Tryg SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tryg Bundle

Tryg, a leading Nordic insurance company, demonstrates robust strengths in its strong brand recognition and extensive customer base across its core markets. However, it faces external threats from increasing competition and evolving regulatory landscapes. Understanding these dynamics is crucial for any investor or strategist looking to navigate the insurance sector.

The company's opportunities lie in digital transformation and expanding its product offerings to meet changing consumer needs. Conversely, its weaknesses may include potential inefficiencies in legacy systems or a reliance on traditional distribution channels. Don't miss out on the complete picture.

Want the full story behind Tryg’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Tryg maintains its formidable position as the Nordic region's largest non-life insurance provider. The company holds a leading market share in Denmark and ranks among the top three in Norway and Sweden, serving over 5.3 million customers. This extensive footprint provides significant scale advantages and operational efficiencies. The successful integration of RSA's Scandinavian business has further solidified Tryg's dominance, creating a more balanced and resilient business profile across these key markets. This strategic expansion bolsters its competitive edge.

Tryg demonstrates exceptional profitability, consistently outperforming European peers with notably low combined ratios. In 2024, the company successfully met all financial targets, reporting a robust insurance service result of DKK 7,324 million and an impressive combined ratio of 81.0%. This strong financial position is further solidified by a high solvency ratio of 199% as of Q2 2025. Such financial strength enables significant shareholder returns through increased dividends and ongoing share buyback programs.

Tryg has demonstrated robust strategic execution, successfully de-risking its Corporate portfolio and achieving substantial synergies from the RSA Scandinavia acquisition. The company is on track to exceed its DKK 900 million synergy target from the RSA acquisition by year-end 2024, showcasing strong integration capabilities. Their 'United Towards '27' strategy targets further growth through enhanced scale, technical excellence, and customer focus. This includes leveraging their expanded size for IT system consolidation and realizing additional economies of scale in claims handling, aiming for sustained operational efficiency and market leadership into 2025.

Commitment to Digitalization and Innovation

Tryg demonstrates a strong commitment to digitalization, actively investing in technology to enhance both customer experience and operational efficiency. A prime example is their advanced use of AI to automate liability assessments for car collision claims in Denmark, a solution currently being expanded across Sweden and Norway by late 2024. This strategic focus aims to have over 70% of claims submitted digitally and a substantial portion settled via digital channels, significantly improving efficiency and customer satisfaction. The company targets continuous digital transformation to streamline processes and maintain its competitive edge in the Nordic insurance market.

- AI automates Danish car collision liability assessments, expanding to Sweden and Norway by Q4 2024.

- Goal: Over 70% of claims submitted digitally, enhancing operational efficiency.

Robust Shareholder Returns and Capital Management

Tryg demonstrates a robust commitment to shareholder value, consistently delivering strong returns through both dividend payments and active share buyback programs. This strategy is reinforced by a solid capital base and a highly resilient business model, enabling the company to navigate various economic landscapes effectively. For the 2025-2027 period, Tryg has set an ambitious target for shareholder remuneration, aiming for DKK 17-18 billion. This financial commitment underlines its stable performance and future outlook.

- Shareholder remuneration ambition: DKK 17-18 billion for 2025-2027.

- Consistent use of dividends and share buybacks.

- Supported by strong capital position and resilient business model.

Tryg dominates the Nordic non-life insurance market, serving over 5.3 million customers and achieving an 81.0% combined ratio in 2024. Its strong financial health, with a 199% solvency ratio as of Q2 2025, supports robust shareholder returns, targeting DKK 17-18 billion for 2025-2027. Strategic execution, including exceeding RSA synergy targets by 2024, and advanced digitalization, like AI-automated claims expanding by Q4 2024, cement its competitive edge.

| 2024 Combined Ratio | 81.0% | |||

| Q2 2025 Solvency Ratio | 199% | |||

| 2025-2027 Shareholder Remuneration Target | DKK 17-18 Billion |

What is included in the product

Analyzes Tryg’s competitive position through key internal and external factors.

