The Trade Desk PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Trade Desk Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping The Trade Desk's trajectory. From evolving data privacy regulations to the rapid advancements in AI, understanding these external forces is paramount for strategic decision-making. Our comprehensive PESTLE analysis provides you with the deep-dive insights needed to anticipate market shifts and identify opportunities. Gain a competitive edge by leveraging this expertly crafted intelligence. Download the full version now to fortify your strategy and navigate the complex landscape of the ad-tech industry.

Political factors

The Trade Desk navigates a global patchwork of data privacy rules, including Europe's GDPR and California's CCPA. These regulations govern how personal data is handled for advertising purposes, directly impacting The Trade Desk's ability to target audiences.

The evolving US state-level privacy landscape, with new laws emerging frequently, presents ongoing challenges. Requirements for universal opt-out mechanisms and enhanced protections for children's data necessitate continuous adaptation of The Trade Desk's operational frameworks.

Failure to comply with these diverse and dynamic privacy laws can result in substantial legal penalties and operational disruptions for The Trade Desk. For instance, significant fines can be levied under GDPR for data breaches or improper consent management.

The digital advertising sector, especially ad tech, is under a microscope for antitrust issues, with major players like Google facing intense scrutiny. Recent legal actions, such as the US Department of Justice's lawsuit against Google alleging monopolistic control over digital ad markets, highlight these concerns. These investigations, which continued into 2024, aim to foster a more open and competitive ad landscape.

These antitrust actions, particularly those focusing on Google's alleged dominance in ad exchange and publisher ad server markets, could level the playing field. For independent ad tech companies like The Trade Desk, a more competitive environment could lead to increased opportunities and fairer access to advertising inventory, potentially boosting their market share.

The Trade Desk maintains stringent policies regarding political advertising, emphasizing transparency and prohibiting microtargeting. Advertisers must disclose comprehensive details, such as Federal Election Commission (FEC) identification numbers or Employer Identification Numbers (EINs), to ensure accountability. These rules also enforce audience size limitations, preventing campaigns from engaging in overly narrow targeting practices, a crucial element for fair electoral processes.

International Trade Policies and Digital Taxes

Changes in international trade policies significantly influence The Trade Desk's global reach and revenue streams. For instance, shifts in trade agreements or the imposition of new tariffs can alter the cost of doing business in key markets. The company's ability to operate and monetize across borders is directly affected by these governmental decisions.

Digital services taxes (DSTs) are a growing concern for global advertising technology firms like The Trade Desk. Several countries, including those in the European Union and others, have introduced or are considering DSTs, which could directly impact The Trade Desk's net revenue. For example, France's DST, implemented in 2020, has been a point of contention, with its scope and application evolving. As of early 2025, discussions around a potential global minimum tax agreement, as proposed by the OECD, continue to shape the landscape for digital taxation, potentially affecting The Trade Desk's tax liabilities across various jurisdictions.

Cross-border data flow regulations are increasingly complex and can directly impact The Trade Desk's core business model, which relies on the movement and analysis of data. Stricter data localization rules, requiring data to be stored within specific national borders, can fragment operations and increase compliance costs. The ongoing evolution of these regulations, such as those related to privacy frameworks like GDPR in Europe or similar initiatives emerging globally, necessitates continuous adaptation of The Trade Desk's data handling and processing strategies to ensure compliance and maintain operational efficiency.

- Digital Tax Landscape: As of early 2025, over 40 countries have either implemented or are actively considering digital services taxes, creating a complex and fragmented global tax environment for companies like The Trade Desk.

- Data Flow Restrictions: The European Union's General Data Protection Regulation (GDPR) and similar privacy laws enacted in 2024 in countries like Brazil and India have led to increased scrutiny and potential limitations on cross-border data transfers, impacting programmatic advertising.

- Trade Policy Volatility: The potential for new trade disputes or changes in existing trade agreements could introduce tariffs or other barriers that affect The Trade Desk's ability to serve advertisers in specific international markets.

Government Spending on Advertising

Government spending on advertising, particularly for public service announcements or during significant national events, can significantly impact the overall advertising market. For programmatic platforms like The Trade Desk, increased government ad spend can translate into higher demand for their services, especially when these campaigns utilize digital channels. For instance, in 2024, governments globally are expected to allocate substantial budgets towards public health initiatives and infrastructure promotion, much of which will likely be channeled through digital advertising.

The presence or absence of substantial political advertising spend, especially in election years, can create notable fluctuations in quarterly revenue for ad tech companies. Many governments use advertising to inform citizens about policies, services, or public health campaigns, and the scale of this spending can be considerable. For example, in the lead-up to the 2024 US elections, political ad spending was projected to reach record highs, with a significant portion expected to be digitally placed and targeted, benefiting platforms like The Trade Desk.

