Vishay Intertechnology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vishay Intertechnology Bundle

Gain a strategic advantage with our comprehensive PESTLE Analysis of Vishay Intertechnology. Understand the intricate interplay of political, economic, social, technological, legal, and environmental factors shaping its operational landscape. This expert-crafted report offers critical insights for investors, strategists, and market analysts alike. Don't be left in the dark about the forces driving change; unlock actionable intelligence to refine your own market approach. Purchase the full PESTLE Analysis now and equip yourself with the knowledge to navigate Vishay's evolving future.

Political factors

Global trade policies, especially persistent trade tensions between major economies like the US and China, directly affect Vishay Intertechnology's operational costs and supply chain stability. These policies can introduce tariffs on critical raw materials and finished goods, influencing Vishay's pricing strategies for its electronic components and potentially impacting its overall profitability. For instance, the imposition of tariffs can increase the cost of semiconductors and other essential inputs, forcing Vishay to reassess its sourcing and manufacturing locations to minimize these financial burdens.

Geopolitical risks, such as the ongoing regional conflicts in Eastern Europe and the Middle East, directly threaten Vishay's complex global supply chains. These instabilities can disrupt manufacturing operations and shipping routes in critical sourcing regions, impacting the availability and cost of essential components for Vishay's semiconductor products.

The semiconductor industry's deep interconnectedness means that political instability in any key manufacturing hub, like Taiwan, could have cascading effects on Vishay's production and delivery schedules throughout 2024 and into 2025. The company must maintain robust risk assessment protocols to ensure consistent supply and mitigate potential production stoppages.

Government initiatives, like the US CHIPS and Science Act of 2022, are injecting billions into semiconductor manufacturing, aiming to boost domestic production. This legislation, which includes significant investment tax credits and direct subsidies, presents a substantial opportunity for companies like Vishay Intertechnology to expand their onshore capabilities and invest in research and development. For instance, the act allocates over $52 billion for semiconductor manufacturing and R&D, potentially creating a more favorable environment for domestic component suppliers.

Regulatory Environment and Compliance

The political climate significantly shapes Vishay Intertechnology's operational landscape through a complex web of regulations. These include stringent product safety standards, robust intellectual property protection laws, and anti-trust regulations that Vishay must meticulously adhere to across its global operations. Navigating these diverse national and international legal frameworks is paramount for maintaining market access and ensuring uninterrupted business continuity, directly impacting how Vishay approaches product design and market entry.

Compliance with these varying regulatory requirements is not merely a procedural hurdle but a strategic imperative. For instance, changes in trade policies or tariffs, as seen with evolving international trade agreements in late 2023 and early 2024, can directly affect Vishay's supply chain costs and market competitiveness. Furthermore, the ongoing focus on cybersecurity regulations, particularly in regions like the European Union with its GDPR, necessitates continuous investment in data protection measures, influencing Vishay's digital infrastructure and operational protocols.

- Product Safety Standards: Vishay must comply with standards like IEC and UL certifications for its electronic components, ensuring they meet safety benchmarks in over 100 countries.

- Intellectual Property: Protection of Vishay's patents, with a portfolio spanning thousands of patents globally, is crucial against infringement, impacting R&D investment and competitive advantage.

- Anti-Trust Laws: Adherence to competition laws in major markets like the US, EU, and China prevents monopolistic practices and ensures fair market access.

- Trade Policies: Fluctuations in tariffs and trade agreements, such as those impacting semiconductor trade in 2024, directly influence Vishay's manufacturing and distribution strategies.

Regional Development and Investment Incentives

Government backing for regional tech centers, like the Welsh Government's grant for Vishay's Newport site, directly impacts investment and job growth decisions. These incentives cultivate local semiconductor ecosystems, offering Vishay competitive edges in particular markets and access to specialized talent. For instance, in 2023, the Welsh Government announced a £10 million grant to support Vishay's expansion plans in Newport, aiming to secure hundreds of high-value jobs and bolster the region's advanced manufacturing capabilities.

Such support can translate into tangible benefits for companies like Vishay. It can lower operational costs, accelerate research and development, and improve supply chain efficiency by concentrating resources and expertise. The focus on developing these hubs also signals a commitment to long-term industrial strategy, which can attract further private sector investment and create a more robust business environment.

Vishay's experience in Newport highlights how strategic regional development initiatives can foster growth. The company's expansion efforts, supported by government grants, are expected to create approximately 150 new jobs by the end of 2024, primarily in skilled engineering and production roles. This investment not only benefits Vishay but also strengthens the broader semiconductor supply chain within the UK.

These regional incentives are crucial for Vishay's competitive positioning. By leveraging government support, Vishay can enhance its manufacturing capacity and technological innovation, particularly in advanced component production. This strategy allows the company to tap into emerging market demands and solidify its presence in key geographical areas with strong governmental backing for the electronics sector.

