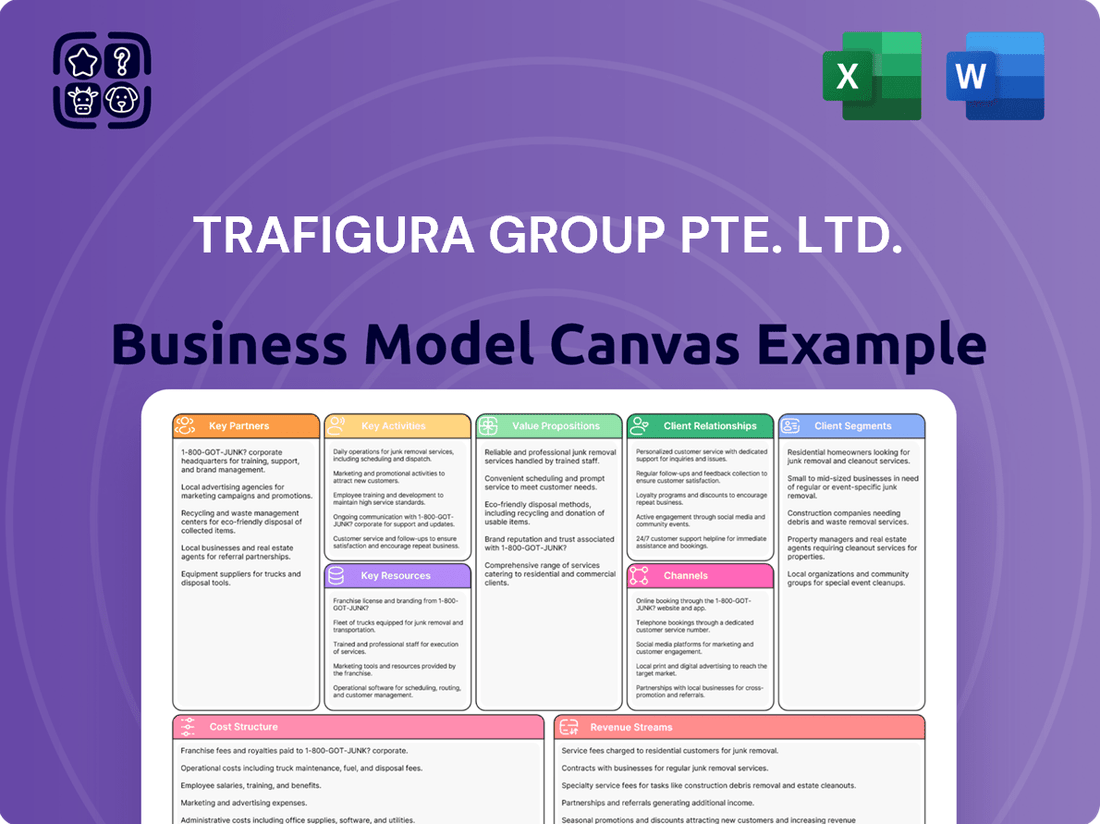

Trafigura Group Pte. Ltd. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Trafigura Group Pte. Ltd. Bundle

Unlock the full strategic blueprint behind Trafigura Group Pte. Ltd.'s business model. This in-depth Business Model Canvas reveals how the company drives value through its extensive global trading network and secures key partnerships in resource-rich regions. Understand their diverse revenue streams, from commodity trading to logistics, and how they manage complex cost structures. This comprehensive analysis is essential for anyone seeking to grasp the operational intricacies of a leading commodities trader.

See how Trafigura Group Pte. Ltd. leverages its vast infrastructure and deep market knowledge to serve critical customer segments across various industries. The full Business Model Canvas details their core activities, from sourcing and transportation to risk management, and highlights the unique value propositions they offer. Download the complete version to gain a strategic edge and accelerate your own business planning.

Partnerships

Trafigura Group establishes vital long-term offtake agreements with producers and miners, serving as their primary commodity suppliers. These partners include national oil companies, independent oil producers, and major mining corporations, ensuring a consistent and diverse supply of crude oil, petroleum products, metals, and minerals. For instance, in 2023, Trafigura traded 6.2 million barrels per day of oil and petroleum products and 83.3 million tonnes of metals and minerals. These crucial partnerships are frequently solidified by Trafigura providing significant financing and technical expertise to support production and development.

Trafigura relies on a vast consortium of global banks, investment funds, and capital market participants for essential credit lines and trade finance facilities. These critical relationships, which include major institutions like HSBC and Citi, enable the funding of large-scale commodity transactions, managing liquidity, and financing crucial infrastructure projects. For instance, in early 2024, Trafigura secured a new multi-billion dollar revolving credit facility, demonstrating its ongoing access to significant capital. This ability to consistently secure billions in financing, vital for its extensive global operations, fundamentally underpins its entire business model.

