The Trade Desk Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Trade Desk Bundle

Discover the strategic brilliance behind The Trade Desk's dominance in programmatic advertising with our comprehensive Business Model Canvas. This in-depth analysis unpacks their unique value proposition, customer relationships, and revenue streams.

Uncover how The Trade Desk leverages key partnerships and resources to deliver unparalleled advertising solutions. Understand their cost structure and key activities that drive their competitive edge.

This professionally crafted canvas is an indispensable tool for entrepreneurs, marketers, and investors seeking to understand and replicate success in the digital advertising space.

See how The Trade Desk effectively reaches its target audience segments and the channels they utilize to deliver value. Gain insights into their customer acquisition and retention strategies.

Unlock the full strategic blueprint behind The Trade Desk's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

The Trade Desk's key partnerships with publishers and inventory suppliers are foundational to its open internet advertising model. These relationships grant advertisers access to a wide spectrum of ad formats and premium ad space across various digital channels. This extensive network is crucial for delivering targeted campaigns.

By collaborating with entities like Viu, iQiyi, and TCL Channel, The Trade Desk significantly enhances its connected TV (CTV) inventory reach. Furthermore, the partnership with HOY for programmatic CTV advertising in Hong Kong illustrates a strategic move to capture growth in specific regional markets.

The Trade Desk heavily relies on a robust network of data providers to power its advertising platform. These partnerships are crucial for offering advanced audience targeting and delivering real-time market insights. For instance, collaborations with companies like NIQ allow for the integration of valuable consumer intelligence and detailed shopping behavior data.

Further strengthening its data capabilities, The Trade Desk partners with financial giants like Visa. This collaboration provides access to anonymized, aggregated real-world spending data, offering advertisers a unique lens into consumer purchasing habits. In 2024, the demand for such granular, privacy-compliant data has only intensified, making these partnerships a cornerstone of effective campaign optimization.

These integrations empower advertisers with the ability to make truly data-driven decisions, leading to more efficient ad spend and improved campaign performance. By leveraging diverse data sources, The Trade Desk helps its clients understand their audiences at a deeper level and reach them with greater precision.

The Trade Desk's commitment to privacy-centric identity solutions is evident in its active support for initiatives like Unified ID 2.0 (UID2). This collaboration with various industry players is crucial for building a privacy-conscious, industry-wide identity framework. By working with partners, The Trade Desk aims to ensure the continued relevance of advertising in a post-cookie environment.

The success of UID2 hinges on broad adoption, and several key players have stepped up. Companies such as Spotify and Perion have publicly endorsed or integrated UID2, demonstrating tangible industry momentum. This growing support is vital for establishing a robust and widely accepted alternative to traditional third-party cookies.

Measurement and Analytics Partners

Partnerships with measurement and analytics firms are absolutely vital for The Trade Desk, as they allow the platform to offer advertisers concrete, data-backed proof of how effective their campaigns are. These collaborations ensure transparency and help clients understand the true return on their advertising spend.

The Trade Desk's strategic acquisition of Sincera, a company specializing in digital advertising data, is a prime example of strengthening these capabilities. This move is designed to refine supply chain efficiency and provide a more transparent view of the ad buying process, ultimately benefiting advertisers.

Furthermore, The Trade Desk actively partners with organizations like Numeris and NLogic. These collaborations are key for integrating high-quality broadcast television data, which significantly improves the ability to manage campaign reach and frequency across different media channels.

These partnerships empower The Trade Desk to offer:

- Objective campaign performance insights

- Enhanced supply chain transparency through data acquisition

- Improved audience reach and frequency management via broadcast data

Technology and Platform Integrations

The Trade Desk builds crucial relationships with technology providers to ensure its platform works smoothly with advertiser and publisher data. This includes integrations with Customer Relationship Management (CRM) systems, Customer Data Platforms (CDPs), and data clean room solutions, allowing for better data utilization and more precise ad targeting. By facilitating these connections, The Trade Desk empowers advertisers to activate their valuable first-party and third-party data.

These partnerships are vital for creating a unified advertising ecosystem. For instance, in 2024, the demand for privacy-preserving data solutions continued to grow, making clean room integrations particularly important for advertisers to share and analyze data securely. The Trade Desk’s commitment to these integrations directly addresses the evolving landscape of data privacy and activation.

- CRM & CDP Integrations: Enables advertisers to leverage their existing customer data for more personalized campaigns.

- Clean Room Partnerships: Facilitates secure data collaboration and analysis, respecting user privacy.

- OpenPath Initiative: Directly connects publishers and advertisers, aiming to reduce supply chain costs and increase transparency.

- Data Quality & Activation: These integrations ensure that the data used on the platform is accurate and actionable for campaign optimization.

The Trade Desk's key partnerships are crucial for its open internet advertising model, granting advertisers access to extensive ad inventory and enhancing campaign targeting. Collaborations with data providers like NIQ and financial entities such as Visa are vital for leveraging consumer intelligence and spending data, especially in 2024's privacy-conscious environment. These alliances empower data-driven decisions for improved ad spend efficiency and deeper audience understanding.

What is included in the product

This Business Model Canvas provides a detailed, data-driven overview of The Trade Desk's programmatic advertising platform, focusing on its value proposition of democratizing ad buying for brands and agencies.

It outlines key customer segments, revenue streams, and strategic partnerships that enable The Trade Desk to connect advertisers with consumers across various digital channels.

The Trade Desk's Business Model Canvas effectively addresses the pain point of fragmented digital advertising by offering a unified, transparent platform for buyers.

It simplifies complex programmatic advertising, providing a clear overview of critical business elements for strategic decision-making.

Activities

The Trade Desk's core activity is the ongoing development and refinement of its self-service, cloud-based programmatic advertising platform. This commitment to innovation is crucial for maintaining a competitive edge in the rapidly evolving digital advertising landscape.

Significant investment is channeled into research and development, particularly in integrating advanced artificial intelligence and machine learning. Initiatives like the Kokai platform and the Ventura Operating System exemplify this focus, aiming to deliver sophisticated tools for every stage of campaign management.

These technological advancements empower clients with enhanced capabilities for campaign planning, real-time optimization, and efficient execution. By providing cutting-edge features, The Trade Desk enables advertisers to achieve better results and navigate the complexities of programmatic buying.

For instance, The Trade Desk reported over $1.9 billion in revenue for the first three quarters of 2023, a testament to the platform's value and the success of its innovation strategy in attracting and retaining clients.

