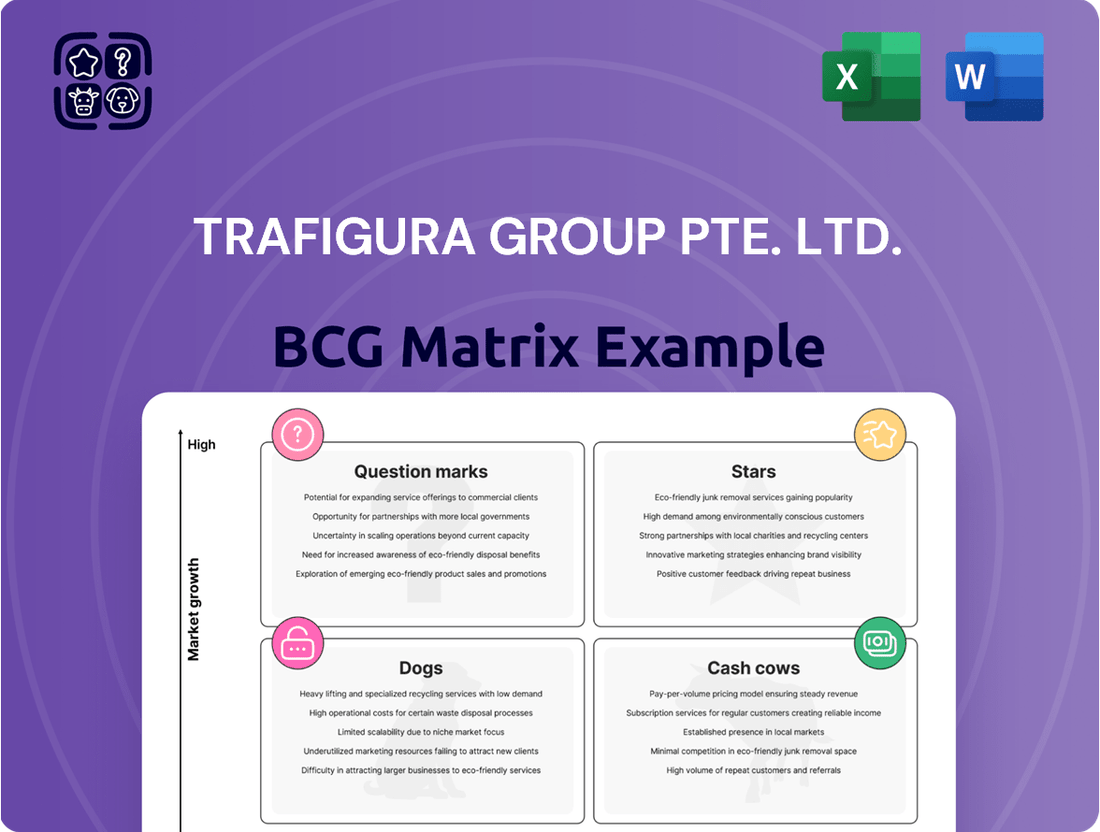

Trafigura Group Pte. Ltd. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Trafigura Group Pte. Ltd. Bundle

Trafigura's diverse portfolio presents a complex BCG Matrix. Analyzing commodities trading reveals various positions, from high-growth potential to established cash generators. Identifying which areas shine and which require strategic adjustments is crucial. This preliminary look hints at intricate market dynamics. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Trafigura is heavily investing in transition metals like cobalt, nickel, and lithium, crucial for the energy transition. These metals are seeing increased demand due to electric vehicles and renewable energy. Trafigura's strategic focus includes infrastructure investments. In 2024, cobalt prices fluctuated significantly, impacting trading strategies.

Trafigura's strategy includes investments in renewable energy. Nala Renewables and MorGen Energy are key subsidiaries in this area. Investments target high-growth markets, like solar and wind. This low-carbon shift aligns with sustainability goals. In 2024, renewable energy investments reached $1.5 billion.

Trafigura is heavily invested in carbon credits, especially carbon-removal credits, expecting high demand. They're funding projects to generate these credits. In 2024, the voluntary carbon market was valued around $2 billion. Trafigura's strategy aligns with net-zero targets and regulations.

Infrastructure Development in Growth Regions

Trafigura strategically invests in infrastructure, such as ports, railways, and pipelines, to bolster its trading operations. This includes projects like the Lobito Atlantic Railway corridor in Angola, which connects to copper-rich regions. These investments secure access to commodities and support expansion in key markets. For instance, in 2024, Trafigura increased its investment in the Lobito Atlantic Railway to $455 million.

- Infrastructure investments enhance trading capabilities.

- Strategic positioning in growing commodity markets.

- Focus on regions with high demand, like Angola.

- Supports core trading activities and expansion.

Acquisition of Greenergy

Trafigura's acquisition of Greenergy significantly impacts its business portfolio, as indicated by a BCG Matrix analysis. This acquisition enhances Trafigura's fuel supply capabilities by integrating Greenergy's infrastructure and expertise. It also positions Trafigura to capitalize on the rising demand for renewable fuels, aligning with global sustainability trends. This strategic move likely boosts Trafigura's market share and diversifies its revenue streams.

