Ngern Tid Lor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ngern Tid Lor Bundle

Ngern Tid Lor operates in a dynamic financial services landscape where buyer power, especially from its diverse customer base, presents a significant consideration. The threat of new entrants, while potentially moderate due to regulatory hurdles, requires constant vigilance. Understanding the intensity of rivalry among existing players is crucial for Ngern Tid Lor's strategic positioning.

The complete report reveals the real forces shaping Ngern Tid Lor’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ngern Tid Lor's access to a diverse range of funding sources significantly diminishes the bargaining power of any single capital provider. Its strong ties with Bank of Ayudhya (BAY), a major financial institution, offer a stable and substantial funding channel.

Furthermore, relationships with international development finance institutions such as the International Finance Corporation (IFC) and the Asian Development Bank (ADB) provide additional layers of financial support and credibility. This multi-faceted approach to capital acquisition means Ngern Tid Lor is not overly dependent on any one source.

The company's successful bond issuance in 2024, which saw strong investor demand, further underscores its robust liquidity and ease of access to capital markets. This ability to tap into various funding avenues, including debt markets, directly translates to a reduced reliance on individual lenders, thereby weakening their bargaining leverage.

The bargaining power of suppliers, particularly those providing capital, significantly influences Ngern Tid Lor's financial health. Lenders and investors hold sway through the interest rates and loan terms they dictate. In 2024, Ngern Tid Lor's funding costs saw an increase due to prevailing higher interest rates, which directly impacted its net interest margin.

Despite this pressure, Ngern Tid Lor demonstrated resilience by adjusting its lending yields upwards. This strategic move allowed the company to absorb some of the increased capital costs by passing a portion onto its borrowers, showcasing its ability to manage supplier power in the capital market.

The Bank of Thailand (BOT) significantly shapes the funding landscape, impacting how easily and affordably Ngern Tid Lor can access capital. While typically stable, upcoming regulations focusing on financial stability or capital adequacy could inadvertently strengthen the negotiating position of institutional lenders.

Ngern Tid Lor's proactive approach to regulatory compliance and robust corporate governance are key strengths in managing these potential shifts. For instance, in 2024, the BOT continued its focus on consumer protection and digital finance, which, while not directly impacting borrowing costs, emphasizes the need for transparency in funding arrangements.

Concentration of Key Suppliers

A concentration of key suppliers, particularly for specialized financial technology or critical data services, could grant these providers significant bargaining power over Ngern Tid Lor. Even with diversified funding, reliance on a limited number of technology vendors for core operations, such as loan origination software or advanced analytics platforms, presents a potential vulnerability. For instance, if a dominant provider of AI-driven credit scoring models were to increase prices or restrict access, Ngern Tid Lor could face operational disruptions and increased costs.

However, Ngern Tid Lor's strategic focus on developing in-house technological capabilities and its commitment to digital transformation are crucial mitigating factors. By building internal expertise and diversifying its technology stack where possible, the company aims to reduce its dependence on any single supplier. This proactive approach helps to maintain a more balanced negotiation position. For example, as of early 2024, Ngern Tid Lor reported significant investments in its digital platform, aiming to enhance its self-sufficiency in key technology areas.

- Supplier Concentration Risk: Reliance on a few key technology providers for financial services can increase supplier leverage.

- Impact on Costs: Increased supplier power can translate to higher operating costs for Ngern Tid Lor.

- Mitigation Strategy: Ngern Tid Lor's investment in in-house digital capabilities aims to reduce dependence on external suppliers.

- Industry Trend: The financial sector's increasing reliance on specialized tech makes supplier concentration a relevant concern.

Switching Costs for Ngern Tid Lor

The costs Ngern Tid Lor might incur if they switch funding sources or technology providers can influence supplier leverage. For instance, integrating new core banking systems or loan origination platforms can involve significant upfront investment and operational disruption.

Ngern Tid Lor’s relationships with major Thai banks and international financial institutions provide a diverse funding base, which can mitigate the bargaining power of any single supplier. In 2023, the company secured new credit facilities, demonstrating its ability to diversify funding avenues and reduce reliance on any one source.