Simplifies complex strategic thinking by offering a clear, actionable framework for identifying and leveraging Tryg's competitive advantages.

Weaknesses

Tryg's business remains heavily concentrated in the Nordic region, with over 90% of its gross written premiums stemming from Denmark, Norway, and Sweden as of its latest 2024 financial reporting. This substantial reliance on a single geographic area exposes the company to specific localized economic downturns, such as potential shifts in Nordic consumer spending or regulatory changes in any of these core markets. Such concentration inherently limits broader international diversification, potentially constraining long-term growth potential compared to global insurance peers. For instance, a significant economic slowdown in 2025 across Scandinavia could disproportionately impact Tryg's premium volumes and profitability.

Tryg's significant exposure to long-tail insurance lines, such as workers' compensation and liability, introduces considerable reserving risk. The ultimate cost of claims in these segments, which can extend over many years, remains uncertain, making accurate provisioning challenging. For instance, Tryg's Q1 2024 financial report highlighted ongoing attention to reserving adequacy, especially given current inflationary pressures affecting future claim payouts. Unforeseen shifts in legal interpretations or sustained inflation, potentially impacting the 2025 outlook, could necessitate further reserve strengthening, directly eroding profitability in these lines.

The highly competitive Nordic insurance market, featuring both established insurers and emerging insurtech challengers, poses a significant risk of customer churn for Tryg. In markets like Denmark and Norway, where annual switching of insurance providers is common, maintaining customer loyalty becomes particularly challenging. This intense competition, driven by aggressive pricing strategies and innovative product offerings, could lead to a decline in Tryg's customer base, impacting revenue streams. As of early 2025, market analysis indicates sustained pressure on retention metrics across the region, necessitating robust loyalty programs.

Valuation Concerns and Modest Growth Forecasts

Tryg's valuation metrics currently present a potential weakness, with its price-to-earnings ratio recently observed around 16.5x, surpassing the broader European insurance sector average of approximately 12.0x in early 2024. This suggests the stock may be fully valued, potentially limiting significant upside. Analysts project a modest annual earnings growth for Tryg of roughly 3-5% for 2024-2025, which could trail the market's overall expansion. Such forecasts might temper investor enthusiasm and restrict substantial share price appreciation in the near term.

- Tryg's P/E ratio: ~16.5x (early 2024)

- Sector average P/E: ~12.0x (early 2024)

- Projected EPS growth: 3-5% (2024-2025)

Dependence on Successful IT System Integration

Tryg's strategy hinges significantly on integrating IT systems from its acquisitions, especially RSA Scandinavia, to leverage its expanded scale. This large-scale IT integration is inherently complex, carrying substantial execution risk. Any delays or cost overruns, such as potential additional IT expenditure exceeding initial 2024 projections, could severely impact operational efficiency.

Operational disruptions from integration challenges might hinder Tryg's ability to realize anticipated synergies, affecting its financial performance through 2025.

- IT integration projects, like those following the RSA Scandinavia acquisition, pose significant operational risks.

- Delays or cost overruns could impact Tryg's efficiency and synergy realization targets for 2024 and 2025.

- Successful integration is critical for maximizing the benefits of Tryg's increased market presence.