Trafigura maintains extensive key partnerships with a global network of vessel owners, freight operators, pipeline operators, and rail companies. These collaborations are crucial for ensuring the efficient and reliable transportation of diverse commodities worldwide. While Trafigura operates its own substantial chartering desk, it heavily leverages these third-party partners for expansive global reach and capacity, managing a fleet of over 4,000 vessels in 2023. This allows them to book everything from supertankers to smaller vessels, facilitating complex logistical operations across various modes of transport.

Industrial Consumers & End-Users

Strategic relationships with large-scale industrial consumers like oil refineries, smelters, and power generation companies are crucial for Trafigura. These partnerships, often secured through long-term supply contracts, provide a stable demand base for their extensive commodity portfolio. Such agreements ensure predictability for both parties, allowing for tailored product blending and precise delivery schedules to meet specific industrial needs. This client base underpins Trafigura's substantial trading volumes across energy, metals, and bulk minerals.

- Trafigura's 2023 oil and petroleum products volumes reached 6.4 million barrels per day.

- Long-term contracts ensure consistent demand from global industrial clients.

- Partnerships often involve customized commodity blends for specific industrial processes.

- The company serves over 150 countries, indicating a vast industrial client network in 2024.

Infrastructure & Joint Venture Partners

Trafigura significantly enhances its global supply chain by forming strategic joint ventures and partnerships focused on critical infrastructure. These collaborations involve working with port authorities, terminal operators, and other industry players to invest in vital assets like storage facilities, pipelines, and port infrastructure worldwide. A key example is Nala Renewables, a joint venture established in 2020 with the aim to invest in renewable energy projects, targeting 2 GW of capacity by 2025.

- In 2024, Trafigura continues to leverage partnerships for infrastructure, such as its stake in the Porto Sudeste iron ore terminal in Brazil.

- The Nala Renewables venture, a 50/50 partnership, actively acquires and develops solar, wind, and power storage projects globally.

- These infrastructure investments are crucial for optimizing commodity flows and reducing operational costs across Trafigura’s extensive network.

- Strategic alliances bolster Trafigura’s market position and ensure resilient supply chains for its diverse trading activities.

Trafigura's global operations are underpinned by a diverse network of key partnerships, crucial for its entire value chain. These include long-term supply agreements with major producers like national oil companies and mining corporations, alongside vital credit lines from global financial institutions. Strategic alliances with logistics providers ensure efficient global commodity movement, while long-term contracts with industrial consumers secure stable demand. Furthermore, joint ventures in infrastructure, such as Nala Renewables targeting 2 GW by 2025, bolster their asset base and operational efficiency.

| Partnership Type | Key Role | 2024 Impact/Data |

|---|---|---|

| Producers/Miners | Consistent commodity supply | Oil/petroleum volumes at 6.4 million bpd (2023); ongoing long-term deals. |

| Financial Institutions | Funding and liquidity | Secured new multi-billion dollar revolving credit facility in early 2024. |

| Logistics Providers | Global transportation | Managed over 4,000 vessels (2023); extensive third-party network for reach. |

| Industrial Consumers | Stable demand base | Serves over 150 countries; long-term contracts ensure demand predictability. |

What is included in the product

This Business Model Canvas for Trafigura Group Pte. Ltd. outlines its core strategy as a global commodity trading and logistics powerhouse, focusing on efficient sourcing, transportation, and distribution of vital resources.

It details how Trafigura leverages its extensive network, risk management expertise, and financial capabilities to connect producers and consumers across diverse markets.

Trafigura's Business Model Canvas acts as a pain point reliever by offering a high-level view of their complex trading operations, enabling quick identification of how they mitigate risks and manage logistics for clients.

This canvas provides a concise, one-page snapshot that simplifies Trafigura's commodity trading and logistics strategy, making it an invaluable tool for internal understanding and external communication.

Activities

Trafigura’s core activity involves the extensive purchase and sale of physical commodities globally, leveraging sophisticated arbitrage strategies. This includes profiting from price discrepancies across diverse geographic markets, time periods through contango or backwardation, and varying product grades. Traders utilize deep market knowledge and real-time data to execute complex trades, ensuring efficient physical flow of goods from source to destination. For instance, in 2023, Trafigura's oil and petroleum products trading volumes reached 6.9 million barrels per day, underscoring the scale of these operations. This relentless focus on optimizing commodity flows and exploiting market inefficiencies remains central to their profitability, contributing significantly to their H1 2024 net profit of 1.5 billion USD.

Trafigura excels in managing the entire end-to-end logistics for global commodity flows, ensuring seamless movement from source to destination. This encompasses the meticulous chartering of vessels, arranging diverse land-based transport, and precise inventory management across storage facilities. In 2023, Trafigura shipped 304.5 million tonnes of oil and petroleum products, highlighting their vast operational scale. Their expertise also extends to overseeing customs clearance and final delivery, optimizing these complex, global supply chains for competitive advantage and significant value creation.

