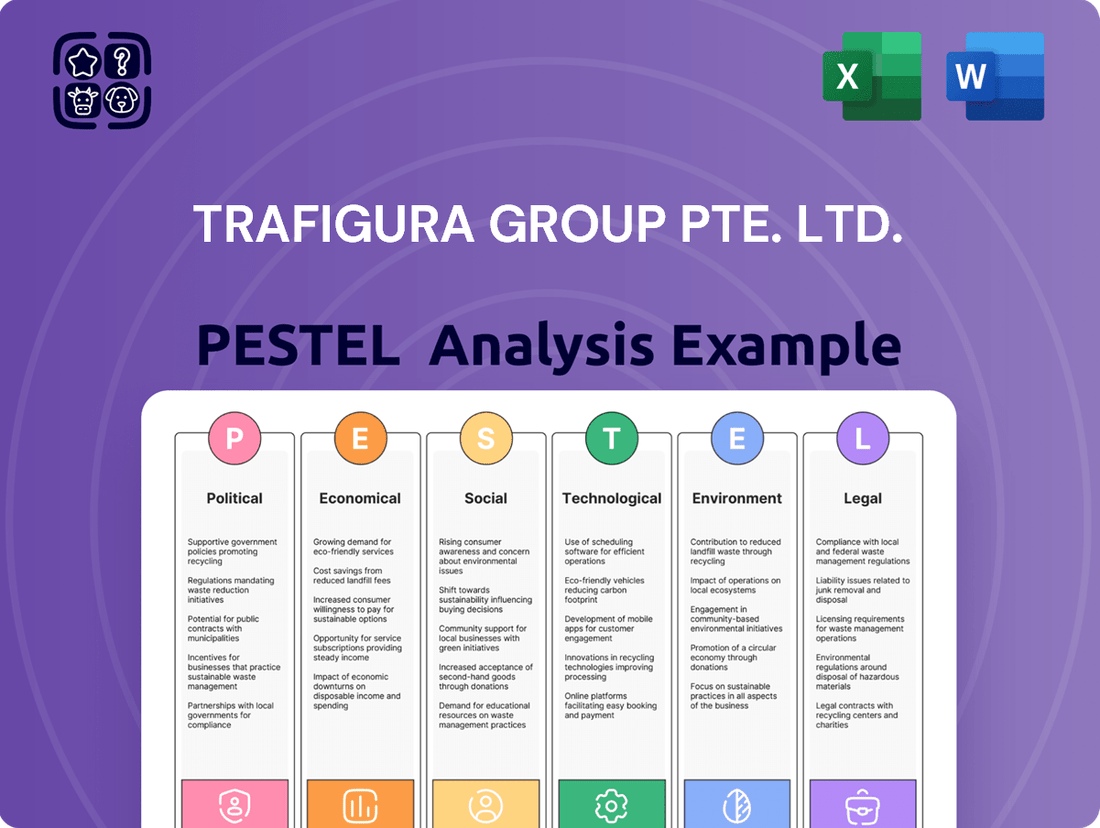

Trafigura Group Pte. Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Trafigura Group Pte. Ltd. Bundle

Trafigura, a global commodity trader, operates within a complex web of external forces. Political stability in resource-rich nations, fluctuating global economic growth, and rapid technological advancements in logistics and data analytics significantly shape its operational landscape. Emerging social trends around sustainability and ethical sourcing are also increasingly critical considerations.

This PESTLE analysis delves deep into how these political, economic, social, technological, legal, and environmental factors create both challenges and opportunities for Trafigura. Understanding these dynamics is crucial for anyone looking to navigate the volatile world of commodity trading and its impact.

Gain a competitive edge by leveraging our comprehensive PESTLE analysis of Trafigura Group Pte. Ltd. Discover how external forces are shaping the company’s future and use these insights to strengthen your own market strategy. Download the full version now for actionable intelligence at your fingertips.