While these established relationships create some switching costs, Ngern Tid Lor's commitment to technological innovation means they regularly assess various service providers for efficiency and cost-effectiveness. This proactive approach allows them to maintain flexibility and negotiate favorable terms.

- Diversified Funding: Ngern Tid Lor’s access to multiple banking partners and international capital markets reduces dependence on individual suppliers.

- Technological Agility: Continuous evaluation of technology providers allows for competitive negotiation and limits the impact of switching costs.

- Relationship Embeddedness: While long-term partnerships can imply switching costs, Ngern Tid Lor actively manages these relationships to maintain leverage.

- Strategic Capital Access: The company’s ability to tap into varied capital markets provides a strong counterbalance to supplier power.

Ngern Tid Lor's diverse funding strategy, including strong ties with Bank of Ayudhya and international institutions like the IFC and ADB, significantly weakens the bargaining power of individual capital providers. The company's successful bond issuance in 2024, attracting strong investor demand, further highlights its robust liquidity and access to capital markets, reducing its reliance on any single lender.

Increased reliance on specialized technology providers for core operations, such as AI-driven credit scoring, could grant these suppliers significant leverage. However, Ngern Tid Lor's investment in in-house digital capabilities, evident in its early 2024 digital platform enhancements, aims to mitigate this by reducing dependence on external vendors and maintaining negotiation flexibility.

The bargaining power of suppliers is a key factor for Ngern Tid Lor, particularly concerning capital and technology. While diverse funding sources and technological investments help manage this power, potential regulatory shifts or supplier concentration risks remain considerations for the company's operational and financial strategy.

| Supplier Type | Potential Impact on Ngern Tid Lor | Mitigation Strategies | 2024 Data/Context |

|---|---|---|---|

| Capital Providers (Banks, Lenders) | Higher interest rates, stricter loan terms, increased funding costs. | Diversified funding sources (BAY, IFC, ADB), bond issuances, strong creditworthiness. | Funding costs increased due to higher interest rates, partially offset by adjusted lending yields. |

| Technology Providers (FinTech, Software) | Price increases for critical software, restricted access to platforms, service disruptions. | Developing in-house technological capabilities, diversifying technology stack, strong vendor management. | Significant investments in digital platform to enhance self-sufficiency in key tech areas. |

