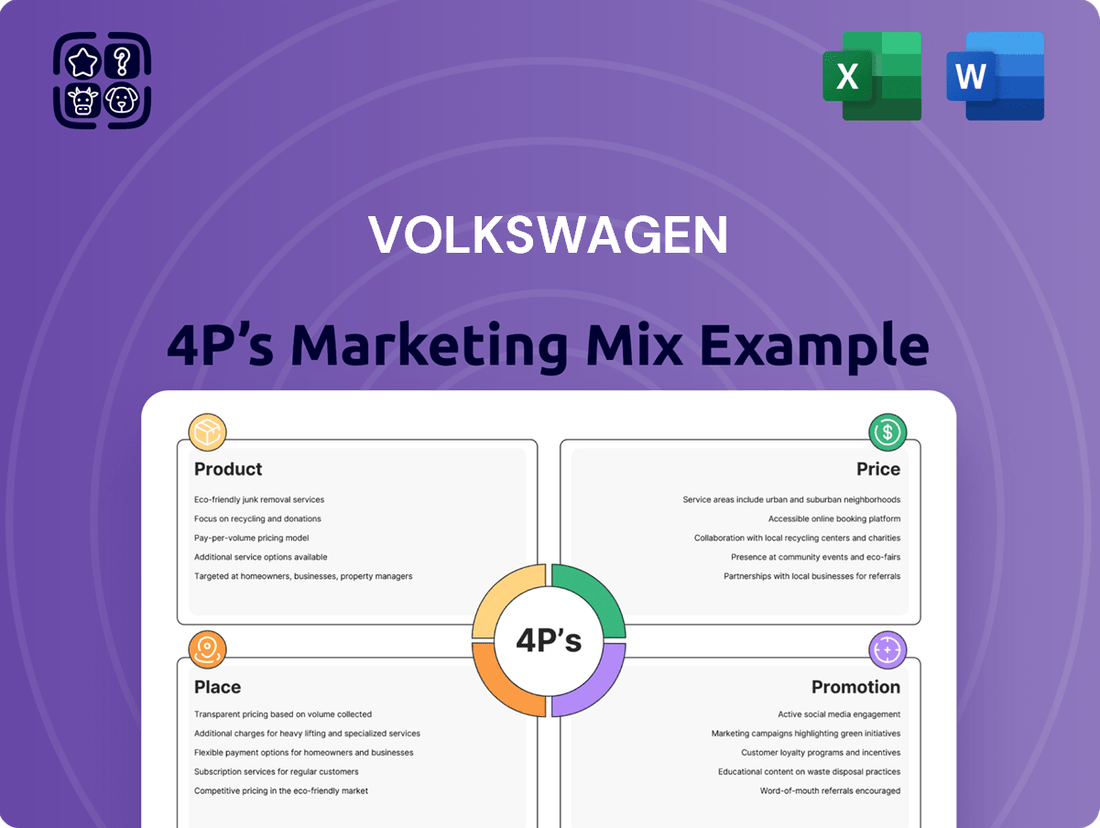

Volkswagen masterfully orchestrates its marketing through the 4Ps. Their product strategy focuses on reliability and German engineering, while pricing positions them as accessible premium vehicles. The brand’s extensive dealer network ensures widespread availability, and their promotional campaigns emphasize heritage and innovation.

Dive deeper into how Volkswagen leverages Product, Price, Place, and Promotion to maintain its competitive edge. This analysis goes beyond surface-level observations, offering actionable insights.

Unlock the full potential of this data. Get immediate access to a comprehensive, editable 4Ps Marketing Mix Analysis for Volkswagen, perfect for strategic planning or academic research.

Product

Volkswagen boasts an extensive vehicle lineup, encompassing passenger cars such as sedans, SUVs, and hatchbacks, designed to appeal to a wide array of global customer preferences. This broad selection allows Volkswagen to effectively meet diverse mobility needs, from economical urban transport to spacious family haulers and sporty performance vehicles. In 2024, the brand continued to strengthen this diverse portfolio with strategic updates and new model introductions, aiming to capture a larger market share across various segments.

