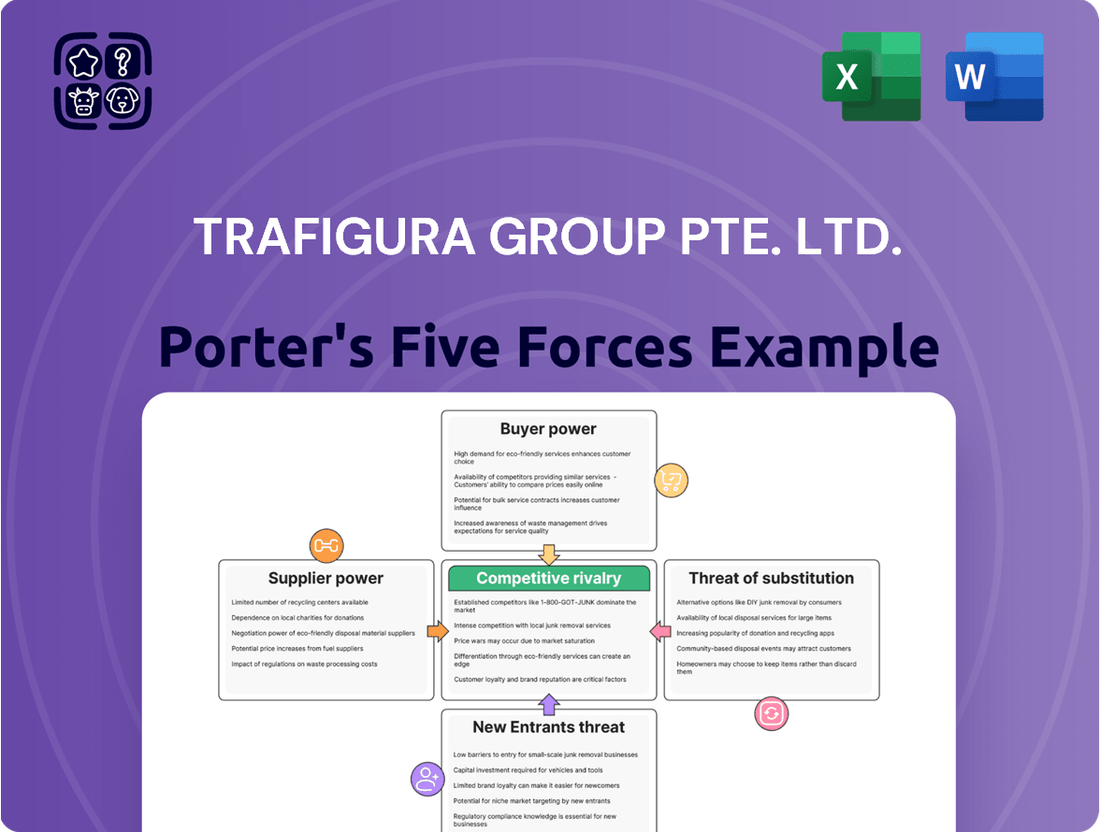

Trafigura Group Pte. Ltd. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Trafigura Group Pte. Ltd. Bundle

Trafigura Group Pte. Ltd. operates in a dynamic global commodities market, where Porter's Five Forces reveal significant competitive pressures. The threat of new entrants, while moderate due to high capital requirements, is always present in this lucrative sector. Intense rivalry among existing players, including Glencore and Vitol, shapes pricing and market share dynamics.

Suppliers, particularly major oil and mining companies, wield considerable power, impacting Trafigura's sourcing costs and availability. Conversely, buyers, such as refineries and industrial consumers, also exert influence through their purchasing volume and negotiation leverage. The threat of substitutes, though less pronounced in core commodity trading, exists in alternative energy sources and evolving consumption patterns.

