The Trade Desk Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Trade Desk Bundle

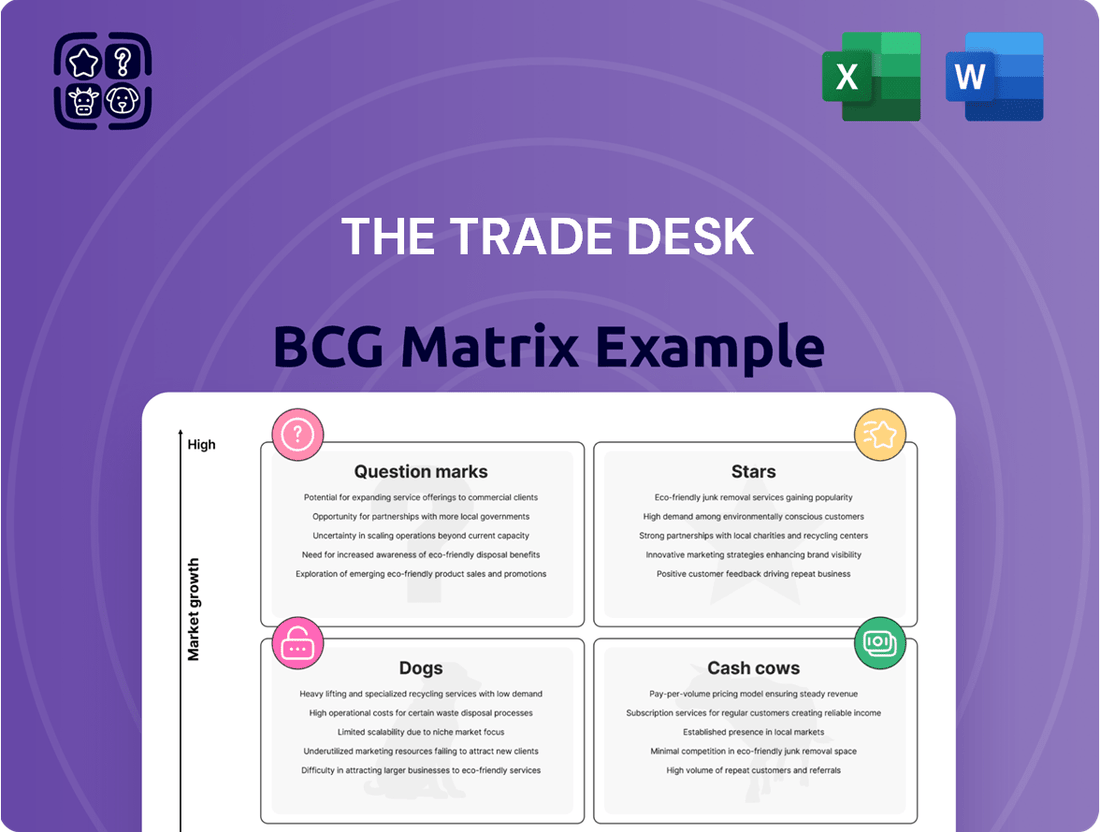

Curious about how The Trade Desk's diverse product portfolio stacks up? Our BCG Matrix analysis offers a strategic snapshot, revealing which offerings are market leaders (Stars), steady revenue generators (Cash Cows), resource drains (Dogs), or potential growth opportunities (Question Marks).

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for The Trade Desk.

Stars

The Trade Desk's dominance in Connected TV (CTV) advertising stands as a major catalyst for its growth. CTV consistently emerges as their most significant and rapidly expanding segment, underscoring its crucial role in the company's success. This leadership position allows The Trade Desk to effectively leverage the significant migration from traditional linear television to streaming platforms.

The company's strategic foresight places it advantageously to capture a substantial share of the vast global advertising market, estimated to be around $1 trillion. Their commitment to this burgeoning sector is evident in their considerable investments, particularly in the technology infrastructure, sales teams, and customer support personnel specifically focused on advancing their CTV advertising capabilities and offerings.

