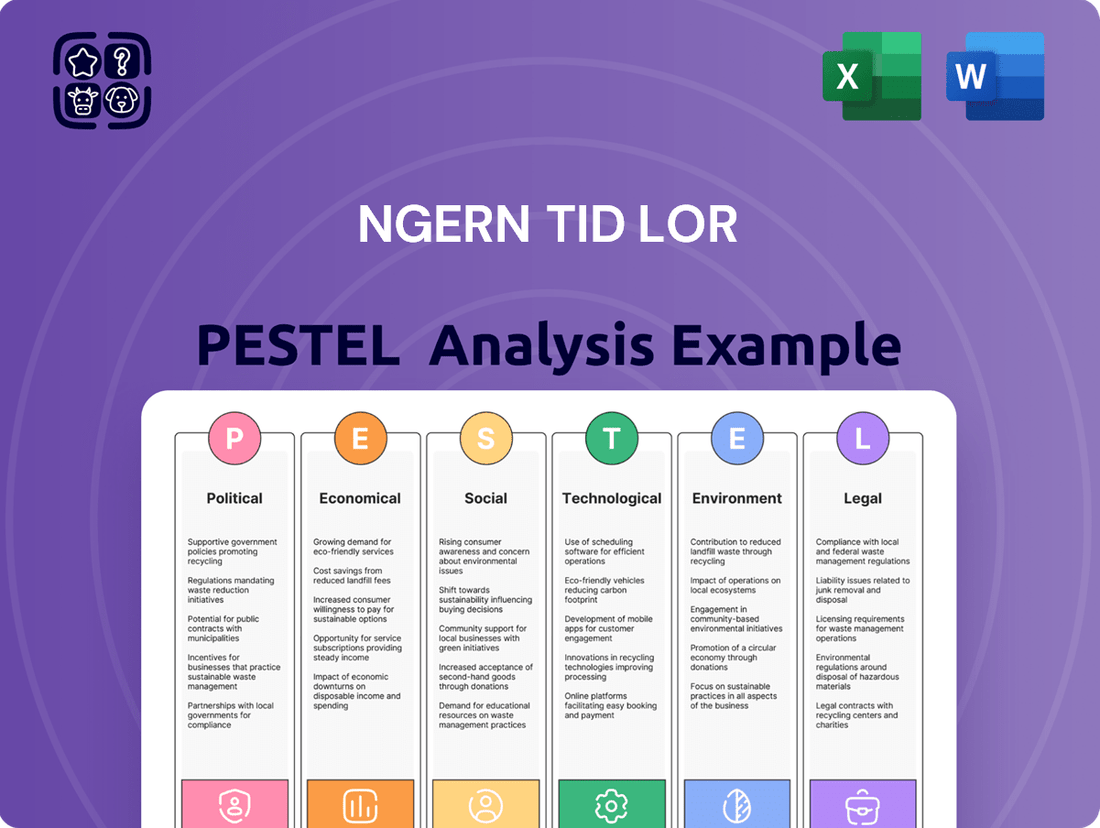

Ngern Tid Lor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ngern Tid Lor Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Ngern Tid Lor's trajectory. Our PESTLE analysis provides a comprehensive overview of the external forces influencing the company's operations and strategic decisions. Gain a competitive advantage by understanding these dynamics. Download the full version now for actionable insights to inform your strategy.

Political factors

Political stability in Thailand is a crucial element for investor confidence and the effective execution of economic policies. Uncertainties, such as the suspension of the Prime Minister, can create delays, potentially impacting the 2026 budget process and economic growth from late 2024 through mid-2025.

For Ngern Tid Lor, a financial services company, this means that a predictable regulatory landscape and stable economic conditions are essential for successful long-term planning and continued expansion. The company's ability to operate and grow is directly tied to the government's capacity to maintain order and implement consistent economic strategies.

The Thai government and the Bank of Thailand (BOT) are strongly committed to advancing financial inclusion, a goal that directly supports Ngern Tid Lor's core business of providing financial services to those often overlooked by traditional banking. These efforts are designed to bring more people into the formal financial system.

Key initiatives, such as the National e-Payment Master Plan, are actively pushing for a shift away from cash-based transactions towards digital platforms. This focus on transparency and efficiency in payments could significantly broaden the market for digital financial services, a sector where Ngern Tid Lor operates.

By 2024, Thailand had seen a significant increase in digital payment adoption, with mobile payments growing substantially year-on-year. This governmental push creates a favorable ecosystem for companies like Ngern Tid Lor, which specialize in accessible and user-friendly financial solutions for a wide demographic.

Thailand's household debt remains a significant concern, reaching an estimated 16.42 trillion baht by the end of 2024. This high level of indebtedness necessitates government intervention and policy adjustments.

