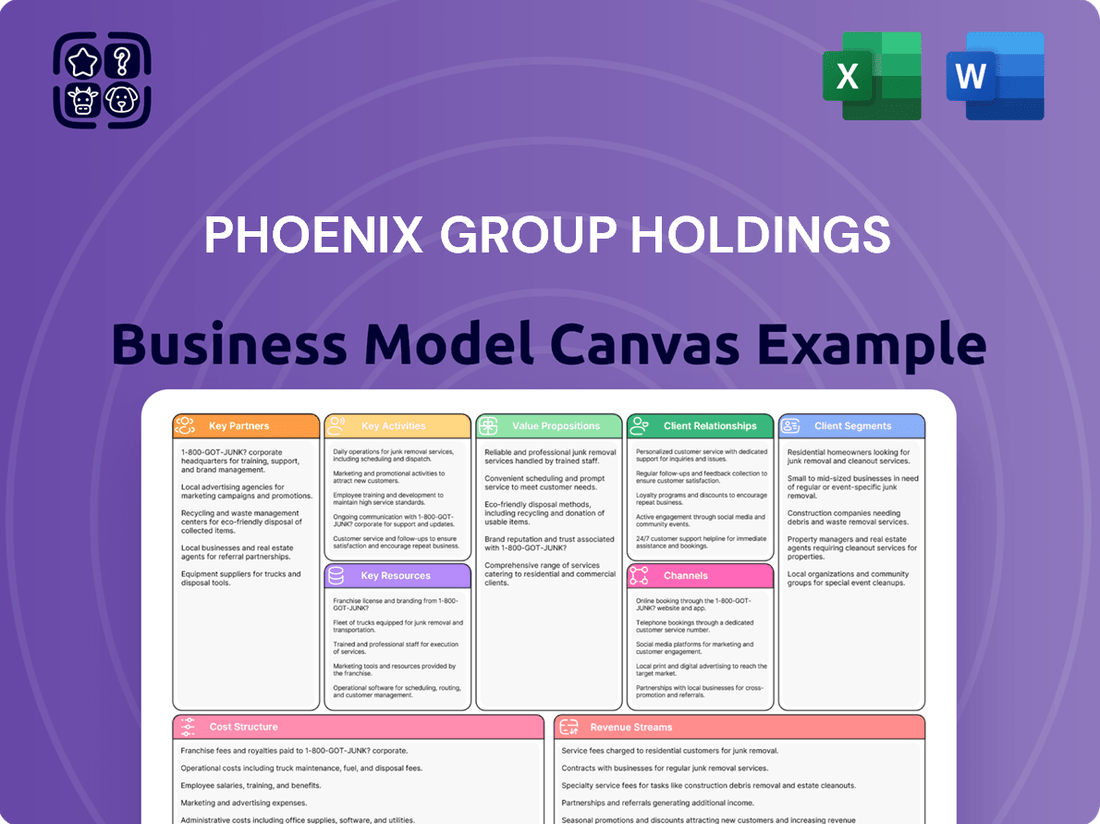

Phoenix Group Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Phoenix Group Holdings Bundle

Unlock the full strategic blueprint behind Phoenix Group Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value through its diverse customer segments and key partnerships. Discover their innovative revenue streams and cost structure, essential for understanding their market dominance.

Dive deeper into Phoenix Group Holdings’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie. Get it now to gain a competitive edge.

Partnerships

Phoenix Group Holdings actively cultivates relationships with external asset management firms to oversee the significant capital held within its closed and open life assurance funds. These collaborations are instrumental in achieving superior investment returns, maintaining broad portfolio diversification, and reliably fulfilling its commitments to policyholders. For instance, as of the end of 2023, Phoenix Group managed substantial assets, with its strategic partnerships playing a vital role in navigating complex market conditions and enhancing value.

Phoenix Group Holdings actively collaborates with technology and digital solution providers to streamline its operations and elevate customer interactions. These partnerships are crucial for implementing advanced policy administration systems and sophisticated data analytics platforms, enabling more personalized customer engagement. For instance, in 2024, Phoenix Group continued its investment in cloud-based solutions, aiming to reduce IT infrastructure costs by an estimated 15% by year-end.

Leveraging these external technological capabilities is central to Phoenix Group's ongoing digital transformation. By integrating cutting-edge digital customer engagement tools, the company seeks to foster stronger relationships and improve service delivery. This strategic reliance on specialized tech partners allows Phoenix to remain agile and responsive in a rapidly evolving market landscape.

Independent Financial Advisors (IFAs) are a cornerstone of Phoenix Group's distribution strategy, particularly for its open products under the Standard Life brand. These advisors act as a vital conduit, connecting Phoenix's comprehensive pension and savings offerings with a wider array of customers.

This strategic reliance on IFAs allows Phoenix Group to significantly broaden its market penetration. By leveraging the established client relationships and trust that IFAs have cultivated, the company can effectively reach segments of the population it might otherwise struggle to access directly, thereby fueling new business acquisition.

In 2024, the UK's financial advisory market continued to see strong demand for pensions and savings advice, with IFAs playing a pivotal role in guiding individuals through complex financial planning. Phoenix Group's engagement with this network is crucial for maintaining its competitive edge in this dynamic environment.

Acquisition Targets and M&A Advisors

Phoenix Group Holdings' strategy hinges on acquiring closed life assurance funds, making partnerships with potential sellers and M&A advisors crucial. These relationships are vital for identifying and executing these complex transactions. For instance, in 2023, Phoenix Group completed the acquisition of the legacy Standard Life business, a significant deal that underscored the importance of strong advisory networks.

The company relies on a robust network of M&A advisory firms, legal counsel, and due diligence specialists to navigate the intricacies of these acquisitions. These partners are essential for assessing the financial health of target funds and ensuring regulatory compliance. Phoenix Group’s ability to secure favorable deal terms and efficiently integrate new businesses directly correlates with the quality of these key partnerships.

- M&A Advisory Firms: Essential for deal origination, valuation, and negotiation.

- Legal Counsel: Critical for structuring transactions and ensuring compliance.

- Due Diligence Specialists: Provide in-depth analysis of target assets and liabilities.

- Selling Entities: The source of the closed life assurance funds that form the core of Phoenix Group's business.

