Tryg Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tryg Bundle

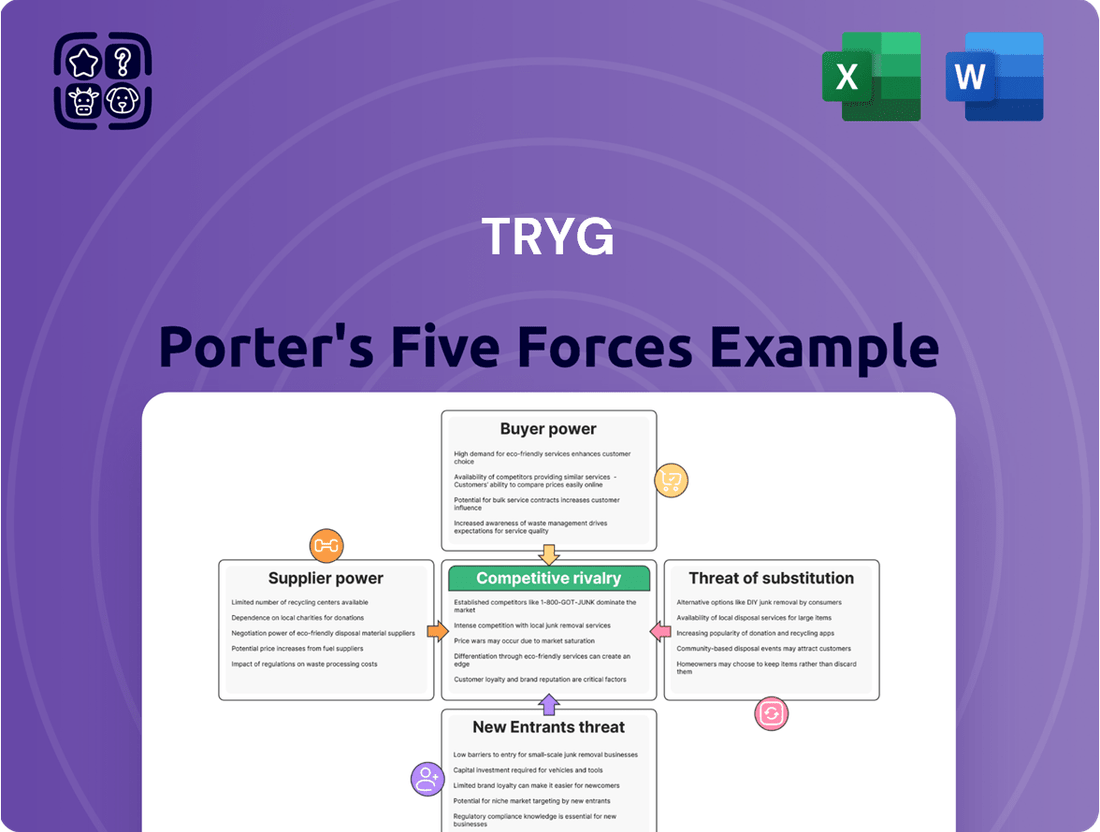

Porter's Five Forces Analysis offers a powerful lens to dissect the competitive landscape surrounding Tryg. Understanding the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry is crucial for strategic positioning.

This framework reveals the underlying dynamics that shape profitability and influence Tryg's market share. By examining these forces, we can identify key challenges and opportunities within Tryg's operating environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Tryg’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

For Tryg, primary suppliers are reinsurers and claims handling services, not traditional manufacturers. The reinsurance market's abundant capacity, evident in stable 2024 pricing, limits supplier power by fostering competition. Tryg's significant scale, with gross premiums earned reaching DKK 23.9 billion in 2023, grants it strong leverage in negotiating favorable terms with repair shop networks and other service providers. This large operational footprint ensures a favorable bargaining position, reducing supplier influence. Overall, core suppliers possess limited power over Tryg.