The complete report reveals the real forces shaping Trafigura Group Pte. Ltd.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers is significantly influenced by the concentration of producers for specific commodities. In markets dominated by a few large National Oil Companies or mining giants, these suppliers, like Saudi Aramco or Vale, can exert substantial control over pricing and terms. Trafigura mitigates this risk by diversifying its sourcing across numerous countries and producers globally. This strategy helps reduce dependence on any single entity, safeguarding Trafigura's supply chain stability and commercial flexibility, especially crucial in the volatile commodity markets of 2024.

Geopolitical events in resource-rich nations profoundly impact commodity supply, significantly empowering governments and state-owned enterprises. For instance, ongoing tensions, like those seen in the Red Sea region in 2024 affecting shipping lanes and energy flows, can disrupt the global movement of resources. This forces traders like Trafigura to navigate complex and volatile supply landscapes, directly increasing supplier bargaining power. Building strong, diversified relationships with a wide array of global suppliers is a crucial strategy to mitigate these risks and ensure operational resilience.

The potential for commodity producers to enter the trading space themselves, known as forward integration, presents a long-term pressure on firms like Trafigura. While some large producers, such as certain oil majors, possess their own trading arms, the immense complexity, specialized risk management expertise, and extensive global logistics network required for successful trading operations present significant barriers. Trafigura’s established infrastructure, handling over 250 million tonnes of oil and petroleum products in 2024, and specialized knowledge help maintain its crucial intermediary role. This makes direct competition from suppliers a high-cost, high-risk endeavor for most.

Importance of volume to suppliers

Large-volume off-takers like Trafigura are crucial customers for global commodity producers, which significantly tempers supplier power. Producers heavily rely on major traders to consistently move vast quantities of their products, like the 6.6 million barrels per day of oil and petroleum products Trafigura handled in 2023, to the global market. This mutual dependency fosters long-term relationships, allowing Trafigura to secure more favorable terms and pricing.

- Trafigura’s substantial 2023 oil and petroleum product volumes averaged 6.6 million barrels per day.

- The group traded 91.1 million tonnes of non-ferrous metals and bulk minerals in 2023.

- Such significant off-take volumes ensure producers prioritize maintaining strong relationships with Trafigura.

- This scale provides Trafigura with enhanced negotiating leverage over suppliers.

Availability of substitute commodities

The availability of substitute commodities significantly constrains supplier pricing power for Trafigura. For instance, a power utility might opt for natural gas over coal if prices shift, as seen in early 2024 with fluctuating energy markets. Trafigura's expansive multi-commodity portfolio, which includes metals, minerals, and energy products, allows it to adapt swiftly to these market dynamics. This diversified approach mitigates the leverage of any single commodity supplier, enhancing Trafigura's operational flexibility and procurement strength.

- In 2024, global natural gas prices showed volatility, impacting coal demand.

- Trafigura's diverse portfolio covers over 100 commodities.

- This diversification reduces reliance on any single supplier or commodity.

Supplier bargaining power for Trafigura is tempered by its vast off-take volumes, like handling 6.6 million barrels of oil daily in 2023, and its broad commodity diversification across over 100 products. However, highly concentrated producers and geopolitical risks, such as Red Sea tensions in 2024, can increase supplier leverage. The high barriers to entry for producers in complex global trading also limit direct competition.

| Factor | Impact on Supplier Power | 2024 Context/Data |

|---|---|---|

| Volume Off-take | Lowers | 6.6M bpd oil (2023) |

| Diversification | Lowers | 100+ commodities |

| Geopolitics | Increases | Red Sea tensions |

What is included in the product

This Porter's Five Forces analysis for Trafigura Group Pte. Ltd. scrutinizes the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within the global commodity trading sector.

Quickly identify and mitigate the impact of intense rivalry and buyer power within the global commodities market.

Customers Bargaining Power

Customers in commodity markets, such as large industrial consumers, state-owned utilities, and refiners, are highly price-sensitive because products like crude oil or metals are largely undifferentiated. This intense competition means they will readily switch to the most competitive offer available. Consequently, traders like Trafigura must operate on very thin margins, which were evident in the more normalized trading conditions of 2024 compared to previous years. This forces aggressive competition based on price and superior logistical efficiency to secure contracts.