Reinsurance Providers

Phoenix Group's engagement with reinsurance providers is crucial for managing the financial risks inherent in its long-term insurance liabilities. These partnerships allow Phoenix to transfer a portion of its risk to other insurance companies, thereby protecting its capital base from significant unexpected claims.

These strategic alliances are instrumental in optimizing Phoenix Group's capital requirements. By reinsuring a portion of its risk, the company can reduce the amount of capital it needs to hold against those liabilities, freeing up resources for other business activities or investments.

The resilience of Phoenix Group's balance sheet is significantly enhanced through these reinsurance arrangements. They act as a buffer against adverse mortality, morbidity, or lapse experience, ensuring the company can meet its obligations even in challenging economic or demographic environments.

- Risk Mitigation: Reinsurance directly addresses the long-term financial risks associated with Phoenix's annuity and life insurance portfolios.

- Capital Efficiency: By sharing risk, Phoenix can operate with a more efficient capital structure, potentially improving its return on equity.

- Balance Sheet Strength: Reinsurance agreements bolster the company's financial stability, providing greater certainty in its ability to pay future claims.

- Market Access: Partnerships with reinsurers can also facilitate access to new markets or product offerings by sharing the underwriting expertise and capacity.

Phoenix Group Holdings relies on strategic alliances with Independent Financial Advisors (IFAs) to distribute its open products, particularly under the Standard Life brand. These partnerships are vital for reaching a broad customer base and driving new business acquisition by leveraging the trust IFAs have built with their clients.

The UK financial advisory sector in 2024 continued to show robust demand for pension and savings advice, underscoring the critical role IFAs play in guiding individuals through financial planning. Phoenix Group's active engagement with this network remains essential for maintaining its competitive position.

Phoenix Group's strategy of acquiring closed life assurance funds necessitates strong relationships with potential sellers and M&A advisors. These collaborations are key to identifying and executing complex transactions, as demonstrated by the significant 2023 acquisition of the legacy Standard Life business.

The company engages a diverse range of partners, including M&A advisors, legal counsel, and due diligence specialists, to navigate acquisition intricacies and ensure regulatory compliance. The success of these deals and the efficient integration of new businesses are directly tied to the strength of these relationships.

| Key Partnership Type | Role in Business Model | Example/Impact |

|---|---|---|

| Independent Financial Advisors (IFAs) | Distribution channel for open products | Broaden market penetration for Standard Life brand; crucial in 2024's strong demand for financial advice. |

| M&A Advisory Firms & Legal Counsel | Facilitate acquisition of closed funds | Essential for deal origination, structuring, and compliance; critical for transactions like the 2023 Standard Life acquisition. |

| Asset Managers | Manage investment of life assurance funds | Achieve superior returns and diversification for policyholder assets. |

| Technology Providers | Enhance operations and customer experience | Support digital transformation, aiming for cost efficiencies like an estimated 15% IT infrastructure reduction in 2024. |

| Reinsurance Providers | Mitigate long-term insurance risks | Optimize capital structure and strengthen balance sheet resilience by transferring risk. |

What is included in the product

A detailed breakdown of Phoenix Group Holdings' strategy, this Business Model Canvas highlights their focus on acquiring and managing closed-book life insurance and pension businesses, leveraging operational efficiencies and cost synergies to deliver value.

This model clearly outlines their key partners, core activities, and value propositions centered on capital-light growth and customer retention within the mature UK financial services market.

Phoenix Group Holdings' Business Model Canvas acts as a pain point reliever by providing a clear, actionable framework that simplifies complex strategic challenges.

It helps eliminate the pain of disjointed planning by offering a unified, one-page view of their entire business, enabling efficient problem-solving.

Activities

Phoenix Group Holdings' key activity of acquiring and integrating closed funds involves meticulously identifying, purchasing, and merging these legacy life assurance portfolios from other insurance companies. This core operation is crucial for expanding their asset base and generating fee income. In 2024, Phoenix continued its strategy of inorganic growth, demonstrating its capacity to absorb and manage these complex assets.

The process is far from simple; it requires rigorous due diligence to assess the financial health and liabilities of the target funds. Following this, intricate legal and financial maneuvers are executed to complete the acquisition. Phoenix's expertise in this area allows them to navigate these challenges efficiently, ensuring a smooth transition for policyholders and stakeholders.

A significant part of this activity is the subsequent migration and consolidation of policyholder data and IT systems. This is a critical operational undertaking, ensuring that all policies are managed effectively within Phoenix's existing infrastructure. Successful integration allows for economies of scale and improved operational efficiency, which are vital for profitability in the closed book market.

Phoenix Group’s efficient management of in-force books involves optimizing acquired closed life insurance portfolios. The core activity is maximizing value through streamlined operations and astute capital management, ensuring long-term solvency and profitability.

This optimization includes rigorous asset-liability management to align investments with future payout obligations. For instance, as of December 31, 2023, Phoenix Group's Solvency II ratio stood at a robust 219%, reflecting strong capital buffers to manage these liabilities effectively.

Cost reduction initiatives are paramount in this process, driving operational efficiencies. The group’s focus on digital transformation and automation further supports these efforts, contributing to a more competitive cost base for managing these mature books.

Actuarial expertise plays a critical role in accurately assessing risks and ensuring adequate provisioning. Phoenix Group leverages deep actuarial knowledge to navigate complex regulatory environments and maintain profitability from these legacy portfolios.

Phoenix Group, through its Standard Life brand, is deeply engaged in creating and distributing a variety of open financial products. This encompasses pensions, bonds, and equity release solutions designed to meet diverse customer needs.

The process involves meticulous market research to identify emerging trends and customer preferences. This data directly informs the design of new products, ensuring they are competitive and relevant in the current financial landscape.

Building and maintaining strong distribution channels is a critical activity. Phoenix Group focuses on securing partnerships and leveraging digital platforms to reach a broad customer base, aiming for significant market penetration.

In 2024, Standard Life continued to enhance its product offerings, with a particular focus on retirement solutions. The company reported that its open products segment saw consistent growth, contributing positively to overall group performance.

Customer Service and Policy Administration

Phoenix Group Holdings' customer service and policy administration are central to its operations, serving millions of policyholders. This involves efficiently handling policy inquiries, processing claims, and managing a vast array of administrative tasks to ensure policyholder satisfaction and operational smoothness.

