Phoenix Group Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Phoenix Group Holdings Bundle

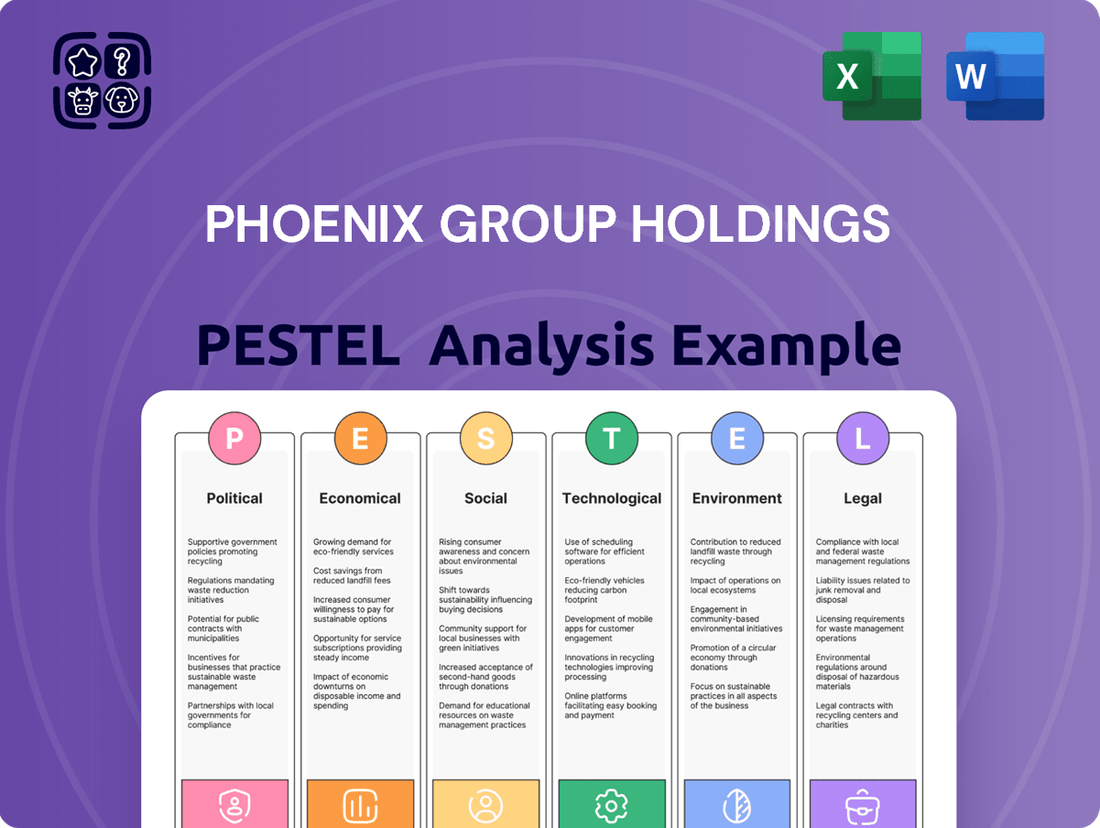

Unlock the critical external forces shaping Phoenix Group Holdings with our comprehensive PESTLE analysis. Understand the intricate interplay of political stability, economic fluctuations, evolving social attitudes, technological advancements, environmental regulations, and legal frameworks impacting their operations. This in-depth analysis provides the strategic clarity you need to anticipate market shifts and identify emerging opportunities.

Don't get caught off guard by external pressures; gain a proactive advantage. Our PESTLE analysis for Phoenix Group Holdings is meticulously researched and ready for immediate application, empowering you to make informed strategic decisions. Secure your competitive edge by purchasing the full version today and access actionable intelligence.

Political factors

The UK government's focus on pension reform, particularly the expected Pension Schemes Bill in 2025, presents a significant political factor for Phoenix Group. These reforms are designed to consolidate the estimated 11.6 million dormant defined contribution (DC) pension pots, a move that could streamline administration and potentially increase engagement with these savings.

Key aspects of these proposed reforms include the introduction of a value for money framework for DC schemes, which will scrutinize performance and charges, and incentives for greater investment in UK assets. Phoenix Group, as a leading provider of workplace pensions, is actively participating in consultations, aiming to influence the final shape of these policies to foster an environment that encourages long-term savings and investment.

The Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) are pivotal in shaping the operating environment for Phoenix Group within the UK. Their oversight directly impacts how Phoenix designs products and interacts with its customer base.

The FCA's current strategic priorities, emphasizing consumer protection and financial literacy, necessitate a keen focus on product transparency and responsible customer engagement for Phoenix Group. Tackling financial crime also means robust compliance measures are essential.

