Vishay Intertechnology Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vishay Intertechnology Bundle

Vishay Intertechnology's marketing mix is a carefully orchestrated blend of advanced product offerings, strategic pricing, efficient global distribution, and targeted promotional activities. Their product portfolio, spanning a wide range of passive and active electronic components, addresses diverse industry needs. The company's pricing reflects its commitment to quality and innovation within the competitive semiconductor market.

Their "Place" strategy emphasizes broad accessibility through extensive distribution channels, ensuring their components reach manufacturers worldwide. Promotion focuses on technical expertise, reliability, and strong customer relationships, often leveraging industry trade shows and digital platforms to showcase their solutions.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Vishay Intertechnology's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a leading component manufacturer.

Product

Vishay Intertechnology boasts an exceptionally broad product catalog, recognized as one of the largest in the world for discrete semiconductors and passive electronic components. This extensive portfolio is a cornerstone of their marketing strategy, providing a one-stop shop for many manufacturers.

Their offerings encompass a vast array of critical electronic building blocks. This includes essential items like diodes, rectifiers, MOSFETs, optoelectronics, resistors, inductors, and capacitors, covering a significant portion of the electronic component landscape.

This comprehensive selection allows Vishay to cater to a wide spectrum of clients. Manufacturers of everything from consumer electronics and automotive systems to industrial equipment and medical devices rely on Vishay's diverse component range.

As of their latest reports, Vishay's commitment to a deep and varied component offering continues to be a primary driver of their market presence, supporting innovation across multiple high-growth sectors.

Vishay Intertechnology's components are foundational for advancements across critical sectors. In 2024, the automotive industry alone is projected to see a significant increase in electronic content per vehicle, driving demand for Vishay's automotive-grade resistors, capacitors, and diodes. Their products are also indispensable in industrial automation, powering everything from advanced robotics to sophisticated control systems.

The computing and telecommunications sectors rely heavily on Vishay's power management ICs and passive components for high-speed data transmission and efficient energy use. For instance, the ongoing expansion of 5G infrastructure in 2024-2025 necessitates robust and reliable components like those Vishay offers. Their reach extends to the demanding military, aerospace, and medical markets, where Vishay's high-reliability products are critical for mission-critical applications.

Vishay Intertechnology is strategically targeting high-growth technology sectors, a key element of its product strategy. This includes significant expansion in areas like e-mobility, artificial intelligence (AI), smart grid infrastructure, and sustainable energy solutions. For instance, Vishay's advancements in Silicon Carbide (SiC) MOSFETs and diodes are critical components for electric vehicles and the power management needs of AI servers, demonstrating a clear focus on future-facing markets.

Commitment to Quality and Reliability

Vishay Intertechnology places a paramount focus on the quality and reliability of its components, ensuring they meet rigorous industry standards. This commitment is particularly evident in their development of automotive-grade components, a segment that demands exceptional durability and consistent performance. For instance, Vishay has been actively expanding its manufacturing capacity for high-demand product lines throughout 2024 and into early 2025 to meet escalating customer needs.

This unwavering dedication to quality is not merely a selling point but a critical necessity for Vishay's products. Many of their components are integral to sensitive and mission-critical applications across diverse sectors like automotive, industrial, and medical. The company’s investment in advanced testing and quality control processes underpins its reputation for dependable solutions.

- Automotive-Grade Compliance: Vishay ensures its components meet stringent automotive qualifications, crucial for safety and performance in vehicles.

- Capacity Expansion: In 2024, Vishay increased production capacity for key product families, demonstrating a commitment to reliable supply.

- Critical Application Focus: High reliability is essential for components used in medical devices, aerospace, and industrial automation.

- Quality Assurance: Investments in advanced testing and manufacturing processes reinforce Vishay's reputation for dependable electronic components.

Innovation through R&D and Acquisitions

Vishay Intertechnology prioritizes innovation by consistently investing in research and development (R&D) and strategically acquiring companies to bolster its product offerings and address technological gaps. This dual approach fuels continuous advancement and expands its market presence.

Recent examples highlight this strategy. In 2023, Vishay acquired Ametherm, a move designed to significantly enhance its portfolio of inrush current limiters and thermistor solutions. Furthermore, the acquisition of the Newport facility in 2024 is set to dramatically increase Vishay's production capacity for Silicon Carbide (SiC) semiconductors, a critical component for next-generation power electronics.