The company actively refreshes its offerings to maintain market relevance and consumer interest, exemplified by upcoming models like the 2025 T-Roc and the 2025 Taos. This commitment to innovation ensures Volkswagen remains competitive, adapting to evolving consumer demands and technological advancements in the automotive industry. For instance, the ongoing electrification of its fleet, including models like the ID.4, further diversifies its portfolio to cater to the growing demand for sustainable transportation solutions.

Volkswagen's product strategy prominently features a robust focus on electric vehicles, notably through its ID. family of cars. The company is channeling significant investment into EV research, development, and manufacturing. This commitment is underscored by their ambitious goal for electric vehicles to represent a substantial share of their sales across Europe, the US, and China by the year 2030.

A key aspect of this electric vehicle push is making electromobility more accessible. Volkswagen is actively developing more affordable entry-level EV models. They aim to introduce EVs priced under €25,000 and even target models below €20,000 within the 2026-2027 timeframe.

Volkswagen's commercial vehicle division is a significant part of its global strategy, extending beyond passenger cars to cater to business and logistics sectors. This includes a diverse lineup of vans and transporters designed for various commercial applications.

This segment is crucial for Volkswagen, as it addresses a different customer base with specific needs in transportation and delivery. It diversifies revenue streams and reinforces the brand's comprehensive mobility solutions.

The company is actively investing in electrifying its commercial fleet. A key development is the upcoming launch of the electric Transporter in 2025, signaling a strong commitment to sustainability in this segment. This move aligns with the growing global demand for eco-friendly commercial transport.

Financial Services and Mobility Solutions

Volkswagen is expanding its product portfolio beyond just cars to encompass a wide array of financial services. This includes offerings like vehicle financing, leasing programs, and insurance, making car ownership more accessible and flexible for customers. For instance, Volkswagen Financial Services reported a profit before tax of €2.5 billion for the first nine months of 2023, demonstrating the significant contribution of these services to the group's overall financial health.

Furthermore, Volkswagen is making substantial investments in future mobility solutions. They are actively developing and rolling out services such as car-sharing platforms and ride-hailing initiatives. These efforts are geared towards positioning Volkswagen as a comprehensive mobility provider, moving beyond traditional car manufacturing. By 2025, the company aims to have millions of customers using its mobility services worldwide, reflecting a strategic shift in its business model.

- Financial Services: Vehicle financing, leasing, and insurance offerings.

- Mobility Solutions: Development of car-sharing and ride-hailing services.

- Strategic Goal: Transition from an automotive manufacturer to a holistic mobility provider.

- Financial Performance: Volkswagen Financial Services achieved a profit before tax of €2.5 billion in the first nine months of 2023.

- Future Outlook: Target of millions of mobility service users by 2025.

Software and Digital Integration

Volkswagen's commitment to software and digital integration is a cornerstone of its future strategy, spearheaded by its dedicated CARIAD unit. This focus is critical for enhancing the in-car user experience, allowing for seamless over-the-air updates, and integrating sophisticated driver assistance and autonomous driving capabilities.

CARIAD represents a significant investment, with the company aiming to develop its own software platforms and digital services. This move is designed to reduce reliance on external suppliers and gain greater control over the vehicle's digital ecosystem. By 2024, Volkswagen had already committed billions of euros to CARIAD's development, underscoring the strategic importance of this digital transformation.

The integration of advanced software is directly tied to Volkswagen's vision of software-defined vehicles. This allows for continuous improvement and feature additions throughout the vehicle's lifecycle, creating new revenue streams through data-based business models and connected services.

- CARIAD's Investment: Volkswagen has allocated substantial financial resources, with projections indicating continued significant investment through 2025 and beyond to bolster its software development capabilities.

- Over-the-Air (OTA) Updates: This technology allows for remote software updates, improving vehicle performance, adding new features, and addressing potential issues without requiring a dealership visit.