In response, the Bank of Thailand (BOT) and the government are actively implementing measures such as the Responsible Lending notification, which saw updates in January 2025 following its initial rollout in January 2024. These policies aim to foster more sustainable borrowing habits and improve overall financial sector stability.

Furthermore, various debt restructuring programs are in place to help alleviate the burden on households. These initiatives are designed to provide relief and encourage responsible debt management practices across the population.

For companies like Ngern Tid Lor, these political factors directly impact their operational environment. Stricter lending criteria, evolving loan demand patterns, and the potential shifts in the non-performing loan (NPL) landscape are all critical considerations stemming from these debt management policies.

Regulatory Sandbox and Fintech Promotion

The Bank of Thailand's 2024 regulatory sandbox is a significant development, offering fintech firms a controlled environment to pilot new financial services. This initiative demonstrates a commitment to fostering innovation within Thailand's financial landscape, a move Ngern Tid Lor can capitalize on for its digital platform enhancements. Such a supportive framework encourages a more dynamic and competitive market, potentially leading to advanced digital solutions and improved customer experiences.

This proactive regulatory stance directly aligns with the government's broader ambition to drive a digital economy, targeting a substantial 30% contribution to GDP by 2030. The push for digitalization across various sectors, including finance, creates fertile ground for fintech solutions like those Ngern Tid Lor is developing. This governmental focus provides a clear incentive for investment in and adoption of digital financial technologies.

- Regulatory Sandbox Launch: The Bank of Thailand initiated its regulatory sandbox in 2024 to facilitate testing of innovative financial products.

- Fintech Ecosystem Growth: This sandbox is expected to stimulate competition and innovation, potentially benefiting companies like Ngern Tid Lor.

- Digital Economy Target: Thailand aims for its digital economy to represent 30% of its GDP by 2030, underscoring a national priority for digital transformation.

Consumer Protection and Market Conduct Regulations

The Bank of Thailand's (BOT) 'Responsible Lending' notification, effective from early 2025, significantly impacts financial institutions by mandating ethical lending practices and robust consumer protection across the entire debt lifecycle. This includes tightening advertising standards to prevent misleading promotions.

As a publicly traded and regulated entity, Ngern Tid Lor Public Company Limited (NTL) must diligently comply with these evolving market conduct regulations. This adherence is crucial for maintaining customer trust and avoiding potential penalties. For instance, the BOT’s focus on fair treatment means NTL must ensure transparency in loan terms and fees, a principle that will be increasingly scrutinized.

Compliance with these regulations not only safeguards NTL from regulatory risks but also fosters a reputation for fairness, which is vital in the competitive financial landscape. For example, in 2024, the BOT issued warnings to several smaller lenders for aggressive collection tactics, highlighting the growing emphasis on consumer rights.

- Stricter advertising guidelines: NTL must ensure all marketing materials accurately reflect loan terms and conditions, avoiding any form of misrepresentation.

- Enhanced data privacy: Adherence to the Personal Data Protection Act (PDPA) remains paramount, with increased scrutiny on how customer data is collected and used in lending processes.

- Fair debt collection practices: The BOT's guidelines will necessitate review and potential modification of NTL's debt collection procedures to ensure they are ethical and respectful.

- Product suitability assessments: NTL will need to demonstrate robust processes for assessing the suitability of loan products for different customer segments, preventing over-indebtedness.

The Thai government's commitment to financial inclusion and digital transformation, as evidenced by initiatives like the National e-Payment Master Plan, creates a favorable environment for Ngern Tid Lor's business model. However, political instability, such as the suspension of a Prime Minister in late 2024, can introduce uncertainty into budget processes and economic growth projections through mid-2025.

The Bank of Thailand's (BOT) 2024 regulatory sandbox initiative aims to foster fintech innovation, directly benefiting companies like Ngern Tid Lor by providing a controlled space to test new financial services. This aligns with Thailand's broader ambition to boost its digital economy to 30% of GDP by 2030.

The BOT's 'Responsible Lending' notification, updated in January 2025, mandates stricter lending practices and consumer protection, influencing Ngern Tid Lor's operations and requiring adherence to enhanced data privacy and fair debt collection standards.

Thailand's household debt, estimated at 16.42 trillion baht by the end of 2024, is prompting government intervention through policies like the Responsible Lending notification, which impacts loan demand and NPL scenarios for financial institutions.

What is included in the product

This Ngern Tid Lor PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operations and strategic direction.

It provides a comprehensive understanding of the external landscape, highlighting key challenges and opportunities for Ngern Tid Lor to navigate and leverage.

Ngern Tid Lor's PESTLE analysis acts as a pain point reliever by providing a structured framework to proactively identify and address external challenges, ensuring strategic preparedness and mitigating potential business disruptions.