Government policies, particularly those aimed at bolstering domestic semiconductor manufacturing like the US CHIPS Act and similar initiatives in Europe and Asia, directly influence Vishay's investment decisions and competitive landscape. These policies, often including substantial subsidies and tax credits, are designed to incentivize onshoring and R&D, potentially reducing reliance on overseas production for critical components by 2025.

Geopolitical tensions and trade disputes between major economic blocs continue to pose risks to Vishay's global supply chains, impacting the cost and availability of raw materials and finished goods. Navigating these evolving trade dynamics, including tariffs and export controls implemented throughout 2024, requires agile sourcing and manufacturing strategies to maintain cost competitiveness.

Regulatory environments, encompassing product safety standards, intellectual property protection, and anti-trust laws, create a complex compliance framework for Vishay's operations across various jurisdictions. Adherence to these diverse regulations, which are subject to ongoing updates and enforcement, is critical for market access and operational continuity, particularly as cybersecurity mandates intensify.

Government support for regional technology hubs and manufacturing initiatives, such as grants for facility expansions or R&D, offers tangible benefits for companies like Vishay. These incentives can lower operational costs, foster local talent development, and strengthen regional semiconductor ecosystems, as evidenced by targeted investments in 2023 and 2024.

What is included in the product

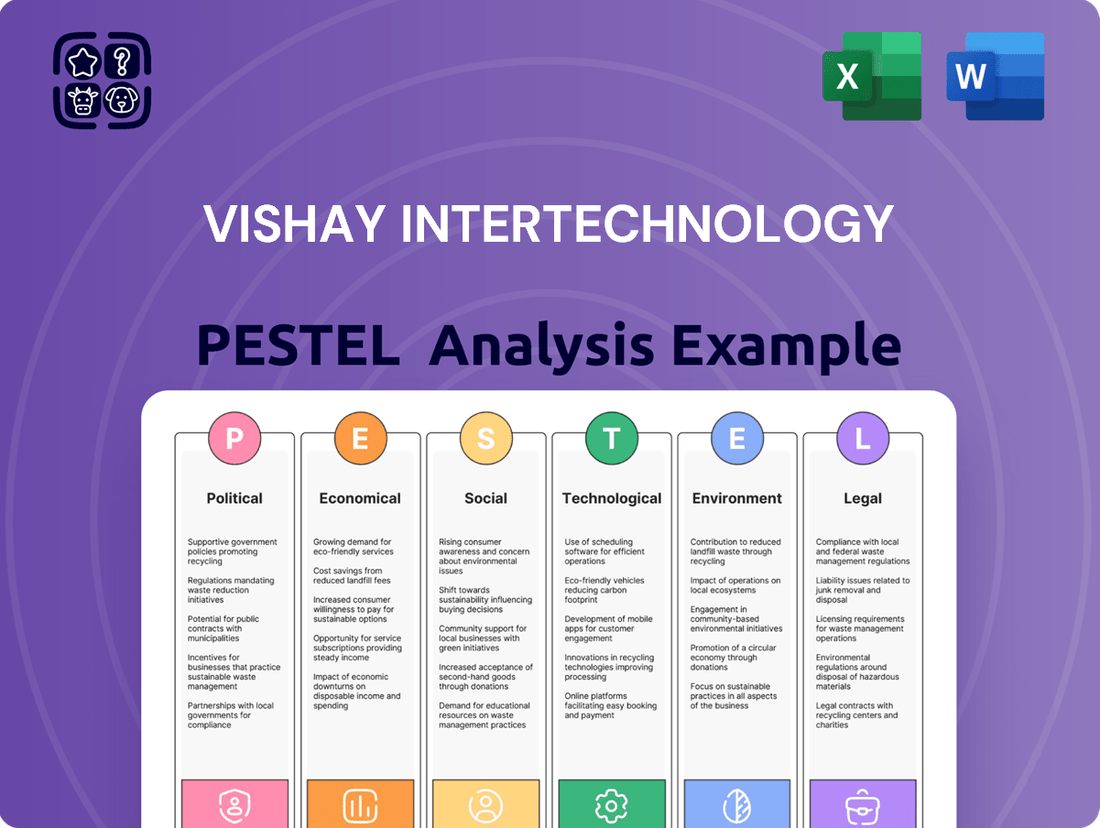

Vishay Intertechnology's PESTLE analysis delves into how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—impact its operations and strategic positioning.

This comprehensive review offers actionable insights for stakeholders to navigate industry challenges and capitalize on emerging opportunities.

A concise Vishay Intertechnology PESTLE analysis provides a readily digestible overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for quick decision-making.

Economic factors

The global semiconductor market is on a strong upward trajectory. Forecasts suggest a significant expansion in 2025, with growth rates estimated between 11% and 12.5%. This would translate to market revenues in the range of $697 billion to $700.9 billion, underscoring a dynamic and expanding industry.

