The Trade Desk Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Trade Desk Bundle

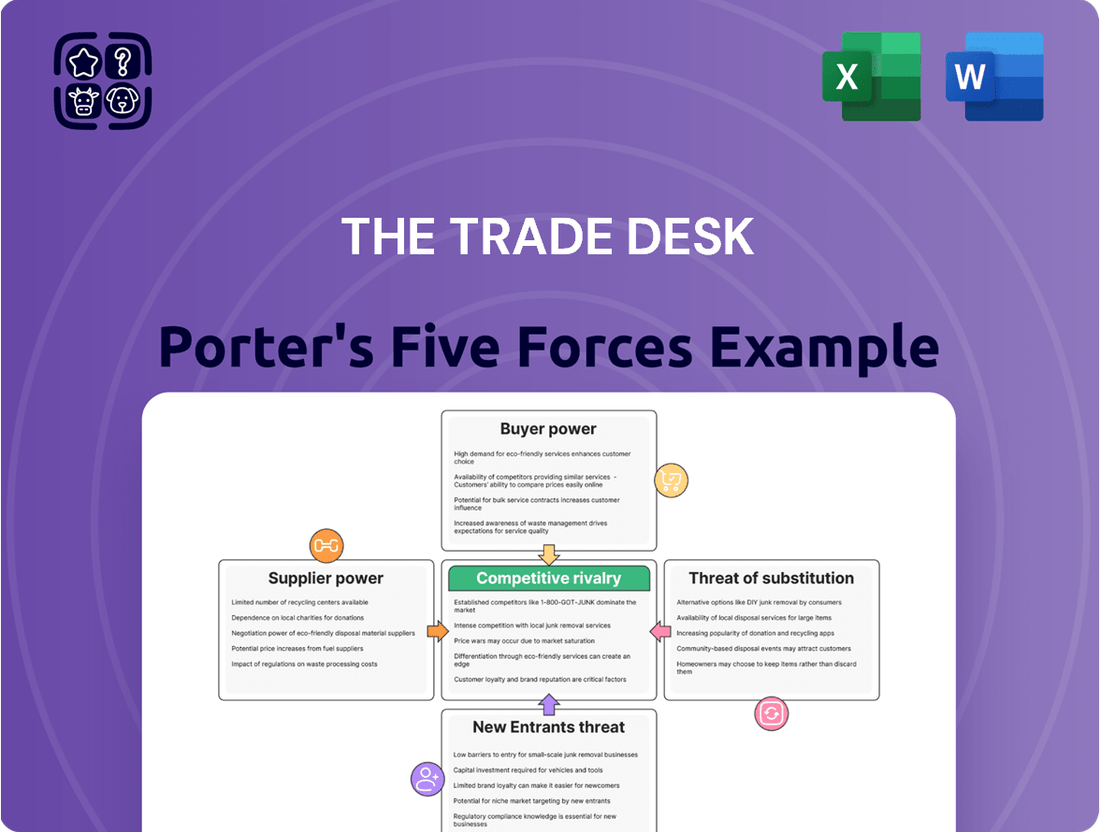

The Trade Desk operates in a dynamic digital advertising landscape, a key area to understand through Porter's Five Forces. Analyzing buyer power reveals how advertisers and agencies influence pricing and terms, while supplier power assesses the leverage held by data providers and media channels.

Furthermore, the threat of new entrants and the intensity of rivalry among existing players significantly shape market conditions for The Trade Desk. Understanding the threat of substitutes is also crucial, as alternative advertising methods could emerge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore The Trade Desk’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Trade Desk's reliance on data providers for audience insights and ad inventory from publishers and Supply-Side Platforms (SSPs) is a key factor in supplier power. The concentration and distinctiveness of these data sets or premium inventory sources can significantly impact this power dynamic.

However, strategic initiatives like the development of first-party data solutions and direct publisher integrations, such as OpenPath, are designed to diminish dependence on concentrated intermediaries. This move aims to create more direct relationships and potentially rebalance supplier leverage.

The Trade Desk, as a cloud-native platform, relies heavily on major cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. The bargaining power of these providers is substantial because The Trade Desk incurs high switching costs and requires highly specialized, globally distributed infrastructure to operate its ad-buying platform effectively.