These initiatives are crucial for maintaining Vishay's competitive edge. The company's commitment to R&D is reflected in its ongoing product development cycles, while acquisitions like Ametherm and the Newport factory expansion directly address market demand for advanced materials and increased manufacturing output. This ensures Vishay remains at the forefront of technological innovation in the semiconductor industry.

- R&D Investment: Vishay consistently allocates resources to internal R&D for new product creation and technology enhancement.

- Strategic Acquisitions: The company actively seeks and integrates businesses that complement its existing portfolio and technological capabilities, such as Ametherm and the Newport SiC facility.

- Product Portfolio Expansion: Acquisitions directly contribute to broadening Vishay's range of solutions, particularly in high-growth areas like advanced thermistors and SiC semiconductors.

- Market Reach Enhancement: By filling technology gaps and increasing production capacity, Vishay improves its ability to serve a wider customer base and meet escalating market demands.

Vishay's product strategy centers on an exceptionally broad and deep portfolio of discrete semiconductors and passive electronic components. This extensive range, one of the largest globally, positions Vishay as a convenient single source for manufacturers across numerous industries, from automotive to industrial and consumer electronics.

What is included in the product

This analysis offers a comprehensive review of Vishay Intertechnology's marketing mix, detailing their product portfolio, pricing strategies, distribution channels, and promotional activities to understand their market positioning.

This Vishay Intertechnology 4P's Marketing Mix Analysis provides a structured framework to identify and address potential market friction points, acting as a pain point reliever for strategic planning.

It simplifies complex marketing strategies into actionable insights, allowing for swift identification and resolution of challenges impacting Vishay's market presence.

Place

Vishay Intertechnology boasts a significant global manufacturing footprint, with operations strategically spread across the Americas, Europe, and Asia. This extensive network, comprising numerous facilities, underpins its ability to offer localized production and build a resilient supply chain. For instance, as of early 2024, Vishay operates over 20 manufacturing sites globally, a testament to its commitment to widespread operational reach.

This worldwide presence is crucial for optimizing production efficiencies and effectively serving a diverse international customer base. By having manufacturing capabilities in key regions, Vishay can better respond to regional market demands and reduce lead times. The company's continued investment in its manufacturing infrastructure, including the ongoing strategic restructuring, highlights its dedication to maintaining a competitive edge in the global market.

Vishay Intertechnology leverages a robust global distribution network alongside its direct sales force to ensure its components reach original equipment manufacturers (OEMs) and electronic manufacturing services (EMS) providers worldwide. This multi-channel strategy is vital for broad market penetration.

Key partnerships with major distributors, such as Mouser Electronics, play a significant role, especially in facilitating new product introductions and expanding reach to a diverse customer base. These collaborations are fundamental to Vishay's market strategy.

In fiscal year 2023, Vishay's revenue reached $3.04 billion, demonstrating the effectiveness of its extensive distribution channels in driving sales across various industries. This network allows for efficient delivery and support of their extensive product portfolio.

Vishay is actively boosting its manufacturing capabilities through substantial capital expenditures. These strategic investments are primarily focused on expanding capacity for high-demand product segments, such as power semiconductors. For instance, the company is increasing its MOSFET production capacity and investing in new wafer fabrication facilities.

These capacity enhancements are crucial for ensuring a consistent and reliable supply chain to meet escalating customer needs. By proactively investing, Vishay aims to position itself to capitalize on future market growth and navigate potential upturns effectively.

Optimized Supply Chain Management

Vishay Intertechnology places a strong emphasis on optimizing its supply chain for enhanced operational efficiency and cost control. This involves continuous efforts to streamline processes, from procurement to delivery, and strategically manage inventory levels to minimize holding costs and obsolescence. By focusing on these areas, Vishay aims to build a more agile and responsive supply chain.

Recent strategic initiatives underscore this commitment, with Vishay actively engaged in restructuring its manufacturing operations. These plans include consolidating production sites and strategically relocating manufacturing to optimize its global footprint. For instance, the company has been evaluating its facility network to identify opportunities for greater synergy and cost savings, a move projected to improve overall production economics.

The ultimate goal of these supply chain optimizations is to significantly improve cycle times, meaning the time from order placement to customer delivery. Enhanced logistical efficiency, including better transportation management and warehousing strategies, is also a key target. These improvements are crucial for meeting customer demands more effectively in a dynamic market environment.