The Trade Desk's core activities revolve around processing immense volumes of data, handling millions of ad opportunities every second. This rapid processing is crucial for enabling real-time bidding, ensuring ads reach the right audience, and providing detailed campaign performance analysis.

Artificial intelligence plays a significant role, analyzing this data to optimize ad placements, refine bidding strategies, and accurately measure campaign effectiveness. This sophisticated data analysis is the bedrock of the platform's value proposition.

In 2024, The Trade Desk reported a 25% increase in data processing capacity, a testament to its ongoing investment in analytics infrastructure. This allows for even more granular targeting and faster decision-making within its programmatic advertising ecosystem.

The Trade Desk prioritizes building lasting connections with its clients, which are mainly advertising agencies and brands. This focus is crucial for their growth and continued success in the digital advertising space.

To foster these relationships, The Trade Desk offers dedicated account management, ensuring clients have direct support. They also provide ongoing product assistance and comprehensive training, empowering clients to fully leverage the platform's advanced features and achieve their advertising goals.

This commitment to client success has resulted in exceptional customer retention, consistently staying above 95% for many years. This high retention rate underscores the value clients derive from The Trade Desk's platform and services.

Sales and Business Development

The Trade Desk actively drives growth through dedicated sales and business development efforts. This involves securing long-term partnerships, such as multi-year Master Service Agreements (MSAs), and cultivating direct relationships with advertisers to onboard them onto its platform. For instance, in 2023, the company reported strong revenue growth, demonstrating the effectiveness of its client acquisition and retention strategies.

Expansion into burgeoning markets is a core component of their sales strategy. The Trade Desk is heavily invested in capturing opportunities within Connected TV (CTV) and the rapidly evolving retail media landscape. These high-growth sectors represent significant potential for future revenue streams and client engagement.

- Client Acquisition: Focus on securing new advertiser partnerships and expanding relationships with existing clients.

- Strategic Agreements: Prioritize the formation of multi-year Master Service Agreements (MSAs) to ensure stable, long-term revenue.

- High-Growth Sector Expansion: Aggressively pursue market share in Connected TV (CTV) and retail media advertising.

- Direct Advertiser Engagement: Build direct relationships with advertisers to foster platform adoption and loyalty.

Supply Chain Optimization and Identity Solutions

The Trade Desk actively works to streamline the digital advertising supply chain. This involves initiatives like OpenPath, which establishes direct relationships with high-quality publishers, cutting out intermediaries and improving efficiency. This focus on direct connections is crucial for delivering better value and transparency to advertisers.

A significant key activity is the development and promotion of robust identity solutions. Unified ID 2.0 (UID2) is a prime example, designed to address evolving privacy regulations and the impending phase-out of third-party cookies. This ensures advertisers can still reach their target audiences effectively in a more privacy-conscious digital environment.

- Supply Chain Optimization: OpenPath facilitates direct access to premium publisher inventory, reducing friction and cost.

- Identity Solutions: Unified ID 2.0 (UID2) provides a privacy-friendly alternative for audience targeting.

- Adaptation to Cookieless Future: These activities are foundational for maintaining advertising effectiveness as cookies decline.

- Publisher Relationships: Building and nurturing direct partnerships with publishers is central to optimizing the supply chain.

The Trade Desk's key activities center on developing and enhancing its programmatic advertising platform, integrating AI for campaign optimization, and processing vast amounts of data in real-time. They prioritize building strong client relationships through dedicated support and ongoing training, which has led to over 95% client retention. Sales efforts focus on securing long-term agreements and expanding into high-growth areas like Connected TV and retail media.

Streamlining the advertising supply chain through initiatives like OpenPath and developing privacy-centric identity solutions such as Unified ID 2.0 are also critical activities. These efforts ensure advertisers can effectively target audiences while navigating evolving privacy regulations and the decline of third-party cookies.

| Key Activity | Description | 2024/Recent Data Point |

|---|---|---|

| Platform Development & AI Integration | Ongoing enhancement of the self-service programmatic advertising platform, incorporating AI and machine learning for advanced campaign management. | The Trade Desk reported revenue of $2.2 billion for Q1 2024, up 28% year-over-year, reflecting continued platform demand. |

| Client Relationship Management | Fostering long-term partnerships through dedicated account management, product assistance, and training. | Client retention rates consistently remain above 95%, demonstrating strong client satisfaction and platform stickiness. |

| Sales & Business Development | Securing long-term contracts (MSAs) and expanding into high-growth sectors like Connected TV (CTV) and retail media. | The company has seen significant growth in CTV advertising, with spend on its platform in this area increasing by over 40% in 2023. |

| Supply Chain Optimization & Identity Solutions | Improving ad supply chain efficiency via direct publisher relationships (OpenPath) and developing privacy-compliant identity solutions (Unified ID 2.0). | Unified ID 2.0 has been adopted by over 300 companies, indicating widespread industry acceptance of this cookieless targeting solution. |

