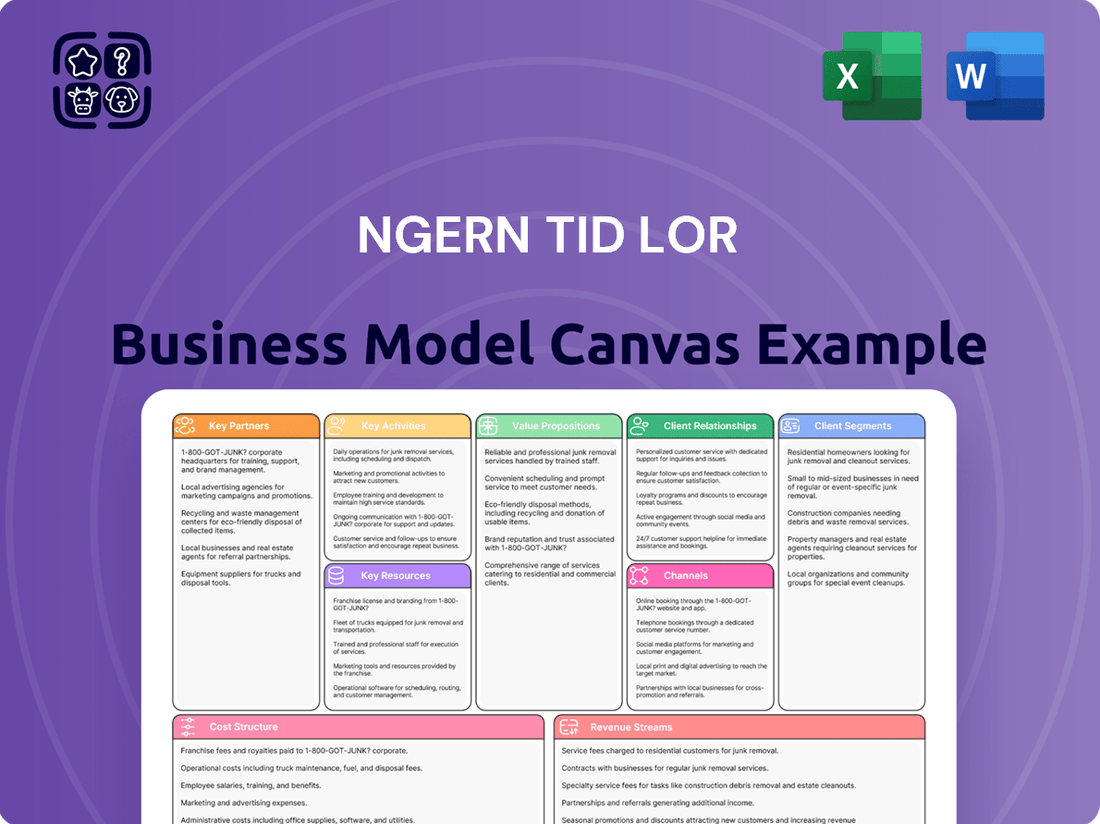

Ngern Tid Lor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ngern Tid Lor Bundle

Unlock the full strategic blueprint behind Ngern Tid Lor's innovative business model. This comprehensive Business Model Canvas meticulously details their customer segments, value propositions, and key revenue streams, offering a clear roadmap to their success.

Dive deeper into Ngern Tid Lor’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Ngern Tid Lor operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Ngern Tid Lor’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in Ngern Tid Lor’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Ngern Tid Lor maintains crucial strategic alliances with leading non-life insurance providers in Thailand, acting as a major insurance broker. These partnerships are essential for offering a diverse portfolio of products, including compulsory and voluntary motor insurance, to its extensive customer base. By serving as a one-stop shop, TIDLOR significantly enhances customer convenience and value. This model generates substantial commission-based revenue, contributing to the company's financial performance. In 2024, such partnerships continue to underpin TIDLOR's robust insurance segment growth.

Ngern Tid Lor strategically partners with various domestic and international banks and financial institutions, securing essential credit facilities to fund its extensive loan portfolio. For instance, in 2024, the company continued to leverage diverse funding sources to support its growth. Additionally, it actively raises capital by issuing debentures to a broad base of institutional and retail investors, ensuring robust liquidity. These crucial relationships are fundamental for securing the necessary capital and maintaining high liquidity, which is vital for sustaining and expanding its lending operations across Thailand.

Ngern Tid Lor maintains essential relationships with key regulatory bodies such as the Bank of Thailand (BOT) and the Office of Insurance Commission (OIC). Adhering to their stringent regulations is fundamental for securing necessary licenses and ensuring operational legitimacy, particularly given the evolving financial landscape in 2024. This close partnership guarantees the company operates within established legal frameworks, which is crucial for fostering market stability in the Thai financial sector. Such compliance also significantly builds and maintains consumer trust, underpinning the company's reputation and long-term viability.