Tryg's reliance on the Nordic region (over 90% of 2024 premiums) and significant long-tail insurance exposure introduce concentration and reserving risks. Its valuation, with a P/E ratio around 16.5x in early 2024, exceeds the sector average of 12.0x, potentially limiting upside. Furthermore, intense market competition and complex IT integration risks, particularly for 2024-2025, could hinder efficiency and synergy realization.

| Weakness Area | Key Metric (2024/2025) | Details |

|---|---|---|

| Geographic Concentration | Nordic Premiums: >90% | Exposes to localized economic downturns, limiting diversification. |

| Valuation | P/E Ratio: ~16.5x (early 2024) | Above sector average (~12.0x), modest EPS growth (3-5% 2024-2025). |

| Operational Risk | IT Integration Complexity | Potential for delays/cost overruns impacting 2025 synergies. |

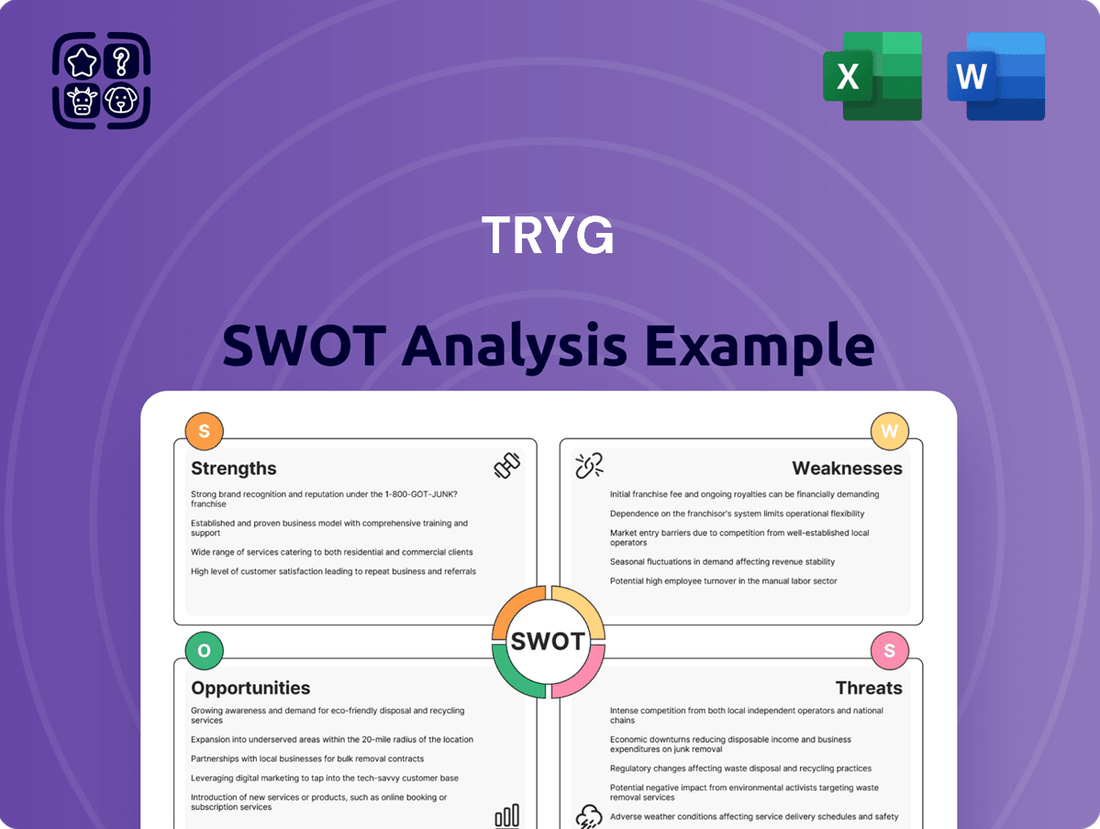

What You See Is What You Get

Tryg SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version. This ensures you know exactly what you're buying – a comprehensive and professionally crafted analysis of Tryg's strategic position. You'll gain valuable insights into the company's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Tryg has a strong opportunity to expand its digital and AI-powered services to enhance efficiency and customer experience. Building on success, such as the 2024 AI-driven claims processing pilots in Denmark that reduced handling times by up to 15%, scaling this across all Nordic markets can significantly lower operational costs and boost customer satisfaction. Continued investment in advanced digital platforms will streamline processes, allowing for the launch of innovative, personalized insurance products by mid-2025, further securing market leadership.