These providers often have extensive proprietary technologies and economies of scale that make it challenging for companies like The Trade Desk to easily migrate. For instance, AWS reported revenue of $24.2 billion in Q1 2024, highlighting its massive scale and market dominance, which translates to significant leverage.

However, The Trade Desk can mitigate this supplier power by actively optimizing its cloud expenditure through efficient resource management and negotiating favorable terms. Furthermore, exploring multi-cloud strategies or even developing some level of hybrid infrastructure could provide alternative options, thereby reducing its dependence on any single provider.

The ad tech industry's reliance on highly specialized talent, especially in AI and machine learning, grants these experts considerable bargaining power. This scarcity directly influences labor costs and the pace of innovation for companies like The Trade Desk. As of early 2024, demand for AI and machine learning engineers continues to outstrip supply, with average salaries for these roles often exceeding $150,000 annually in major tech hubs.

The Trade Desk's strategic focus on attracting and retaining top engineering talent, evidenced by its significant investments in its Kokai platform, highlights its understanding of this dynamic. The ability to secure and develop these specialized skills is crucial for maintaining a competitive edge in developing sophisticated advertising solutions.

Payment Processors and Financial Services

The Trade Desk relies heavily on payment processors and financial services to manage the significant flow of ad spend. While essential, the bargaining power of individual payment processors is generally moderate due to the commoditized nature of many services and the presence of numerous alternative providers in the market. The Trade Desk, processing billions in ad spend, can leverage this competition to negotiate favorable terms.

However, the criticality of reliable and secure financial infrastructure means The Trade Desk must maintain strong relationships with its chosen partners. The overall market for payment processing services is substantial, with global transaction volumes expected to continue their upward trajectory. For instance, the digital payments market alone was valued at over $9 trillion in 2023 and is projected to grow significantly in the coming years, indicating a dynamic landscape where providers compete for large clients like The Trade Desk.

- Moderate Supplier Power: The presence of multiple payment processors and financial institutions limits the individual bargaining power of any single supplier.

- Critical Infrastructure Need: The Trade Desk's dependence on seamless financial transactions necessitates robust and reliable payment processing services, requiring careful vendor selection.

- Market Dynamics: The vast and growing global digital payments market, projected to reach over $15 trillion by 2027, offers The Trade Desk ample choice and negotiation leverage.

Measurement and Verification Partners

The Trade Desk relies on measurement and verification partners to validate ad performance, brand safety, and overall transparency. These partnerships are crucial for building trust with advertisers. For instance, in 2024, The Trade Desk continued to expand its partnerships with leading verification firms like DoubleVerify and Integral Ad Science, both of which provide essential independent auditing of ad placements and viewability.

While these partners offer indispensable services, their bargaining power is somewhat diluted. The Trade Desk, being a major player in the programmatic advertising space, has the ability to work with a range of these vendors. Furthermore, the industry's ongoing efforts to establish standardized measurement metrics and protocols can reduce the unique leverage any single partner might hold.

- Industry Push for Standardization: The development of industry-wide standards for viewability and brand safety, such as those promoted by the MRC (Media Rating Council), limits the ability of individual partners to dictate terms.

- Multiple Partner Options: The Trade Desk's ability to integrate with numerous reputable measurement and verification providers means no single partner has a monopolistic hold on these critical services.

- Data Validation Needs: While partners validate data, The Trade Desk's own sophisticated platform and data analytics capabilities also contribute to the overall assurance of ad effectiveness.

- Competitive Landscape: The competitive nature of the verification and measurement market itself tends to keep the bargaining power of individual suppliers in check.

The Trade Desk's reliance on cloud infrastructure providers like AWS, Azure, and Google Cloud presents a significant supplier bargaining power. These providers benefit from immense scale and specialized technology, making switching costs high for The Trade Desk. For example, AWS's Q1 2024 revenue of $24.2 billion underscores its market dominance.

However, The Trade Desk can mitigate this by optimizing cloud spending and exploring multi-cloud strategies. The ad tech industry's demand for specialized AI talent also grants these experts considerable bargaining power, with salaries often exceeding $150,000 annually in major tech hubs as of early 2024.