Evolving regulatory landscapes, such as the implementation of Solvency UK and proposals for targeted pension advice support, present both challenges and opportunities for Phoenix Group. Adapting to these changes is crucial for maintaining compliance and strategic agility.

For instance, the FCA's 2023/24 Business Plan highlights a commitment to ensuring markets work well for consumers, with a focus on areas like retail investments and consumer credit, directly impacting firms like Phoenix Group that operate in these sectors.

Taxation policy changes directly influence Phoenix Group's attractiveness to customers. For example, the April 2024 abolition of the lifetime allowance and adjustments to lump sum taxation have already altered the pension savings environment. These shifts can significantly affect how individuals approach savings and investments.

Ongoing discussions about retirement adequacy and potential future tax policy alterations remain a critical area for Phoenix Group. Any changes to how savings, investments, and pension benefits are taxed could reshape consumer behavior and the appeal of Phoenix Group's offerings. For instance, a shift in capital gains tax could impact investment product demand.

Political Stability and Investor Confidence

The UK's political landscape significantly impacts investor confidence, particularly for companies like Phoenix Group Holdings, which thrives on long-term capital. General elections and shifts in government priorities can create uncertainty, affecting the stability of the long-term savings market. For instance, a stable government is more likely to implement consistent economic policies, fostering a predictable environment for long-term investments crucial for Phoenix Group's annuity business.

Geopolitical tensions, as highlighted by the Bank of England, can introduce significant market volatility. This volatility can deter investors and impact the valuation of assets held within Phoenix Group's substantial in-force life assurance funds. For example, events like the ongoing conflict in Eastern Europe have led to increased economic uncertainty, potentially affecting investment returns and risk appetite.

- UK Political Stability: The UK has generally maintained a stable political system, though recent years have seen increased political activity, including general elections and policy shifts, which can create short-term investor caution.

- Governmental Priorities: Current governmental focus on economic growth and fiscal responsibility supports a more predictable environment for financial services.

- Investor Confidence: Confidence remains robust but is sensitive to major policy announcements affecting the financial sector or the broader economy.

- Geopolitical Impact: The Bank of England has noted that global geopolitical risks contribute to financial market volatility, directly influencing the investment strategies and performance of institutions managing large asset pools.

Government's Net Zero and ESG Agenda

The UK government's ambitious net-zero by 2050 targets and wider Environmental, Social, and Governance (ESG) frameworks significantly influence Phoenix Group Holdings. These mandates present both compliance requirements and avenues for growth, particularly in sustainable investment. Phoenix actively shapes its investment portfolios and operational practices to align with these critical climate goals.

Phoenix Group is a vocal participant in discussions with policymakers, advocating for policies that can accelerate investment in climate solutions. The company recognizes that while government commitments are important, current policy and regulatory frameworks may not fully address all the challenges in transitioning to a low-carbon economy. This active engagement underscores Phoenix's commitment to driving systemic change.

- Government Net-Zero Targets: The UK legally committed to reducing emissions by at least 100% of 1990 levels by 2050, a target that necessitates significant shifts across all sectors, including financial services.

- ESG Integration: Phoenix Group is increasingly integrating ESG factors into its investment decisions, reflecting a broader market trend driven by regulatory pressures and investor demand for sustainable assets.

- Advocacy for Climate Finance: Phoenix, along with other financial institutions, is actively lobbying for clearer regulatory pathways and incentives to de-risk and scale up investments in green technologies and infrastructure.

- Opportunity in Green Finance: The drive towards net-zero is creating substantial opportunities in areas like renewable energy, green bonds, and sustainable infrastructure, which Phoenix is strategically positioned to capitalize on.

Government reforms, such as the proposed Pension Schemes Bill in 2025, aim to consolidate dormant pension pots, potentially benefiting Phoenix Group by streamlining administration and increasing engagement with savings. The FCA's focus on consumer protection and financial literacy, as evidenced in its 2023/24 Business Plan, requires Phoenix to maintain high standards of product transparency and customer care. Changes in taxation policy, like the 2024 abolition of the lifetime allowance, directly impact customer savings behavior and the appeal of Phoenix's offerings.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Phoenix Group Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic planning, identifying potential threats and opportunities within the company's operating landscape.

Provides a concise PESTLE analysis of the Phoenix Group, simplifying complex external factors into actionable insights for strategic decision-making.

Helps alleviate the pain of navigating intricate market dynamics by offering a clear, categorized overview of political, economic, social, technological, environmental, and legal influences on the Phoenix Group.

Economic factors

Interest rate fluctuations are a major driver for Phoenix Group. As of early 2024, the Bank of England’s base rate has been held at 5.25%, a significant increase from the near-zero levels seen previously. This higher rate environment generally benefits Phoenix by improving the yields on its substantial investment portfolio, which underpins its in-force business and new annuity sales.

