Phoenix Group Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Phoenix Group Holdings Bundle

The Phoenix Group Holdings boasts significant strengths, particularly in its diversified product portfolio and established brand reputation. However, like any dynamic entity, it faces potential threats from evolving market regulations and intense industry competition. Understanding these internal capabilities and external pressures is crucial for strategic decision-making.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Phoenix Group Holdings is the UK's largest long-term savings and retirement business, a position that grants it unparalleled economies of scale. This market leadership, as of early 2025, means the group manages a vast customer base and significant assets under management, estimated to be in the hundreds of billions of pounds. This scale translates into substantial negotiating power with suppliers, driving down operational costs and enhancing profitability.

The company's dominant market position provides a robust foundation for operational efficiencies, allowing it to invest more heavily in technology and customer service. Having built a significant in-force book of policies over many years, Phoenix benefits from a stable and predictable stream of cash flow, which is crucial for reinvestment and shareholder returns.

Phoenix Group Holdings possesses profound expertise in managing closed life assurance funds, a specialized and intricate segment of the financial services industry. This deep knowledge base is crucial for their business model.

Their specialization allows for the efficient assimilation of newly acquired closed books and the systematic enhancement of their value. This is achieved through stringent operational oversight and astute capital deployment strategies.

As of the first half of 2024, Phoenix Group reported managing £74 billion in assets under administration for its closed book business, demonstrating the scale of their operations in this niche.

This established proficiency in a complex market provides Phoenix Group with a substantial competitive edge, enabling them to navigate regulatory landscapes and operational challenges effectively.

Phoenix Group's core strength lies in its consistent and predictable cash generation, a direct result of its established in-force business portfolios. This reliable cash flow provides significant financial flexibility, allowing the company to pursue growth opportunities and shareholder returns without undue strain.

In 2023, Phoenix Group reported strong cash generation, with its operating cash flow reaching £1.3 billion. This robust performance underscores the efficiency of its business model in converting premiums and investment income into usable cash.

This financial firepower enables Phoenix Group to not only fund strategic investments in technology and business enhancement but also to consistently deliver attractive dividends to its shareholders, a key component of its investor appeal.

Diversified Product Offering via Standard Life

Phoenix Group's acquisition of Standard Life significantly broadened its horizons beyond its established closed book business. This strategic move has endowed the company with a robust portfolio of open products, encompassing pensions, bonds, and equity release solutions, all marketed under the recognizable Standard Life brand. This diversification is crucial, as it lessens the company's dependence on the naturally declining closed book assets and opens up substantial avenues for growth within the dynamic long-term savings and retirement sector. As of the first half of 2024, Standard Life's open business contributed significantly to Phoenix Group's overall strategy, with assets under administration in the open segment showing continued positive momentum.

The integration of Standard Life's open products offers Phoenix Group a dual advantage. Firstly, it provides a vital revenue stream that is not inherently limited by the run-off nature of closed books. Secondly, it positions the company as a key player in the expanding market for active long-term savings and retirement planning. This allows Phoenix Group to leverage the trust and brand recognition associated with Standard Life to capture new customers and market share. The company's focus on these growth areas is reflected in its ongoing investment in digital platforms and customer engagement initiatives for its open book offerings.

- Diversified Revenue Streams: Reduced reliance on closed book assets by offering pensions, bonds, and equity release.

- Brand Strength: Leverages the established and trusted Standard Life brand for open market products.

- Growth Potential: Positions Phoenix Group to capitalize on the expanding long-term savings and retirement market.

- Customer Acquisition: Enables the company to attract new customers through a wider product suite.

Efficient Operations and Capital Management

Phoenix Group Holdings excels in its operational efficiency and astute capital management, consistently aiming to optimize shareholder value. This strategic focus is particularly vital in the insurance sector, which requires robust financial health and effective resource allocation.

The company's commitment to cost control and maximizing returns on deployed capital underpins its financial resilience. This approach ensures that Phoenix Group can navigate market fluctuations and invest strategically for future growth.

Key indicators of this strength include:

- Strong Solvency Ratios: Phoenix Group has consistently maintained strong solvency capital requirement (SCR) ratios, demonstrating its ability to meet its obligations. For instance, as of year-end 2023, their SCR ratio stood at a robust 223%, well above regulatory requirements.