What is included in the product

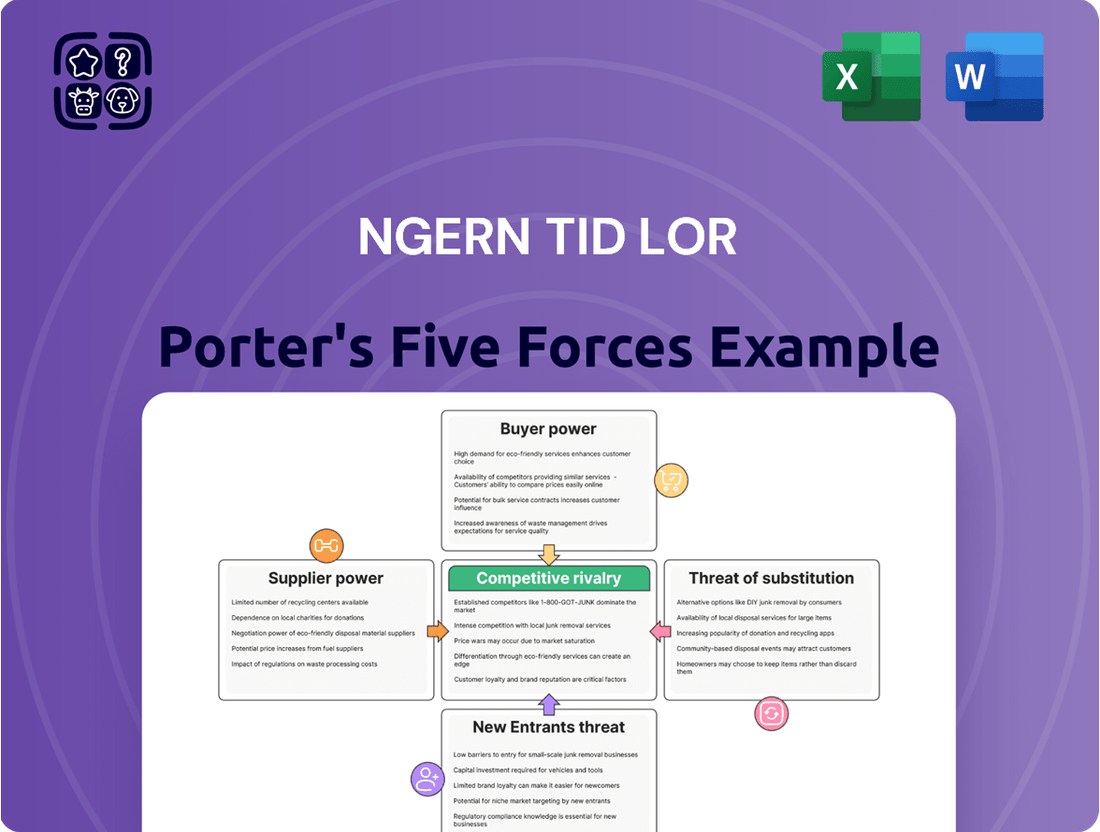

This analysis unpacks the competitive landscape for Ngern Tid Lor, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the auto title loan industry.

Ngern Tid Lor's Porter's Five Forces Analysis provides a visually intuitive way to identify and address competitive threats, acting as a strategic compass for navigating market challenges.

Customers Bargaining Power

Ngern Tid Lor's strategic focus on serving underserved individuals and small businesses, who historically lack access to conventional banking, significantly influences customer bargaining power. This niche market often possesses fewer readily available alternatives for financial services.

Consequently, customers in this segment generally exhibit lower bargaining power. For instance, in 2024, Thailand's unbanked population remained a substantial segment, with approximately 30% of adults lacking formal bank accounts, highlighting the limited options for many potential Ngern Tid Lor clients.

Ngern Tid Lor's commitment to financial inclusion directly addresses this gap, catering to a demand that traditional institutions have not fully met. This specialization means customers often rely on Ngern Tid Lor for essential financial products.

Ngern Tid Lor's customer base, often comprising low-income households and small businesses, exhibits significant price sensitivity. This means they are highly attuned to the cost of borrowing, which can push lending rates and associated fees downward. For instance, in 2024, the average household income in Thailand remained relatively modest, underscoring the need for accessible financial products.

This heightened sensitivity directly impacts Ngern Tid Lor's operations, forcing a careful balance between maintaining profitability and ensuring affordability for its clientele. The company's approach to adjusting lending yields demonstrates a clear understanding of this dynamic, aiming to remain competitive and accessible in a market where every percentage point matters.

The bargaining power of customers within the microfinance sector is significantly influenced by the availability of alternative providers. In Thailand, while traditional banks might have stricter lending criteria, the microfinance landscape features numerous non-bank institutions and even informal lenders. This creates a competitive environment where customers can seek services elsewhere if Ngern Tid Lor's terms are not favorable.

Competitors like Muangthai Capital Public Company Limited and AutoX, for instance, offer similar loan products. Muangthai Capital, as of early 2024, reported a substantial loan portfolio, indicating its significant market presence. This availability of comparable services means Ngern Tid Lor cannot unilaterally dictate terms or pricing, as customers possess the leverage to switch to a provider offering better rates or more convenient conditions.

Low Switching Costs for Customers

For customers in the market for vehicle title loans or personal loans, the ability to switch between microfinance providers is often quite straightforward. This is particularly true as more services move online, making the process of comparison and application much simpler. For instance, in 2024, a significant portion of loan applications in emerging markets are initiated through mobile platforms, reducing the friction associated with changing lenders.

This ease of switching directly translates into increased bargaining power for customers. They can readily explore options from different companies, comparing interest rates, repayment terms, and processing times. If one provider isn't meeting their expectations, it's relatively simple to move to another that offers more favorable conditions. This competitive dynamic encourages providers to offer attractive terms to retain their customer base.