Here's how government spending on advertising can influence the ad tech landscape:

- Increased Demand: Government campaigns for public health, national security, or civic engagement often leverage digital advertising, boosting demand for programmatic solutions.

- Revenue Impact: Significant government ad budgets, especially during election cycles or major public initiatives, can directly contribute to the quarterly revenue forecasts of ad tech companies.

- Shifts in Ad Spend: Government focus on specific initiatives can cause temporary but substantial shifts in overall ad spend, creating opportunities for platforms adept at capturing these budgets.

- Data Utilization: Governments increasingly seek data-driven approaches to reach specific demographics, aligning with the capabilities of programmatic advertising platforms.

The ongoing evolution of data privacy regulations globally, such as the GDPR and emerging state-level laws in the US, directly impacts how The Trade Desk can collect and utilize data for targeted advertising, necessitating continuous compliance adjustments. Antitrust scrutiny on major players like Google could create a more competitive environment, potentially benefiting independent ad tech firms. Furthermore, digital services taxes being implemented or considered by various countries could affect The Trade Desk's net revenue, while cross-border data flow restrictions add complexity to its operational model.

What is included in the product

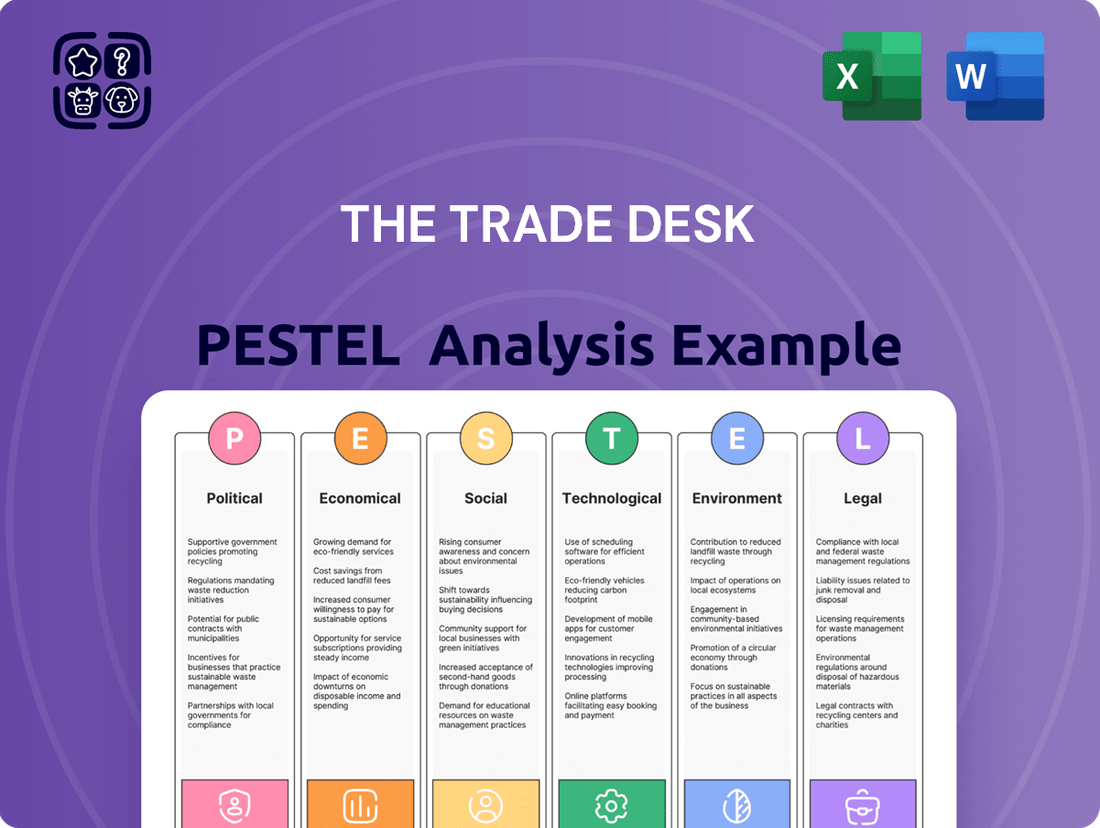

The Trade Desk PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic positioning within the digital advertising landscape.

This comprehensive evaluation identifies key external drivers that present both challenges and opportunities for The Trade Desk's continued growth and innovation.

The Trade Desk PESTLE analysis provides a structured framework to proactively identify and mitigate external risks, acting as a crucial pain point reliever by empowering informed strategic decisions and market positioning.

Economic factors

The global advertising market is experiencing robust growth, with digital channels driving this expansion. Projections show global ad spend is set to surpass $1 trillion for the first time in 2024, with further increases anticipated through 2025.

This positive market trajectory, fueled by increasing digital adoption, creates a fertile ground for The Trade Desk's programmatic advertising solutions. The company benefits directly from this overall market expansion.