The Trade Desk's ability to attract and retain such talent, as seen with its Kokai platform, is crucial for competitive advantage.

| Supplier Category | Bargaining Power Level | Key Factors | Mitigation Strategies |

| Cloud Infrastructure Providers (AWS, Azure, Google Cloud) | High | Economies of scale, specialized technology, high switching costs | Cost optimization, multi-cloud exploration |

| Specialized Talent (AI/ML Engineers) | High | Scarcity of skills, high demand | Talent acquisition and retention programs |

| Data Providers | Moderate to High | Concentration of data sets, distinctiveness of inventory | First-party data development, direct publisher integrations (OpenPath) |

| Payment Processors | Moderate | Commoditized services, numerous alternatives | Leveraging competition, negotiating favorable terms |

| Measurement & Verification Partners | Moderate | Multiple vendor options, industry standardization efforts | Diversifying partnerships, leveraging internal analytics |

What is included in the product

This analysis deeply examines the competitive forces impacting The Trade Desk, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the company's strategic positioning within the digital advertising ecosystem.

Instantly identify and mitigate competitive threats by visualizing The Trade Desk's position across all five forces.

Empower strategic planning with a dynamic, data-driven view of industry pressures affecting The Trade Desk.

Customers Bargaining Power

The Trade Desk's main clients are advertising agencies and brands that use its self-service platform to buy digital ads. These customers, particularly major agencies handling significant advertising expenditures, wield considerable influence. For instance, in 2023, the global digital advertising market was valued at over $600 billion, highlighting the sheer scale of spending controlled by these entities.

This substantial spending power allows these customers to negotiate favorable terms, demand strong performance metrics, and even explore alternative demand-side platforms (DSPs). The ability to shift budgets based on results or cost-effectiveness directly impacts The Trade Desk's pricing strategies and the services it prioritizes. Agencies managing millions in ad spend can exert significant pressure for better rates or customized solutions.

While The Trade Desk works to integrate its platform deeply into client operations, some advertisers, especially smaller ones, might face minimal costs when shifting to an alternative demand-side platform (DSP). This ease of switching can amplify customer bargaining power, prompting The Trade Desk to consistently improve its offerings and maintain competitive pricing strategies.

Large brands and agencies are increasingly exploring bringing their programmatic ad buying in-house, essentially building their own demand-side platform (DSP) capabilities. This trend significantly enhances customer bargaining power because it offers a direct alternative to relying on third-party platforms like The Trade Desk. For instance, a 2024 survey indicated that 60% of major advertisers were either currently in-housing or actively evaluating the process.

Demand for Transparency and Performance

Customers in the programmatic advertising world are really pushing for more clarity. They want to know exactly where their money is going, how their ad campaigns are performing, and how their supply path is being optimized. This need for transparency gives them significant leverage.

This demand directly impacts demand-side platforms (DSPs) like The Trade Desk. When clients understand these metrics better, they can more effectively negotiate terms and push for better value. For instance, if a client sees their ad spend isn't translating into measurable results, they have the data to demand improvements or seek alternatives.

The Trade Desk, in 2024, has continued to emphasize its commitment to transparency and performance. Reports from industry analysts in late 2023 and early 2024 highlighted that advertisers are increasingly prioritizing platforms that offer detailed reporting on ad placement, audience reach, and conversion rates. This focus is a direct response to customer pressure.

- Increased Scrutiny on Ad Spend: Advertisers are demanding detailed breakdowns of where every dollar goes, from media costs to platform fees.

- Supply Path Optimization (SPO) Focus: Buyers want assurance that their ads are reaching the intended audience efficiently, with fewer intermediaries.

- Verifiable Performance Metrics: The emphasis is shifting from impressions to measurable outcomes like conversions, brand lift, and return on ad spend (ROAS).

- Data-Driven Negotiations: Customers use performance data to negotiate better rates and service level agreements.

Consolidation of Ad Spend

The advertising industry is seeing significant consolidation, meaning fewer, larger customers for platforms like The Trade Desk. For instance, major holding companies have been acquiring smaller agencies, and brands are increasingly consolidating their ad tech partners. This trend strengthens the bargaining power of these larger entities.

These consolidated customers represent a substantial portion of ad spend. In 2023, the top 10 global advertising holding groups accounted for a significant percentage of worldwide ad expenditure, giving them considerable leverage to negotiate pricing and terms. This concentration of buying power can pressure platforms to offer more favorable conditions.

- Fewer, Larger Clients: Consolidation in the agency world and brand partnerships creates fewer but more substantial clients.

- Increased Leverage: These larger clients command greater negotiation power due to the volume of business they bring.