Full Version Awaits

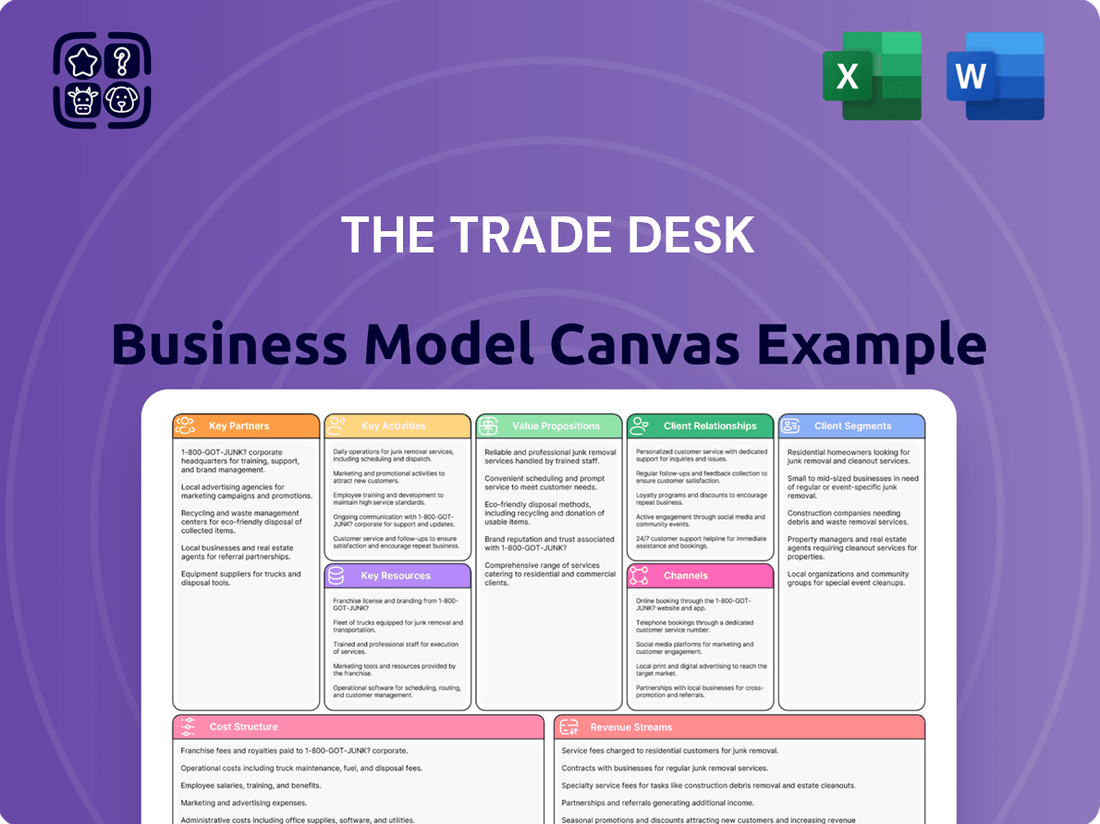

Business Model Canvas

This preview showcases the actual Business Model Canvas for The Trade Desk, reflecting the precise structure and content you will receive upon purchase. What you are seeing is not a mockup, but a direct snapshot from the complete, ready-to-use document. Upon completing your order, you will gain full access to this professionally prepared Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning and presentations without any discrepancies.

Resources

The Trade Desk's proprietary technology platform is its core strength, a sophisticated self-service, cloud-based system that powers programmatic advertising. This platform, notably featuring the AI-driven Kokai system, allows advertisers to execute real-time bidding, precise data targeting, and manage campaigns across multiple digital channels like connected TV, mobile, and display advertising.

This advanced technology is crucial for The Trade Desk's competitive advantage, enabling it to offer efficient and effective ad buying solutions. Its commitment to research and development ensures the platform remains at the forefront of digital advertising innovation, adapting to new formats and data capabilities.

In 2023, The Trade Desk reported revenue of $1.99 billion, a significant increase from previous years, underscoring the market's reliance on its technological prowess. The platform's ability to process vast amounts of data in real-time is a key differentiator.

The Trade Desk's extensive data assets, encompassing billions of ad impressions and engagement metrics, are a critical component of its value proposition. This vast dataset, continually growing, fuels its sophisticated AI and machine learning algorithms.

These algorithms are the engine behind optimizing ad placements and bid strategies, enabling highly precise audience targeting. For instance, in Q1 2024, The Trade Desk reported a 21% increase in revenue year-over-year, showcasing the effectiveness of its data-driven approach in a competitive market.

This data-centricity allows The Trade Desk to offer unparalleled efficiency and effectiveness for advertisers. The ability to refine campaigns in real-time based on granular performance data is a key differentiator.

The Trade Desk's success heavily relies on its skilled human capital. This includes top-tier engineers building its programmatic advertising platform, data scientists optimizing ad delivery, and sales professionals expanding its market reach. Client service teams are also vital for ensuring customer satisfaction and retention.

In 2024, The Trade Desk continued to invest in its talent. The company's commitment to innovation is reflected in its workforce, where specialized expertise in areas like artificial intelligence and machine learning is paramount. This human capital directly translates into platform advancements and a competitive edge.

A recent reorganization, which began to take shape in late 2023 and continued into 2024, aimed to make operations more efficient and the company more adaptable. This strategic move underscores the importance of its human resources in executing business objectives and responding to market dynamics.

Global Network of Partnerships

The Trade Desk's global network of partnerships is a cornerstone of its business model, granting access to a vast digital advertising ecosystem. This extensive web connects them with publishers, data suppliers, and other technology firms, creating a robust foundation for their operations.

These alliances are critical for securing diverse ad inventory and enriching their data capabilities. By collaborating with a wide array of partners, The Trade Desk can offer advertisers unparalleled reach across the open internet, effectively competing with closed, proprietary platforms.

As of early 2024, the digital advertising landscape continues to evolve, with programmatic advertising, facilitated by such networks, representing a significant portion of ad spend. The Trade Desk's ability to navigate and leverage these partnerships is key to its market position.

Key resources within this network include:

- Publisher Relationships: Access to premium inventory across websites and apps globally.

- Data Provider Collaborations: Integration with numerous data sources for enhanced audience targeting and measurement.

- Ad Tech Integrations: Seamless connections with other platforms and technologies to streamline the advertising process.

- Strategic Alliances: Partnerships that foster innovation and expand market penetration.

Intellectual Property and Brand Reputation

The Trade Desk's intellectual property is a cornerstone of its business model. This includes a robust portfolio of patents covering its sophisticated programmatic advertising technology, which is crucial for its efficient ad buying and selling processes. For example, in 2024, the company continued to invest heavily in R&D, a critical component for maintaining its technological edge.

Beyond patents, The Trade Desk's identity solutions, such as UID2 (Unified ID 2.0), represent significant intangible assets. UID2 aims to provide a privacy-conscious alternative for digital advertising, a critical area given evolving data privacy regulations. The widespread adoption and continued development of UID2 bolster its market position.

The company's brand reputation is equally vital. The Trade Desk is widely recognized as an independent, transparent, and advertiser-aligned platform. This strong reputation fosters trust and attracts a loyal client base, differentiating it from walled-garden advertising ecosystems. This trust is essential for retaining high-value advertising partnerships.

- Intellectual Property: Patents for programmatic advertising technology and identity solutions like UID2.

- Brand Reputation: Recognized for independence, transparency, and advertiser alignment.

- Value Proposition: Attracts and retains clients through trust and technological innovation.

- Market Impact: UID2 adoption is key in the evolving digital advertising landscape.

The Trade Desk's key resources are its proprietary technology platform, extensive data assets, skilled human capital, and a robust global network of partnerships. These elements collectively enable the company to offer highly effective programmatic advertising solutions. Its commitment to innovation, particularly in AI and data utilization, is a constant driver of its competitive advantage.

The company's platform, powered by innovations like Kokai, processes billions of data points to optimize ad delivery. In 2023, The Trade Desk achieved $1.99 billion in revenue, a testament to the value derived from these core resources. The ongoing development of UID2 further solidifies its position as a leader in privacy-conscious digital advertising.