Suppliers of specialized technology, data analytics, and digital platforms wield significant bargaining power over Tryg. As Tryg increasingly relies on sophisticated data for pricing, underwriting, and operational efficiency, these providers of AI-driven tools and digital infrastructure become critical partners. For instance, global Insurtech funding reached approximately $2.1 billion in Q1 2024, highlighting the industry's reliance on external innovation. Strategic partnerships with key tech firms are essential for Tryg to maintain its competitive edge and drive future innovation in the evolving insurance landscape.

Distribution partners, such as banks and real estate agents, hold some bargaining power as they offer access to a broad customer base. Tryg maintains a significant strategic partnership with Danske Bank, which is crucial for distributing insurance products across the Nordic region. This collaboration, while mutually beneficial, grants Danske Bank a degree of leverage due to its extensive customer network, which reached approximately 3.4 million personal customers in 2024. The bank's wide reach makes it a vital channel for Tryg, influencing terms and conditions.

Labor market dynamics

The specialized labor market, including actuaries, underwriters, and data scientists, forms a critical supplier group for Tryg. Intense competition for these skilled professionals, especially in financial services and tech, drives up labor costs. In 2024, the Nordic labor markets maintain high organization and centralized wage negotiations, influencing overall cost structures significantly. This structure can limit Tryg's flexibility in managing salary expenses, as collective agreements often set minimum wage increases and benefits.

- Danish average wage growth was around 4% in Q1 2024, impacting operational expenses.

- The demand for data scientists in Nordic insurance grew by approximately 15% in 2024.

- Actuarial salaries in Denmark saw a median increase of 3.5% in 2024.

- Collective agreements cover over 80% of Danish employees, centralizing wage bargaining.

Strategic partnerships and networks

Tryg’s strategic partnership with AXA Corporate Solutions for its Nordic customers' international needs significantly impacts supplier power. This reliance on AXA's global network for comprehensive international coverage grants AXA a notable degree of bargaining power. The quality and extensive reach of this network are indispensable for Tryg to effectively service large corporate clients with complex global operations, making AXA a critical supplier.

- AXA’s network is vital for Tryg’s global corporate client segment.

- Dependence on AXA enhances its supplier bargaining power.

- The partnership ensures seamless international insurance solutions.

- Maintaining this relationship is crucial for Tryg’s market competitiveness in 2024.

Tryg faces varied supplier power; reinsurers and claims services have limited leverage due to market capacity and Tryg’s DKK 23.9 billion gross premiums in 2023. However, specialized tech providers, crucial for data analytics with global Insurtech funding at $2.1 billion in Q1 2024, wield significant influence. Skilled labor like actuaries, seeing 3.5% salary increases in 2024, and strategic partners such as AXA Corporate Solutions also exert considerable bargaining power.

| Supplier Group | 2024 Influence | Key Data |

|---|---|---|

| Reinsurers/Claims | Limited | Stable pricing; Tryg's scale |

| Tech/Data Analytics | Significant | Insurtech funding $2.1B (Q1 2024) |

| Specialized Labor | Significant | Actuarial salaries +3.5% (2024) |

| AXA Corporate Solutions | Significant | Critical global network reliance |

What is included in the product

This analysis examines the five competitive forces impacting Tryg, detailing industry attractiveness, competitive intensity, and strategic positioning for long-term success.

Instantly pinpoint competitive pressures with a visual, easy-to-understand threat assessment.

Understand the impact of each force on profitability, empowering strategic adjustments.

Customers Bargaining Power

Individual and small business customers demonstrate high price sensitivity, a trend amplified by the widespread use of online comparison tools and aggregator websites in 2024. This digital transparency allows customers to effortlessly compare insurance quotes and switch providers, intensifying price competition among insurers like Tryg. The ease of comparison necessitates competitive pricing strategies, with many Nordic customers regularly re-evaluating policies. This dynamic is a defining characteristic of the modern Nordic insurance market, where customer retention often hinges on pricing. This forces insurers to balance competitive rates with profitability.

