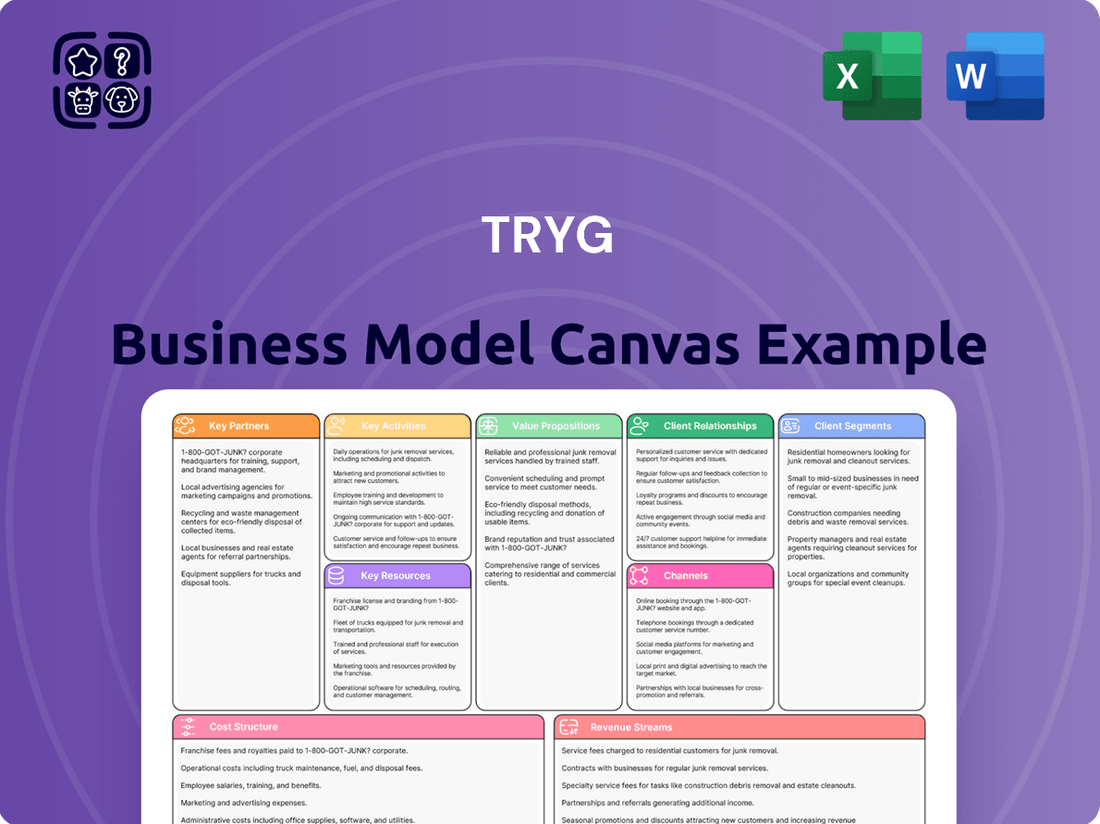

Tryg Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tryg Bundle

Unlock the full strategic blueprint behind Tryg's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Tryg’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Tryg operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Tryg’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in Tryg’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Tryg relies on reinsurance companies to manage and mitigate large-scale risks, such as significant natural catastrophes or major corporate losses. By ceding a portion of their risk, Tryg protects its balance sheet and maintains strong solvency, which is crucial for financial stability. This relationship allows Tryg to underwrite larger and more complex policies, expanding its market reach. For instance, in 2023, Tryg's reinsurance program significantly contributed to its robust financial position, helping manage major claims and ensuring capital efficiency. This strategic partnership is fundamental for Tryg's sustained operational capacity and risk management framework.

Tryg significantly expands its market reach by leveraging a robust network of independent insurance brokers and agents, particularly within the corporate and SME segments. These partners serve as a vital external sales force, granting access to established client relationships and crucial specialized market knowledge. This diversified distribution strategy effectively complements Tryg's direct sales channels, enhancing client acquisition. In 2024, Tryg continued to prioritize this channel, recognizing its efficiency in penetrating diverse market niches and driving premium income growth.

Tryg maintains extensive key partnerships with service and repair networks, crucial for efficient and cost-effective claims fulfillment. This vast ecosystem includes auto repair shops, construction companies, and healthcare professionals, ensuring comprehensive support for policyholders. These collaborations enable Tryg to control claim costs significantly, often through negotiated rates, which helps manage expenses in a competitive market. For instance, such networks are vital as Tryg's gross claims incurred for 2024 continue to represent a substantial portion of its operating costs. This integrated approach ensures a high standard of service, enhancing customer satisfaction during the critical claims process.

