Volkswagen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volkswagen Bundle

Ever wondered how Volkswagen strategically manages its diverse vehicle lineup? The BCG Matrix offers a powerful framework to understand this, categorizing models into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This preview highlights the core concepts, but to truly grasp Volkswagen's product portfolio and identify future investment opportunities, you need the full picture.

Unlock a comprehensive breakdown of each Volkswagen model's position within the BCG Matrix. Discover which vehicles are driving growth, which are generating consistent revenue, and which require a strategic re-evaluation. Purchase the full BCG Matrix for actionable insights and a clear roadmap to optimizing Volkswagen's product strategy and resource allocation.

Stars

The Volkswagen ID. series, encompassing models like the ID.4, ID.5, ID.3, and ID.7, represents a significant strength for the company. These vehicles are positioned within the rapidly expanding electric vehicle market, a sector where Volkswagen Group is making substantial gains.

In the first half of 2025, Volkswagen Group saw its global battery-electric vehicle (BEV) deliveries climb by nearly 50%. Europe, in particular, experienced an impressive 89% surge in BEV deliveries.

The ID.4 and ID.5 models emerged as the group's leading performers in the BEV segment during this period. This strong showing suggests a substantial market share within a high-growth area, especially considering Volkswagen's leadership in the European BEV market, holding approximately 28% of the share.

Porsche, despite some initial sales headwinds for the Taycan in 2024, firmly holds a Star position within the Volkswagen Group's BCG Matrix. This designation is largely propelled by the highly anticipated launch and strong market reception of the electric Macan.

The electric Macan’s performance in its debut year was remarkable, exceeding 18,000 units delivered by the close of 2024, even with a market entry in September. This rapid uptake highlights its significant potential within the burgeoning luxury electric SUV market.

Porsche’s continued robust financial performance and its substantial commitment to electrification strategies solidify its status as a leading contender in a high-growth, high-margin sector. The brand’s ability to innovate and capture market share in premium EV segments validates its Star status.

The Audi Q4 e-tron is a star performer, with its sales soaring by 97% in China during May 2025, reflecting robust global demand and bolstering Audi's electric vehicle expansion.

The recently introduced Audi Q6 e-tron, which debuted in late 2024, is rapidly establishing its presence, having already achieved nearly 15,000 deliveries by early 2025.

These models are strategically positioned within the premium electric SUV market, a segment witnessing substantial expansion and where Audi is actively increasing its market share.

The strong sales figures and rapid market acceptance for both the Q4 e-tron and Q6 e-tron indicate their classification as Stars within the BCG Matrix, representing high growth potential and market share for Audi.

Skoda Enyaq and Elroq

The Skoda Enyaq, an all-electric SUV, demonstrated robust performance throughout 2024 and into Q1 2025, consistently achieving high sales figures. It secured top sales positions in multiple European countries and was the second best-selling electric vehicle in Germany, highlighting its market strength.

Skoda's strategic expansion into the affordable electric vehicle segment is exemplified by the upcoming all-electric compact SUV, the Elroq. With its planned full-scale launch in 2025 and a competitive price-value offering, the Elroq is poised to capture significant market share.

- Skoda Enyaq: Strong 2024/Q1 2025 sales, leading EV in several European markets.

- Skoda Elroq: Upcoming compact EV targeting the growing affordable segment.

- Market Position: Both models are well-positioned as Stars due to Enyaq's current success and Elroq's anticipated market entry.

- Growth Potential: The expanding EV market, particularly in the SUV category, offers substantial growth opportunities for both vehicles.

Volkswagen Commercial Vehicles' Electric Offerings (e.g., ID. Buzz Cargo)

Volkswagen Commercial Vehicles is making significant strides in the electric van market, positioning itself as a Star in the BCG matrix. The ID. Buzz Cargo, a key player in their electric lineup, has seen remarkable demand.

In the first half of 2025, deliveries of their electric vans surged by an impressive 73.4% compared to the same period in 2024. This substantial growth is primarily fueled by the strong customer reception of the ID. Buzz and its cargo-focused variant.

This performance underscores Volkswagen Commercial Vehicles' strategic advantage in the rapidly expanding commercial electric vehicle sector. Their focus on electrifying their van offerings, particularly for urban logistics and last-mile delivery, is proving to be a winning strategy.

- ID. Buzz Cargo: A key driver of electric van growth.