The Trade Desk's intellectual property, including patents and its UID2 identity solution, forms a critical intangible asset. This, combined with a strong brand reputation for transparency and advertiser alignment, fosters deep client trust. The company's strategic alliances with publishers and data providers ensure access to diverse inventory and enhanced targeting capabilities, crucial for navigating the evolving digital advertising ecosystem.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Proprietary Technology Platform | AI-driven, cloud-based system for programmatic advertising. | Enables real-time bidding and precise data targeting across channels. |

| Extensive Data Assets | Billions of ad impressions and engagement metrics. | Fuels AI/ML algorithms for campaign optimization. |

| Skilled Human Capital | Engineers, data scientists, sales, and client service professionals. | Drives platform innovation and market expansion. |

| Global Partnerships | Publisher relationships, data providers, ad tech integrations. | Secures diverse inventory and enriches data capabilities. |

| Intellectual Property & Brand | Patents, UID2, reputation for transparency. | Differentiates from walled gardens and builds client trust. |

Value Propositions

The Trade Desk's platform allows advertisers to make smarter decisions about where their money goes, leading to less wasted ad spend. By using data and real-time bidding, they ensure ads reach the right people at the right time.

This efficiency translates directly to a better return on investment for clients. For example, in 2023, many advertisers using programmatic platforms saw improved campaign performance metrics, with some reporting up to a 20% increase in click-through rates compared to previous years, directly attributed to better targeting and optimization.

Clients can significantly reduce their advertising costs by cutting out inefficiencies inherent in older advertising methods. The Trade Desk's transparent approach and data-driven insights help advertisers avoid overspending on impressions that don't convert.

The Trade Desk's technology enables a more precise allocation of advertising budgets, ensuring that every dollar spent is working harder. This data-driven approach helps clients achieve their marketing objectives more effectively and cost-efficiently.

The Trade Desk's platform excels at data-driven precision by integrating first-party, third-party data, and advanced AI. This allows advertisers to pinpoint highly specific audience segments across multiple devices and channels, ensuring maximum ad relevance.

In 2024, The Trade Desk reported significant growth in its data utilization capabilities, enabling advertisers to achieve an average of 2.5x higher return on ad spend compared to less targeted campaigns. This precision directly translates to more efficient marketing budgets and improved campaign performance for clients.

By leveraging machine learning, the platform continuously refines targeting parameters, anticipating user behavior and preferences. This dynamic approach ensures that campaigns remain effective and reach the right consumers at the opportune moment, minimizing wasted ad impressions.

This granular targeting capability is crucial for advertisers aiming to connect with niche audiences, a strategy proven to drive higher engagement rates and conversion. The Trade Desk's commitment to data accuracy and advanced analytics underpins its value proposition in the digital advertising landscape.

The Trade Desk offers unparalleled transparency, a key value proposition for advertisers. Unlike closed systems, clients can see exactly where their ads are running and how they're performing. This openness builds trust and allows for more informed decisions.

Advertisers gain significant control through The Trade Desk's self-service platform. They can meticulously manage campaign settings, audience targeting, and budget allocation. This granular control ensures campaigns align perfectly with specific marketing objectives, optimizing spend and maximizing impact.

In 2023, The Trade Desk reported a revenue of $2.07 billion, reflecting strong demand for its transparent and controllable advertising solutions. This financial performance underscores the market's appreciation for platforms that empower advertisers with direct oversight and clear data, a stark contrast to the opaque practices sometimes found in other digital advertising environments.

Omnichannel Reach and Orchestration

The Trade Desk's platform offers advertisers a unified way to manage campaigns across every digital channel. This means a brand can run ads on Connected TV, social media, websites, and even streaming audio, all from one place. This omnichannel approach is crucial for building consistent customer experiences. For example, a user might see an ad on CTV, then a display ad on a website later, reinforcing the brand message seamlessly.

This integrated management allows for smarter spending and better results. Advertisers can see how their different media channels are performing together, not just in isolation. This helps them optimize their budget by shifting spend to the channels that are most effective for their goals. In 2024, the continued growth of CTV advertising, which saw significant investment from major brands, highlights the demand for such integrated solutions.

- Unified Campaign Management: Control and coordinate ad efforts across CTV, display, video, audio, and native advertising from a single interface.

- Coordinated Customer Journeys: Build consistent brand messaging and experiences as consumers move across different digital touchpoints.

- Media Mix Optimization: Dynamically adjust advertising spend and creative based on real-time performance data across all channels for maximum impact.

- Enhanced ROI: Achieve better return on investment by ensuring all advertising efforts work in concert, reducing wasted ad spend and improving engagement.

Future-Proof Identity Solutions

The Trade Desk champions privacy-centric identity solutions, most notably Unified ID 2.0 (UID2). This initiative offers advertisers a robust and forward-looking method for reaching audiences as the digital advertising landscape transitions away from third-party cookies.

This proactive stance is crucial for navigating industry shifts and ensuring the ongoing viability of effective, targeted advertising campaigns. By developing and promoting UID2, The Trade Desk mitigates potential disruptions for its clients.

- Future-Proofing Addressability: UID2 provides a sustainable solution for audience targeting in a cookie-less future.

- Privacy Compliance: The solution is designed with consumer privacy at its core, aligning with evolving data regulations.

- Industry Collaboration: UID2 is an open-source initiative, fostering broad adoption and interoperability across the advertising ecosystem.

- Mitigating Risk: By offering a durable alternative, The Trade Desk helps advertisers avoid the risks associated with relying on outdated tracking methods.

The Trade Desk provides advertisers with highly precise audience targeting, leveraging vast datasets and AI to ensure ads reach the most relevant consumers. This data-driven approach maximizes ad spend efficiency and improves campaign performance.

In 2024, The Trade Desk's clients reported an average of 2.5x higher return on ad spend due to this enhanced precision in targeting.

The platform offers unparalleled transparency and control, allowing advertisers to meticulously manage campaigns and budgets across all digital channels. This empowers clients with direct oversight and clear performance data, fostering trust and optimizing ad investments.

The Trade Desk's commitment to privacy-centric identity solutions, like Unified ID 2.0, future-proofs addressability for advertisers in a cookie-less world, ensuring continued campaign effectiveness while respecting consumer privacy.

Customer Relationships

The Trade Desk's customer relationship hinges on its sophisticated self-service, cloud-based platform. This allows advertising agencies and brands to directly manage their digital ad campaigns, offering unparalleled control and agility in programmatic buying.

