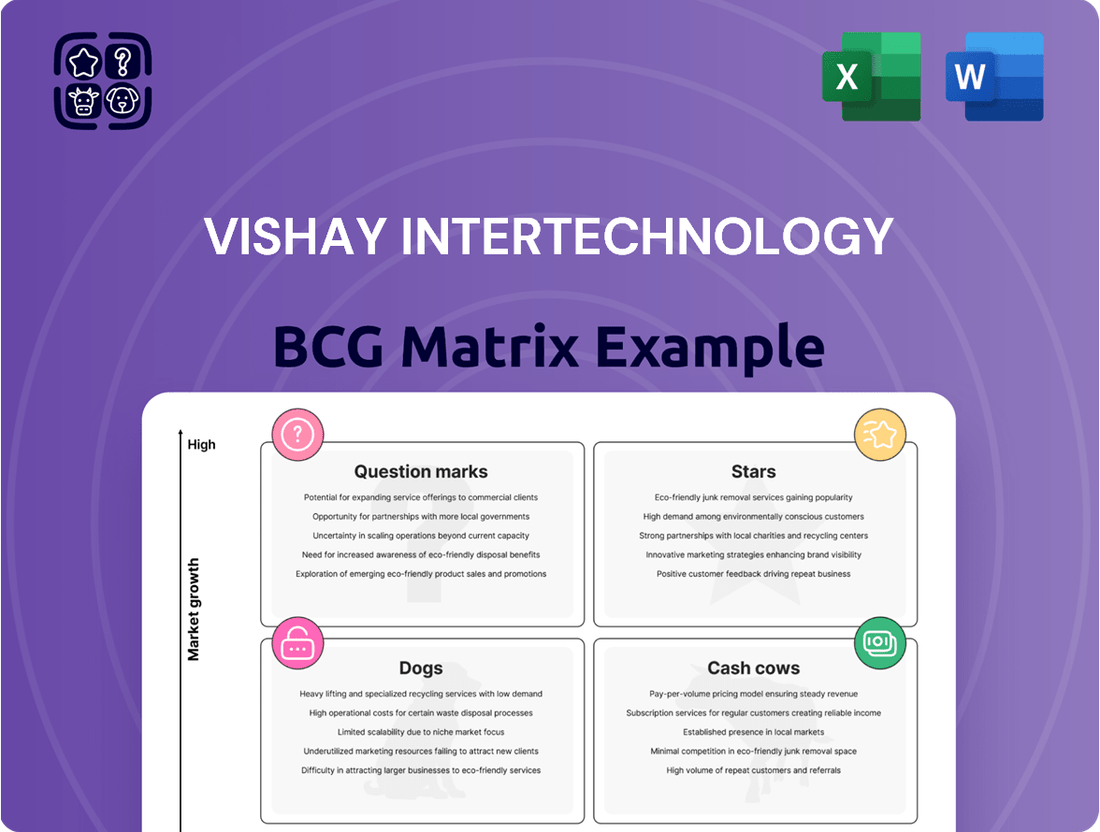

Vishay Intertechnology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vishay Intertechnology Bundle

Vishay Intertechnology's product portfolio is a dynamic landscape, with some offerings poised for explosive growth and others providing stable, reliable income. Understanding where each product falls within the BCG Matrix is crucial for informed strategic decision-making.

This preview offers a glimpse into Vishay's market position, highlighting potential Stars and Cash Cows, but it only scratches the surface of the actionable intelligence available.

To truly harness the power of this analysis and identify opportunities for investment and resource allocation, you need the complete picture.

Purchase the full Vishay Intertechnology BCG Matrix report to gain a comprehensive quadrant-by-quadrant breakdown, revealing the true potential and challenges of each product line.

Don't miss out on the strategic clarity that can propel your business forward; invest in the full report today for a roadmap to optimizing Vishay's product strategy and securing future success.

Stars

Vishay is making significant investments in Silicon Carbide (SiC) technology, launching new 1200V, 1700V, and 650V planar MOSFETs throughout 2024 and into 2025. They are also increasing production for their advanced split-gate MOSFETs. This strategic push is aimed squarely at rapidly expanding markets like electric vehicles and renewable energy.