- Volume-Based Discounts: A substantial portion of ad spend is concentrated, enabling these major players to seek volume-based concessions.

- Streamlined Vendor Relationships: Brands are reducing their vendor lists, further empowering the remaining partners.

The Trade Desk's customers, primarily large advertising agencies and brands, possess significant bargaining power due to their substantial ad spend. This allows them to negotiate favorable terms and demand performance transparency. For example, the global digital ad market exceeded $600 billion in 2023, underscoring the financial clout of these buyers.

Customers are increasingly seeking in-housing of programmatic advertising, creating a direct alternative to platforms like The Trade Desk. A 2024 survey found 60% of major advertisers were evaluating or implementing this strategy, directly increasing their leverage.

The demand for greater transparency in ad spend, supply path optimization, and verifiable performance metrics empowers customers to negotiate more effectively. The Trade Desk's 2024 focus on detailed reporting reflects this customer-driven need for clarity and accountability.

| Factor | Impact on The Trade Desk | Supporting Data (2023-2024) |

|---|---|---|

| Client Spending Power | High, enabling negotiation of terms and pricing. | Global digital ad market >$600 billion (2023). |

| In-Housing Trend | Increases client leverage by offering alternatives. | 60% of major advertisers evaluating/implementing in-housing (2024). |

| Demand for Transparency | Drives platform improvements and negotiation leverage. | Advertisers prioritize platforms with detailed performance reporting. |

What You See Is What You Get

The Trade Desk Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces analysis of The Trade Desk you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual document detailing the industry's competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This professionally written analysis is fully formatted and ready to use, providing actionable insights into The Trade Desk's market position.

Rivalry Among Competitors

The programmatic advertising landscape is intensely competitive, with major players like Google, through its Display & Video 360 (DV360), and Amazon posing significant challenges. These giants leverage their vast data ecosystems and market influence, creating a formidable competitive environment for independent platforms.

The Trade Desk differentiates itself by emphasizing its independence and objectivity as a demand-side platform (DSP). This allows it to offer a neutral stance, not tied to a specific media inventory or publisher, which is a key selling point for advertisers seeking unbiased reach.

Technological innovation is a critical battleground, and The Trade Desk invests heavily in this area. Initiatives like its Kokai operating system aim to enhance data processing and platform efficiency, while OpenPath seeks to create more direct relationships between buyers and sellers, cutting out intermediaries.

In 2023, the global programmatic advertising market was valued at approximately $120 billion, with significant growth projected. The Trade Desk's revenue for the full year 2023 reached $1.97 billion, demonstrating its ability to capture market share despite the presence of tech behemoths.

The digital advertising market, and programmatic advertising in particular, is booming. Global ad spend is expected to hit $843.48 billion by 2025, with programmatic taking a substantial slice. This rapid expansion naturally intensifies competition as companies battle for their piece of the growing market.

The competitive landscape for The Trade Desk is intensely shaped by relentless innovation in features, targeting precision, and platform efficiency. Companies constantly strive to outdo each other by offering superior advertising solutions.

The Trade Desk actively combats this rivalry by pouring resources into cutting-edge AI tools, enhancing its Connected TV (CTV) capabilities, and developing robust identity solutions like Unified ID 2.0. These investments are vital for staying ahead and drawing in clients.

For instance, in 2023, The Trade Desk reported significant growth, with revenue reaching $1.97 billion, up 21% year-over-year, demonstrating the market's demand for its differentiated offerings and technological advancements.

Pricing Pressure and Margins

The Trade Desk operates in a highly competitive digital advertising space, which inevitably leads to pricing pressure. This pressure directly impacts the profit margins of Demand-Side Platforms (DSPs) like The Trade Desk. Advertisers are increasingly scrutinizing their spending, prioritizing cost-efficiency and a demonstrable return on ad spend (ROAS). Consequently, DSPs must find a delicate balance between offering attractive pricing to win business and ensuring their own profitability.

This dynamic means that maintaining healthy margins requires continuous innovation and operational efficiency. The Trade Desk, for instance, must justify its value proposition beyond just price, focusing on superior targeting capabilities, data analytics, and campaign performance. In 2024, the digital ad market continued its robust growth, with global ad spending projected to reach over $1 trillion, according to various industry reports. However, within this growth, the demand for measurable results intensifies competition, forcing all players to optimize their pricing strategies.