Economic volatility often prompts businesses to tighten their belts, particularly regarding advertising budgets. This necessitates a more nimble and results-driven approach from marketers, pushing them to demonstrate clear ROI on every dollar spent. The Trade Desk, a major player in programmatic advertising, must navigate this environment by proving its platform's efficiency in reaching target audiences effectively, even during economic downturns.

While The Trade Desk has historically demonstrated robust performance, a broad economic slowdown could temper the expected growth in overall ad spending. For instance, if global GDP growth, which was projected to be around 2.7% in 2024 by the IMF, falters, companies might scale back their marketing investments. This moderation in ad spend could directly influence The Trade Desk's revenue trajectory, emphasizing the need for continuous innovation and value proposition refinement.

The ad tech landscape is intensely competitive, featuring dominant incumbents and agile newcomers. The Trade Desk's success hinges on its capacity to offer a superior self-service platform and strategically expand into high-growth sectors such as Connected TV (CTV) and retail media networks.

Navigating the dominance of 'walled gardens' like Google and Meta remains a significant challenge. These platforms control vast user data and ad inventory, creating barriers to entry and requiring significant innovation for independent players like The Trade Desk to thrive.

The market saw significant shifts in 2024, with CTV advertising spend projected to reach over $30 billion in the US alone, according to eMarketer. This growth presents a prime opportunity for The Trade Desk, provided it can effectively differentiate its offerings and capture a larger share of this expanding market.

Inflation and Interest Rates

High inflation and elevated interest rates, like those seen through 2024 and into early 2025, can significantly squeeze advertiser budgets. As the cost of goods and services rises, companies often look to cut expenses, and marketing is frequently among the first areas impacted. This can lead to a reduction in discretionary ad spend, directly affecting platforms like The Trade Desk.

These macroeconomic conditions also ripple through to consumer spending. When interest rates are high, borrowing becomes more expensive, and consumers may curb spending on non-essential items. This decreased consumer demand can further incentivize businesses to pare back their advertising efforts.

For investors, persistent inflation and rising interest rates can make growth stocks, such as The Trade Desk, appear less attractive. Higher discount rates used in valuation models reduce the present value of future earnings, potentially leading to stock price pullbacks. For instance, the Federal Reserve maintained its benchmark interest rate above 5% through much of 2024, a significant shift from previous years, impacting valuations across the tech sector.

- Inflationary Pressures: U.S. CPI remained elevated in 2024, though showing signs of moderation, impacting media buying costs.

- Interest Rate Hikes: The Federal Reserve's policy rate staying above 5% in 2024 increased the cost of capital for businesses and reduced the present value of future cash flows for growth companies.

- Advertiser Budget Sensitivity: Companies facing higher input costs and uncertain consumer demand are likely to reduce their marketing expenditures, impacting revenue for ad-tech companies.

- Investor Sentiment Shift: Higher interest rates typically lead to a reallocation of capital away from growth stocks towards more value-oriented or fixed-income investments.

Growth of Programmatic and CTV Advertising

Programmatic advertising is solidifying its role as the dominant method for media buying, with substantial growth anticipated. This trend means more advertising dollars are flowing through automated platforms, increasing efficiency and targeting capabilities for advertisers.

Connected TV (CTV) stands out as the most significant and rapidly expanding sector for The Trade Desk. This growth is fueled by two major forces: the proliferation of streaming services offering ad-supported tiers and a consistent increase in households adopting smart TVs and streaming devices.

The CTV market is experiencing explosive growth. For instance, in 2024, global CTV advertising spend was projected to reach over $30 billion, with continued double-digit growth expected through 2025. This surge indicates a fundamental shift in how consumers watch content and how advertisers reach them.

- Programmatic Dominance: Programmatic buying is increasingly the standard for digital ad transactions, offering data-driven efficiency.

- CTV as a Growth Engine: Connected TV represents The Trade Desk's largest and fastest-expanding market segment.

- Drivers of CTV Growth: The rise of ad-supported streaming services and broader consumer adoption of smart TVs are key catalysts.

- Market Size and Trajectory: Global CTV ad spend is a multi-billion dollar market, showing robust year-over-year increases.

The global advertising market's continued expansion, projected to exceed $1 trillion in 2024, provides a strong tailwind for The Trade Desk. This growth is largely driven by digital channels, with Connected TV (CTV) emerging as a particularly lucrative segment, expected to surpass $30 billion in US ad spend in 2024.

However, economic headwinds like persistent inflation and elevated interest rates, with the Federal Reserve maintaining rates above 5% through 2024, present challenges. These conditions can shrink advertiser budgets and dampen investor enthusiasm for growth stocks, potentially impacting The Trade Desk's revenue and valuation.

