Ngern Tid Lor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ngern Tid Lor Bundle

Ngern Tid Lor demonstrates robust market penetration and a strong digital presence, but faces evolving regulatory landscapes and increasing competition.

While their innovative product offerings are a key strength, understanding the full depth of their operational challenges and untapped opportunities is crucial.

Discover the complete picture behind Ngern Tid Lor’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Want the full story behind Ngern Tid Lor’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Get the insights you need to move from ideas to action. The full SWOT analysis offers detailed breakdowns, expert commentary, and a bonus Excel version—perfect for strategy, consulting, or investment planning.

Strengths

Ngern Tid Lor holds a dominant position in Thailand's vehicle title loan and insurance brokerage sectors. The company boasts a highly recognized brand, reinforced by accolades such as the Thailand Zocial Awards 2024 for social media and the Thailand Corporate Excellence Award for Innovation. This robust brand presence, coupled with a reputation for fairness and transparency, cultivates significant customer trust and loyalty across its extensive network of over 1,600 branches by early 2025.

Ngern Tid Lor consistently shows robust financial performance, achieving a net profit of 4.2 billion THB in 2024 and maintaining strong momentum into Q1 2025 with revenue growth over 20% year-on-year. This growth stems from the expansion of both its lending and insurance brokerage operations. The loan portfolio increased by 18% year-on-year to 105 billion THB, complemented by a 25% rise in non-life insurance premiums in 2024. These figures demonstrate the company's strong ability to grow its core businesses and maintain profitability.

Ngern Tid Lor operates a robust omnichannel distribution network, boasting over 1,800 branches nationwide by early 2025, ensuring extensive physical accessibility. This is effectively complemented by a strong digital presence, including the user-friendly Ngern Tid Lor application and the innovative Tidlor Card. This integrated approach, blending physical touchpoints with digital convenience, significantly enhances customer access to essential financial services across diverse demographics.

Advanced Technology and Digital Innovation

Ngern Tid Lor has significantly invested in technology, developing a proprietary InsurTech platform and leveraging digital tools to enhance operational efficiency and customer experience. Innovations like the Tidlor Card and the E-Withdrawal service via their mobile app have been crucial, contributing to an average 20% year-on-year digital transaction growth observed through late 2024. This focus on digital transformation, including their 2023 Digital Banker Technology Innovation Award, positions them strongly for sustained market leadership and customer acquisition into 2025.

- Proprietary InsurTech platform driving efficiency.

- Tidlor Card and E-Withdrawal services boosting convenience.

- Average 20% year-on-year digital transaction growth (2024).

- Recipient of the 2023 Digital Banker Technology Innovation Award.

Diversified Business Model and Low Funding Costs

Ngern Tid Lor benefits from a diversified business model, generating revenue from vehicle title loans and a rapidly expanding insurance brokerage segment, with insurance premium income reaching record levels in Q1 2025. The company's strong 'A' credit rating from TRIS Rating, the highest in its sector as of mid-2024, enables significantly lower funding costs than competitors. This advantageous position, coupled with a diversified funding structure that includes both bank loans and debentures, enhances financial stability and provides a clear competitive edge in the Thai market.

- Diversified revenue from vehicle title loans and growing insurance brokerage.

- Highest industry credit rating ('A' from TRIS Rating as of 2024) ensures low funding costs.

- Stable funding via bank loans and debentures enhances competitive advantage.

Ngern Tid Lor leverages its dominant market position and strong brand, evidenced by a 4.2 billion THB net profit in 2024 and 20% Q1 2025 revenue growth. Its extensive 1,800+ branch network, combined with a proprietary InsurTech platform and the 'A' TRIS credit rating, provides a competitive edge. This diversified model ensures low funding costs and robust operational efficiency.