- Efficient Expense Management: The group has demonstrated success in managing its operational expenses, contributing to improved profitability. In 2024, they targeted a further 5% reduction in operating expenses across key business units.

- Effective Capital Deployment: Phoenix Group actively manages its capital to support growth initiatives, shareholder returns, and strategic acquisitions, as evidenced by their consistent dividend payouts and share buyback programs.

- Productivity Gains: Investments in technology and process improvements have led to enhanced productivity, allowing for better service delivery and cost savings. Digitalization efforts in 2024 aimed to automate 30% of customer onboarding processes.

Phoenix Group's market leadership in the UK's long-term savings and retirement sector is a significant strength, underpinned by substantial economies of scale. This allows for efficient operations and strong negotiating power. The company's deep expertise in managing complex closed life assurance funds, as demonstrated by £74 billion in assets under administration for this segment in H1 2024, provides a distinct competitive advantage.

The integration of Standard Life has diversified Phoenix's revenue streams, reducing reliance on declining closed books and tapping into the growing open market for pensions and savings. This strategic move leverages the trusted Standard Life brand, enhancing customer acquisition potential in a dynamic sector.

Phoenix Group consistently generates robust and predictable cash flow, with operating cash flow reaching £1.3 billion in 2023. This financial strength supports strategic investments, such as targeted 5% operating expense reductions in 2024, and consistent shareholder returns, reinforcing investor confidence.

The company maintains strong solvency ratios, with an SCR ratio of 223% at year-end 2023, exceeding regulatory requirements. Furthermore, their commitment to productivity gains through digitalization, aiming to automate 30% of customer onboarding in 2024, highlights their focus on efficiency and value optimization.

| Strength Area | Key Metric/Fact | Period/Year |

|---|---|---|

| Market Leadership & Scale | UK's largest long-term savings and retirement business | Early 2025 |

| Closed Book Expertise | £74 billion in assets under administration (closed book) | H1 2024 |

| Cash Generation | £1.3 billion operating cash flow | 2023 |

| Solvency & Efficiency | 223% Solvency Capital Requirement (SCR) ratio | Year-end 2023 |