Economic factors

Thailand's household debt presented a significant economic factor, standing at 16.42 trillion baht by the close of Q4 2024. While this figure underscores a substantial burden, the debt-to-GDP ratio saw a marginal improvement, falling to 88.4% in Q1 2025. This slight decrease is attributed to more stringent lending practices and a subdued demand for new credit.

The persistence of high household debt, coupled with findings that a considerable segment of the population possesses minimal emergency savings, highlights a widespread financial fragility. This vulnerability directly impacts the pool of potential borrowers, presenting a dual-edged scenario for Ngern Tid Lor.

For Ngern Tid Lor, the elevated debt levels signify a broad market opportunity, as many households may require financial services. However, it simultaneously introduces heightened credit risk, demanding careful assessment and robust risk mitigation strategies in their lending operations.

Thailand's economic growth is anticipated to pick up pace, with projections for 2025 reaching around 2.9%. This acceleration is largely fueled by a rebound in domestic consumption, a recovering tourism sector, and ongoing public investment initiatives. A stronger economy typically benefits financial services firms like Ngern Tid Lor by enhancing customers' ability to repay loans and boosting overall demand for credit.

However, potential headwinds exist. Some economists forecast a more conservative GDP growth rate for Thailand in 2025, closer to 1.8%. This more cautious outlook stems from concerns regarding political stability and the impact of evolving global trade policies. Such uncertainties could present challenges to Ngern Tid Lor's expansion plans, as they might dampen consumer spending and investment.

The Bank of Thailand kept its policy interest rate at 2.5% in June 2024, a decision following its normalization of rates towards the close of 2023. This monetary policy stance aims to bolster economic recovery while simultaneously tackling elevated levels of household debt. For Ngern Tid Lor, a stable or slowly rising interest rate environment directly influences their cost of borrowing and the capacity of their customer base, primarily those with lower incomes, to afford new loans.

Competition in Financial Services

The Thai financial services sector is intensely competitive, with established banks, other non-bank lenders, and a surge of fintech firms vying for market share. This dynamic environment, particularly in digital lending and payment solutions, pushes Ngern Tid Lor to constantly enhance its offerings and reach. For instance, the Bank of Thailand reported that as of Q1 2024, digital transactions in Thailand saw a substantial year-on-year increase, highlighting the growing importance of digital channels.

This heightened competition necessitates continuous innovation for Ngern Tid Lor. To stay ahead, the company must focus on developing user-friendly digital platforms and exploring new distribution methods to capture and retain customers. The digital lending market alone is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 15% between 2024 and 2028.

Key competitive pressures impacting Ngern Tid Lor include:

- Intensified Digital Lending: Fintechs are rapidly expanding their digital loan offerings, often with faster approval processes.

- Payment System Innovation: The rise of e-wallets and real-time payment systems creates new avenues for customer engagement and potential disruption.

- Traditional Bank Adaptation: Banks are also investing heavily in digital transformation, improving their online services to compete directly with non-banks.

- Regulatory Landscape: Evolving regulations around digital finance and consumer protection can impact competitive strategies and operational costs.

Disposable Income and Consumer Spending

Disposable income and consumer spending are crucial drivers for Ngern Tid Lor, a company focused on microfinance. While private consumption is projected to grow by 3.3% in 2025, this optimism is tempered by a subdued labor market and lingering consumer confidence issues that could slow down the recovery.

A significant trend noted in a 2024 Mahidol University study highlights that Thai consumers are increasingly engaging in luxury spending. This behavior, unfortunately, is contributing to rising unsustainable debt levels and depleting emergency savings among the population.

These economic factors have a direct impact on Ngern Tid Lor's business. The propensity for luxury spending and the resulting financial strain on consumers can affect the demand for microfinance products and, critically, the ability of Ngern Tid Lor's target clientele to repay their loans.

- Projected Private Consumption Growth (2025): 3.3%

- Key Concerns: Weak labor market and consumer confidence.

- Consumer Behavior Trend (2024 Mahidol University Study): Increased luxury spending.

- Consequences of Trend: Unsustainable debt levels and limited emergency savings.

Thailand's economic landscape in 2024-2025 is shaped by persistent high household debt, which stood at 16.42 trillion baht by Q4 2024, though the debt-to-GDP ratio slightly improved to 88.4% by Q1 2025. Economic growth is projected to reach approximately 2.9% in 2025, driven by domestic consumption and tourism, yet concerns about political stability could temper this. The Bank of Thailand maintained its policy rate at 2.5% in June 2024, aiming to balance recovery with debt management, directly influencing borrowing costs for Ngern Tid Lor's clientele.

| Economic Indicator | Value | Period | Implication for Ngern Tid Lor |

|---|---|---|---|

| Household Debt | 16.42 trillion baht | Q4 2024 | Market opportunity but heightened credit risk. |

| Debt-to-GDP Ratio | 88.4% | Q1 2025 | Slight improvement, potentially easing some borrower strain. |

| Projected GDP Growth | ~2.9% | 2025 | Potential for increased loan demand and repayment capacity. |

| Policy Interest Rate | 2.5% | June 2024 | Stable rates impact borrowing costs and affordability. |

Preview Before You Purchase

Ngern Tid Lor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ngern Tid Lor delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the key drivers and challenges shaping Ngern Tid Lor's strategic landscape. This detailed report provides actionable insights for informed decision-making.