Ensuring regulatory compliance in all customer interactions is a paramount ongoing activity. This meticulous adherence to regulations protects both the policyholders and the company, fostering trust and maintaining operational integrity.

Key activities in this segment include:

- Policyholder Support: Providing timely and accurate responses to policy inquiries and managing policy lifecycle events.

- Claims Management: Efficiently processing and settling claims, a critical function for policyholder trust.

- Administrative Efficiency: Streamlining back-office processes for policy administration and customer data management.

- Regulatory Adherence: Consistently meeting all legal and regulatory requirements in customer service and policy handling.

In 2024, Phoenix Group Holdings continued to focus on enhancing its digital service capabilities, aiming to improve the experience for its extensive customer base. The company reported strong customer retention rates, underscoring the effectiveness of its service delivery.

Capital and Risk Management

Phoenix Group's capital and risk management is crucial for its financial health and adherence to regulations. This encompasses closely watching solvency ratios and actively managing investment risks. The company aims to maintain robust capital buffers to comfortably cover present and future financial commitments.

- Solvency Ratios: For instance, in 2023, Phoenix Group reported a Solvency II coverage ratio of 213%, demonstrating a strong capital position.

- Investment Risk Management: The group diversifies its investment portfolio across various asset classes to mitigate potential downturns.

- Capital Buffers: Maintaining excess capital above regulatory minimums ensures resilience against unexpected market shocks and supports strategic growth initiatives.

- Regulatory Compliance: Adherence to stringent regulatory frameworks, such as Solvency II, is a cornerstone of their risk management strategy, safeguarding policyholder interests.

Phoenix Group Holdings' key activities revolve around acquiring and managing closed life insurance books, optimizing these portfolios for profitability, and distributing open financial products. These operations are supported by robust customer service, policy administration, and stringent capital and risk management. The group's strategy emphasizes inorganic growth through acquisitions, operational efficiency via cost reduction and digital transformation, and strong actuarial and investment management to ensure solvency and deliver value.

| Key Activity | Description | 2023/2024 Data/Insights |

|---|---|---|

| Acquiring and Integrating Closed Funds | Identifying, purchasing, and merging legacy life assurance portfolios. | Continued inorganic growth strategy in 2024; demonstrated capacity to manage complex assets. |

| Optimizing In-Force Books | Maximizing value through streamlined operations and capital management. | Solvency II ratio of 219% as of December 31, 2023; focus on cost reduction and digital transformation. |

| Open Financial Product Distribution | Creating and distributing pensions, bonds, and equity release solutions. | Standard Life brand focused on retirement solutions; open products segment saw consistent growth in 2024. |

| Customer Service & Policy Administration | Handling inquiries, claims, and administrative tasks efficiently. | Enhanced digital service capabilities in 2024; reported strong customer retention rates. |

| Capital & Risk Management | Monitoring solvency ratios and managing investment risks. | Solvency II coverage ratio of 213% in 2023; diversification of investment portfolio. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a generic sample or a mockup; it represents the full, unedited content and structure of the deliverable. Once your order is complete, you will gain immediate access to this identical file, ready for immediate use and customization.

Resources

Phoenix Group Holdings' substantial financial capital is a cornerstone, allowing for significant acquisitions and robust support for its policyholder obligations. This financial strength is critical for maintaining market confidence and operational stability.

The company actively manages extensive investment portfolios across its diverse funds. In 2024, Phoenix Group reported assets under administration of £246 billion, reflecting the scale of its investment activities and their contribution to generating income.

These investment portfolios are not merely passive holdings; they are actively managed to generate returns that underpin the group's profitability and its ability to meet long-term commitments to policyholders.

The income derived from these investments is a vital component of Phoenix Group's business model, providing a consistent revenue stream that complements its insurance and asset management operations.

Phoenix Group Holdings leverages a substantial reservoir of policyholder data, enhanced by sophisticated analytics and seasoned actuarial expertise. This powerful combination allows them to precisely price the risks associated with their acquired businesses, effectively manage the associated liabilities, and uncover opportunities for enhanced efficiency and value generation within their portfolios.

This accumulated intellectual capital represents a significant competitive advantage for Phoenix. For instance, in 2024, Phoenix reported a significant increase in its asset management capabilities, managing over £30 billion in assets under administration, a testament to their data-driven approach to identifying and capitalizing on market opportunities.

Phoenix Group Holdings relies on a sophisticated technology infrastructure, encompassing advanced policy administration systems, to manage its diverse insurance products efficiently. This digital backbone is crucial for streamlining operations and ensuring timely service delivery to its customer base.

Significant and ongoing investment in technology is a cornerstone of Phoenix Group's strategy. In 2024, the company continued to prioritize upgrades and enhancements aimed at boosting automation across its business processes.

These technological advancements directly contribute to strengthening data security measures, a critical component in safeguarding sensitive customer information. Furthermore, the focus on digital platforms is designed to elevate the overall customer experience.

Brand Reputation and Customer Trust

Phoenix Group Holdings leverages the formidable brand reputation of Standard Life as a cornerstone of its business model. This established trust is a vital intangible asset, essential for attracting and retaining customers, especially in the long-term savings and retirement sector. In 2024, Standard Life continued to be a recognized and respected name, contributing significantly to customer acquisition and loyalty.

The brand equity built over years is instrumental in fostering deep trust with both individual customers and financial intermediaries. This trust translates directly into greater business volume and a more stable customer base for Phoenix Group. For instance, continued positive customer feedback and industry recognition in 2024 underscored the strength of this trusted brand.

- Brand Strength: Standard Life's reputation is a key differentiator in a competitive market.

- Customer Acquisition: A trusted brand directly supports efforts to attract new policyholders.

- Customer Retention: Long-term trust encourages policyholders to remain with Phoenix Group.

- Intermediary Relationships: Financial advisors and platforms are more likely to recommend trusted brands.

Skilled Workforce

Phoenix Group Holdings relies heavily on a highly skilled workforce. This includes actuaries essential for risk assessment and product development, investment managers who steer the company's capital, and M&A specialists crucial for strategic growth. In 2024, the company continued to invest in specialized training programs to ensure its teams remain at the forefront of financial services innovation.

IT professionals are also a critical resource, maintaining and enhancing the complex technological infrastructure that underpins Phoenix Group's operations. Customer service experts ensure client satisfaction and retention, a vital component of the insurance business. By the end of 2023, Phoenix Group reported that over 90% of its customer queries were resolved on the first contact, a testament to the effectiveness of its service teams.