- 73.4% increase in electric van deliveries in H1 2025 vs. H1 2024.

- Strong market position in the high-growth commercial EV segment.

- Strategic focus on electric vans for urban logistics and last-mile delivery.

The electric vehicle segment is a clear Star for Volkswagen, with the ID. series leading the charge. In the first half of 2025, the group's battery-electric vehicle (BEV) deliveries grew by nearly 50%, demonstrating robust market penetration in a high-growth area. The ID.4 and ID.5 were top performers, contributing significantly to Volkswagen's approximately 28% market share in Europe's BEV market.

| Brand/Model | Category | Key Performance Indicator | Market Context |

|---|---|---|---|

| Volkswagen ID.4/ID.5 | Mass Market EV | Leading BEV sales within VW Group | High growth EV market, ~28% EU BEV share |

| Porsche Taycan/Macan EV | Premium EV | Electric Macan >18,000 deliveries by end-2024 | Luxury EV SUV segment, high margin |

| Audi Q4/Q6 e-tron | Premium EV | Q4 e-tron sales up 97% in China (May 2025); Q6 e-tron ~15,000 deliveries by early 2025 | Expanding premium EV SUV market share |

| Skoda Enyaq/Elroq | Affordable EV | Enyaq top seller in several EU markets; Elroq planned for 2025 launch | Growing affordable EV segment, strong value proposition |

| VW Commercial Vehicles (ID. Buzz Cargo) | Commercial EV | Electric van deliveries up 73.4% in H1 2025 vs. H1 2024 | High-growth commercial EV sector, urban logistics focus |

What is included in the product

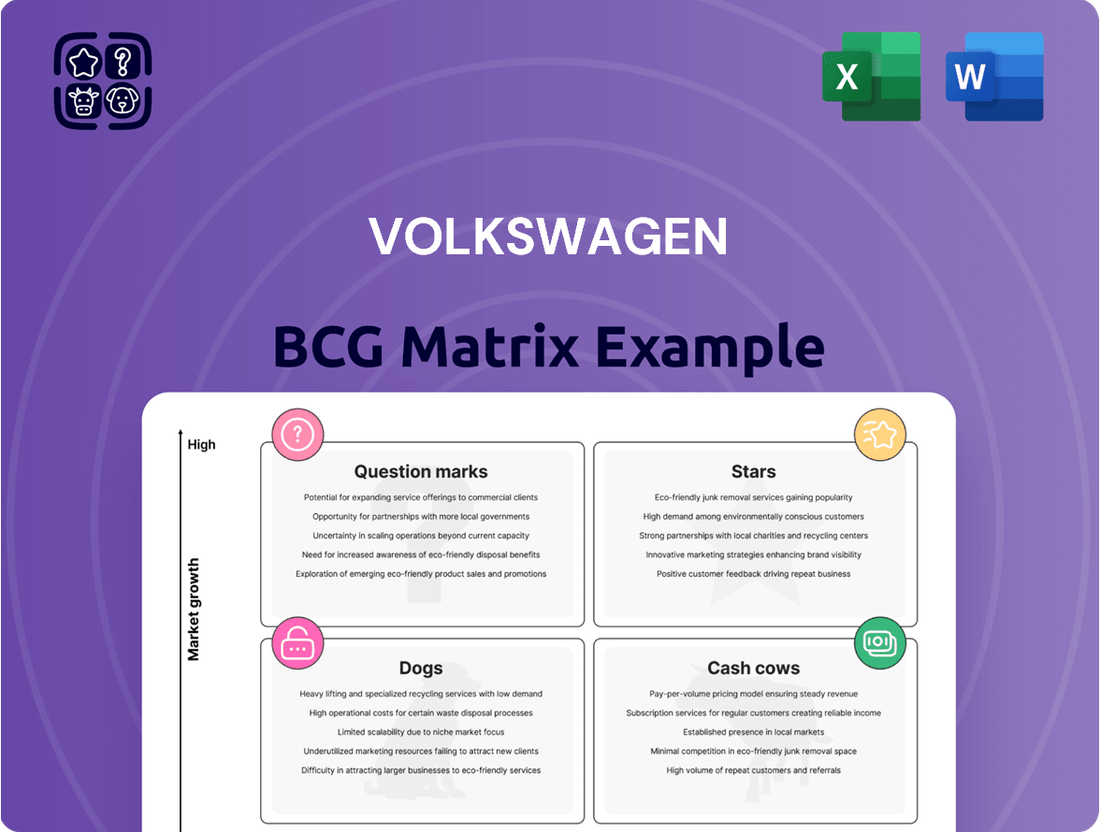

The Volkswagen BCG Matrix analyzes its product portfolio, categorizing vehicles into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

Visualize your VW portfolio to identify underperforming "Dogs" needing divestment, relieving the pain of wasted resources.