Trafigura actively manages its significant exposure to market, credit, and operational risks inherent in global commodity trading. The company extensively utilizes financial derivatives, such as futures, options, and swaps, to hedge against volatile commodity prices and currency fluctuations, which remained a key focus in 2024 given ongoing market uncertainty. Sophisticated, real-time risk management systems are continuously deployed to monitor these exposures. A dedicated team of experts is in place to mitigate potential losses, ensuring robust financial stability across its diverse operations.

Structured Trade Finance

Trafigura’s Structured Trade Finance provides crucial financial lifelines to producers, especially those in emerging markets lacking traditional bank access. This includes substantial prepayment facilities and inventory financing, securing commodity supply for Trafigura while injecting vital working capital for partners. These strategic deals foster a loyal supplier network and contribute significantly to Trafigura’s financing income. For instance, in fiscal year 2023, Trafigura’s net financing income was reported at $1.5 billion, reflecting the scale of these activities.

- Prepayment facilities provide producers with upfront capital against future deliveries.

- Inventory financing helps manage working capital for commodity stockpiles.

- These tailored solutions secure vital supply chains for Trafigura.

- Such activities contribute to the group’s robust financing income.

Asset Investment & Operation

Trafigura strategically invests in, develops, and operates crucial physical infrastructure supporting its global trading activities. This includes owning substantial stakes in ports, terminals, storage depots, and production facilities, like their 2024 investments in renewable energy infrastructure through Nala Renewables. These assets provide greater control over the entire supply chain, generating stable operational income. They also offer additional trading and blending opportunities, enhancing market reach and efficiency.

- Trafigura's asset base, including investments in Puma Energy and Nyrstar, significantly enhances supply chain resilience.

- For 2024, the company continues to expand its physical footprint to optimize commodity flows globally.

- These strategic assets contribute to diversified revenue streams beyond core trading margins.

- The owned infrastructure allows for optimized blending and storage, adding value to traded commodities.

Trafigura’s core activities involve global physical commodity trading, leveraging arbitrage strategies and extensive logistics management for efficient flow. They actively manage market and credit risks, notably in 2024 through derivatives, and provide crucial structured trade finance. Strategic investments in infrastructure, including 2024 renewable energy projects, enhance supply chain control and efficiency.

| Key Activity | 2023 Volume/Value | 2024 Focus/Update |

|---|---|---|

| Oil Trading Volume | 6.9M bpd | Optimizing flows |

| Net Profit (H1) | $1.5B | Sustaining profitability |

| Infrastructure Investment | Puma Energy, Nyrstar | Renewable energy expansion |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Trafigura Group Pte. Ltd. that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their core activities, value propositions, customer segments, and revenue streams, providing an immediate, actionable insight into their global commodity trading operations. You'll gain access to the same professionally structured content, ready for your analysis and integration into your own strategic planning.

Resources

Trafigura's global network, featuring over 100 offices worldwide, is its most vital resource, enabling a vast intelligence web. This extensive presence, staffed by expert traders, analysts, and operators, provides unparalleled market insights and local expertise. Real-time information flow, crucial for a trading powerhouse, is a direct benefit of this expansive reach. This human and intellectual capital allows Trafigura to swiftly identify and capitalize on market opportunities, essential for their significant trading volumes, which exceeded 300 million tonnes of oil products and metals in 2024.

Trafigura maintains extensive access to capital, leveraging multi-billion dollar credit lines from a diverse syndicate of international banks.

These robust facilities, including a significant 2024 European revolving credit facility, are critical for financing its vast physical commodity trades globally.

This financial strength also enables the company to manage substantial margin calls on hedges and fund strategic infrastructure investments.

In 2024, Trafigura reported total credit lines exceeding $70 billion, highlighting its massive financial firepower.

This deep liquidity and strong balance sheet act as a formidable barrier, deterring potential competitors in the commodity trading sector.

Trafigura Group's strategic physical infrastructure, encompassing owned and operated port terminals, storage facilities, and pipelines, provides a significant competitive advantage. These assets ensure logistical flexibility, reducing reliance on third parties and enabling crucial blending opportunities. Such infrastructure generated stable, long-term revenue, contributing to Trafigura's record 2024 first-half net profit of $3.5 billion. Key holdings include a substantial stake in Puma Energy, boasting over 1,800 retail sites and 90 storage terminals globally, and majority ownership in Nyrstar's smelting operations.