- Actuaries: Provide essential expertise in pricing, reserving, and product design.

- Investment Managers: Drive portfolio performance and capital allocation strategies.

- M&A Specialists: Facilitate strategic acquisitions and integration processes.

- IT Professionals: Ensure operational efficiency and digital transformation.

- Customer Service Experts: Maintain high levels of client satisfaction and loyalty.

Phoenix Group Holdings' key resources are its significant financial capital, extensive investment portfolios, and a deep well of policyholder data combined with actuarial expertise. These form the bedrock of its acquisition strategy and ongoing operations. The company also leverages the strong Standard Life brand and a skilled workforce.

| Resource Category | Key Components | 2024 Data/Significance |

|---|---|---|

| Financial Capital | Substantial cash reserves, access to capital markets | Underpins acquisitions and policyholder obligations; maintains market confidence. |

| Investment Portfolios | Actively managed diverse funds | £246 billion assets under administration (2024); generate income and support profitability. |

| Data & Expertise | Policyholder data, analytics, actuarial skills | Precise risk pricing, liability management, and value identification. |

| Brand Equity | Standard Life reputation | Attracts and retains customers and intermediaries, fostering trust and business volume. |

| Human Capital | Skilled workforce (actuaries, investment managers, IT, customer service) | Drives innovation, operational efficiency, and customer satisfaction; over 90% first-contact query resolution (late 2023). |

Value Propositions

Phoenix Group Holdings provides policyholders of closed funds with secure and efficient management of their long-term savings and retirement policies. This core offering aims to deliver peace of mind through expert stewardship of these significant assets.

The company's deep expertise in optimizing these "closed books" of business ensures continuity and stability for millions of customers. This focus on efficient management is crucial for policyholders who rely on these savings for their future financial security.

As of December 31, 2023, Phoenix Group managed £334 billion of assets, demonstrating the scale of their commitment to managing long-term savings. Their strategy focuses on delivering strong cash generation, with approximately £1.7 billion of shareholder capital returned in 2023.

This approach allows Phoenix Group to efficiently manage substantial long-term savings portfolios, offering customers confidence in the stewardship of their retirement funds. The company's commitment to customer continuity underscores its value proposition in this segment.

Phoenix Group, through its Standard Life brand, offers a comprehensive suite of retirement and savings products. These offerings include adaptable pension plans, guaranteed annuities, and diverse investment vehicles, all crafted to support individuals in their financial planning for retirement and beyond.

In 2024, Standard Life continued to be a significant player in the UK retirement market. The company managed a substantial portion of the nation's pension assets, demonstrating its scale and the trust placed in its solutions by millions of customers.

The emphasis is on providing reliable pathways to financial security in later life. This involves products designed for both accumulation of wealth and for generating steady income streams during retirement, catering to a wide spectrum of customer needs and risk appetites.

Phoenix Group Holdings provides significant value to selling entities by offering a streamlined and efficient process for acquiring and integrating closed life assurance funds. This divestment allows these companies to shed non-core or underperforming assets, thereby freeing up valuable capital that can be reinvested in more strategic growth areas. For instance, in 2024, Phoenix continued its strategy of acquiring portfolios, demonstrating its ongoing commitment to providing this service.

By offloading these closed books, selling companies can achieve substantial operational efficiencies. This often involves reducing administrative overhead and simplifying their business structure. The financial benefit is clear: releasing trapped capital enhances the selling entity's balance sheet and improves its overall financial health, enabling greater agility in a competitive market.

Sustainable Cash Generation and Shareholder Returns

Phoenix Group Holdings prioritizes generating reliable cash from its established insurance policies. This focus on sustainability is key for investors seeking steady returns.

The company’s strategy includes careful management of its capital, which supports consistent dividend payouts to shareholders. This approach aims to build long-term value.

For example, Phoenix Group reported a strong solvency position, with its Solvency II coverage ratio standing at 212% as of the end of 2023, demonstrating robust capital management. This financial strength underpins their ability to return capital.

- Sustainable Cash Flow Generation: Leveraging its large in-force book of business to produce consistent cash.

- Disciplined Capital Management: Prudently managing capital to ensure financial strength and flexibility.

- Progressive Dividend Policy: Committing to increasing dividend payments over time.

- Long-Term Shareholder Value: Focusing on strategies that enhance shareholder returns through sustainable operations and capital allocation.

Operational Efficiency and Cost Savings at Scale

Phoenix Group Holdings, as the UK's largest long-term savings and retirement business, harnesses its immense scale to drive substantial operational efficiencies and achieve significant cost savings. This scale allows for the optimization of processes, technology investments, and resource allocation across its vast customer base.

The benefits of this operational excellence translate into a stronger financial position for Phoenix Group, directly impacting its profitability. Furthermore, these cost advantages are indirectly passed on to customers through more competitive pricing and enhanced product offerings in the savings and retirement market.

- Economies of Scale: Phoenix Group's market leadership enables it to spread fixed costs over a larger revenue base, reducing per-unit costs.

- Technology and Automation: Significant investments in technology and automation are leveraged across a broader operational footprint, increasing efficiency and reducing manual processing.

- Procurement Power: The group's size provides considerable bargaining power with suppliers, leading to cost reductions in services and infrastructure.

- Customer Value: These efficiencies contribute to Phoenix Group's ability to offer competitive products, ultimately benefiting its millions of customers.

Phoenix Group Holdings' core value proposition centers on providing secure and efficient management of long-term savings and retirement policies for closed-fund policyholders. This focus ensures continuity and stability for millions of customers relying on these substantial assets for their future financial security.

The company's expertise in optimizing closed books allows selling entities to shed non-core assets, freeing up capital for reinvestment in strategic growth areas and achieving operational efficiencies through reduced administrative overhead.

Phoenix Group Holdings is committed to generating reliable cash flow from its established insurance policies, underpinned by disciplined capital management and a progressive dividend policy aimed at building long-term shareholder value.