- Intensified Competition: The programmatic advertising ecosystem features numerous DSPs, leading to fierce competition for advertiser budgets.

- Advertiser Focus on ROAS: Marketers are more data-driven than ever, demanding clear proof of campaign effectiveness and efficient spend.

- Margin Squeeze: The need to offer competitive rates can compress profit margins if operational costs are not managed effectively.

- Value-Added Services: The Trade Desk differentiates itself by offering advanced analytics, AI-driven optimization, and premium inventory access, which helps command better pricing.

Regulatory Scrutiny and Market Shifts

Regulatory actions, like the ongoing antitrust investigations into Google's ad practices, are significantly altering the digital advertising landscape. These probes, which intensified throughout 2024, aim to address concerns over market dominance, potentially leveling the playing field for independent demand-side platforms (DSPs) such as The Trade Desk. Such scrutiny can lead to structural changes or behavioral remedies that reduce the incumbent's advantages.

The impact of this regulatory pressure creates new strategic opportunities and influences market dynamics. By potentially curtailing the dominance of integrated players, these investigations could foster a more competitive environment, allowing The Trade Desk to attract clients seeking alternatives to walled-garden ecosystems. This shift is crucial for companies prioritizing transparency and independent data utilization.

- Antitrust investigations into major tech players, including Google’s ad tech business, were a significant focus in 2024, aiming to address market concentration.

- These regulatory actions have the potential to create a more equitable market, benefiting independent DSPs like The Trade Desk.

- The ongoing scrutiny influences strategic planning and market entry for all participants in the digital advertising ecosystem.

The competitive rivalry in the programmatic advertising space is fierce, driven by a handful of dominant tech giants and a multitude of smaller players all vying for advertiser spend. The Trade Desk, as an independent DSP, navigates this landscape by focusing on its technological edge and neutrality. For instance, the global programmatic advertising market was projected to reach over $120 billion in 2023, highlighting the immense opportunity but also the intense competition for market share. The Trade Desk's commitment to innovation, particularly in areas like Connected TV (CTV) and its Unified ID 2.0 initiative, aims to provide a superior value proposition that differentiates it from competitors.

| Competitor | Key Differentiators | 2023 Revenue (Est. Billions) |

|---|---|---|

| Google (DV360) | Vast data ecosystem, integration with Google's ad stack | N/A (Part of Alphabet) |

| Amazon DSP | Access to Amazon's first-party data, retail media integration | N/A (Part of Amazon) |

| The Trade Desk | Independence, advanced analytics, CTV leadership, Unified ID 2.0 | $1.97 |

| X (formerly Twitter) | Social media platform, direct audience engagement | N/A (Private) |

SSubstitutes Threaten

Advertisers have the option to bypass Demand-Side Platforms (DSPs) like The Trade Desk by directly negotiating ad space with publishers. This direct approach can offer more granular control over placements and pricing. However, it often sacrifices the significant advantages of programmatic advertising, such as broad reach and sophisticated targeting capabilities.

For instance, while a direct deal might seem appealing for a niche campaign, it typically lacks the automated bidding, real-time optimization, and access to aggregated data that DSPs leverage to maximize campaign performance and efficiency. In 2024, the programmatic advertising market continued its robust growth, exceeding hundreds of billions globally, highlighting the ongoing preference for automated solutions over manual negotiations for most advertisers seeking scale and effectiveness.

Large platforms like Meta and Google, often referred to as 'walled gardens', present a significant threat of substitutes for The Trade Desk. These giants offer advertisers direct access to vast audiences within their integrated ecosystems, bypassing open programmatic channels.

Advertisers are drawn to these platforms for their extensive reach and the wealth of proprietary data they hold, allowing for highly targeted campaigns. For instance, in 2023, Meta's advertising revenue reached approximately $134.9 billion, demonstrating the immense scale and advertiser commitment to these closed systems.

Google's advertising revenue for 2023 was even larger, exceeding $237.8 billion, underscoring the dominance of these integrated advertising environments. This direct-buy alternative competes directly with The Trade Desk's offerings in the programmatic space.

The perceived simplicity and established user base of these walled gardens can make them a compelling substitute, especially for advertisers less focused on the granular control and data transparency offered by programmatic solutions.