- Focus on operational efficiency and cost management within the supply chain.

- Streamlining processes and reducing inventory levels are key objectives.

- Consolidation of manufacturing facilities and production transfers are part of recent restructuring plans.

- Aims to improve cycle times and enhance overall logistical efficiency.

Direct Sales and Customer Engagement

Vishay Intertechnology’s direct sales force is a cornerstone of its strategy, focusing on major original equipment manufacturers (OEMs) and fostering deep customer relationships. This approach allows for direct technical support and the development of customized solutions, crucial in the business-to-business electronics sector. The company’s Vishay 3.0 initiative emphasizes a ‘Think Customer First’ philosophy, aiming to boost service levels and responsiveness.

This direct engagement is particularly effective for understanding nuanced customer requirements and building enduring partnerships. For instance, in the semiconductor industry, where component selection profoundly impacts product performance and design cycles, direct interaction can accelerate design wins and reduce time-to-market for Vishay's clients.

- Direct Sales Teams: Dedicated personnel manage relationships with key OEMs, ensuring focused attention.

- Technical Support: Vishay offers in-depth engineering assistance to help customers integrate their components.

- Tailored Solutions: The company collaborates with clients to develop components that meet specific application needs.

- Customer-Centric Initiatives: Vishay 3.0’s ‘Think Customer First’ philosophy drives improvements in service and engagement.

Vishay's global manufacturing presence, with over 20 sites as of early 2024 across the Americas, Europe, and Asia, ensures localized production and supply chain resilience. This extensive network supports efficient production and caters to diverse international customer demands.

The company strategically leverages a robust global distribution network, including key partnerships with distributors like Mouser Electronics, to reach original equipment manufacturers (OEMs) and electronic manufacturing services (EMS) providers worldwide. This multi-channel approach is vital for broad market penetration and facilitating new product introductions.

Vishay is actively investing in its manufacturing capabilities, particularly in high-demand segments like power semiconductors, to boost capacity for MOSFETs and wafer fabrication facilities. These investments aim to ensure a consistent supply chain and capitalize on future market growth, supporting its fiscal year 2023 revenue of $3.04 billion.

Vishay's direct sales force focuses on major OEMs, offering technical support and tailored solutions, aligning with its Vishay 3.0 initiative's customer-centric approach. This direct engagement accelerates design wins and strengthens customer partnerships.