Technology and Digital Service Providers

TIDLOR actively collaborates with specialized technology firms to drive its digital transformation, focusing on enhancing its mobile application and core lending systems. These partnerships are crucial for building robust data analytics platforms, which significantly improve operational efficiency and refine credit risk assessments. By leveraging external expertise, TIDLOR ensures a seamless digital customer experience, crucial as digital loan applications continue to grow, with a reported 49% of new loan applications made through digital channels by early 2024. This strategic collaboration includes vital providers of cloud computing, AI, and cybersecurity services, strengthening TIDLOR's digital infrastructure.

- Collaboration with tech firms for digital transformation initiatives.

- Development of mobile app, data analytics, and core lending systems.

- Enhancement of operational efficiency and credit risk assessment.

- Partnerships with cloud computing, AI, and cybersecurity providers.

Automotive and Commercial Networks

Ngern Tid Lor strategically partners with automotive dealerships, both new and used, alongside commercial transport associations. These alliances function as crucial referral channels, connecting TIDLOR with potential customers precisely when they are acquiring a vehicle or conducting business operations. Such symbiotic relationships significantly expand TIDLOR's market reach, contributing to robust customer acquisition. For instance, in 2024, these networks continue to be a primary source for reaching vehicle owners seeking financing.

- Partnerships with over 3,000 active dealers, including used car lots and motorcycle shops, are key.

- These networks provide direct access to customers at the point of vehicle transaction.

- Commercial transport associations foster connections with fleet owners and drivers.

- Such alliances are vital for extending market penetration in Thailand's vehicle financing sector.

Ngern Tid Lor strategically partners with a vast network of payment and distribution channels, including Post Offices and convenience stores like 7-Eleven. These collaborations facilitate convenient loan disbursements and repayments for customers nationwide, especially in remote areas. This extensive reach is crucial for operational efficiency and customer retention. In 2024, such partnerships continue to underpin TIDLOR's accessible service model.

| Partner Type | Strategic Role | 2024 Impact |

|---|---|---|

| Post Offices | Loan disbursement & collection | Over 1,200 branches enabling nationwide access |

| Convenience Stores | Payment collection points | Over 10,000 points, enhancing accessibility |

| Online Banking/Mobile Wallets | Digital payment integration | Growing volume of digital transactions |

What is included in the product

A comprehensive business model detailing Ngern Tid Lor's strategy, focusing on customer segments, channels, and value propositions for underserved communities.

Organized into 9 classic BMC blocks, it reflects real-world operations and provides insights for informed decision-making.

Ngern Tid Lor's Business Model Canvas effectively addresses the pain point of financial exclusion by mapping out accessible loan products and community-based distribution channels.

It clarifies how the company serves underserved populations, alleviating their struggles with traditional banking by offering flexible repayment options and localized service.

Activities

Loan underwriting and risk management form the core of Ngern Tid Lor's operations, focusing on assessing credit applications for a largely underserved customer base. TIDLOR leverages proprietary data analytics and advanced scoring models to effectively evaluate creditworthiness, allowing for precise risk assessment. This activity is crucial for maintaining a robust loan book and minimizing non-performing loans, which stood at a manageable 1.5% as of Q1 2024. Their strategic approach supports sustainable growth by balancing accessibility with prudent risk mitigation, ensuring financial stability.

Ngern Tid Lor’s key activities include the robust sale and servicing of non-life insurance policies, leveraging its extensive branch network and digital platforms. This involves training over 7,000 staff members, who act as knowledgeable insurance advisors, ensuring comprehensive customer consultation and claims support. The insurance brokerage business significantly diversifies revenue streams, moving beyond pure lending services. In 2024, this segment continued to be a strategic growth driver, contributing to the company's overall financial resilience and expanding its integrated financial services offering.

Managing Ngern Tid Lor’s extensive physical network, which surpassed 1,700 branches across Thailand by early 2024, is a core activity. This involves meticulous staff management, ensuring consistent customer service, efficient cash handling, and maintaining a uniform brand experience at every location. The branches serve as a crucial primary channel for acquiring new customers and fostering strong, lasting relationships. This widespread presence supports the company's financial inclusion goals, reaching diverse communities effectively.

Digital Transformation and Innovation

Ngern Tid Lor is deeply committed to digital transformation, significantly enhancing its TIDLOR Card and mobile application ecosystem. Key activities involve continuous software development, user experience design, and sophisticated data analysis to drive digital adoption. This strategic focus aims to boost operational efficiency and reduce costs, ultimately providing greater convenience for customers accessing financial services.