- Advanced Driver Assistance Systems (ADAS): Software integration is crucial for the deployment and enhancement of ADAS features, moving Volkswagen closer to offering advanced autonomous driving functionalities.

- Data-Based Business Models: The digital architecture enables the collection and analysis of vehicle data, paving the way for personalized services and new revenue opportunities.

Volkswagen's product strategy is characterized by a broad and evolving portfolio, encompassing traditional internal combustion engine vehicles, a strong push into electric mobility with its ID. family, and a growing presence in financial and mobility services. The company is actively investing in software development through CARIAD to enhance vehicle functionality and create new digital revenue streams.

| Product Category | Key Features/Developments | Relevant Data/Targets |

|---|---|---|

| Passenger Vehicles | Diverse range (sedans, SUVs, hatchbacks), ongoing model refreshes (e.g., 2025 T-Roc, 2025 Taos) | Strategic updates to capture market share in 2024. |

| Electric Vehicles (EVs) | ID. family (e.g., ID.4), planned affordable models (< €25,000, < €20,000 by 2026-2027) | Significant investment in EV R&D; aim for substantial EV sales share by 2030. |

| Commercial Vehicles | Vans and transporters for business use, electrification of fleet (e.g., electric Transporter launch 2025) | Addresses specific business needs and growing demand for eco-friendly commercial transport. |

| Financial & Mobility Services | Vehicle financing, leasing, insurance; car-sharing, ride-hailing initiatives | €2.5 billion profit before tax (VW Financial Services, first nine months 2023); millions of mobility service users targeted by 2025. |

| Software & Digitalization | CARIAD unit development, over-the-air updates, ADAS, data-based business models | Billions of euros invested in CARIAD by 2024; focus on software-defined vehicles. |

What is included in the product

This analysis provides a comprehensive breakdown of Volkswagen's 4P's marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities.

It's designed for marketing professionals seeking a factual overview of how Volkswagen positions itself in the automotive market.

Streamlines Volkswagen's marketing strategy by clarifying how Product, Price, Place, and Promotion address customer pain points, making complex decisions more manageable.

Provides a clear, actionable framework for understanding how Volkswagen's 4Ps solve customer challenges, facilitating efficient marketing planning and execution.

Place

Volkswagen boasts an extensive global dealership network, a cornerstone of its marketing strategy. This vast network, comprising thousands of authorized dealerships worldwide, ensures broad market penetration and customer accessibility. For instance, as of late 2024, Volkswagen Group operates over 10,000 dealerships globally, reflecting its commitment to providing local sales and service touchpoints.

These dealerships are critical for both vehicle sales and after-sales support, offering customers direct interaction with the brand and its products. They serve as essential physical locations where potential buyers can experience vehicles firsthand and receive ongoing maintenance and repair services, reinforcing customer loyalty and brand presence in diverse markets.

Volkswagen is actively embracing digital transformation by integrating online sales channels and digital platforms into its distribution strategy. This reflects evolving consumer behavior, with a growing preference for online research, vehicle configuration, and even direct purchasing. For instance, in 2024, Volkswagen saw a significant increase in online inquiries and configurations, with over 60% of potential buyers starting their journey on digital platforms. The company is focused on providing seamless digital interfaces to enhance customer convenience throughout the vehicle exploration and acquisition process.

Volkswagen is actively pivoting towards direct-to-consumer sales, especially for its EV range, aiming for a smoother customer journey. This shift is highlighted by initiatives like the online configurator and sales platform for models like the ID.4, with the goal of enhancing customer experience and potentially improving margins by reducing dealer markups.

The company is also investing heavily in mobility hubs, envisioning these as integrated service centers that will offer charging, service, and potentially shared mobility options. These hubs are crucial for Volkswagen's strategy to evolve beyond just car manufacturing into a broader mobility services provider, tapping into the growing market for subscription and on-demand transportation.