Preview the Actual Deliverable

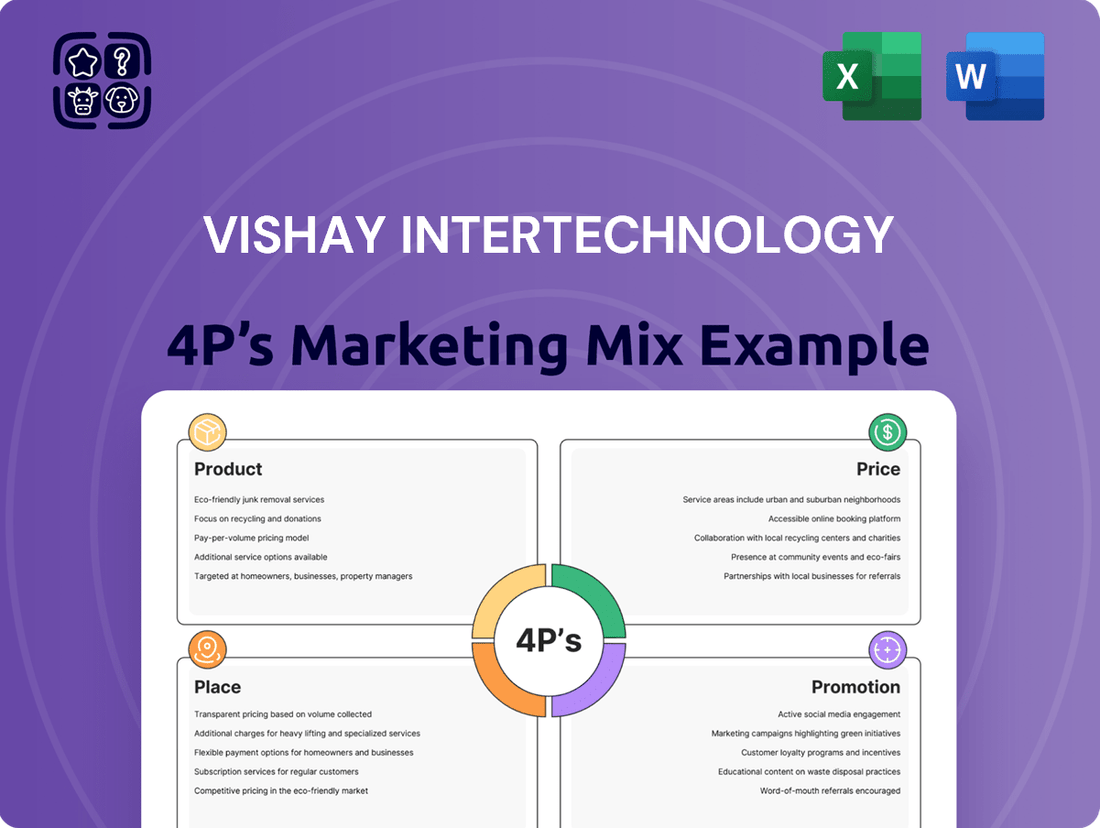

Vishay Intertechnology 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Vishay Intertechnology's 4P's Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, covering Product, Price, Place, and Promotion in detail. This isn't a teaser or a sample; it’s the actual content you’ll receive when you complete your order, offering valuable insights into Vishay's strategic approach.

Promotion

Vishay Intertechnology leverages industry trade shows like APEC (Applied Power Electronics Conference) and ELECRAMA to showcase its cutting-edge passive and semiconductor components. These events are crucial for demonstrating new product launches and technological innovations directly to a targeted audience.

In 2024, APEC saw significant activity, with Vishay highlighting its latest solutions for power management and electric vehicles, sectors experiencing rapid growth. For instance, the company showcased its new automotive-grade MOSFETs and high-voltage capacitors, critical for the evolving automotive and industrial power electronics markets.

Participation in these key events allows Vishay to foster direct engagement with both current and prospective customers. This interaction is vital for gathering market feedback, understanding emerging needs, and solidifying relationships within the power electronics and energy sectors, reinforcing their commitment to innovation.

Vishay Intertechnology leverages technical publications and online resources as a core element of its marketing strategy, recognizing the critical need for detailed product information among its target audience. These resources are essential for design engineers and procurement professionals who rely on precise specifications to integrate Vishay's components into complex electronic systems. For instance, during the 2023 fiscal year, Vishay published numerous updated datasheets and application notes, reflecting the continuous innovation in their product lines, particularly in power management and sensing technologies.

The company's website serves as a central hub, offering a comprehensive library of technical documentation, including thousands of datasheets, extensive application notes, and interactive design tools. This digital infrastructure ensures that potential customers can easily access the information needed to evaluate and select Vishay's offerings. In 2024, Vishay is further enhancing its online presence with a focus on user experience and accessibility for its global engineering community.

Beyond product-specific data, Vishay's investor relations portals provide crucial financial and strategic information, supporting financial analysts and stakeholders in their decision-making processes. These platforms offer insights into market trends and company performance, complementing the technical data with a broader business context. This dual approach to information dissemination underscores Vishay's commitment to transparency and support for its diverse customer base.

Vishay actively cultivates strategic partnerships with key distributors and influential industry organizations to significantly expand its market reach and effectively promote its diverse product portfolio. These collaborations are crucial for driving product adoption and increasing brand visibility across various sectors.

For example, Vishay's participation in Wales Tech Week 2025 serves as a prime illustration of its commitment to industry engagement and technology promotion. Furthermore, recognizing top-tier distributors such as Mouser Electronics highlights Vishay's dedication to fostering strong channel relationships, which are vital for customer access and sales growth.

These carefully chosen alliances act as powerful amplifiers for Vishay's market presence, allowing for more efficient product introduction and increased penetration into new and existing markets. In 2024, Vishay reported revenue of $3.1 billion, with a significant portion attributed to the success of its distribution channels and collaborative marketing initiatives.

Targeted Marketing for Key Segments

Vishay Intertechnology focuses its promotional efforts on specific, high-growth market segments. This targeted marketing strategy is crucial for maximizing impact and resource allocation. For instance, the automotive sector, a key area for Vishay, saw continued demand for its components in 2024, driven by trends in electrification and advanced driver-assistance systems (ADAS).