This impressive growth is fueled by robust demand across several critical sectors. Such widespread demand creates a fertile ground for companies like Vishay Intertechnology, particularly for their discrete semiconductors and passive electronic components.

Megatrends like Artificial Intelligence (AI), Electric Vehicles (EVs), and 5G are creating massive demand for the electronic components Vishay Intertechnology produces. The increasing sophistication of AI applications, from data centers to edge computing, requires advanced semiconductors and passive components. For instance, the global AI market was projected to reach over $1.8 trillion by 2030, a significant driver for component suppliers like Vishay.

The automotive industry's rapid shift towards electrification, with EVs becoming mainstream, directly boosts demand for Vishay's power management components, sensors, and discrete devices. In 2024, global EV sales are expected to surpass 15 million units, a substantial increase that requires robust and efficient electronic solutions. Vishay's focus on these high-growth sectors positions it well to capitalize on these transformative technological shifts.

While the electronics industry saw a strong rebound in 2024, global macroeconomic headwinds such as persistent inflation and elevated interest rates are creating uncertainty. These conditions can dampen end-consumer spending on discretionary items like electronic devices, potentially impacting Vishay's sales volumes.

For instance, the International Monetary Fund (IMF) projected global inflation to be around 5.9% in 2024, a slight decrease from 2023, but still significantly above pre-pandemic levels. Higher borrowing costs associated with interest rate hikes further strain household budgets, leading to cautious consumer behavior.

Vishay's ability to adapt its demand forecasting and inventory management strategies will be crucial. By closely monitoring economic indicators and consumer sentiment, the company can better position itself to manage potential shifts in market demand and mitigate the impact of economic volatility.

Supply Chain Dynamics and Input Costs

Supply chain disruptions remain a significant challenge for Vishay Intertechnology. For instance, the semiconductor industry experienced considerable volatility in 2023 and early 2024, impacting the availability and cost of critical components. This led to extended lead times and higher prices for essential materials.

Inventory corrections throughout the electronics sector in 2023 also created headwinds. As companies adjusted their stock levels, demand for Vishay's products saw some fluctuations, requiring careful production planning and inventory management to avoid excess or shortages. This balancing act directly affects operational efficiency and cost control.

Fluctuating raw material costs, particularly for metals like copper and aluminum, continue to exert pressure on Vishay's margins. For example, copper prices saw significant increases in late 2023 and into 2024, driven by global demand and geopolitical factors, directly impacting Vishay's cost of goods sold.

- Supply Chain Resilience: Vishay's efforts to diversify its supplier base and build stronger relationships with key manufacturers are crucial for mitigating future disruptions.

- Raw Material Cost Management: Strategies like forward contracts and hedging are employed to manage the volatility of metal prices, aiming to stabilize input costs.

- Inventory Optimization: Advanced forecasting and demand planning tools are being utilized to better align production with market demand, reducing the impact of inventory corrections.

- Operational Efficiency: Streamlining manufacturing processes and investing in automation are key to maintaining profitability in the face of rising input costs and supply chain complexities.

Currency Fluctuations and Investment Returns

As a global semiconductor manufacturer, Vishay Intertechnology's financial results are significantly influenced by currency fluctuations. For instance, in Q1 2024, Vishay reported that a stronger U.S. dollar relative to other currencies negatively impacted its reported net sales. This exposure means that revenues earned in foreign currencies can translate to fewer dollars when repatriated, directly affecting reported profitability and the value of international investments.

The company's investment returns are inherently tied to these currency movements, requiring a proactive approach to financial risk management. Vishay actively employs hedging strategies to mitigate the impact of foreign exchange volatility. These strategies are crucial for stabilizing earnings and ensuring that unforeseen currency shifts do not derail strategic investment plans or overall financial performance.

Consider the following impacts:

- Revenue Translation: Vishay's sales in Europe and Asia, reported in Euros and Yen respectively, can decrease in USD terms if those currencies weaken against the dollar.

- Cost of Goods Sold: Conversely, if Vishay sources raw materials or components in currencies that strengthen against the USD, its production costs can rise.

- Net Income Impact: The net effect of these revenue and cost translations directly influences Vishay's reported net income and earnings per share.

- Investment Valuation: The value of Vishay's international assets and liabilities fluctuates with exchange rates, impacting the company's balance sheet and the perceived return on foreign capital investments.

The global semiconductor market is projected for significant growth in 2025, with revenues expected to reach between $697 billion and $700.9 billion, reflecting an 11% to 12.5% expansion. This surge is driven by strong demand in sectors like AI and electric vehicles, creating opportunities for Vishay Intertechnology's components.

