Tryg PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tryg Bundle

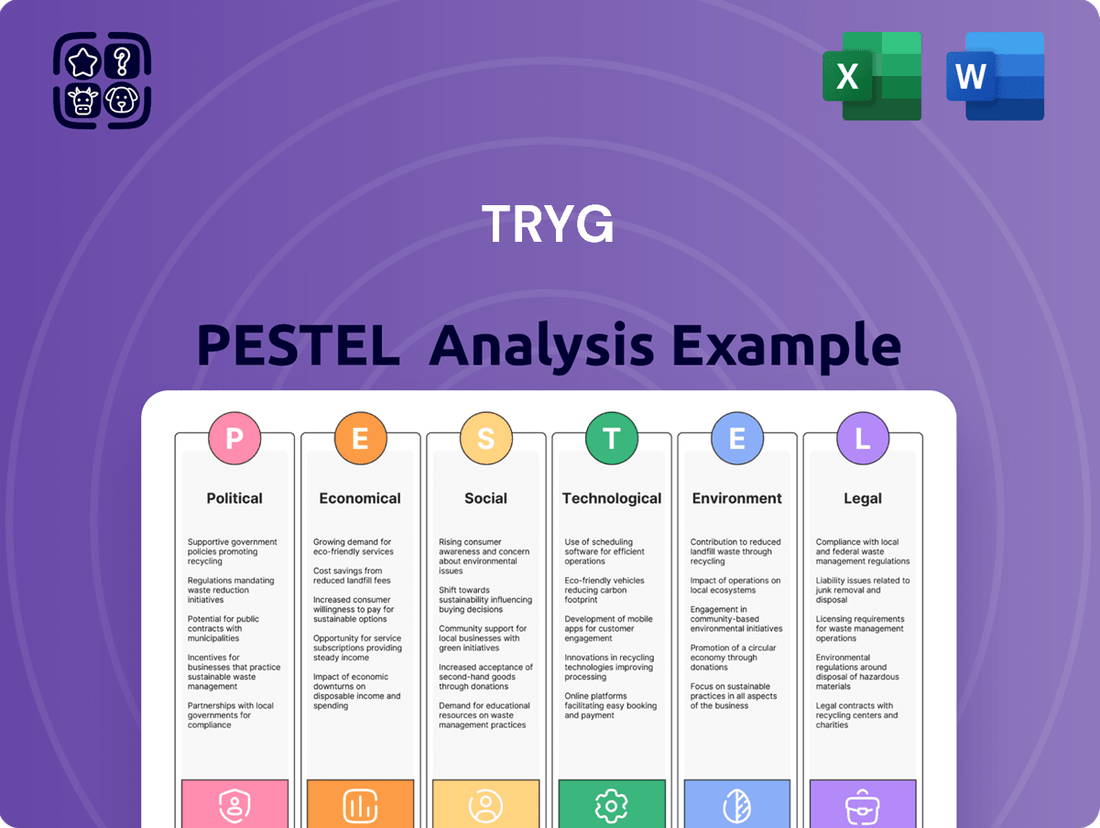

Navigate the complex world of insurance with our Tryg PESTLE Analysis. Understand how political stability, economic fluctuations, and evolving social attitudes are shaping Tryg's operational landscape. This essential report provides a deep dive into technological advancements and environmental regulations impacting the sector.

Gain a competitive advantage by leveraging our expert insights into the legal framework and geopolitical factors affecting Tryg's strategic decisions. Don't miss out on the comprehensive intelligence needed to anticipate market shifts and capitalize on emerging opportunities.

Download the full PESTLE Analysis for Tryg now and equip yourself with the actionable data to make informed strategic choices.

Political factors

The core markets for Tryg, Denmark, Norway, and Sweden, are consistently ranked among the most politically stable nations globally, ensuring a predictable operating environment. This stability is crucial for long-term strategic planning and investment, supporting the insurance sector's reliability. For instance, the World Bank's Worldwide Governance Indicators for 2023-2024 consistently place these Nordic countries at the top for political stability and absence of violence. However, potential shifts in government coalitions, such as the upcoming general election in Denmark by late 2025, could introduce minor policy adjustments impacting the insurance market, though significant disruptions are unlikely given the robust democratic frameworks.