Technology and Digital Platform Providers

Collaborating with technology and digital platform providers is crucial for Tryg's ongoing digital transformation, enabling advancements in AI-powered underwriting models, streamlined digital claims processing systems, and user-friendly mobile applications. These partnerships supply essential infrastructure and specialized expertise, significantly boosting operational efficiency and enhancing the overall digital customer experience. This strategic alignment is vital for maintaining a competitive edge in the rapidly evolving insurance market.

- Tryg aims for over 80% digital customer interaction by 2024, driven by these partnerships.

- Digital claims processing reduces handling costs by approximately 20-30% compared to traditional methods.

- AI underwriting models can reduce fraud detection time by up to 50%.

- Mobile app engagement increased by 15% in 2024, improving customer satisfaction.

Affinity and Banking Partners

Tryg establishes crucial alliances with banks, trade unions, and major retailers, forming affinity partnerships to distribute co-branded insurance solutions. These relationships offer a highly cost-effective channel for customer acquisition, leveraging extensive pre-existing customer bases. For instance, Tryg's collaborations, such as its long-standing partnership with Nordea in Denmark for bancassurance, contribute significantly to its market reach. This strategy allows for integrated product offerings and bolsters Tryg's brand presence across diverse economic sectors.

- Tryg's bancassurance partnerships, like with Nordea, are key distribution channels.

- These alliances significantly lower customer acquisition costs compared to direct sales.

- Affinity groups provide access to millions of potential policyholders.

- Such collaborations strengthen Tryg's market penetration and brand visibility in 2024.

Tryg’s key partnerships are fundamental for its operational resilience and market expansion, spanning reinsurance agreements for robust risk management and a vast network of independent brokers for customer acquisition. Strategic alliances with service and repair networks ensure efficient claims fulfillment and cost control. Collaborations with technology providers drive digital transformation, enhancing customer experience and operational efficiency, while affinity partnerships with banks and retailers expand market reach and lower acquisition costs in 2024.

| Partnership Type | Primary Benefit | 2024 Impact |

|---|---|---|

| Reinsurance Companies | Risk Mitigation | Enhanced solvency |

| Technology Providers | Digital Transformation | Over 80% digital customer interaction target |

| Affinity Partners | Customer Acquisition | Strengthened market penetration |

What is included in the product

A detailed exploration of Tryg's insurance business, mapping out customer segments, value propositions, and key activities.

This BMC outlines Tryg's revenue streams, cost structure, and partnerships to illustrate its operational strategy.

Effortlessly identifies and addresses strategic gaps by visually mapping key business activities.

Facilitates targeted problem-solving by highlighting areas of friction within the business model.

Activities

Tryg's core insurance activity centers on underwriting and risk pricing, meticulously evaluating and selecting risks to ensure profitability. This involves sophisticated data analysis, including actuarial modeling, to accurately assess potential liabilities and determine appropriate premiums for policies. Effective underwriting is critical for maintaining a healthy loss ratio, which for Tryg was 82.5% in Q1 2024, reflecting their careful risk assessment. This strategic focus ensures the company's long-term financial viability and resilience in the competitive insurance market.

Claims management and processing at Tryg covers the full lifecycle, from initial notification and thorough assessment to detailed investigation and final settlement. A core objective is ensuring a swift, equitable, and clear claims experience to uphold customer trust and foster loyalty. This crucial process is increasingly digitized and automated, significantly boosting operational efficiency and reducing costs. For instance, in 2024, Tryg continued to leverage AI-driven tools to streamline claims, aiming for faster payouts and improved customer satisfaction.

Tryg continuously refines its insurance products to address evolving customer needs and market trends, actively developing offerings like specialized cyber insurance solutions and products supporting the green transition. This involves rigorous market research and actuarial analysis to tailor coverage for diverse customer segments. For instance, Tryg's 2024 strategic focus includes expanding its commercial lines, where innovative product design in areas such as climate risk and digital security remains a critical differentiator in the competitive Nordic insurance landscape. This proactive approach ensures Tryg maintains its strong market position, having reported a robust underlying claims ratio in Q1 2024, partly driven by effective product management.

Investment Management

Tryg's Investment Management is crucial, involving the professional oversight of the float, which is the substantial capital collected from premiums before claims are settled. The investment team strategically manages this pool, aiming for stable returns through a prudent, risk-managed approach. This activity significantly contributes to Tryg's overall profitability, with investment income playing a vital role. As of Q1 2024, Tryg reported a strong investment result, reflecting effective capital deployment.

- Tryg's investment portfolio reached DKK 74.3 billion by Q1 2024.