However, persistent inflation and high interest rates present economic headwinds, potentially dampening consumer spending on electronics. Global inflation was around 5.9% in 2024 according to the IMF, impacting purchasing power.

Supply chain issues and raw material cost volatility, such as rising copper prices in 2024, continue to challenge profit margins. Vishay is managing these by diversifying suppliers and employing hedging strategies for raw materials.

Currency fluctuations also impact Vishay's financial performance; a stronger U.S. dollar in Q1 2024 negatively affected reported net sales for the company.

| Factor | 2024/2025 Data Point | Impact on Vishay |

|---|---|---|

| Semiconductor Market Growth | 11%-12.5% projected in 2025 | Increased demand for Vishay's components |

| Global Inflation (IMF) | Approx. 5.9% in 2024 | Potential reduction in consumer spending on electronics |

| Copper Prices | Significant increases in late 2023/early 2024 | Increased cost of goods sold, pressure on margins |

| Currency Exchange Rates | Stronger USD in Q1 2024 | Negative impact on reported net sales |

Full Version Awaits

Vishay Intertechnology PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis of Vishay Intertechnology provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It delves into market trends, competitive landscapes, and regulatory environments relevant to the semiconductor industry. You will gain actionable insights into the strategic challenges and opportunities Vishay faces.

Sociological factors

Consumers increasingly want smaller, more intelligent, and affordable electronics. This demand directly impacts Vishay, pushing for the miniaturization of their semiconductors and passive components to align with market trends in wearables and smart home devices. For example, the global wearable technology market was valued at approximately $125.3 billion in 2023 and is projected to reach $350 billion by 2030, highlighting the significant growth opportunity for miniaturized components.

The accelerating adoption of smart technologies, particularly the Internet of Things (IoT) and Industrial IoT (IIoT), is a significant sociological trend directly benefiting Vishay Intertechnology. This expansion means a larger addressable market for Vishay's passive and active components, which are crucial for the functionality of these connected devices. The widespread integration of IoT devices, from smart home appliances to complex industrial automation systems, drives demand for Vishay's sensor, power management, and connectivity solutions.

By 2025, the global IoT market is projected to reach over $1.1 trillion, with the industrial sector (IIoT) accounting for a substantial portion of this growth. This societal shift towards interconnectedness requires continuous innovation in component technology to support higher data transmission rates, improved energy efficiency, and enhanced processing power within increasingly miniaturized form factors, a core competency for Vishay.

The semiconductor industry, including companies like Vishay Intertechnology, is grappling with significant global talent shortages. There's a pronounced need for highly skilled engineers, particularly in areas like advanced circuit design, process technology, and materials science, as well as for specialized technicians to operate complex manufacturing equipment. For instance, a 2024 report by the Semiconductor Industry Association (SIA) highlighted that the U.S. alone could face a deficit of over 70,000 skilled workers by 2030 if current educational and training trends continue.

Vishay's ability to attract and retain this specialized workforce is paramount to its sustained competitive advantage. Success in research and development, the continuous improvement of manufacturing processes, and the innovation pipeline all hinge on having access to top-tier talent. Without it, Vishay’s capacity for developing next-generation components and maintaining efficient, high-quality production could be significantly hampered, directly impacting its market position and long-term growth prospects.

Emphasis on Corporate Social Responsibility

Societal expectations are increasingly pushing companies like Vishay Intertechnology to prioritize corporate social responsibility (CSR). This means not only focusing on profit but also on how their operations impact people and the planet. There's a growing demand for ethical labor practices throughout the supply chain and meaningful engagement with the communities where they operate. For example, Vishay's sustainability reports highlight their efforts in reducing greenhouse gas emissions, aiming for a 20% reduction by 2030 compared to 2022 levels, demonstrating a tangible commitment to environmental stewardship.

Vishay's proactive stance on CSR significantly bolsters its brand reputation. Consumers are more likely to support companies they perceive as ethical and responsible, and this extends to investors. Socially conscious investors, often guided by ESG (Environmental, Social, and Governance) principles, are channeling capital towards businesses that align with their values. In 2024, ESG funds saw continued inflows, with global assets under management in ESG-focused ETFs reaching over $3.5 trillion, indicating a strong market appetite for such commitments.

- Ethical Labor Practices: Vishay's supplier code of conduct outlines strict adherence to fair wages, safe working conditions, and prohibitions against child or forced labor across its global operations.

- Community Engagement: The company actively participates in local initiatives, contributing to educational programs and environmental clean-up efforts in the regions where its facilities are located.

- Sustainability Initiatives: Vishay has set targets for water conservation and waste reduction, with a reported 15% decrease in water intensity across its manufacturing sites in 2023.

- Investor Appeal: A strong CSR profile enhances Vishay's attractiveness to a growing segment of the investment community focused on long-term, sustainable value creation.