Advanced Data Analytics & Technology Platforms

Trafigura leverages sophisticated, proprietary technology for trade execution, risk management, and logistics optimization across its global commodity flows. Advanced data analytics and machine learning models are continuously applied to anticipate market trends, predict supply-demand imbalances, and optimize complex shipping routes efficiently. These cutting-edge systems are a vital key resource, enabling Trafigura to maintain a significant competitive edge in a data-intensive global trading environment, handling millions of tonnes of commodities annually. Their 2024 focus continues to prioritize digital transformation for operational excellence.

- Proprietary systems enhance trade execution and risk management.

- Machine learning optimizes global logistics and shipping.

- Data analytics informs market trend prediction and supply chain efficiency.

- Continued investment in digital transformation remains a 2024 strategic priority.

Long-Standing Counterparty Relationships

Trafigura's decades of reliable operation have forged deep trust and strong relationships across a global network of producers, consumers, governments, and financial institutions. These long-standing ties are a critical resource, enabling access to exclusive deals and preferential financing terms, crucial for securing reliable supply and offtake agreements. A robust reputation in commodity trading is a tangible asset, underpinning the firm's ability to navigate complex global markets.

- Facilitates over 7.5 million barrels of oil and petroleum products traded daily as of 2024, supported by strong counterparty networks.

- Enables access to diverse financing options from over 100 banks, leveraging long-term relationships for liquidity.

- Supports a vast physical asset base, including over 100 vessels and numerous storage facilities, secured through trusted partnerships.

- Underpins supply chain resilience, critical given 2024 geopolitical shifts impacting commodity flows.

Trafigura’s key resources are its vast global network and human capital, offering unparalleled market intelligence and operational reach for over 300 million tonnes of commodities in 2024. Robust financial strength, with over $70 billion in credit lines for 2024, ensures liquidity for massive trades and strategic investments. Critical physical infrastructure, including Puma Energy, along with proprietary technology for trade and logistics optimization, underpins its efficiency. Strong relationships across the value chain, supporting over 7.5 million barrels of oil traded daily in 2024, further solidify its market position.

| Key Resource | 2024 Data Point | Impact |

|---|---|---|

| Global Network & Human Capital | Over 300M tonnes oil/metals traded | Enables vast market intelligence and trading volume. |

| Access to Capital | Over $70 billion in credit lines | Funds global trades and manages financial risks. |

| Physical Infrastructure | Puma Energy: 1,800+ retail sites | Ensures logistical control and stable revenue streams. |

| Relationships & Reputation | 7.5M barrels oil/day traded | Secures supply, offtake, and diverse financing. |

Value Propositions

Trafigura provides industrial consumers with a reliable and efficient supply of essential raw materials, like crude oil and refined products, tailored to their precise quality and timing needs, even amidst volatile global markets. The company actively manages the intricate complexities and inherent risks of global sourcing and logistics, ensuring a stable supply chain for its clients. This allows customers to concentrate fully on their core manufacturing or refining operations without worrying about commodity procurement. Given the global energy market shifts in 2024, Trafigura’s ability to secure and deliver commodities consistently remains paramount for clients, underpinning their operational stability and profitability.

Trafigura provides producers, especially smaller or state-owned entities, with guaranteed market access for their commodities, ensuring a steady revenue stream. This includes offering upfront financing, which supported over $70 billion in trade finance lines across the industry in 2024, and comprehensive logistical solutions. Producers gain access to a global customer base, bypassing the complexities of international distribution. This model ensures revenue certainty and efficient delivery of their output worldwide.

Trafigura offers comprehensive risk mitigation, shielding its partners from volatile commodity price swings and currency fluctuations. This service is crucial for producers and consumers, allowing them to lock in prices and manage budgets with greater certainty. By absorbing significant market risk, Trafigura enables stable operations for its clients. As a leading global commodity trader, their robust financial position, with a record turnover of $244 billion in fiscal year 2023, underpins their capacity to provide these essential risk management solutions.

Enhanced Supply Chain & Logistics Expertise

Trafigura delivers significant value beyond mere commodity trading by offering highly efficient, optimized logistics and supply chain management. This includes customized product blending to precise specifications and ensuring just-in-time delivery for partners. Their expertise in managing complex multimodal transportation, evidenced by handling over 400 million tonnes of commodities in fiscal year 2023, significantly reduces costs and improves operational efficiency for their global clientele. This integrated approach ensures seamless flow from source to destination.

- Customized blending meets precise client specifications.

- Just-in-time delivery optimizes partner inventories.

- Complex multimodal transportation expertise reduces costs.

- Over 400 million tonnes of commodities handled in 2023.

Provision of Capital & Structured Finance

Trafigura acts as a crucial source of capital within the global commodity ecosystem, offering bespoke structured finance and prepayment deals directly to producers. This provides vital liquidity, allowing producers to fund operations and expansion, which is essential given the capital-intensive nature of commodity production. This creates a symbiotic relationship where Trafigura secures future supply of critical commodities, such as metals and energy, in exchange for providing essential capital. This financial engineering is a key differentiator, enabling robust supply chain relationships and market access.