Higher rates can also bolster solvency ratios, a critical metric for insurers like Phoenix, by making it easier to meet long-term obligations. Conversely, a sustained return to very low interest rates, as experienced in the decade prior to 2022, would likely compress investment returns and create challenges in profitably managing long-dated liabilities. The Bank of England's ongoing monitoring, as detailed in its Financial Stability Reports, highlights the persistent sensitivity of the insurance sector to these rate shifts.

Inflation directly erodes the purchasing power of retirees, meaning their money buys less than before. This can accelerate the depletion of retirement savings and increase interest in financial products designed to keep pace with rising prices. For instance, the UK Consumer Price Index (CPI) saw a significant increase, reaching 8.7% in May 2023, a level not seen in decades, impacting the real value of long-term savings.

Phoenix Group, as a major provider of retirement income products, must carefully manage its assets to ensure they can meet future liabilities, especially when inflation is high. This involves sophisticated asset-liability matching and investment strategies that aim to preserve the real value of assets against inflationary pressures. They might increase allocations to assets like inflation-linked bonds or equities with pricing power.

The rising cost of living also puts pressure on households to save less for retirement. When everyday expenses like energy, food, and housing increase substantially, individuals may have less disposable income available for long-term savings goals. For example, in early 2024, many households in the UK continued to experience squeezed budgets due to persistent inflation, potentially impacting their capacity to contribute to pensions.

The health of the UK economy directly impacts Phoenix Group's new business volumes in pensions and savings. In 2024, the UK economy is showing signs of stabilization, with GDP growth projected to be around 0.5% for the year, according to the Office for Budget Responsibility. This modest growth suggests a cautious environment for consumer spending.

Consumer spending patterns are a key driver for Phoenix Group. While inflation has eased from its 2023 peaks, reaching an estimated 2.3% in early 2025, household budgets remain under pressure. This can limit the capacity for long-term savings, potentially impacting new inflows into pension and savings products.

Economic slowdowns pose a significant risk. Should the UK enter a recession, as some forecasts suggest a possibility for late 2024 or early 2025, disposable incomes would likely decline. This scenario could lead to reduced new business and an increase in customers opting for withdrawals from existing savings plans.

Investment Market Performance

The performance of global and UK investment markets significantly influences Phoenix Group Holdings' assets under administration (AUA) and its solvency. Fluctuations in bond and equity markets directly impact the value of the assets managed by the group. For instance, the FTSE 100 experienced periods of volatility in early 2024, with significant swings influenced by inflation data and interest rate expectations.

Market volatility, characterized by rapid asset price corrections, presents inherent risks to the financial system, a concern frequently highlighted by the Bank of England. In 2023, global equity markets saw a notable recovery, but concerns over geopolitical instability and inflation persisted, creating an unpredictable investment landscape. This backdrop necessitates robust risk management for companies like Phoenix Group.

Phoenix Group's strategic approach incorporates sophisticated capital management techniques to effectively navigate these market dynamics. This includes strategies aimed at maintaining strong solvency ratios even amidst adverse market conditions. The group’s ability to adapt its capital allocation in response to market shifts is crucial for sustained financial health.

Key market performance indicators for Phoenix Group's consideration include:

- UK Gilt Yields: As of mid-2024, yields on long-dated UK government bonds have shown a tendency to fluctuate, impacting bond valuations within Phoenix Group's portfolio.

- Global Equity Market Returns: Major indices like the S&P 500 and the MSCI World Index have demonstrated mixed performance, reflecting varying economic conditions across different regions.

- Inflation Rates: Persistent inflation in the UK and globally influences central bank policy and, consequently, investment returns and discount rates used in financial valuations.

- Interest Rate Environment: Central bank interest rate decisions, such as those by the Bank of England and the Federal Reserve, directly affect the cost of capital and the attractiveness of different asset classes.

Capital Allocation and Deleveraging

Phoenix Group's financial strategy in 2024 centers on robust capital allocation and proactive deleveraging, bolstered by upgraded cash generation targets. This strong performance provides significant financial flexibility, enabling the company to reduce debt and invest strategically in future growth opportunities.

The emphasis on capital efficiency and generating sustainable cash flow is a cornerstone of Phoenix Group's approach. This underpins their commitment to a progressive dividend policy, rewarding shareholders while also ensuring the capacity to pursue value-enhancing strategic initiatives, including potential mergers and acquisitions (M&A).

- Upgraded Cash Generation: Phoenix Group's 2024 financial results indicated an upward revision of its cash generation targets, demonstrating operational strength.

- Deleveraging Focus: The company is actively utilizing its financial flexibility to reduce outstanding debt, strengthening its balance sheet.

- Strategic Investment Capacity: Improved cash flow supports investments in growth areas and potential M&A activities, indicating a confident outlook.