Growth in Healthcare and Medical Electronics

Societal shifts, notably an aging global population and a heightened emphasis on personal health and well-being, are significantly driving expansion within the healthcare and medical electronics industries. This trend translates directly into a robust demand for dependable, high-performance electronic components, creating a promising and growing market for Vishay's specialized product offerings.

For instance, the global population aged 65 and over is projected to reach 1.5 billion by 2050, a substantial increase that will invariably boost demand for medical devices and monitoring equipment. This demographic shift underscores the increasing need for advanced medical electronics, a sector where Vishay's components play a crucial role in everything from diagnostic tools to patient monitoring systems.

- Aging Demographics: Global population aged 65+ expected to hit 1.5 billion by 2050, increasing demand for healthcare solutions.

- Health & Wellness Focus: Growing consumer interest in preventative care and personal health monitoring fuels the medical device market.

- Technological Integration: Advancements in wearable tech and remote patient monitoring require sophisticated, miniaturized electronic components.

- Market Growth: The global medical electronics market was valued at approximately $130 billion in 2023 and is anticipated to grow at a CAGR of over 7% through 2030, presenting a substantial opportunity for component suppliers like Vishay.

Societal trends like the increasing demand for miniaturized and intelligent electronics, exemplified by the wearable tech market's projected growth to $350 billion by 2030, directly benefit Vishay. The expansion of the IoT and IIoT, with the global IoT market expected to exceed $1.1 trillion by 2025, also creates a larger market for Vishay's essential components, driving demand for their sensor and connectivity solutions.

Technological factors

The rapid growth of Artificial Intelligence (AI) and high-performance computing (HPC) is a major driver for Vishay Intertechnology. These technologies require increasingly sophisticated semiconductors and passive components to function. For instance, the global AI chip market was projected to reach $109.3 billion in 2024, a significant increase from previous years.

Vishay's extensive product portfolio, featuring MOSFETs, diodes, and inductors, plays a crucial role in powering AI servers and accelerators. These components are fundamental to the immense computational power needed for complex AI tasks, from machine learning to data analysis. The demand for these specialized components is expected to continue its upward trajectory as AI adoption expands across industries.

The global automotive market is rapidly shifting towards electrification and advanced driver assistance systems (ADAS). This transition necessitates a significant upgrade in power electronics and sensor technology to handle higher voltages and increased data processing demands. For example, the EV market saw sales surge by approximately 31% globally in 2023, reaching over 13.6 million units, according to the International Energy Agency (IEA).

Vishay Intertechnology is strategically positioned to capitalize on this trend through its investments in Silicon Carbide (SiC) technology. SiC devices offer superior performance characteristics compared to traditional silicon, such as higher efficiency, faster switching speeds, and better thermal management, which are crucial for EV powertrains and charging solutions.

The company’s development of new automotive-grade products, including MOSFETs and diodes utilizing SiC, directly addresses the growing need for robust and efficient components in electric vehicles. These components are vital for optimizing energy consumption and extending the range of EVs, as well as for improving the speed and reliability of charging infrastructure.

The accelerating global deployment of 5G networks is a significant technological driver, directly fueling demand for advanced electronic components. This expansion necessitates a substantial increase in high-frequency, high-speed semiconductors and radio frequency (RF) components. For Vishay Intertechnology, this translates into a robust market opportunity as their specialized product portfolio is crucial for building the very infrastructure and end-user devices that power 5G connectivity, enabling the faster data speeds and expanded network capabilities consumers and businesses increasingly expect.

Innovation in Material Science and Component Design

Vishay's commitment to innovation in material science and component design, particularly with new silicon carbide (SiC) platforms, is a key technological driver. This continuous advancement is essential for enhancing the performance and efficiency of electronic devices across various sectors. For instance, the development of advanced packaging techniques allows for smaller, more powerful components, directly impacting product miniaturization and thermal management.

Vishay's ongoing research and development efforts are central to capitalizing on these trends. The company's focus on creating next-generation SiC MOSFETs and diodes positions it to meet the growing demand for high-efficiency power electronics. In 2023, Vishay reported significant investment in R&D, underscoring its dedication to staying ahead in this rapidly evolving technological landscape.

- SiC Technology Advancement: Continued development of SiC MOSFETs and diodes for improved power conversion efficiency.

- Advanced Packaging Solutions: Focus on innovative packaging to reduce size, improve thermal performance, and increase reliability.

- R&D Investment: Sustained investment in research and development to drive material science breakthroughs.

- Market Responsiveness: Adapting component design to meet emerging needs in electric vehicles, renewable energy, and industrial automation.

Automation and Smart Manufacturing Processes

The electronics industry's embrace of automation and smart manufacturing, often termed Industry 4.0, directly influences Vishay Intertechnology's operational efficiency and cost management. For instance, reports from 2024 indicated a significant surge in investments by semiconductor manufacturers in advanced automation, with the global smart manufacturing market expected to reach hundreds of billions by the end of the decade.