Sociological factors

Financial literacy in Thailand is on an upward trend, with 71.4% of adults deemed financially literate in 2022, an increase from 67.4% in 2020. This growing awareness is crucial, as a notable segment of the population still struggles with insufficient emergency funds and resorts to high-risk borrowing, often driven by social pressures and conspicuous consumption.

Ngern Tid Lor has a significant opportunity to leverage this evolving landscape by actively educating its customer base on sound borrowing practices and effective financial planning strategies. Such initiatives can foster deeper customer loyalty and, importantly, mitigate potential credit risks by promoting more responsible financial behavior.

Ngern Tid Lor’s strategic focus on underserved populations, including individuals and small businesses lacking traditional banking access, directly addresses a significant market gap. For instance, Thailand's significant rural population, estimated to be around 48% in 2024, presents a prime demographic for microfinance solutions. Their financial needs often revolve around working capital and asset financing, areas where Ngern Tid Lor excels.

Demographic shifts are actively shaping the demand for Ngern Tid Lor's services. Thailand's aging population, with a projected increase in those over 65 to over 20% by 2025, may require specialized financial products to supplement retirement income or manage healthcare costs. Conversely, ongoing rural-to-urban migration, with Bangkok and surrounding areas attracting a large proportion of internal migrants, creates new pockets of demand for accessible credit and financial management tools.

Deeply understanding the unique financial needs and preferences of these segments is paramount for Ngern Tid Lor's continued success and expansion. For example, data from 2024 indicated that many small Thai businesses in non-formal sectors prioritize flexible repayment schedules and quick loan processing. Tailoring product offerings to these specific requirements, such as offering smaller loan amounts with more frequent repayment options, can significantly enhance market penetration and customer loyalty.

Trust in non-bank financial institutions like Ngern Tid Lor is paramount, particularly for customers who may have had limited access to traditional banking services. In 2023, Thailand's financial inclusion rate stood at approximately 97%, but significant segments still rely on alternative lenders, underscoring the importance of trust. Ngern Tid Lor's commitment to transparent operations and fair lending practices directly fuels this trust, making it a preferred choice for microfinance solutions.

A strong brand reputation built on reliability and fairness is a key sociological factor for Ngern Tid Lor. By consistently delivering on its promises and engaging with communities, the company fosters a sense of security and dependability. This is crucial as many of its clients are small business owners and individuals seeking accessible financial support, making trust a cornerstone of customer loyalty and growth.

Ngern Tid Lor's positioning as a household name synonymous with financial inclusion further amplifies the impact of trust. This association encourages new customers to engage with the company, knowing they are dealing with a reputable entity. In 2024, continued community outreach programs and customer-centric service enhancements are expected to reinforce this positive perception, driving further adoption of their financial products.

Consumer Adoption of Digital Channels

Sociological factors significantly influence consumer adoption of digital channels, particularly in Thailand. The widespread availability of smartphones and advancements in internet infrastructure have fueled a surge in digital payments and mobile banking services. For instance, a 2024 report indicated that over 80% of the Thai population owns a smartphone, with mobile internet penetration exceeding 75%. This digital-first mindset among consumers directly impacts how they seek and interact with financial services.

Ngern Tid Lor's strategy acknowledges this by integrating its established branch network with robust digital offerings. This dual approach caters to diverse consumer preferences, ensuring accessibility for those who still value in-person interactions while also serving the growing segment comfortable with online platforms. This is crucial as consumer expectations rapidly shift towards convenience and immediate access to financial solutions.

The ongoing transition to digital interactions necessitates sustained investment in creating intuitive and secure online platforms. This commitment is vital for building trust and encouraging continued adoption. For example, to enhance user experience, Ngern Tid Lor has invested in upgrading its mobile application, aiming for seamless navigation and enhanced security features, a move that aligns with general consumer demands for reliable digital services.

Key sociological trends impacting digital channel adoption include:

- Increasing digital literacy: Younger generations and a growing portion of the older population are becoming more comfortable with technology.

- Demand for convenience: Consumers increasingly expect financial transactions to be quick, easy, and accessible anytime, anywhere.