The company's success is therefore intrinsically linked to its ability to demonstrate clear ROI and navigate the dominance of major tech platforms, while capitalizing on the shift towards programmatic buying and the burgeoning CTV market.

| Economic Factor | 2024/2025 Trend | Impact on The Trade Desk |

| Global Ad Spend Growth | Projected to exceed $1 trillion in 2024; continued growth expected. | Positive revenue potential due to increased overall market activity. |

| Inflation & Interest Rates | Rates above 5% in 2024; inflation showing moderation but remains a factor. | Can reduce advertiser budgets; higher discount rates can impact stock valuation. |

| CTV Market Expansion | US CTV ad spend over $30 billion in 2024; strong double-digit growth anticipated. | Significant growth opportunity for The Trade Desk's platform. |

Same Document Delivered

The Trade Desk PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of The Trade Desk delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping its strategic landscape.

Sociological factors

Consumer behavior is increasingly migrating towards digital platforms, with a significant surge in video content and streaming service consumption. This fundamental shift directly influences advertising budget allocations, steering them away from traditional media and towards digital channels. For instance, by 2024, digital ad spending was projected to reach over $375 billion in the US alone, with video advertising a substantial portion of that growth.

The Trade Desk is strategically positioned to capitalize on this evolution through its strong emphasis on Connected TV (CTV). As more consumers adopt ad-supported streaming models, the demand for programmatic advertising on these platforms rises. Reports indicated that CTV ad spending was expected to surpass $30 billion globally in 2024, highlighting the immense opportunity.

Consumers are increasingly seeking tailored advertising that speaks directly to their interests, a trend amplified by growing digital engagement. This rising demand for personalization means brands must deliver relevant messages, driving the need for sophisticated targeting tools. The Trade Desk's platform is well-positioned to meet this, leveraging AI and first-party data to create these individualized experiences.

Societal concerns about data privacy are increasingly influencing the advertising landscape. This trend is directly linked to the growing adoption of ad-blockers, with global estimates suggesting that over 800 million devices use ad-blocking software, impacting billions in ad revenue.

The Trade Desk is proactively addressing these shifts by championing privacy-centric advertising solutions. A prime example is Unified ID 2.0 (UID2), an open-source framework designed to provide a more transparent and privacy-preserving alternative for audience targeting.

UID2 aims to give consumers greater control over their data, allowing them to opt-in and manage their digital identity. This approach is crucial for maintaining effective advertising capabilities while respecting user privacy, a balance that is becoming paramount for industry sustainability.

Shift Towards Non-Disruptive Advertising

Societal shifts are increasingly steering consumers away from intrusive advertising. They now actively seek out advertisements that feel natural and integrated within the content they consume, rather than those that interrupt their experience. This growing preference for less disruptive ad formats is a significant trend influencing the digital advertising landscape.

This evolving consumer sentiment directly benefits platforms like The Trade Desk, which specialize in enabling advertisers to reach audiences through more sophisticated and user-friendly methods. The demand for native advertising and other seamlessly integrated ad formats means that The Trade Desk's ability to support a wide array of diverse ad placements is a key competitive advantage. For instance, by mid-2024, native advertising was projected to account for a substantial portion of digital ad spending, with estimates suggesting it would surpass traditional display advertising in many key markets.

- Consumer Preference for Seamless Integration: A 2024 survey indicated that over 60% of consumers find non-disruptive or native ads more engaging than pop-ups or pre-roll video ads.

- Growth in Native Advertising Spend: Projections for 2025 indicate global spending on native advertising will reach over $100 billion, highlighting its increasing importance.

- Platform Adaptability: The Trade Desk's investment in advanced AI and data management allows for the creation and delivery of personalized native ad experiences across various digital channels.

- Enhanced User Experience Focus: This trend encourages ad tech companies to prioritize user experience, moving away from intrusive formats that can lead to ad fatigue and brand damage.

Influence of Authenticity and Social Commerce

Authenticity has become a critical factor for consumers, particularly on social media, directly shaping how they perceive and interact with brands. This trend significantly influences advertising strategies for platforms like The Trade Desk, as genuine content drives higher engagement.

The burgeoning growth of social commerce and shoppable content presents a new avenue for advertisers. To capitalize on this, campaigns must be relatable and authentic, often incorporating influencer partnerships and seamless in-app purchasing options. For instance, by mid-2024, social commerce sales were projected to reach over $1.2 trillion globally, highlighting the immense opportunity for brands that master authentic engagement within these environments.

- Consumer demand for authenticity: Studies in 2024 indicated that over 80% of Gen Z consumers prioritize brands that demonstrate authenticity and transparency.

- Social commerce growth: Projections suggest social commerce will constitute a significant portion of total e-commerce sales, with platforms actively integrating shopping features.

- Influencer marketing ROI: Authentic collaborations with influencers continue to show strong returns, with brands investing heavily in micro and nano-influencers for more genuine audience connections.

- Impact on ad spend: Advertisers are shifting budgets towards content that feels less like a traditional advertisement and more like a genuine recommendation or experience.