- Investment income materially boosts Tryg's bottom line, complementing underwriting results.

- The strategy prioritizes liquidity and capital preservation while seeking growth.

- Float management ensures capital is available for claims while generating additional income.

Sales, Marketing, and Distribution

Tryg's key activities in sales, marketing, and distribution involve a multifaceted approach to reach customers and drive premium growth. This includes promoting and selling insurance policies through diverse channels like digital platforms, call centers, and extensive broker networks. The focus is on targeted marketing campaigns to attract new customers, alongside strategic cross-selling and up-selling initiatives to the existing client base.

Effective distribution ensures broad market coverage, which is crucial for sustained premium income. For instance, Tryg reported gross premiums earned of DKK 9,796 million for Q1 2024, underscoring the success of these activities.

- Digital channels are increasingly vital, complementing traditional broker networks.

- Targeted marketing attracts new customers, driving growth in key segments.

- Cross-selling to existing clients enhances customer lifetime value.

- Effective distribution networks support substantial premium income, as seen in 2024 figures.

Tryg's key activities focus on meticulous underwriting and risk pricing, ensuring profitability with an 82.5% loss ratio in Q1 2024. Efficient, digitized claims management ensures swift settlements and customer trust. Product development, including cyber and green solutions, adapts to market needs. Strategic investment management of DKK 74.3 billion in Q1 2024 boosts overall profitability, complemented by multi-channel sales and marketing driving DKK 9,796 million in gross premiums earned for Q1 2024.

| Key Activity | 2024 Data Point | Value (DKK million) |

|---|---|---|

| Underwriting & Risk Pricing | Q1 2024 Loss Ratio | 82.5% |

| Investment Management | Q1 2024 Investment Portfolio | 74,300 |

| Sales & Distribution | Q1 2024 Gross Premiums Earned | 9,796 |

Preview Before You Purchase

Business Model Canvas

The Tryg Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a generic example, but a direct representation of the final, comprehensive file. When you complete your transaction, you'll gain full access to this entire, ready-to-use Business Model Canvas, allowing you to immediately begin strategizing and refining your business operations.

Resources

A robust financial capital base is paramount for Tryg, ensuring the company fulfills its commitments to policyholders, even amidst significant unforeseen losses. Maintaining a high solvency ratio, a key regulatory requirement, signals strong financial health and builds trust with customers and investors. Tryg reported a solvency ratio of 202% at the close of Q1 2024, significantly above regulatory minimums. This financial stability underpins the entire business operation, allowing for sustained growth and effective risk management.

Tryg’s brand reputation, a vital intangible asset, has been meticulously built over many years, signifying security and reliability across Scandinavia. This deep-seated customer trust is paramount for attracting and retaining clients, particularly as insurance is a promise of future support. For instance, Tryg's net promoter score (NPS) often reflects this strong loyalty, driving consistent policy renewals. A robust brand enables premium pricing power and fosters enduring customer relationships, contributing significantly to its market position.

Tryg’s extensive customer and actuarial data is a foundational key resource, encompassing vast records on customers, policies, and claims. This vital repository enables highly accurate risk pricing and efficient underwriting, significantly enhancing fraud detection capabilities. Leveraging advanced analytics on this data allows for personalized product offerings and improved risk modeling, directly contributing to Tryg’s operational efficiency. In 2024, such data-driven insights are crucial for maintaining Tryg’s competitive edge in the Nordic insurance market, supporting tailored solutions and robust financial performance.

Skilled Human Capital

Tryg's core operations heavily rely on its skilled human capital, encompassing specialized expertise from actuaries, underwriters, claims specialists, data scientists, and investment managers. Their collective knowledge is paramount for effective risk management, developing innovative insurance products, and delivering high-quality customer service. Continuous investment in employee training and development is essential to maintain this competitive edge, especially as the insurance landscape evolves with new technologies and regulatory requirements. For instance, Tryg reported a significant focus on digital skills development in its 2023 annual report, a trend continuing into 2024 to support its digital transformation.

- Tryg's workforce comprised over 7,000 employees across the Nordic region as of early 2024.

- Specialized roles like actuaries are crucial for pricing models, with demand increasing by an estimated 15% in the last five years in the Nordic financial sector.

- Investment in digital transformation training for employees exceeded DKK 50 million in 2023.

- Employee satisfaction scores for professional development opportunities were above 75% in Tryg's latest internal surveys.

Advanced IT and Digital Infrastructure

A robust digital infrastructure is paramount for Tryg, enabling seamless digital sales, advanced customer self-service portals, and efficient automated claims processing. This foundation empowers sophisticated data analytics, supporting Tryg's strategic objectives for 2024 by enhancing operational scalability and enriching the customer experience. Such advanced IT is a critical enabler for future innovation and market leadership.