- Acquisition of Greenergy strengthens fuel supply and adds renewable production.

- Aligns with the shift towards low-carbon fuels.

- Expands market share in a growing segment.

Trafigura’s Stars in the BCG Matrix include its robust positioning in transition metals, crucial for the high-growth electric vehicle and renewable energy sectors, with cobalt prices fluctuating in 2024. Its ventures into renewable energy, through subsidiaries like Nala Renewables, represent another Star, attracting $1.5 billion in investments by 2024. The acquisition of Greenergy further solidifies its Star status, capitalizing on rising demand for renewable fuels and expanding market share. Carbon-removal credits also emerge as a Star, with the voluntary carbon market valued around $2 billion in 2024.

| Category | Key Investment | 2024 Market Data/Investment |

|---|---|---|

| Transition Metals | Cobalt, Lithium | Cobalt price fluctuations; high EV demand |

| Renewable Energy | Nala Renewables, MorGen Energy | $1.5 billion investment |

| Renewable Fuels | Greenergy Acquisition | Enhanced fuel supply capabilities |

| Carbon Credits | Carbon-removal projects | Voluntary market ~$2 billion |

What is included in the product

Tailored analysis for the featured company’s product portfolio.

Printable summary optimized for A4 and mobile PDFs, offering a portable, concise overview of Trafigura's portfolio.

Cash Cows

Trafigura excels in oil and petroleum trading, a cash cow. In 2024, the company saw substantial revenue from this sector. It leverages its strong market position and logistics. Despite market volatility, it continues to generate significant cash flow. This mature market contributes heavily to Trafigura's financial stability.

Trafigura's robust logistics and supply chain network, featuring storage terminals and shipping, is a key advantage. This network efficiently moves commodities in established markets, ensuring steady cash flow. In 2024, Trafigura's revenue reached $259.7 billion, demonstrating the network's financial impact and stability. Their shipping operations handled over 300 million metric tons of cargo.

Trafigura's base metals trading, including copper, lead, and zinc, remains a cash cow, generating substantial and steady revenue. Despite the move towards transition metals, these established markets leverage existing infrastructure. In 2024, base metals trading provided a dependable revenue stream, reflecting Trafigura's strong market position. This consistent performance supports the company's overall financial stability.

Financing Solutions

Trafigura's financing solutions are a core cash cow, enhancing its trading activities. This involves offering financial services to clients. It leverages their financial strength. These services generate additional revenue. In 2024, financing contributed significantly to Trafigura's profits.

- Financing services bolster trading, creating a steady income source.

- Trafigura uses its strong market position for these financial services.

- This strategy helps to diversify and stabilize revenue streams.

- In 2024, Trafigura's revenue was over $240 billion.

Puma Energy (Retail Fuel Network)

Puma Energy, a downstream energy business, operates a large retail fuel network, especially in Africa and Latin America, and is a key part of Trafigura Group Pte. Ltd. This makes it a mature asset. The business has shown profitability and provides a consistent revenue stream. Trafigura's stake in Puma Energy is a stable part of its portfolio.

- Trafigura's stake in Puma Energy offers steady revenue.

- Puma Energy has a strong presence in Africa and Latin America.

- The retail fuel network is a key driver of revenue.

- The business is considered a mature asset.

Trafigura’s established global market leadership in core commodity trading, including oil and metals, acts as a significant cash cow. These mature segments leverage extensive infrastructure and strong client relationships, ensuring high market share and consistent revenue generation. In 2024, the company’s gross profit reached $7.4 billion, demonstrating the robust profitability from these stable operations. This consistent cash flow is crucial for supporting Trafigura’s diversified portfolio and strategic growth initiatives.

| Cash Cow Segment | Key Contribution | 2024 Data Point | ||

|---|---|---|---|---|

| Oil & Petroleum Trading | Consistent Revenue | Over $250 billion in revenue | ||

| Logistics & Shipping | Operational Efficiency | 300M+ tons cargo handled | ||

| Base Metals Trading | Stable Profitability | Significant portion of $7.4B gross profit |

Delivered as Shown

Trafigura Group Pte. Ltd. BCG Matrix

The Trafigura Group Pte. Ltd. BCG Matrix preview mirrors the complete, purchased document. It's a ready-to-use analysis, free from watermarks, and designed for your strategic planning. Download instantly and begin your assessment. It’s the full, final report.

Dogs

Trafigura's bulk minerals trading volumes have decreased, signaling potential challenges. This suggests some segments are in low-growth markets or where Trafigura's market share is minimal. Such segments may be "dogs" in the BCG matrix, potentially less profitable. In 2024, Trafigura's net profit dropped to $3.3 billion due to market volatility.

Some of Trafigura's industrial assets, including Nyrstar, have struggled. Nyrstar faced impairments, impacting profitability. These assets operate in low-growth markets. This aligns with the "Dogs" quadrant. In 2024, Nyrstar's losses continued, reflecting market challenges.