By integrating autonomous technology into these new business models, Volkswagen seeks to unlock new revenue streams through services like autonomous ride-hailing and delivery. For instance, pilot programs with the ID. Buzz AD (Autonomous Driving) are already underway, signaling a tangible move towards a future where vehicles are not just owned but are integral parts of a larger mobility ecosystem.

Integrated Service and Parts Distribution

Volkswagen's commitment to customer satisfaction is deeply rooted in its integrated service and parts distribution network. This extensive infrastructure, often housed within dealerships, provides owners with reliable access to genuine Volkswagen parts and certified maintenance, vital for preserving vehicle performance and resale value.

The company's global logistics operations are finely tuned to ensure a consistent supply of spare parts and components, minimizing downtime for repairs and maintenance across its diverse vehicle portfolio. For instance, in 2023, Volkswagen Group reported significant investments in its after-sales services, aiming to enhance customer loyalty and streamline parts availability.

- Global Parts Network: Volkswagen operates a sophisticated network for distributing over 300,000 different spare parts worldwide, ensuring availability for its extensive range of models.

- Genuine Parts Focus: Emphasizing genuine parts contributes to vehicle reliability and safety, a key differentiator in the competitive automotive market.

- Service Integration: The integration of service centers within dealerships offers a one-stop solution for vehicle maintenance and repair, enhancing customer convenience.

- After-Sales Investment: Volkswagen Group continues to invest in its after-sales operations, recognizing its importance for long-term customer retention and revenue generation, with figures from 2024 expected to show continued focus on digitalizing service processes.

Strategic Regional Focus

Volkswagen's strategic regional focus is a cornerstone of its global marketing strategy, particularly emphasizing markets like China and North America. These regions represent significant growth opportunities and are crucial for the company's overall performance. For instance, in 2023, China remained Volkswagen Group's largest single market, with deliveries reaching over 3.2 million vehicles, although this represented a slight decrease compared to 2022. North America also presents a vital area for expansion and product adaptation.

To effectively cater to these diverse markets, Volkswagen implements tailored product offerings and distribution strategies. This includes local production initiatives to reduce costs and better meet consumer preferences. In China, the company has a strong presence with joint ventures and a portfolio of vehicles specifically designed for the local market, often featuring extended wheelbases and advanced technology. Similarly, in North America, there's a renewed emphasis on SUVs and electric vehicles, aligning with consumer demand trends. Volkswagen's investment in local manufacturing, such as its Chattanooga, Tennessee plant, underscores this commitment to regional adaptation.

- China's Dominance: In 2023, Volkswagen Group delivered approximately 3.2 million vehicles in China, highlighting its crucial role as the group's largest market.

- North American Resurgence: The company is strategically investing in North America, focusing on popular segments like SUVs and electric vehicles to capture market share.

- Localized Production: Volkswagen operates key manufacturing facilities in strategic regions, such as the plant in Chattanooga, Tennessee, to better serve local market demands and optimize supply chains.

- Tailored Product Portfolios: Product development is increasingly driven by regional preferences, with specific models and features introduced to align with local consumer needs and regulatory environments.

Volkswagen's distribution strategy is multifaceted, blending a vast physical dealership network with expanding digital sales channels and a forward-looking approach to mobility hubs. This ensures broad accessibility, caters to evolving consumer preferences for online engagement, and positions the company for future growth in integrated transportation services.

Full Version Awaits

Volkswagen 4P's Marketing Mix Analysis

The preview you see here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Volkswagen 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain insights into Volkswagen's product portfolio, pricing tactics, distribution channels, and promotional activities. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing a complete overview.

Promotion

Volkswagen orchestrates integrated marketing campaigns across both traditional and digital platforms, ensuring a consistent brand narrative and highlighting product advantages. For instance, in 2024, their "Think Blue." initiative continued to emphasize sustainability, resonating with environmentally conscious consumers. These efforts are designed to boost brand visibility, cultivate customer engagement, and propel sales across their varied automotive offerings.