- Trust in online security: While growing, consumer confidence in the security of digital financial platforms remains a critical factor for wider adoption.

- Influence of social media: Peer recommendations and digital marketing play a significant role in shaping consumer perceptions and choices regarding financial services.

Social Impact and Financial Inclusion

Ngern Tid Lor plays a significant role in social empowerment by extending financial services to individuals often overlooked by traditional banks. By offering vehicle title loans and personal loans, the company unlocks capital for everyday people and small enterprises, facilitating everything from essential purchases to business growth.

The company's dedication to sustainable ESG practices and active participation in social initiatives further solidifies its positive societal contribution. For example, in 2023, Ngern Tid Lor reported a loan portfolio of over 40 billion Thai Baht, directly impacting thousands of lives and businesses across Thailand.

- Financial Access: Providing loans to underserved segments, enabling economic participation.

- Small Business Support: Capitalizing entrepreneurs and micro-enterprises for growth.

- Social Initiatives: Engaging in community programs that foster financial literacy and well-being.

- ESG Commitment: Integrating environmental, social, and governance principles into operations.

Societal trust in financial institutions, especially non-banks like Ngern Tid Lor, is a critical driver of customer acquisition and loyalty. By demonstrating transparency and fair lending, Ngern Tid Lor builds this trust, crucial for its target demographic of individuals and small businesses. This trust is further enhanced by its reputation as a reliable provider of accessible financial solutions, fostering repeat business and positive word-of-mouth referrals.

Technological factors

Thailand's financial landscape is rapidly digitizing, with internet and mobile banking becoming the go-to methods for transactions. This shift is incredibly important for companies like Ngern Tid Lor as they aim to connect with more people.

Ngern Tid Lor's approach of blending its physical branches with digital offerings is key to serving its customer base effectively. By integrating online and mobile platforms, the company is making financial services more readily available.

The increasing adoption of digital channels directly supports Thailand's ambition to become a cashless society. For instance, the Bank of Thailand reported that the value of mobile transactions in 2023 reached trillions of Thai baht, highlighting the significant growth.

This digital push not only boosts efficiency for Ngern Tid Lor but also provides customers with enhanced convenience and accessibility. It's a strategic move that aligns perfectly with the nation's technological advancements and evolving consumer preferences.

The Thai financial sector is rapidly adopting AI and data analytics. This integration aims to boost data analysis, refine customer interactions, and bolster risk management. For instance, in June 2025, the Bank of Thailand issued draft regulations for managing AI risks within financial services, signaling a significant regulatory focus.

Ngern Tid Lor can capitalize on these technological advancements. AI can enhance credit scoring accuracy, enabling more tailored loan products and improving fraud detection. This aligns perfectly with Ngern Tid Lor's strategic emphasis on technology-driven risk assessment, potentially leading to greater operational efficiency and better customer segmentation.

Thailand's fintech sector is booming, experiencing an impressive 82.47% growth in active companies over the last five years, making it a leader in ASEAN. This dynamic environment, while offering avenues for expansion, also intensifies competition for established players like Ngern Tid Lor.

To stay ahead, Ngern Tid Lor must prioritize ongoing innovation in its digital lending and insurance brokerage offerings. This is crucial to effectively compete against nimble fintech startups and other digital financial service providers that are rapidly entering the market.

Cybersecurity and Data Protection

As Ngern Tid Lor increasingly utilizes digital channels and handles vast amounts of customer data, robust cybersecurity measures are no longer optional but a fundamental necessity. The growing sophistication of cyber threats demands constant vigilance and investment in advanced protection systems to safeguard sensitive information.

The Thai government is reinforcing its commitment to digital security with plans to introduce an Amended 2023 Emergency Decree on cybersecurity. This critical legislation is slated to become effective in early 2025, signaling a stricter regulatory environment for data protection and cybersecurity practices across all industries, including financial services.

To navigate this evolving landscape, Ngern Tid Lor must prioritize significant investments in building and maintaining comprehensive cybersecurity frameworks. This proactive approach is crucial not only for protecting customer data from breaches but also for fostering and preserving public trust in its digital platforms.

Compliance with these new and upcoming data privacy regulations is paramount. Failure to adhere to these standards could result in substantial penalties and reputational damage, underscoring the importance of integrating cybersecurity into the core of Ngern Tid Lor's operations.

- Increased Digital Reliance: Ngern Tid Lor's expansion into digital lending and insurance services in 2024-2025 amplifies its exposure to cyber risks.

- Regulatory Shifts: The Amended 2023 Emergency Decree on cybersecurity, effective early 2025, will mandate higher standards for data protection.

- Customer Trust: A strong cybersecurity posture is vital for maintaining customer confidence, especially as digital transactions grow.

- Investment Imperative: Allocating resources to advanced security technologies and expert personnel is essential for compliance and risk mitigation.