Switching costs for customers of Trafigura Group are generally low, as the global commodity market allows sourcing from numerous traders. To mitigate this, Trafigura focuses on fostering long-term relationships, providing reliable delivery, and offering extensive risk management services, which remain crucial in the volatile 2024 energy and metals markets. They also provide tailored financing solutions, enhancing loyalty by integrating deeply into customer operations. These value-added services make switching to competitors a less attractive proposition, solidifying client retention.

Trafigura serves a vast array of global customers, ranging from large state-owned enterprises to smaller industrial clients. While major buyers, particularly those involved in substantial commodity off-take agreements, can exert considerable bargaining power due to their volume, Trafigura's extensive reach mitigates this risk. The company's diverse customer base across numerous geographies and sectors, handling over 7 million barrels of oil and products daily in 2023, prevents over-reliance on any single buyer. This broad portfolio, maintained through 2024, enhances its negotiating position.

Access to market information

Increased transparency and accessible market data empower customers in commodity markets, allowing them to compare prices and terms more effectively from various suppliers. This heightened access typically strengthens buyer bargaining power. However, Trafigura skillfully transforms this potential threat into a relationship-building opportunity by utilizing its extensive market intelligence and advanced analytics. For instance, in 2024, Trafigura continues to leverage its proprietary data platforms, processing vast amounts of real-time market information, which it then shares as valuable insights with its clients.

- Customers gain leverage from readily available price discovery tools.

- Trafigura's 2024 market analysis helps clients optimize procurement strategies.

- Proprietary intelligence mitigates the threat of commoditization for Trafigura.

- This approach enhances long-term customer loyalty and engagement.

Threat of backward integration

The threat of customers engaging in backward integration against Trafigura is considerably low. While large industrial consumers of commodities could theoretically establish their own trading and logistics arms, the capital expenditure and operational complexities are immense. For instance, replicating Trafigura's global network, which includes over 96 offices and operations in 48 countries as of 2024, alongside its sophisticated risk management systems for volatile commodity prices, presents an almost insurmountable barrier. Trafigura's established expertise and vast infrastructure, handling 6.6 million barrels of oil equivalent per day and 81.4 million tonnes of metals and minerals in 2023, act as a formidable deterrent, making self-sourcing economically unfeasible for most buyers.

- Global presence: Trafigura operates over 96 offices in 48 countries, a scale difficult for customers to replicate.

- Volume handled: In 2023, Trafigura moved 6.6 million barrels of oil equivalent per day, showcasing immense logistical capacity.

- Capital intensity: Building a comparable trading and logistics network requires billions in infrastructure and working capital.

Customers exert significant bargaining power in undifferentiated commodity markets due to low switching costs, leading to thin margins for Trafigura in 2024. However, Trafigura mitigates this by offering extensive value-added services like risk management and tailored financing. Its vast, diversified global customer base across 48 countries, coupled with advanced market intelligence, further diminishes individual buyer leverage. The substantial capital barriers for backward integration also limit customer power.

| Factor | 2024 Impact | Trafigura Countermeasure |

|---|---|---|

| Price Sensitivity | High due to undifferentiated products, leading to thin margins. | Logistical efficiency, risk management services. |

| Switching Costs | Generally low for customers. | Tailored financing, long-term relationships. |

| Backward Integration Threat | Very low; replicating Trafigura's 96+ offices and global network is immense. | Vast infrastructure, deep expertise, 2023 volume of 6.6M bpd oil/81.4M tonnes metals. |

Same Document Delivered

Trafigura Group Pte. Ltd. Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Trafigura Group Pte. Ltd. will detail the intense competitive rivalry within the global commodity trading sector, highlighting the strategic importance of scale and market access. It will also delve into the significant bargaining power of suppliers, particularly in securing crucial raw materials and shipping capacity, and the considerable power of buyers, who often possess substantial leverage due to the commoditized nature of many traded goods. Furthermore, the analysis will explore the moderate threat of new entrants, which is constrained by high capital requirements and established relationships, alongside the substantial threat of substitutes, as alternative energy sources and materials continue to emerge and gain traction in the market.