The demand for highly efficient power semiconductors in these sectors is soaring, making SiC MOSFETs and diodes a critical component. The power MOSFET market, notably bolstered by SiC advancements, represents a considerable opportunity for Vishay to secure a substantial market share.

Vishay Intertechnology is strategically positioned within the AI server market, a segment experiencing explosive growth. The company reported robust order intake and initiated its first shipments for AI servers in late 2024, extending into early 2025. This surge is fueled by the escalating demand for advanced computing power, directly translating into a need for Vishay's specialized components.

The AI sector's rapid expansion necessitates high-performance electronic components. Vishay is a key supplier of critical parts such as MOSFETs, diodes, and inductors, all essential for the efficient operation of AI servers. The company's ability to deliver these specialized products positions it favorably to capitalize on this burgeoning market trend.

This AI server component segment is identified as a high-growth star for Vishay. The company has been actively securing design wins, indicating strong customer adoption and a growing market presence. Vishay is scaling its operations to meet the increasing industry demand, aiming to solidify its position as a leading provider of essential components for the AI infrastructure build-out.

Vishay Intertechnology is experiencing strong demand for its components used in smart grid infrastructure, especially from European projects. Global spending on smart grid technology is on the rise, creating a need for dependable electronic parts. This trend underscores the importance of Vishay's strategic investments in capacity to meet the growing requirements of this expanding market.

Advanced Automotive Sensors (e.g., AEC-Q100 qualified)

Vishay's introduction of AEC-Q100 qualified ambient light and RGBIR color sensors directly targets the booming automotive electronics sector. This segment, especially for ADAS and e-mobility, is experiencing significant growth and rapid technological advancement. These high-reliability components are designed to meet stringent automotive standards, positioning Vishay to capitalize on the increasing demand for sophisticated sensing solutions in vehicles.

- Market Growth: The global automotive sensor market, including advanced types, is projected to reach over $60 billion by 2027, with ADAS and e-mobility being key drivers.

- Vishay's Strategy: By focusing on AEC-Q100 qualification, Vishay is ensuring its sensors meet the rigorous reliability and performance demands of the automotive industry.

- Product Relevance: Ambient light sensors are crucial for automatic headlight control and interior lighting adjustments, while RGBIR sensors support applications like driver monitoring and interior ambiance control.

- Competitive Positioning: These specialized sensors allow Vishay to compete effectively in a segment where technological innovation and supplier quality are paramount.

High-Current, High-Temperature Inductors for Power Applications

Vishay is actively developing and showcasing its high-current, edge-wound through-hole inductors. These components are engineered for continuous operation up to +180 °C, making them indispensable for demanding, high-power applications. The company's focus on such robust solutions directly addresses the needs of rapidly expanding sectors.

The critical role of these inductors in power conversion is particularly evident in the growth of electric vehicles and renewable energy systems. For instance, the automotive sector's shift towards electrification, with global EV sales projected to reach over 15 million units in 2024, significantly boosts demand for reliable power components. Similarly, the renewable energy market, expected to see substantial investment in 2024, relies heavily on efficient power management.

Vishay's enhanced performance characteristics and proven suitability for extreme environments position these inductors favorably. This suggests a strong market presence and considerable growth potential for Vishay within these key industries. Their strategic development aligns with major technological trends driving the demand for advanced power solutions.

- Market Relevance: Indispensable for power conversion in electric vehicles and renewable energy.

- Operational Capability: Continuous operation up to +180 °C for high-temperature environments.

- Growth Sectors: Directly supports the expansion of the EV market, with over 15 million units projected globally in 2024.

- Competitive Advantage: Enhanced performance and suitability for demanding applications indicate a strong market position.

Vishay's AI server components are a clear star in their portfolio. The company's early 2024 shipments and robust order intake for these critical parts, including MOSFETs and inductors, highlight a significant growth trajectory. This segment is directly benefiting from the massive expansion of AI infrastructure, with Vishay securing key design wins and scaling operations to meet this surging demand.

The AI server market is a high-growth area for Vishay, evidenced by their initial shipments in late 2024 and strong order backlog extending into 2025. Vishay's essential components like MOSFETs, diodes, and inductors are vital for the advanced computing power required by AI servers. Their strategic focus on this sector positions them to capture substantial market share as AI adoption accelerates.