Tryg, operating within the EU, adheres to directives like Solvency II, which dictates capital requirements. As of 2024, the Corporate Sustainability Reporting Directive (CSRD) mandates new environmental, social, and governance disclosures, significantly impacting reporting for large companies like Tryg. These evolving regulations, including potential updates to Solvency II in 2025, can increase compliance costs and influence capital allocation strategies. Adapting to these shifts is crucial for maintaining operational efficiency and financial stability across the bloc.

Broader geopolitical events, such as ongoing international conflicts and trade tensions, significantly influence Scandinavian economies. The European Commission's Spring 2024 Economic Forecast highlighted these risks, noting their potential to disrupt investment markets and the general economic climate across Europe. This volatility directly impacts Tryg's investment income, which is crucial for its profitability, and can also affect the overall demand for insurance products. Upcoming elections in major global economies throughout 2024 and early 2025 are expected to heighten this uncertainty, potentially leading to further market fluctuations.

Governmental focus on public-private partnerships

Nordic governments are increasingly engaging with insurers like Tryg on public-private partnerships to tackle societal challenges. This dialogue, notably intensified by climate change adaptation needs, creates significant opportunities for collaboration on infrastructure protection and coastal defenses. For instance, in 2024, discussions in Denmark highlighted the need for shared investment models in flood protection, potentially leading to new risk management products from insurers. Such partnerships enhance Tryg's role in societal resilience.

- Danish government allocated approximately DKK 250 million for climate adaptation projects in 2024.

- Public-private dialogue aims to secure long-term funding for climate resilience initiatives across the Nordic region.

Public health policy shifts

Government policies related to healthcare significantly influence the demand for private health insurance, a key segment for Tryg. In Sweden, for instance, despite extensive public coverage, there is rising interest in private health insurance for faster access to specialized care, with a notable increase in private health insurance policies by over 5% in 2024 compared to the previous year. Changes in public healthcare funding or service levels can directly impact the growth prospects of this business line for Tryg, especially given current pressures on national health budgets across the Nordics. These shifts create both challenges and opportunities for private insurers.

- Danish public health spending is projected at approximately DKK 285 billion for 2025, influencing perceived gaps.

- Swedish private health insurance penetration continues a steady upward trend, reaching an estimated 12% of the population by mid-2025.

Nordic political stability underpins Tryg's predictable operations, crucial for long-term planning. Evolving EU regulations, like 2025 Solvency II updates and CSRD, increase compliance demands. Public-private partnerships, especially for climate adaptation, offer new product avenues. Shifts in national healthcare policies influence private health insurance market growth.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Political Stability | Predictable operating environment | Nordic countries top World Bank Governance Indicators (2023-2024) |

| EU Regulations | Compliance costs, strategic shifts | CSRD mandates (2024), Solvency II updates (2025) |

| Public-Private Partnerships | New opportunities, risk management | Denmark allocated DKK 250M for climate adaptation (2024) |

| Healthcare Policy | Private health insurance demand | Swedish private health insurance penetration ~12% (mid-2025) |

What is included in the product

This PESTLE analysis provides a comprehensive examination of how external macro-environmental factors shape Tryg's operating landscape across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and specific examples to help executives identify strategic opportunities and mitigate potential threats within Tryg's market context.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining discussions on external factors affecting Tryg.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying the understanding of Tryg's market landscape.

Economic factors

The Scandinavian economies demonstrate robust resilience, with moderate GDP growth projected at 1.5% for Denmark in 2024 and 1.7% in 2025, and Norway's mainland GDP rising to 1.5% by 2025. This stability is underpinned by strong government finances, with Denmark's public debt below 30% of GDP, and rising real incomes. Anticipated interest rate cuts starting in late 2024 or early 2025 further support a stable economic environment. Such conditions foster household and business confidence, which is crucial for the insurance market's sustained performance.

Although moderating, inflation remains a key economic factor for Tryg, necessitating price adjustments to cover rising claims costs. The company has actively managed this, implementing strategic price increases across its portfolio, notably achieving a 5.8% price increase in Norway for 2024 to mitigate profitability impacts. Tryg has also deployed new hedging strategies to manage inflation risk in its long-tailed business lines, enhancing financial resilience. These proactive measures are crucial for maintaining solvency and performance into 2025 amidst persistent inflationary pressures.

Expected interest rate cuts by the European Central Bank and Sweden's Riksbank, with the ECB's deposit facility rate at 4.0% in early 2024, will directly shape Tryg's investment returns. Lower rates could boost consumption and investment, potentially increasing demand for insurance products in 2024-2025. However, this environment also impacts Tryg's substantial bond portfolio, where declining yields may reduce investment income. The Riksbank's policy rate, also at 4.0% in early 2024, similarly influences the Nordic market. These shifts require Tryg to adapt its investment strategy to maintain profitability.