The low switching costs are a key factor influencing customer loyalty and pricing strategies in the microfinance sector. For example, a survey of microloan borrowers in Southeast Asia in early 2024 revealed that over 60% had considered or switched lenders within the past year due to better offers or faster disbursement times.

- Low Switching Costs: Customers can easily move between microfinance providers for vehicle title loans and personal loans.

- Digitalization Impact: Increased online and mobile services further simplify the process of changing lenders.

- Enhanced Bargaining Power: Customers can leverage competition to secure better loan terms and faster services.

- Market Impact: Providers must offer competitive rates and efficient services to retain customers in this low-switching-cost environment.

Impact of Digital Channels on Customer Empowerment

The increasing prevalence of digital lending platforms and mobile applications in Thailand significantly bolsters customer bargaining power. These digital tools grant consumers unprecedented access to information, enabling them to easily compare loan products, interest rates, and terms from various providers. This ease of access and comparison means customers are better informed than ever before, allowing them to negotiate for more favorable terms or switch to competitors offering superior value. For instance, the digital transformation in financial services has seen a surge in user adoption; by the end of 2023, mobile banking penetration in Thailand reached over 70% of the adult population, indicating a strong customer reliance on digital channels for financial transactions and information gathering.

Ngern Tid Lor's strategic investment in digital channels, such as the Tidlor Card and E-Withdrawal services, directly addresses this shift in customer behavior. While these innovations enhance customer convenience and accessibility, they simultaneously equip customers with the knowledge and tools to demand better service and more competitive offerings. This heightened customer awareness, fueled by readily available digital information, intensifies competition among lenders. In 2024, the Thai fintech sector continued to expand, with digital lending platforms reporting a 25% year-on-year growth in loan disbursement volume, underscoring the market's responsiveness to digitally empowered consumers.

- Digital Access: Over 70% of Thai adults use mobile banking, providing easy access to loan product comparisons.

- Informed Consumers: Digital platforms empower customers to readily compare rates and terms, increasing their negotiation leverage.

- Competitive Landscape: The 25% growth in digital lending volume in 2024 reflects lenders adapting to customer demands for better digital services.

- Service Expectations: Investments like Ngern Tid Lor's digital channels meet customer demand but also raise expectations for service quality and pricing.

Ngern Tid Lor's customer base often has limited alternatives, especially for those underserved by traditional banking. This lack of options generally reduces their bargaining power, as seen in Thailand where around 30% of adults were unbanked in 2024, highlighting fewer choices for many. Despite this, customers are price-sensitive due to modest average incomes in 2024, pushing lenders to maintain affordability.

The availability of numerous alternative microfinance providers and informal lenders in Thailand means customers can switch if Ngern Tid Lor's terms are unfavorable. Competitors like Muangthai Capital, which had a substantial loan portfolio as of early 2024, offer similar products, creating a competitive environment. This accessibility to comparable services prevents Ngern Tid Lor from unilaterally setting terms, as customers can leverage competition for better rates or conditions.

Digitalization significantly enhances customer bargaining power by enabling easy comparison of loan products, rates, and terms across various providers. With over 70% of Thai adults using mobile banking by the end of 2023, customers are well-informed and can negotiate better terms or switch to competitors offering superior value. The 25% year-on-year growth in digital lending volume in 2024 reflects lenders adapting to these digitally empowered consumers.

Full Version Awaits

Ngern Tid Lor Porter's Five Forces Analysis

This preview shows the exact Ngern Tid Lor Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It comprehensively details the competitive landscape for Ngern Tid Lor, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. This in-depth analysis provides critical insights into the strategic positioning and potential challenges faced by the company. Understand the forces shaping Ngern Tid Lor's market to inform your own business strategies and identify opportunities for growth.

Rivalry Among Competitors

The Thai microfinance and non-bank lending landscape is quite crowded, featuring numerous companies actively competing. This means Ngern Tid Lor faces rivalry not just from established giants but also from newer, agile players. For instance, Muangthai Capital is a major competitor, and companies like AutoX are also making their mark, particularly in vehicle-backed lending.