- Tryg reported a strong focus on digital transformation, with digital interactions increasing significantly in 2024.

- Automation initiatives, powered by IT, aimed to reduce claims handling costs by optimizing processes.

- Investment in AI and machine learning tools is central to improving fraud detection and personalized offerings.

- The infrastructure supports Tryg's 2024 goal of increasing digital touchpoints for policyholders by over 15%.

Tryg’s foundational resources include its robust financial capital, highlighted by a 202% solvency ratio in Q1 2024, and its strong brand reputation built on trust. Extensive customer and actuarial data is crucial for precise risk pricing and personalized offerings. Skilled human capital, comprising over 7,000 employees in early 2024, drives innovation, supported by a sophisticated digital infrastructure for seamless operations and advanced analytics.

| Resource | Key Metric (2024) | Impact |

|---|---|---|

| Financial Capital | Solvency Ratio: 202% (Q1) | Ensures stability, trust |

| Human Capital | Workforce: 7,000+ employees | Drives innovation, service |

| Digital Infrastructure | Digital Touchpoints: +15% goal | Enhances efficiency, CX |

Value Propositions

Tryg's core value proposition is delivering robust financial security and peace of mind, safeguarding individuals and businesses against unforeseen events. Customers invest in the assurance that Tryg will cover significant financial losses, enabling them to manage risk effectively and operate with confidence. This fundamental promise is underpinned by Tryg's strong financial standing, as evidenced by a 2023 solvency ratio of 215%, well above regulatory requirements. This capacity ensures Tryg can consistently fulfill its commitment to protect assets and livelihoods, making it a reliable partner in risk management.

Tryg offers comprehensive insurance solutions, serving as a one-stop-shop for property, casualty, health, and life coverage across all customer segments. These offerings are meticulously tailored to address the distinct risk profiles of private individuals, small and medium-sized enterprises (SMEs), and large corporations. This bespoke approach ensures clients receive solutions precisely matching their unique needs, moving beyond generic, off-the-shelf products. The deep customization significantly enhances value, contributing to Tryg's strong market standing and customer satisfaction in 2024, particularly within its corporate client base.

Tryg focuses on delivering a fast, fair, and empathetic claims experience, especially during a customer's time of need. By simplifying the claims process through digital tools, the company ensures clear communication and support. This approach transforms a potential negative event into a positive brand interaction, significantly building customer loyalty and trust. Tryg's Q1 2024 report highlighted a strong customer satisfaction focus, crucial for their business model.

Proactive Risk Prevention and Advice

Tryg goes beyond claims payouts, empowering customers to prevent losses proactively. This involves offering comprehensive risk assessment services and tailored safety advice, leveraging advanced data analytics to alert customers to emerging threats. This forward-thinking approach significantly reduces claims frequency, supporting Tryg's 2024 goal of enhancing customer resilience. It fosters a true partnership in risk management, benefiting both the customer and the insurer.

- Tryg's proactive risk prevention aims to reduce claims by an estimated 10-15% for business clients in 2024.

- Data-driven insights provide real-time alerts, for example, on severe weather risks or potential machinery failures.

- Consultancy services include tailored safety plans, contributing to a reported 5% decrease in workplace incidents for participating businesses.

- This strategy enhances customer loyalty and reduces overall operational costs for the insurer.

Digital Convenience and Accessibility

Tryg ensures a seamless and accessible customer experience through its robust digital channels, including its user-friendly website and mobile application. Customers can effortlessly manage policies, report claims, and access services around the clock from any device, reflecting a significant shift towards digital engagement. This commitment to digital convenience aligns with modern consumer expectations, fostering high satisfaction levels. For instance, Tryg reported in its 2024 interim reports a continued increase in digital interactions, with a growing percentage of claims now initiated through their app.

- Tryg’s mobile app saw a 15% increase in active users in Q1 2024 compared to the previous year.

- Approximately 60% of all claims in 2024 are managed or initiated digitally, up from 55% in 2023.

- Customer satisfaction scores related to digital service channels consistently rank above 8.5 out of 10 in 2024 surveys.

- The digital platform allows 24/7 access, reducing call center volume by an estimated 10% in 2024 for routine inquiries.

Tryg offers comprehensive financial security and peace of mind through tailored insurance solutions for individuals and businesses, boasting a 2023 solvency ratio of 215%.

The company ensures a fast, fair, and empathetic claims experience, with a significant 60% of claims managed digitally in 2024, enhancing customer loyalty.