| Digitalization Target | Automate 30% of customer onboarding | 2024 |

What is included in the product

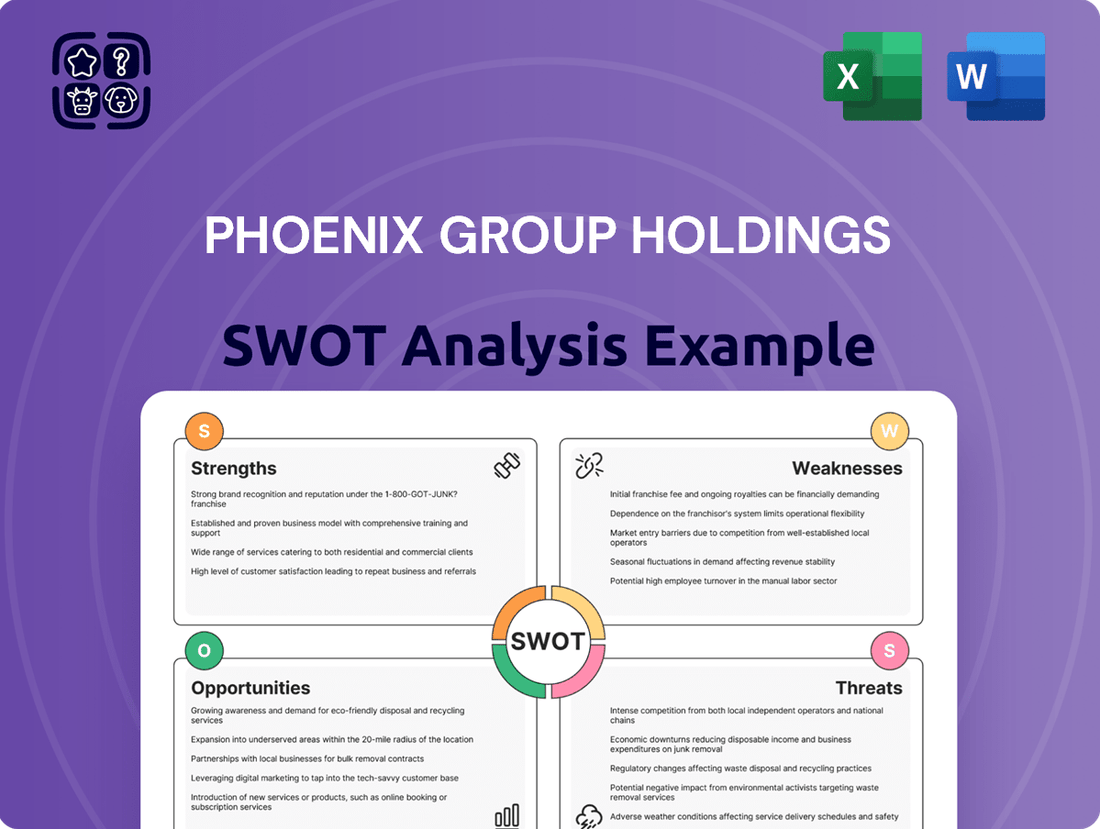

This analysis offers a comprehensive overview of Phoenix Group Holdings' internal capabilities and external market dynamics, highlighting key strengths and weaknesses alongside significant opportunities and threats.

Offers a clear, actionable SWOT analysis of Phoenix Group Holdings, highlighting key areas for improvement and growth to alleviate strategic uncertainty.

Weaknesses

Phoenix Group's reliance on its closed books, while a core strength, presents a significant weakness due to their finite nature. These books naturally run off over time, meaning Phoenix must constantly acquire new closed books to sustain its scale and revenue streams. This dependency creates an ongoing strategic imperative to identify and secure attractive acquisition targets in a competitive market. Failure to do so would inevitably lead to a decline in the performance of its foundational business segment.

Phoenix Group's reliance on acquiring closed life assurance funds presents significant integration risks. Successfully merging disparate IT systems, operational processes, and diverse customer portfolios from these acquisitions is a complex undertaking. For instance, integrating the Standard Life Assurance business, acquired in 2018, involved extensive work to harmonize platforms and customer data. Failure to manage this integration effectively can result in operational inefficiencies, escalating costs, and potential service disruptions for customers, impacting the company's overall performance.

As a company focused on long-term savings and retirement, Phoenix Group is inherently sensitive to market volatility. Fluctuations in interest rates, equity markets, and inflation directly impact the value of its investment portfolio. For instance, a significant downturn in equity markets in 2024 could reduce the value of assets under management, affecting profitability and capital adequacy ratios.

High Regulatory Burden and Compliance Costs

Phoenix Group operates within the United Kingdom's stringent financial services landscape, subjecting it to considerable regulatory oversight. This means adhering to a complex web of rules and directives, which is a constant challenge.

Compliance with evolving regulations, such as the Solvency II capital requirements and the Financial Conduct Authority's Consumer Duty, demands significant investment in systems, personnel, and ongoing training. For instance, the implementation of the Consumer Duty in 2023 required substantial adjustments to business practices across the sector.

These compliance efforts translate into substantial ongoing costs and necessitate a dedicated allocation of resources, impacting profitability and operational efficiency. The financial burden of maintaining compliance can be a significant drain on company resources.

Furthermore, the potential for severe penalties, including substantial fines and reputational damage, underscores the critical importance of meticulous adherence to these regulatory frameworks. A single compliance failure can have far-reaching negative consequences.

- Regulatory Scrutiny: Phoenix Group faces intense oversight from UK financial regulators.

- Compliance Costs: Significant investment is required to meet evolving standards like Solvency II and the Consumer Duty.

- Resource Allocation: Substantial personnel and system resources are dedicated to ensuring compliance.

- Risk of Penalties: Non-compliance carries the risk of severe financial penalties and reputational harm.

Brand Awareness for Open Products vs. Competitors

While Standard Life is a well-known name, it competes in a crowded open market. It faces strong established financial institutions and nimble fintech companies, making it a challenge to stand out. For instance, as of early 2024, the UK pensions and investments market sees significant competition, with major players like Aviva and Scottish Widows also heavily investing in brand visibility and digital offerings.

This competitive landscape means Standard Life might struggle to achieve the same level of top-of-mind brand recognition or be perceived as cutting-edge compared to some rivals. This can impact its ability to attract new customers for its open products, a crucial area for future growth.