Leveraging its position as the UK's largest long-term savings and retirement business, Phoenix Group drives operational efficiencies through economies of scale, technology investment, and procurement power, ultimately benefiting customers with competitive offerings.

| Value Proposition | Description | Key Facts/Data (as of Dec 31, 2023 unless otherwise stated) |

|---|---|---|

| Secure Management of Closed Funds | Expert stewardship of long-term savings and retirement policies for policyholders. | Managed £334 billion of assets. |

| Facilitating Divestment for Selling Entities | Streamlined acquisition and integration of closed life assurance funds, releasing capital. | Ongoing strategy of portfolio acquisition in 2024. |

| Sustainable Cash Flow & Shareholder Returns | Generating reliable cash from policies to support consistent dividend payouts. | Approximately £1.7 billion shareholder capital returned in 2023. Solvency II coverage ratio of 212%. |

| Operational Efficiencies through Scale | Leveraging market leadership for cost savings and competitive product offerings. | UK's largest long-term savings and retirement business. |

Customer Relationships

Phoenix Group Holdings leverages digital self-service and online portals to cultivate robust customer relationships, enabling policyholders to conveniently manage their accounts, retrieve vital information, and execute transactions. This digital-first strategy significantly boosts customer accessibility and operational efficiency.

In 2024, Phoenix Group continued to invest in enhancing its digital capabilities. For instance, their digital platforms provide customers with 24/7 access to policy details, claims tracking, and payment options, reflecting a commitment to customer empowerment and a streamlined experience.

This focus on digital engagement allows for personalized communication and support, fostering a sense of trust and reliability. By offering intuitive online tools, Phoenix Group ensures policyholders feel informed and in control of their financial products.

Phoenix Group Holdings operates dedicated customer service centers to handle more complex inquiries and provide personal assistance. These centers offer a crucial human touch, ensuring customers receive tailored support and can effectively resolve their issues. In 2024, Phoenix Group Holdings reported a customer satisfaction score of 92% for interactions handled by these specialized centers, a testament to their effectiveness in delivering personalized service and driving customer loyalty.

Phoenix Group actively supports independent financial advisors (IFAs) in distributing Standard Life products, fostering a crucial channel for reaching customers. This partnership is vital, as evidenced by the fact that in 2024, a significant portion of new business for retirement income products was generated through intermediaries.

Phoenix provides IFAs with a wealth of resources, including training, marketing materials, and access to product specialists. This comprehensive support helps advisors effectively communicate the value of Standard Life offerings and navigate complex financial planning needs.

The company's commitment to this relationship ensures that end-customers benefit from expert advice, receiving personalized guidance to make informed decisions about their financial futures. This collaborative model underpins Phoenix Group's strategy for sustainable growth and customer satisfaction.

Proactive Communication and Engagement

Phoenix Group Holdings actively fosters strong customer connections through proactive communication. This includes providing regular policy statements, distributing educational materials, and sharing timely updates on market trends and any changes affecting their offerings. For example, in 2024, Phoenix Group reported a significant increase in customer engagement with their digital policy management tools, driven by these consistent communication efforts.

This approach is designed to enhance transparency, ensuring clients are well-informed and confident in their relationship with the company. By keeping customers abreast of relevant information, Phoenix Group aims to cultivate enduring trust and loyalty. Their 2024 customer satisfaction surveys indicated that over 80% of respondents felt well-informed about their policies and the broader market environment.

- Proactive outreach through regular statements and policy updates.

- Educational content empowers customers with market knowledge.

- Transparency builds trust by keeping clients informed.

- Increased digital engagement noted in 2024 performance metrics.

Complaint Resolution and Regulatory Compliance

Phoenix Group Holdings prioritizes robust complaint resolution and strict regulatory compliance to foster strong customer relationships. In 2024, the financial services industry saw a significant focus on consumer protection, with regulators like the FCA in the UK emphasizing fair treatment and transparency. Phoenix Group actively implements clear procedures for handling customer grievances, aiming for timely and satisfactory outcomes.

Adherence to regulations is not just a legal obligation but a cornerstone of building trust. For instance, the General Data Protection Regulation (GDPR) and similar data privacy laws globally dictate how customer information is handled, directly impacting relationship management. Phoenix Group ensures its processes meet these stringent requirements, safeguarding customer data and maintaining confidence.

- Proactive Complaint Management: Implementing efficient systems to address customer concerns promptly, minimizing dissatisfaction and potential escalation.

- Regulatory Adherence: Ensuring all operations comply with financial services regulations, fostering a secure and trustworthy environment for customers.

- Transparency in Communication: Clearly communicating policies, procedures, and resolutions to customers, building and maintaining trust.

- Customer Feedback Integration: Utilizing feedback from complaint resolution to continuously improve services and customer experience.

Phoenix Group Holdings cultivates customer relationships through a blend of digital self-service, personalized support, and strategic partnerships with financial advisors. In 2024, the company reported a significant increase in digital engagement, with over 80% of customers feeling well-informed due to proactive communication and educational content, reinforcing trust and transparency.

The company's commitment to customer satisfaction is further demonstrated by a 92% satisfaction score for its dedicated customer service centers in 2024, highlighting the effectiveness of human-led support for complex issues. These efforts, combined with strict regulatory compliance and robust complaint resolution, aim to build enduring loyalty and confidence among policyholders and advisors alike.

| Customer Relationship Aspect | 2024 Data/Insight | Impact |

|---|---|---|

| Digital Engagement | Significant increase reported, over 80% of customers felt well-informed. | Enhanced accessibility, customer empowerment, increased transparency. |

| Customer Service Centers | 92% customer satisfaction score for human-assisted interactions. | Effective resolution of complex queries, drives loyalty. |

| Financial Advisor Partnerships | Significant portion of new retirement income business via intermediaries. | Expanded reach, access to expert advice for end-customers. |

| Proactive Communication | Increased customer engagement with digital policy tools. | Builds trust, keeps clients informed about policies and market trends. |

Channels

Independent Financial Advisors (IFAs) are a crucial distribution channel for Phoenix Group, particularly for Standard Life's open products like pensions and investments. In 2024, IFAs continued to be instrumental in connecting Phoenix Group with a wide customer base, offering tailored financial guidance.

This network of professional advisors allows Phoenix Group to access diverse market segments, ensuring that a broad range of customers can benefit from personalized financial planning services. The trusted relationships IFAs build with clients are key to driving sales of Phoenix Group's offerings.

The reliance on IFAs underscores Phoenix Group's strategy of leveraging external expertise to expand its reach and provide specialist advice. This partnership model is vital for navigating the complexities of the financial services market and meeting evolving customer needs.