The company’s multi-brand strategy, encompassing marques like Audi, Porsche, and Skoda, is crucial for capturing diverse market segments and broadening its overall reach. This approach allows Volkswagen to cater to a wider array of consumer preferences and price points, a strategy that has proven effective in navigating the competitive automotive landscape. By 2025, this diversified portfolio is expected to further solidify its global market penetration.

Volkswagen places a significant emphasis on digital and social media engagement as a core component of its marketing strategy. In 2024, the company continued to invest heavily in online advertising, reaching millions of potential customers across various platforms. This digital push aims to effectively communicate product features and foster deeper brand loyalty.

Social media platforms are crucial for Volkswagen's outreach, enabling direct interaction with a broad audience. Content marketing efforts, including engaging videos and informative posts, are designed to highlight the innovative aspects of their vehicles, such as AI-powered infotainment systems, which are increasingly becoming a key promotional differentiator for the brand in 2025.

Volkswagen's promotional strategy deeply embeds its brand story, emphasizing a legacy of German engineering and a forward-looking commitment to innovation and sustainability. This narrative is crucial for communicating core values to a diverse audience, from individual investors to business strategists.

The company effectively utilizes storytelling to articulate its vision for future mobility, particularly its significant pivot towards electrification and digitalization. This approach aims to resonate with consumers seeking clarity and confidence in these evolving sectors.

Recent campaigns, such as the 'Enter Electric!' initiative launched in 2023, directly tackle potential consumer hesitations regarding electric vehicles (EVs). By highlighting the advantages of their EV lineup, Volkswagen is actively shaping perceptions and driving adoption.

In 2024, Volkswagen continued to invest heavily in digital marketing, with a reported 25% increase in online advertising spend focused on EV awareness and brand storytelling. This digital push aligns with their sustainability goals, aiming to reduce the carbon footprint of their marketing activities while reaching a broader, tech-savvy demographic.

Public Relations and Corporate Communications

Public relations is a cornerstone of Volkswagen's strategy, focusing on shaping its brand perception and conveying its corporate vision. This involves proactive engagement through press releases and media relations, alongside highlighting its commitment to corporate social responsibility. For example, Volkswagen’s 2023 sustainability report detailed a 40% reduction in CO2 emissions per vehicle produced since 2018, demonstrating tangible progress.

Key communication channels for Volkswagen include its comprehensive annual reports and dedicated sustainability reports. These documents are crucial for transparency, providing stakeholders with detailed insights into the company's financial performance, strategic direction, and environmental, social, and governance (ESG) initiatives. In 2024, Volkswagen announced a significant investment of €180 billion for the period 2024-2028 focusing on electrification, digitalization, and sustainability, which was widely communicated through these channels.

- Brand Image Management: Proactive media engagement and crisis communication to maintain a positive public perception, especially following past emissions challenges.

- Corporate Social Responsibility (CSR): Showcasing initiatives like sustainable manufacturing and community engagement to build trust and enhance reputation. Volkswagen's 2024 ESG rating improved to A- by MSCI, reflecting these efforts.

- Stakeholder Communication: Utilizing annual and sustainability reports to provide transparent updates on financial health, strategic goals, and ESG performance to investors, employees, and the public.

- Media Relations: Cultivating strong relationships with journalists and media outlets to ensure accurate and favorable coverage of company news, product launches, and technological advancements.

Sponsorships and Events

Volkswagen actively engages in sponsorships and events to boost its brand presence and connect with consumers. In 2024, the company continued its strategic involvement in major automotive exhibitions like the Geneva International Motor Show (though its participation varies year to year) and regional auto shows, allowing direct interaction with new vehicle models and technological advancements. This approach is crucial for demonstrating their commitment to innovation, such as advancements in electric vehicle (EV) technology.

Beyond auto shows, Volkswagen's event strategy often includes partnerships with prominent sporting events. For example, their continued association with football clubs and tournaments provides significant global visibility. In 2024, the brand also focused on cultural initiatives that align with its values, aiming to foster a deeper connection with a broader audience. These sponsorships are designed to enhance brand recall and reinforce Volkswagen's image as a forward-thinking automotive manufacturer.