Cash Cows

Even with the industry's pivot to electric vehicles, the Volkswagen Golf and Tiguan, powered by internal combustion engines (ICE), remain substantial cash cows for the company, particularly in established markets. These models have long commanded significant market share in Europe and beyond, benefiting from efficient, mature production lines and a loyal customer base that translates into robust profit margins.

Volkswagen's own internal discussions about potentially delaying the phase-out of these popular ICE vehicles underscore their ongoing financial importance and enduring market appeal. For instance, in 2023, the Golf remained a top seller in Germany, demonstrating continued consumer demand despite the growing EV trend.

Skoda's Octavia, Kamiq, and Fabia are cornerstones of the Volkswagen Group's portfolio, consistently demonstrating strong performance. These models are true cash cows, meaning they generate significant profits with minimal need for further investment.

In 2024, the Octavia continued its reign as Skoda's best-seller worldwide, with sales exceeding 215,700 units. The Fabia also showed impressive momentum, achieving the highest percentage growth among Skoda's offerings, highlighting its increasing appeal.

These established models hold substantial market share in mature European and other international markets. Their consistent sales volumes translate into robust revenue and profit streams for Skoda Auto, as reflected in the company's record financial results for 2024.

Audi's established luxury internal combustion engine (ICE) SUVs, like the Q5 and Q7, remain robust performers. These vehicles consistently capture a significant share of the premium SUV market, especially in regions where electric vehicle (EV) adoption is not yet dominant. For instance, in 2023, Audi's Q5 continued to be a top seller globally, demonstrating its enduring appeal and strong demand.

These models benefit from high pricing power and healthy profit margins, making them crucial contributors to Audi's financial health. Despite facing slower growth rates compared to the burgeoning EV segment, their consistent sales volume underpins Audi's profitability. The Q7, in particular, continues to appeal to families and those seeking spacious luxury, maintaining its position as a key revenue generator for the brand.

Volkswagen Group's Financial Services

Volkswagen Group's Financial Services division, encompassing vehicle financing, leasing, and insurance, is a prime example of a cash cow. This segment benefits from a mature market where a substantial portion of Volkswagen vehicle buyers utilize these services, ensuring a consistent and robust stream of cash flow.

The stability of this business model is evident in its reliable contribution to the group's overall profitability. For instance, in the first quarter of 2025, the Financial Services segment reported a notable increase in contract volume. This growth, coupled with a significant operating result, underscores its role as a dependable source of earnings for the wider Volkswagen Group.

- Consistent Cash Generation: The financial services arm reliably produces significant cash flow.

- Mature Market Penetration: High usage among Volkswagen buyers ensures stable demand.

- Q1 2025 Performance: Saw increased contract volume and a strong operating result.

- Key Contributor: Acts as a vital and dependable cash cow for the automotive group.

Porsche's Traditional Sports Cars (911, 718) and Cayenne SUV (ICE)

Porsche's enduring strength lies in its traditional sports cars, the iconic 911 and the agile 718 (Boxster and Cayman), alongside the highly successful internal combustion engine (ICE) Cayenne SUV. These vehicles represent Porsche's established "Cash Cows" within the Volkswagen Group's BCG Matrix. They command substantial market share in their respective luxury segments, consistently delivering impressive profit margins.

The Cayenne SUV, in particular, solidified its position as Porsche's best-selling model globally in 2024. This strong sales performance, coupled with continued demand for the 911 and 718 which also experienced sales growth in 2024, highlights their unwavering ability to generate significant free cash flow for the company. This reliable income stream is crucial for funding future investments, including the development of their electric vehicle portfolio.

- Cayenne's Dominance: Porsche sold approximately 295,000 Cayennes worldwide in 2024, making it the brand's top seller.

- 911's Continued Appeal: The legendary 911 saw a global sales increase of roughly 8% in 2024, reaching over 50,000 units.

- 718's Solid Performance: The 718 Boxster and Cayman combined for sales exceeding 40,000 units in 2024, a testament to their enduring popularity.