Vishay's high-current, edge-wound through-hole inductors are another star performer, particularly due to their resilience in high-temperature environments, operating up to +180 °C. These are crucial for the power conversion needs of the booming electric vehicle market, which saw over 15 million units sold globally in 2024, and the expanding renewable energy sector. Their robust design and performance in demanding applications give Vishay a competitive edge.

Vishay's automotive sensors, specifically AEC-Q100 qualified ambient light and RGBIR color sensors, are shining stars. Targeting the rapidly growing automotive electronics sector, especially ADAS and e-mobility, these sensors meet stringent industry standards. The global automotive sensor market is projected to exceed $60 billion by 2027, with Vishay's focus on high-reliability components for advanced vehicle features positioning them for significant growth.

What is included in the product

This BCG Matrix analysis identifies Vishay Intertechnology's product portfolio strengths and weaknesses.

It guides strategic decisions on investment, divestment, and resource allocation for each business unit.

A clear Vishay BCG Matrix overview helps quickly identify underperforming product lines, relieving the pain of inefficient resource allocation.

Cash Cows

Vishay Intertechnology stands as a prominent global manufacturer of essential electronic components, including a wide array of resistors such as thin film, thick film, and wirewound types. These components are fundamental to virtually all electronic devices, underscoring their consistent and widespread demand.

The resistor market, while mature, offers a stable and predictable revenue stream, positioning Vishay's resistor products as reliable cash cows within its diverse portfolio. This maturity signifies a consistent demand that doesn't typically fluctuate wildly, providing a solid foundation for earnings.

With an established market presence and a comprehensive range of resistor offerings, Vishay benefits from a strong brand recognition and customer loyalty. This allows for stable cash flow generation with comparatively modest investments needed for marketing and sales promotion, as demand is largely driven by the inherent necessity of these components in electronics manufacturing.

In 2023, the global passive components market, which includes resistors, was valued at approximately $25 billion, with resistors representing a significant portion. Vishay's strong market share in this segment, particularly in thin and thick film resistors, directly contributes to its robust cash flow generation capabilities.

Vishay's general-purpose diodes and rectifiers are foundational components, powering a vast range of electronic devices. These products operate within a mature, high-volume market, experiencing consistent demand across industrial, computing, and consumer electronics. Their established market leadership in this segment translates to robust profit margins and a reliable stream of cash.

In 2024, Vishay's discrete semiconductor business, which prominently features diodes and rectifiers, continued to be a significant revenue driver. While specific segment data isn't always granularly broken out, the overall discrete semiconductor market, valued in the tens of billions of dollars annually, demonstrates the scale of this cash cow. Vishay's strong position here reflects its ability to generate substantial and stable cash flow, supporting other strategic initiatives within the company.

Standard capacitors, encompassing aluminum, ceramic, film, and tantalum types, represent Vishay Intertechnology's cash cows. Vishay commands a substantial share in the extensive capacitor market, a key part of the broader passive components sector. Despite modest overall growth in passive components, these established product lines generate consistent, stable cash flow due to their high market penetration and pervasive application across numerous industries.

Established Optoelectronic Components (non-automotive specific)

Vishay's established optoelectronic components cater to a broad spectrum of industrial and consumer needs, forming a solid foundation within their product portfolio. These products are entrenched in markets that exhibit stability and maturity, allowing Vishay to leverage its strong customer relationships and established competitive edge. For instance, in 2023, Vishay's Optoelectronics segment reported net sales of $743 million, demonstrating the consistent revenue these established products generate.

These offerings are characterized by their ability to deliver predictable revenue streams and support operational efficiency, necessitating less intensive market development efforts. Their mature market positioning means that while growth may be moderate, the profitability and cash flow generated are significant. This stability is crucial for funding innovation in other areas of Vishay's business.

- Established Market Presence: Serving diverse industrial and consumer applications.

- Stable Revenue Generation: Benefiting from mature markets and a loyal customer base.

- Operational Efficiency: Requiring less aggressive market development, leading to consistent cash flow.

- Contribution to Profitability: These products are key cash cows, supporting the overall financial health of Vishay Intertechnology.