While digital advertising, especially programmatic, is The Trade Desk's core, traditional channels like linear TV and print remain viable substitutes for advertisers. However, these legacy mediums struggle to match the granular targeting and performance analytics that digital platforms offer. For instance, in 2024, while digital ad spend continues to surge, traditional media, though still significant, faces challenges in demonstrating direct ROI compared to programmatic campaigns.

Marketing Automation and CRM Systems

While not direct replacements for purchasing ad inventory, sophisticated marketing automation and CRM systems pose a threat by enabling brands to manage customer interactions and personalization in-house. These platforms, such as HubSpot or Salesforce Marketing Cloud, can reduce reliance on external ad tech for certain engagement objectives. For instance, in 2024, the marketing automation market was valued at over $6.4 billion, indicating significant investment in these capabilities.

These integrated solutions allow companies to nurture leads, segment audiences, and deliver tailored messaging across various channels, potentially diminishing the perceived necessity of programmatic advertising for some customer lifecycle stages. This trend is further amplified as these platforms increasingly incorporate AI-driven personalization features.

- Marketing Automation & CRM Value: The global marketing automation market reached over $6.4 billion in 2024.

- In-house Capabilities: These systems allow for direct customer communication and personalization, reducing external platform dependence.

- Reduced Ad Spend Need: Certain customer engagement strategies can be managed without dedicated ad buying platforms.

- AI Integration: The increasing use of AI in these platforms enhances their ability to deliver personalized customer experiences.

In-House Media Buying Teams

Brands building their own in-house media buying teams, equipped with proprietary technology and data management, present a significant threat of substitution for Demand-Side Platforms (DSPs) like The Trade Desk. This trend directly challenges the need for outsourcing ad campaign management. For instance, major advertisers like Procter & Gamble have invested heavily in internal capabilities, aiming for enhanced control over their media spend and a deeper understanding of their customer data.

This shift is fueled by a desire for greater control over data ownership and campaign execution. Companies are increasingly looking to leverage their first-party data more effectively, which can be challenging when relying solely on external DSPs. The ability to directly manage and analyze campaign performance internally offers a potential cost-saving and strategic advantage.

- In-house teams reduce reliance on third-party DSPs for campaign management.

- Brands seek greater control over their proprietary data and its utilization.

- This trend is driven by a desire for enhanced campaign performance and cost efficiency.

- Companies like P&G have publicly stated their commitment to building internal media capabilities.

The threat of substitutes for The Trade Desk centers on alternative ways advertisers can reach audiences. Direct deals with publishers offer more control but lack programmatic efficiencies. For example, in 2024, while programmatic spending continued to grow, direct negotiations still exist for specific needs.

Large, integrated platforms like Google and Meta act as significant substitutes. Their vast user bases and proprietary data allow for highly targeted campaigns within their ecosystems, bypassing open exchanges. Meta's advertising revenue reached approximately $134.9 billion in 2023, while Google's exceeded $237.8 billion in the same year, highlighting their dominance.

While traditional media like TV and print are substitutes, they can't match digital's targeting and analytics. Marketing automation and CRM systems also pose a threat by enabling in-house customer engagement, reducing reliance on ad platforms for certain functions. The marketing automation market alone was valued at over $6.4 billion in 2024.

Furthermore, brands building in-house media buying teams, like Procter & Gamble, aim for greater control over data and execution, directly challenging the need for external DSPs. This trend is driven by a desire for enhanced campaign performance and cost efficiency.

| Threat Category | Examples | Key Characteristics | 2023/2024 Data Point |

| Direct Publisher Deals | Negotiating ad space directly with websites/apps | Granular control, potentially less reach/targeting | Programmatic market continued robust global growth in 2024 |

| Walled Gardens | Meta, Google | Vast audiences, proprietary data, integrated ecosystems | Meta Ad Revenue (2023): ~$134.9 billion Google Ad Revenue (2023): ~$237.8 billion |

| Traditional Media | Linear TV, Print | Broad reach, limited targeting/analytics | Digital ad spend surged in 2024, impacting traditional media ROI |

| In-house Capabilities | Marketing Automation/CRM, Internal Media Teams | Enhanced data control, direct customer engagement | Marketing Automation Market (2024): >$6.4 billion |

Entrants Threaten

Developing a sophisticated, global Demand-Side Platform (DSP) comparable to The Trade Desk's requires immense capital. Significant investments are needed for cutting-edge technology infrastructure, securing vital data partnerships, and attracting top-tier engineering and data science talent. For instance, The Trade Desk's ongoing investment in its open internet platform, including AI and data capabilities, represents a substantial ongoing commitment. This financial and technical hurdle naturally deters many potential new players from entering the market.