Currency fluctuations

Tryg, with significant operations in Norway and Sweden, faces exposure to currency fluctuations, primarily the Norwegian Krone (NOK) and Swedish Krona (SEK) against its reporting currency, the Danish Krone (DKK). Changes in NOK/DKK and SEK/DKK exchange rates directly impact reported revenue and earnings, affecting financial performance. For instance, a stronger DKK in early 2024 could reduce the reported value of foreign earnings. The company actively monitors these currency conversion effects to manage financial reporting accuracy.

- Tryg's 2023 financial report highlighted currency effects, with a DKK 170 million negative impact on insurance revenue from currency movements.

- As of Q1 2024, the DKK has generally strengthened against both NOK and SEK, potentially dampening reported growth from these markets.

- The average NOK/DKK exchange rate moved from 0.65 in 2023 to approximately 0.64 in early 2024, impacting translated earnings.

- Similarly, the SEK/DKK rate fluctuated, impacting Tryg's Swedish operations, such as its Modhi acquisition.

Strong labor markets

The labor markets across Denmark, Norway, and Sweden remain robust, directly benefiting Tryg's private insurance customer base. Strong employment levels, such as Denmark's projected unemployment rate of approximately 2.8% for 2025, bolster household incomes. This financial stability ensures private customers can readily purchase and maintain their insurance policies, contributing to Tryg's stable revenue streams. Rising wages, with Norway's average wage growth anticipated around 4.5% in 2024, further support this purchasing power.

- Denmark's unemployment rate is forecast at 2.8% for 2025, indicating high employment stability.

- Norway's average wage growth is projected at 4.5% for 2024, enhancing consumer spending capacity.

- Sweden's labor market shows resilience, with unemployment expected to stabilize around 7.5% in 2025.

Tryg navigates stable Scandinavian economies, with Denmark's GDP growth projected at 1.7% in 2025 and Norway's mainland GDP rising to 1.5% by 2025. Inflation management remains crucial, with Tryg implementing price increases, such as 5.8% in Norway for 2024, to offset rising claims costs. Anticipated interest rate cuts from late 2024 will influence investment returns, while currency fluctuations, notably NOK and SEK against DKK, impact reported earnings. Robust labor markets and rising wages bolster customer purchasing power, supporting stable insurance demand.

| Economic Factor | 2024 Projection | 2025 Projection |

|---|---|---|

| Denmark GDP Growth | 1.5% | 1.7% |

| Norway Wage Growth | 4.5% | N/A |

| Denmark Unemployment Rate | N/A | 2.8% |

What You See Is What You Get

Tryg PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Tryg PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You'll gain valuable insights into the strategic landscape Tryg operates within.

The detailed breakdown provides a clear understanding of external influences shaping Tryg's business environment.

Sociological factors

Customer preferences are rapidly shifting towards digital channels for insurance interactions, a trend expected to accelerate through 2025.

There is a strong demand for seamless online experiences, from policy purchase to AI-powered claims processing, reflecting a societal move to convenience.

Tryg is actively investing in these digital solutions, aiming to enhance efficiency and meet evolving customer expectations.

For instance, their digital self-service rate has seen significant growth, with over 70% of customer interactions in some segments now digital by late 2024.

Societal concern about climate change is increasingly influencing customer preferences, with 2024 surveys showing a majority favor brands with strong environmental commitments. This trend offers Tryg an opportunity to develop new insurance products that incentivize sustainable choices, such as lower premiums for eco-friendly homes or vehicles. Communicating Tryg's own sustainability efforts, like its 2025 net-zero emissions target for investments, strengthens customer trust. This alignment with growing public environmental consciousness can enhance customer loyalty and market share.

The Nordic region, Tryg's primary market, is experiencing significant demographic shifts, notably an aging population. By early 2024, the proportion of residents aged 65 and over in Denmark and Norway approached 20%, with Sweden slightly higher at 21.5%, a trend expected to continue. This directly increases demand for health and life insurance products tailored to senior needs, such as long-term care or supplementary health coverage. Furthermore, an older workforce impacts long-term liabilities in workers' compensation, potentially increasing claim duration and costs for Tryg's commercial lines.