This fragmentation directly translates into heightened competition. Each of these entities is vying for the same customer base, particularly those segments underserved by traditional banking. This fierce competition often leads to pressure on pricing and a constant need for innovation to attract and retain customers.

In 2023, the total outstanding microfinance loans in Thailand reached approximately THB 420 billion, indicating a substantial market size but also the intensity of the battle for a piece of this pie. Ngern Tid Lor's strategy must account for this dynamic, ensuring it can differentiate its offerings to stand out.

The financial services sector, particularly vehicle title loans, is characterized by fierce competition, which frequently triggers price wars. This intense rivalry directly squeezes lending yields and puts considerable pressure on net interest margins for companies like Ngern Tid Lor.

Despite Ngern Tid Lor's success in boosting its lending yields, the highly competitive nature of the market, especially in vehicle title loans, acts as a ceiling on how much it can increase rates. For instance, in 2023, the non-bank financial institution sector saw a significant increase in loan volume, indicating heightened competition for borrowers.

Ngern Tid Lor differentiates itself in the competitive microfinance landscape through a focus on accessibility, rapid service delivery, and a strong customer-centric philosophy. This is evidenced by its significant physical presence, boasting over 1,200 branches across Thailand as of early 2024, making it highly accessible to its target demographic. This extensive network, combined with robust digital platforms, allows for quicker loan processing and a more convenient customer experience compared to many traditional lenders.

The company further distinguishes its offerings through integrated insurance brokerage services, providing a more holistic financial solution for its clients. While Ngern Tid Lor has made substantial investments in these differentiation strategies, the microfinance sector is dynamic. Competitors are actively enhancing their own digital capabilities and customer service models. For instance, by the end of 2023, several key competitors had also reported significant growth in their mobile banking adoption rates, indicating a sector-wide push towards similar customer-facing innovations.

Marketing and Brand Building Efforts

Competitors are pouring resources into marketing and brand building to capture market share and foster customer loyalty. AutoX, for example, has recently rolled out substantial marketing initiatives, aiming to enhance its visibility and appeal. This heightened promotional activity intensifies the pressure on all players to invest in their own brand presence and customer engagement strategies to remain competitive.

Ngern Tid Lor's established brand recognition and broad operational reach are significant assets, allowing it to connect with a wider customer base. However, maintaining this strong brand equity and extensive network necessitates continuous and substantial investment in marketing, advertising, and community outreach programs. This ongoing expenditure is crucial for defending its market position against aggressive competitor campaigns.

- Increased Marketing Spend: Competitors are boosting advertising budgets; AutoX's recent campaign reportedly cost upwards of $5 million.

- Brand Differentiation: Ngern Tid Lor's brand strength is a key differentiator, but requires sustained investment.

- Customer Acquisition Costs: Rising marketing efforts are likely increasing customer acquisition costs across the sector.

- Digital Presence: Competitors are enhancing their digital marketing and social media engagement to attract younger demographics.

Regulatory Environment and Compliance Burden

The regulatory environment profoundly impacts competitive rivalry. Stringent rules, like those from the Bank of Thailand (BOT), can deter new entrants by raising the cost and complexity of compliance. For instance, recent BOT notifications emphasizing responsible lending and asset quality scrutiny directly affect all existing financial institutions.

This heightened focus on compliance can, however, benefit established players with well-developed operational and risk management systems. Ngern Tid Lor, for example, likely benefits from its existing robust compliance infrastructure, allowing it to navigate these stricter requirements more effectively than less prepared competitors. Such regulations can therefore consolidate market share among firms that demonstrate strong adherence.

- Regulatory Impact: Stricter regulations can act as a barrier to entry, limiting new competition.

- Compliance Burden: Increased scrutiny on responsible lending and asset quality, as seen in recent BOT notifications, elevates compliance costs for all players.

- Competitive Advantage: Companies with strong existing compliance frameworks, like Ngern Tid Lor, are better positioned to manage these burdens and potentially gain market share.