- Brand Visibility: Participation in major auto shows like IAA Mobility (Munich) in September 2023 showcased new models and electrification strategies.

- Customer Engagement: Direct interaction at events allows for immediate feedback and relationship building with potential buyers.

- Technological Showcase: Events serve as platforms to highlight innovations, particularly in the rapidly evolving EV market, such as the ID. series.

- Global Reach: Sponsoring international sporting events, like partnerships with football leagues, extends brand awareness across diverse demographics.

Volkswagen's promotional activities are multifaceted, blending digital engagement with traditional outreach. Their 2024 digital marketing spend saw a 25% increase, focusing on electric vehicle (EV) awareness and brand storytelling. This digital push aims to reach tech-savvy demographics while reinforcing sustainability goals.

Public relations efforts are key to shaping Volkswagen's brand perception and communicating its corporate vision. Their 2023 sustainability report highlighted a 40% reduction in CO2 emissions per vehicle since 2018, demonstrating concrete progress in environmental responsibility.

Sponsorships and events are vital for boosting brand presence and consumer connection. Volkswagen's continued involvement in major auto exhibitions, like IAA Mobility in September 2023, serves as a platform to showcase innovations, particularly in their EV lineup.

Volkswagen's promotional mix emphasizes its legacy of German engineering and commitment to future mobility, especially electrification and digitalization. Initiatives like the 'Enter Electric!' campaign directly address consumer hesitations about EVs, aiming to drive adoption and shape market perceptions.

Price

Volkswagen's pricing strategy centers on value-based pricing, reflecting the perceived worth, superior quality, and advanced technology in its vehicles. This strategy aims to position VW as offering premium quality at an accessible price point, differentiating it from both budget brands and ultra-luxury marques.

For instance, the 2024 Volkswagen Atlas, a popular family SUV, starts with an MSRP around $38,000, aligning with its spacious interior, robust safety features, and refined driving experience. This pricing reflects the value proposition of a well-equipped, reliable vehicle suitable for everyday use and longer journeys.

The 2025 Volkswagen Golf GTI is expected to continue this trend, with anticipated pricing in the mid-$30,000s. This price point acknowledges the GTI's performance heritage, sporty design, and the cutting-edge technology it typically offers, appealing to enthusiasts who value driving dynamics and brand legacy.

Volkswagen utilizes a competitive pricing strategy, ensuring its vehicles are attractively priced against rivals in each segment. For instance, the 2024 Volkswagen ID.4 electric SUV starts around $41,160, directly competing with models like the Ford Mustang Mach-E and Hyundai Ioniq 5.

This approach aims to make Volkswagen models, from compact cars to larger SUVs and the growing EV lineup, accessible and appealing to a broad customer base. In 2023, Volkswagen saw a global sales increase of 12%, reaching 4.87 million vehicles, reflecting the success of its market-aligned pricing.

The pricing is carefully calibrated to balance market share acquisition with profitability, considering production costs and brand positioning. For example, the 2024 Volkswagen Tiguan, a key player in the compact SUV market, has a starting MSRP of approximately $28,995, positioning it favorably against competitors like the Honda CR-V and Toyota RAV4.

Volkswagen Financial Services plays a crucial role in making vehicles accessible through flexible financing and leasing. In 2024, they continue to offer a broad spectrum of options, including competitive credit terms and varied payment plans designed to suit different budgets and needs. This approach significantly broadens the customer base by reducing upfront costs and offering predictable monthly expenses, a key factor in consumer purchasing decisions for automotive products.

These tailored financial products, which can also bundle insurance solutions, aim to simplify the ownership journey. By providing these comprehensive packages, Volkswagen addresses potential customer concerns about long-term costs and commitment. For instance, in late 2024, many markets saw interest rates stabilize, making Volkswagen's financing options particularly attractive for buyers looking for predictable budgeting over the life of their vehicle.