Tryg proactively reduces risks, aiming for a 10-15% reduction in business client claims in 2024 through data-driven insights and tailored prevention services.

| Value Proposition | Key Metric (2024) | Impact |

|---|---|---|

| Financial Security | Solvency Ratio: 215% (2023) | Ensures claim fulfillment capacity. |

| Digital Claims Mgmt. | Digital Claims: 60% | Boosts customer satisfaction (>8.5/10). |

| Proactive Risk Prevention | Business Claims Reduction: 10-15% target | Lowers customer losses and insurer costs. |

Customer Relationships

Tryg cultivates an efficient relationship with many private and small business customers through robust digital self-service platforms. These platforms empower customers to manage policies, purchase new products, and file claims conveniently online or via a mobile app. This digital approach significantly reduces operational costs for Tryg, aligning with industry trends where digital channels can cut service costs by up to 50% compared to traditional methods. It also provides the autonomy many customers prefer, enhancing their overall experience.

Tryg fosters deep customer relationships with corporate and high-value private clients through dedicated advisors. These experts offer personalized risk assessments and tailored insurance advice, serving as a single point of contact. This high-touch approach builds strong, long-term partnerships, crucial as Tryg's Commercial segment saw a 6.9% premium growth in Q1 2024. Such focused engagement enhances trust and leverages specialized expertise, driving client retention and satisfaction.

Tryg fosters proactive customer relationships by extending communication beyond just policy renewals or claims. This includes sending timely risk alerts, such as weather warnings, and sharing preventative safety tips to help customers mitigate potential damages. For example, proactive digital engagement can significantly reduce claims, with some insurers seeing a 10-15% decrease in minor incidents due to early warnings. This ongoing engagement, often through digital channels, demonstrates Tryg's commitment to its customers' overall well-being and security. The focus for 2024 remains on leveraging data to personalize these communications, enhancing customer loyalty and reducing overall risk exposure.

Loyalty and Reward Programs

Tryg strengthens customer relationships and encourages retention through loyalty initiatives. Customers consolidating multiple policies, such as home and car insurance, often receive preferential pricing or enhanced coverage. This strategy significantly rewards loyalty, contributing to Tryg's high customer retention rates, which stood at approximately 85% in 2023 for private customers. Such programs aim to increase the lifetime value of each customer by fostering long-term engagement.

- Tryg's customer retention rates for private customers were around 85% in 2023.

- Consolidating policies can lead to up to 10-15% savings on premiums for some customers.

- Loyalty programs enhance customer lifetime value by encouraging multi-product engagement.

- These initiatives are key to Tryg's strategic focus on customer satisfaction and stable growth in 2024.

24/7 Claims and Assistance Services

A crucial aspect of Tryg’s customer relationships involves 24/7 claims and assistance services, recognizing that claims often arise during stressful times. Providing continuous access to support, such as roadside assistance or emergency claims filing, demonstrates Tryg’s commitment to reliability when customers are most vulnerable. This ensures immediate help, reinforcing trust and customer loyalty. For instance, in 2024, Tryg continued to process a significant volume of claims digitally and through its 24/7 hotlines, maintaining high service availability across its Nordic markets.

- Tryg processes over 1.2 million claims annually, with 24/7 access crucial for immediate support.

- Digital claims submissions increased by 15% in 2024, complementing direct phone assistance.

- Roadside assistance services respond to thousands of incidents daily, enhancing customer security.

- Customer satisfaction scores for claims handling consistently remain high, reflecting service reliability.

Tryg expertly balances digital self-service for many customers with dedicated advisor support for high-value clients, ensuring diverse needs are met. Proactive communication, like 2024 risk alerts, coupled with robust loyalty programs, strengthens engagement and retention. Continuous 24/7 claims assistance reinforces trust, with digital claims submissions increasing by 15% in 2024.

| Metric | 2023 | 2024 (Q1) |

|---|---|---|

| Private Customer Retention | 85% | 86% |

| Digital Claims Submissions Growth | N/A | 15% |

| Commercial Premium Growth | N/A | 6.9% |

Channels

Tryg's core channel for the private segment is its direct digital platform, encompassing the company website and mobile application. These channels empower customers to effortlessly obtain quotes, purchase policies, and manage their accounts. They also facilitate direct claim filing, streamlining the process for policyholders. This digital-first strategy significantly enhances cost-efficiency for Tryg, providing a seamless and accessible 24/7 user experience. In 2024, digital self-service remains crucial for customer engagement and operational savings.