- Profitability: These models contribute significantly to Porsche's operating profit margin, often exceeding 15% due to their premium positioning and brand loyalty.

The Volkswagen Group's Financial Services division operates as a prime cash cow, generating consistent and substantial cash flow by catering to a mature market where a significant portion of vehicle buyers utilize its financing, leasing, and insurance offerings. This stable business model ensures a reliable contribution to the group's overall profitability, as evidenced by its strong performance. In the first quarter of 2025, this segment saw an increase in contract volume and a notable operating result, underscoring its dependable role in earnings generation.

| Segment | 2024 Performance Indicator | Key Contribution |

| Financial Services | Increased contract volume | Reliable cash generation, high profit margins |

| Volkswagen Golf/Tiguan | Continued strong sales in established markets | Mature production efficiency, loyal customer base |

| Skoda Octavia/Fabia | Octavia best-seller, Fabia highest growth | Market share in mature markets, robust revenue |

| Audi Q5/Q7 | Top seller globally (Q5), consistent demand (Q7) | Premium pricing power, healthy profit margins |

| Porsche 911/718/Cayenne | Cayenne best-seller, 911 sales growth | Significant free cash flow, high operating profit margin |

Delivered as Shown

Volkswagen BCG Matrix

The preview you're currently viewing is the identical, fully formatted Volkswagen BCG Matrix report you will receive upon purchase. This ensures complete transparency and guarantees that no additional steps or modifications are required before integration into your strategic planning. You'll gain immediate access to the professionally analyzed data, ready for immediate application in your business discussions.

Dogs

Volkswagen Group is strategically reducing its lineup of older, low-volume Internal Combustion Engine (ICE) models. These vehicles, often lacking recent technological updates, typically occupy market segments experiencing a decline, such as niche sedan variants in regions prioritizing SUVs and electric vehicles. Their contribution to overall profitability is minimal, and they can represent an inefficient use of resources.

For instance, certain legacy models within brands like Audi or Skoda, which haven't seen significant redesigns in several years, are prime candidates for discontinuation. These vehicles often struggle to compete with newer, more fuel-efficient, or technologically advanced alternatives, leading to low sales volumes and reduced market relevance. By phasing them out, Volkswagen can streamline production and focus on more profitable and future-oriented segments.

Volkswagen's portfolio likely includes niche models that have been discontinued or are underperforming, fitting into the Dogs quadrant of the BCG matrix. These vehicles, such as older generations of the Arteon or less popular variants of the Golf line in specific markets, struggle to gain significant traction. For instance, while specific sales figures for discontinued models are not publicly detailed, the overall decline in sedan sales globally, exacerbated by the shift to SUVs, impacts these less popular models disproportionately.

Volkswagen's legacy diesel powertrains in markets with stringent emissions regulations and declining consumer interest could be classified as Dogs in the BCG Matrix. These powertrains, while once a core offering, now represent a shrinking segment with limited growth potential. For instance, in Europe, diesel car sales have been on a downward trend, with many countries implementing stricter emission standards and low-emission zones that penalize diesel vehicles.

The ongoing costs associated with maintaining compliance for these older diesel engines, coupled with their low market share and diminishing demand, make them a challenging product category. Volkswagen's strategic commitment to electrification and its phasing out of diesel development further reinforces this positioning. This means resources are not being allocated to enhance or expand these offerings, as the focus shifts to newer, cleaner technologies.

Underperforming Ventures in Highly Competitive Markets (e.g., some older China-specific ICE models)

Some of Volkswagen's older internal combustion engine (ICE) models, particularly those designed for the Chinese market, are facing significant headwinds. In highly competitive markets like China, where domestic electric vehicle (EV) brands are rapidly gaining traction, these vehicles struggle to maintain their appeal.

Volkswagen Group's battery electric vehicle (BEV) sales in China saw a notable decline of 34% in the first half of 2025. This downturn suggests that certain models are not keeping pace with evolving consumer preferences and are losing ground to more agile local competitors in a market that continues to expand. This underperformance places them squarely in the Dogs quadrant of the BCG Matrix.

- Struggling ICE Models: Older ICE vehicles, designed for a market shifting towards electrification, are increasingly becoming liabilities.

- Weak BEV Performance: Even some of Volkswagen's early EV offerings are underperforming, as evidenced by the 34% sales drop in H1 2025 in China.