Societal shifts are increasingly steering consumers away from intrusive advertising, favoring integrated and less disruptive formats. By mid-2024, native advertising was projected to account for a substantial portion of digital ad spending, surpassing traditional display advertising in many key markets.

Authenticity is paramount, especially on social media, influencing brand perception and interaction. By mid-2024, social commerce sales were projected to exceed $1.2 trillion globally, underscoring the value of relatable and authentic campaigns.

Growing concerns about data privacy are impacting the advertising landscape, leading to increased ad-blocker usage. Global estimates suggest over 800 million devices employ ad-blocking software, affecting billions in ad revenue.

| Societal Factor | Trend | Impact on Trade Desk | Relevant Data Point (2024/2025) |

| Ad Format Preference | Shift towards integrated/native ads | Leverages The Trade Desk's platform for diverse placements | Native ad spending projected to exceed $100 billion globally by 2025. |

| Authenticity Demand | Prioritization of genuine brand content | Benefits from social commerce and influencer marketing focus | 80% of Gen Z consumers prioritize authentic brands. |

| Data Privacy Concerns | Increased ad-blocker usage | Drives adoption of privacy-centric solutions like UID2.0 | Over 800 million devices use ad-blocking software globally. |

Technological factors

AI and machine learning are fundamentally reshaping the advertising technology landscape. These advancements are streamlining creative development, making media buying more efficient, and crucially, bolstering defenses against ad fraud. The Trade Desk is leveraging these technologies to gain a competitive edge.

The Trade Desk's Kokai platform embodies this AI-driven approach. It functions as a sophisticated forecasting tool designed to unlock substantial cost savings and elevate the effectiveness of advertising campaigns. This focus on intelligent optimization is a cornerstone of their operational strategy.

For instance, in 2024, the global ad spend on AI-powered advertising solutions was projected to reach tens of billions of dollars, highlighting the industry's rapid adoption. The Trade Desk's investments in Kokai position them to capitalize on this growth by offering demonstrably superior campaign outcomes and operational efficiencies.

The digital advertising landscape is undergoing a significant transformation with the planned deprecation of third-party cookies, a move that directly impacts how companies like The Trade Desk operate and innovate. This necessitates a pivot towards privacy-centric advertising approaches and the development of robust alternative identity solutions.

The Trade Desk is actively addressing this challenge with its Unified ID 2.0 (UID2) initiative. UID2 is designed to function as a privacy-conscious identifier, aiming to step in as a replacement for traditional cookies and facilitate reliable cross-device tracking, a crucial element for effective audience targeting in the evolving digital ecosystem.

As of early 2024, UID2 has gained substantial industry traction. Over 100 major publishers and data providers have integrated UID2, with early adoption indicating strong potential for its widespread use as a privacy-safe alternative to third-party cookies, supporting continued ad personalization and measurement capabilities.

Connected TV (CTV) is experiencing a significant boom, becoming a vital engine for programmatic advertising growth. The Trade Desk is actively capitalizing on this trend, strategically expanding its CTV operations by partnering with ad-supported streaming services. This focus allows them to leverage CTV's inherent precision to redefine brand-audience engagement.

By 2024, the CTV advertising market was projected to reach $32.7 billion in the U.S., underscoring its massive potential. The Trade Desk's platform, for instance, enables advertisers to reach specific demographics on streaming platforms, moving beyond broad traditional TV buys and offering a more targeted approach that resonates with consumers.

Platform Integration and Interoperability

Platform integration and interoperability are paramount in today's fragmented digital advertising landscape. The Trade Desk's strength lies in its ability to connect disparate ad formats, devices, and channels, allowing for more unified and efficient campaign management. For instance, its self-service platform provides clients with a single interface to orchestrate campaigns across display, video, audio, and native advertising, a significant advantage for maximizing ad spend effectiveness. This seamless integration is a key technological driver for The Trade Desk.

The Trade Desk's commitment to interoperability is further exemplified by its OpenPath initiative. This program is designed to create more direct connections between publishers and advertisers, aiming to streamline the programmatic supply chain and potentially reduce costs by bypassing certain intermediaries. This focus on direct integration is a strategic technological move that enhances efficiency and transparency within the ad tech ecosystem. By mid-2024, the demand for interoperable solutions continues to grow as advertisers seek greater control and visibility over their ad investments.

- Unified Campaign Management: The Trade Desk's platform allows clients to manage campaigns across display, video, audio, and native formats from a single interface.

- OpenPath Initiative: This aims to foster direct relationships between publishers and advertisers, bypassing some traditional supply-side platforms (SSPs).

- Efficiency Gains: Seamless integration across channels and formats leads to more efficient ad spend by reducing fragmentation and improving targeting capabilities.

- Market Demand: The ongoing trend in the ad tech industry favors platforms that can demonstrate strong interoperability and integration capabilities.