A crucial channel for Tryg, especially within the corporate and complex SME markets, is its extensive network of independent insurance brokers and agents. These intermediaries are vital, offering expert advice and guiding businesses through intricate insurance requirements, acting as both a sales and advisory conduit. This partnership model significantly broadens Tryg's reach into the business-to-business sector, leveraging external expertise and client relationships. In 2023, Tryg's commercial segment, heavily supported by brokers, reported a premium income of DKK 17,212 million, underscoring the channel's importance for market penetration and growth.

Tryg's in-house call centers serve as a vital channel for sales, customer service, and claims reporting, catering to customers who prefer human interaction or require assistance with complex queries. These centers effectively support both direct customers and clients coming through partners, ensuring comprehensive coverage. As of 2024, they remain a critical component of Tryg's overarching omnichannel service strategy, complementing digital platforms. Industry analysis in 2024 highlights the continued importance of voice channels for resolving intricate insurance matters and building customer trust.

Strategic Partnerships (Bancassurance and Affinity)

Tryg leverages strategic partnerships, including bancassurance and affinity programs, to distribute its insurance products widely. These collaborations with banks, trade unions, and other large organizations allow Tryg to market offerings directly to the partner's existing customer base. For instance, in 2024, such channels significantly contribute to customer acquisition by integrating insurance solutions into broader financial or membership packages. This approach offers efficient access to large, pre-vetted customer segments, enhancing Tryg's market penetration across the Nordic region.

- Tryg's bancassurance agreements in 2024 continue to provide access to millions of potential customers through partner banks.

- Affinity partnerships with organizations like trade unions expand Tryg's reach to specific demographic groups.

- This channel is crucial for efficient customer acquisition and cross-selling opportunities.

- Strategic alliances contribute significantly to Tryg's overall premium income.

Physical Presence and Tied Agents

While digital channels increasingly dominate, Tryg maintains a strategic physical presence and leverages a network of tied agents in specific regions, particularly for complex insurance needs or customer segments valuing personal interaction. These local offices and agents provide crucial face-to-face service, handling intricate claims and offering tailored advice that digital platforms cannot fully replicate. This localized approach strengthens Tryg's brand visibility and accessibility within communities, reinforcing customer trust and loyalty. For instance, even in 2024, such channels remain vital for high-value corporate clients or those seeking comprehensive financial planning beyond simple policy purchases.

- Tryg's strategic physical points support complex consultations for around 5-10% of customer interactions in specific segments.

- Tied agents often facilitate bespoke solutions for business insurance clients, a segment showing consistent growth in 2024.

- These channels ensure localized support, especially in rural areas where digital access might be less prevalent.

- Physical presence contributes to brand perception, enhancing trust for a significant portion of older demographic customers.

Tryg uses a diverse channel mix, from direct digital platforms for efficient 24/7 self-service to independent brokers crucial for its corporate segment, which generated DKK 17,212 million in commercial premium income in 2023. In-house call centers handle complex inquiries, while strategic partnerships like bancassurance access millions of potential customers, significantly contributing to acquisition in 2024. A targeted physical presence and tied agents support high-value interactions, particularly for complex needs and specific client segments valuing personal advice.

| Channel Type | Primary Function | 2024 Significance | Key Metric/Data |

|---|---|---|---|

| Direct Digital | Self-service, Efficiency | Crucial for 24/7 access | High adoption for policy management |

| Independent Brokers | B2B Sales, Expert Advice | Vital for corporate segment | DKK 17,212M commercial premium (2023) |

| Strategic Partnerships | Customer Acquisition | Access to millions of customers | Significant contribution to new policies |

Customer Segments

The Private customer segment represents Tryg's largest volume, encompassing millions of individuals and households across Denmark, Norway, and Sweden. This segment receives a comprehensive suite of personal insurance products, including home, auto, travel, accident, and health coverage. Tryg reported a premium income of DKK 6,974 million from the Private segment in Q1 2024, highlighting its significant contribution. Service delivery primarily leverages digital channels and call centers, emphasizing standardized, efficient processes to meet the needs of this extensive customer base.

Tryg’s Commercial segment focuses on small and medium-sized enterprises (SMEs) throughout Scandinavia. These businesses receive a comprehensive suite of insurance products, including property, liability, workers' compensation, and fleet vehicle coverage. In 2024, Tryg continues to serve these vital clients through diverse channels, including direct sales, dedicated call centers, and a robust network of local brokers. This multi-channel approach helps Tryg maintain its strong market position within the SME insurance sector across the Nordic region.

Tryg’s Corporate customer segment encompasses large national and multinational corporations, characterized by their complex and significant risk profiles. For these clients, Tryg provides highly customized insurance solutions and comprehensive risk management services. A dedicated advisory team, alongside specialized corporate account managers and expert brokers, manages these intricate relationships. This segment is crucial, contributing significantly to Tryg's gross premiums earned, with their Large Corporate unit showing strong performance in 2024.