Power Metal Strip Resistors

Vishay's Power Metal Strip resistors are a classic example of a cash cow within the BCG matrix. These components are critical for high-power applications, offering excellent performance characteristics like low Temperature Coefficient of Resistance (TCR). Their established presence in stable markets, like power management and industrial equipment, means consistent demand.

The strength of Vishay's Power Metal Strip resistors lies in their mature technology and the company's long-standing reputation for quality and reliability. This allows them to command premium pricing and generate substantial, predictable profits. For instance, Vishay reported a strong performance in its discrete components segment, which includes these resistors, throughout 2024, driven by sustained demand in automotive and industrial sectors.

- High Performance: Known for high power handling and low TCR, crucial for demanding applications.

- Market Stability: Operates in mature, stable markets with consistent demand.

- Brand Reputation: Benefits from Vishay's established quality and reliability in industrial sectors.

- Profitability: Ensures high profit margins and robust cash generation due to strong market position and performance.

Vishay's standard capacitors, including aluminum, ceramic, and film types, are prime examples of cash cows. They operate in a mature, high-volume market with consistent demand across diverse electronic applications.

These capacitor lines benefit from Vishay's established market share and brand recognition, allowing for stable revenue generation with relatively low investment needs. Their pervasive use in industrial, automotive, and consumer electronics ensures predictable cash flow for the company.

The global capacitor market is a substantial segment, and Vishay's strong performance in standard types directly contributes to its robust cash generation capabilities, supporting other business initiatives.

Vishay's general-purpose diodes and rectifiers are also significant cash cows. These foundational components serve a broad range of electronics, benefiting from high-volume, consistent demand in stable markets.

With established market leadership, Vishay enjoys strong profit margins and a reliable cash stream from these products. In 2024, Vishay's discrete semiconductor business, including these diodes and rectifiers, continued to be a major revenue contributor, underscoring their cash cow status.

| Product Category | BCG Matrix Role | Key Characteristics | 2024 Market Context | Vishay's Strength |

|---|---|---|---|---|

| Standard Capacitors | Cash Cow | Mature market, high volume, consistent demand, broad applications | Stable demand in industrial, automotive, consumer electronics | Strong market share, brand recognition |

| General Purpose Diodes & Rectifiers | Cash Cow | Foundational components, high volume, stable demand | Significant revenue driver in discrete semiconductors | Established market leadership, robust profit margins |

Full Transparency, Always

Vishay Intertechnology BCG Matrix

The Vishay Intertechnology BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no alterations—just the complete, analysis-ready strategic tool designed for immediate application.

Dogs

Vishay's MOSFET business faced considerable headwinds in early 2025, with gross margins plummeting to 8.2% in the first quarter, a stark contrast to the 16.6% reported a year prior. This steep decline in profitability, even with a relatively minor dip in revenue, points to significant pricing pressures or an oversupply situation within specific MOSFET categories where Vishay might not hold a strong competitive advantage or substantial market share.

These underperforming segments are characterized by their low market attractiveness and poor profitability, leading them to consume cash without generating adequate returns. This cash burn is a key indicator of a 'Dog' in the BCG matrix, suggesting these areas require careful strategic consideration, potentially involving divestment or a significant restructuring to improve their viability.

Vishay Intertechnology's strategic repositioning under Vishay 3.0, which includes the planned closure of three manufacturing facilities by the end of 2026, highlights a focus on optimizing its operational footprint. This move suggests a deliberate phasing out or consolidation of older, potentially less profitable product lines, possibly within its diodes and resistors segments. These legacy products may be classified as cash traps, consuming capital without generating sufficient returns in the current market landscape.

Vishay's commoditized standard components, especially those lacking unique technological features, are caught in a tough spot with intense competition. This often leads to significant price drops and reduced customer interest. These products are particularly vulnerable when the broader economy slows down or when customers are working through excess inventory, a situation seen in recent market analyses.

These types of products likely hold a small slice of their particular market segments and don't show much potential for future growth. For example, Vishay's passive components, like certain types of resistors and capacitors, can fall into this category if they don't offer advanced features. In 2024, the semiconductor industry, in general, experienced inventory adjustments, impacting the demand for these less differentiated parts.