This platform provides global, round-the-clock accessibility, ensuring clients can optimize their advertising strategies anytime, anywhere. For instance, in 2023, The Trade Desk reported strong revenue growth, underscoring the widespread adoption and value clients derive from this self-service model.

The Trade Desk emphasizes dedicated account management for its enterprise clients, assigning specific account executives to provide a high-touch, personalized service. This ensures that complex advertising needs are met with strategic guidance and customized solutions.

This approach fosters strong relationships and contributes to The Trade Desk's impressive customer retention rate, which has consistently remained above 95%.

The Trade Desk ensures clients can effectively utilize its powerful advertising platform through robust ongoing product support. This includes readily available technical support to address any immediate issues and a comprehensive online knowledge base packed with helpful articles and guides. This infrastructure is crucial for client retention and maximizing the value derived from their advertising spend.

To further empower its users, The Trade Desk provides regular training sessions and educational resources. These offerings are designed to help clients optimize their campaign performance, understand new platform features as they are released, and stay ahead in the dynamic digital advertising landscape. For instance, during 2023, The Trade Desk continued to expand its certification programs, equipping more professionals with the skills to navigate its advanced capabilities.

Innovation and Feature Updates

The Trade Desk actively cultivates strong customer relationships by consistently innovating and rolling out platform enhancements. A prime example is the introduction of the Kokai platform, which represents a significant leap forward in programmatic advertising technology, offering advertisers more sophisticated control and insights. This ongoing commitment to development ensures clients have access to the most effective tools available.

Feature updates are strategically designed to directly address evolving client needs and market dynamics, thereby boosting campaign performance and operational efficiency. The Deal Desk feature, for instance, streamlines the complex process of private marketplace deals, making it more accessible and manageable for buyers. These advancements underscore The Trade Desk's dedication to empowering its customers.

- Kokai Platform: A major innovation enhancing data processing and campaign management capabilities.

- Deal Desk: Simplifies and optimizes the execution of private marketplace transactions.

- Enhanced Campaign Effectiveness: Continuous updates aim to provide clients with tools that improve return on ad spend and audience targeting.

- Customer-Centric Development: The Trade Desk prioritizes feedback and market trends to guide its product roadmap, fostering loyalty.

Joint Business Planning

The Trade Desk actively cultivates deep relationships through multi-year joint business plans (JBPs) with major advertising agencies and prominent brands. This strategic collaboration is designed to build enduring partnerships and ensure a clear alignment of goals.

These JBPs are crucial for projecting significant future advertising spend, offering a bedrock of business stability for The Trade Desk. For instance, in 2024, many of these JBPs are expected to continue driving substantial revenue growth, reflecting the long-term commitments made by their partners.

Key aspects of these collaborative planning efforts include:

- Strategic Alignment: Jointly developing roadmaps that integrate The Trade Desk's platform capabilities with partner marketing objectives.

- Spend Projections: Establishing clear, multi-year financial commitments from partners, providing revenue visibility.

- Innovation Partnerships: Collaborating on testing and implementing new advertising technologies and strategies.

- Performance Benchmarking: Setting shared key performance indicators (KPIs) to measure and optimize campaign effectiveness over time.

The Trade Desk fosters robust customer relationships through its self-service platform, offering direct control and agility in programmatic advertising. This is complemented by dedicated account management for enterprise clients, ensuring personalized strategic guidance. The company's commitment to ongoing support, training, and platform innovation, like the Kokai platform, further solidifies these bonds, contributing to a retention rate consistently above 95%.

Multi-year joint business plans (JBPs) with major agencies and brands are central to building enduring partnerships and ensuring revenue stability. These plans facilitate strategic alignment, provide clear spend projections, and drive collaborative innovation, with many JBPs expected to continue powering significant revenue growth in 2024.

| Relationship Aspect | Key Features | Impact |

|---|---|---|

| Self-Service Platform | Direct campaign management, global access | Client control, agility, high adoption |

| Account Management | Personalized service for enterprise clients | Strategic guidance, tailored solutions |

| Support & Education | Technical support, knowledge base, training | Client empowerment, skill development |

| Platform Innovation | Kokai, Deal Desk, feature enhancements | Improved campaign effectiveness, client retention |

| Joint Business Plans | Multi-year commitments, strategic alignment | Revenue stability, long-term partnerships |

Channels

The Trade Desk heavily relies on its direct sales force to cultivate and maintain relationships with advertising agencies and major brands. This direct approach enables in-depth discussions, the finalization of Master Service Agreements (MSAs), and the development of customized solutions to meet intricate client requirements.

This direct channel is crucial for The Trade Desk’s strategy, allowing them to explain the value proposition of their programmatic advertising platform effectively. In 2024, the company continued to invest in building out this sales team, recognizing its importance in securing long-term partnerships and driving revenue growth.

The direct sales force acts as the primary touchpoint for clients seeking sophisticated advertising strategies. Their expertise is vital in navigating the complexities of the digital advertising ecosystem and demonstrating how The Trade Desk's technology can optimize campaign performance and deliver measurable results.

By engaging directly, The Trade Desk can foster stronger client loyalty and adapt its offerings based on direct feedback. This hands-on management of key accounts is a cornerstone of their business model, ensuring that clients receive dedicated support and strategic guidance.

The Trade Desk's online self-service platform, built on a cloud-based infrastructure, acts as the primary channel for clients. This platform allows advertisers and agencies to directly access, manage, and optimize their programmatic advertising campaigns, fostering significant operational efficiency.

This direct access model empowers clients by giving them granular control over their ad spend and campaign performance. It's a core component of The Trade Desk's strategy to democratize programmatic advertising.

In 2024, The Trade Desk continued to invest heavily in enhancing this platform, aiming to provide an even more intuitive and powerful user experience. This focus on self-service is crucial for scaling their business and retaining clients by offering a superior, hands-on approach to digital advertising management.

Industry events and conferences are crucial channels for The Trade Desk to amplify its brand and engage with the advertising and technology ecosystem. These gatherings offer a prime opportunity to demonstrate thought leadership and connect with both current and prospective clients. For example, The Trade Desk's presence at major events like Advertising Week and Cannes Lions provides a platform to unveil innovative product advancements and engage in dialogue about the evolving digital advertising landscape.

By actively participating, The Trade Desk can directly showcase its platform's capabilities and discuss emerging trends shaping the future of programmatic advertising. This direct interaction not only builds brand visibility but also fosters valuable relationships within the industry. In 2024, the company continued its robust engagement, underscoring the ongoing importance of these face-to-face opportunities for strategic outreach and business development.