Blockchain and Digital Payment Infrastructure

The Bank of Thailand's continued exploration of a digital Thai Baht, with pilot programs in 2024, alongside the widespread adoption of PromptPay, has fundamentally reshaped Thailand's payment landscape. This evolution towards digital infrastructure presents significant opportunities for companies like Ngern Tid Lor. By leveraging blockchain technology, Ngern Tid Lor could streamline its transaction processes, potentially leading to reduced operational costs and enhanced transparency. This aligns with broader trends observed in the Bank of Thailand's regulatory sandbox, which actively encourages innovative financial solutions.

Blockchain's inherent security and immutability make it a compelling option for managing financial flows and customer data more efficiently. For Ngern Tid Lor, this could translate into faster settlement times, improved record-keeping, and a more robust fraud prevention system. The ongoing development of Thailand's digital payment infrastructure, supported by government initiatives, indicates a favorable environment for adopting such advanced technologies.

- Digital Thai Baht Pilots: The Bank of Thailand's ongoing exploration of a central bank digital currency (CBDC) in 2024 aims to modernize payment systems.

- PromptPay Adoption: As of early 2024, PromptPay has facilitated billions of transactions, demonstrating high consumer and business acceptance of digital payments in Thailand.

- Blockchain in Sandbox: Initiatives within the Bank of Thailand's regulatory sandbox have showcased the potential of blockchain for reducing transaction fees and improving speed.

- Cost Reduction Potential: Implementing blockchain for inter-company settlements could lead to an estimated 10-15% reduction in transaction processing costs, based on industry benchmarks.

Thailand's financial sector is rapidly digitizing, with internet and mobile banking becoming the primary transaction methods, a trend Ngern Tid Lor is actively leveraging. The company's strategy of integrating physical branches with digital platforms enhances accessibility and customer reach, aligning with Thailand's push towards a cashless society, evidenced by trillions of baht in mobile transactions in 2023.

AI and data analytics are increasingly adopted, improving data analysis, customer engagement, and risk management, with the Bank of Thailand issuing draft AI risk management regulations in June 2025. Ngern Tid Lor can harness AI for more accurate credit scoring and fraud detection, boosting efficiency and customer segmentation.

The booming fintech sector, with an 82.47% growth in active companies over five years, presents both opportunities and intensified competition, requiring Ngern Tid Lor to continuously innovate its digital lending and insurance offerings.

Robust cybersecurity is paramount due to increasing digital reliance and sophisticated cyber threats, with Thailand's Amended 2023 Emergency Decree on cybersecurity, effective early 2025, mandating higher data protection standards. Ngern Tid Lor must invest in advanced security to maintain customer trust and ensure regulatory compliance.

The Bank of Thailand's exploration of a digital Thai Baht and PromptPay's widespread adoption are reshaping payments, offering Ngern Tid Lor opportunities to streamline transactions and reduce costs through blockchain technology, as showcased in the Bank of Thailand's regulatory sandbox.

Legal factors

The Bank of Thailand (BOT) acts as the main governing body for financial companies, including personal loan providers like Ngern Tid Lor. Recent BOT directives, such as the Responsible Lending regulations which saw key updates in January 2025, are significantly tightening lending operations. These rules mandate more rigorous standards for loan origination, debt management, and how financial products are advertised.

Ngern Tid Lor is therefore obligated to meticulously adhere to these updated BOT guidelines across all stages of their lending processes. For instance, the January 2025 updates to responsible lending rules may introduce stricter debt-to-income ratio requirements or enhanced disclosure obligations for borrowers. Failure to comply could result in penalties or reputational damage, impacting the company's operational license and market standing.

Consumer protection laws are a significant consideration for Ngern Tid Lor in Thailand. The Bank of Thailand (BOT) has established guidelines that prioritize fair treatment and clear communication for borrowers. For instance, the BOT's Consumer Protection Policy, updated in 2023, mandates that financial institutions must provide loan agreements with easily understandable terms and conditions, preventing predatory practices.

Ngern Tid Lor's business model, which involves providing loans, is directly impacted by these regulations. The company must ensure its marketing is responsible, its terms and conditions are transparent, and that it has effective processes for resolving customer complaints. This adherence not only builds customer trust but also helps the company avoid potential legal penalties and reputational damage.

In 2024, financial institutions in Thailand are facing increased scrutiny regarding data privacy and fair lending practices. Ngern Tid Lor, like its peers, must invest in robust compliance frameworks to meet these evolving consumer protection standards, ensuring customer data is handled securely and loan offers are equitable.

The Thai government is actively enhancing its cybersecurity posture, with updated legislation anticipated to take effect in early 2025. This evolving legal landscape directly impacts companies like Ngern Tid Lor, which manage substantial volumes of sensitive customer information.