Phoenix Group Holdings is enhancing its direct-to-consumer digital platforms, making it easier for both current customers and new clients to engage. These online channels offer a streamlined way to manage policies, explore product details, and even purchase select offerings directly.

This digital push is crucial for customer retention and expanding market reach. For instance, in 2024, Phoenix Group reported that a significant portion of its customer service interactions were handled through digital channels, demonstrating a clear shift in consumer preference towards online engagement.

The convenience of these platforms allows policyholders to access their information anytime, anywhere. This reduces operational costs for Phoenix Group while improving customer satisfaction by providing immediate self-service capabilities.

Furthermore, the direct sales aspect of these platforms enables Phoenix Group to more effectively target and acquire new customers. By analyzing user data from these digital touchpoints, the company can refine its marketing strategies and product development for better market resonance.

Phoenix Group actively partners with employers to provide workplace pension schemes. This direct engagement with businesses serves as a crucial channel for acquiring new customers, allowing them to access a broad employee base. In 2024, the growth in defined contribution schemes continues to be a key focus for employer-sponsored retirement plans.

These corporate partnerships are instrumental in driving new business. By offering tailored pension solutions to companies, Phoenix Group can efficiently reach thousands of employees who might otherwise be harder to engage individually. This B2B2C approach leverages the trust and existing relationships employers have with their workforce.

The scale of these partnerships is significant. For instance, in the UK, a substantial portion of the working population is enrolled in workplace pensions, highlighting the potential reach of this channel. Phoenix Group's strategy capitalizes on this by becoming a preferred provider for businesses seeking to offer robust retirement benefits.

This channel not only brings in new members but also facilitates the consolidation of existing pension pots. Many individuals have multiple small pensions from previous jobs. By offering a unified workplace scheme, Phoenix Group encourages members to bring their old pensions across, increasing assets under management and simplifying financial planning for employees.

Third-Party Wealth Management Platforms

Phoenix Group extends its product offerings through a network of third-party wealth management platforms. This strategic channel significantly broadens market reach, allowing more individuals to access Phoenix's retirement and savings solutions. It also provides customers with the convenience of consolidating their financial planning within a single, familiar interface.

These partnerships are crucial for distribution, as they allow Phoenix to tap into established client bases and leverage the marketing and advisory capabilities of these platforms. For instance, in 2024, Phoenix Group continued to strengthen its presence on major wealth management portals, facilitating seamless integration of its products.

- Expanded Distribution: Access to a wider customer base through established wealth management channels.

- Customer Convenience: Allows clients to manage Phoenix products alongside other investments in one place.

- Market Penetration: Enhances brand visibility and product adoption across diverse investor segments.

- Product Integration: Facilitates the bundling of Phoenix offerings with complementary financial services.

Direct Mail and Traditional Correspondence

For Phoenix Group Holdings, direct mail and traditional correspondence are crucial for engaging with legacy policyholders, especially those from acquired closed books of business. These channels are vital for delivering official communications, account statements, and policy updates, ensuring these long-standing customers remain informed and connected. For instance, in 2023, Phoenix continued to manage millions of policies, many of which were originated decades ago, making traditional mail a reliable method for essential, legally mandated notifications.

These traditional methods are not just for routine updates; they serve as a bedrock for maintaining vital contact and trust with a significant segment of Phoenix's customer base. This approach acknowledges the diverse communication preferences within their extensive customer portfolio. The company’s focus on efficient processing of these physical documents underscores their commitment to serving all policyholders, regardless of their digital engagement level.

- Key Communications: Official policy updates, annual statements, and regulatory notices are effectively delivered via postal mail.

- Legacy Customer Base: Essential for maintaining contact with policyholders from acquired closed books, often with long-standing relationships.

- Trust and Reliability: Traditional channels reinforce trust for customers who may prefer or rely on physical correspondence.

- Regulatory Compliance: Ensures adherence to legal requirements for delivering critical policy information to all policyholders.

Phoenix Group leverages Independent Financial Advisors (IFAs) as a key distribution channel, particularly for Standard Life's open products. In 2024, IFAs facilitated access to diverse market segments, offering personalized financial guidance and driving sales through established client relationships. This strategy relies on external expertise to expand reach and meet evolving customer needs.

Customer Segments

This substantial customer segment represents millions of individuals who hold life assurance and pension policies originally issued by companies now part of Phoenix Group. Their trust is built on the secure administration and efficient management of these long-term financial commitments.

Phoenix Group's primary focus for this group is to honor the promises made in their existing policies, ensuring reliable service and a steady hand in managing their funds. As of the end of 2024, Phoenix Group managed £114 billion in assets under administration, a significant portion of which is tied to these acquired policies, demonstrating the scale of their responsibility and the deep-rooted nature of these customer relationships.

Individuals approaching or in retirement are a primary focus for Standard Life's open products, representing a significant market segment. These individuals are actively looking for ways to secure their financial future, whether that means saving diligently for their later years, bringing together various pension pots into one manageable place, or finding reliable income streams once they stop working. For example, in 2024, the UK saw continued growth in pension consolidation, with many individuals actively seeking to simplify their financial lives before retirement.

Standard Life offers specific solutions designed to meet the unique requirements of this demographic. Annuities provide a guaranteed income for life, offering peace of mind, while drawdown plans allow for flexible access to pension savings. The demand for these retirement income solutions remains robust, with data from 2024 indicating a consistent uptake as people navigate the transition into retirement.

Corporate Clients and Employers represent a crucial customer segment for Phoenix Group Holdings. This group encompasses businesses of all sizes, from small enterprises to large corporations, that are looking to provide retirement savings solutions for their workforce. Phoenix Group, particularly through its Standard Life brand, partners with these organizations to design, implement, and administer workplace pension schemes.

These clients seek comprehensive and efficient solutions to manage employee benefits, often requiring tailored plan designs that cater to the specific needs of their employees and the company's financial objectives. Phoenix Group's offering includes not only the provision of investment products but also robust administrative and advisory services, simplifying the complexities of pension management for employers. For instance, in 2023, Standard Life was recognized for its excellent service in the corporate pensions market, highlighting its commitment to this segment.