The Trade Desk's core self-service, cloud-based platform for programmatic ad buying across the open internet is a clear leader, fitting squarely into the high-growth, high-market-share category. This segment is experiencing significant expansion, with the global programmatic advertising market expected to reach $133.6 billion in 2024, demonstrating its robust trajectory. TTD's platform provides advertisers with sophisticated tools to manage data-driven campaigns efficiently across a multitude of ad formats, from display to connected TV.

The Trade Desk's Kokai platform is a shining star in its business portfolio. Its rapid adoption rate, with two-thirds of clients already on board, underscores the platform's value.

This next-generation AI technology is delivering tangible results, showing significant improvements in advertising efficiency. Specifically, clients are seeing reduced costs per conversion and acquisition, a clear indicator of its effectiveness.

The company anticipates full client adoption of Kokai by the end of 2025. This widespread integration is expected to further cement The Trade Desk's market leadership, driven by Kokai's advanced optimization capabilities.

Unified ID 2.0 (UID2) Initiative

Unified ID 2.0 (UID2) is a significant player in the evolving digital advertising landscape, developed by The Trade Desk to offer a privacy-conscious alternative to third-party cookies. Its purpose is to maintain the effectiveness of advertising while respecting user privacy. The rapid expansion of its adoption across major streaming services and publishers clearly marks it as a star within The Trade Desk's BCG Matrix.

UID2's strength lies in its ability to provide a privacy-compliant method for audience targeting across the open internet, a critical need as cookie deprecation accelerates. By the end of 2023, over 100 major publishers and 20 leading DSPs had adopted UID2, demonstrating substantial market traction. This widespread acceptance positions UID2 as a key growth driver for The Trade Desk.

- Market Adoption: Over 100 publishers and 20 DSPs integrated UID2 by the close of 2023.

- Industry Support: Major streaming services are also embracing UID2 for audience identification.

- Privacy Compliance: It offers a privacy-enhancing solution in a cookie-less future.

- Growth Potential: Its increasing adoption fuels its position as a star in the BCG Matrix.

Strategic Partnerships and Publisher Integrations

The Trade Desk actively cultivates strategic partnerships to solidify its position in the digital advertising landscape. Collaborations with entities like Warner Bros. Discovery and The Guardian are key examples, offering advertisers access to premium, direct inventory.

The recent integration with HOY for OpenPath is another significant move, further streamlining the supply path for advertisers. These publisher integrations are vital for The Trade Desk's growth, ensuring transparency and quality inventory access, which is increasingly important in the complex digital ad ecosystem.

- Warner Bros. Discovery Partnership: Provides access to premium video inventory.

- The Guardian Integration: Enhances access to high-quality journalistic content.

- HOY for OpenPath: Aims to improve supply path transparency and efficiency.

- Market Share Growth: These partnerships directly contribute to expanding The Trade Desk's reach and advertiser value proposition.

The Trade Desk's Kokai platform is a definite star, showing impressive client adoption with two-thirds already on board. This next-gen AI technology is boosting ad efficiency, leading to lower costs per conversion for clients. Full adoption is expected by the end of 2025, which will further solidify The Trade Desk's market leadership through Kokai's advanced optimization capabilities.

Unified ID 2.0 (UID2) is another star, offering a privacy-friendly alternative to cookies. Its rapid expansion across streaming services and publishers highlights its critical role in the evolving digital ad space. By the close of 2023, over 100 major publishers and 20 leading DSPs had integrated UID2, demonstrating its significant market traction and growth potential.

| Key Initiatives | BCG Category | Rationale | Key Data/Milestones |

| Kokai Platform | Star | Next-generation AI technology driving significant improvements in advertising efficiency and client ROI. | Two-thirds of clients already adopted; full adoption anticipated by end of 2025. |

| Unified ID 2.0 (UID2) | Star | Privacy-conscious identity solution positioned to replace third-party cookies, ensuring continued ad effectiveness. | Over 100 publishers and 20 DSPs integrated by end of 2023; growing adoption across major streaming services. |

What is included in the product

Analyzes The Trade Desk's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

Offers strategic guidance on resource allocation, highlighting which Trade Desk units to invest in, hold, or divest for optimal performance.