- In 2024, Trafigura continued to leverage its strong banking relationships, securing significant credit facilities to support these financing activities.

- Their structured finance deals often extend over multiple years, ensuring stable supply for their trading operations.

- These prepayment agreements help producers manage cash flow in volatile commodity markets.

- This model is particularly valuable for projects requiring upfront investment before production yields returns.

Trafigura delivers tailored, reliable global supply and market access for essential commodities, managing intricate logistics and providing crucial risk mitigation. They offer significant trade finance, exceeding $70 billion in 2024, and vital capital to producers. This integrated approach optimizes supply chains and ensures operational stability for partners worldwide.

| Value Area | Key Offering | 2024 Data/Context |

|---|---|---|

| Supply Chain Reliability | Guaranteed Supply & Delivery | Critical amidst 2024 global energy market shifts |

| Financial Support | Trade Finance & Prepayments | Over $70 billion in trade finance lines in 2024 |

| Operational Efficiency | Logistics & Risk Management | Handled over 400 million tonnes in FY2023 |

Customer Relationships

High-value and strategic partners at Trafigura are managed through dedicated key account teams, ensuring a single point of contact and highly personalized service. These specialized teams deeply understand client operations, enabling them to proactively offer tailored trading, risk management, and financing solutions. This high-touch approach fosters significant loyalty and cultivates long-term partnerships, essential for maintaining their substantial global trade volumes. In 2023, Trafigura shipped 254.8 million tonnes of oil and petroleum products, alongside 90.5 million tonnes of metals and minerals, reflecting the scale of relationships managed.

Trafigura moves beyond simple transactions, cultivating deep, long-term strategic alliances with key producers and consumers globally. These relationships often materialize as multi-year offtake or supply agreements, such as their 2024 agreements for LNG and metals, ensuring stable commodity flows. They also engage in joint ventures for critical infrastructure and integrated financing-marketing deals, like recent investments in energy transition assets. This collaborative model fosters mutual success and deepens business integration across the value chain, strengthening their market position.

Trafigura actively engages in co-development with clients, engineering tailored solutions for their complex challenges. This includes designing unique financing structures for large-scale projects, such as facilitating over $70 billion in financing across operations in 2024. They also develop specific fuel blends to meet evolving environmental regulations, adapting to global shifts like IMO 2020. This collaborative process positions Trafigura as an indispensable partner, not merely a transactional supplier, ensuring long-term strategic alliances.

Reputation & Trust-Based Engagement

Trafigura Group's customer relationships are fundamentally built on trust, crucial in a market where single transactions often exceed hundreds of millions of dollars. Maintaining an impeccable reputation for integrity and consistent performance is paramount, especially given their 2023 revenue of $244.3 billion. Every interaction is meticulously managed to uphold this standard, ensuring discretion and reliability in all dealings.

- In 2023, Trafigura handled 7.3 million barrels of oil and petroleum products daily.

- Their global presence extends across 150 countries, requiring robust trust networks.

- The company's net debt was $16.7 billion as of September 2023, reflecting significant transaction volumes.

- Customer relationships are critical for securing long-term contracts in volatile commodity markets.

Digital Client Portals & Self-Service

Trafigura complements its high-touch client relationships with secure digital portals, offering corporate clients self-service capabilities. These platforms enable real-time shipment tracking and access to crucial contract details and documentation, enhancing operational transparency. Clients can efficiently view market data and manage their accounts, streamlining routine interactions. This digital integration, crucial for Trafigura's 2024 operations, supports the efficient flow of over 200 million tonnes of commodities annually.

- Real-time shipment tracking for enhanced visibility.

- Access to contracts and documentation.

- Direct viewing of current market data.

- Efficient self-management of client accounts.

Trafigura cultivates high-touch, long-term relationships with strategic clients, offering tailored trading and financing solutions. These alliances, crucial for their 2024 operations, involve co-development and multi-year agreements ensuring stable commodity flows. Trust and an impeccable reputation are paramount, underpinning transactions exceeding hundreds of millions of dollars. Digital portals complement this, providing clients efficient self-service access to crucial data.

Channels

Trafigura's core channel relies on its global network of expert traders and marketers, strategically positioned in key hubs like Geneva, Singapore, Houston, and Montevideo. These dedicated teams directly engage clients, negotiating complex deals for commodities, including the over 70 million tonnes of oil and petroleum products traded in 2024. This direct, relationship-driven approach, central to their 2024 business model, enables tailored transaction structuring and real-time market insights for optimal client solutions.