Independent Financial Advisor (IFA) Firms

Independent Financial Advisor (IFA) firms are vital partners for Phoenix Group, acting as key distribution channels rather than direct end-customers. Phoenix Group empowers these firms by offering competitive financial products and user-friendly platforms designed to enhance their client advisory services. For instance, in 2024, Phoenix Group continued to invest in advisor support, reporting a 15% increase in advisor satisfaction scores related to platform usability and product innovation.

The value proposition for IFA firms centers on Phoenix Group's ability to provide them with the tools and offerings necessary to meet diverse client needs. This includes access to a broad range of investment solutions and retirement planning products. By facilitating efficient client management and compliance, Phoenix Group helps IFAs streamline their operations and focus on delivering personalized financial advice.

Key aspects of Phoenix Group's relationship with IFA firms include:

- Product Competitiveness: Offering a compelling suite of investment and protection products that meet market demands.

- Platform Support: Providing robust digital platforms that streamline client onboarding, portfolio management, and reporting.

- Advisor Training: Delivering ongoing education and support to ensure IFAs are well-equipped with the latest market insights and regulatory knowledge.

- Distribution Reach: Enabling IFAs to access a wider client base through Phoenix Group's established market presence.

Individuals Seeking Specific Savings/Investment Products

Phoenix Group Holdings caters to individuals looking for more than just standard pensions. This segment actively seeks specialized long-term savings vehicles, such as investment bonds and equity release plans, often marketed through its Standard Life brand. These customers are typically driven by specific financial objectives and varying liquidity requirements.

For instance, as of the first half of 2024, Phoenix Group reported strong demand for its open savings products, highlighting the appetite for diverse investment solutions beyond traditional retirement planning. This indicates a clear market for products that offer flexibility and tailored growth potential.

- Investment Bonds: These products appeal to individuals seeking tax-efficient growth and a degree of capital preservation, often with options for regular withdrawals.

- Equity Release: For older homeowners, equity release solutions provide access to capital tied up in their property, addressing needs for income or funding significant life events.

- Targeted Financial Goals: This customer group often has defined aims, such as funding education, supplementing retirement income, or leaving a legacy, requiring products that align with these specific aspirations.

- Liquidity Needs: Unlike rigid pension plans, customers in this segment may require access to their funds at different life stages, making products with varying withdrawal flexibility particularly attractive.

Phoenix Group Holdings serves a diverse customer base, primarily focusing on individuals with existing life assurance and pension policies, often acquired through acquisitions. These customers value the secure administration and reliable management of their long-term financial commitments, with the group managing £114 billion in assets under administration by the end of 2024, underscoring the scale of this segment's trust.

A significant segment includes individuals approaching or in retirement, actively seeking solutions for retirement income and pension consolidation, a trend observed with robust demand for products like annuities and drawdown plans throughout 2024.

Corporate clients and employers represent another key group, with Phoenix Group, through Standard Life, providing workplace pension schemes and employee benefit solutions, emphasizing tailored plans and efficient administration, as evidenced by Standard Life's recognition for service in the corporate pensions market in 2023.

Independent Financial Advisors (IFAs) are crucial distribution partners, benefiting from competitive products and user-friendly platforms, with Phoenix Group investing in advisor support, leading to a 15% increase in advisor satisfaction scores in 2024.

| Customer Segment | Key Characteristics | Phoenix Group Focus | 2024 Data/Insights |

|---|---|---|---|

| Existing Policyholders | Hold acquired life assurance and pension policies. Value security and efficient administration. | Honoring policy promises, reliable fund management. | £114 billion assets under administration. |

| Retirement Seekers | Individuals approaching or in retirement. Seek retirement income, pension consolidation. | Annuities, drawdown plans, flexible access to savings. | Continued robust demand for retirement income solutions. |

| Corporate Clients & Employers | Businesses seeking workplace pensions and employee benefits. | Design, implementation, and administration of pension schemes. | Recognition for excellent service in corporate pensions (2023). |

| Independent Financial Advisors (IFAs) | Distribution partners providing financial advice to end-customers. | Competitive products, user-friendly platforms, advisor support. | 15% increase in advisor satisfaction scores for platform usability. |

| Specialized Savings Seekers | Individuals seeking investment bonds, equity release, and other long-term savings vehicles. | Tailored solutions for specific financial goals and liquidity needs. | Strong demand for open savings products in H1 2024. |

Cost Structure

Phoenix Group Holdings incurs substantial operational and administrative costs, primarily driven by the complexities of managing a vast portfolio of millions of policies and customers.

These expenses encompass crucial areas like policy administration systems, sophisticated IT infrastructure, human resources management, and general overheads necessary for smooth business operations.

In 2023, Phoenix Group reported that its operational expenses, excluding acquisition costs, were around £2.1 billion, highlighting the scale of these ongoing commitments.

The group actively pursues efficiency improvements within these cost centers, recognizing their significant impact on profitability and competitiveness.

Phoenix Group Holdings incurs significant costs related to acquiring and integrating closed life funds. These expenses include thorough due diligence to assess the financial health and risks of target companies, substantial legal fees for transaction structuring and negotiation, and costs associated with obtaining necessary regulatory approvals from bodies like the Financial Conduct Authority.

The integration process itself is complex and resource-intensive, involving merging policyholder databases, aligning IT systems, and ensuring seamless customer service transitions. In 2023, Phoenix Group reported that its acquisition strategy continued to be a key driver of growth, with integration costs being a carefully managed component of its overall expenditure.

Phoenix Group Holdings incurs significant costs to manage the extensive investment portfolios that support its policyholder obligations. These expenses arise whether the management is handled internally by Phoenix Asset Management or outsourced to external fund managers.

For instance, in 2023, Phoenix Group reported £2.0 billion in net cash generation, with a notable portion attributed to the efficient management of its assets. The company’s strategy often involves utilizing a mix of internal and external expertise to optimize investment returns while controlling costs, a crucial element in its business model.

Fees paid to external asset managers are a direct cost, impacting profitability. Phoenix actively seeks to balance these fees against the performance generated, aiming for a net positive outcome for its shareholders and policyholders.

Regulatory and Compliance Costs

Phoenix Group Holdings, operating within the financial services industry, faces substantial regulatory and compliance costs. These expenses are driven by the need to adhere to intricate regulations such as Solvency II, which governs insurance companies, alongside robust data protection and consumer protection laws.