The Trade Desk BCG Matrix offers a clear, visual overview of business unit performance, alleviating the pain point of strategic uncertainty.

Cash Cows

The Trade Desk's core self-service DSP platform is a powerhouse, acting as a significant cash cow within the company's portfolio. It consistently delivers strong profit margins and robust cash flow, a testament to its established position in the digital advertising market. This platform, essential for agencies and brands managing their ad campaigns, benefits from streamlined operations and a highly scalable infrastructure, allowing it to handle significant volume efficiently.

While the digital advertising landscape is always evolving, this foundational DSP remains a bedrock of profitability for The Trade Desk. Its stability and efficiency mean it continues to be a reliable source of income, even as newer technologies emerge. For example, in 2023, The Trade Desk reported total revenue of $1.96 billion, with its core DSP services being the primary driver of this success.

The Trade Desk boasts a remarkable customer retention rate, consistently exceeding 95% for the last eleven years. This high level of loyalty signifies the deep value and integration of its advertising platform within client operations.

This sticky customer base provides a highly predictable and stable revenue foundation, allowing The Trade Desk to effectively 'milk' these existing relationships. Consequently, the company can allocate fewer resources to costly new customer acquisition, prioritizing investment in product development and innovation.

The Trade Desk's proprietary bid-factor-based architecture is a significant technological asset, enabling highly granular programmatic bidding. This sophisticated system allows advertisers to optimize their return on investment by making precise decisions at scale, directly contributing to The Trade Desk's robust gross profit margins.

This established technology functions as a cash cow by ensuring efficient and profitable transactions within the programmatic advertising ecosystem. For instance, in Q1 2024, The Trade Desk reported a gross profit margin of 63.6%, a testament to the effectiveness of its underlying technology in driving profitable ad spend for its clients.

Established Global Presence and Market Leadership

The Trade Desk's established global presence and market leadership firmly place it as a cash cow within the Boston Consulting Group (BCG) matrix. Its position as a leading technology platform for ad buyers, processing substantial overall revenue and gross advertising spend, indicates a robust market share in the programmatic advertising industry. This dominance enables significant economies of scale and strong brand recognition, translating into consistent profitability even within more mature digital advertising segments.

The company's ability to generate consistent profits is underpinned by several key factors:

- Market Share: As of the first quarter of 2024, The Trade Desk reported over $400 million in quarterly revenue, demonstrating its significant penetration in the programmatic advertising space.

- Economies of Scale: Its large operational footprint and extensive client base allow for cost efficiencies in technology development and data management, enhancing profit margins.

- Brand Recognition: The Trade Desk is widely recognized by advertisers and agencies, fostering trust and a preference for its platform, which contributes to sustained demand.

- Profitability: The company consistently reports strong EBITDA margins, often exceeding 30%, highlighting its ability to convert revenue into operating profit.

Robust Financial Health and Profitability

The Trade Desk's robust financial health and consistent profitability firmly establish it as a cash cow within the BCG matrix. In 2024, the company showcased impressive adjusted EBITDA margins, reflecting its operational efficiency and pricing power in the digital advertising space. This strong profitability translates directly into significant free cash flow generation, providing a stable financial foundation.

The Trade Desk has adeptly navigated market dynamics and made strategic investments while simultaneously maintaining high margins. For instance, its ability to scale its platform and services has not come at the expense of profitability, a testament to its effective business model. This financial stability allows the company to confidently fund new growth initiatives and deliver value back to its shareholders through various mechanisms.

- Consistent Profitability: Demonstrated by strong adjusted EBITDA margins throughout 2024, indicating efficient operations and pricing power.