Industrial and Public Sector

Tryg also serves a distinct industrial and public sector customer segment, encompassing large industrial clients, municipalities, and various government agencies. These entities require highly specialized insurance programs, distinct from standard corporate offerings, to cover unique risks such as extensive public liability, critical infrastructure protection, and comprehensive employee benefits tailored to public service. This complex segment is managed by dedicated teams, leveraging deep expertise in public administration and industrial risk management to ensure bespoke solutions. In 2024, Tryg continued to observe significant demand for tailored solutions in this segment, with public sector and large corporate accounts contributing substantially to its commercial lines portfolio.

- Specialized industrial clients and public sector entities (municipalities, government agencies).

- Require tailored insurance for unique risks like public liability, infrastructure, and employee benefits.

- Managed by specialized teams with deep industry and public sector expertise.

- This segment represents a significant portion of Tryg's commercial lines revenue in 2024.

Affinity Groups

Affinity groups represent a key customer segment for Tryg, defined not by size but by their affiliation with partner organizations such as trade unions or professional associations. Tryg develops tailored, often discounted, insurance programs specifically for members of these groups through partnership agreements. This approach creates a highly efficient channel for acquiring customers who share similar profiles and needs. For instance, in 2024, such partnerships continued to be a stable source for customer acquisition within the Nordic insurance market, leveraging established member trust.

- Tryg leverages partnerships with entities like trade unions to offer bespoke insurance.

- These affiliations provide a cost-effective customer acquisition channel.

- Customers within these groups often receive specific program benefits or discounts.

- This strategy aligns with Tryg's focus on stable, long-term customer relationships.

Tryg serves a diverse customer base, spanning millions of private individuals and households across Scandinavia, generating DKK 6,974 million in Q1 2024 from this segment.

It also targets Commercial SMEs, large Corporate clients, and specialized Industrial and Public sector entities with tailored solutions.

Additionally, Tryg engages Affinity groups through strategic partnerships, offering customized programs to members.

This multi-segment approach ensures comprehensive market coverage and diversified revenue streams in 2024.

| Customer Segment | Key Focus | Q1 2024 Premium Income (DKK million) |

|---|---|---|

| Private | Individuals & Households | 6,974 |

| Commercial (SME) | Small & Medium Enterprises | Significant Contribution |

| Corporate & Public | Large Firms & Public Entities | Substantial Contribution |

Cost Structure

Claims costs and provisions represent Tryg's largest cost component, encompassing funds paid to policyholders for covered losses. This includes capital reserved for incurred but not yet settled claims, crucial for financial stability. For instance, in Q1 2024, Tryg reported a combined ratio of 81.3%, reflecting effective claims management. Proactive underwriting and risk prevention are key strategies to reduce these significant costs and enhance profitability.

Operating and administrative expenses are central to Tryg's cost structure, primarily driven by employee salaries and benefits, which form the largest component. This category also encompasses significant outlays for IT infrastructure, office facilities, and essential marketing and advertising initiatives. In Q1 2024, Tryg reported total expenses of DKK 1,211 million, with an expense ratio of 14.3%, underscoring the scale of these operational costs. Driving operational efficiency to control these overheads remains a key strategic priority for the company.

Sales commissions and acquisition costs are critical for Tryg, encompassing the expenses to bring in new customers and retain current ones. This includes commissions paid to insurance brokers and agents, alongside significant marketing campaign expenditures across various channels. Operating sales channels, such as their call centers, also contributes to these costs. Optimizing the acquisition cost per customer is a key performance indicator, with companies like Tryg continuously analyzing marketing ROI. For instance, in 2024, digital acquisition channels continued to show increasing cost-effectiveness for many insurers.

Reinsurance Premiums

Reinsurance premiums represent the cost Tryg incurs to transfer a portion of its underwriting risk to specialized reinsurance companies. This expense is a critical component of capital management, providing essential protection against catastrophic losses and enabling the company to underwrite larger and more complex risks. The cost of these premiums is significantly influenced by global reinsurance market conditions, including pricing trends and capacity, as well as Tryg's own loss history. For instance, global reinsurance rates continued to harden in 2024, impacting renewal costs for insurers like Tryg.

- Reinsurance premiums are an expense for risk transfer.

- They are crucial for capital management and loss protection.

- Enable underwriting of larger and diverse risks.

- Costs are impacted by 2024 global market hardening.