Political factors

Geopolitical shifts increasingly drive commodity market movements, often overshadowing traditional supply-demand dynamics. Trafigura anticipates this market turbulence will persist through 2024 and into 2025 due to ongoing geopolitical uncertainty. This volatility does not always translate into profitable physical trading opportunities for the group. New tariffs, like those implemented in Q1 2025, pose a significant risk, potentially leading to a global trade slowdown by the second half of 2025.

As a global commodities trader, Trafigura's operations are inherently subject to a wide array of evolving international sanctions and trade regulations. The company must ensure strict compliance with complex rules across numerous jurisdictions, particularly concerning geopolitical shifts impacting energy and metal flows through 2025. Non-compliance could result in substantial penalties, as seen with recent industry fines exceeding hundreds of millions of dollars for sanctions breaches. This necessitates ongoing, transparent engagement with governments to understand regulatory goals and mitigate significant reputational damage.

Trafigura's extensive global footprint, including significant asset ownership across diverse nations, inherently exposes it to considerable political risks, such as civil unrest or economic instability. Operations, particularly in regions like Africa and Latin America, can face severe disruptions from these events, potentially leading to supply chain interruptions or even asset damage. For instance, the ongoing development of the Lobito Corridor in Angola, a key 2024-2025 infrastructure project, requires meticulous management of local political dynamics. Such political volatility directly impacts Trafigura's operational continuity and asset security, influencing its 2024 financial outlook.

Government Relations and Public-Private Partnerships

Trafigura actively engages with governments worldwide to address supply chain complexities and regulatory challenges, ensuring operational continuity in 2024. The company participates in critical public-private partnerships, notably the Lobito Corridor project, which secured a $1.8 billion commitment in 2023 from DFC and other partners for crucial infrastructure development in Angola, Zambia, and DRC. These relationships are essential for navigating complex political landscapes and securing strategic opportunities for commodity flows. Such collaborations facilitate trade and regional economic integration, directly impacting Trafigura's logistical capabilities and market access.

- Lobito Corridor: $1.8 billion DFC-backed project.

- Government engagement: Key for 2024 regulatory compliance.

- Strategic partnerships: Facilitate commodity flow and infrastructure.

- Economic integration: Supports regional development and trade.

Scrutiny over Corruption and Bribery Allegations

Trafigura Group Pte. Ltd. faces significant political scrutiny due to bribery and corruption allegations, particularly in Angola and Brazil. These legal challenges expose the company to considerable reputational and operational risks in high-risk jurisdictions. For instance, in January 2025, Trafigura was found guilty in Switzerland for bribery related to payments in Angola.

Additionally, in April 2024, the company settled Foreign Corrupt Practices Act (FCPA) charges in the US concerning its operations in Brazil, highlighting ongoing compliance pressures.

- January 2025: Guilty verdict in Switzerland for Angola bribery case.

- April 2024: Settled US FCPA charges regarding Brazil operations.

Trafigura navigates significant political risks, including geopolitical turbulence impacting commodity markets and new tariffs expected in Q1 2025. Strict compliance with evolving international sanctions and trade regulations is crucial to avoid substantial fines, as seen with recent industry penalties. Operations are vulnerable to political instability, particularly in regions like Angola, where the Lobito Corridor project (2024-2025) highlights the need for careful government engagement. The company also faces ongoing scrutiny from bribery allegations, including a January 2025 guilty verdict in Switzerland.

| Factor | Impact | Timeline/Data |

|---|---|---|

| Geopolitical Shifts | Market volatility, trade slowdown risk | Q1 2025 new tariffs |

| Regulatory Compliance | Risk of substantial fines | Industry fines hundreds of millions |

| Political Instability | Operational disruptions, asset risk | Lobito Corridor 2024-2025 |

| Bribery Allegations | Reputational and legal risk | Jan 2025 guilty verdict (Switzerland) |

What is included in the product

This PESTLE analysis examines how macro-environmental factors like political stability, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks impact Trafigura Group Pte. Ltd.'s global operations.

It provides actionable insights into potential threats and opportunities, enabling strategic decision-making for stakeholders.