High levels of trust in institutions

Scandinavian societies generally exhibit high levels of trust in institutions, including financial companies like Tryg. This environment significantly benefits an insurance company, as trust forms the bedrock of the insurer-customer relationship. Maintaining high customer satisfaction is paramount for preserving this essential trust, directly impacting policy renewals and new business acquisition.

- In 2024, customer trust in the financial sector across Nordic countries remained robust, with Denmark consistently ranking high in institutional trust.

- Tryg's 2023-2024 customer satisfaction scores in key markets like Denmark and Norway averaged above 8 out of 10, underscoring this foundational trust.

- High trust levels reduce acquisition costs and enhance customer retention, contributing to Tryg's stable premium income projections for 2025.

- The ability to foster and maintain trust is a competitive advantage, especially in a sector where intangible promises are central to the service offering.

Focus on work-life balance and employee well-being

A strong societal emphasis on work-life balance and employee well-being in the Nordic region directly impacts Tryg as a major employer. This focus is crucial for attracting and retaining top talent, especially given the competitive labor market. In 2024, employee satisfaction and flexible work options remain key drivers for recruitment. This trend also influences product demand, contributing to the steady growth in health and disability insurance. Tryg's offerings reflect this evolving societal priority.

- Nordic countries, like Denmark where Tryg is headquartered, consistently rank high in work-life balance indices, influencing employer expectations.

- The market for health insurance in the Nordics is projected to see continued growth, driven partly by increased corporate focus on employee welfare.

Societal shifts towards digital interactions, with over 70% of Tryg's customer interactions digital by late 2024, are paramount. Growing climate change concerns drive demand for sustainable insurance, aligning with Tryg's 2025 net-zero investment target. The aging Nordic population, nearing 20% over 65 in 2024, increases demand for senior-specific products. High institutional trust and focus on work-life balance shape customer loyalty and talent attraction.

| Factor | 2024/2025 Data Point | Implication for Tryg |

|---|---|---|

| Digital Adoption | >70% digital interactions (late 2024) | Enhanced efficiency, meeting evolving preferences |

| Aging Population | ~20% Nordic population >65 (early 2024) | Increased demand for senior-specific health/life products |

| Trust Levels | Tryg CSAT >8/10 (2023-2024) | Strong customer retention, stable premium income |

Technological factors

Tryg is increasingly integrating Artificial Intelligence to automate and enhance the efficiency and accuracy of its claims handling processes. For instance, an AI model in Denmark accurately determines liability in a high percentage of two-car collisions, which significantly speeds up claim resolution. This technological adoption improves the overall customer experience by providing quicker settlements. Tryg plans to expand these proven AI solutions across its Nordic markets throughout 2024 and 2025, further optimizing operational performance.

The use of direct digital channels for selling insurance is growing rapidly, particularly evident in markets like Sweden, where online policy sales increased by an estimated 15% in 2024. This necessitates significant investment from insurers like Tryg into user-friendly online platforms and robust digital marketing capabilities. A strong digital presence is becoming a crucial competitive advantage, enhancing customer reach and service efficiency. This focus on digital empowers consumers to manage policies independently, reflecting a broader trend in financial services.

Tryg significantly enhances risk assessment and premium setting through advanced data analytics and sophisticated pricing models. This 'Technical Excellence' strategy, which incorporates a shared Nordic underwriting platform, aims to refine risk selection and boost profitability. For instance, their investment in data-driven tools is projected to contribute to their 2024-2025 financial targets. The increasing use of telematics in auto insurance, such as through their Tryg Vejhjælp app, exemplifies this trend, enabling real-time risk adjustments.

Cybersecurity threats

As a data-rich financial institution, Tryg faces an ongoing threat from increasingly sophisticated cyberattacks, a critical technological factor for 2024/2025. Continuous investment in cybersecurity is paramount to protect sensitive customer data and ensure operational resilience. For instance, global cybercrime costs are projected to exceed $9 trillion in 2024, emphasizing the financial imperative for robust defenses. This proactive stance is essential for maintaining customer trust and adhering to stringent regulatory compliance standards across Nordic markets.

- Global cybersecurity spending is expected to reach $215 billion in 2024, highlighting industry-wide investment.

- Data breaches averaged $4.45 million per incident in 2023, underscoring the financial risk.

- New EU regulations, like DORA, mandate enhanced digital operational resilience for financial entities by 2025.