- Market Dynamics: Regulatory shifts can reshape the competitive landscape, favoring firms with proactive compliance strategies.

The competitive rivalry within Thailand's microfinance sector is intense, with Ngern Tid Lor facing off against numerous established and emerging players. This crowded market, exemplified by competitors like Muangthai Capital and AutoX, forces companies to constantly innovate and differentiate their services to attract and retain customers. The overall loan volume in the non-bank financial institution sector surged in 2023, underscoring the high demand and aggressive competition for borrowers.

| Competitor | Key Strategy | 2023 Market Presence Indication |

|---|---|---|

| Muangthai Capital | Established presence, broad customer reach | Significant market share in vehicle title loans |

| AutoX | Aggressive marketing, digital focus | Notable growth in marketing initiatives and digital engagement |

| Ngern Tid Lor | Branch network, integrated services, customer service | Over 1,200 branches, strong brand recognition |

SSubstitutes Threaten

Traditional bank loans offer a significant substitute threat to Ngern Tid Lor, particularly for customers who might eventually qualify for more conventional financing. As of early 2024, Thai banks have been showing increased interest in expanding their customer base, with some actively seeking to onboard individuals previously considered outside their typical lending profiles. This trend could directly impact Ngern Tid Lor's market if banks relax their stringent creditworthiness requirements or if their target demographic’s financial standing improves enough to meet bank eligibility criteria.

Informal lending channels represent a significant threat of substitutes for Ngern Tid Lor. These unregulated lenders, often operating outside traditional banking systems, provide quick access to funds with minimal documentation, appealing to borrowers who may not qualify for or have time for formal loan applications.

The accessibility and speed offered by informal lenders are particularly strong substitutes, especially for immediate financial needs. For instance, a significant portion of the unbanked population in many emerging markets relies on these informal channels for everything from small personal expenses to emergency funds, highlighting their persistent relevance.

While informal lending typically comes with higher interest rates and less consumer protection, the convenience factor can outweigh these drawbacks for certain segments of the population. This readily available alternative means Ngern Tid Lor must continually demonstrate its value proposition in terms of competitive pricing, efficient service, and tailored product offerings to retain and attract customers.

The sheer prevalence of informal lending, particularly in regions with lower financial inclusion rates, underscores its role as a viable substitute. In 2024, estimates suggest that informal credit markets still play a crucial role in the financial lives of millions, making it a constant competitive pressure.

Individuals and small businesses increasingly consider personal savings and retained earnings as viable alternatives to formal loans, especially for smaller capital requirements. This direct self-financing bypasses interest payments and loan origination fees, offering a cost-effective solution. For instance, in 2024, personal savings rates in many developed economies remained robust, providing a cushion for smaller ventures.

This trend acts as a significant substitute threat, particularly for Ngern Tid Lor's micro-financing and small business loan products. While self-financing might not cover substantial investments, its accessibility for immediate, smaller needs can divert a portion of the potential customer base. The ability to access and utilize personal funds directly reduces the perceived need for external credit, thereby diminishing the demand for loan products.

Government-backed Microfinance Programs

Government-backed microfinance programs present a significant threat of substitution for companies like Ngern Tid Lor. These initiatives often provide loans at lower interest rates or with more lenient repayment schedules, directly competing with private sector lenders. For instance, in 2024, many developing nations continued to bolster their financial inclusion agendas through state-supported microfinance, aiming to reach underserved populations.

These government programs are designed to foster economic growth and social welfare, meaning their primary objective isn't profit maximization. This allows them to offer more attractive terms to borrowers who might otherwise turn to private lenders.

- Lower Interest Rates: Government programs can subsidize interest, making them inherently cheaper than market-driven rates.

- Enhanced Accessibility: Often targeting specific demographics or regions, these programs can be more accessible to certain customer segments.

- Broader Mandate: Their focus on financial inclusion rather than pure profit can lead to more flexible lending criteria.

- Customer Loyalty: Borrowers may develop loyalty to government programs that provide essential financial services with favorable terms.