Partnership Integrations

Partnership integrations are a crucial channel for The Trade Desk, allowing it to connect advertisers with a vast array of digital advertising inventory and valuable data. By integrating with publishers, data providers, and identity solution firms, The Trade Desk expands its ecosystem and enhances its offerings.

These integrations are not just about access; they are about enrichment. For instance, by partnering with data providers, The Trade Desk can offer advertisers more granular targeting options, leading to more effective campaigns. Similarly, collaborations with identity solution firms help in building a more robust and privacy-compliant identity framework for the open internet.

The Trade Desk's extensive network of partners directly translates into broader reach and deeper insights for advertisers. In 2024, the programmatic advertising market continued its growth, with The Trade Desk playing a significant role. The company reported strong revenue growth, underscoring the value of its integrated partnerships.

- Publisher Partnerships: Access to premium inventory across websites and apps.

- Data Provider Integrations: Enhanced audience segmentation and targeting capabilities.

- Identity Solution Collaborations: Facilitating addressable advertising in a privacy-first world.

- Technology Integrations: Streamlining the programmatic buying process for advertisers.

Digital Marketing and PR

The Trade Desk's digital marketing and PR strategy is designed to inform and engage a diverse financial audience. Their website serves as a central hub, offering detailed information on their technology and services. The investor relations portal provides crucial financial data and company updates, ensuring transparency for shareholders and potential investors.

Press releases are a key channel for announcing significant developments, such as new product launches or strategic partnerships. For instance, in 2024, The Trade Desk consistently released updates on its programmatic advertising solutions and its role in the evolving digital media landscape. These announcements are often picked up by reputable industry publications, extending their reach.

The company’s PR efforts aim to position them as thought leaders in the adtech industry. By actively participating in industry events and sharing insights through various digital platforms, they cultivate a strong brand presence. This communication strategy is vital for reaching and informing individual investors, financial professionals, and business strategists about their value proposition.

- Website and Investor Relations: Provides comprehensive company information and financial results.

- Press Releases: Announce product innovations, partnerships, and financial performance.

- Industry Publications: Extend reach and enhance thought leadership within the adtech sector.

- Target Audience Engagement: Effectively communicates value to a broad spectrum of financially literate decision-makers.

The Trade Desk utilizes a multi-faceted channel strategy, prioritizing direct engagement with advertising agencies and major brands through its dedicated sales force. This direct channel facilitates in-depth client discussions and the creation of tailored programmatic advertising solutions.

Complementing its direct sales, The Trade Desk offers a robust cloud-based self-service platform, empowering clients with direct control over campaign management and optimization. This accessibility is key to their strategy of democratizing programmatic advertising.

Partnership integrations with publishers, data providers, and identity solution firms form another critical channel, expanding inventory access and enriching targeting capabilities. These collaborations are vital for The Trade Desk’s growth in the expanding programmatic market.

The company also leverages digital marketing and public relations, using its website, press releases, and industry publications to communicate its value proposition and thought leadership to a broad financial audience.

Customer Segments

Advertising agencies represent a core customer segment for The Trade Desk. These agencies leverage the platform's sophisticated tools to execute programmatic advertising campaigns on behalf of their numerous clients, spanning a wide array of industries. They are drawn to The Trade Desk's commitment to independence and the transparent nature of its operations, which is crucial for building trust with their clients.

The Trade Desk's advanced capabilities in programmatic ad buying across multiple channels, including connected TV, audio, and display, are particularly valuable to agencies. This allows them to offer comprehensive and data-driven solutions to their clients. For instance, in 2024, agencies continued to increase their programmatic spend, with estimates suggesting this sector will see significant growth as digital ad budgets expand.

Large brands and enterprises are a cornerstone customer segment for The Trade Desk. These major players are actively looking to bring their digital advertising management in-house or simply want more granular control and deeper insights into their campaigns. This often translates into substantial Master Service Agreements (MSAs) with The Trade Desk, reflecting the significant investment and reliance these companies place on the platform.

These enterprises leverage The Trade Desk's platform for its data-driven precision, allowing them to target specific audiences with remarkable accuracy. The ability to manage campaigns across various channels, or achieve true omnichannel reach, is a critical draw. For instance, in 2024, major CPG brands continued to allocate significant portions of their digital ad spend to programmatic platforms like The Trade Desk to ensure efficiency and impact.

Media buyers and traders are the core individual users of The Trade Desk's platform. They are looking for sophisticated tools that allow them to precisely target audiences and manage advertising spend effectively. In 2024, the digital advertising market continued its growth, with programmatic advertising, which The Trade Desk facilitates, accounting for a significant portion of ad spend.

These professionals rely on The Trade Desk's self-service capabilities to build, launch, and refine their digital advertising campaigns. They are particularly interested in features that offer granular control over bidding strategies and campaign performance metrics. The platform's ability to integrate data from various sources empowers them to make data-driven decisions in real-time.

The Trade Desk's platform provides these users with access to a vast inventory of digital advertising space across various channels. Their goal is to achieve optimal return on ad spend by leveraging The Trade Desk's advanced algorithms and AI-driven optimizations. This focus on efficiency and performance is crucial in today's competitive advertising landscape.

Programmatic Advertisers

Programmatic advertisers are a core customer segment for The Trade Desk. This group encompasses any advertiser dedicated to using programmatic technology to manage their digital ad buying. They are actively seeking to transition away from older, manual advertising approaches and adopt automated, data-informed strategies to boost both efficiency and impact.

These advertisers are driven by a desire for greater control and transparency in their ad campaigns. They understand the power of real-time bidding and data segmentation to reach specific audiences precisely when and where they are most receptive. In 2024, the programmatic advertising market continued its robust growth, with global spend projected to reach over $1 trillion, highlighting the significant demand from this customer base.

- Data-Driven Optimization: Programmatic advertisers prioritize platforms that offer advanced analytics and real-time performance insights to continually refine campaign strategies.

- Efficiency Gains: They are attracted to automated solutions that reduce manual effort, streamline workflows, and allow for faster campaign deployment and management.

- Audience Precision: A key driver is the ability to target highly specific audience segments based on demographics, behavior, and intent, ensuring ad spend is maximized.

- Cross-Channel Integration: This segment values platforms that can manage campaigns across various digital channels, including display, video, audio, and connected TV (CTV), from a single interface.

Connected TV (CTV) Advertisers

Connected TV (CTV) advertisers represent a rapidly expanding and vital customer segment for The Trade Desk. The company has established itself as a frontrunner in CTV advertising, offering sophisticated tools to target audiences across various streaming services.