The company's messaging often emphasizes how its products enable technological advancements within these chosen segments. Vishay components are highlighted for their contributions to critical applications such as e-mobility solutions, which are experiencing robust growth, and the expansion of smart grid infrastructure, a vital area for energy efficiency. Furthermore, the burgeoning field of AI infrastructure relies heavily on the types of power management and sensing components Vishay provides.

This tailored approach ensures that Vishay's value proposition resonates with the specific needs and priorities of its target customers. By articulating how its solutions address key challenges and opportunities in areas like AI servers and industrial automation, Vishay effectively communicates its differentiators. This strategic focus on relevant market segments, supported by concrete examples of product application, strengthens its market position.

- Automotive Sector Growth: Vishay's components are integral to the increasing demand for electric vehicles and advanced driver-assistance systems.

- E-Mobility Contributions: The company's products play a role in the ongoing expansion and technological evolution of electric transportation.

- Smart Grid Advancement: Vishay's solutions support the development and implementation of more efficient and intelligent energy networks.

- AI Infrastructure Support: Key components from Vishay are essential for the performance and development of AI servers and related technologies.

Investor Relations and Corporate Communications

Vishay Intertechnology prioritizes investor relations and corporate communications to keep stakeholders informed. This includes regular financial result releases, earnings conference calls, and investor presentations detailing strategic initiatives like Vishay 3.0 and the company's future outlook. For example, in their Q1 2024 earnings call, Vishay reported a revenue of $772.0 million, demonstrating their commitment to transparent financial reporting.

These communications are crucial for enabling financially-literate decision-makers, including individual investors and financial professionals, to understand Vishay's performance and strategic direction. Clear and consistent information builds investor confidence and fosters a deeper market understanding of the company's value proposition.

- Financial Transparency: Regular updates on financial performance, including quarterly earnings reports.

- Strategic Communication: Detailed explanations of initiatives such as Vishay 3.0 to articulate growth strategies.

- Investor Engagement: Platforms like earnings calls and presentations facilitate direct interaction and information dissemination.

- Market Confidence: Open and honest communication aims to build trust and encourage informed investment decisions.

Vishay's promotional strategy is multi-faceted, emphasizing industry events, digital resources, strategic partnerships, and targeted market segment communication. This approach aims to inform and engage a diverse audience, from design engineers to financial analysts.

The company utilizes key trade shows like APEC to showcase innovations, particularly in high-growth areas such as automotive and e-mobility. In 2024, Vishay highlighted new automotive-grade MOSFETs and high-voltage capacitors at these events, directly engaging with potential customers and gathering market feedback.

Moreover, Vishay's robust online presence, featuring extensive technical datasheets and application notes, serves as a vital resource for engineers. This digital accessibility is complemented by clear investor relations communications, ensuring all stakeholders have access to critical financial and strategic information.

Vishay also actively fosters partnerships with distributors and industry organizations, which are critical for expanding market reach and driving product adoption, contributing to their reported 2024 revenue of $3.1 billion.

Price

Vishay's pricing for critical components like discrete semiconductors and passive electronic parts is deeply rooted in value-based strategies. These aren't just generic parts; they're the backbone of countless electronic devices, from automotive systems to medical equipment. The company’s pricing reflects the indispensable nature and high-stakes performance these components deliver.

The inherent value Vishay offers stems directly from the unwavering quality, proven reliability, and superior performance of its components, especially in challenging environments. This allows for pricing that acknowledges the crucial role these parts play in ensuring the functionality, safety, and overall effectiveness of the end product. For instance, Vishay's automotive-grade components must meet stringent reliability standards, justifying a premium.

Operating in a fiercely competitive global landscape, Vishay Intertechnology's pricing strategy is finely tuned to remain attractive while underscoring its technological prowess and superior product quality. The company diligently tracks competitor pricing benchmarks and evolving market demand, ensuring its offerings are compellingly positioned to capture customer interest.

This strategic approach to pricing is fundamental for Vishay to not only retain its existing market share but also to effectively secure new design wins, a critical driver for sustained growth in the semiconductor industry. For instance, in the first quarter of 2024, Vishay reported revenue of $790.6 million, demonstrating its ability to generate sales amidst intense competition.