The burgeoning demand for sustainable products presents a significant opportunity for Tryg, especially as the global green economy expands. The insurance industry is seeing a notable shift, with an estimated 60% of consumers globally expressing interest in sustainable insurance options by 2024. Tryg can proactively develop and promote specialized green insurance products, such as policies tailored for the rapidly growing electric vehicle market, which is projected to see over 17 million units sold worldwide in 2024, or for large-scale renewable energy projects. This strategic alignment with broader environmental, social, and governance (ESG) trends not only strengthens Tryg's brand reputation but also attracts a new, environmentally conscious customer segment. The Nordic region, where Tryg operates, is particularly receptive to ESG initiatives, further enhancing this opportunity.

Tryg, following its acquisition of RSA's Scandinavian businesses, is poised to achieve significant economies of scale, targeting over DKK 1.2 billion in synergies by 2025.

This expanded scale allows the company to further streamline operations, optimize procurement, and enhance fraud prevention efforts, directly improving its insurance service result, which saw a robust 15.2% in Q1 2024.

By replicating successful commercial strategies and best practices across its Nordic markets, Tryg aims to boost profitability and deliver sustained value.

Expansion into New and Emerging Risk Areas

The evolving risk landscape presents significant opportunities for Tryg to offer new insurance products. There is a strong and growing demand for cyber-risk coverage, especially among small and medium-sized enterprises (SMEs) across the Nordic region. By developing expertise and innovative products in emerging areas like cyber insurance, Tryg can effectively tap into new revenue streams and meet the evolving needs of its customer base. The Nordic cyber insurance market is projected to grow substantially, offering a fertile ground for expansion.

- Global cyber insurance premiums are estimated to reach $20 billion by 2025.

- Nordic SMEs increasingly seek specialized protection against digital threats.

- Tryg's investment in new risk solutions can capture a share of this growing market.

Increased Market Consolidation and Strategic Partnerships

The European and Scandinavian insurance markets are currently experiencing a significant wave of consolidation, presenting Tryg with prime opportunities for strategic expansion. This trend allows a major player like Tryg to pursue further acquisitions, potentially expanding its geographical footprint or diversifying into new insurance segments. For instance, the market saw over 15 significant M&A deals across Europe in Q4 2024 alone, indicating robust activity. Additionally, forming strategic partnerships with emerging fintech or insurtech companies can enhance Tryg's product offerings and digital distribution channels, aligning with the projected 15% growth in digital insurance adoption by mid-2025.

- Market consolidation offers acquisition potential to expand Tryg's reach.

- Strategic partnerships can enhance product innovation and digital distribution.

- The European insurance M&A landscape remains active through 2025.

Tryg can leverage digital and AI advancements, such as scaling AI-driven claims processing, to enhance efficiency and launch innovative products by mid-2025. The growing demand for sustainable insurance, with 60% of consumers interested by 2024, offers a clear path for new green product development. Furthermore, strategic acquisitions amidst market consolidation and the burgeoning cyber insurance market, projected to reach $20 billion globally by 2025, present substantial growth avenues.

| Opportunity | Key Metric (2024/2025) | Impact |

|---|---|---|

| Digital & AI Expansion | AI claims processing reduced time by 15% (2024) | Lower operational costs, enhanced customer satisfaction |

| Sustainable Products | 60% of consumers interested in sustainable insurance (2024) | Attract new segments, strengthen ESG brand |

| Economies of Scale | DKK 1.2 billion in synergies targeted by 2025 | Improved profitability, optimized operations |

| Cyber Insurance | Global premiums estimated to reach $20 billion by 2025 | New revenue streams, meet evolving customer needs |

| Market Consolidation | 15+ M&A deals in Europe Q4 2024 | Strategic expansion, enhanced product offerings |

Threats

The Nordic insurance market faces intense competition, stemming from established players and agile insurtech startups, which collectively drive significant price pressure. This environment can lead to price wars, potentially impacting Tryg's net earned premiums, which stood at DKK 24.3 billion in Q1 2024, and eroding its market share. Competitors are rapidly innovating with digital services and new product offerings, such as usage-based insurance models, demanding continuous adaptation from Tryg to maintain its leading position and protect its profitability.