Data Analytics and Measurement Capabilities

The Trade Desk heavily leverages advanced data analytics to refine advertising campaigns and deeply understand consumer trends, which is critical in the digital advertising landscape. Its platform empowers advertisers with sophisticated tools to pinpoint specific audiences, thereby making ad spend more effective. This focus on measurement is further amplified by continuous AI integration, ensuring that campaign performance can be precisely tracked and optimized. For instance, The Trade Desk reported a 20% increase in programmatic advertising spend in 2024, a growth directly linked to enhanced data analytics and measurement capabilities that demonstrate clear return on investment for clients.

These technological factors translate into tangible benefits for The Trade Desk's clients through:

- Enhanced Audience Targeting: Precision in reaching desired demographic and psychographic segments.

- Campaign Optimization: Real-time adjustments based on performance data to maximize efficiency.

- Demonstrable ROI: Clear metrics to prove the effectiveness of advertising investments.

- AI-Driven Insights: Predictive analytics and automated optimization powered by artificial intelligence.

The Trade Desk is at the forefront of technological advancements in advertising, particularly with its AI-powered Kokai platform, designed for campaign optimization and cost savings. This is crucial as global ad spend on AI solutions was projected to reach tens of billions in 2024, a market The Trade Desk is poised to capture.

The deprecation of third-party cookies is a significant technological shift, driving The Trade Desk's development of privacy-centric solutions like Unified ID 2.0 (UID2). By early 2024, over 100 major publishers and data providers had adopted UID2, signaling its strong potential as a cookie alternative.

The explosive growth of Connected TV (CTV) is another key technological factor, with the U.S. CTV ad market projected to hit $32.7 billion by 2024. The Trade Desk's strategic expansion in CTV allows advertisers to leverage its precision for targeted audience engagement.

Interoperability is a core technological strength, enabling unified campaign management across various formats and channels. The OpenPath initiative further streamlines the ad tech ecosystem by fostering direct publisher-advertiser connections, a trend gaining momentum by mid-2024.

| Technological Factor | Description | Impact on The Trade Desk | Key Initiatives/Data Points |

| AI & Machine Learning | Enhances creative development, media buying efficiency, and fraud detection. | Drives competitive advantage and campaign effectiveness. | Kokai platform; 2024 projected global AI ad spend in tens of billions. |

| Cookie Deprecation | Phasing out of third-party cookies necessitates new identity solutions. | Requires pivot to privacy-centric advertising. | Unified ID 2.0 (UID2); Over 100 publishers/data providers adopted UID2 by early 2024. |

| Connected TV (CTV) Growth | Rapid expansion of streaming services as an advertising channel. | Capitalizes on CTV's precision for brand-audience engagement. | 2024 U.S. CTV ad market projected at $32.7 billion. |

| Platform Interoperability | Seamless integration across diverse ad formats, devices, and channels. | Enables unified and efficient campaign management. | OpenPath initiative; Growing market demand for integrated solutions by mid-2024. |

Legal factors

The Trade Desk operates within a landscape increasingly shaped by stringent global data privacy regulations. The General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States set critical benchmarks for data handling, requiring explicit user consent for data collection and processing. These laws directly influence how The Trade Desk collects, uses, and stores personal data, impacting its programmatic advertising capabilities.

The dynamic nature of these regulations presents a continuous challenge. As of 2024, more U.S. states are enacting their own privacy laws, creating a fragmented but increasingly restrictive environment. For instance, Virginia's Consumer Data Protection Act (CDPA) and Colorado's Privacy Act (CPA) mirror many GDPR and CCPA principles, demanding robust consent management and data access rights for consumers. This necessitates ongoing adaptation of The Trade Desk's platform to ensure compliance across diverse jurisdictions.

These privacy mandates significantly impact The Trade Desk's core business by restricting third-party cookie usage and requiring greater transparency in data utilization. The company must invest in developing privacy-centric advertising solutions, such as its Unified ID 2.0 initiative, to maintain effective targeting and measurement while respecting user privacy. Failure to adapt can lead to substantial fines and reputational damage, as seen with past enforcement actions under GDPR and CCPA.

Antitrust litigation is a growing concern in the ad tech sector, with a particular focus on the market power wielded by dominant companies. The Trade Desk, as a significant player, operates within this evolving regulatory environment.

Recent legal actions, such as ongoing investigations and lawsuits targeting Google's ad tech operations, highlight the potential for significant industry shifts. These cases often scrutinize practices related to market dominance and potential anti-competitive behavior.

For instance, the U.S. Department of Justice's antitrust lawsuit filed in early 2023 against Google, alleging monopolization of digital advertising technology, could set precedents. Such rulings might necessitate divestitures or changes to business models, directly impacting how companies like The Trade Desk interact with the broader ecosystem.

These legal challenges could reshape the competitive landscape, potentially creating new opportunities or increasing compliance burdens for all participants, including The Trade Desk, as regulators aim to foster a more open and competitive ad tech market.