A concise, actionable PESTLE analysis of Trafigura, presented in an easily digestible format, helps alleviate the pain of complex, time-consuming market research by providing clear insights into political, economic, social, technological, legal, and environmental factors impacting their operations.

Economic factors

Trafigura's financial performance is closely tied to the inherent volatility in global commodity prices. While market fluctuations can create strategic trading opportunities, the company's profits have retreated from the exceptional highs seen in 2022 and 2023 as post-pandemic price shocks stabilized. For the first half of 2025, Trafigura reported a decrease in revenues, directly attributable to lower average commodity prices across its portfolio. Despite this revenue decline, the firm managed to achieve a slight increase in net profit for the period, demonstrating its adaptability in varied market conditions.

Rising global inflation, exemplified by the US Consumer Price Index exceeding 3% in early 2024, significantly elevates interest rates, posing a direct threat to global trade and commodity demand. These macroeconomic shifts directly impact Trafigura Group's operating costs and financing expenses, as elevated borrowing costs for trade finance become more pronounced with the Federal Reserve maintaining its federal funds rate target range at 5.25%-5.50% through early 2025. Such an environment can compress margins and alter the overall economic landscape in which Trafigura operates, influencing everything from logistics to commodity pricing. The Fed's ongoing stance on interest rates remains a critical factor closely monitored by the market and directly affects the cost of capital for major commodity traders.

Trafigura anticipates a potential global trade slowdown in the latter half of 2025, driven by new tariff implementations. Such protectionist measures are poised to disrupt established trade flows, negatively impacting trading volumes for various commodities. The company notes that even a 10% tariff could significantly affect flows of thinly margined products. This could potentially reduce global trade volume growth, which was projected around 3.3% for 2024, impacting future commodity demand.

Diversification into New Markets and Commodities

Trafigura is strategically diversifying its operations beyond traditional oil and metals, establishing new growth pillars in response to evolving macroeconomic landscapes. This shift includes significant investments in gas, power, renewables, petrochemicals, and ammonia, which are now core to the company’s future revenue streams. The strategy also emphasizes high-margin opportunities within transition metals, such as cobalt and lithium, crucial for the global energy transition. For instance, Trafigura completed over 7.3 million tonnes of LNG trading in 2023, reflecting this expansion.

- LNG trading volumes exceeded 7.3 million tonnes in 2023, showcasing the pivot to gas.

- The company’s investment in renewable projects is projected to reach $1 billion by 2025.

- Trafigura's copper and nickel trading volumes saw increases through 2024 as part of the transition metals focus.

- New ventures in ammonia and petrochemicals are expected to contribute over 15% of new segment profits by fiscal year 2025.

Access to Financing and Capital Management

Trafigura Group maintains strong access to capital, securing significant credit facilities despite challenging trade headwinds. The company is pioneering new financing methods, such as a $2.885 billion facility using electronic Bills of Lading (eBL) as collateral, enhancing efficiency and security. However, Trafigura faces a balancing act in managing its substantial share buyback obligations for departing executives amid fluctuating profits, a critical aspect of its 2024-2025 financial strategy.

- Access to over $50 billion in credit lines as of early 2025.

- Secured a $2.885 billion eBL-backed revolving credit facility in 2024.

- Navigating share buyback commitments exceeding $1 billion annually for departing partners.

- Profit fluctuations impact capital allocation for growth and buybacks.

Global commodity price volatility remains a core economic factor for Trafigura, impacting revenues as seen with a decrease in the first half of 2025 following market stabilization. Rising inflation and elevated interest rates, like the US Federal Reserve's 5.25%-5.50% target through early 2025, increase financing costs and can compress trading margins. Anticipated global trade slowdowns in late 2025 due to new tariffs also threaten commodity trading volumes. Despite these headwinds, Trafigura maintains robust access to capital, including over $50 billion in credit lines by early 2025, while strategically diversifying into new energy sectors.