Trafigura's strategic shifts involve divesting from or downsizing operations. This is often seen in areas where performance lagged or didn't align with long-term goals. For example, in 2024, Trafigura reduced its stake in certain mining projects. These moves help redirect resources, potentially mirroring "Dogs" that need restructuring.

Underperforming Regional Oil Markets (e.g., Mongolia)

The Mongolian oil market, an underperforming region for Trafigura, suffered substantial losses due to alleged misconduct. This situation underscores the risks present in smaller, potentially lower-growth regional markets. These areas may lack robust internal controls, leading to financial setbacks. Despite oil trading's typical Cash Cow status, specific regional operations can become Dogs.

- Trafigura faced losses in Mongolia due to misconduct, highlighting regional market risks.

- Smaller markets may have weaker internal controls.

- Oil trading is generally a Cash Cow, but regional operations can be Dogs.

- Underperforming regions can significantly impact overall profitability.

Segments with Minimal Market Share in Low-Demand Commodities

Segments with minimal market share in low-demand commodities can be considered "dogs" within Trafigura's portfolio. These segments typically generate low revenue and profit margins. For example, in 2024, Trafigura's focus was on core areas like oil and metals, with less emphasis on niche commodities. These areas may require divestiture or restructuring.

- Low Profitability: Dogs usually have low or negative profit margins.

- Minimal Investment: Limited investment is allocated to these segments.

- Potential Divestiture: Trafigura might consider selling off these segments.

- Market Analysis: Continuous market analysis is crucial to assess these segments.

Trafigura's "Dogs" include struggling segments like bulk minerals trading, where volumes decreased and market share is minimal. Industrial assets such as Nyrstar continued facing losses in 2024, indicating low-growth market challenges. The company also reduced stakes in certain mining projects in 2024 and suffered losses in the Mongolian oil market due to misconduct, highlighting underperforming regional operations.

| Segment | Status (2024) | BCG Quadrant |

|---|---|---|

| Nyrstar | Continued Losses | Dog |

| Mongolian Oil Market | Substantial Losses | Dog |

| Bulk Minerals Trading | Decreased Volumes | Dog |

Question Marks

Trafigura is venturing into emerging renewable energy technologies such as green hydrogen and ammonia. They are investing in related projects in high-growth markets. However, their current market share and profitability are likely low. This positions these ventures as 'Question Marks,' needing significant investment to become 'Stars.' In 2024, global green hydrogen production is projected to reach 0.1 million tonnes.

Trafigura's renewable energy expansions, like the Romanian solar project, are "Question Marks" in its BCG matrix. These ventures involve entering new geographic markets, indicating low initial market share and high growth potential. The financial success of these projects will determine their evolution within the matrix. For example, in 2024, the global renewable energy market grew by 15%, presenting significant opportunities.

Trafigura actively invests in early-stage energy transition projects, launching funds to support ventures. These investments target sectors like renewable energy and hydrogen, aiming for high future growth. However, these projects face significant risks, including technological and market uncertainties, leading to potentially low, or even negative, returns in the short term. As of 2024, Trafigura has invested over $2 billion in renewable energy projects.

Expansion in Specific Transition Metal Supply Chain Segments

While Trafigura's transition metals trading is a Star, specific expansions, like refinery investments or sourcing agreements, are question marks. These ventures face market uncertainty. Success hinges on competitive dynamics and evolving demand, crucial for classifying them accurately. Consider the volatility in nickel prices; they fluctuated significantly in 2024.

- Nickel prices saw major shifts in 2024, impacting profitability.

- Investments in refining capacity are capital-intensive and risky.

- Securing long-term sourcing deals is vital for supply chain stability.

- The future of these initiatives depends on market adaptation.

Development of Carbon Capture and Storage Projects

Trafigura's foray into carbon capture and storage (CCS) aligns with its sustainability goals. Purchasing carbon dioxide removal credits from new facilities shows strategic interest. CCS is a high-growth area, yet the market is still developing. This 'Question Mark' status demands investment and market development for future returns.

- Trafigura invested in carbon capture projects, anticipating significant growth.

- The global CCS market was valued at USD 2.85 billion in 2023, with projections reaching USD 15.77 billion by 2032.

- CCS projects face challenges related to technology maturity and regulatory frameworks.

- Developing CCS infrastructure requires substantial capital and long-term commitment.

Trafigura's Question Marks encompass emerging ventures like green hydrogen and early-stage renewable energy projects, characterized by high growth potential but low current market share. These initiatives, including over $2 billion invested in renewables by 2024, require significant capital and face market uncertainties. Success hinges on substantial investment and market development to transition them into future Stars. For instance, global green hydrogen production is projected at 0.1 million tonnes in 2024, highlighting the nascent market stage.

| Investment Area | 2024 Status/Projection | Market Growth Potential |

|---|---|---|

| Green Hydrogen Production | 0.1 million tonnes globally | High, 50%+ CAGR (2024-2030) |

| Renewable Energy Market | 15% global growth | High, sustained growth |

| Trafigura Renewable Investment | Over $2 billion invested | Significant capital needs |

BCG Matrix Data Sources

The Trafigura BCG Matrix is sourced from financial reports, market analysis, and industry publications.