Peer-to-Peer (P2P) Lending Platforms

The rise of peer-to-peer (P2P) lending platforms presents a growing substitute threat for traditional lenders like Ngern Tid Lor. These platforms, powered by financial technology, directly connect borrowers with individual investors, bypassing traditional banking structures. While the P2P lending market in Thailand is still in its nascent stages, its potential for growth as an alternative funding source is significant.

As of early 2024, the global P2P lending market has seen substantial expansion, with projections indicating continued strong growth. In Thailand specifically, regulatory frameworks are evolving to support fintech innovations, which could accelerate the adoption of P2P platforms. This trend suggests that borrowers seeking financing might increasingly turn to these digital channels, potentially diverting market share from established financial institutions.

- Fintech Advancement: P2P platforms leverage technology to streamline lending processes, offering potentially faster approvals and more competitive rates for certain borrower segments.

- Market Penetration: While currently a smaller portion of the overall lending market in Thailand, the accessibility and increasing user adoption of digital financial services indicate a growing potential for P2P platforms as substitutes.

- Borrower Diversification: P2P lending can cater to a broader range of borrowers, including those who may not meet the strict criteria of traditional banks, thereby expanding the substitute options available.

- Investor Appeal: These platforms also offer alternative investment opportunities for individuals seeking higher yields than traditional savings accounts, further solidifying their position in the financial ecosystem.

Alternative financing options, such as credit unions and specialized non-bank lenders, present a tangible substitute threat to Ngern Tid Lor. These entities often focus on niche markets or specific customer segments, offering tailored products that can appeal to borrowers seeking alternatives to traditional banks or Ngern Tid Lor's offerings. By early 2024, many such specialized lenders in Thailand had expanded their reach, leveraging digital channels to attract a wider customer base.

These specialized lenders can offer competitive pricing and quicker decision-making processes, directly challenging Ngern Tid Lor's market position. For instance, some credit unions in 2024 reported growth in their personal loan portfolios, attracting customers with flexible repayment terms and lower overheads compared to larger institutions.

Entrants Threaten

The financial services sector in Thailand, especially for companies like Ngern Tid Lor that operate as non-bank lenders, faces substantial regulatory hurdles. Obtaining the necessary licenses from the Bank of Thailand is a complex and time-consuming process, effectively acting as a significant barrier for new players looking to enter the market, particularly those aiming for substantial operations.

These stringent licensing requirements are designed to ensure financial stability and consumer protection, but they also create a formidable entry barrier. For instance, the capital adequacy ratios and operational compliance standards mandated by the Bank of Thailand can be prohibitively expensive for startups. As of early 2024, the Bank of Thailand continues to emphasize robust oversight for all financial institutions, reinforcing these entry challenges.

Establishing a nationwide microfinance operation, akin to Ngern Tid Lor's model, demands considerable capital. Think about the costs involved: setting up numerous physical branches across the country, building robust technological systems for operations and customer management, and crucially, funding the initial loan portfolios to serve a broad customer base. These upfront investments can easily run into hundreds of millions of dollars, acting as a significant hurdle for any newcomer wanting to compete effectively from the outset.

For instance, in 2024, the average cost to establish a new bank branch in a developing market can range from $500,000 to over $1 million, depending on location and technology integration. Scaling this across a national network, alongside the significant investment in IT infrastructure and the essential capital to back loans, clearly illustrates the substantial financial barrier to entry for new microfinance providers aiming for significant market penetration.

Ngern Tid Lor has cultivated a significant level of brand recognition and customer trust, particularly within its core demographic, by leveraging years of consistent service delivery and a widespread branch presence. This deep-seated loyalty presents a substantial hurdle for any new competitor aiming to enter the market.

New entrants would face considerable challenges in replicating Ngern Tid Lor's established reputation. They would likely need to commit substantial financial resources towards aggressive marketing campaigns and dedicated efforts to build personal relationships with customers to even begin to erode the existing brand loyalty.

Distribution Network and Reach

The threat of new entrants for Ngern Tid Lor is significantly mitigated by its established distribution network. With over 1,800 branches spread across Thailand, Ngern Tid Lor has built a formidable physical presence. This extensive network is further augmented by robust digital channels, creating a comprehensive customer touchpoint.