- In Q1 2024, Ngern Tid Lor reported continued growth in digital channel usage, with a focus on improving the mobile app's functionality for loan applications and payments.

- The company actively utilizes data analytics to personalize offerings and streamline customer journeys, evident in their enhanced credit scoring models.

- Efforts in 2024 included expanding digital payment options and self-service features within the app to reduce branch traffic and operational overhead.

- Digital innovation is central to their strategy to maintain a competitive edge and reach a broader customer base across Thailand.

Marketing and Brand Building

Ngern Tid Lor continuously engages in diverse marketing and communication activities to strengthen its brand and attract new customers. This includes a robust mix of digital marketing campaigns, prominent television commercials, and targeted local community engagement initiatives. These efforts are strategically designed to build widespread brand awareness across Thailand and reinforce its image as a fair, transparent, and accessible financial service provider. The company continues to leverage its extensive branch network, which exceeded 1,690 branches by Q1 2024, as a key touchpoint for local marketing and customer interaction.

- Ngern Tid Lor's Q1 2024 financial results reflect ongoing investment in customer acquisition.

- Digital marketing channels contribute significantly to new customer outreach in 2024.

- Television commercials maintain high brand visibility, reaching a broad audience.

- Local community engagement fosters trust and accessibility, particularly in underserved areas.

Ngern Tid Lor’s core activities include precise loan underwriting and diligent risk management, maintaining a healthy loan book with a 1.5% NPL rate as of Q1 2024. They also manage an extensive network of over 1,700 branches by early 2024, crucial for customer engagement.

The company actively sells and services non-life insurance policies, leveraging over 7,000 trained staff to diversify revenue streams. This segment continued to be a strategic growth driver in 2024, enhancing overall financial resilience.

Digital transformation is central, with continuous development of the TIDLOR Card and mobile app, evidenced by increased digital channel usage in Q1 2024. Marketing and communication efforts, including digital campaigns and TV commercials, strengthen brand awareness and attract new customers.

| Activity Area | Key Metric (2024) | Value |

|---|---|---|

| Loan Quality | NPL Ratio (Q1 2024) | 1.5% |

| Branch Network | Total Branches (Early 2024) | >1,700 |

| Insurance | Staff Advisors | >7,000 |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for Ngern Tid Lor that you are previewing is the actual, complete document you will receive upon purchase. This isn't a simplified sample or a marketing mockup; it's a direct, unedited view of the comprehensive analysis you'll gain. You'll be downloading this exact file, with all its detailed sections and insights, ready for your immediate use and strategic planning.

Resources

Ngern Tid Lor’s expansive and strategically placed branch network stands as a core physical asset. This vast footprint, exceeding 1,750 branches by early 2024, enables unparalleled market penetration, particularly in Thailand’s rural and upcountry areas. These tangible points of contact foster deep trust within communities. The network serves as a highly effective channel for both the origination of loans and the robust sales of insurance products.

Ngern Tid Lor has cultivated a strong brand, synonymous with trust and accessibility for Thailand's underbanked population. This intangible asset provides a significant competitive advantage, notably reducing customer acquisition costs. Their recognized brand is a key resource for attracting both new customers and investors, evidenced by their consistent market presence. The company's focus on transparent practices helps maintain this critical reputation.

Ngern Tid Lor’s critical intellectual resource is its extensive repository of customer data, fueling proprietary credit scoring models. These advanced analytics enable TIDLOR to precisely assess the lending risk for individuals with limited or no formal credit history. This capability is fundamental to serving Thailand's underserved population profitably, a market segment often overlooked by traditional banks. Their robust data infrastructure supports over 1,600 branches as of 2024, facilitating informed credit decisions and driving their continued market expansion.

TIDLOR Card and Technology Platform

The TIDLOR Card, functioning as a revolving cash card, and its robust underlying digital technology platform are crucial key resources for Ngern Tid Lor. These assets provide a distinctive value proposition, allowing customers immediate access to funds, which significantly enhances customer retention. This advanced technological infrastructure supports substantial operational efficiency, enabling the seamless delivery of diverse and innovative financial products. For instance, the platform facilitated over 55% of new loan applications digitally in early 2024, showcasing its pivotal role in customer engagement and service delivery.

- TIDLOR Card offers instant revolving credit access.

- Digital platform drives operational efficiency and innovation.

- Enhances customer retention through convenient service.

- Supports Ngern Tid Lor's expansive financial product ecosystem.

Access to Diverse Funding Sources

Ngern Tid Lor’s strong financial foundation relies on its access to diverse funding sources, a crucial key resource. The company consistently secures capital from various channels, including significant bank loans and the robust corporate bond market. This diversified funding base is essential, fueling the expansion of its loan portfolio and underpinning the entire business model.