Tiered Pricing for Model Variants

Volkswagen employs a tiered pricing strategy across its extensive model lineup, offering various trims and configurations to cater to a broad customer base. This approach ensures accessibility for budget-conscious buyers while also appealing to those seeking enhanced features and premium appointments. For instance, the 2024 Volkswagen Atlas offers a starting MSRP of approximately $37,775 for the SE trim, scaling up to over $50,000 for the fully equipped SEL Premium R-Line, demonstrating a clear price progression based on features and luxury.

This tiered structure allows Volkswagen to capture a wider market share by offering vehicles that meet diverse needs and financial capacities. Customers can select from:

- Entry-level models: Providing essential functionality and competitive pricing.

- Mid-range options: Balancing features, performance, and value.

- Top-tier variants: Offering advanced technology, premium materials, and enhanced performance for a higher price point.

Promotional Incentives and Discounts

Volkswagen actively uses promotional incentives, discounts, and special offers to boost sales and react to changing market conditions. These can range from seasonal sales events to targeted deals on their growing electric vehicle lineup, aiming to attract a wider customer base and encourage immediate purchases.

For instance, during the first half of 2024, Volkswagen Group offered significant discounts on select models, particularly in Europe, to clear inventory and stimulate demand amidst economic uncertainties. These promotions often include attractive financing options and extended warranty periods, especially for their ID series of electric vehicles.

The company also focuses on loyalty programs to retain existing customers, offering exclusive benefits and early access to new models. These initiatives are crucial for building long-term relationships and encouraging repeat business, especially as competition in the automotive sector intensifies.

- Seasonal Promotions: Volkswagen often runs special campaigns during key selling periods like summer or year-end to drive traffic and sales.

- EV Incentives: Significant discounts and tax credits are frequently applied to electric models like the ID.4 to accelerate adoption and meet sustainability goals.

- Loyalty Programs: Existing Volkswagen owners may benefit from preferential pricing or trade-in bonuses on new vehicle purchases.

- Financing Deals: Attractive low-APR financing options are regularly advertised to make vehicle ownership more accessible.

Volkswagen's pricing strategy is a deliberate blend of value-based, competitive, and tiered approaches, aiming to capture a broad market while maintaining profitability. This multi-faceted strategy ensures vehicles are perceived as offering quality and technology at accessible price points, with specific models like the 2024 Atlas starting around $37,775 and the 2024 ID.4 electric SUV around $41,160, directly confronting key competitors.

Volkswagen Financial Services actively supports this by offering diverse financing and leasing options, making ownership more attainable. For instance, in late 2024, stabilizing interest rates made their flexible credit terms and payment plans particularly appealing to a wide customer base.

Promotional incentives, including discounts and special financing, are frequently employed, especially for electric models, to stimulate sales and adapt to market dynamics. This is evident in early 2024 European promotions offering significant discounts on select models.

The brand’s tiered pricing across its lineup, from entry-level to premium variants, caters to varying customer needs and budgets. This strategy is reflected in the 2024 Atlas pricing, which ranges from approximately $37,775 for the SE trim to over $50,000 for the SEL Premium R-Line.

| Model | Starting MSRP (Approx. 2024/2025) | Key Competitors | Pricing Strategy Element |

| Volkswagen Atlas | $37,775 | Honda Pilot, Toyota Highlander | Tiered, Value-Based |

| Volkswagen Golf GTI | Mid-$30,000s (Expected) | Honda Civic Si, Hyundai Elantra N | Competitive, Performance-Oriented |

| Volkswagen ID.4 | $41,160 | Ford Mustang Mach-E, Hyundai Ioniq 5 | Competitive, EV Incentives |

| Volkswagen Tiguan | $28,995 | Honda CR-V, Toyota RAV4 | Competitive, Value-Based |

4P's Marketing Mix Analysis Data Sources

Our Volkswagen 4P's Marketing Mix Analysis is built upon a foundation of comprehensive data. We utilize official Volkswagen press releases, product launch announcements, and corporate strategy documents to understand their Product and Promotion initiatives. For Place and Price insights, we analyze dealership networks, official pricing guides, and competitive market data from automotive industry reports.