For many standard insurance products, customers face relatively low costs and effort when switching providers. Digital platforms have significantly streamlined the process of obtaining quotes and purchasing new policies, thereby reducing the traditional lock-in effect for incumbent insurers like Tryg. However, insurers often employ strategies such as price walking and cumulative discounts to create artificial switching barriers for loyal customers. Despite these efforts, a 2024 industry report noted that approximately 15-20% of European insurance customers considered switching providers within the past year due to perceived value.

Customers increasingly expect seamless digital experiences, from policy purchase to claims handling, significantly boosting their bargaining power. There is a growing demand for personalized products like usage-based insurance, where over 60% of consumers globally are open to sharing data for better pricing, a trend accelerating in 2024. Insurers, including Tryg, that fail to meet these evolving digital expectations risk losing customers to more agile competitors. This shift means customers can easily compare and switch providers based on digital convenience and tailored offerings.

Power of large corporate clients

Large corporate clients, contributing substantial premiums to insurers like Tryg, possess significant bargaining power. They can actively negotiate bespoke coverage, competitive pricing, and tailored service levels due to their business volume and complex risk profiles. Their specialized needs, often requiring unique solutions for areas like property and casualty or employee benefits, provide them with considerable leverage over standard individual consumers. For instance, Tryg's commercial segment, catering to these large clients, saw a 3.0% premium growth in Q1 2024, highlighting their strategic importance and influence.

- Large corporate clients represent a significant portion of the total premium volume for insurers.

- Their ability to switch providers offers substantial negotiation leverage.

- Complex risk profiles necessitate customized, rather than standardized, insurance products.

- The commercial insurance market values long-term relationships and tailored solutions for these key accounts.

High customer satisfaction and loyalty as a mitigator

High customer satisfaction and loyalty significantly reduce the bargaining power of customers, even when switching costs are low. Tryg actively prioritizes customer satisfaction, understanding its direct correlation with robust retention rates and optimized distribution costs. In the Nordic markets, despite the ease of switching insurance providers, customer retention remained strong, though evolving. As of 2024, Tryg continues to leverage its customer-centric approach to mitigate competitive pressures.

- Tryg's customer satisfaction scores are a key performance indicator, directly influencing retention rates.

- High loyalty reduces acquisition costs, which are substantial in competitive insurance markets.

- Nordic insurance markets show a trend of increasing customer churn, making loyalty even more critical.

- In 2024, Tryg aims to further enhance digital service offerings to boost customer engagement and loyalty.

Customers, particularly individual and small businesses, possess high bargaining power due to intense price sensitivity, easy online comparison tools, and low switching costs. Large corporate clients amplify this power through their ability to negotiate bespoke solutions and pricing. Tryg must offer competitive rates, seamless digital experiences, and foster strong loyalty to mitigate this pressure. This dynamic is crucial for retention in the evolving 2024 Nordic insurance market.

| Customer Segment | Key Power Driver | Impact on Tryg |

|---|---|---|

| Individual/SMB | Price Sensitivity, Easy Switch | Competitive Pricing Focus |

| Corporate Clients | Volume, Negotiation | Tailored Solutions Demand |

| All Customers | Digital Experience | Loyalty & Retention Critical |

Same Document Delivered

Tryg Porter's Five Forces Analysis

This comprehensive Porter's Five Forces analysis of Tryg provides an in-depth examination of the competitive landscape within the insurance industry. The document you are previewing is the exact, fully formatted report you will receive immediately after purchase, ensuring no surprises. It meticulously details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This is the complete, ready-to-use analysis file, professionally prepared for your strategic decision-making needs.

Rivalry Among Competitors

The Scandinavian insurance market is mature and moderately concentrated, featuring major players like Tryg, If P&C, and Folksam. Tryg, the second-largest P&C insurer in the Nordic region, holds leading positions in Denmark and strong footholds in Norway and Sweden. This market position was significantly bolstered by its 2021 acquisition of RSA's Scandinavian business, including Codan and Trygg-Hansa. Such concentration among a few large entities, with Tryg’s 2023 gross premium income reaching DKK 39.4 billion, often leads to intense competition for market share.