Rivalry Among Competitors

The commodity trading industry presents high competitive rivalry, featuring a robust mix of large, diversified players like Glencore, Vitol, and Mercuria, alongside various specialized niche traders. This intense competition constantly pressures Trafigura's trading margins, demanding continuous innovation in strategies and operational efficiency. Following a period of significant market volatility and record profits, the competitive landscape intensified in 2024 as overall commodity trading margins compressed. This environment necessitates agile decision-making and strong risk management to maintain market share and profitability against well-established rivals.

Scale is paramount in commodity trading, allowing for robust risk diversification and access to more favorable financing terms, crucial for global operations. This imperative drives significant industry consolidation, as larger entities acquire smaller competitors to expand market share and operational footprint. Trafigura Group Pte. Ltd. exemplifies this with its immense scale, evidenced by its 2023 revenue of $244.3 billion, and an extensive global network spanning 150 offices in 48 countries. This vast infrastructure and financial capacity provide a substantial competitive advantage, enabling efficient logistics and resilient supply chains in the volatile global commodities market.

In the commodities trading sector, competition for Trafigura Group is primarily based on price given the standardized nature of products like crude oil and metals.

This intense price-based rivalry leads to inherently thin profit margins across the industry.

Success is therefore determined by superior logistical efficiency, stringent risk management practices, and the ability to capitalize on minor arbitrage opportunities.

After record highs in 2022, profitability for oil trading significantly decreased in 2024 due to a decline in price volatility, impacting overall sector returns.

The race for talent and technology

The race for top trading talent and advanced technological capabilities intensifies competitive rivalry for firms like Trafigura. Companies fiercely compete for experienced traders who can navigate volatile global commodity markets, which saw significant shifts in 2024. This fierce competition extends to data scientists developing sophisticated AI-driven trading models, vital for optimizing supply chains and predicting price movements.

- Major trading houses allocated substantial 2024 budgets to AI and machine learning development.

- Demand for quantitative analysts in commodity trading roles increased by an estimated 15% in early 2024.

- Talent acquisition costs for senior traders and data scientists rose by approximately 10% in the last year.

- Leading firms like Trafigura continue to invest in proprietary trading platforms to gain an edge.

Shifting focus to new commodities

Competitive rivalry is intensifying as traders shift focus to new commodities, particularly those vital for the energy transition. This includes metals like lithium and cobalt, and the broader renewable sector, where firms aim to establish early dominance. Competitors such as Mercuria are actively recruiting talent to expand their base metals operations, directly challenging Trafigura's established position. To secure future growth, Trafigura itself is diversifying, investing in areas like petrochemicals and ammonia, reflecting broader industry trends in 2024.

- Mercuria actively expanded its base metals team in 2024, signaling heightened competition.

- Trafigura announced a $300 million investment in renewable energy projects by early 2024.

- Demand for energy transition metals like lithium surged by over 20% in 2024.

Competitive rivalry for Trafigura is intense, driven by large players like Glencore and Vitol, leading to compressed margins in 2024.

Success hinges on scale, superior logistics, and talent acquisition, with demand for quantitative analysts up 15% in early 2024.

The race for energy transition commodities like lithium, which surged over 20% in 2024, further heightens competition.

| Metric | 2023 | 2024 (Est.) |

|---|---|---|

| Trafigura Revenue | $244.3B | $230-250B |

| Oil Trading Profitability | High | Reduced |

| Lithium Demand Growth | 15% | >20% |

SSubstitutes Threaten

The global energy transition presents a significant long-term threat of substitution for fossil fuels like oil and coal. Renewables are increasingly vital, with global renewable capacity additions projected to reach 500 GW in 2024, driven by surging power demand. Trafigura actively addresses this by building a third pillar in gas, power, and renewables. The company is investing in low-carbon assets and expanding its trading of environmental products, reflecting a strategic shift in response to market dynamics.