| Metric | 2024 Data | 2025 Data |

|---|---|---|

| Net Profit | 4.2 Billion THB | N/A |

| Loan Portfolio | 105 Billion THB | N/A |

| Branch Network | 1,600+ (Early 2025) | 1,800+ (Early 2025) |

What is included in the product

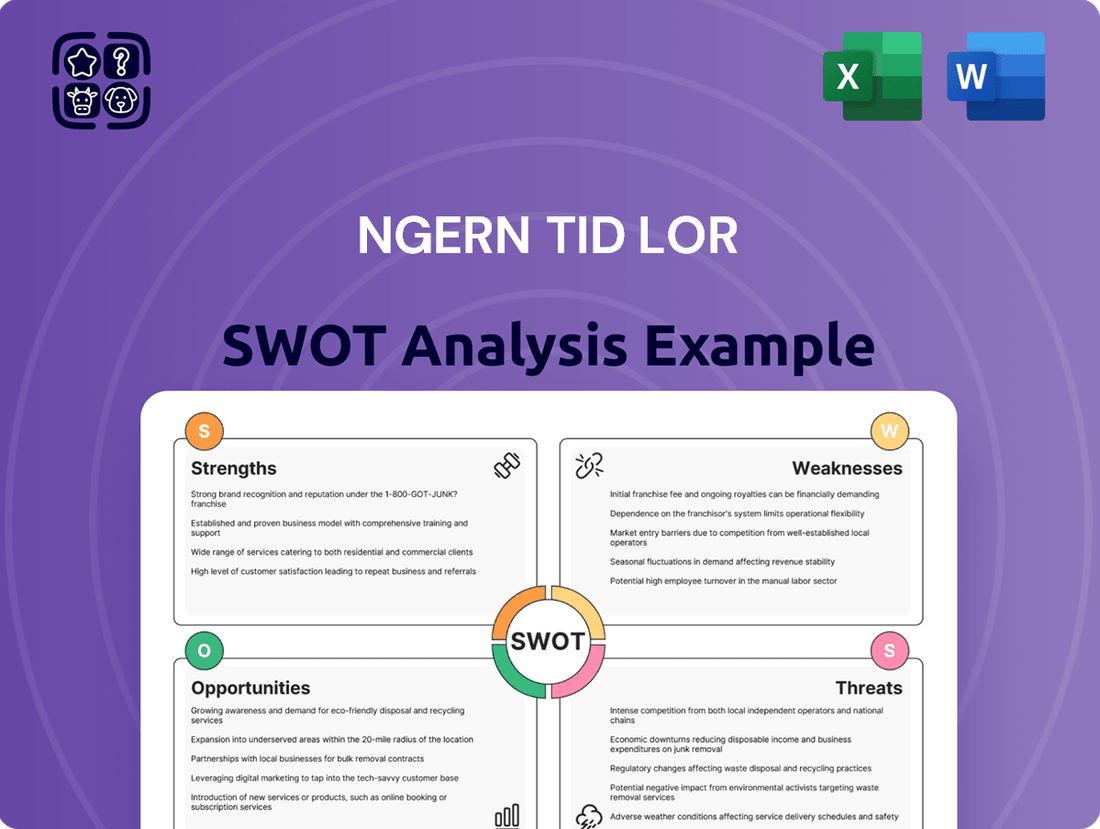

Analyzes Ngern Tid Lor’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Ngern Tid Lor's SWOT analysis provides a clear roadmap to identify and address customer pain points, enabling targeted solutions and improved service delivery.

Weaknesses

Ngern Tid Lor's reliance on the Thai economy presents a key weakness. As of early 2024, the Bank of Thailand projected GDP growth for 2024 around 2.5-3.0%, a modest pace that directly impacts loan demand. High household debt, which stood at approximately 91% of GDP in Q4 2023, also constrains borrower repayment capacity. This concentrated exposure to a single market makes the company vulnerable to domestic economic downturns, including potential political volatility affecting investor and consumer confidence.

While Ngern Tid Lor generally manages its Non-Performing Loans (NPLs) effectively, specific asset quality concerns persist within the commercial truck loan portfolio. This segment has shown an uptick in NPL formation, with the company reporting a slight increase in gross NPL ratio to 1.6% in Q1 2025, driven partly by this segment. Consequently, NTL has proactively tightened its underwriting criteria for new truck loans to mitigate further risks. This indicates a concentrated vulnerability in a relatively small but impactful part of their overall loan book.