- Brand Recognition: Standard Life is recognized, but faces intense competition from established financial services giants and innovative fintechs in the open product market.

- Market Saturation: The open market for financial products is highly competitive, requiring significant investment in marketing to differentiate and capture market share.

- Perception of Innovation: Compared to some agile competitors, Standard Life may face challenges in being perceived as a leader in innovation, potentially hindering new customer acquisition.

- Growth Limitations: Lower top-of-mind awareness and a perception of lagging innovation could limit the potential for new business growth in the open product segment.

Phoenix Group's reliance on acquiring closed books, while its core business, represents a significant weakness due to their finite nature. These books naturally run off over time, necessitating continuous acquisition of new closed books to maintain scale and revenue. This creates an ongoing strategic imperative to identify and secure attractive acquisition targets within a competitive market, and failure to do so could lead to a decline in its foundational business performance.

What You See Is What You Get

Phoenix Group Holdings SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Phoenix Group Holdings. This comprehensive document covers their Strengths, Weaknesses, Opportunities, and Threats in detail. The complete version, offering actionable insights, becomes available immediately after purchase. Gain a clear understanding of Phoenix Group Holdings' strategic position with this authentic report.

Opportunities

The UK life insurance market is still seeing consolidation, which means more chances for Phoenix Group to snap up closed life assurance funds. This trend offers a consistent pipeline for growth through acquisitions.

As established insurers shed non-core assets, Phoenix Group's demonstrated track record in managing these legacy portfolios makes it an attractive acquirer. This positions them to be a go-to buyer in the sector.

By strategically acquiring these closed books, Phoenix Group can significantly bolster its asset under management. For instance, in 2023, Phoenix Group completed the acquisition of SunLife's UK heritage business, adding £3 billion in assets under administration, showcasing their continued activity in this space.

These acquisitions not only expand Phoenix Group's asset base but also reinforce its market leadership. This strategy allows them to leverage economies of scale and enhance operational efficiencies in managing a larger, consolidated book of business.

Phoenix Group can capitalize on the strong recognition of the Standard Life brand to broaden its appeal in the open market, targeting products such as pensions, savings bonds, and equity release. This strategic move allows them to tap into a wider customer base and increase market share beyond their existing closed-book portfolios.

The increasing demand for retirement solutions in the UK, fueled by an aging demographic, presents a substantial growth avenue. For instance, by the end of 2024, projections indicate that over 20% of the UK population will be aged 65 or over, creating a significant pool of potential customers actively seeking retirement income and savings products.

Expanding open product offerings allows Phoenix Group to diversify its revenue streams and reduce reliance on its heritage business. This diversification is crucial for long-term financial stability and resilience, especially as the regulatory landscape for closed books evolves.

By effectively leveraging the Standard Life brand equity, Phoenix Group is well-positioned to attract new customers seeking flexible and robust retirement planning tools, thereby driving organic growth and enhancing its competitive standing in the UK financial services sector through 2025.

Phoenix Group can seize opportunities by accelerating its digital transformation. Investing in advanced analytics and AI can unlock significant operational efficiencies and provide deeply personalized customer experiences. For instance, in 2024, many financial services firms reported a 10-15% reduction in operational costs through AI-driven automation, a benchmark Phoenix could aim for.

Enhanced customer platforms offer a direct path to improving engagement and loyalty. By leveraging data analytics, Phoenix can tailor product offerings, leading to higher conversion rates and increased customer lifetime value. The global financial services industry saw a 20% increase in customer satisfaction scores in 2024 following significant investments in digital customer interaction tools.

Developing new digital distribution channels is another key opportunity. This allows Phoenix to reach a broader customer base and tap into new revenue streams, moving beyond traditional sales methods. Companies that effectively expanded their digital presence in 2024 often saw a 5-10% uplift in new customer acquisition.

Ultimately, these digital initiatives will bolster Phoenix Group's competitive edge by reducing costs and creating more relevant, accessible services for its customers, a crucial factor in the evolving market landscape.

Demographic Tailwinds from Aging Population

The aging demographic in the UK presents a substantial opportunity for Phoenix Group. As the population gets older, there’s a natural and growing need for long-term savings, retirement planning, and products designed for later life. This societal shift creates a consistent demand for Phoenix Group's core offerings, including pensions, bonds, and equity release solutions. For instance, the Office for National Statistics projected that by mid-2041, the proportion of people aged 65 and over in the UK could reach 25%.