- Significant Free Cash Flow: The company's ability to generate substantial free cash flow in 2024 underscores its financial strength and operational effectiveness.

- Margin Maintenance: The Trade Desk has successfully maintained high margins even while scaling its business and investing in future growth.

- Financial Stability: This financial resilience enables funding for innovation and shareholder returns, solidifying its cash cow status.

The Trade Desk's core self-service DSP platform is a major cash cow, consistently generating substantial profits and cash flow. Its established market position and efficient, scalable infrastructure enable it to handle high volumes of advertising spend effectively.

This stable revenue stream is supported by exceptional customer loyalty, with retention rates consistently above 95%, allowing the company to focus resources on innovation rather than costly new client acquisition.

The Trade Desk's advanced technology, including its proprietary bid-factor-based architecture, drives profitable transactions and contributes to strong gross profit margins, as evidenced by a 63.6% gross profit margin in Q1 2024.

This robust financial performance, characterized by strong adjusted EBITDA margins and significant free cash flow generation in 2024, solidifies its status as a cash cow within the BCG matrix.

| Metric | 2023 Value | Q1 2024 Value |

|---|---|---|

| Total Revenue | $1.96 Billion | $400+ Million (Quarterly) |

| Gross Profit Margin | ~63% (Typical) | 63.6% |

| Adjusted EBITDA Margin | >30% (Typical) | Strongly Positive |

| Customer Retention | >95% (11 Years Running) | N/A |

What You’re Viewing Is Included

The Trade Desk BCG Matrix

The BCG Matrix analysis you are previewing is the identical, fully-formatted document you will receive immediately after purchase. This comprehensive report, crafted by industry experts, is designed to provide actionable insights into The Trade Desk's product portfolio, allowing for strategic decision-making without any alterations or missing sections.

Dogs

The Trade Desk's Q4 2024 performance was impacted by execution missteps, leading to a revenue miss. These weren't tied to a single product but rather internal operational challenges. For instance, the company reported a revenue of $493 million for Q4 2024, falling short of analyst expectations.

These operational inefficiencies, stemming from a complex reporting structure, resulted in temporary underperformance across various business segments. While specific segments weren't detailed as being in the 'question mark' quadrant of a BCG matrix, these areas essentially acted as drags on overall growth. Resources were consumed in these areas without generating the anticipated returns during that period.

Legacy client segments exhibiting slow adoption of The Trade Desk's Kokai platform are demonstrating characteristics of a 'dog' in the BCG Matrix. These established client groups, often accustomed to older operational processes, are showing a reluctance to fully integrate Kokai, leading to a less efficient or stagnant growth trajectory for these segments.

The Trade Desk's 2023 annual report indicated that while overall platform growth remained strong, specific legacy segments required more intensive resources for integration support. This suggests that while these segments still contribute revenue, their potential for future high growth is limited, and the investment needed for their transition may not yield proportionate returns.

Agency feedback in early 2024 highlighted that some larger, more traditional agencies are prioritizing existing, less advanced workflows over the immediate adoption of Kokai. This inertia is a key factor in classifying these segments as dogs, as they are not capitalizing on the enhanced capabilities and potential efficiencies Kokai offers.

For example, while The Trade Desk reported a 20% year-over-year increase in overall platform revenue in Q4 2023, the growth within these specific legacy segments was notably lower, estimated to be in the single digits, underscoring their 'dog' status.

Within The Trade Desk's portfolio, niche or commoditized display advertising inventory would likely fall into the 'dogs' category of the BCG Matrix. These are segments where The Trade Desk might have a small market presence or where competition from low-cost providers is exceptionally fierce, limiting growth potential.

For example, consider very specific, low-demand placements within older web formats that have little strategic value. In 2024, while programmatic display advertising reached an estimated $200 billion globally, these niche areas represent a fraction of that and offer minimal differentiation or pricing power.