The Trade Desk operates under stringent consumer protection laws, particularly concerning deceptive advertising. These regulations, enforced by bodies like the Federal Trade Commission (FTC) in the US, mandate transparency in how advertisements are presented and targeted. For instance, the FTC's Endorsement Guides require clear disclosure of material connections between advertisers and endorsers, a critical aspect for influencer marketing prevalent in digital advertising.

Failure to comply can lead to significant penalties, including fines and reputational damage. In 2023, the FTC reported issuing over $1.3 billion in fines related to deceptive advertising and unfair or deceptive acts or practices, highlighting the serious financial implications of non-compliance. The Trade Desk must therefore ensure its platform and its clients' campaigns avoid misleading claims or manipulative targeting practices.

In 2024, continued focus on data privacy and ethical AI in advertising means The Trade Desk must also proactively address concerns about algorithmic bias and the potential for discriminatory ad delivery, which can be viewed as a form of consumer harm. Adherence to evolving privacy regulations, such as those mirroring the GDPR or CCPA, is paramount.

Intellectual Property Rights and Content Usage

The Trade Desk must diligently manage intellectual property rights for all content featured on its advertising platform. This includes securing proper licensing for creative assets used in programmatic campaigns and ensuring that no advertisements infringe upon existing copyrights or trademarks. Failure to do so can lead to significant legal challenges and financial penalties.

Compliance with these regulations is paramount for maintaining the integrity of The Trade Desk's services and client trust. For instance, in 2023, the advertising industry saw increased scrutiny over data privacy and content originality, highlighting the importance of robust IP management.

- Copyright Protection: Ensuring all visual and textual content used in ads adheres to copyright laws, requiring licenses for stock imagery, music, and video.

- Trademark Infringement: Verifying that campaign creative does not utilize or mimic protected trademarks of other entities without authorization.

- Licensing Agreements: Establishing clear and legally sound licensing agreements for all third-party content integrated into ad campaigns facilitated by The Trade Desk.

Lawsuits and Securities Allegations

The Trade Desk has navigated significant legal challenges, including class-action lawsuits alleging privacy violations. These suits often center on the company's tracking technologies, such as Unified ID 2.0 (UID2) and Adsrvr Pixel, with accusations of secretly collecting and monetizing personal information without adequate consent. For instance, in 2023, The Trade Desk continued to address ongoing litigation related to past privacy practices, though specific settlement figures or ongoing trial details are subject to change and often confidential until resolved.

Furthermore, the company has faced securities fraud class-action lawsuits. These have typically stemmed from allegations of misrepresentations concerning its business operations and the development and rollout of its artificial intelligence forecasting tool, Kokai. While specific financial penalties or outcomes of these securities lawsuits can vary, they highlight the scrutiny faced by technology companies regarding transparency and disclosure in their business practices and product advancements.

- Privacy Lawsuits: Allegations often focus on the collection and monetization of user data through technologies like UID2, impacting consumer trust and regulatory scrutiny.

- Securities Fraud Allegations: Lawsuits have targeted claims about business operations and AI tool rollouts, creating potential financial and reputational risks.

- Regulatory Environment: Ongoing legal battles underscore the increasing importance of data privacy regulations globally, influencing operational strategies.

- Litigation Costs: Defending against such lawsuits can incur substantial legal fees and potential settlement costs, impacting profitability.

The Trade Desk operates under a complex web of global legal frameworks, with data privacy regulations like GDPR and CCPA significantly shaping its operations. In 2024, the trend of states enacting their own privacy laws, such as those in Virginia and Colorado, continues, demanding constant platform adaptation. The company's investment in privacy-centric solutions like Unified ID 2.0 is crucial to navigate these evolving restrictions and maintain its advertising capabilities while respecting user consent.

Environmental factors

The digital advertising sector, including platforms like The Trade Desk, is increasingly scrutinized for its environmental impact. Estimates suggest this industry could account for as much as 2% of global carbon emissions by 2025, a significant figure driven by the sheer volume of internet traffic and the energy demands of data centers and ad delivery systems.

This substantial footprint stems from the complex infrastructure required for online advertising, from data storage and processing to the constant flow of information for ad targeting and measurement. The energy consumption of servers, network equipment, and end-user devices all contribute to this environmental burden.

As sustainability becomes a key concern for businesses and consumers alike, companies in the digital advertising space face growing pressure to mitigate their carbon emissions. This includes exploring more energy-efficient technologies and operational practices to reduce their environmental footprint.

The digital advertising industry is seeing a significant push towards sustainability, focusing on lowering carbon footprints. Many companies are now actively tracking their emissions and establishing Science-Based Targets (SBTs) to align with global climate goals.

Despite this growing awareness, challenges remain. A key hurdle is the absence of universally agreed-upon industry standards for measuring and reporting environmental impact, alongside a need for greater education on sustainable practices across the sector.