- Capital Efficiency: A core tenet of their strategy is maximizing the return on capital employed, driving sustainable value creation.

Economic factors significantly shape Phoenix Group's operational landscape. The Bank of England's base rate, held at 5.25% in early 2024, generally benefits Phoenix by enhancing investment yields, though a return to very low rates would compress returns. Persistent inflation, with the UK CPI at 8.7% in May 2023, erodes retiree purchasing power and necessitates sophisticated asset-liability management to preserve the real value of savings.

The UK economy's projected 0.5% GDP growth for 2024 suggests a cautious consumer spending environment, potentially impacting new business volumes for Phoenix. While inflation eased to an estimated 2.3% by early 2025, continued budget pressures on households could limit long-term savings contributions. Economic slowdowns or recessions, a possibility for late 2024 or early 2025, would likely reduce disposable incomes and increase customer withdrawals.

| Economic Factor | Impact on Phoenix Group | Relevant Data (2023-2025) |

|---|---|---|

| Interest Rates | Affects investment yields and solvency ratios. Higher rates are generally beneficial. | Bank of England Base Rate: 5.25% (early 2024) |

| Inflation | Impacts retiree purchasing power and real value of savings; necessitates asset-liability matching. | UK CPI: 8.7% (May 2023), estimated 2.3% (early 2025) |

| Economic Growth (GDP) | Influences consumer spending and new business volumes in pensions and savings. | UK GDP growth projected at 0.5% (2024) |

| Market Performance | Directly impacts assets under administration (AUA) and solvency. | FTSE 100 showed volatility in early 2024. |

Full Version Awaits

Phoenix Group Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Phoenix Group Holdings. It provides critical insights into the external forces shaping the company's strategic landscape. Understand the opportunities and threats through this detailed examination.

Sociological factors

The United Kingdom's population is indeed aging rapidly, a trend that directly fuels demand for Phoenix Group's core offerings. By 2030, it's estimated that over 20% of the UK population will be aged 65 or over, a substantial increase from current figures.

This demographic shift means a growing number of individuals will be seeking solutions for retirement income, wealth management, and long-term care planning. Phoenix Group's strategic focus on supporting customers through their retirement journey aligns perfectly with this evolving societal need, positioning them to capitalize on this expanding market segment.

Phoenix Group's stated purpose, to help people "journey to and through retirement," directly addresses this demographic reality. The company's business model is intrinsically linked to the increasing number of individuals entering their retirement years, a significant societal transformation.

Societal views on saving and planning for retirement are definitely shifting. People are increasingly aware that they need to secure their financial future. This growing recognition is a key factor for companies like Phoenix Group.

Phoenix Group, through its Phoenix Insights initiative, plays a proactive role in this evolving landscape. They highlight the problem of under-saving and push for policies that encourage more long-term saving habits. For example, in 2023, Phoenix Insights research indicated that millions of people were at risk of not having enough for retirement.

Furthermore, there's a noticeable move towards more adaptable retirement lifestyles. This means people want more options than just stopping work completely at a certain age. Phoenix Group is responding to this by developing products that cater to this demand for flexibility in how and when people access their retirement funds.

Financial literacy levels across the UK directly impact how well Phoenix Group's pension and savings products perform. When people understand their finances better, they're more likely to engage with and utilize these offerings effectively. For instance, recent surveys indicate that while general financial confidence is rising, a significant portion of the population still struggles with long-term savings planning, particularly concerning retirement.

The Financial Conduct Authority (FCA) is actively pushing for strategies that help consumers manage their money, especially those who don't seek professional financial advice. This focus is crucial for products like pensions, where informed decisions are vital for future security. The FCA's interventions aim to bridge this knowledge gap.

Phoenix Group is responding by investing in digital tools and resources designed to boost customer engagement and financial well-being. An example is their 'How much will I need in retirement' tool, which provides personalized insights. This proactive approach helps customers make more informed choices about their retirement savings.

Public Trust in Financial Institutions

Public trust is a bedrock for Phoenix Group Holdings, especially in the long-term savings and retirement sector. Without it, customer confidence in entrusting their future financial security wanes. Phoenix Group actively cultivates this trust through a steadfast commitment to transparent operations, ethical business conduct, and prioritizing customer needs. This dedication is reflected in their efforts to maintain high levels of customer satisfaction, a key indicator of trust.

Phoenix Group’s sustainability reporting further underscores its societal responsibility, a factor increasingly influencing public perception. For instance, in their 2023 sustainability report, they detailed initiatives focused on responsible investment and ethical governance, aiming to reinforce stakeholder confidence. This proactive approach to demonstrating their commitment to broader societal well-being is vital for building and preserving public trust in the financial services industry.