Price competition in the insurance sector remains fierce, especially within personal and small commercial lines, largely amplified by the prevalence of price comparison websites. This intense rivalry places significant pressure on insurers to maintain profitability through disciplined underwriting and stringent cost efficiency measures. In response, companies like Tryg are acutely focused on operational performance. Tryg aims for a combined ratio of around 81% by 2027, a target affirmed in their 2024 outlook, emphasizing their commitment to achieving superior financial results amidst competitive pricing pressures.

Competition in the insurance sector increasingly hinges on digital capabilities, customer experience, and innovation. Insurers are heavily investing in new technologies like AI and advanced data analytics to enhance customer experience and operational efficiency. For instance, many providers are targeting over 70% digital claims processing by late 2024 to streamline operations. The ability to offer seamless, user-friendly digital services is becoming a key differentiator, influencing customer choice. This focus on digital transformation is crucial for gaining and maintaining a competitive edge in 2024.

Strategic partnerships and distribution channels

Competitive rivalry intensifies as insurers vie for strategic partnerships, especially with banks through bancassurance models, and other large affinity groups. These alliances offer crucial access to extensive customer bases, making them a primary battleground for market share. Tryg’s long-standing partnership with Danske Bank exemplifies this strategy, significantly bolstering its distribution network and customer reach in the Nordic region. Such collaborations are vital for growth and maintaining a strong competitive position.

- Tryg's bancassurance agreements, like with Danske Bank, are central to its distribution strategy, contributing significantly to its customer acquisition in 2024.

- These partnerships enable insurers to tap into millions of potential customers, a key driver of premium growth.

- In 2024, securing new or expanding existing bank partnerships remains a top priority for major Nordic insurers.

- The competitive landscape for these exclusive distribution channels is fierce, with insurers offering various incentives to partners.

Consolidation and M&A activity

The market has seen significant consolidation, exemplified by Tryg's acquisition of RSA Scandinavia, completed in 2021, which substantially increased its scale. Mergers and acquisitions remain a key strategy for achieving growth and economies of scale in the competitive insurance sector. This ongoing trend intensifies rivalry as major players become larger and more dominant. For instance, global M&A activity in financial services continued to show resilience into 2024, reflecting strategic shifts and market positioning.

- Tryg's acquisition of RSA Scandinavia was valued at approximately 7.2 billion GBP.

- Post-acquisition, Tryg became the largest non-life insurer in Scandinavia.

- Consolidation often leads to fewer, but larger, competitors.

- The European insurance M&A market saw continued interest in 2024, driven by scale and efficiency.

Competitive rivalry in the Scandinavian insurance market is intense, driven by concentration among major players like Tryg, whose 2023 gross premium income reached DKK 39.4 billion. Fierce price competition, especially amplified by comparison websites, pressures profitability, with Tryg targeting an 81% combined ratio by 2027. Digital capabilities and strategic partnerships, such as Tryg’s bancassurance with Danske Bank, are crucial for customer acquisition and market share in 2024. Ongoing consolidation, exemplified by Tryg’s 2021 RSA Scandinavia acquisition, further intensifies this rivalry.

| Metric | Value (2023/2024) | Source | ||

|---|---|---|---|---|

| Tryg GWP | DKK 39.4B | Tryg Annual Report | ||

| Tryg Combined Ratio Target | 81% by 2027 | Tryg 2024 Outlook | ||

| Digital Claims Processing Target | 70%+ by late 2024 | Industry Trend |

SSubstitutes Threaten

For some risks, particularly for large corporations, self-insurance or retaining higher levels of risk through elevated deductibles can be a direct substitute for traditional insurance offerings. This is a viable option for companies with sophisticated risk management capabilities and the financial capacity to absorb significant losses. For instance, in 2024, many large multinational firms continued to expand their captive insurance programs to manage complex risks internally. However, this threat is considerably lower for individuals and small to medium-sized enterprises (SMEs) who typically lack the financial resilience and infrastructure to bear large, unexpected losses without external coverage.