Established demand-side platforms (DSPs) like The Trade Desk benefit significantly from powerful network effects. More advertisers using a platform lead to better publisher inventory, which in turn attracts more advertisers due to improved targeting capabilities. This creates a self-reinforcing cycle that is difficult for newcomers to break into.

New entrants face substantial hurdles in replicating this established ecosystem. They struggle to accumulate the critical mass of both advertiser demand and publisher inventory necessary to compete effectively. For instance, The Trade Desk reported its Unified ID 2.0 initiative gaining traction with over 50 partners in early 2024, demonstrating the network effect in action by building a shared identity solution.

The evolving landscape of data privacy regulations, such as the EU's GDPR and California's CCPA, presents a formidable barrier for new entrants. These complex legal frameworks require significant investment in compliance infrastructure and specialized legal counsel. For instance, the Digital Markets Act (DMA) in Europe is reshaping how digital platforms operate, adding another layer of complexity.

Furthermore, the ongoing deprecation of third-party cookies necessitates the development of sophisticated, privacy-compliant identity solutions. Building and scaling these solutions demands deep technical expertise and considerable financial resources, making it challenging for newcomers to compete with established players who have already invested in these areas.

Client Relationships and Trust

The barrier to entry for new competitors is significantly elevated by the ingrained nature of client relationships and the deep trust advertisers place in The Trade Desk. Building this level of confidence requires a consistent history of delivering results and maintaining absolute transparency, which is a considerable hurdle for any newcomer.

New entrants would struggle to pry business away from an incumbent with a remarkable 95% customer retention rate, as reported by The Trade Desk. This demonstrates the loyalty and satisfaction enjoyed by existing clients, making it difficult for new platforms to gain a foothold.

- High Customer Retention: The Trade Desk's 95% customer retention underscores the difficulty new entrants face in attracting and keeping clients.

- Time and Trust Investment: Establishing trust and strong relationships with advertising agencies and brands is a time-consuming process.

- Proven Performance: New entrants must demonstrate a superior track record of performance and transparency to even begin competing.

- Incumbency Advantage: The established reputation and existing partnerships of The Trade Desk create a powerful advantage against potential new players.

Scalability and Global Reach

For a new Demand-Side Platform (DSP) to challenge established players like The Trade Desk, achieving global reach across numerous ad formats and devices is paramount. This requires substantial investment in infrastructure and partnerships.

The sheer complexity and cost associated with building out this global network and integrating with a vast array of inventory and data providers worldwide present a formidable hurdle for any new entrant. Startups often lack the capital and established relationships necessary to replicate this extensive reach quickly.

Consider the significant upfront investment required. Building out data centers, establishing legal entities in multiple countries, and securing direct integrations with publishers globally are capital-intensive endeavors. For instance, major DSPs have spent years and billions of dollars cultivating these networks.

- Global Reach Requirement: New DSPs must offer access to diverse ad inventory across multiple formats and devices worldwide to compete.

- Scalability Challenge: Achieving the necessary scale to serve global campaigns efficiently is a significant technical and operational hurdle.

- Integration Complexity: Integrating with thousands of global publishers, data providers, and ad exchanges demands extensive resources and expertise.

- Capital Investment: The substantial financial outlay for infrastructure, partnerships, and talent makes market entry extremely difficult for startups.

New entrants face substantial barriers due to the massive capital required for technology, data partnerships, and talent, alongside the difficulty of replicating established network effects and deep client trust. The Trade Desk's 95% customer retention rate highlights the loyalty it commands. Furthermore, navigating complex data privacy regulations like GDPR and CCPA, and developing privacy-compliant identity solutions after cookie deprecation, demand significant investment and expertise, making market entry exceptionally challenging.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for The Trade Desk is built upon a robust foundation of data, including industry-specific market research reports, financial filings from public companies, and proprietary data from leading ad tech analytics firms. This blend ensures a comprehensive understanding of competitive pressures, supplier relationships, buyer leverage, and potential new entrants within the digital advertising ecosystem.