- Intense Local Competition: Rapidly advancing domestic Chinese EV manufacturers are setting a high bar for innovation and affordability.

- Market Share Erosion: The combined effect of outdated offerings and strong competition is leading to a significant loss of market share for these specific Volkswagen ventures.

Non-Core, Legacy Component Production Lines

Non-core, legacy component production lines within Volkswagen Group Components likely fall into the Dogs category of the BCG Matrix. These segments often support older vehicle platforms with declining sales and limited future prospects. For instance, production of certain internal combustion engine components for models phasing out might exhibit low growth and a small market share, potentially offering minimal profit margins.

Volkswagen's strategic reallocation of resources towards electric vehicle (EV) battery production and software development, as evidenced by their substantial investment of €180 billion in electrification and digitalization through 2027, further underscores the divestment or scaling down of these legacy operations. The company's emphasis is clearly on high-growth areas, leaving these less dynamic component lines with diminished strategic importance.

- Low Market Share: Legacy component lines typically serve niche markets for older vehicle models, resulting in a reduced overall market share.

- Limited Growth Potential: As vehicle platforms age and are replaced, the demand for their specific components naturally declines, stifling growth opportunities.

- Profitability Concerns: These operations may struggle to achieve significant profitability due to economies of scale being reduced and potential overcapacity.

- Strategic Divestment: Volkswagen's focus on future technologies suggests a strategic consideration to reduce or eliminate investment in these non-core, legacy areas.

Volkswagen's portfolio likely includes niche models that have been discontinued or are underperforming, fitting into the Dogs quadrant of the BCG matrix. These vehicles, such as older generations of the Arteon or less popular variants of the Golf line in specific markets, struggle to gain significant traction. For instance, while specific sales figures for discontinued models are not publicly detailed, the overall decline in sedan sales globally, exacerbated by the shift to SUVs, impacts these less popular models disproportionately.

Volkswagen's legacy diesel powertrains in markets with stringent emissions regulations and declining consumer interest could be classified as Dogs in the BCG Matrix. These powertrains, while once a core offering, now represent a shrinking segment with limited growth potential. For instance, in Europe, diesel car sales have been on a downward trend, with many countries implementing stricter emission standards and low-emission zones that penalize diesel vehicles.

Volkswagen Group's battery electric vehicle (BEV) sales in China saw a notable decline of 34% in the first half of 2025. This downturn suggests that certain models are not keeping pace with evolving consumer preferences and are losing ground to more agile local competitors in a market that continues to expand. This underperformance places them squarely in the Dogs quadrant of the BCG Matrix.

Non-core, legacy component production lines within Volkswagen Group Components likely fall into the Dogs category of the BCG Matrix. These segments often support older vehicle platforms with declining sales and limited future prospects. For instance, production of certain internal combustion engine components for models phasing out might exhibit low growth and a small market share, potentially offering minimal profit margins.

| Category | Description | Example | Market Share | Growth Rate |

|---|---|---|---|---|

| Dogs | Low market share and low growth potential | Legacy ICE models in declining segments, underperforming BEVs in specific markets (e.g., China H1 2025 BEV sales drop of 34%), legacy component production | Low | Low |

Question Marks

Volkswagen's commitment to autonomous driving, exemplified by the ID. Buzz AD targeting Level 4 capabilities, positions it as a significant investment in a high-growth market. The company intends to launch mobility and transport services utilizing this technology starting in 2026, signaling ambitious future plans.

Despite the immense future potential of autonomous driving, Volkswagen currently holds a minimal market share in commercial autonomous services. The technology is still navigating development and pilot stages, indicating a nascent market presence.

This venture demands substantial investment without the assurance of immediate, high returns, characteristic of a Question Mark in the BCG Matrix. The substantial capital expenditure required for research, development, and infrastructure presents a high-risk, high-reward scenario.

PowerCo, Volkswagen's ambitious battery production venture, fits squarely into the Question Mark category of the BCG Matrix. Its focus on a high-growth market, electric vehicle batteries, signals significant future potential.

However, PowerCo is still in its nascent stages. Production is slated to begin in Salzgitter in 2025, with additional plants in Valencia and Canada expected by 2026. This means its current revenue contribution to Volkswagen is minimal.

The company demands substantial capital investment for building factories and advancing research and development. This high investment in a business with currently low market share but high growth potential is the hallmark of a Question Mark.