Trafigura maintains a crucial global network of physical offices spanning over 50 countries, acting as a primary channel for deal origination and relationship building. These local presences provide invaluable on-the-ground intelligence and direct access to regional producers, consumers, and government entities. This boots on the ground approach, as seen in 2024, is vital for navigating complex local market dynamics and securing trade flows. Such extensive reach supports robust commodity trading operations, underpinning significant global volumes.

Trafigura’s owned and operated ports, terminals, and storage facilities, such as the Puma Energy network, act as crucial physical channels to the market. These strategic infrastructure assets serve as vital hubs, enabling interaction with diverse customers for essential storage, blending, and offtake services. They are physical platforms for delivering value and engaging directly with the global energy and commodities market. As of 2024, these assets underpin the company’s extensive trading operations, ensuring efficient global distribution and market reach.

Industry Conferences & Forums

Trafigura actively leverages industry conferences and forums like CERAWeek 2024, which convened over 8,000 attendees, as crucial channels for high-level networking and deal origination. These events enable senior leadership and trading teams to engage directly with C-suite executives, fostering strategic dialogues vital for commodity trading relationships. Maintaining a prominent presence at forums such as LME Week, attracting over 2,000 delegates, is essential for brand building and market visibility within the energy and metals sectors. This direct engagement facilitates new partnership opportunities and reinforces existing commercial ties.

- CERAWeek 2024 facilitated over 8,000 attendees for energy sector dialogue.

- LME Week 2024 attracts over 2,000 global metals industry professionals.

- These forums are critical for direct engagement with C-suite executives.

- Networking at events drives new deal origination and strengthens existing partnerships.

Joint Ventures & Strategic Alliances

Joint ventures and strategic alliances are crucial channels for Trafigura, enabling indirect access to new markets and customer segments. By partnering with local entities or companies possessing complementary assets, Trafigura significantly extends its global reach and can offer more integrated service solutions. For instance, a 2024 joint venture with a specialized logistics provider could establish a new channel to efficiently serve a specific inland market in a region like South America. These collaborations enhance market penetration and operational efficiency.

- Trafigura’s 2024 activities show continued reliance on partnerships to expand into new energy transition commodities.

- Strategic alliances with port operators or infrastructure firms in 2024 facilitate optimized supply chains.

- Partnerships in Africa, for example, allow Trafigura to navigate local regulations and market dynamics more effectively.

Trafigura’s channels are multi-faceted, emphasizing direct engagement through global trading teams and a network of over 50 physical offices for deal origination and client relationships. Strategic owned infrastructure, like the Puma Energy network, provides crucial physical market access and service delivery. Additionally, active participation in industry forums such as CERAWeek 2024, which drew over 8,000 attendees, and strategic joint ventures extend market reach and foster new opportunities.

| Channel Type | 2024 Metric | Data Point |

|---|---|---|

| Direct Trading | Oil/Petroleum Traded | >70 million tonnes |

| Physical Presence | Global Offices | >50 countries |

| Industry Forums | CERAWeek Attendees | >8,000 |

Customer Segments

Oil refiners and petrochemical companies form a foundational customer segment for Trafigura, demanding a consistent, high-volume supply of specific crude oil grades and refined feedstocks. Trafigura adeptly sources these commodities globally, leveraging its extensive network to manage intricate logistics from origin to refinery gates. For instance, in 2024, Trafigura continues to facilitate the movement of millions of barrels of oil daily, ensuring precise technical specifications are met through strategic blending and quality control. This critical service ensures the uninterrupted operations of refineries and petrochemical plants worldwide.

This customer segment primarily encompasses metals smelters and refiners, which convert raw metal concentrates like copper, zinc, and lead into high-value finished metals. Trafigura serves these entities by ensuring a consistent, reliable supply of essential raw materials, crucial for continuous operations. Simultaneously, Trafigura acts as a key off-taker, purchasing the processed finished metals directly from them. This integrated approach allows Trafigura to manage the entire global supply chain, from sourcing at the mine to delivering to the industrial end-user, facilitating over 70 million tonnes of non-ferrous and bulk commodities handled in 2024.

National and independent commodity producers, including national oil companies and major mining corporations, form a critical customer segment for Trafigura. These entities seek a dependable partner to market and transport their vast production globally, often lacking the extensive logistical networks themselves. Trafigura serves as their essential marketing arm, facilitating market access and providing crucial price risk management solutions. For example, Trafigura's 2024 trading volumes continue to underscore its role, handling millions of tonnes of metals and energy products, offering vital financing to producers, and ensuring their output reaches international markets efficiently.

Power Generation & Utility Companies

Power Generation & Utility Companies are a crucial customer segment for Trafigura, relying on the firm for essential commodities. Trafigura supplies these clients with critical fuels like natural gas, LNG, and coal, which are vital for electricity generation. This ensures operational continuity, particularly as global energy demand continues to be robust, with natural gas consumption projected to remain significant into 2024. The company manages supply security and offers flexible pricing structures, helping utilities manage their substantial operational expenditures. This partnership is key for maintaining stable energy grids and supporting the transition to a more diversified energy mix.