Ngern Tid Lor's operations necessitate strict adherence to data privacy regulations and the implementation of strong cybersecurity protocols. Failure to comply could expose the company to significant risks, including substantial financial penalties and reputational damage.

In 2023, Thailand saw a notable increase in reported cybercrimes, highlighting the urgency for businesses to bolster their digital defenses. The new legal framework is expected to mandate more rigorous data protection standards, potentially increasing compliance costs but also fostering greater customer trust.

Lending and Interest Rate Ceilings

Regulations on interest rate caps significantly influence Ngern Tid Lor's financial performance by directly affecting how much they can charge for various loan products. These caps, which vary by loan type such as personal loans and vehicle title loans, are a fundamental legal consideration for any microfinance institution operating in Thailand. While specific updated figures for 2024-2025 regarding these caps aren't readily available in the general discussion, the principle remains that these legal limitations shape pricing strategies and the overall viability of their lending models.

These interest rate ceilings are a constant legal factor that Ngern Tid Lor must navigate. They directly impact the company's revenue streams and overall profitability, requiring careful management of loan portfolios and operational costs to remain competitive and compliant. The microfinance sector, by its nature, operates within these established legal frameworks, which dictate the maximum allowable interest rates on consumer credit.

- Impact on Revenue: Interest rate caps directly limit the potential earnings Ngern Tid Lor can generate from its loan products, influencing its pricing strategies.

- Constant Legal Consideration: These regulations are an ongoing legal challenge that requires continuous monitoring and adaptation in business operations.

- Pricing Strategy Influence: The legal limits on interest rates necessitate careful consideration when setting prices for various loan types to ensure profitability.

- Product Development: Regulations can also steer the development of new financial products that align with legal requirements and market demand.

Licensing and Operational Requirements

Ngern Tid Lor's operation as a microfinance and insurance provider is heavily regulated, requiring specific licenses from bodies like the Ministry of Finance and the Office of Insurance Commission. In 2024, Thailand’s regulatory landscape continued to emphasize consumer protection and financial stability, meaning compliance with evolving operational standards is non-negotiable for continued business. Failure to maintain these licenses or adhere to stipulated operational requirements can directly impact Ngern Tid Lor's ability to conduct business and pursue growth opportunities.

Key licensing and operational considerations for Ngern Tid Lor include:

- Microfinance License: Ensuring the company meets capital adequacy ratios and lending practices mandated by the Ministry of Finance.

- Insurance Broker License: Adherence to the Office of Insurance Commission's regulations regarding product disclosure, customer suitability, and solvency.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Continuous compliance with stringent AML/KYC protocols to prevent financial crime.

- Data Privacy Regulations: Meeting the requirements of Thailand's Personal Data Protection Act (PDPA) to safeguard customer information.

Ngern Tid Lor operates under a strict legal framework, with the Bank of Thailand (BOT) setting key directives. For instance, the Responsible Lending regulations, updated in January 2025, impose more rigorous standards for loan origination and borrower disclosures, directly affecting Ngern Tid Lor's operational procedures and potentially impacting its loan approval rates and customer acquisition strategies.

Environmental factors

Thailand is actively pushing for ESG integration within its financial services industry. The introduction of Thailand ESG Extra Funds (Thai ESGX) in May 2025, complete with tax incentives, is a significant step to encourage sustainable investment practices across the nation.

Ngern Tid Lor's stated dedication to sustainable ESG business practices provides a strong foundation for aligning with these national objectives. This alignment can attract investors who prioritize sustainability and bolster the company's overall corporate reputation in the market.

By embracing these ESG principles, Ngern Tid Lor can tap into a growing pool of capital directed towards environmentally and socially responsible investments. This strategic move can also lead to improved operational efficiencies and better risk management, further solidifying its market position.

Ngern Tid Lor, as a financial services provider, must consider how climate change impacts its borrowers, many of whom are small business owners and individuals. For instance, extreme weather events, which are becoming more frequent due to climate change, can directly affect agricultural borrowers' income or damage property used as collateral, thereby impacting their ability to repay loans. In 2024, Thailand experienced a notably hot and dry season, which impacted agricultural output in several regions, a trend projected to continue.

These environmental shifts can indirectly influence Ngern Tid Lor's loan portfolio. A decline in agricultural productivity or damage to assets can reduce borrowers' cash flow and increase their default risk. For example, a severe flood in the central plains, a region vital for rice production, could disproportionately affect borrowers in that area. The World Bank estimated in 2025 that Thailand's economy faces significant risks from climate-related disasters, potentially leading to substantial economic losses.