- Transparency: Phoenix Group emphasizes clear communication regarding product terms, fees, and investment performance.

- Responsible Practices: Adherence to regulatory standards and ethical conduct in all business dealings.

- Customer Centricity: Focus on delivering value and support to meet customer financial goals.

- Societal Impact: Reporting on ESG (Environmental, Social, and Governance) initiatives demonstrates a commitment beyond profit.

Diversity, Equity, and Inclusion (DEI)

Societal expectations for companies to champion diversity, equity, and inclusion (DEI) are growing significantly. Phoenix Group actively cultivates an inclusive environment, demonstrating this through initiatives like supporting colleagues who are also caregivers. This commitment to DEI is crucial for attracting and retaining a skilled workforce, a vital component for the company's sustained success and competitive edge in the market.

In 2024, Phoenix Group reported that 50% of its workforce identified as female, and 10% identified as LGBTQ+. This demonstrates a tangible step towards building a diverse team. The company’s focus on inclusive policies, such as its comprehensive parental leave and flexible working arrangements, directly addresses the evolving needs of employees and contributes to a positive employer brand.

- Workforce Diversity: Phoenix Group aims to reflect the diversity of its customer base within its workforce.

- Inclusive Policies: The company implements policies designed to support all employees, including those with caring responsibilities.

- Talent Attraction and Retention: A strong DEI focus is a key driver in attracting and keeping top talent.

- Societal Impact: Demonstrating commitment to DEI enhances Phoenix Group's reputation and societal standing.

The aging UK population presents a significant opportunity for Phoenix Group, as more individuals require retirement planning and wealth management solutions. By 2030, over 20% of the UK population is projected to be 65 or older, a demographic trend Phoenix Group's retirement-focused business model is well-positioned to serve.

Shifting societal attitudes towards financial planning are increasing demand for long-term savings products. Phoenix Group's Phoenix Insights initiative actively addresses under-saving, highlighting in 2023 that millions were at risk of insufficient retirement funds, underscoring the need for their services.

Public trust is paramount, and Phoenix Group cultivates this through transparency and ethical conduct, as evidenced by their 2023 sustainability report detailing responsible investment. Furthermore, a growing emphasis on diversity, equity, and inclusion is reflected in their workforce, with 50% female and 10% LGBTQ+ representation reported in 2024, alongside inclusive policies.

Technological factors

Phoenix Group is heavily investing in its digital capabilities to boost customer experience and financial well-being. They are rolling out online dashboards, mobile apps, and self-service portals for pension members, aiming for greater engagement.

These digital tools are designed to provide members with easier access to their pension information and facilitate better financial planning. This focus on a digitally-led savings journey is crucial for improving overall customer satisfaction.

Continued investment in digital infrastructure is a priority, especially as Phoenix Group integrates policies from acquisitions. This integration is key to offering a unified and seamless digital experience for all customers.

Data analytics and AI are central to Phoenix Group's strategy for optimizing operations and understanding its vast customer base, especially within its large closed books of business. By analyzing data, the company can identify trends, improve efficiency, and uncover new avenues for growth in its open product segments. This focus on data-driven insights is key to personalizing customer experiences and tailoring product offerings.

Phoenix Group is actively pursuing digital transformation, with AI data centers being a core component of this initiative, aiming to be a primary enabler. This technological investment allows for more sophisticated data processing and the development of advanced analytical capabilities. In 2024, the company continued to invest in its digital infrastructure, recognizing the critical role of AI in future business success and customer engagement.

As financial services increasingly move online, cybersecurity risks are a major concern for Phoenix Group. Protecting sensitive customer data and maintaining trust is paramount, necessitating significant investment in advanced security systems. The increasing sophistication of cyber threats means this is an ongoing challenge.

Compliance with data protection regulations, such as the UK GDPR, is a continuous requirement, adding to the operational burden and cost. Phoenix Group must ensure its data handling practices remain compliant to avoid penalties and reputational damage.

The Bank of England's ongoing cyber stress tests, which commenced in 2023 and are set to continue through 2025, underscore the critical importance of operational resilience in the financial sector. These tests are designed to assess how well firms can withstand and recover from cyber-attacks, impacting how Phoenix Group must approach its defensive strategies.

Automation and Operational Efficiency

Technological advancements are revolutionizing how Phoenix Group operates, particularly in areas like claims processing, policy administration, and investment management. Automation here significantly boosts efficiency and reduces operational costs. For instance, by implementing AI-driven tools for claims assessment, Phoenix Group can achieve faster processing times and lower error rates, directly contributing to cost savings.

This drive for operational efficiency is a core strategic objective for Phoenix Group, aimed at optimizing its extensive in-force business. Streamlining these complex processes through advanced technology directly translates into improved net margins and enhanced overall profitability. The company's commitment to digital transformation is evident in its ongoing investments in cloud computing and data analytics to support these initiatives.