These technological shifts necessitate ongoing investment in advanced manufacturing techniques to maintain and improve productivity and product quality. By integrating robotics, AI-driven quality control, and data analytics into its production lines, Vishay can streamline processes, reduce waste, and ultimately enhance its competitive edge in a rapidly evolving market.

Key impacts include:

- Enhanced Productivity: Automation can significantly increase output per employee and per machine.

- Improved Quality Control: Smart sensors and AI can detect defects earlier and more accurately.

- Cost Reduction: Optimized processes and reduced material waste lead to lower production costs.

- Increased Agility: Flexible manufacturing systems allow for quicker adaptation to changing product demands.

The increasing demand for high-performance computing (HPC) and artificial intelligence (AI) drives Vishay's component sales, as these technologies require advanced semiconductors. The global AI chip market was anticipated to reach $109.3 billion in 2024. Vishay's MOSFETs and diodes are crucial for AI servers and accelerators, supporting the immense processing power needed for machine learning.

The automotive sector's shift to electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is another key technological factor. EV sales surged by roughly 31% globally in 2023, exceeding 13.6 million units. Vishay's investment in Silicon Carbide (SiC) technology positions it to supply essential components for EV powertrains and charging systems, offering superior efficiency and performance.

The widespread deployment of 5G networks also fuels demand for Vishay's high-frequency and high-speed semiconductors. This expansion requires robust infrastructure and advanced end-user devices, areas where Vishay's specialized components are vital. Furthermore, advancements in automation within the electronics industry, often termed Industry 4.0, are enhancing Vishay's operational efficiency and cost management through robotics and AI-driven quality control.

| Technological Factor | Impact on Vishay | Key Data/Trend |

| AI & HPC Growth | Increased demand for advanced semiconductors | AI chip market projected at $109.3 billion in 2024 |

| Automotive Electrification (EVs) & ADAS | Demand for power electronics and SiC technology | Global EV sales increased by ~31% in 2023 (13.6M+ units) |

| 5G Network Expansion | Need for high-frequency and high-speed components | Growing infrastructure and device requirements |

| Industry 4.0 & Automation | Enhanced manufacturing efficiency and cost reduction | Increased investments in advanced automation by semiconductor firms |

Legal factors

Vishay Intertechnology navigates a stringent global regulatory landscape concerning environmental protection. This includes strict adherence to rules governing air emissions, wastewater quality, and the responsible handling of hazardous materials across its manufacturing facilities. For instance, in 2023, the company reported ongoing investments in environmental control technologies to meet evolving standards, a trend expected to continue through 2024 and 2025.

Meeting international environmental management standards, such as ISO 14001, is critical for Vishay's operational integrity and market access. This focus directly influences production methods, the selection of raw materials, and the overall supply chain management, ensuring sustainable practices are integrated into daily business. The company's commitment to these standards is a key factor in maintaining its reputation and operational license in various jurisdictions.

Vishay Intertechnology must adhere to stringent product safety and quality standards, frequently dictated by industry-specific regulations. For instance, the AEC-Q200 qualification is essential for components used in the demanding automotive sector, directly shaping Vishay's product development and production.

Maintaining certifications such as ISO 9001 is paramount, showcasing Vishay's dedication to quality and bolstering customer confidence. This commitment is a key differentiator in the competitive electronics market, impacting market penetration and long-term customer relationships.

In 2023, Vishay reported a significant focus on quality management systems, with continuous efforts to meet evolving global regulatory requirements across its diverse product lines.

Vishay Intertechnology's ability to protect its innovations through intellectual property (IP) rights, including patents and trademarks, is crucial for maintaining its market position. These legal protections are essential for safeguarding proprietary technologies and preventing competitors from copying Vishay's designs and manufacturing processes.

The legal landscape surrounding IP rights significantly shapes Vishay's competitive environment. Companies like Vishay must navigate varying international patent laws to secure their inventions globally, impacting their ability to enter new markets or defend against infringement claims. For instance, in 2023, the semiconductor industry saw continued emphasis on patent litigation and licensing agreements as a key competitive strategy.

Responsible Sourcing Regulations

Responsible sourcing regulations are increasingly impacting the electronics industry, requiring companies like Vishay Intertechnology to actively manage their supply chains for ethical and conflict-free materials. This heightened scrutiny, particularly around minerals like tin, tantalum, tungsten, and gold originating from conflict zones, necessitates robust due diligence processes. Vishay's stated commitment to eliminating conflict minerals from its products demonstrates an effort to align with international standards and address growing consumer and investor expectations for ethical business practices. Failure to comply can lead to reputational damage and potential supply chain disruptions.