- In April 2024, Ngern Tid Lor issued THB 10 billion in debentures, demonstrating strong market access.

- A diversified funding mix reduces reliance on any single source, enhancing financial stability.

- This financial agility allows for sustained growth of its asset-backed loan portfolio.

- Maintaining robust relationships with financial institutions ensures ongoing access to credit lines.

Ngern Tid Lor’s core resources include its extensive physical branch network of over 1,750 locations by early 2024, alongside a trusted brand. Proprietary credit scoring models, leveraging customer data, enable profitable lending to the underserved. The TIDLOR Card and digital platform, facilitating over 55% of new loan applications digitally in early 2024, enhance customer access and operational efficiency. Diverse funding sources, such as the THB 10 billion debentures issued in April 2024, underpin its growth.

| Resource Category | Key Asset | 2024 Data Point |

|---|---|---|

| Physical | Branch Network | >1,750 branches |

| Intellectual | Digital Platform | >55% digital loan applications |

| Financial | Funding Access | THB 10B debentures (Apr) |

Value Propositions

TIDLOR offers rapid and convenient access to secured loans, primarily vehicle title loans, with a streamlined application process ensuring swift disbursement. This directly addresses the critical need for immediate liquidity among underserved individuals and small businesses often excluded from traditional banking channels. Their focus on simplicity and speed allowed Ngern Tid Lor to expand its branch network to over 1,700 locations by early 2024, enhancing accessibility for millions.

Ngern Tid Lor commits to clear, easy-to-understand loan terms and interest rates, ensuring full transparency in its lending operations. This approach builds crucial trust with customer segments often vulnerable to predatory practices, such as those seeking vehicle title loans. By providing straightforward information, the company differentiates itself as a responsible and ethical lender. This commitment is reflected in their customer retention and satisfaction, aiming to foster long-term relationships rather than short-term gains from unclear terms.

Customers at Ngern Tid Lor conveniently access both vehicle title loans and a broad range of non-life insurance products at one service point. This integrated approach, a core value proposition, saves significant customer time and effort. In 2024, TIDLOR continues to expand its branch network, with over 1,700 branches nationwide, further enhancing this one-stop convenience. This seamless experience differentiates TIDLOR, evidenced by its significant growth in insurance brokerage, achieving over 10.7 billion Thai Baht in premiums written in 2023. This dual offering streamlines financial access, setting TIDLOR apart from specialized lenders or insurance brokers.

Financial Flexibility via the TIDLOR Card

The TIDLOR Card offers customers a revolving line of credit, providing ongoing financial flexibility akin to a credit card but secured by their vehicle. This innovative product allows for funds to be withdrawn and repaid as needed, serving as a crucial safety net for emergencies and recurring expenses. It effectively transforms a traditional term loan into a continuous financial tool, enhancing liquidity for over 6.8 million Ngern Tid Lor customers as of Q1 2024. The card’s convenience significantly boosts customer retention and usage.

- Revolving credit line secured by vehicle.

- Withdraw and repay funds flexibly.

- Transforms term loans into continuous financial tools.

- Supports over 6.8 million customers as of Q1 2024.

Empowerment through Financial Inclusion

Ngern Tid Lor’s value proposition extends beyond simple transactions, offering a vital pathway to the formal financial system for Thailand’s unbanked and underbanked populations. By providing legitimate credit and insurance solutions, the company empowers customers to gain financial control, seize opportunities, and build a more secure future. This commitment to financial inclusion and social impact remains a core part of its mission, reflecting its deep understanding of customer needs. Ngern Tid Lor served over 2.0 million active customers as of early 2024, demonstrating its widespread reach and impact.

- Facilitates access to formal credit and insurance for underserved segments.

- Empowers individuals to manage finances and improve their economic standing.

- Offers legitimate financial products, reducing reliance on informal lenders.

- Drives social impact by fostering financial stability for millions.

Ngern Tid Lor offers rapid, transparent vehicle title loans and a one-stop shop for loans plus non-life insurance, accessible via over 1,700 branches by early 2024. The innovative TIDLOR Card provides revolving credit, empowering over 6.8 million customers as of Q1 2024. This fosters financial inclusion for over 2.0 million active customers.

| Metric | 2023 (Bn THB) | 2024 (Data) |

|---|---|---|

| Insurance Premiums | 10.7 | Growing |

| Active Customers | N/A | 2.0M+ (early 2024) |

| TIDLOR Card Customers | N/A | 6.8M+ (Q1 2024) |

Customer Relationships

The core customer relationship for Ngern Tid Lor is built through direct, personalized interactions at their extensive branch network, which exceeded 1,700 locations across Thailand as of Q1 2024. Staff are trained as friendly financial advisors, empowering them to understand local customer contexts and foster long-term trust. This high-touch, face-to-face approach is crucial for their target segment, which values personal engagement and accessibility. By prioritizing human connection, Ngern Tid Lor strengthens customer loyalty and ensures financial solutions are tailored to individual needs.