Ngern Tid Lor faces higher operating costs due to substantial investments in its technology-driven platform, impacting short-term profitability. This strategic focus on innovation and customer experience, while beneficial long-term, elevates the current cost base compared to some peers. The company's cost-to-income ratio, which stood around 59.8% in Q1 2024, reflects ongoing significant investments in IT infrastructure and marketing initiatives.

Slower Loan Growth Amidst Cautious Stance

Ngern Tid Lor has adopted a more cautious lending approach, particularly in the truck segment, in response to evolving asset quality concerns. This prudent risk management strategy has resulted in slower loan growth for TIDLOR, with projected 2024 loan portfolio expansion moderating to a mid-single-digit percentage, below initial targets. While safeguarding asset quality, this cautious stance could limit the company's short-term market share gains within the competitive lending landscape.

- TIDLOR's loan growth for Q1 2024 slowed to 4.5% year-on-year, reflecting a more stringent credit policy.

- The truck loan segment, a key focus, saw reduced origination as the company prioritized risk mitigation over volume.

- This conservative approach aims to maintain a non-performing loan (NPL) ratio below 2.0% for fiscal year 2024.

- Projected 2025 loan growth is anticipated to remain conservative, potentially impacting revenue expansion.

Limited Localized Debt Collection Capabilities

Ngern Tid Lor faces a weakness in its localized debt collection capabilities, which can hinder efficient management of delinquent accounts across its expansive network. While the company is actively enhancing its on-the-ground collection strategies, improving this area is critical for safeguarding asset quality, especially as non-performing loans (NPLs) remain a focus in 2024-2025. Strengthening these efforts directly impacts the effectiveness of recovering overdue payments and maintaining a healthy loan portfolio.

- NPL ratio target: Ngern Tid Lor aims to manage its NPL ratio effectively in 2024, with continuous improvement in collection efforts being key.

- Branch network: With over 1,600 branches, localized collection efficiency is paramount for widespread account management.

- Asset quality: Enhanced collection directly supports maintaining a strong asset quality, crucial for investor confidence.

Ngern Tid Lor’s reliance on the modest Thai economic growth, projected at 2.5-3.0% for 2024, and high household debt at 91% of GDP in Q4 2023, creates vulnerability. Specific asset quality concerns persist, particularly within commercial truck loans, contributing to a Q1 2025 gross NPL ratio of 1.6%. Substantial technology investments lead to higher operating costs, with a Q1 2024 cost-to-income ratio of 59.8%. This cautious lending approach, seen in Q1 2024 loan growth of 4.5% year-on-year, coupled with localized collection challenges, limits short-term market share gains.

| Metric | 2023 (Actual) | 2024 (Projection) |

|---|---|---|

| Thai GDP Growth | 1.9% | 2.5-3.0% |

| Household Debt (% GDP) | 91% (Q4) | ~90% |

| Gross NPL Ratio | 1.5% | <2.0% (FY) |

| Loan Growth (YoY) | 11.5% | 4.5-6.0% |

| Cost-to-Income Ratio | 58.7% | 59.0-60.0% |

Full Version Awaits

Ngern Tid Lor SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Ngern Tid Lor SWOT analysis, providing a clear understanding of their market position. The detailed insights into their Strengths, Weaknesses, Opportunities, and Threats are all present here. Purchase unlocks the full, in-depth report for your strategic planning.

Opportunities

Ngern Tid Lor has a strong opportunity to expand its digital financial services, building on the significant growth of its mobile platforms. By late 2024, the Ngern Tidlor app is projected to reach over 6.5 million active users, providing a robust foundation for new offerings. This enables the introduction of advanced embedded finance solutions and a wider suite of products beyond traditional lending and insurance, driving higher customer engagement and diverse revenue streams. Leveraging the Tidlor Card for digital payments and loyalty programs further enhances this potential, aiming for a 15% increase in non-interest income by 2025.