New Insurtech models, particularly peer-to-peer (P2P) insurance, are emerging as a substitute, pooling premiums directly from groups to cover claims. While still a niche market, these models challenge traditional insurers like Tryg by offering greater transparency and potentially lower operational costs. The global P2P insurance market, though small, is projected to grow significantly, indicating a long-term threat. For instance, the Insurtech sector attracted substantial investment in 2024, signaling innovation in direct-to-consumer models. These alternatives could erode market share for specific insurance lines over time.

Embedded insurance products, increasingly offered at the point of sale for other services like travel or electronics, present a substantial substitute threat. This trend, driven by digital platforms and open APIs, allows for seamless integration, bypassing traditional standalone policies. For instance, the global embedded insurance market is projected to grow significantly, with estimates suggesting it could exceed $100 billion by 2027. This shifts the distribution dynamic, reducing direct customer interaction with established insurers like Tryg and challenging conventional sales channels.

Government social security programs

Government social security programs in Nordic countries, like Denmark where Tryg operates, significantly act as substitutes for private insurance. Extensive public healthcare and social safety nets limit the demand for private health or unemployment insurance compared to markets with less comprehensive state provisions. For instance, in 2024, public spending on health in Denmark is projected to remain substantial, reducing the baseline need for private health coverage. However, increasing pressure on public systems, driven by aging populations and rising healthcare costs, is fostering a growing demand for private supplementary solutions.

- In 2024, Danish public health expenditure is projected to remain robust, covering essential services.

- Despite this, private health insurance in Denmark saw a slight increase in uptake, reflecting demand for faster access or specialized care.

- The share of private health insurance in Nordic countries remains lower than in many other European nations, due to strong public systems.

- Aging demographics and fiscal pressures are driving a gradual shift towards more private supplementation for certain services.

Risk prevention and mitigation technologies

The rise of risk prevention and mitigation technologies presents a significant substitute threat to insurance providers like Tryg. Technologies such as advanced driver-assistance systems (ADAS) in vehicles, which reduced accident rates by up to 27% in 2024 for certain features, lessen the need for comprehensive auto coverage. Smart home security systems, seeing a 15% adoption increase in 2024, similarly reduce property damage risks.

Furthermore, workplace safety wearables, including those from Tryg’s partner PRECURE, actively prevent injuries, directly lowering occupational claims. These innovations reduce both claim frequency and severity, partially substituting the traditional role of insurance by mitigating the underlying risk.

- ADAS reduced accident rates by up to 27% in 2024 for specific features.

- Smart home security system adoption increased by 15% in 2024.

- Workplace safety wearables directly lower occupational injury claims.

The threat of substitutes for Tryg is multifaceted, stemming from large corporations opting for self-insurance and the rise of Insurtechs, which attracted substantial investment in 2024. Embedded insurance, projected to exceed $100 billion by 2027, bypasses traditional channels, while robust Nordic social security, with significant 2024 public health spending, reduces private coverage needs. Additionally, risk prevention technologies, like ADAS reducing accidents by up to 27% in 2024, directly lessen the demand for insurance by mitigating underlying risks.

| Substitute Type | Key Impact | 2024 Data Point | ||

|---|---|---|---|---|

| Self-Insurance | Reduced corporate demand | Large firms expanded captive programs | ||

| Insurtech/P2P | New transparent models | Substantial sector investment | ||

| Embedded Insurance | Shifted distribution | Projected >$100B by 2027 | ||

| Public Social Security | Lower private demand | Robust Danish health expenditure | ||

| Risk Mitigation Tech | Reduced claim frequency | ADAS cut accidents by 27% |

Entrants Threaten

The insurance industry presents a high barrier to entry due to its significant capital and regulatory demands. New entrants face stringent solvency requirements, such as Solvency II, which mandate substantial capital reserves to cover potential claims. In 2024, European insurers typically maintain robust Solvency II ratios, often exceeding 200%, underscoring the immense capital needed. This regulatory environment makes it exceptionally difficult for new companies to establish a foothold and compete effectively.