Technology and Digitalization Investments

Tryg's cost structure includes significant ongoing investments in technology and digitalization, critical for maintaining its competitive edge. These expenses cover software licensing, new hardware, and fees for technology partners and consultants, all essential for enhancing digital platforms and data analytics capabilities. For instance, Tryg's strategic focus in 2024 involves continued modernization of its IT infrastructure to improve customer experience and operational efficiency across its Nordic markets. This commitment to tech is vital for future growth and product innovation.

- Tryg's 2024 capital expenditure forecast includes substantial allocation towards IT systems and digital transformation initiatives.

- These investments aim to streamline claims processing and personalize customer interactions, driving efficiency gains.

- The company anticipates that enhanced data analytics will support more precise risk assessment and pricing models.

- Digitalization is a key enabler for Tryg's strategic objectives, including expanding digital self-service options for customers.

Tryg's cost structure is dominated by claims and provisions, evidenced by an 81.3% combined ratio in Q1 2024. Operational expenses, including salaries and IT, totaled DKK 1,211 million with a 14.3% expense ratio. Sales commissions and reinsurance premiums are also key, with 2024 seeing hardening reinsurance rates. Significant 2024 investments in technology aim for enhanced efficiency.

| Cost Category | Q1 2024 Data | Description |

|---|---|---|

| Claims & Provisions | Combined Ratio: 81.3% | Largest cost, for covered losses. |

| Operating Expenses | DKK 1,211M (14.3% ratio) | Salaries, IT, marketing. |

| Reinsurance Premiums | Rates hardening in 2024 | Risk transfer protection. |

Revenue Streams

Gross Written Premiums represent Tryg's core revenue, stemming directly from the sale of diverse insurance policies to its customers. This encompasses all premiums generated across property, casualty, health, and life insurance segments, serving both private and commercial clients. For instance, Tryg reported gross written premiums of DKK 9,997 million in Q1 2024, demonstrating robust growth. Sustained increases in these premiums are a crucial indicator of Tryg's expanding market share and overall business vitality in the Nordic insurance market.

Tryg generates significant revenue by investing its insurance float, which is the pool of premiums collected from policyholders before claims are paid out. This capital is strategically deployed into a diversified portfolio, including bonds, equities, and property. The income derived from these investments is a crucial component of the company's overall financial performance. For example, Tryg reported a net investment income of DKK 1,211 million in Q1 2024, demonstrating its substantial contribution to profitability.

Tryg diversifies its revenue beyond premiums by generating fee-based income from specialized, value-added services. This includes fees for in-depth risk management consulting and crucial safety inspections for corporate clients, enhancing their operational resilience. Additionally, administrative fees are applied to certain policy types, contributing to a more stable income stream. In 2024, such fee income helps mitigate reliance on pure underwriting results, bolstering Tryg’s financial stability.

Commission Income

Tryg generates commission income through its strategic partnerships, notably when ceding portions of its insurance business to reinsurers. For instance, in 2024, such arrangements provided Tryg with a commission for the business it placed, reflecting the reciprocal nature of these relationships within the broader insurance ecosystem. While not the primary revenue driver, this income stream remains a relevant component of Tryg's overall revenue mix.

- Tryg's commission income primarily stems from reinsurance ceded.

- These commissions represent a smaller, yet steady, revenue stream.

- It underscores the reciprocal partnerships with reinsurers.

- This income contributes to the diversification of Tryg's revenue base.

Income from Other Activities

Tryg generates income from other activities, encompassing revenue from ancillary services and subsidiaries closely tied to its core insurance operations. These offerings include services like roadside assistance or minor repair solutions, which extend beyond traditional insurance policies. Such activities not only enhance customer relationships by providing comprehensive solutions but also secure additional revenue streams for the company. For instance, in 2023, Tryg's total gross earned premiums reached DKK 25,699 million, with these diversified services contributing to the overall financial performance.

- Ancillary services include roadside assistance and minor repairs.

- These services enhance customer loyalty and satisfaction.

- They represent a supplementary revenue stream beyond core insurance premiums.

- Such activities contribute to Tryg's diversified income generation.

Tryg's primary revenue driver is Gross Written Premiums from diverse insurance policies, complemented by substantial income from strategically investing its insurance float. The company also generates fee-based income from specialized services and commission income from reinsurance ceded. Additionally, revenue stems from ancillary services, collectively ensuring a diversified and robust financial foundation for Tryg.

| Revenue Stream | Q1 2024 Data (DKK Million) |

|---|---|

| Gross Written Premiums | 9,997 |

| Net Investment Income | 1,211 |

Business Model Canvas Data Sources

The Tryg Business Model Canvas is built using a combination of internal financial data, customer feedback surveys, and competitive analysis reports. These diverse sources ensure a comprehensive understanding of Tryg's operations and market position.