The Trade Desk's reliance on cloud infrastructure means its operations are tied to the substantial energy consumption of data centers and ad servers. These facilities are critical for processing and delivering digital advertisements, but their power needs contribute significantly to environmental concerns.

Recognizing this, The Trade Desk is actively pursuing strategies to minimize its carbon footprint. This includes optimizing its ad servers for greater efficiency and exploring more sustainable cloud storage solutions. Streamlining the ad delivery process itself also plays a key role in reducing energy usage.

For instance, the broader digital advertising industry's energy consumption is a growing focus. While specific figures for The Trade Desk's direct data center energy use aren't publicly detailed, the industry's trend toward greener computing is undeniable. Major cloud providers, which The Trade Desk likely utilizes, are increasingly investing in renewable energy sources to power their operations, aiming for significant carbon reductions by 2025 and beyond.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, including investors and consumers, increasingly demand robust Corporate Social Responsibility (CSR) and a proactive stance on environmental issues. This trend directly impacts how companies like The Trade Desk are perceived and valued. For instance, in 2024, a significant majority of global consumers indicated that they consider a company's environmental impact when making purchasing decisions, highlighting the growing importance of sustainability in brand loyalty.

The Trade Desk's dedication to sustainable practices can significantly bolster its brand reputation. This commitment can also attract and retain environmentally conscious clients who prioritize partnering with businesses that align with their own CSR goals. By demonstrating tangible efforts in areas like carbon footprint reduction and ethical data usage, The Trade Desk can differentiate itself in the competitive digital advertising landscape.

- Investor Scrutiny: ESG (Environmental, Social, and Governance) factors are now central to many investment decisions, with a growing number of funds focusing on sustainability.

- Consumer Preference: Surveys consistently show a preference for brands demonstrating environmental responsibility, influencing purchasing power.

- Talent Acquisition: A strong CSR profile can also attract top talent who seek to work for purpose-driven organizations.

- Regulatory Landscape: Evolving environmental regulations globally may necessitate greater transparency and action from digital advertising platforms.

Regulatory Pressure for Green Practices

While specific environmental regulations targeting the ad tech sector are still in their nascent stages, the broader trend indicates increasing governmental and public scrutiny on all industries to adopt sustainable practices. This evolving landscape means digital advertising companies, including The Trade Desk, may face future mandates to measure, report, and ultimately reduce their carbon footprints. For instance, the European Union's Digital Markets Act (DMA) and Digital Services Act (DSA) are already shaping the digital advertising ecosystem, and while not directly environmental, they signal a heightened regulatory environment that could easily incorporate sustainability.

The increasing focus on Environmental, Social, and Governance (ESG) criteria by investors and regulators alike suggests that companies will need to demonstrate tangible efforts towards environmental responsibility. This pressure could manifest in requirements for data center energy efficiency, supply chain transparency regarding emissions, and the development of less energy-intensive digital advertising technologies.

- Growing ESG Scrutiny: Investors are increasingly prioritizing companies with strong ESG performance, influencing corporate strategy and disclosure requirements.

- Potential for Carbon Reporting: Future regulations may compel digital advertising platforms to quantify and report their greenhouse gas emissions, similar to other energy-intensive industries.

- Industry-Wide Sustainability Push: Broader governmental and consumer demand for green practices will likely trickle down to the digital advertising sector, pushing for more sustainable operations and ad delivery methods.

The digital advertising sector, including The Trade Desk, faces growing pressure to address its environmental impact, with estimates suggesting the industry could contribute up to 2% of global carbon emissions by 2025. This is largely due to the significant energy demands of data centers and ad delivery systems. The Trade Desk is actively working to improve its efficiency by optimizing ad servers and exploring sustainable cloud solutions to reduce its carbon footprint, aligning with a broader industry push towards greener computing.

This environmental focus is driven by increasing stakeholder demand. By 2024, a significant majority of global consumers indicated that a company's environmental impact influences their purchasing decisions, underscoring the importance of sustainability for brand perception and loyalty. Furthermore, investors are increasingly scrutinizing ESG factors, making strong CSR performance a key differentiator for companies like The Trade Desk in attracting both capital and environmentally conscious clients.

Future regulatory landscapes may also mandate greater transparency and action on carbon emissions within the digital advertising space. While specific environmental regulations for ad tech are still emerging, broader trends and initiatives like the EU's Digital Markets Act signal a heightened regulatory environment. This could lead to requirements for platforms to quantify and report greenhouse gas emissions, further pushing the industry toward more sustainable operations.

PESTLE Analysis Data Sources

Our PESTLE Analysis for The Trade Desk is meticulously constructed using data from leading industry research firms, government economic reports, and reputable technology trend analyses. We ensure each factor—political, economic, social, technological, legal, and environmental—is informed by current, verifiable market intelligence.