- In 2024, Trafigura continued to be a major player in LNG trading, with volumes moving from established producers to demand centers.

- The global coal market in 2024 saw varied regional demand, with some utilities still heavily reliant on it for baseload power.

- Natural gas prices in 2024 experienced fluctuations, making secure supply arrangements crucial for utility budgeting.

- Trafigura's logistical capabilities ensure timely delivery of these high-volume commodities to power generation facilities worldwide.

Financial Institutions & Other Traders

Trafigura actively serves a critical segment of financial institutions, encompassing other commodity trading houses, hedge funds, and various financial entities. The company functions as a significant market maker within this sphere, consistently providing essential liquidity and engaging in frequent inter-dealer trades. This customer segment is indispensable for Trafigura’s sophisticated risk management activities, enabling effective hedging and exposure management. Furthermore, these relationships are vital for gathering broad, real-time market intelligence, which informs Trafigura’s trading strategies.

- Market Maker Role: Trafigura's active participation facilitates efficient price discovery and transaction flow.

- Liquidity Provision: Essential for maintaining smooth operations across volatile commodity markets.

- Risk Management Support: Key for offsetting positions and managing financial exposures.

- Market Intelligence: Direct interactions provide invaluable insights into market sentiment and trends.

Trafigura caters to a broad global customer base, primarily industrial end-users like oil refiners, metal smelters, and power utilities, supplying critical raw materials and fuels. They also partner with commodity producers for marketing and logistics, facilitating global market access. Additionally, financial institutions leverage Trafigura for market making and risk management, contributing to overall market liquidity.

| Segment | Focus | 2024 Role |

|---|---|---|

| Industrial Users | Raw Material Supply | Ensuring operational continuity |

| Producers | Market Access | Marketing & financing their output |

| Financial Entities | Liquidity & Risk | Market making and hedging solutions |

Cost Structure

The cost of commodities purchased represents Trafigura's largest expense, encompassing the vast majority of its total expenditures, particularly for oil, metals, and minerals. This core variable cost is directly tied to trading volume and fluctuating global commodity market prices. For instance, in fiscal year 2023, Trafigura reported significant cost of sales relative to its $244.3 billion revenue, underscoring this component's dominance. The group's profitability fundamentally relies on its ability to negotiate highly favorable purchasing terms. This remains a critical factor for financial performance into 2024 amidst volatile market conditions.

Logistics and transportation expenses represent a significant cost category for Trafigura, encompassing all outlays for moving physical commodities globally. This includes substantial vessel chartering fees, freight charges, marine insurance, port fees, storage costs, and land-based transportation networks. Efficiently managing these complex expenditures is crucial for the company's profitability, especially given the volatile shipping markets observed in 2024. Trafigura’s ability to optimize these costs directly impacts its trading margins.

Given the inherently capital-intensive nature of global commodity trading, Trafigura Group Pte. Ltd. faces substantial financing and interest costs. Interest expenses on its extensive credit facilities and trade finance loans represent a major operating cost, significantly impacting profitability. The company requires billions of dollars in working capital, with total credit facilities reaching approximately USD 75 billion as of September 2023 to fund its vast operations. Management actively optimizes the cost of this capital, which contributed to a net interest expense of USD 3.6 billion in 2023, a critical line item for the group.

Personnel & Compensation Expenses

Personnel and compensation expenses are a significant cost for Trafigura, driven by highly competitive salaries and substantial performance-based bonuses for its global traders, analysts, and senior management. This structure is critical for attracting and retaining top-tier talent in the volatile commodities trading sector. The company's compensation model aligns employee incentives with overall business performance, directly influencing profitability and market share. In 2023, Trafigura reported employee benefit expenses, which include salaries and bonuses, contributing to its overall operating costs.

- Compensation is heavily weighted towards performance-based bonuses for traders.

- Attracting and retaining top talent is crucial for market success.

- Employee benefits contribute significantly to operational expenses.

- Compensation directly aligns with company profitability.

Infrastructure & Asset Upkeep

Trafigura’s Infrastructure & Asset Upkeep encompasses significant depreciation, maintenance, and operational expenses tied to its vast network of physical assets. This includes the continuous upkeep of ports, terminals, storage tanks, and other essential infrastructure globally. Such costs represent fixed and semi-fixed expenditures crucial for supporting the company’s extensive trading and logistics operations. Ensuring the safety and reliability of these assets is paramount for maintaining uninterrupted supply chains.

- In 2023, Trafigura reported property, plant, and equipment (PP&E) valued at approximately $10.5 billion.

- These assets necessitate ongoing investment to maintain operational integrity and compliance.

- The company’s focus on energy transition assets, including renewable infrastructure, continues to grow.