- Automation in Claims: AI and machine learning are increasingly used to automate claims assessment, leading to quicker payouts and reduced manual intervention.

- Policy Administration: Digital platforms streamline policy onboarding, servicing, and renewals, improving customer experience and operational speed.

- Fund Management Efficiency: Algorithmic trading and automated portfolio rebalancing contribute to more efficient and cost-effective fund management.

- Cost Savings: Operational efficiencies gained through automation are projected to yield significant cost savings, bolstering Phoenix Group's financial performance.

Fintech Partnerships and Innovation

Phoenix Group Holdings is actively leveraging strategic partnerships with fintech innovators to enhance its offerings. Collaborations with companies like Raindrop and Money Hub are specifically designed to boost customer engagement and uncover new approaches to retirement savings and income generation. These alliances grant Phoenix access to cutting-edge technologies and advanced capabilities, crucial for addressing changing customer demands and maintaining a competitive edge in a rapidly evolving financial landscape.

These fintech collaborations are more than just access to new tools; they represent a strategic move to integrate advanced digital solutions into Phoenix Group's core business. For instance, the integration of Raindrop's technology could streamline the onboarding process for retirement accounts, while Money Hub might offer enhanced data analytics for personalized financial advice. By embracing these partnerships, Phoenix aims to provide a more seamless and responsive experience for its customers, particularly in the critical areas of long-term financial planning.

Looking at the broader fintech trend, the UK's Open Banking initiative, in effect since early 2020, has spurred significant innovation, with an estimated 7.5 million UK consumers and businesses using Open Banking services by early 2024. This regulatory environment fosters the kind of partnerships Phoenix Group is pursuing, enabling greater data sharing and the development of integrated financial products. Phoenix’s engagement in this space positions it to capitalize on these trends, offering potentially more tailored and efficient solutions than traditional providers.

Key benefits derived from these fintech partnerships include:

- Enhanced Customer Experience: Streamlined digital interfaces and personalized financial tools.

- Access to New Technologies: Integration of AI, data analytics, and blockchain for improved services.

- Product Innovation: Development of novel retirement savings and income solutions.

- Competitive Advantage: Staying ahead in a market driven by digital transformation and evolving consumer expectations.

Phoenix Group's technological advancement is centered on digital transformation, aiming to enhance customer experience through online dashboards and mobile apps. This focus on digital engagement is critical for improving financial planning and overall satisfaction, especially as they integrate acquired policies into a unified digital ecosystem.

The company is heavily leveraging data analytics and AI to optimize operations and understand its substantial customer base within its closed books of business. Investments in AI data centers are a core part of this strategy for 2024, underscoring the critical role of advanced technology in future success and customer interaction.

Automation in processes like claims handling and policy administration, powered by AI and machine learning, is driving significant operational efficiencies and cost reductions. These advancements are key to optimizing their extensive in-force business, directly impacting net margins and profitability.

Strategic fintech partnerships, such as those with Raindrop and Money Hub, are enhancing customer engagement and product innovation in retirement savings. These collaborations, bolstered by the UK's Open Banking initiative, which saw around 7.5 million users by early 2024, allow Phoenix to integrate cutting-edge solutions and maintain a competitive edge.

Legal factors

The shift from Solvency II to Solvency UK is a significant legal development for Phoenix Group, directly influencing its capital needs and how it manages risks. This regulatory evolution, overseen by the Prudential Regulation Authority (PRA), is crucial for maintaining financial health and enabling dividend payments. For instance, the PRA's ongoing consultations on Solvency UK are expected to finalize rules impacting insurers' internal models and risk-free rate curves, which will shape Phoenix Group’s capital management strategies throughout 2024 and into 2025.

Consumer protection laws are a significant legal factor for Phoenix Group. The Financial Conduct Authority's (FCA) Consumer Duty, implemented in 2023, mandates that firms act to deliver good outcomes for retail customers. This means Phoenix must ensure its product design, marketing, and communication strategies consistently put customers' best interests first, with clear and fair disclosures.

This regulatory shift directly impacts how Phoenix Group engages with its customers, particularly concerning pension decisions. The FCA's emphasis on targeted support means Phoenix needs robust processes to help consumers make informed choices, avoiding potential harm and ensuring fair treatment throughout the customer journey.

Phoenix Group, operating under stringent data protection laws like the UK GDPR, must meticulously manage customer information. Penalties for non-compliance can be substantial, with potential fines reaching up to 4% of global annual turnover or €20 million, whichever is greater. This necessitates continuous investment in secure data handling systems and ongoing staff training to ensure adherence to privacy principles and safeguard customer trust, a critical asset in the financial services sector.