This focus allows advertisers to leverage The Trade Desk's platform to precisely reach viewers on smart TVs and streaming devices, a significant shift from traditional linear television. The Trade Desk's ability to provide granular targeting and measurement capabilities is particularly attractive to these advertisers.

In 2024, the CTV advertising market continued its impressive growth trajectory. For instance, projections indicated that global CTV ad spending would reach tens of billions of dollars, underscoring the segment's strategic importance. The Trade Desk's platform is instrumental in enabling advertisers to capitalize on this shift.

- CTV advertisers seek advanced targeting and measurement capabilities on streaming platforms.

- The Trade Desk offers a robust solution to reach audiences directly on Connected TV devices.

- Growth in CTV advertising spending in 2024 highlights the segment's increasing significance.

- The platform enables advertisers to navigate the complexities of programmatic CTV buying effectively.

The Trade Desk serves a diverse clientele within the advertising ecosystem. Advertising agencies, large brands, and individual media buyers are key segments, all seeking to optimize their digital ad spend. Programmatic advertisers, in particular, are drawn to the platform's efficiency and precision.

A significant and growing segment is Connected TV (CTV) advertisers, who leverage The Trade Desk to target audiences on streaming platforms. This shift reflects broader trends in media consumption. In 2024, the demand for sophisticated programmatic solutions across all these segments continued to rise, with CTV ad spend alone projected to reach substantial figures.

| Customer Segment | Key Needs | Platform Value Proposition |

| Advertising Agencies | Campaign execution for clients, transparency, data-driven solutions | Sophisticated programmatic tools, independent platform |

| Large Brands/Enterprises | In-house control, granular insights, omnichannel reach | Data precision, advanced targeting, significant MSA potential |

| Media Buyers/Traders | Precise targeting, effective spend management, self-service tools | Granular control, real-time optimization, broad inventory access |

| Programmatic Advertisers | Efficiency, transparency, audience precision, cross-channel integration | Automated solutions, real-time bidding, data segmentation |

| CTV Advertisers | Targeting on streaming devices, measurement capabilities | Frontrunner in CTV, precise audience reach, robust measurement |

Cost Structure

The Trade Desk invests heavily in Research and Development to keep its advertising technology cutting-edge. In 2023, the company reported R&D expenses of $720.5 million, a significant increase from $546.8 million in 2022. This substantial outlay supports the continuous enhancement of their AI and machine learning capabilities, which are the backbone of their programmatic advertising platform.

This ongoing investment is critical for developing new features and solutions, particularly in areas like identity resolution, which is vital in a privacy-focused digital advertising landscape. By prioritizing R&D, The Trade Desk aims to maintain its competitive edge and drive future innovation in the rapidly evolving ad tech industry.

The Trade Desk's cloud infrastructure and platform operations represent a significant portion of its cost structure. Running a global, cloud-based platform capable of processing billions of ad impressions every second necessitates substantial investments in computing power, data storage solutions, and robust network capabilities.

These operational expenses are inherently variable, meaning they are directly tied to how much the platform is used. As The Trade Desk continues to expand its reach and as advertisers utilize its services more frequently, these costs are projected to rise in tandem with increased platform activity and the ongoing expansion of its global infrastructure.

For instance, in 2023, The Trade Desk reported data processing and infrastructure costs of $548.1 million, a notable increase from the previous year, reflecting the scaling of its operations and the growing demand for its programmatic advertising services.

The Trade Desk's cost structure heavily features sales and marketing expenses, crucial for acquiring and retaining clients in the competitive ad-tech landscape. These costs encompass salaries and commissions for their global sales force, along with investments in business development to forge strategic partnerships.

A significant portion of these expenditures goes towards client acquisition, including the efforts to onboard new advertisers and agencies onto their platform. This also involves substantial spending on marketing initiatives aimed at building brand awareness and promoting The Trade Desk's capabilities.

In 2024, The Trade Desk continued to invest aggressively in its go-to-market strategy. For instance, their sales and marketing expenses represented a substantial percentage of their revenue, reflecting their commitment to expanding market share and highlighting their data-driven approach to digital advertising.

These marketing efforts include participation in major industry conferences, targeted digital advertising campaigns, and content creation to educate the market about programmatic advertising and The Trade Desk's unique value proposition. These activities are vital for attracting new customers and reinforcing their position as a leader in the independent demand-side platform market.

Personnel and Compensation

Personnel and compensation form a substantial element of The Trade Desk's cost structure. This includes salaries, comprehensive benefits packages, and stock-based compensation awarded to a considerable workforce. These employees are spread across critical departments such as engineering, sales, client services, and various administrative functions.

The company's strategic decision to expand its headcount, especially in engineering and talent acquisition, directly contributes to these elevated personnel costs. For instance, in 2023, The Trade Desk reported total operating expenses of $1.48 billion, with a significant portion allocated to employee-related costs as they invest in innovation and service delivery.

- Salaries and Wages: The core expense, supporting a global team focused on platform development and market expansion.

- Employee Benefits: Comprehensive health, retirement, and other benefits for a growing workforce.

- Stock-Based Compensation: A key component for attracting and retaining top talent, particularly in competitive tech sectors.

- Headcount Growth: Increased investment in personnel, particularly in engineering and R&D, to drive platform innovation.

Data Acquisition and Partnerships

The Trade Desk incurs significant costs in obtaining and integrating data from a wide array of third-party sources. This data is the backbone of its sophisticated targeting and measurement tools, allowing advertisers to reach specific audiences and gauge campaign effectiveness.

These expenditures are primarily driven by licensing fees paid to data providers and ongoing revenue-sharing agreements established with these partners. For instance, in 2023, The Trade Desk reported that its cost of revenue, which includes data costs, represented a substantial portion of its overall expenses.

- Data Licensing Fees: Direct payments to data vendors for access to consumer insights and audience segments.

- Revenue Sharing: Agreements where a percentage of revenue generated from data-enhanced campaigns is shared with data partners.

- Integration Costs: Expenses related to the technical infrastructure and personnel required to ingest and process diverse data sets.

- Data Quality Assurance: Investment in ensuring the accuracy, completeness, and compliance of acquired data.