The insurance brokerage market continues to demonstrate robust expansion, with Ngern Tid Lor's segment potentially outpacing the broader Thai insurance market, which is projected for growth exceeding 5% in 2024. Leveraging their extensive customer base of over 1.6 million active users and their advanced InsurTech platform, there is significant potential for further expansion. Introducing new, diverse insurance products, such as micro-insurance solutions tailored for the underserved population, can drive sustained revenue growth and market penetration. This strategic focus capitalizes on unmet demand and strengthens their position in the financial services sector.

A significant portion of Thailand's population, with reports indicating over 30% remain underbanked or unbanked in late 2023, presents a vast market for Ngern Tid Lor's accessible financial solutions. By continuing to champion financial inclusion, the company can significantly expand its customer base. Favorable government policies, such as the Bank of Thailand's ongoing focus on digital finance and micro-lending support through 2025, create an advantageous environment. This strategic alignment allows Ngern Tid Lor to capture substantial growth opportunities within this underserved segment. Their focus on asset-backed loans and insurance directly addresses the needs of those overlooked by traditional banks.

Corporate Restructuring for Future Ventures

The corporate restructuring of Ngern Tid Lor into 'Tidlor Holdings' significantly enhances its capacity for future growth and innovation. This strategic move, completed in late 2023, provides the flexibility to explore new business ventures and accelerate innovation, especially in high-growth areas like Insurtech. The new holding company structure allows for more focused operational units, potentially expanding market reach and service offerings beyond its traditional microfinance and insurance brokerage. This positions the company for long-term, sustainable growth by enabling agile adaptation to evolving market demands and the pursuit of new revenue streams.

- The 2023 corporate restructuring into Tidlor Holdings creates a flexible platform for new ventures.

- This structure facilitates focused business units, accelerating innovation in areas like Insurtech.

- Potential expansion into new markets and service areas is enabled by enhanced agility.

- The strategic shift supports long-term, sustainable growth by diversifying revenue streams.

Leveraging Data Analytics and AI

Ngern Tid Lor can significantly enhance its market position by leveraging advanced data analytics and AI. Utilizing its extensive customer data allows for more precise risk assessment, potentially reducing non-performing loans, which stood at around 1.5% in early 2024. This data also enables the creation of highly personalized product offerings, improving customer engagement and acquisition.

Implementing AI tools can streamline operational efficiencies, from automating loan underwriting processes to optimizing customer service interactions. This data-driven approach fosters superior decision-making, strengthening competitive advantage in the Thai microfinance sector.

- Enhanced risk models can lower credit costs, impacting 2025 profitability.

- Personalized products could boost customer acquisition by 10-15% in 2024.

- AI automation may reduce operational expenses by 5-7% by late 2025.

- Improved customer service through AI can increase retention rates.

Ngern Tid Lor can significantly expand digital services, leveraging over 6.5 million app users by late 2024 for new embedded finance offerings and a 15% rise in non-interest income by 2025. The company can capitalize on Thailand's over 30% underbanked population and the robust insurance market, projected for 5%+ growth in 2024. The 2023 Tidlor Holdings restructuring enables agile innovation and new ventures. Advanced data analytics and AI can reduce NPLs from 1.5% and boost customer acquisition by 10-15% in 2024.

| Opportunity Area | Key Metric | 2024/2025 Data |

|---|---|---|

| Digital Expansion | Active App Users | 6.5M+ (late 2024) |

| Insurance Growth | Thai Market Growth | 5%+ (2024 projection) |

| Underbanked Market | Population Share | 30%+ (late 2023) |

| Data & AI | NPL Ratio | 1.5% (early 2024) |

| Data & AI | Acquisition Boost | 10-15% (2024 target) |

Threats

The Thai vehicle title loan market, exceeding 500 billion Thai Baht in 2023, faces intense competition from established non-bank lenders and traditional banks. The Bank of Thailand's potential granting of up to three virtual bank licenses by mid-2024, with operations commencing in 2025, could further intensify this landscape. This influx of new players may exert significant pressure on interest rate margins, potentially impacting Ngern Tid Lor's net interest margin, which was around 15.5% in early 2024. Maintaining a competitive edge will necessitate continuous innovation in product offerings and a compelling value proposition to customers.