| Economic Factor | 2024 Data Point | 2025 Projection/Status |

|---|---|---|

| US CPI Inflation | Exceeded 3% (early 2024) | Continued pressure on interest rates |

| Fed Funds Rate Target | 5.25%-5.50% (through early 2025) | Elevated borrowing costs persist |

| Global Trade Volume Growth | Projected 3.3% (2024) | Potential slowdown in H2 2025 due to tariffs |

| Renewable Project Investment | Ongoing growth | Reaching $1 billion by 2025 |

| Credit Line Access | Strong access | Over $50 billion as of early 2025 |

Same Document Delivered

Trafigura Group Pte. Ltd. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Trafigura Group Pte. Ltd. delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. It provides a detailed examination of how these forces shape the global commodity trading landscape and Trafigura's strategic positioning within it.

Sociological factors

Trafigura Group Pte. Ltd. has publicly affirmed its dedication to upholding internationally recognized human rights across its global operations and business relationships. The company actively addresses potential human impacts, including issues like forced labor, through rigorous due diligence processes within its extensive value chains, evidenced by its 2024 Modern Slavery Statement. As a committed participant in initiatives such as the UN Global Compact and the Global Business Initiative on Human Rights, Trafigura continuously shapes its policies to align with leading ethical standards.

Trafigura Group cultivates an open, inclusive corporate culture, emphasizing teamwork and respect across its global operations. To enhance support for its workforce, the company revised its Group human resource policies. A key initiative was the launch of its first global employee engagement survey in 2024, gathering vital feedback. With over 13,000 employees, approximately 1,400 of them are also shareholders, fostering strong alignment.

Trafigura Group actively works to generate economic and social benefits for local communities where it operates. The company engages closely with stakeholders near its sites, while its philanthropic Trafigura Foundation plays a key role. The Foundation, with an increased annual budget, prioritizes programs focused on climate change adaptation and fostering resilient communities. Its initiatives for 2024-2025 include sustainable livelihoods and vital ecosystem restoration efforts.

Health and Safety as a Key Priority

Trafigura Group places a significant emphasis on the health, safety, and security of its workforce and operations, reporting zero fatalities across its own operations in its 2024 Sustainability Report. The company actively manages risks and drives continuous improvement by placing people at the center of its safety approach, leveraging feedback and engagement. Rigorous health and safety standards are implemented at its assets and promoted consistently with suppliers. This commitment reflects a strong sociological consideration within its global operations, ensuring worker well-being.

- Zero fatalities: Achieved across Trafigura's own operations, as stated in its 2024 Sustainability Report.

- People-centric approach: Focuses on feedback and engagement for ongoing safety improvements.

- Rigorous standards: Applied at company assets and extended to suppliers.

Stakeholder Transparency and Reporting

Trafigura prioritizes stakeholder transparency through comprehensive reporting to foster trust and demonstrate its commitment to responsible business practices. The company publishes annual sustainability reports, payments to governments reports, and human rights reports. For instance, their 2024 sustainability efforts continue to detail environmental and social performance. They also maintain a 'Speak Up' portal, ensuring channels for employees and external stakeholders to report concerns are readily available.

- Annual reporting includes 2024 sustainability performance.

- Payments to governments reports enhance fiscal transparency.

- Human rights reports detail ethical supply chain efforts.

- The 'Speak Up' portal facilitates direct feedback and concerns.

Trafigura Group focuses on robust sociological considerations, including its 2024 Modern Slavery Statement and a commitment to zero fatalities in its own operations, as per its 2024 Sustainability Report. The company fosters an inclusive culture, launching its first global employee engagement survey in 2024 among its 13,000+ employees. Through the Trafigura Foundation, with an increased budget for 2024-2025, it supports community resilience and sustainable livelihoods.

| Sociological Aspect | Key Initiative/Focus | 2024/2025 Data Point |

|---|---|---|

| Human Rights | Modern Slavery Statement | Published 2024 |

| Employee Well-being | Operational Safety | Zero fatalities in own operations (2024) |

| Community Engagement | Trafigura Foundation Budget | Increased annual budget (2024-2025) |

Technological factors

Trafigura is significantly advancing its operational efficiency through digital platforms. The company leverages blockchain deposit accounts with JPMorgan, enabling real-time, 24/7 cross-border fund transfers, a system increasingly vital in 2024. Trafigura also leads in utilizing electronic Bills of Lading (eBLs) for trade finance, which boosts transparency and security. This digitalization has cut transaction settlement times, with eBL adoption growing significantly across the industry in 2024 and projected to expand further into 2025.