Vishay Intertechnology, operating within a business-to-business framework, commonly employs volume discounts and long-term contracts. These strategies are crucial for securing large orders from original equipment manufacturers (OEMs) and electronic manufacturing services (EMS) providers, reflecting industry norms aimed at fostering stable partnerships and predictable revenue streams. For instance, in the semiconductor industry, which Vishay serves, such agreements can lock in pricing for extended periods, often 12-24 months, providing a hedge against market volatility for both supplier and buyer.

Impact of Raw Material Costs and Operational Efficiency

Vishay Intertechnology's pricing strategy is significantly shaped by the unpredictable nature of raw material costs, labor expenses, and depreciation charges. For instance, the semiconductor industry, where Vishay operates, often sees volatility in the prices of silicon wafers and specialized chemicals, directly impacting production expenses.

The company's commitment to operational efficiency, demonstrated through ongoing restructuring and manufacturing optimization, is crucial for offering competitive prices. By streamlining processes and reducing overhead, Vishay aims to mitigate the impact of rising input costs, allowing for more stable and attractive pricing for its diverse product portfolio.

These cost-reduction efforts directly translate into improved financial health, as evidenced by their gross margins. For the first quarter of 2024, Vishay reported a gross margin of 33.3%, up from 30.3% in the prior year's period, showcasing the positive effect of efficiency gains.

- Raw Material Volatility: Fluctuations in the cost of key inputs like silicon and rare earth metals can directly affect Vishay's cost of goods sold.

- Operational Efficiency Gains: Initiatives like factory consolidation and automation are designed to lower per-unit production costs.

- Impact on Gross Margins: Improved operational efficiency in Q1 2024 contributed to a gross margin of 33.3%, an increase from 30.3% in Q1 2023.

- Competitive Pricing: Cost savings allow Vishay to maintain competitive pricing in a crowded electronics market, balancing market share and profitability.

Strategic Investments and Future Growth Alignment

Vishay's pricing strategy is intrinsically linked to its significant capital expenditures, amounting to $249.8 million in 2023, dedicated to expanding production capacity and advancing technological capabilities. These investments are foundational for achieving future profitability targets and capturing growth in burgeoning technology markets.

The company's robust financial health, evidenced by a strong balance sheet and positive cash flow generation, provides the necessary flexibility for strategic pricing decisions and continued investment. This financial acumen underpins Vishay's ability to support higher growth trajectories.

- Capacity Expansion: Investments in new facilities and equipment to meet growing demand.

- Technological Development: Funding for R&D to enhance product performance and introduce new technologies.

- Financial Prudence: Maintaining a healthy balance sheet and consistent cash flow to support strategic initiatives.

- Market Alignment: Pricing structures designed to reflect value and foster growth in key sectors.

Vishay's pricing is a careful balance between reflecting the intrinsic value of its high-reliability components and remaining competitive. The company leverages its technological edge and strong brand reputation to justify premium pricing for critical applications, particularly in the automotive and industrial sectors. This is supported by their Q1 2024 revenue of $790.6 million, indicating success in translating value into sales.

To maintain market competitiveness, Vishay actively monitors competitor pricing and market demand, ensuring its value proposition is compelling. This strategy is vital for securing new design wins, a key growth driver in the semiconductor market.

Volume discounts and long-term contracts are standard for Vishay, fostering stable relationships with major customers like OEMs and EMS providers. These agreements, often spanning 12-24 months in the semiconductor industry, provide price stability for both Vishay and its clients amidst market fluctuations.

The company's pricing is also influenced by input costs, such as silicon and specialized chemicals, which can be volatile. However, operational efficiency gains, like those contributing to a Q1 2024 gross margin of 33.3% (up from 30.3% year-over-year), help mitigate these pressures and support competitive pricing.

| Metric | Value (Q1 2024) | Previous Year (Q1 2023) | Significance |

|---|---|---|---|

| Revenue | $790.6 million | N/A | Demonstrates sales generation in a competitive market. |

| Gross Margin | 33.3% | 30.3% | Highlights positive impact of efficiency on profitability. |

| Capital Expenditures | $249.8 million (FY 2023) | N/A | Supports capacity expansion and technological advancement, impacting future pricing. |

4P's Marketing Mix Analysis Data Sources

Our Vishay Intertechnology 4P's analysis is grounded in a comprehensive review of official company disclosures, including SEC filings and investor presentations. We supplement this with data from industry reports and competitive intelligence to provide a robust understanding of their market strategy.