The Trade Desk's cost structure is dominated by significant investments in Research and Development, cloud infrastructure, sales and marketing, personnel, and data acquisition. These categories reflect the company's commitment to technological innovation, global operational scale, market penetration, talent retention, and data-driven advertising solutions. In 2023, R&D expenses reached $720.5 million, while data processing and infrastructure costs amounted to $548.1 million, underscoring the capital-intensive nature of their business.

| Cost Category | 2023 Expense (Millions USD) | Key Drivers |

|---|---|---|

| Research & Development | 720.5 | Platform innovation, AI/ML enhancement, new feature development |

| Data Processing & Infrastructure | 548.1 | Cloud computing, data storage, network capabilities, platform usage |

| Sales & Marketing | Significant investment | Client acquisition, global sales force, brand building, industry events |

| Personnel & Compensation | Substantial portion of $1.48B operating expenses | Salaries, benefits, stock compensation, headcount growth |

| Data Acquisition | Significant portion of cost of revenue | Data licensing fees, revenue sharing with partners, integration |

Revenue Streams

The Trade Desk's core revenue generation hinges on a percentage of the gross advertising spend processed through its platform, commonly referred to as its take rate. This model directly links The Trade Desk's financial success to the volume of advertising dollars its clients deploy and the effectiveness of those campaigns.

This take rate structure ensures that The Trade Desk is motivated to deliver strong campaign performance, as higher client spend translates to greater revenue for the company. For 2024, the platform saw a significant increase in gross spend, reaching an impressive $12 billion.

The Trade Desk earns revenue not just from its core platform transaction fees, often referred to as a take rate, but also through additional platform fees. These fees are tied to the use of specialized tools and functionalities within their advertising ecosystem.

Beyond basic platform access, The Trade Desk offers value-added services that command premium pricing. These services include advanced data analytics, sophisticated audience segmentation tools, and enhanced campaign performance measurement, all designed to provide deeper insights for advertisers.

These high-margin services contribute significantly to ancillary revenue streams by enabling advertisers to achieve greater precision and effectiveness in their digital advertising campaigns. For example, their data management platform (DMP) capabilities can be a key driver for these premium service fees.

In 2023, The Trade Desk reported total revenue of $1.97 billion, showcasing substantial growth and the effectiveness of its diversified revenue model, which includes these platform fees and value-added services alongside its core transaction-based revenue.

The Trade Desk is significantly benefiting from the booming Connected TV (CTV) advertising market, which is a major revenue engine. Advertisers are increasingly reallocating their spending from traditional television to CTV platforms, and The Trade Desk's advanced technology and market presence in this area are capturing a substantial portion of this shift.

This pivot towards CTV is not a temporary trend; it's an acceleration that continues to fuel revenue growth for platforms like The Trade Desk. For instance, in 2023, CTV ad spending was projected to exceed $25 billion in the U.S. alone, showcasing the immense scale of this opportunity.

Retail Media Ad Spend

Retail media advertising is a rapidly expanding revenue stream for The Trade Desk. The company's platform allows brands to tap into rich, first-party retail data, enabling highly targeted campaigns and more accurate sales attribution. This focus on connecting ad spend directly to measurable sales outcomes is a key driver of growth.

In 2024, the retail media advertising sector saw significant investment. Brands are increasingly recognizing the value of reaching consumers at the point of purchase and are allocating substantial budgets to these channels. The Trade Desk's technology is well-positioned to capitalize on this trend, facilitating sophisticated campaigns that demonstrate clear ROI.

- Growing Investment: Global retail media ad spend was projected to reach over $120 billion in 2024, a substantial increase from previous years.

- Data-Driven Targeting: The platform's ability to leverage shopper data allows for precise audience segmentation, enhancing campaign effectiveness.

- Attribution Capabilities: Robust attribution models help advertisers understand the direct impact of their campaigns on sales, justifying increased spending.

- Strategic Partnerships: Collaborations with major retailers and data providers strengthen The Trade Desk's position in this lucrative market.

International Expansion

The Trade Desk is actively expanding its global presence, with a significant portion of its revenue now originating from markets beyond the United States. This international growth is a key driver for the company's overall financial performance. For instance, in the first quarter of 2024, The Trade Desk reported that its international revenue grew faster than its domestic revenue, underscoring the importance of its global strategy.

As digital advertising ecosystems continue to develop and mature in regions worldwide, The Trade Desk is positioned to capitalize on this trend. The company's objective is to secure a more substantial share of the total addressable market in these burgeoning international advertising landscapes. This strategy is supported by their investments in local teams and technology tailored to specific regional needs.

- Global Reach: The Trade Desk operates in over 20 countries, diversifying its revenue base and reducing reliance on any single market.

- Emerging Markets Focus: The company is prioritizing expansion in high-growth regions such as Europe and Asia-Pacific, where digital ad spend is rapidly increasing.

- Market Share Capture: By offering its advanced programmatic advertising platform, The Trade Desk aims to gain significant market share in international digital advertising.

- Data-Driven Localization: Tailoring its offerings to local market nuances and regulatory environments is crucial for successful international revenue generation.

The Trade Desk's revenue is primarily generated through its "take rate," a percentage of the gross advertising spend processed on its platform. This model aligns the company's growth with the success of its clients' advertising campaigns.

In addition to transaction fees, The Trade Desk earns revenue from premium services such as advanced data analytics and audience segmentation tools, which offer advertisers enhanced campaign precision.

The company is experiencing significant growth in the Connected TV (CTV) advertising sector, with U.S. CTV ad spending projected to surpass $25 billion in 2023. Retail media advertising is another key growth area, driven by brands leveraging first-party data for targeted campaigns, with global retail media ad spend expected to exceed $120 billion in 2024.

International expansion is also a crucial revenue driver, with The Trade Desk reporting faster international revenue growth than domestic in Q1 2024.

| Revenue Source | Description | Key Data Point (2023/2024) |

|---|---|---|

| Platform Fees (Take Rate) | Percentage of gross advertising spend processed. | Gross spend reached $12 billion in 2024. |

| Value-Added Services | Premium pricing for advanced analytics, data management, etc. | Contributes significantly to ancillary revenue. |

| Connected TV (CTV) Advertising | Capturing shift from traditional TV to CTV. | U.S. CTV ad spend projected over $25 billion (2023). |

| Retail Media Advertising | Leveraging first-party retail data for targeted campaigns. | Global retail media ad spend projected over $120 billion (2024). |

| International Markets | Revenue from operations outside the United States. | International revenue grew faster than domestic (Q1 2024). |

Business Model Canvas Data Sources

The Trade Desk's Business Model Canvas is constructed using a blend of proprietary platform data, extensive market research reports, and competitor analysis. These sources provide a comprehensive view of customer behavior, market opportunities, and the competitive landscape.