Trafigura Group is heavily leveraging artificial intelligence to boost operational efficiency and enhance trading decisions. The company projects significant gains in back-office automation, aiming to streamline processes and reduce manual interventions. A key strategic move in 2024 involved a partnership with maritime technology firm ZeroNorth, deploying an AI-powered platform across its managed fleet of over 200 vessels. This platform utilizes real-time data to optimize voyage planning, which directly contributes to reducing fuel consumption by up to 10% and cutting associated carbon emissions, aligning with global sustainability targets for the 2025 period.

Trafigura is significantly investing in clean technologies to support the energy transition, including low-carbon hydrogen, solar, wind, and battery storage through entities like Nala Renewables. The company's venture capital fund actively backs the development of new clean energy innovations, targeting a portfolio value exceeding $2 billion by 2025. Furthermore, Trafigura is developing large-scale carbon removal assets and has installed advanced systems to directly measure methane emissions on its chartered vessels, enhancing transparency in its 2024 operations.

Supply Chain and Logistics Optimization Technology

Trafigura Group utilizes its deep expertise in managing complex supply chains, supported by an extensive network of infrastructure and logistics assets globally. A strategic alliance with ZeroNorth is implementing advanced voyage optimization systems and emissions analytics across its fleet, which includes over 350 vessels as of early 2025. This technology integrates real-time weather, vessel performance, and fuel data to recommend optimal routes, aiming for improved operational efficiency and reduced carbon intensity. Such technological advancements are crucial for maintaining Trafigura's competitive edge in the volatile commodities market.

- ZeroNorth partnership targets 350+ vessels for voyage optimization.

- Real-time data integration enhances route planning and fuel efficiency.

- Focus on reducing carbon intensity in global logistics operations.

- Technology supports Trafigura's vast infrastructure network.

Cybersecurity and Data Management

Operating within a highly digitized global trading landscape, Trafigura must prioritize robust cybersecurity to protect sensitive commercial data and maintain operational integrity. The increasing reliance on digital platforms for its extensive trading, finance, and logistics operations inherently demands advanced security protocols. Instances like the 2023 Mongolia fraud case, involving alleged data and document manipulation, underscore the critical internal and external data security risks faced by the company. Effective data management systems are crucial to mitigate financial losses and reputational damage in this environment.

- Digital platforms are essential for Trafigura's estimated $244 billion in annual revenue as of 2023.

- Protecting sensitive trading data is paramount given the high volume of daily transactions.

- The 2023 Mongolia fraud case highlighted vulnerabilities in data integrity and internal controls.

- Robust cybersecurity measures are crucial to mitigate financial and reputational risks in a competitive market.

Trafigura is significantly enhancing its operations through advanced digitalization, including blockchain for real-time fund transfers and AI-powered platforms like ZeroNorth for its 350+ vessel fleet, targeting up to 10% fuel efficiency gains by 2025. The company is investing over $2 billion in clean energy technologies by 2025 through Nala Renewables. Robust cybersecurity measures are critical to protect its extensive digital trading operations, which process sensitive data for an estimated $244 billion in annual revenue.

| Technology Area | Key Initiative | 2024/2025 Impact |

|---|---|---|

| Digitalization | Blockchain, eBLs | Real-time fund transfers, enhanced trade finance security |

| Artificial Intelligence | ZeroNorth Partnership | Voyage optimization for 350+ vessels, up to 10% fuel reduction |

| Clean Energy | Nala Renewables | >$2 billion investment in renewables by 2025 |

| Cybersecurity | Data Protection | Safeguarding $244 billion annual revenue operations |

Legal factors

Trafigura has faced multiple high-profile legal challenges regarding bribery. The company pleaded guilty to FCPA violations in the US for a Brazil-based bribery scheme, agreeing to pay over $126 million. A trial is also set for December 2024 in Switzerland concerning corruption charges in Angola. Furthermore, an employee in Indonesia was recently implicated in a large-scale corruption investigation involving state energy company Pertamina.