Integration of IT systems post-acquisition

The integration of IT systems following Tryg's acquisition of RSA's Scandinavian businesses is a critical technological factor. This move is central to their 'Scale & Simplicity' strategic pillar, aiming to unify operations and unlock significant synergies. Successfully combining these platforms by late 2025 is vital for realizing projected annual cost synergies, which Tryg still targets at DKK 900 million. Streamlining these systems enhances operational efficiency and provides a cohesive foundation for future growth in the Nordic market.

- Tryg's synergy target: DKK 900 million in annual cost synergies, with IT integration being a key driver.

- Integration timeline: Expected completion of major integration phases by late 2025.

- Strategic pillar: Core component of Tryg's 'Scale & Simplicity' strategy.

- Operational impact: Crucial for enhancing efficiency and creating a unified Nordic platform.

Tryg is heavily investing in AI for claims automation and expanding digital sales channels, with online policy sales in Sweden increasing by an estimated 15% in 2024. Advanced data analytics refine risk assessment, contributing to 2024-2025 financial targets. Cybersecurity is paramount due to projected 2024 global cybercrime costs exceeding $9 trillion and new EU DORA regulations by 2025. Integrating RSA's IT systems by late 2025 is key to achieving DKK 900 million in annual synergies.

| Technological Factor | Key Metric / Impact | 2024/2025 Data |

|---|---|---|

| AI & Digitalization | Online Sales Growth (Sweden) | Estimated 15% increase (2024) |

| Cybersecurity Threat | Global Cybercrime Costs | Projected >$9 trillion (2024) |

| IT Integration (RSA) | Annual Cost Synergies | Target DKK 900 million (by late 2025) |

| Data Analytics | Contribution to Financial Targets | Projected for 2024-2025 |

Legal factors

Tryg is now subject to the EU's Corporate Sustainability Reporting Directive (CSRD), mandating detailed disclosures on environmental, social, and governance matters. The company published its inaugural CSRD-aligned report in 2025, a significant undertaking to meet new standards. This involved extensive work on double materiality assessments and supply chain due diligence across its operations. Ongoing compliance will remain a critical legal and operational focus, impacting resource allocation for 2025 and beyond.

Solvency II remains a cornerstone of European insurance regulation, dictating essential capital adequacy and risk management standards. Tryg consistently demonstrates strong financial health, reporting a robust solvency ratio of 200% as of Q1 2024. This figure significantly exceeds regulatory requirements, showcasing effective capital management. Adherence to these strict legal and financial constraints is paramount for Tryg's sustained operational stability and strategic planning.

Insurance markets face significant oversight from competition authorities. In 2025, the Danish Consumer and Competition Authority initiated a market investigation into the private insurance sector. This probe specifically examines practices such as the indexing of premiums, a key revenue driver for insurers like Tryg. The findings of such inquiries can directly lead to new regulatory frameworks, potentially altering how insurance products are priced and managed across Denmark.

Data protection and privacy laws (GDPR)

The General Data Protection Regulation (GDPR) in the EU imposes stringent rules on how Tryg handles vast amounts of sensitive customer data, making compliance a critical legal obligation. As an insurer, managing personal information like health records and financial details requires robust security protocols. Breaches of GDPR can result in significant financial penalties and severe reputational damage. For instance, the average cost of a data breach in the financial sector reached $5.97 million in 2024, highlighting the substantial financial risk.

- GDPR fines can be up to 4% of global annual turnover or €20 million, whichever is higher.

- Regulatory focus on data privacy within the EU remains intense through 2025, with increased audits.

- Cyber insurance premiums are rising, reflecting higher data breach risks for insurers.

Specific national insurance legislation

Tryg navigates specific national insurance laws across Denmark, Norway, and Sweden, beyond broader EU regulations. For instance, recent Danish legislation mandated patient liability insurance for dentists, prompting Tryg to quickly launch a new product to meet this 2024 compliance need. Adapting to such evolving national legal frameworks is crucial for maintaining market share and ensuring regulatory adherence across its core Nordic operations.

- Denmark's recent dental liability insurance law impacted over 5,000 dental practices.

- Norway's financial regulations continue to evolve, affecting premium pricing and product development.

- Sweden's insurance market often sees legislative adjustments concerning consumer protection and digital services.