These 'dog' segments are characterized by low margins and require substantial investment to gain any meaningful traction, making them unattractive for further resource allocation. The Trade Desk's strategic emphasis remains on high-quality, data-driven inventory where it can command premium pricing and drive significant client outcomes.

De-emphasized traditional agency relationships

The Trade Desk's strategic pivot towards cultivating direct relationships with major brands, particularly Fortune 100 companies, suggests a potential recalibration of its focus. This emphasis on larger, high-value clients might mean a reduced emphasis on certain traditional agency partnerships or the mid-market segment.

This strategic realignment could result in a slower growth trajectory and a diminished relative market share within these less-prioritized client tiers. Consequently, these segments could be viewed as 'dogs' within The Trade Desk's evolving business portfolio, reflecting their current strategic positioning.

- Focus on Fortune 100 clients: The Trade Desk reported that its top 100 clients represented over 70% of its revenue in 2023, highlighting the significance of large enterprise relationships.

- Direct Brand Relationships: By prioritizing direct engagement, The Trade Desk aims to build deeper partnerships and offer more tailored programmatic advertising solutions.

- Mid-market Segment Potential: While not explicitly stated as a 'dog,' a de-emphasis on mid-market clients would naturally lead to lower growth and market share in that specific area.

- Agency Model Evolution: The shift implies a move away from solely relying on traditional agency models, favoring direct access to brands for greater control and efficiency.

Underperforming international ventures or non-strategic partnerships

Underperforming international ventures or non-strategic partnerships fall into the 'dog' quadrant of The Trade Desk's BCG Matrix. These are typically nascent international markets where the company's investment is minimal, local competition is intense, or programmatic advertising adoption is sluggish. For instance, while The Trade Desk has a significant presence in North America and Europe, smaller emerging markets might represent these 'dog' assets if they aren't generating substantial revenue or showing clear growth potential.

Similarly, past collaborations or alliances that did not deliver the anticipated strategic value or revenue growth would also be classified here. These partnerships might continue to consume resources, such as management attention or integration costs, without contributing meaningfully to The Trade Desk's overall performance. Identifying and managing these 'dog' assets is crucial for optimizing resource allocation and focusing on high-potential growth areas.

- Nascent Markets: Areas with low programmatic penetration and high local competition, such as certain smaller African or Southeast Asian markets, could be considered 'dogs' if The Trade Desk's investment and market share are minimal.

- Underperforming Partnerships: Past joint ventures or strategic alliances that failed to achieve projected user acquisition or revenue targets, thereby providing low returns on invested capital.

- Resource Drain: These ventures or partnerships often tie up capital and management bandwidth that could be better deployed in more promising segments of the business.

Segments within The Trade Desk's portfolio that are characterized by low growth and low market share, such as niche display inventory or underperforming international ventures, are considered 'dogs' in the BCG Matrix. These areas consume resources without generating significant returns, often due to intense competition or slow adoption rates. The company's strategic focus on high-value clients and advanced platforms like Kokai indicates a move away from these less promising segments.

For example, legacy client segments with slow Kokai adoption and specific commoditized display inventory are examples of 'dogs'. These segments, while contributing to overall revenue, exhibit limited future growth potential and require disproportionate investment for their transition or maintenance. The Trade Desk's 2023 revenue from its top 100 clients exceeded 70%, underscoring a strategic emphasis on high-growth, high-value relationships over these slower-moving segments.

Question Marks

The planned launch of Ventura, The Trade Desk's new streaming TV operating system in late 2025, is a significant question mark within their business portfolio. This ambitious initiative aims to directly challenge established players like Roku and Amazon by offering a transparent and neutral ad-centric OS. Success in this venture is currently unproven, demanding substantial investment to capture market share in the highly competitive and fragmented Connected TV operating system market.

The OpenPath initiative, The Trade Desk's streamlined connection to premium publishers on the open internet, is positioned as a star in the BCG matrix, exhibiting high growth and a developing market share. Its direct approach simplifies access, attracting major publishers and indicating strong future potential.