Therefore, assessing and mitigating these indirect environmental risks is crucial for Ngern Tid Lor's lending practices. This could involve developing more robust credit scoring models that account for climate vulnerability or offering flexible loan products for borrowers in high-risk areas. Understanding the localized impact of climate change on borrower resilience allows for more prudent risk management and sustainable financial operations.

Thailand is actively shaping its financial landscape with the ongoing development of a Sustainable Finance Taxonomy, a crucial initiative expected to finalize its second phase in 2025. This taxonomy will serve as a compass, directing investments towards economic activities deemed environmentally sound.

This framework is designed to foster the creation and growth of sustainable financial products, such as green bonds and green loans, which are becoming increasingly important in the global financial market. For instance, the Thai green bond market saw significant growth, with issuance reaching approximately THB 40 billion in 2023, a clear indicator of increasing investor appetite.

For Ngern Tid Lor, this presents a strategic opportunity. The company could proactively explore the introduction of its own green financial products, tapping into this growing market segment. Alternatively, aligning its existing or future funding strategies with the principles of this taxonomy would demonstrate a commitment to sustainability and potentially attract a wider investor base.

Regulatory Reporting on Environmental Impact

As environmental, social, and governance (ESG) factors gain traction, financial institutions like Ngern Tid Lor are encountering heightened demands for transparent reporting on their environmental impact. This includes detailing the environmental consequences of their lending and investment activities.

Ngern Tid Lor, being a publicly traded entity in Thailand, must diligently track and adhere to evolving environmental reporting standards. The company is expected to disclose information concerning its greenhouse gas emissions and overall governance practices, aligning with the requirements for Thai ESG funds. For instance, the Stock Exchange of Thailand (SET) has been actively promoting ESG disclosure, with a growing number of listed companies reporting on their sustainability performance. In 2023, over 60% of SET-listed companies published sustainability reports, a figure expected to rise in 2024 and 2025 as regulatory expectations solidify.

These evolving requirements necessitate robust data collection and management systems to accurately measure and report on key environmental metrics. Staying ahead of these regulatory shifts will be crucial for maintaining investor confidence and ensuring compliance.

- Increased Scrutiny on Environmental Footprint: Financial institutions face growing pressure to quantify and report on direct and indirect environmental impacts.

- Thai ESG Fund Mandates: Compliance with reporting standards for Thai ESG funds, including greenhouse gas emissions and governance, is becoming a key consideration.

- Evolving Disclosure Standards: Ngern Tid Lor must adapt to evolving global and local reporting frameworks, such as those influenced by the Task Force on Climate-related Financial Disclosures (TCFD).

- Investor Demand for Transparency: Investors are increasingly demanding clear and verifiable data on a company's environmental performance, impacting capital allocation decisions.

Resource Efficiency in Operations

Ngern Tid Lor, while not a manufacturing firm, manages a wide network of branches, making operational resource efficiency a key environmental consideration. The company actively pursues initiatives like reducing energy consumption across its locations and optimizing paper usage to lessen its environmental footprint. These efforts are in line with growing corporate sustainability expectations and can directly translate into reduced operating expenses.

Specific examples of their commitment include:

- Implementing energy-saving measures in over 500 branches nationwide.

- Digitizing more customer interactions to significantly cut down on paper waste.

- Exploring partnerships for eco-friendly office supplies and waste management solutions.

- Targeting a 10% reduction in utility costs per branch by the end of 2025 through efficiency programs.

Environmental factors significantly influence Ngern Tid Lor's operations and strategic planning, particularly concerning climate change impacts on its borrower base, which includes many individuals and small business owners. The increasing frequency of extreme weather events in Thailand, such as the prolonged dry season in 2024 impacting agriculture, directly affects borrowers' repayment capacities and the value of collateral.

Thailand's push for sustainable finance, evidenced by the upcoming Sustainable Finance Taxonomy (finalizing phase two in 2025) and the introduction of Thai ESG Extra Funds in May 2025, creates both challenges and opportunities. Ngern Tid Lor must align its practices with these evolving regulatory landscapes and investor expectations for ESG transparency.

The company's own operational efficiency, such as energy reduction across its 500+ branches and digitization to minimize paper waste, is a direct response to environmental considerations and contributes to cost savings. These efforts are crucial for maintaining investor confidence and ensuring long-term compliance with growing sustainability demands.

Ngern Tid Lor's environmental performance is increasingly under scrutiny, requiring diligent tracking and adherence to evolving disclosure standards, including greenhouse gas emissions. The Stock Exchange of Thailand's promotion of ESG disclosure, with over 60% of listed companies reporting in 2023, highlights the growing importance of transparent environmental reporting for maintaining investor trust and access to capital.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ngern Tid Lor is built on a robust foundation of data from official Thai government agencies, reputable financial institutions, and leading market research firms. We incorporate economic indicators, regulatory updates, and socio-cultural trends to ensure comprehensive insights.