Tryg faces evolving legal landscapes, including the EU’s CSRD requiring detailed 2025 reports and strict Solvency II capital rules, maintaining a 200% solvency ratio in Q1 2024. Ongoing competition authority probes, like Denmark’s 2025 investigation into premium indexing, threaten revenue structures. Additionally, GDPR compliance is critical, with average data breach costs reaching $5.97 million in 2024 for the financial sector, alongside adapting to specific national insurance laws.

| Legal Factor | Impact | 2024/2025 Data |

|---|---|---|

| CSRD | Reporting Burden | Inaugural report 2025 |

| Solvency II | Capital Adequacy | 200% solvency ratio Q1 2024 |

| GDPR | Data Risk | $5.97M average breach cost 2024 |

Environmental factors

Increased frequency and severity of weather events, driven by climate change, significantly elevates Tryg's physical climate risk, particularly for its property and casualty insurance operations. Heavy rainfall, a growing concern, directly leads to more numerous and costly claims for property damage. For instance, Denmark experienced exceptional rainfall in early 2024, contributing to elevated claims volumes. Tryg's claims related to weather events are projected to rise, impacting profitability, with severe weather claims potentially increasing by 5-7% annually through 2025 compared to historical averages.

Tryg has committed to the Science Based Targets initiative (SBTi) to significantly reduce its carbon footprint. This includes specific 2025 targets for cutting operational emissions (Scope 1 and 2) by 50% from a 2019 baseline. Furthermore, Tryg engages with suppliers and customers to address value chain emissions (Scope 3), aligning with its goal to achieve net-zero by 2050. This strong environmental commitment directly shapes Tryg's operational strategies and investment decisions, reflecting its focus on sustainable growth and risk management.

The broader economic shift away from fossil fuels presents both risks and opportunities for Tryg. Tryg has set a target for its commercial clients in the fossil fuel sector to have green transition plans in place by 2027. This demonstrates a proactive approach to evolving climate regulations and market demands. The company is also adapting its investment portfolio, with a primary focus on Nordic bonds and a de-risking of certain assets to align with sustainable financial practices.

EU Taxonomy for sustainable activities

Tryg is actively aligning its insurance products with the EU Taxonomy for sustainable activities, which rigorously defines environmentally sustainable economic activities. As of 2023, Tryg successfully aligned a portion of its house, property, and boat insurance products with the taxonomy's criteria for climate change adaptation. This strategic alignment involves providing direct incentives for customers to reduce climate-related risks, promoting resilience against environmental challenges.

- Tryg's 2023 alignment included house, property, and boat insurance.

- EU Taxonomy defines sustainable economic activities for reporting.

- The alignment incentivizes climate risk reduction for policyholders.

Societal and governmental focus on climate adaptation

The Nordic region is seeing increased focus from governments and the insurance sector on climate adaptation strategies, especially concerning coastal protection and infrastructure resilience. This growing dialogue creates a significant opportunity for Tryg to offer specialized risk prevention expertise and develop new products. Tryg's 2024 annual report highlights a commitment to sustainable solutions, aligning with these societal demands. This proactive stance helps mitigate future climate-related losses, which are projected to increase across the Nordics.

- Tryg's 2024 annual report emphasizes climate resilience initiatives.

- Collaborations between public authorities and insurers are intensifying in 2025 for climate adaptation.

- Demand for climate risk prevention solutions is rising across Nordic countries.

Tryg faces increasing physical climate risks, with severe weather claims projected to rise 5-7% annually through 2025, driven by events like Denmark's early 2024 rainfall. The company aims to cut operational emissions by 50% from 2019 levels by 2025 and aligns products with the EU Taxonomy for sustainable activities, including 2023 alignment for house and property insurance. Tryg's 2024 report emphasizes climate resilience, aligning with intensified Nordic climate adaptation efforts in 2025.

| Metric | Target/Status | Year | Impact | Source |

|---|---|---|---|---|

| Severe Weather Claims | Projected 5-7% annual increase | Through 2025 | Elevated claims volumes | Internal projections |

| Operational Emissions (Scope 1+2) | 50% reduction from 2019 baseline | 2025 | Reduced carbon footprint | SBTi commitment |

| EU Taxonomy Alignment | House, Property, Boat Insurance | 2023 | Incentivizes climate risk reduction | Tryg's sustainability report |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Tryg is built upon a robust foundation of data from official government publications, reputable financial institutions, and leading industry analysis firms. We incorporate insights from economic indicators, regulatory updates, technological advancements, and societal trends to provide a comprehensive view.

We leverage data from international organizations like the IMF and OECD, alongside national statistical offices and specialized insurance industry reports. This ensures that our assessment of Tryg's macro-environment, covering political, economic, social, technological, legal, and environmental factors, is grounded in timely and reliable information.