Replicating such a widespread and integrated distribution system presents a substantial barrier for any new player. The capital investment required to establish a comparable physical footprint and develop sophisticated digital platforms would be immense.

- Extensive Branch Network: Over 1,800 branches nationwide.

- Digital Integration: Complemented by a strong digital presence.

- High Barrier to Entry: Significant capital and time investment needed to replicate.

Virtual Banks and Fintech Disruptors

The threat of new entrants in the banking sector is escalating due to the Bank of Thailand's approval of virtual bank licenses. This move is expected to foster innovation and competition, bringing in tech-savvy players. For instance, the digital lending market saw significant growth, with some platforms reporting over 20% year-on-year increases in loan disbursements in early 2024, indicating a strong appetite for alternative financial services.

These virtual banks and fintech disruptors often operate with a lean overhead structure compared to traditional brick-and-mortar banks. This efficiency allows them to potentially offer more attractive interest rates or novel digital services that cater to evolving customer preferences. The rapid adoption of digital payment solutions, with transaction volumes exceeding 15 trillion Thai baht in 2023, underscores the market's readiness for digital-first financial offerings.

The competitive landscape is shifting as these new entrants leverage advanced technology and data analytics to reach underserved segments of the market. Their ability to onboard customers quickly and provide personalized financial solutions poses a direct challenge to incumbent institutions. By focusing on user experience and accessibility, they are redefining customer expectations for banking services.

Key implications for Ngern Tid Lor include:

- Increased competition: New digital-only banks may enter the market, offering competitive loan products and deposit accounts.

- Pressure on margins: Fintechs with lower operating costs could drive down interest rate margins for traditional lenders.

- Shift in customer preferences: Consumers may increasingly favor digital channels for banking, demanding seamless online experiences.

- Opportunities for partnership: Collaboration with fintechs could provide Ngern Tid Lor with access to new technologies and customer bases.

The threat of new entrants for Ngern Tid Lor remains moderate, largely due to significant regulatory and capital barriers. While the Bank of Thailand's approval of virtual bank licenses in 2024 introduces a new wave of tech-savvy competitors, the established infrastructure and brand loyalty of companies like Ngern Tid Lor present a substantial defense. The extensive network of over 1,800 branches, combined with integrated digital channels, requires immense investment to replicate, effectively deterring many potential new players.

However, the rise of virtual banks and agile fintech firms with lower overheads and a focus on digital-first offerings is a notable development. These entities can potentially offer competitive rates and innovative services, increasing competition and putting pressure on margins for incumbent lenders. For instance, the digital lending market in Thailand saw a growth of over 20% in loan disbursements in early 2024, highlighting the market's receptiveness to these newer models.

Ngern Tid Lor's established brand recognition and customer trust, built over years of service, also act as a significant barrier. New entrants would need substantial marketing investment and time to build comparable customer relationships and loyalty, especially within Ngern Tid Lor's core demographic.

| Factor | Impact on Ngern Tid Lor | Mitigating Factors |

|---|---|---|

| Regulatory Hurdles (e.g., Bank of Thailand licenses) | High barrier for new entrants, ensuring stability. | Ongoing stringent oversight reinforces these challenges. |

| Capital Requirements (e.g., nationwide microfinance) | Prohibitive upfront costs for startups (branches, tech, loan portfolios). | Estimated cost for establishing a new bank branch in 2024 can exceed $1 million. |

| Brand Recognition & Customer Loyalty | Significant hurdle for new competitors to overcome. | Years of consistent service and widespread presence build deep trust. |

| Distribution Network (Branches & Digital) | Formidable physical and digital touchpoint advantage. | Replication requires immense capital investment and time. |

| Virtual Banks & Fintech Disruption | Increasing competition, potential margin pressure, shift in customer preferences. | Opportunities for partnership; market growth in digital lending (over 20% YoY in early 2024). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ngern Tid Lor is built upon a foundation of comprehensive data, including Ngern Tid Lor's annual reports and investor presentations, alongside industry-specific market research reports and competitor financial disclosures.