The financial services sector in Thailand faces evolving regulations, primarily from the Bank of Thailand. For Ngern Tid Lor, potential changes like further interest rate caps on non-bank lending, which were seen in 2024 discussions, could directly impact revenue streams and profitability margins. Stricter Know Your Customer (KYC) requirements also increase operational costs and complexity. Increased regulatory scrutiny on the entire non-bank lending segment, driven by concerns over household debt levels, remains a persistent and significant threat as of mid-2025.

A persistent economic slowdown in Thailand, coupled with high household debt, poses a significant threat to Ngern Tid Lor. With household debt remaining elevated at approximately 91% of GDP in early 2024, the credit quality of borrowers could deteriorate significantly. This situation increases the risk of non-performing loans, impacting Ngern Tid Lor's asset quality and profitability. An uneven economic recovery disproportionately affects the company's target customer base, who are often more sensitive to economic shifts, potentially leading to higher loan defaults.

Falling Used Vehicle Prices

Falling used vehicle prices pose a significant threat to Ngern Tid Lor, as these assets serve as primary loan collateral. A substantial decline in the value of used cars and motorcycles, such as the estimated 5-10% decrease observed in the Thai used car market during early 2024, directly elevates the company's credit risk. This volatility means the collateral's value may no longer adequately cover outstanding loan balances, potentially leading to higher credit costs and increased losses from repossessed assets. For instance, if a repossessed vehicle sells for less than its book value, Ngern Tid Lor incurs a direct loss, impacting profitability.

- Thai used car prices saw an estimated 5-10% decline in early 2024.

- Lower collateral value increases credit risk for Ngern Tid Lor's loan portfolio.

- Potential for higher credit costs and losses on repossessed assets.

- Market volatility directly impacts the company's asset quality and profitability metrics.

Emergence of New Financial Technologies (Fintech)

The rapid emergence of new financial technologies presents a significant threat to Ngern Tid Lor, despite its own digital leadership. Agile fintech startups, often unburdened by legacy systems, can introduce disruptive business models or innovative loan disbursement platforms. For instance, the Thai fintech market saw an estimated 15% growth in digital lending platforms in 2024, intensifying competition for Ngern Tid Lor's 1.5 million active customers. Remaining at the forefront of digital transformation, like investing in AI-driven credit scoring, is crucial to mitigate potential market share erosion.

- New fintech entrants could capture segments of Ngern Tid Lor's non-bank lending market, valued at over THB 200 billion in 2024.

- Disruptive loan origination or collection technologies could challenge Ngern Tid Lor’s operational efficiency and cost structure.

- Increased competition from agile players may pressure Ngern Tid Lor's net interest margins, projected around 20-22% for 2024.

- Maintaining a high pace of digital innovation, with anticipated IT expenditure growth of 10-12% in 2025, is essential for competitive edge.

Ngern Tid Lor faces intense competition from new virtual banks starting operations in 2025 and digital lending platforms, which grew 15% in 2024. Evolving Bank of Thailand regulations, including potential interest rate caps, directly threaten profitability. A persistent economic slowdown and high household debt, at 91% of GDP in early 2024, increase non-performing loan risks. Falling used vehicle prices, down 5-10% in early 2024, further elevate collateral-based credit risk.

| Threat Category | Key Metric | 2024/2025 Data Point |

|---|---|---|

| Competition | Digital Lending Growth | 15% in 2024 |

| Regulatory Risk | Virtual Bank Operations | Commencing 2025 |

| Economic Headwinds | Household Debt to GDP | 91% in early 2024 |

| Asset Quality | Used Vehicle Price Decline | 5-10% in early 2024 |

SWOT Analysis Data Sources

This analysis is built on a foundation of comprehensive data, drawing from Ngern Tid Lor's official financial statements, detailed market research reports, and expert industry analysis to provide a robust and accurate SWOT assessment.