Ngern Tid Lor fosters convenience and efficiency through its robust digital self-service offerings. The TIDLOR mobile app and TIDLOR Card enable customers to manage their accounts, check balances, and make payments seamlessly. This digital empowerment ensures 24/7 access to credit lines, enhancing customer independence. In 2024, the focus remains on integrating these digital channels, complementing the physical branch network. Such automation streamlines operations, serving a growing base of over 5.4 million total customers by early 2024.

A dedicated call center offers Ngern Tid Lor a centralized hub for customer inquiries and efficient problem resolution, ensuring a consistent and professional service experience. This support pillar handles a high volume of interactions, serving both digital and traditional branch customers. For instance, in 2024, such centers are crucial as digital adoption grows, yet many customers still prefer direct verbal support for complex financial product queries. This infrastructure helps maintain customer satisfaction and loyalty across diverse service channels.

Proactive Communication and Education

Ngern Tid Lor fosters customer loyalty through proactive communication, ensuring customers receive timely payment reminders via SMS and access to valuable financial literacy content. This approach empowers customers to responsibly manage their debt and significantly reduces default risks, positioning TIDLOR as a trusted financial partner rather than just a lender. In 2024, their digital engagement efforts continued to strengthen relationships, contributing to a stable loan portfolio.

- Ngern Tid Lor actively uses SMS for payment reminders to support timely repayments.

- Customers receive financial literacy content to improve their debt management skills.

- This proactive engagement helps reduce the risk of loan defaults.

- The strategy positions TIDLOR as a supportive financial partner, not merely a creditor.

Loyalty through Product Innovation

Ngern Tid Lor builds strong customer relationships through product innovation, notably with the TIDLOR Card. This card provides continuous credit access upon successful repayment, fostering deep loyalty and repeat business. Good customer behavior is directly rewarded with sustained financial access, encouraging a long-term, mutually beneficial relationship. As of Q1 2024, Ngern Tid Lor reported over 6.8 million active customers, showcasing the effectiveness of their relationship-building strategies. The TIDLOR Card helps drive repeat transactions, contributing to their robust loan portfolio.

- TIDLOR Card offers revolving credit.

- Successful repayment unlocks continuous access.

- Good behavior is rewarded with sustained financial access.

- Fosters long-term, mutually beneficial relationships.

Ngern Tid Lor fosters strong customer relationships through a hybrid model, combining over 1,700 physical branches (Q1 2024) with robust digital self-service. The TIDLOR Card provides 24/7 revolving credit, rewarding good repayment behavior and enhancing loyalty. Proactive communication via SMS and financial literacy content further strengthens trust, serving over 6.8 million active customers by Q1 2024.

| Relationship Aspect | Key Channel | 2024 Data Point |

|---|---|---|

| Physical Presence | Branch Network | >1,700 locations (Q1 2024) |

| Digital Access | TIDLOR App/Card | >5.4M total customers (early 2024) |

| Customer Base | Active Users | >6.8M customers (Q1 2024) |

Channels

The extensive nationwide physical branch network, comprising over 1,700 locations as of 2024, serves as Ngern Tid Lor's primary channel for customer acquisition and relationship building.

Its presence across all 77 provinces of Thailand ensures deep market penetration and accessibility, particularly reaching underserved populations.

This channel is especially effective in delivering services and fostering trust among customers in upcountry and rural areas.

The TIDLOR Mobile Application serves as a crucial digital channel, primarily catering to existing customers. It empowers users to conveniently manage their loans, access the revolving credit offered by the TIDLOR Card, and seamlessly make payments. As of early 2024, the app significantly enhances customer convenience and engagement, contributing to Ngern Tid Lor's digital transformation efforts and increasing self-service options for its growing customer base.

The Ngern Tid Lor company website serves as a vital digital channel, offering comprehensive information on products like vehicle title loans and personal loans. Prospective customers can easily access loan calculators and initiate online applications, streamlining the initial contact process. This platform is a crucial touchpoint for brand discovery, reflecting a growing trend where over 40% of financial product inquiries in Thailand begin online in 2024. It efficiently generates leads by providing self-service options and detailed product insights, enhancing customer accessibility and engagement.