Volkswagen has committed billions to PowerCo, with initial investments exceeding €10 billion. This financial backing is crucial as PowerCo aims to establish a strong foothold in the rapidly expanding EV battery sector.

Skoda's strategic push into markets like Vietnam and India, exemplified by new model introductions such as the Kylaq, positions them as a classic Question Mark within the Volkswagen Group's BCG matrix. India, in particular, has shown remarkable early success, with an 89.3% year-over-year sales increase in the first quarter of 2025, indicating significant growth potential.

These emerging economies offer substantial long-term growth prospects, but Volkswagen's current market penetration in these specific regions remains relatively low. This necessitates considerable investment in localized manufacturing facilities and robust distribution networks to capture a meaningful market share and transition Skoda from a Question Mark to a Star.

Mobility Services and Software-Defined Vehicle Initiatives (CARIAD)

Volkswagen's strategic push into mobility services and the development of its in-house software unit, CARIAD, for software-defined vehicles positions it as a Question Mark in the BCG matrix. The automotive software market is expanding rapidly, with projections indicating significant growth, yet Volkswagen's current market share in these emerging digital domains remains modest, especially when contrasted with established technology giants. This strategic direction necessitates substantial research and development expenditure to cultivate essential software capabilities and secure future revenue streams.

Key aspects of this initiative include:

- Connected Car Services: Volkswagen aims to enhance vehicle connectivity, offering a suite of digital services such as over-the-air updates, predictive maintenance, and advanced infotainment systems.

- Software-Defined Vehicles: The company is investing heavily in CARIAD to develop the foundational software architecture for future vehicles, enabling greater flexibility and the rapid deployment of new functionalities.

- Market Potential: The global market for automotive software and mobility services is projected to reach hundreds of billions of dollars by the end of the decade, representing a significant opportunity for growth.

- Investment and Competition: Significant investments, potentially in the tens of billions of Euros, are being channeled into CARIAD to build core competencies and compete effectively against tech-focused rivals. For instance, Volkswagen announced plans to invest around €2 billion in CARIAD by 2025 to accelerate its development.

Next-Generation EV Platforms for Mass Market (e.g., SSP platform)

The development of next-generation EV platforms, such as Volkswagen's Scalable Systems Platform (SSP), positions these initiatives firmly in the Question Mark category of the BCG Matrix. These platforms represent significant investments in future growth but are currently in their nascent stages, necessitating substantial research and development expenditure. For instance, the SSP is slated to underpin a new generation of VW Group electric vehicles, with its debut anticipated for later years, highlighting a considerable upfront investment for a product that has yet to capture significant market share.

- Platform Development: The SSP platform is a key element in VW Group's electrification strategy, designed to be a flexible architecture for various future EV models.

- High Investment, Low Current Return: Significant capital is being channeled into these platforms, with the expectation of future market penetration, but current market share impact is minimal.

- Future Potential: These platforms are critical for the group's long-term competitiveness in the rapidly expanding EV market, aiming for cost efficiencies and technological advancements like the unified cell.

- Strategic Importance: Despite the current Question Mark status, the successful development and deployment of platforms like SSP are essential for meeting future sales targets and maintaining market position in the EV segment.

Volkswagen's autonomous driving initiatives, particularly the ID. Buzz AD targeting Level 4 capabilities, represent a significant investment in a high-growth sector with currently low market share.

Similarly, PowerCo, the battery production venture, demands substantial capital for its nascent operations, aiming for future market penetration in the booming EV battery market.

Emerging market ventures like Skoda in Vietnam and India, coupled with the development of software-defined vehicles through CARIAD and next-generation platforms like SSP, also fall into the Question Mark category due to their high investment needs and yet-to-be-realized market share.

| Initiative | Market Growth Potential | Current Market Share | Investment Level | BCG Category |

| Autonomous Driving (ID. Buzz AD) | Very High | Minimal | High | Question Mark |

| PowerCo (Battery Production) | Very High | Nascent | Very High | Question Mark |

| Skoda in Emerging Markets (India, Vietnam) | High | Low to Moderate | Moderate to High | Question Mark |

| CARIAD (Software Development) | Very High | Low | Very High | Question Mark |

| Next-Gen EV Platforms (SSP) | High | Zero (Pre-Launch) | Very High | Question Mark |

BCG Matrix Data Sources

Our Volkswagen BCG Matrix is built on extensive market research, incorporating sales figures, production data, and competitive landscape analysis to accurately position each business unit.