- Maintenance budgets are critical for minimizing downtime and ensuring efficient commodity flows.

Trafigura's cost structure is primarily driven by the cost of commodities purchased, which fluctuates with global market prices and trading volumes, representing its largest expense. Substantial outlays also go towards global logistics and transportation, including volatile shipping costs in 2024, alongside significant interest expenses from its extensive credit facilities. Personnel compensation, heavily performance-based, and the continuous upkeep of its extensive infrastructure assets further define its operational expenditures. These core costs are actively managed to sustain profitability in the dynamic 2024 commodity landscape.

| Cost Category | 2023 Data | Impact in 2024 |

|---|---|---|

| Revenue | $244.3 billion | Base for cost of sales ratio |

| Net Interest Expense | $3.6 billion | Major financing cost |

| Credit Facilities | ~$75 billion (Sep 2023) | Working capital requirement |

Revenue Streams

Trafigura’s core revenue comes from gross margins on physical commodity trading, representing the spread between purchase and sale prices. This captures value from geographic, timing, and quality-based price differentials across global markets. For example, in fiscal year 2023, Trafigura reported a gross profit of $12.3 billion, largely driven by these arbitrage opportunities. This fundamental engine leverages market inefficiencies, ensuring profitability even amidst volatile commodity prices. It remains the most significant contributor to their financial performance in 2024.

Trafigura generates significant revenue through its value-added logistics and transformation services, extending beyond basic commodity trading. This includes charging premiums for complex transportation solutions, leveraging its global network of over 100 owned or chartered vessels and extensive storage facilities. For instance, in 2024, their strategic investments in infrastructure continued to support these operations. Revenue is also derived from blending different grades of commodities like crude oil or metals, creating higher-value products tailored to specific customer needs. This specialized service income, earned on top of the fundamental trading margin, significantly contributes to the group's overall profitability.

Trafigura generates substantial income through its structured and trade finance activities, providing crucial liquidity solutions to partners. This involves earning fees and interest by offering prepayment facilities to producers, such as those in the metals and energy sectors, or extending credit terms to consumers. By strategically deploying capital, Trafigura secures a return on its financing, which also helps to lock in long-term, favorable supply and offtake contracts. For example, in 2024, such financing remains vital for global commodity flows, supporting over $70 billion in trade finance facilities, ensuring market stability and operational efficiency.

Returns from Infrastructure Asset Operations

Trafigura's owned infrastructure assets, including terminals, ports, and storage facilities, generate direct revenue streams. This income comes from fees charged to third parties for asset usage, contributing to a stable and recurring revenue base. These assets also provide significant operational efficiencies and opportunities for Trafigura's own trading desks, enhancing overall profitability. In 2023, Trafigura reported significant investments in its asset base, with an adjusted EBITDA of $12.3 billion for the year, underscoring the value of these operations.

- Direct fees from third-party usage of terminals and storage.

- Operational efficiencies benefiting internal trading activities.

- Stable, recurring revenue source for the Group.

- Integral to Trafigura's global commodity trading network.

Gains from Derivatives & Hedging Activities

While primarily utilized for managing market risks, Trafigura's sophisticated hedging and derivatives activities also generate significant revenue. This includes profits derived from proprietary trading positions, which are informed by deep macroeconomic and market analysis. The company also earns fees by offering complex risk management solutions to its diverse client base. Such gains contribute to Trafigura's overall financial performance.

- For the fiscal year ending September 30, 2024, Trafigura reported a net profit of $5.3 billion.

- Gains from financial instruments, including derivatives, underpin a portion of the trading profit.

- The group's strong performance in 2024 was supported by robust trading in metals and minerals.

- Risk management products offered to clients diversify revenue streams beyond physical commodity trading.

Trafigura's sophisticated hedging and derivatives activities generate significant revenue, leveraging proprietary trading positions and fees from risk management solutions offered to clients. Gains from financial instruments, including derivatives, underpin a portion of their robust trading profit. For instance, in the fiscal year ending September 30, 2024, Trafigura reported a net profit of $5.3 billion, supported by these operations. This diversified income stream, alongside strong performance in metals and minerals trading, enhances their overall financial results.

| Revenue Stream | 2024 Contribution (Estimate) | 2023 Performance Note |

|---|---|---|

| Proprietary Trading (Derivatives) | Underpins Trading Profit | Contributed to $12.3B Gross Profit |

| Client Risk Management Fees | Diversifies Revenue Streams | Supports Global Commodity Flows |

| Overall Net Profit | $5.3 Billion (FY2024) | Strong Performance Continued |

Business Model Canvas Data Sources

The Trafigura Business Model Canvas is constructed using a blend of internal financial data, extensive market research on commodity trading, and operational insights from their global network. These sources ensure each component accurately reflects the company's strategic positioning and activities.