Pension Schemes Bill and Related Legislation

The forthcoming Pension Schemes Bill, expected in 2025, is poised to significantly alter the UK's pension sector. Key areas of impact include pension consolidation, the implementation of value for money frameworks, and the evolution of retirement income solutions. Phoenix Group must remain vigilant, adapting its strategies and product development to align with these anticipated legislative shifts, which will fundamentally reshape the market.

These changes are critical for Phoenix Group as they will influence how pension assets are managed and how retirement products are designed and marketed. For instance, clearer value for money guidance could lead to greater scrutiny of fees and performance, potentially driving consolidation and innovation in product offerings to meet new regulatory standards. The focus on retirement income solutions suggests a move towards more sophisticated, long-term annuity and drawdown products.

- Legislative Impact: The Pension Schemes Bill 2025 will introduce new regulations affecting pension consolidation and value for money assessments.

- Market Adaptation: Phoenix Group will need to adapt its business model to comply with and capitalize on these regulatory changes.

- Retirement Income Focus: The bill's emphasis on retirement income solutions signals a growing demand for flexible and secure post-retirement products.

- Industry Transformation: These legislative developments are expected to drive significant transformation across the UK pension industry.

Corporate Governance and Reporting Requirements

Phoenix Group Holdings, as a publicly traded entity, navigates a complex web of legal mandates governing its operations and disclosures. These include stringent corporate governance codes and extensive reporting requirements. For instance, the company must issue comprehensive annual reports detailing financial performance and strategic direction, alongside dedicated sustainability reports highlighting its environmental, social, and governance (ESG) efforts. The increasing focus on climate-related financial disclosures means Phoenix Group is also obligated to provide TCFD (Task Force on Climate-related Financial Disclosures) reports, a critical element for investors assessing climate risk.

Adherence to these legal frameworks is not merely a procedural necessity; it is fundamental to fostering transparency and ensuring robust accountability. The Board of Directors and its specialized committees are tasked with overseeing compliance, thereby safeguarding the interests of stakeholders. For example, Phoenix Group's 2023 annual report, released in March 2024, detailed its governance structure and adherence to the UK Corporate Governance Code. This commitment to transparency is vital for maintaining investor confidence, a key factor in the company's ability to access capital markets and secure regulatory approvals for its ongoing business activities.

Key reporting and governance aspects for Phoenix Group include:

- Annual Financial Reports: Providing detailed financial statements and performance reviews, adhering to IFRS standards as per regulatory requirements.

- Sustainability Reporting: Disclosing ESG performance, with a growing emphasis on metrics like carbon emissions reduction targets and diversity in leadership.

- TCFD Disclosures: Reporting on climate-related risks and opportunities, a requirement gaining prominence across financial sectors.

- Corporate Governance Codes: Compliance with codes such as the UK Corporate Governance Code, ensuring board effectiveness and shareholder rights.

Phoenix Group operates within a robust legal framework, necessitating adherence to evolving regulations like Solvency UK, which impacts capital requirements and risk management. The Financial Conduct Authority's Consumer Duty, implemented in 2023, demands a customer-centric approach, influencing product design and communication strategies. Strict data protection laws, such as UK GDPR, mandate secure handling of customer information, with potential fines for non-compliance reaching up to 4% of global annual turnover.

The forthcoming Pension Schemes Bill, anticipated in 2025, is set to reshape the UK pension landscape by introducing frameworks for consolidation and value for money, requiring Phoenix to adapt its offerings in retirement income solutions.

Phoenix Group's public listing subjects it to extensive legal requirements for corporate governance and disclosure, including annual financial reports, sustainability reporting, and Task Force on Climate-related Financial Disclosures (TCFD). Compliance with codes like the UK Corporate Governance Code ensures transparency and stakeholder accountability, crucial for maintaining investor confidence and market access.

Environmental factors

Climate change poses significant physical risks to Phoenix Group’s asset base, from extreme weather events impacting real estate to supply chain disruptions affecting equities. Transition risks are also substantial, with potential policy shifts and evolving consumer preferences creating headwinds for carbon-intensive investments within their portfolio.

Phoenix Group is committed to a net-zero economy by 2050, actively embedding climate considerations into its strategic and financial planning processes. This proactive approach aims to mitigate risks while capitalizing on opportunities arising from the green transition.

In 2024, Phoenix Group's investment portfolio saw a notable shift, with a stated target to increase its exposure to sustainable investments. The company reported that by the end of 2023, over £30 billion of its assets under management were aligned with net-zero pathways.

Decarbonizing operations and investments is a core tenet of their climate strategy. This includes setting science-based targets for emissions reduction across their direct operations and engaging with portfolio companies to drive their own decarbonization efforts.