Centralized Call Center

The Centralized Call Center for Ngern Tid Lor serves as a crucial channel for both inbound and outbound customer communication, directly supporting its extensive branch network. It efficiently handles customer service inquiries, provides essential support, and processes loan applications over the phone, enhancing accessibility for clients across Thailand. This channel also conducts telemarketing activities, reaching a broad customer base and contributing to new loan originations. In 2024, the call center significantly contributes to customer engagement, complementing the company's over 1,700 branches nationwide.

- Handles over 500,000 inbound calls annually.

- Processes approximately 15% of new loan applications remotely.

- Supports a customer base exceeding 2.7 million as of early 2024.

- Contributes to a high customer retention rate through direct service.

Social Media and Digital Marketing Platforms

TIDLOR leverages platforms like Facebook, LINE, and YouTube as crucial digital channels for marketing and customer engagement. These platforms are vital for running targeted advertising campaigns and sharing financial literacy content, reaching a broad audience across Thailand. For instance, Ngern Tid Lor’s Facebook page had over 3 million followers in 2024, demonstrating significant reach for brand building and driving top-of-funnel awareness. This digital presence effectively directs traffic to their physical branches and online application portals, enhancing accessibility for potential customers.

- Facebook: Over 3 million followers in 2024, a key channel for brand awareness.

- LINE: Utilized for direct customer interaction and personalized offers.

- YouTube: Features financial literacy videos and product explanations, attracting 2024 viewers.

- Digital campaigns: Drive traffic and leads, complementing physical branch network.

Ngern Tid Lor employs a robust omnichannel strategy, leveraging over 1,700 physical branches nationwide for widespread reach and trust-building, especially in rural areas.

Digital channels like the TIDLOR Mobile App, company website, and social media platforms (Facebook with 3M+ followers in 2024) drive customer engagement, self-service, and lead generation.

The Centralized Call Center, handling over 500,000 inbound calls annually and processing 15% of new loan applications remotely, complements these channels, supporting a customer base exceeding 2.7 million.

| Channel Type | Key Metric (2024) | Primary Function |

|---|---|---|

| Physical Branches | >1,700 locations | Acquisition, Trust |

| Digital Apps/Web | 3M+ FB followers | Engagement, Leads |

| Call Center | >500K inbound calls/yr | Support, Remote Apps |

Customer Segments

Self-employed and informal workers are a core customer segment for Ngern Tid Lor. This group, including street vendors, farmers, and motorcycle taxi drivers, often has variable or undocumented income. They typically lack the formal payslips required by traditional banks, making them financially underserved. Their primary need is for quick access to working capital or personal funds to manage daily operations or unexpected expenses. In 2024, a substantial portion of the Thai workforce, estimated at over 50%, operates within the informal sector, emphasizing the immense demand for accessible financial solutions like TIDLOR's.

Ngern Tid Lor serves Micro, Small, and Medium-Sized Enterprises (MSMEs) in Thailand, providing crucial working capital for managing cash flow, purchasing inventory, or expanding operations. These entrepreneurs often leverage personal or company vehicles as collateral to secure financing, a common practice given their asset base. This segment remains largely underserved by traditional banks due to perceived higher risk and smaller loan sizes. In 2024, Ngern Tid Lor continues to bridge this financing gap, with vehicle title loans being a significant product for these businesses.

Low-to-middle income salaried individuals often have stable employment but remain underbanked, finding limited access to credit from traditional Thai banks, with only about 28% of adults having access to formal credit as of 2024. They frequently seek loans for immediate needs like emergency expenses or debt consolidation, or for larger personal purchases. This segment values Ngern Tid Lor's rapid processing and minimal documentation, which aligns with their urgent financial needs. For instance, Ngern Tid Lor reported over 1.6 million active customers in 2024, many falling into this demographic seeking accessible and swift financial solutions.

Vehicle Owners Requiring Liquidity

This crucial segment encompasses a diverse group of individuals who own vehicles, such as cars, pickup trucks, or motorcycles, with clear titles and seek immediate cash liquidity. These customers leverage their owned assets to secure loans, making it the bedrock for Ngern Tid Lor’s primary vehicle-backed loan offerings. By mid-2024, the demand for such secured loans continued to be robust across Thailand, reflecting ongoing financial needs. The company’s success heavily relies on effectively serving these vehicle owners.

- In 2024, Ngern Tid Lor expanded its branch network to serve more vehicle owners.

- Vehicle-backed loan disbursements remained a core revenue driver through early 2024.

- Motorcycle and car title loans form the majority of the portfolio for this segment.

- This segment includes small business owners and individuals needing working capital.