Vishay's approach to responsible sourcing directly addresses global regulatory trends. For instance, the European Union's Conflict Minerals Regulation (EU CMRR), which came into full effect in January 2021, mandates that importers of tin, tantalum, tungsten, and gold into the EU conduct due diligence on their upstream suppliers. Vishay, as a global semiconductor manufacturer with extensive supply chains, must demonstrate compliance to ensure market access and maintain customer trust. The company's ongoing efforts are crucial for navigating this complex regulatory landscape, as non-compliance can result in significant penalties and trade barriers.

- Increased Regulatory Oversight: Global regulations like the EU CMRR mandate due diligence for sourcing tin, tantalum, tungsten, and gold, directly impacting Vishay's supply chain management.

- Ethical Sourcing Commitments: Vishay's focus on eliminating conflict minerals is essential for meeting international guidelines and addressing stakeholder demands for ethical practices.

- Supply Chain Transparency: The company must demonstrate transparency and traceability within its supply chain to verify the origin of materials and ensure compliance.

- Reputational and Market Access Risks: Non-compliance with responsible sourcing regulations can lead to negative publicity, loss of customer trust, and restricted access to key markets.

Labor Laws and Employment Regulations

As a global employer with operations in numerous countries, Vishay Intertechnology must navigate a complex web of labor laws and employment regulations. These regulations, which vary significantly by region, dictate crucial aspects of the employment relationship, directly impacting human resource management and overall operational expenses.

Key areas governed by these laws include minimum wage requirements, working hour limits, overtime pay, health and safety standards, and employee benefits such as paid leave and retirement contributions. For instance, in the United States, the Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime pay standards. In Europe, directives like the Working Time Directive establish maximum weekly working hours and minimum rest periods. Vishay's compliance with these diverse legal frameworks is essential to avoid penalties and maintain a stable workforce.

- Minimum Wage Compliance: Vishay must adhere to varying minimum wage laws across its global sites, impacting labor costs. For example, in 2024, the US federal minimum wage remains $7.25 per hour, while many states and cities have set significantly higher rates.

- Working Condition Standards: Regulations concerning workplace safety, hours of work, and rest breaks are critical. In 2024, the EU continues to enforce its Working Time Directive, limiting the average work week to 48 hours.

- Employee Rights and Protections: Laws covering non-discrimination, collective bargaining, and termination procedures influence Vishay's HR policies and potential liabilities. Many countries offer robust protections against unfair dismissal.

- Impact on HR Strategy: Compliance with these diverse labor laws necessitates tailored HR strategies for each operational region, influencing recruitment, compensation, and employee relations.

Vishay Intertechnology operates within a legal framework that mandates compliance with various trade and economic sanctions. These regulations, often imposed by governments or international bodies like the United Nations, restrict business dealings with specific countries, entities, or individuals. Navigating these sanctions is critical for Vishay to avoid legal penalties and maintain access to global markets.

Compliance with export control regulations is also a significant legal factor for Vishay. These laws govern the international transfer of technology, software, and goods, particularly those with potential military applications. For example, adherence to the International Traffic in Arms Regulations (ITAR) or the Export Administration Regulations (EAR) in the United States is vital for companies like Vishay involved in advanced manufacturing.

Vishay's commitment to data privacy and cybersecurity is increasingly shaped by evolving legal requirements. Regulations such as the General Data Protection Regulation (GDPR) in Europe and similar laws in other jurisdictions mandate how personal data is collected, processed, and stored, impacting Vishay's customer interactions and internal data management practices.

Environmental factors

Vishay Intertechnology is actively pursuing sustainability, focusing on reducing its environmental impact, particularly energy use and greenhouse gas (GHG) emissions. The company has established specific annual environmental targets to monitor progress in these areas.

In 2023, Vishay reported a 12% reduction in Scope 1 and Scope 2 GHG emissions compared to their 2019 baseline, demonstrating a tangible commitment to their reduction goals. This aligns with increasing global demands for businesses to demonstrate robust environmental stewardship.

Vishay Intertechnology places a strong emphasis on resource efficiency and responsible waste management, particularly concerning the hazardous materials used in its semiconductor manufacturing processes. This includes robust protocols for the treatment and proper disposal of waste to mitigate environmental harm.

The company's dedication to environmental stewardship is further demonstrated by its pursuit and maintenance of environmental management certifications such as ISO 14001. This certification validates Vishay's systematic approach to minimizing its ecological footprint across its global operations.

As of its latest reporting for fiscal year 2023, Vishay continued to invest in technologies and processes aimed at reducing energy consumption and waste generation per unit of production. While specific waste reduction percentages fluctuate year-over-year based on production volumes and product mix, the overarching strategy prioritizes continuous improvement in these areas.

The increasing consumer and regulatory pressure for greener electronics significantly boosts demand for Vishay's energy-efficient components. For instance, the global market for energy-efficient lighting, a key area for component suppliers, was projected to reach over $100 billion by 2023, indicating strong growth potential.