Phoenix Group is well-positioned to leverage this demographic trend by developing and marketing products specifically tailored to the needs of an aging population. The company can focus on enhancing its suite of retirement income solutions and later-life care financing options.

- Growing Demand: Increased life expectancy and a higher proportion of older individuals directly fuel demand for retirement and savings products.

- Product Tailoring: Opportunity to refine and create specialized financial solutions catering to the unique needs of seniors, such as flexible annuity options or later-life lending.

- Market Stability: The aging population provides a more predictable and stable customer base compared to more volatile younger demographics.

- Asset Accumulation: Older individuals typically have accumulated more assets, creating a larger pool of potential customers for financial services.

Cross-Selling to Existing Customer Base

Phoenix Group's extensive customer base, particularly within its acquired closed books, presents a prime opportunity for cross-selling. Leveraging the Standard Life brand allows for targeted offerings of open products to these existing policyholders. This strategy taps into a pre-qualified audience, potentially leading to substantial revenue growth with reduced customer acquisition costs.

By analyzing the needs of these policyholders, Phoenix can introduce relevant new solutions, thereby deepening customer relationships and unlocking new revenue streams. For instance, if a customer holds a closed annuity product, they might be receptive to a new pension or investment product offered through Standard Life.

The company's existing customer data is a valuable asset for identifying these cross-selling opportunities. In 2024, it's estimated that companies can increase profits by 50-95% by focusing on their existing customer base through cross-selling and upselling initiatives.

- Increased Revenue: Cross-selling to existing customers can significantly boost revenue per customer.

- Lower Acquisition Costs: Reaching out to existing customers is generally less expensive than acquiring new ones.

- Enhanced Customer Loyalty: Providing relevant additional products can strengthen customer relationships and loyalty.

- Product Penetration: This strategy helps increase the penetration of open products within the acquired customer base.

Phoenix Group can strategically acquire closed life assurance funds, a market trend driven by consolidation, offering a consistent growth pipeline. By acting as a preferred acquirer for non-core assets shed by established insurers, Phoenix Group leverages its proven expertise in managing legacy portfolios. For example, the acquisition of SunLife's UK heritage business in 2023 added £3 billion in assets under administration, demonstrating their ongoing activity in this consolidation space.

Leveraging the strong Standard Life brand equity allows Phoenix Group to expand its reach in the open market, targeting products like pensions and savings. This strategic move aims to attract a wider customer base and boost market share. The increasing demand for retirement solutions, driven by the UK's aging demographic, with over 20% of the population expected to be 65+ by the end of 2024, presents a significant growth avenue for these offerings.

Accelerating digital transformation presents a key opportunity, with investments in AI and advanced analytics promising operational efficiencies and personalized customer experiences. Many financial firms in 2024 reported 10-15% cost reductions via AI automation. Enhanced customer platforms can boost engagement and loyalty, with global financial services seeing a 20% rise in customer satisfaction scores in 2024 due to digital interaction tool investments.

Threats

The UK's long-term savings and retirement sector is a battleground, with Phoenix Group facing formidable rivals. Established players like Aviva, Legal & General, and various asset management firms are vying for market share, alongside nimble fintech startups disrupting traditional models. This crowded landscape intensifies pressure on pricing, potentially squeezing Phoenix's profit margins, especially for its open product offerings.

This fierce competition extends to the critical area of closed book acquisitions. Competitors are actively seeking to acquire mature portfolios, which could drive up acquisition costs and limit Phoenix's growth opportunities in this strategic segment. For instance, the UK pensions market saw significant consolidation activity in 2023 and early 2024, with several large deals announced, underscoring the aggressive pursuit of these assets.

Phoenix Group, operating within the heavily regulated financial services sector, faces a constant threat from potential adverse regulatory and policy shifts. Changes in capital requirements, such as evolving solvency regimes like Solvency II or its potential successors, could necessitate increased capital buffers, impacting profitability and strategic flexibility. For instance, a toughening of solvency standards in the UK or Europe could require Phoenix Group to hold more capital against its liabilities, potentially reducing its capacity for new business or dividend payouts.