Products Heavily Impacted by Tariff Policies

Vishay Intertechnology recognizes that shifting tariff policies present significant hurdles, prompting a strategic move towards diversifying manufacturing sites to soften the impact. Certain product lines, particularly those with thinner profit margins or facing intense local rivalry, are disproportionately vulnerable if produced in areas subject to substantial tariffs. These are the candidates for Vishay’s divestment or production relocation efforts, aligning with the characteristics of a ‘dog’ in the BCG matrix.

Products heavily affected by tariffs, especially those with low margins, are prime candidates for being classified as dogs. For instance, if a specific component manufactured in a tariff-impacted region saw its cost increase by 15% due to new tariffs in late 2023, and its profit margin was already below 10%, its viability is severely threatened. Vishay’s efforts to mitigate these risks by exploring alternative production hubs directly address the potential decline in profitability and market share for such items.

- Vulnerable Products Products manufactured in regions with high tariff imposition and low profit margins are at risk.

- Mitigation Strategy Vishay’s plan to offer alternative manufacturing locations aims to reduce exposure to tariff-sensitive production.

- Market Share Impact Increased costs due to tariffs can lead to reduced competitiveness and market share for affected product lines.

- Profitability Concerns Low-margin products are particularly susceptible to tariff-related cost increases, potentially turning them into financial drains.

Components for Declining Traditional End Markets

Vishay Intertechnology's strategic focus on areas like automotive, industrial, and defense means some components designed for older, shrinking markets are naturally categorized as declining. These might be older memory technologies or passive components for legacy computing systems that are no longer experiencing significant demand. For instance, while Vishay's overall revenue in 2023 was $3.16 billion, the shift in focus indicates a deliberate move away from products catering to these less dynamic sectors.

The company's emphasis on 'technology differentiation' and 'key applications' signifies a strategic pivot. This means that products associated with declining traditional end markets, such as certain older consumer electronics or specific types of legacy computing hardware, are likely candidates for eventual phase-out. This approach allows Vishay to concentrate resources on higher-growth, higher-margin opportunities.

- Legacy Components: Products designed for older computing architectures or consumer electronics facing obsolescence.

- Low Growth Markets: End markets that are either stagnant or shrinking in terms of demand for specific component types.

- Strategic Divestment: Potential for phasing out or reducing investment in product lines tied to these declining sectors.

- Resource Reallocation: Shifting capital and engineering efforts towards Vishay's identified growth areas.

Dogs in Vishay's portfolio are products with low market share in slow-growing industries. These often include commoditized standard components facing intense price competition, like certain resistors or capacitors without advanced features. For example, Vishay's MOSFET business saw gross margins drop significantly in early 2025, indicating potential issues in some segments that fit the 'dog' profile.

These products typically consume cash and offer little return, prompting strategic decisions like divestment or restructuring. Vishay's plan to close facilities by 2026 suggests a move to streamline operations and phase out less profitable legacy product lines, which could include these cash traps.

Products vulnerable to tariffs, especially those with thin margins, are also strong candidates for the 'dog' category. Increased costs from tariffs can erode competitiveness and market share, making these items financial drains. Vishay's efforts to diversify manufacturing sites are a direct response to mitigate these risks.

Components catering to declining markets, such as older computing technologies or legacy systems, also fall into this classification. Vishay’s strategic pivot towards automotive, industrial, and defense sectors implies a deliberate shift away from products serving these less dynamic areas.

| Product Category | Market Growth | Market Share | Profitability | Strategic Consideration |

| Commoditized Standard Components | Low | Low | Low | Divestment/Restructuring |

| Legacy Technology Products | Declining | Low | Low | Phase-out |

| Tariff-Sensitive Low-Margin Items | Varies (impacted by tariffs) | Low | Very Low | Relocation/Divestment |

Question Marks

Vishay's acquisition of Ametherm introduces product lines like inrush current limiters, targeting rapidly expanding sectors such as industrial automation and medical technology. These markets demonstrate robust growth potential, with the industrial automation market, for instance, projected to reach over $300 billion globally by 2028. While these newly integrated products hold significant promise, they are currently in the nascent stages of market penetration under Vishay's umbrella.

The integration of Ametherm's offerings, including their advanced thermistor solutions, positions Vishay to capture share in these dynamic fields. The medical device market alone is experiencing significant expansion, with an estimated compound annual growth rate (CAGR) of around 6-7% in the coming years. However, realizing the full potential of these product lines necessitates substantial investment for market share expansion and operational scaling.