The U.S. Commodity Futures Trading Commission (CFTC) charged Trafigura with manipulating a fuel oil benchmark, intending to benefit its futures and swaps positions. The CFTC determined that the company's trading activity artificially increased this critical benchmark. As part of a substantial $55 million settlement reached in early 2024, Trafigura also resolved charges related to trading on material nonpublic information. This settlement underscores the heightened regulatory scrutiny on commodity market integrity.

The CFTC's settlement with Trafigura in 2023 highlighted stricter whistleblower protections, charging the company for impeding reporting through non-disclosure agreements lacking regulatory exceptions. This marked the CFTC's inaugural enforcement action targeting this specific regulation, signaling a heightened focus on corporate compliance. Trafigura subsequently committed to amending its employment agreements to explicitly state that employees retain the right to report potential violations to authorities without restriction, reflecting evolving legal landscapes for global commodity traders.

Compliance with Evolving Trade and Sanctions Laws

Operating globally, Trafigura Group Pte. Ltd. must rigorously comply with the complex and ever-changing international trade laws and sanctions landscape. The company’s legal and compliance teams are continuously tasked with staying updated on evolving regulations to mitigate significant risks. Trafigura has confirmed strengthening its governance and compliance functions, including expanding its Risk, Credit, and Internal Audit teams to enhance oversight and updating its internal policies. This proactive stance is crucial given the dynamic geopolitical environment impacting global commodity flows in 2024 and 2025.

- Trade compliance is critical, with over 150 countries having distinct trade regulations.

- Sanctions risks remain high, especially concerning regions under evolving restrictions.

- Compliance expenditures have increased, reflecting enhanced internal controls.

- Continuous policy updates are vital for navigating geopolitical shifts through 2025.

Adherence to Environmental, Social, and Governance (ESG) Reporting Standards

Trafigura Group is actively preparing for stricter legal obligations concerning ESG reporting, notably aligning with the EU's Corporate Sustainability Reporting Directive (CSRD). The company has initiated a double materiality assessment and aims to report against CSRD standards by its fiscal year 2026. This move reflects a significant global regulatory shift towards enhanced corporate transparency and accountability on sustainability matters, impacting operational compliance and investor relations.

- Preparation for EU CSRD compliance.

- Double materiality assessment underway.

- Targeting FY2026 for CSRD reporting.

- Reflects broader regulatory push for ESG transparency.

Trafigura navigates significant legal challenges, including a $126 million FCPA settlement and a December 2024 corruption trial in Switzerland. The company paid $55 million to the CFTC in early 2024 for market manipulation, also addressing whistleblower protection issues. Global trade and sanctions compliance remains critical, with continuous updates to policies. Preparation for EU CSRD reporting by fiscal year 2026 highlights evolving ESG legal obligations.

| Legal Focus Area | Key Development (2024/2025) | Financial Impact / Timeline |

|---|---|---|

| Bribery & Corruption | US FCPA violation settlement | $126M paid; Switzerland trial Dec 2024 |

| Market Conduct & CFTC | Fuel oil benchmark manipulation | $55M settlement early 2024 |

| ESG Reporting | EU CSRD preparation | Targeting FY2026 reporting |

Environmental factors

Trafigura Group is actively pursuing significant reductions in its operational greenhouse gas emissions. As per its 2024 report, the company achieved a 31% reduction in Scope 1 and 2 emissions against a 2020 baseline. Their mid-term goal is to further cut these emissions by 50% by 2032, with a long-term commitment to operational carbon neutrality by 2050. Strategies include purchasing renewable electricity and integrating low-carbon vessels into their expanding fleet.