While OpenPath is gaining significant traction, particularly with large publishers, widespread adoption across the entire ecosystem is still in its nascent stages. This means its market share, though growing, is not yet dominant, reflecting the ongoing efforts to solidify its position.

Continued investment is crucial for OpenPath to overcome challenges like the perception of an additional cost for publishers, which could hinder broader participation. Successfully navigating these publisher concerns will be key to unlocking its full market impact and solidifying its star status.

The acquisition of Sincera in early 2025 is a strategic move by The Trade Desk to enhance its data capabilities. This integration is intended to bolster the company's data signals and improve campaign optimization, a crucial aspect in the digital advertising landscape.

Currently, Sincera does not generate direct revenue for The Trade Desk, presenting an inherent question mark regarding its future market share and financial impact. The success of this acquisition hinges entirely on how effectively Sincera's data is integrated and leveraged within The Trade Desk's platform.

For instance, The Trade Desk reported a 20% year-over-year increase in revenue for Q1 2024, reaching $395.5 million. The ability to further monetize this growth through enhanced data offerings from Sincera will be key to offsetting the initial investment and proving its strategic value.

Deal Desk Application

Deal Desk, launched by The Trade Desk in June 2025, is a new application focused on improving the tracking and comprehension of digital advertising deal performance, especially within private marketplace transactions.

This innovative application is currently in its early stages of market entry and user adoption, positioning it as a high-growth opportunity with a relatively low current market share.

- Deal Desk Application: A new tool from The Trade Desk for analyzing private marketplace ad deals.

- Launch Date: Announced in June 2025.

- Market Position: Nascent stages, high growth potential, low market share.

- Objective: Enhance understanding and management of digital advertising deal performance.

Deepening Penetration in Emerging International Markets

The Trade Desk's strategic focus on emerging international markets, particularly in Asia-Pacific, positions these regions as question marks within its BCG Matrix. The company is actively working to expand its footprint in these high-growth areas, recognizing their substantial untapped advertising potential.

For instance, The Trade Desk reported a notable 35% revenue growth from the Asia-Pacific region in 2024, underscoring the significant opportunity. However, the company is still in the process of solidifying its market share and adapting its sophisticated programmatic advertising platform to the unique characteristics and competitive landscapes of these diverse markets.

- Asia-Pacific revenue growth: 35% in 2024.

- Market position: Building share in a competitive environment.

- Strategic focus: Deepening penetration and platform localization.

- Potential: High untapped advertising spend and digital adoption.

The Trade Desk's Ventura operating system for streaming TV, slated for a late 2025 launch, represents a significant question mark. It aims to disrupt the CTV OS market, but faces intense competition from established players, demanding substantial investment to gain traction.

The acquisition of Sincera in early 2025 is another question mark, as its immediate revenue generation is nil. Its success hinges on effectively integrating Sincera's data to boost campaign optimization and further monetize The Trade Desk's revenue growth, which saw a 20% increase to $395.5 million in Q1 2024.

Emerging international markets, particularly in Asia-Pacific, are also question marks. While the region showed a strong 35% revenue growth in 2024, The Trade Desk is still building market share and adapting its platform to local nuances.

| Initiative/Market | BCG Category | Current Status | Key Considerations |

|---|---|---|---|

| Ventura (CTV OS) | Question Mark | Pre-launch (late 2025) | High competition, significant investment needed for market penetration. |

| Sincera Acquisition | Question Mark | Post-acquisition (early 2025), no direct revenue yet | Success depends on data integration for campaign optimization; Q1 2024 revenue grew 20% to $395.5M. |

| Asia-Pacific Markets | Question Mark | Expanding presence, building share | 35% revenue growth in 2024, but requires localization and faces competitive landscape. |

BCG Matrix Data Sources

Our Trade Desk BCG Matrix leverages robust data from public company filings, investor reports, and detailed market research to accurately assess product portfolio performance.