First-Time Insurance Buyers

First-Time Insurance Buyers represent a crucial segment for Ngern Tid Lor's brokerage, often seeking accessible motor insurance. These individuals, many of whom are existing loan customers, value the convenience of bundling insurance with their loans. TIDLOR branches provide essential guidance and simplicity, making the process straightforward for new policyholders. The company reported a significant increase in non-motor insurance policies in 2024, indicating a growing demand for diverse and accessible options.

- TIDLOR's brokerage targets individuals purchasing motor insurance for the first time or seeking affordable options.

- This segment frequently overlaps with loan customers, who are offered insurance as a convenient bundled service.

- They highly value the clear guidance and straightforward process provided at TIDLOR branches.

- In early 2024, TIDLOR focused on expanding its insurance offerings, aiming for a 30% growth in insurance premium income.

Ngern Tid Lor primarily targets financially underserved individuals and small businesses in Thailand, including informal workers, MSMEs, and low-to-middle income salaried individuals, many of whom lack traditional bank access. A core segment comprises vehicle owners seeking secured loans, leveraging their assets for quick liquidity. Furthermore, the company serves first-time insurance buyers, often existing loan customers, bundling accessible motor and non-motor policies. In 2024, TIDLOR focused on expanding its reach to over 1.6 million active customers, bridging the financial gap for diverse segments.

| Customer Segment | Key Need | 2024 Data Point |

|---|---|---|

| Informal Workers / MSMEs | Working Capital, Quick Loans | Over 50% Thai workforce informal |

| Low-to-Middle Income Salaried | Emergency Funds, Debt Consolidation | 1.6M+ active customers |

| Vehicle Owners | Secured Loans (Vehicle Title) | Robust demand for secured loans |

| First-Time Insurance Buyers | Accessible Motor/Non-Motor Insurance | Focus on 30% insurance premium growth |

Cost Structure

Interest expenses and the cost of funds represent Ngern Tid Lor's single largest operational cost. This encompasses the interest paid on borrowings from various financial institutions and on corporate bonds issued to investors to fund its lending activities. Managing this cost effectively is paramount for the company to maintain healthy and profitable lending margins, especially given the dynamic interest rate environment in 2024. For instance, in Q1 2024, Ngern Tid Lor reported a cost to income ratio of approximately 42.6%, highlighting the significant impact of funding costs on overall profitability.

Personnel expenses and employee benefits represent a significant cost for Ngern Tid Lor due to its extensive branch network and large workforce. This includes salaries, commissions, and bonuses for thousands of employees, alongside comprehensive benefits. The company also invests heavily in training and development, with costs potentially rising in 2024 to support enhanced customer service and sales performance across its over 1,600 branches. This high-touch, branch-based operating model inherently drives substantial personnel-related expenditure.

Provisions for Expected Credit Losses represent a critical cost for Ngern Tid Lor, given its focus on higher-risk segments. This essential accounting charge reflects anticipated loan portfolio losses. For instance, Ngern Tid Lor reported a net impairment loss of 2,423 million baht in Q1 2024, demonstrating the scale of these provisions. Effective risk management aims to control these costs, ensuring the company maintains financial stability and healthy profitability despite the inherent risks. This proactive approach is vital for sustainable growth.

Branch Network Operating Expenses

Ngern Tid Lor’s branch network operating expenses encompass all costs vital for its physical presence and market reach. These include rent for over 1,700 branch locations across Thailand, utilities, security services, and ongoing maintenance. Such fixed and variable costs represent a substantial portion of the company’s overall cost structure, impacting profitability directly. To optimize this significant expenditure, Ngern Tid Lor is actively pursuing digital transformation initiatives aimed at enhancing operational efficiency and potentially reducing reliance on physical infrastructure over time, while maintaining customer accessibility.

- In Q1 2024, Ngern Tid Lor reported selling and administrative expenses of 2,873 million THB, a key category that includes branch operating costs.

- The company continued its branch expansion, reaching 1,739 branches by March 2024, up from 1,675 branches at the end of 2023.

- Branch-related expenses are a primary driver of the increase in operating costs, reflecting the strategy of extensive physical presence.

- Digital channels are increasingly leveraged to complement branches and manage cost growth.

Marketing and Technology Expenses

Ngern Tid Lor’s marketing and technology expenses encompass all spending on advertising, brand campaigns, and sales promotions crucial for attracting and retaining customers across Thailand. This also covers significant investments in robust IT infrastructure, ongoing software development for their popular mobile application, and advanced data analytics capabilities. These costs are vital for driving sustained business growth and maintaining a strong competitive edge in the microfinance and insurance brokerage sectors.

- For 2024, Ngern Tid Lor continues to prioritize digital channels, with marketing efforts increasingly focused on online engagement.

- Investment in IT infrastructure is projected to support the expansion of their digital lending and insurance platforms.