Tryg, as a major incumbent, benefits from significant economies of scale across claims processing, procurement, and marketing. This operational efficiency is reflected in their Q1 2024 combined ratio of 82.5%, making it tough for new entrants to compete on cost. Furthermore, Tryg possesses strong brand recognition and customer loyalty built over many decades in the Nordic market. Replicating this established trust and market presence would be incredibly costly and time-consuming for any newcomer. Such scale and brand strength act as substantial barriers, limiting the threat of new entrants.

Gaining access to efficient and broad distribution channels presents a substantial barrier for new entrants in the insurance sector. Incumbents like Tryg benefit from deeply entrenched relationships with brokers, agents, and strategic partners, including banks, which are critical for customer reach. For example, in 2024, Tryg continues to leverage its comprehensive network across the Nordics, making it difficult for newcomers to replicate this scale. A new player must either invest heavily in building such networks from scratch or rely solely on direct digital channels, where customer acquisition costs can be high, often exceeding 20% of premium for new business in some lines. This makes rapid customer base acquisition challenging without an established physical or partner presence.

Entry of Insurtech and non-traditional players

The entry of Insurtech and non-traditional players poses a significant threat to established insurers like Tryg. These agile, technology-focused companies, sometimes backed by large tech firms, leverage advanced data analytics and existing customer bases to offer innovative digital products. They often target specific, underserved segments, disrupting the traditional insurance value chain without necessarily becoming full-stack insurers immediately. For instance, global Insurtech funding reached approximately $9.1 billion in 2023, indicating sustained investment in these disruptive models.

- In 2024, many Insurtechs are focusing on AI-driven personalization and embedded insurance solutions.

- New entrants benefit from lower legacy costs and flexible IT infrastructures.

- Customer acquisition costs for digital-first insurers can be significantly lower due to online channels.

- Large tech companies might leverage extensive user data for tailored insurance offerings.

Potential for regulatory changes lowering barriers

While barriers to entry in the insurance sector remain high, potential regulatory shifts could lower them. For instance, discussions regarding ownership restrictions within the Norwegian financial sector, particularly in 2024, indicate a possible opening for new types of investors. Furthermore, the ongoing harmonization of financial regulations at the EU level could streamline cross-border entry, potentially increasing competition for established players like Tryg.

- Norwegian authorities continue to assess frameworks, with potential legislative proposals influencing financial sector ownership by late 2024.

- EU initiatives like the Digital Operational Resilience Act (DORA), effective January 2025, aim for a more integrated digital financial market, potentially easing entry for digital-first competitors.

- The European Insurance and Occupational Pensions Authority (EIOPA) is actively reviewing Solvency II, with proposed revisions that could affect capital requirements and market access for new insurers.

- Global regulatory bodies are also pushing for greater interoperability, which could facilitate the entry of large tech firms into financial services.

Despite significant capital and regulatory demands, such as European insurers often maintaining over 200% Solvency II ratios in 2024, new entrants still pose a threat. Agile Insurtechs, backed by substantial funding and leveraging AI, target niches with lower legacy costs, challenging incumbents like Tryg. While Tryg benefits from its 82.5% Q1 2024 combined ratio and extensive distribution networks, potential regulatory shifts and the entry of large tech firms could further intensify competition.

| Metric | 2024 Data (Expected/Observed) | Implication for New Entrants |

|---|---|---|

| Avg. European Insurer Solvency II Ratio | >200% | High capital barrier for new full-stack insurers. |

| Tryg Q1 2024 Combined Ratio | 82.5% | Cost efficiency benchmark, hard for new players to match. |

| Global Insurtech Funding (2023) | ~$9.1 billion | Sustained investment in disruptive, agile models. |

| Digital-First Customer Acquisition Cost | Potentially >20% of premium (new business) | High initial investment to build customer base digitally. |

| DORA Effectiveness Date | January 2025 | Could ease cross-border digital operations for new players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Tryg leverages a comprehensive approach, integrating data from Tryg's annual reports, investor presentations, and filings with regulatory bodies. We also incorporate insights from industry-specific market research reports and reputable financial news outlets to provide a robust understanding of the competitive landscape.