The increasing frequency and severity of climate-related events, such as heavy rainfall and storms, pose a significant threat to Tryg. As a non-life insurer, Tryg faces direct exposure to elevated claims, impacting its profitability and creating earnings volatility. For instance, severe weather events in 2023 led to increased claims costs across the Nordic region for insurers. Accurately pricing these evolving and unpredictable climate risks remains a substantial challenge for Tryg moving into 2024 and 2025.

The insurance sector faces extensive regulatory oversight, including stringent capital requirements under Solvency II, which Tryg consistently meets, maintaining a robust Solvency II ratio of 190% as of Q1 2024. Ongoing scrutiny from bodies like the Danish Consumer and Competition Authority, which investigated pricing practices in 2023, poses a continuous threat. New regulations, such as potential adjustments to premium tax frameworks or data privacy laws in 2025, could significantly alter Tryg's business model, escalate compliance costs, and potentially impact profitability margins.

Macroeconomic Volatility and Inflation

Economic headwinds, including persistent inflation and potential recessionary pressures, pose a significant threat to Tryg's profitability. High inflation directly elevates claims costs, with property and motor claims seeing increases, impacting underwriting margins if premium adjustments lag. For instance, European inflation rates, though moderating, still influence repair and replacement costs in 2024. Volatility in financial markets also erodes investment income, a crucial component of insurer earnings.

- Inflationary pressures in 2024 are projected to keep claims costs elevated, challenging Tryg's underwriting profitability.

- Potential for reduced investment returns as global financial market volatility persists through 2024 and early 2025.

- The European Central Bank's policy decisions in 2024 directly influence Tryg's investment portfolio performance.

Geopolitical Instability

The current geopolitical landscape introduces significant unpredictability, posing an indirect threat to Tryg's operations despite its strong Nordic focus. Broader global events, such as ongoing conflicts or trade tensions, can create ripple effects impacting the regional economy, disrupting supply chains, and increasing volatility in financial markets. For instance, the economic downturn in certain European sectors in late 2024 due to energy price fluctuations, partly driven by geopolitical events, could depress demand for insurance products or affect investment returns. This uncertainty ultimately impacts Tryg's investment portfolio performance and claims frequency, as seen with rising inflation pressures influencing repair costs in early 2025.

- Economic slowdowns stemming from geopolitical tensions could reduce premium growth across the Nordic insurance market in 2025.

- Increased inflation due to supply chain disruptions may elevate claims costs for property and casualty lines by 3-5% in 2024-2025.

- Financial market volatility can negatively impact Tryg's investment income, a key component of its profitability.

Tryg faces significant threats from intense market competition, driving price pressure and demanding continuous digital innovation. Increasing climate-related events elevate claims costs and challenge accurate risk pricing, impacting profitability. Economic headwinds, including persistent inflation and financial market volatility, erode underwriting margins and investment income. Additionally, evolving regulatory landscapes and geopolitical uncertainties pose ongoing compliance burdens and market risks through 2025.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Market Competition | Price erosion, market share pressure | Q1 2024 Net Earned Premiums: DKK 24.3 billion |

| Climate Risk | Elevated claims costs | Increased claims costs from severe weather in 2023 |

| Economic Headwinds | Inflationary claims, reduced investment income | European inflation influencing repair costs in 2024 |

| Regulatory Changes | Increased compliance costs | Solvency II ratio: 190% as of Q1 2024 |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Tryg's official financial reports, comprehensive market research, and reputable industry analysis to provide a well-rounded perspective.