Vishay's strategic focus on power efficiency is directly aligned with the booming electric vehicle (EV) market, which is expected to see its global market size surpass $1.5 trillion by 2030. Their components are vital for managing power in EV charging infrastructure and onboard systems, directly benefiting from this trend.

Furthermore, the expansion of renewable energy sources, such as solar and wind power, also fuels demand for Vishay's high-efficiency power management solutions. The International Energy Agency reported that renewable energy capacity additions continued to break records in 2023, underscoring the sustained need for advanced semiconductor components in this sector.

Climate Change Impact on Supply Chains

Climate change is increasingly impacting global supply chains. Extreme weather events, such as hurricanes, floods, and droughts, are becoming more frequent and intense. This presents significant risks for companies like Vishay Intertechnology, potentially disrupting manufacturing operations and logistics networks. For instance, a severe flood in a key manufacturing region could halt production, leading to delays and increased costs.

Vishay needs to proactively adapt its supply chain strategies to build resilience against these climate-related disruptions. This involves identifying and diversifying sources for critical raw materials and components. By having multiple suppliers in different geographical locations, Vishay can mitigate the impact of localized weather events. A recent study by McKinsey in 2024 highlighted that companies with resilient supply chains can recover from disruptions up to 40% faster.

- Increased frequency of extreme weather events directly threatens Vishay's manufacturing facilities and transportation routes.

- Supply chain diversification is crucial to offset risks associated with climate-driven disruptions in sourcing key materials.

- Investment in climate adaptation for infrastructure can safeguard Vishay's operational continuity.

- **Global supply chain disruptions** due to climate events are projected to cost the global economy trillions of dollars annually by 2050 according to various economic forecasts.

Regulatory Pressure for Product Lifecycle Management

Environmental regulations are increasingly focusing on the entire lifespan of products, not just their manufacturing. This means companies like Vishay must consider everything from the materials used to how products are disposed of at the end of their useful life.

For Vishay Intertechnology, this translates into a need to meticulously track and manage the substances within their components. Regulations such as the EU's Restriction of Hazardous Substances (RoHS) directive, which was updated in 2022 and continues to be a key compliance area, directly impact the materials Vishay can incorporate. Failure to adhere to these rules can lead to significant market access barriers and potential fines.

The responsibility for product disposal is also a growing concern. Extended Producer Responsibility (EPR) schemes are becoming more prevalent globally, requiring manufacturers to take financial or physical responsibility for the collection, recycling, or disposal of their products. Vishay needs to factor these evolving requirements into its product design and end-of-life strategies to ensure ongoing compliance and sustainability.

- RoHS Directive Updates: Continued monitoring and adaptation to evolving substance restrictions in key markets like the EU and California.

- Extended Producer Responsibility (EPR): Proactive engagement with EPR frameworks in regions where Vishay operates or sells products.

- Material Compliance Audits: Regular internal and external audits to verify adherence to environmental material regulations across all product lines.

- Supply Chain Transparency: Enhancing visibility into the supply chain to ensure component-level compliance with lifecycle management requirements.

Vishay Intertechnology's environmental focus is evident in its 12% reduction in Scope 1 and Scope 2 GHG emissions by 2023, compared to a 2019 baseline. The company is actively investing in energy efficiency and waste reduction, aligning with growing market demands for sustainable electronics, particularly in sectors like electric vehicles and renewable energy where their components are critical.

The increasing frequency of extreme weather events poses a significant risk to Vishay's global supply chain, necessitating robust resilience strategies and supply chain diversification to mitigate potential disruptions. Furthermore, evolving environmental regulations, such as the EU's RoHS directive and global Extended Producer Responsibility schemes, require continuous adaptation in material sourcing and product lifecycle management.

| Environmental Factor | Impact on Vishay | Key Data/Trend |

|---|---|---|

| GHG Emissions Reduction | Demonstrates commitment to sustainability, enhances brand reputation | 12% reduction in Scope 1 & 2 emissions by 2023 (vs. 2019 baseline) |

| Energy Efficiency Demand | Drives demand for Vishay's power management components | Global energy-efficient lighting market projected >$100B by 2023; EV market >$1.5T by 2030 |

| Climate Change Risks | Threatens supply chain stability and operations | Increased frequency/intensity of extreme weather events; McKinsey study shows resilient supply chains recover 40% faster |

| Environmental Regulations | Requires material compliance and end-of-life product management | Updates to RoHS directive; increasing prevalence of EPR schemes globally |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Vishay Intertechnology is informed by a comprehensive review of government publications, economic indicators from international bodies, and reputable industry research. We meticulously gather data on technological advancements, regulatory changes, and geopolitical shifts to provide a holistic understanding of the external environment.