Regulators, investors, and the public are increasingly demanding that financial firms integrate Environmental, Social, and Governance (ESG) criteria into their investment strategies. Phoenix Group is actively responding by focusing on savings and insurance products that empower policyholders to channel funds into supporting the shift towards a low-carbon economy. This commitment extends to actively engaging with carbon-intensive companies within its investment portfolio.

In 2024, the global sustainable investment market continued its upward trajectory, with assets under management (AUM) in ESG funds reaching an estimated $40 trillion, according to data from the Global Sustainable Investment Alliance. Phoenix Group’s strategy aligns with this trend, aiming to leverage its investment power to drive positive environmental change and meet growing policyholder demand for sustainable options. By engaging with high-emitting companies, Phoenix Group seeks to influence corporate behavior and promote greener practices.

Phoenix Group is actively pursuing a net-zero transition, setting ambitious targets to achieve this by 2050, with critical interim goals for 2025 and 2030. This commitment extends to reducing emissions across its operations and supply chain, implementing measures such as enhancing energy efficiency and increasing the proportion of renewable electricity used. The company's success in meeting these long-term climate objectives is intrinsically linked to broader governmental policies and overall economic progress.

Climate-Related Financial Disclosures (TCFD, CSRD)

Phoenix Group is actively enhancing its climate-related financial disclosures, aligning with evolving global standards such as the Task Force on Climate-related Financial Disclosures (TCFD) and preparing for the upcoming Corporate Sustainability Reporting Directive (CSRD). This commitment to transparent reporting on climate impacts and dependencies is strongly supported by the Board of Directors, empowering stakeholders to effectively assess the company's progress toward its sustainability objectives.

The company's proactive approach to these disclosures is crucial for investor confidence and regulatory compliance, particularly as frameworks like CSRD are set to become mandatory for a wider range of companies in the coming years. For instance, under CSRD, companies will need to report on a broad spectrum of environmental, social, and governance (ESG) issues, including climate change, using a standardized format.

Phoenix Group's focus on TCFD recommendations means they are increasingly detailing their governance, strategy, risk management, and metrics and targets related to climate change. This level of detail allows for a more robust understanding of how climate-related risks and opportunities are integrated into the company's core business strategy and financial planning.

The financial implications of climate change are becoming more pronounced, with recent reports indicating significant economic impacts from extreme weather events. By providing clear and comprehensive disclosures, Phoenix Group aims to demonstrate its resilience and strategic foresight in navigating these challenges, thereby attracting sustainable investment and reinforcing its long-term value proposition.

Sustainable Investing and Green Finance

Phoenix Group Holdings is actively investing in climate solutions, aiming to shield customer portfolios from climate change risks. A key initiative is the FTSE Phoenix Climate Aware Index Series, demonstrating a commitment to environmentally conscious investment strategies. This focus on sustainability is a significant part of their broader green finance approach.

The company's strategy for sustainable investing includes integrating Environmental, Social, and Governance (ESG) factors into assets managed by third parties. Furthermore, Phoenix Group leverages its influence to advocate for systemic change within the financial industry, aligning with the growing global momentum towards green finance. For instance, in 2023, the UK's green finance market saw significant growth, with sustainable investment funds attracting billions in net inflows, underscoring the market's increasing demand for such products.

- FTSE Phoenix Climate Aware Index Series: A direct investment in climate solutions.

- ESG Integration: Applying ESG principles across all third-party managed assets.

- System Change Advocacy: Using influence to promote broader sustainable practices.

- Green Finance Alignment: Positioning the company within the expanding green finance sector.

Phoenix Group Holdings is navigating a landscape increasingly defined by climate change, facing both physical and transition risks that impact its asset base and investment strategies. The company is actively aligning with a net-zero economy by 2050, integrating climate considerations into its planning to mitigate these risks and seize opportunities in the green transition.

In 2024, Phoenix Group reported over £30 billion in assets under management aligned with net-zero pathways by the close of 2023, demonstrating a tangible commitment to sustainable investment. This aligns with a burgeoning global market where sustainable investment funds reached an estimated $40 trillion in AUM by 2024, reflecting strong policyholder demand for environmentally conscious options.

The company's commitment to decarbonization extends to operational improvements and engaging with portfolio companies to foster greener practices. Phoenix Group is also enhancing its climate-related financial disclosures, adhering to evolving standards like TCFD and preparing for upcoming regulations such as the CSRD, which mandates broader ESG reporting.

Phoenix Group’s investment in climate solutions, exemplified by the FTSE Phoenix Climate Aware Index Series, underscores its strategy to protect customer portfolios and drive systemic change within finance. This focus positions the company to benefit from the UK's growing green finance market, which saw billions in net inflows in 2023.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Phoenix Group Holdings is built on a robust foundation of data sourced from leading financial news outlets, regulatory bodies, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.