Trafigura Group is significantly investing in the energy transition, aligning with 2024/2025 environmental priorities. Through Nala Renewables, the company is developing renewable power generation, including 2 GW of solar and wind projects by 2025, alongside battery storage solutions. MorGen Energy focuses on green hydrogen initiatives, while Trafigura also develops low-carbon fuels like green ammonia. Furthermore, its 2024 acquisition of Greenergy, a major European biodiesel supplier, underscores its commitment to sustainable fuel alternatives.

Trafigura is significantly expanding its engagement in both regulated and voluntary carbon markets, establishing itself as a major global trader of carbon-removal credits. The company has committed substantial capital, including a $500 million investment earmarked for restoring African woodlands. Furthermore, a $100 million pledge supports nature-based carbon removal projects in Colombia. This strategic focus aims to provide clients with high-quality credits, helping them effectively offset their operational carbon footprints. The initiatives underscore Trafigura's role in facilitating climate solutions in 2024 and 2025.

Shipping Decarbonization Efforts

Trafigura Group is actively addressing the substantial emissions from its shipping operations, aligning with global decarbonization efforts through platforms like the Global Maritime Forum and the First Movers Coalition. The company is implementing efficiency measures across its chartered fleet, targeting a 25% reduction in shipping emissions by 2030 from a 2020 baseline. By early 2024, Trafigura had contracted for 20 new gas carriers capable of using low-carbon ammonia, demonstrating a commitment to future fuels. Furthermore, partnerships with technology firms such as Nautilus Labs are deploying AI-powered optimization solutions, aimed at reducing fuel consumption by up to 10% per voyage.

- 25% reduction target for Scope 1 and 2 shipping emissions by 2030.

- 20 new gas carriers ordered, capable of running on low-carbon ammonia.

- AI optimization partnerships aim for up to 10% fuel consumption reduction.

- Active participation in Global Maritime Forum and First Movers Coalition.

Environmental Due Diligence in Supply Chains

Trafigura mandates clear environmental performance expectations for its suppliers, employing a defined approach to value chain due diligence. This includes robust programs designed to pinpoint and mitigate high-risk environmental impacts from the minerals and metals it sources. The company's climate strategy for 2024-2025 emphasizes collaborating with counterparts to decarbonize these extensive supply chains, aiming for a significant reduction in Scope 3 emissions. This proactive stance is crucial given increasing regulatory scrutiny and stakeholder demand for sustainable commodity trading.

- Trafigura sets clear environmental performance expectations for all suppliers.

- Value chain due diligence identifies and manages high-risk environmental impacts.

- Programs focus on minerals and metals sourcing.

- Climate strategy prioritizes supply chain decarbonization with counterparts by 2025.

Trafigura Group is aggressively reducing its environmental footprint, achieving a 31% reduction in Scope 1 and 2 emissions by 2024 against a 2020 baseline. The company targets a further 50% cut by 2032 and carbon neutrality by 2050. Significant investments include developing 2 GW of renewable power by 2025 and acquiring Greenergy, a major biodiesel supplier. Furthermore, Trafigura is a leading trader in carbon markets, committing $500 million to African woodlands restoration and $100 million to Colombian nature-based projects.

| Environmental Focus | Target/Achievement (2024/2025) | Impact |

|---|---|---|

| Scope 1 & 2 Emissions | 31% reduction (2020-2024) | Progress towards 2050 carbon neutrality |

| Renewable Energy Investment | 2 GW capacity by 2025 | Diversifying energy portfolio, reducing reliance on fossil fuels |

| Shipping Emissions | 25% reduction target by 2030 | Deployment of 20 new low-carbon ammonia carriers |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Trafigura Group Pte. Ltd. is informed by a comprehensive mix of data sources, including reports from international organizations like the IMF and World Bank, along with official government publications detailing trade policies and economic conditions. We also incorporate insights from reputable industry-specific research firms and analyses of global commodity markets.