Customers often swap one commodity for another, like choosing natural gas over coal for power generation or substituting aluminum for copper in some industrial applications based on price and availability. This flexibility significantly caps the pricing power for any single commodity Trafigura trades. However, Trafigura's extensive and diversified portfolio, spanning oil, metals, and minerals, directly addresses this threat. By offering a wide array of options, the company is well-positioned to meet shifting demand patterns and mitigate the direct impact of inter-commodity substitution, ensuring continued relevance in volatile markets. This strategy is crucial as global energy transition trends accelerate in 2024.

Technological advancements continuously introduce new substitutes, directly impacting demand for commodities Trafigura trades. For example, the rapid adoption of electric vehicles, with global EV sales projected to reach over 17 million units in 2024, directly threatens long-term oil demand. Similarly, innovations in synthetic materials, like advanced plastics or lab-grown alternatives, can reduce the need for traditional metals or agricultural products. This innovation risk necessitates constant market monitoring and strategic adaptation to shifting material consumption patterns.

Government policies and regulations

Government policies significantly influence the threat of substitutes for Trafigura, accelerating shifts towards alternative commodities. Mandates like the EU Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in 2024, incentivize lower carbon alternatives. Regulations such as the EU Deforestation Regulation, impacting supply chains from December 2024, favor sustainably sourced products over traditional ones. Such shifts necessitate that traders like Trafigura continually adapt their portfolios to remain competitive.

- EU CBAM transitional phase started in October 2023, with financial obligations beginning in 2026, impacting carbon-intensive imports.

- Global renewable energy investment is projected to reach over 1.7 trillion USD in 2024, driven by government incentives.

- The EU Deforestation Regulation became applicable in June 2023, with compliance for larger operators required by December 2024.

- These regulatory pressures steer demand towards commodities with lower environmental footprints.

Improving energy efficiency

Broad improvements in energy efficiency across industries significantly reduce the overall demand for energy commodities. This means industries and consumers require less oil, gas, and coal to achieve the same output, dampening demand. This structural trend pressures commodity traders like Trafigura to seek new growth areas, such as renewable energy trading. For instance, global energy intensity, a measure of efficiency, is projected to continue its decline in 2024, impacting fossil fuel consumption patterns.

- Global energy intensity projected to fall by 2.5% in 2024, reducing fossil fuel demand.

- Industrial sectors are investing in energy-saving technologies, impacting bulk commodity demand.

- Increased adoption of electric vehicles in 2024 further curbs oil demand.

- Trafigura is expanding into power and renewables trading to counter this shift.

The threat of substitutes for Trafigura is driven by the global energy transition, with renewables like solar and wind projected to see 500 GW added capacity in 2024, directly impacting fossil fuel demand. Customers also readily switch between commodities based on price, such as choosing natural gas over coal, capping pricing power. Technological advancements, including over 17 million EV sales projected for 2024, and government policies like the EU CBAM, further accelerate shifts to lower-carbon or more efficient alternatives, necessitating portfolio diversification.

| Threat Factor | 2024 Data Point | Impact on Trafigura |

|---|---|---|

| Renewable Growth | 500 GW global capacity additions | Reduces fossil fuel reliance |

| EV Adoption | 17M+ global EV sales | Curbs long-term oil demand |

| Energy Efficiency | 2.5% projected fall in global energy intensity | Lowers overall commodity demand |

Entrants Threaten

The commodity trading industry has extremely high barriers to entry due to the immense capital required for physical transactions, complex logistics, and comprehensive risk management. Securing extensive credit lines, like Trafigura's reported $75 billion facility in 2024, poses a significant hurdle for any new player. This capital intensity, essential for global operations and managing market volatility, places immense financial stress on smaller, aspiring entrants, making market penetration exceptionally difficult.