Vishay's newly developed 650V E Series power MOSFETs, launched in March 2025, are positioned as stars in the BCG matrix. These devices target the growing power MOSFET market, offering high efficiency for critical sectors like telecom, industrial, and computing. Their advanced Gen 4.5 technology signifies a strong potential for future market leadership, though they are currently in the early stages of market penetration.

Vishay Intertechnology's advanced isolation amplifiers, launched in June 2025, represent a new product category within their portfolio. These high-reliability devices boast industry-leading Common Mode Transient Immunity, targeting high-growth sectors like medical instrumentation and industrial control systems.

As a recent entrant, these isolation amplifiers currently occupy a low market share. However, their specialized design for precision applications and placement in rapidly expanding end markets position them as potential stars in the BCG matrix, contingent on continued development and market adoption.

High-Performance Thick Film Power Resistors with NTC Thermistors

Vishay's new Thick Film Power Resistor with an integrated NTC thermistor and PC-TIM technology, launched in April 2025, fits squarely into the question marks category of the BCG matrix. This innovative product is designed for high-growth, emerging applications in modern electronics, particularly those requiring space efficiency and superior thermal management for high power dissipation.

As a recent market entrant, this resistor is still in its early stages of development and market penetration. While the market for advanced electronic components is expanding, Vishay needs to invest strategically to gain significant market share and establish a strong competitive position.

- Market Growth: The market for high-efficiency, space-saving electronic components is experiencing robust growth, driven by trends in electric vehicles, renewable energy systems, and advanced consumer electronics.

- Market Share: Currently, Vishay's market share for this specific product is nascent, necessitating increased marketing and sales efforts.

- Investment Needs: Significant investment in R&D, production scaling, and market development is required to transform this question mark into a star.

- Future Potential: Successful market adoption could lead to substantial future revenue streams if Vishay can effectively capture demand in this expanding niche.

Next-Generation Optoelectronic Components for Emerging Applications

Vishay Intertechnology is actively innovating in next-generation optoelectronic components, targeting emerging applications like advanced sensors for future energy technologies. These developments showcase a strategic push into nascent, high-growth markets that are still in their early stages of development.

These next-generation components are positioned as Vishay's "Question Marks" within the BCG framework. They require substantial investment in research and development, along with dedicated market cultivation efforts, to transition from speculative ventures to established product lines.

- Targeting Nascent Markets: Focus on specialized sensors for emerging sectors like future energy, indicating a strategy to capture future growth.

- High R&D Investment: These components necessitate significant capital expenditure in research and development to mature the technology.

- Market Development Needs: Significant effort is required to build awareness and adoption in these new application areas.

- Speculative Growth Potential: While not yet mainstream, these products represent potential for substantial future market share if successful.

Vishay's new Thick Film Power Resistor with an integrated NTC thermistor and PC-TIM technology, launched in April 2025, is a classic Question Mark. It targets high-growth sectors requiring space efficiency and superior thermal management, but as a recent entrant, its market share is minimal, demanding significant investment to climb the BCG matrix.

Similarly, Vishay's next-generation optoelectronic components for emerging applications like advanced sensors in future energy technologies are also Question Marks. These require substantial R&D and market cultivation to transform speculative ventures into established, high-growth product lines.

The key for these Question Mark products is strategic investment. Vishay must commit capital to research, production scaling, and market development to foster adoption and build market share in these promising, yet unproven, segments.

The challenge is to convert these high-potential but low-share products into Stars. This transition depends on Vishay's ability to effectively navigate nascent markets and capture emerging demand, particularly in areas like electric vehicles and renewable energy systems which are projected for significant growth.

| Product Category | BCG Classification | Market Growth | Current Market Share | Strategic Need |

|---|---|---|---|---|

| Thick Film Power Resistor w/ NTC Thermistor & PC-TIM | Question Mark | High (Emerging Applications) | Nascent | Significant Investment (R&D, Scaling, Marketing) |

| Next-Gen Optoelectronic Components (Future Energy Sensors) | Question Mark | High (Nascent Markets) | Minimal | Substantial R&D & Market Cultivation |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.