New legislation or altered supervisory approaches concerning consumer protection, data privacy, or product innovation could also present significant challenges. Increased compliance burdens, such as those stemming from the EU's General Data Protection Regulation (GDPR) or similar initiatives in other markets, can lead to higher operational costs and potential fines for non-compliance. Furthermore, restrictions on certain types of financial products or distribution methods could limit Phoenix Group's revenue streams and market reach.

The dynamic nature of financial regulation means that Phoenix Group must remain vigilant and adaptable. For example, ongoing discussions and potential reforms around pension freedoms and guaranteed asset protection (GAP) insurance could influence the demand for and profitability of its core offerings. The group's ability to navigate these changes effectively will be critical to maintaining its competitive position and financial stability in the 2024-2025 period and beyond.

Phoenix Group Holdings faces significant threats from economic downturns and market volatility. For instance, a prolonged period of high inflation, which saw the UK CPI reach 8.7% in May 2024, can erode the real value of assets and policy reserves. Should interest rates remain elevated, this could also depress asset values within Phoenix's substantial investment portfolio.

Furthermore, economic slowdowns typically lead to reduced consumer spending and a decrease in demand for new financial products, impacting Phoenix's new business volumes. This environment can also pressure profit margins as the cost of doing business rises and investment returns falter.

Technological Disruption from Fintech

The rapid growth of fintech companies poses a significant threat to Phoenix Group, especially in its open products division. These nimble firms are rolling out cutting-edge, digital-first services that often provide better customer experiences and operate with lower overheads. For instance, by mid-2024, the global fintech market was projected to reach $33.5 trillion, showcasing the scale of this disruption.

Phoenix Group must proactively address this by accelerating its own digital transformation. Failing to adapt quickly could lead to a loss of market share as customers are drawn to the more innovative and cost-effective offerings from fintech competitors. This dynamic underscores the critical need for sustained investment in technology and digital capabilities to maintain competitiveness.

Key areas of fintech disruption include:

- Digital Onboarding: Fintechs often streamline customer acquisition through entirely online processes.

- Personalized Financial Advice: AI-driven robo-advisors offer tailored investment strategies at lower costs.

- Payment Innovations: Real-time payment systems and digital wallets are reshaping transactional finance.

- Blockchain and Crypto: Emerging decentralized finance (DeFi) solutions challenge traditional banking models.

Reputational Risk and Customer Trust

Phoenix Group, as a custodian of life savings, navigates a landscape where reputational risk is paramount. A significant operational failure or a data breach, for instance, could erode customer trust, a cornerstone of its business model. In 2024, the financial services sector globally saw an increase in cyber threats, with reports indicating a rise in phishing attacks targeting financial institutions. This heightened threat environment underscores the vulnerability Phoenix Group faces in maintaining its brand image and the loyalty of its millions of customers.

The consequences of losing customer trust can be severe. A mis-selling scandal or widespread negative public perception could directly translate into business attrition and substantial regulatory penalties. For example, in the UK, the Financial Conduct Authority (FCA) has consistently emphasized consumer protection, imposing significant fines on firms for misconduct. Phoenix Group's commitment to customer satisfaction and transparent dealings is therefore crucial for mitigating these potential financial and brand repercussions, safeguarding its long-term shareholder value.

- Operational Failures: Any disruption in service delivery can lead to immediate customer dissatisfaction and loss of confidence.

- Data Security Breaches: The compromise of sensitive customer data poses a significant threat to trust and can result in substantial regulatory fines and legal action.

- Mis-selling Scandals: Past instances in the financial industry highlight the severe reputational and financial damage that can arise from inadequate product suitability advice.

- Negative Public Perception: Adverse media coverage or public sentiment can quickly tarnish a brand's image, impacting customer acquisition and retention efforts.

Phoenix Group faces significant threats from evolving regulatory landscapes and potential policy changes, impacting capital requirements and operational flexibility. For instance, stricter solvency standards, like those discussed for Solvency II in 2024-2025, could necessitate higher capital reserves, potentially limiting strategic options. Furthermore, new consumer protection laws or data privacy regulations, such as those mirroring GDPR, could increase compliance costs and expose the company to penalties.

SWOT Analysis Data Sources

This analysis draws upon Phoenix Group Holdings' official financial statements, comprehensive market research reports, and reputable industry publications to provide a robust and informed SWOT assessment.