New entrants face a formidable barrier in navigating the intricate and ever-evolving international regulatory framework. Compliance with directives such as MiFID II, REMIT, and various global sanctions regimes demands substantial financial investment and specialized expertise in robust compliance systems. For example, global financial crime compliance costs were projected to exceed $200 billion in 2024, underscoring this significant burden. Any potential changes to existing regulatory exemptions could further tighten market entry conditions, making it exceptionally difficult for new players to compete effectively with established giants like Trafigura.

New entrants face a formidable barrier from Trafigura Group's immense economies of scale and deeply entrenched global network. As of 2024, Trafigura leverages its vast trading volumes, which reached 7.4 million barrels per day for oil and petroleum products in 2023, to achieve significant cost advantages in logistics, procurement, and infrastructure utilization. A new player would struggle immensely to replicate this extensive network of suppliers, customers, and critical assets like ports and storage facilities. This established network provides Trafigura with unparalleled access to real-time market intelligence, superior logistical efficiencies, and robust, long-standing relationships, making market penetration exceptionally difficult for any newcomer.

Specialized expertise and risk management

Successful commodity trading, as demonstrated by Trafigura, demands profound institutional knowledge and highly sophisticated risk management capabilities to navigate market, credit, and operational risks effectively. Building this intricate expertise and the robust systems required is an immensely time-consuming and capital-intensive endeavor. For instance, managing a commodity portfolio with billions in exposure, like Trafigura's $244.2 billion revenue in 2023, necessitates real-time data analytics and complex hedging strategies. This high barrier to entry significantly deters potential new entrants who lack the specialized skill set and financial resources to establish such critical infrastructure.

- Commodity traders invest heavily in proprietary risk models.

- Regulatory compliance costs for risk management are substantial.

- Talent acquisition for specialized risk roles is competitive and costly.

- Systems integration for global trading platforms requires years of development.

Emergence of tech-driven trading firms

While traditional barriers to entry remain high for commodity trading, a new competitive threat emerges from tech-driven trading firms and hedge funds. These agile entrants, often focusing on data-intensive niches, leverage advanced analytics and artificial intelligence to gain an edge. This increases pressure on established players like Trafigura to continuously innovate and upgrade their technological capabilities. By 2024, a significant majority of market traders anticipate an increase in the number of such new, technology-focused participants.

- New entrants utilize AI and advanced analytics.

- They target data-intensive trading niches.

- Incumbents face increased innovation pressure.

- A majority of traders expect more tech-driven firms in 2024.

The threat of new entrants in commodity trading remains low for Trafigura due to incredibly high capital requirements, complex regulatory hurdles, and immense economies of scale. While traditional barriers are formidable, new tech-driven firms leveraging AI and advanced analytics pose an emerging, albeit niche, competitive threat. These agile players increase pressure on incumbents like Trafigura to continuously innovate their technological capabilities. Despite this, the overall entry barrier remains exceptionally high for any entity aiming to compete broadly with established giants.

| Barrier Type | Impact on New Entrants | 2024 Data/Context |

|---|---|---|

| Capital Intensity | Extremely High | Trafigura's $75 billion credit facility (2024) |

| Regulatory Compliance | Significant Burden | $200 billion+ global financial crime compliance costs (projected 2024) |

| Economies of Scale | Nearly Insurmountable | Trafigura's 7.4 million bpd oil/petroleum products (2023) |

| Emerging Tech Threat | Increasing Pressure | Majority of traders expect more tech-driven firms (2024) |

Porter's Five Forces Analysis Data Sources

Our Trafigura Porter's Five Forces analysis is built upon a foundation of comprehensive data, incorporating Trafigura's annual reports, investor presentations, and public financial disclosures. We also leverage industry-specific market research reports, commodity price databases, and news from reputable trade publications to capture the dynamics of the global commodity trading sector.