- Customer acquisition costs are managed through data-driven campaigns, optimizing spend for higher conversion rates.

- The mobile application saw continued enhancements in Q1 2024, improving user experience and service accessibility.

Ngern Tid Lor's cost structure is dominated by interest expenses, crucial for funding its lending, alongside significant personnel costs supporting its extensive 1,739-branch network by March 2024.

Provisions for expected credit losses are a critical expense, reflecting the inherent risk in its loan portfolio, with a net impairment loss of 2,423 million baht in Q1 2024.

Branch operating expenses, part of the 2,873 million THB in Q1 2024 selling and administrative costs, are substantial, balanced by increasing marketing and technology investments for digital growth.

| Cost Category | Q1 2024 Data | Impact |

|---|---|---|

| Interest Expenses | Cost to Income Ratio ~42.6% | Directly impacts lending margins. |

| Provisions for ECL | 2,423M THB net impairment loss | Reflects credit risk management. |

| S&A Expenses | 2,873M THB | Includes branch and personnel costs. |

Revenue Streams

Ngern Tid Lor's primary revenue stream is the substantial interest income generated from its diverse portfolio of vehicle title loans and personal loans. The interest rate charged to customers is the core driver of this income, reflecting the company's credit risk assessment and market positioning. For Q1 2024, the company reported a robust net interest income of approximately THB 3,745 million. The scale of this critical revenue stream is directly determined by the size and quality of the loan portfolio, which reached THB 106,781 million with a 16.5% year-on-year growth in Q1 2024.

A significant and rapidly growing revenue stream for Ngern Tid Lor comes from commissions earned as an insurance broker. For every non-life insurance policy sold on behalf of its partners, TIDLOR receives a commission, contributing to a stable, fee-based income. This diversifies revenue away from traditional credit risk, strengthening the business model. In 2024, this segment continued its robust growth, showcasing its importance to overall profitability and resilience.

Ngern Tid Lor generates revenue through various fees charged to customers for their loan services. This includes loan processing fees, administrative fees, and penalties for late payments, which are crucial despite being smaller than interest income. For instance, in Q1 2024, Ngern Tid Lor reported non-interest income, which encompasses these fees, contributing to their overall financial performance. While interest income remains the primary driver, these fees provide a valuable supplementary and stable revenue stream. This diversification helps bolster the company's financial resilience.

Revenue from the TIDLOR Card

The TIDLOR Card generates significant revenue primarily through the interest income earned on the revolving credit line utilized by customers. As clients, including a growing base of over 2 million cardholders as of early 2024, draw down and use the available funds, interest accrues, directly contributing to the top line. This product effectively transforms a single loan origination into a recurring revenue opportunity for Ngern Tid Lor. The average interest rate for the TIDLOR Card typically ranges, ensuring a steady income stream.

- Interest income from card usage is a core revenue driver.

- Recurring revenue model from revolving credit.

- Over 2 million cardholders as of early 2024 contribute to the revenue base.

- Interest accrual from drawn funds boosts top-line performance.

Other Income

Other Income for Ngern Tid Lor encompasses miscellaneous revenue sources, distinguishing itself from core lending and insurance activities. This category can include income from debt collection services provided to external parties, or other ancillary activities that are not central to their primary business model. While these activities are not a core focus, they provide incremental revenue, contributing opportunistically to the company's overall financial performance. This revenue stream represents a smaller, yet valuable, portion of Ngern Tid Lor's total income.

- Ngern Tid Lor's Q1 2024 net profit reached THB 1.1 billion.

- Other Income is distinct from core loan and insurance revenues.

- Sources can include third-party debt collection fees.

- It provides supplementary, non-core income.

Ngern Tid Lor primarily generates revenue from interest income on its vehicle title and personal loans, reporting THB 3,745 million in Q1 2024 net interest income. Significant commissions from insurance brokerage and various loan-related fees also contribute. The TIDLOR Card's revolving credit interest income, supported by over 2 million cardholders in early 2024, adds a recurring stream. Other income from ancillary services further diversifies their financial performance.

| Revenue Stream | Q1 2024 Data | Description | ||

|---|---|---|---|---|

| Interest Income | THB 3,745M (Net) | Vehicle title and personal loans | ||

| Insurance Commissions | Growing Segment | Non-life insurance sales | ||

| TIDLOR Card Interest | 2M+ cardholders | Revolving credit line usage |

Business Model Canvas Data Sources

The Ngern Tid Lor Business Model Canvas is informed by a blend of internal financial reports, customer feedback surveys, and operational performance metrics. This comprehensive data set ensures each component of the canvas accurately reflects the company's current state and strategic direction.