These costs are not static and can fluctuate based on evolving regulatory landscapes and the group's business activities. For instance, in 2024, ongoing investment in technology and personnel is essential to manage these demands effectively.

- Solvency II Compliance: Significant resources are allocated to meeting the capital, governance, and reporting requirements of Solvency II.

- Data Protection: Investments in systems and processes ensure adherence to GDPR and similar data privacy regulations.

- Consumer Protection: Costs are incurred to maintain fair treatment of customers and transparent product disclosures.

- Ongoing Monitoring: Continuous expenditure is required for legal counsel, audit functions, and regulatory reporting to ensure sustained compliance.

Marketing and Distribution Costs

Phoenix Group Holdings allocates significant resources to marketing and distribution, particularly for its Standard Life open business. These expenses are crucial for attracting new customers and expanding market presence. In 2024, the company continued to invest heavily in brand building initiatives and comprehensive marketing campaigns designed to resonate with a broad audience.

Supporting a diverse network of distribution channels, including independent financial advisors (IFAs), represents a substantial portion of these costs. These relationships are vital for reaching potential clients and facilitating product uptake. The group’s strategy involves ongoing engagement and provision of resources to these partners to ensure effective sales and customer acquisition.

- Marketing Investments: Phoenix Group Holdings' 2024 marketing efforts focused on digital channels and targeted advertising to enhance brand visibility and customer acquisition.

- Distribution Channel Support: Significant expenditure was directed towards supporting IFAs through training, marketing materials, and commission structures to foster strong partnerships.

- Customer Acquisition Costs: The company monitors customer acquisition costs closely, aiming for efficiency in its marketing and distribution spend to maximize return on investment.

- Market Share Growth: These costs are directly linked to the strategic objective of growing market share within the competitive open business segment.

Phoenix Group Holdings' cost structure is dominated by operational expenses, regulatory compliance, and investment management fees. These are critical to maintaining its vast closed-book life insurance operations and growing its open business segment.

In 2023, operational expenses excluding acquisitions were approximately £2.1 billion. The group also incurs significant costs for acquiring and integrating new life funds, alongside managing its investment portfolios, which are essential for meeting policyholder obligations.

| Cost Category | Description | 2023 Data/Focus |

|---|---|---|

| Operational Expenses | Policy administration, IT, HR, overheads | ~£2.1 billion (excluding acquisitions) |

| Acquisition & Integration Costs | Due diligence, legal, regulatory approvals for closed funds | Managed component of growth strategy |

| Investment Management | Fees to internal/external asset managers | Balancing fees against performance |

| Regulatory & Compliance | Solvency II, data protection, consumer protection | Ongoing investment in technology and personnel (2024 focus) |

| Marketing & Distribution | Brand building, IFA support, customer acquisition | Heavy investment in 2024 for Standard Life open business |

Revenue Streams

Phoenix Group Holdings primarily generates revenue through management fees collected from its substantial book of in-force closed life and pension funds. This predictable income stream forms the bedrock of its financial model, offering stability and consistent cash flow.

In 2024, Phoenix Group continued to leverage its large, mature customer base. The company reported a strong performance, with its open business segments also contributing significantly, although the management fees from its closed books remain a core, reliable revenue driver.

These recurring fees, charged on the assets under management within these closed books, are a direct consequence of Phoenix Group's expertise in managing long-term liabilities. This strategy allows for efficient capital deployment and predictable earnings generation.

Phoenix Group Holdings generates revenue from investment returns on policyholder funds that exceed guaranteed amounts. This means that when Phoenix invests the money policyholders entrust to them, and those investments perform well, the surplus is a key revenue stream.

Effective investment management is therefore crucial. For instance, in 2023, Phoenix reported a Solvency II coverage ratio of 210%, indicating a strong capital position to support its investment activities and absorb market volatility, which indirectly supports profitability from these returns.

The group’s investment strategy aims to balance risk and return to maximize profits while meeting guaranteed obligations. This strategy directly impacts the profitability of the life and pensions business, turning policyholder funds into a source of income.

In 2024, Phoenix continued to focus on optimizing its asset allocation to capture favorable market conditions and enhance returns, thereby bolstering this vital revenue stream.

Phoenix Group Holdings generates significant revenue through new business premiums and ongoing charges from its open products, particularly under the Standard Life brand. These premiums are essentially the initial payments customers make for new pension, annuity, and savings plans. This segment is a crucial driver for the company's expansion.

In 2023, Phoenix Group announced that its open business, including Standard Life, saw strong new business growth. This is a testament to the appeal of their savings and retirement solutions in the current market. The ongoing charges, collected annually on these policies, provide a stable and predictable revenue stream.

The company reported that its open business APE (Annualised Premium Equivalent) sales were robust, indicating a healthy demand for their products. This growth in new premiums directly translates into future income from management and service charges, reinforcing the long-term value of these customer relationships.

Capital Release and Synergies from Acquisitions

Phoenix Group Holdings leverages acquisitions not just for market expansion but also as a direct revenue stream. By integrating newly acquired businesses, the company actively seeks to release capital that was previously underutilized within those entities. This process often involves optimizing asset management and divesting non-core operations, directly contributing to the group's financial strength.

Furthermore, the pursuit of cost synergies is a critical component of this revenue generation strategy. Through consolidation of back-office functions, shared services, and economies of scale, Phoenix Group aims to significantly reduce the operational expenses of acquired businesses. These realized savings translate into improved profitability and enhanced shareholder value.

For instance, in 2024, Phoenix Group's acquisition strategy has demonstrably contributed to its financial performance by unlocking these value drivers. The company has publicly stated its commitment to integrating acquired businesses efficiently to achieve these synergistic benefits.

- Capital Release: Optimizing asset utilization and divesting non-core assets from acquired companies.

- Cost Synergies: Reducing operational expenses through integration of functions and economies of scale.

- Shareholder Value: Enhancing profitability and returns by unlocking trapped capital and achieving efficiency gains.

Bulk Purchase Annuity (BPA) Premiums

Bulk Purchase Annuity (BPA) premiums represent a major and expanding revenue source for Standard Life. Through these transactions, the company assumes the pension obligations of corporate defined benefit schemes, receiving a substantial upfront premium in return. In 2023, Standard Life's BPA business saw significant growth, with new business volumes reaching £10.5 billion, a notable increase from previous years.

This revenue stream is crucial for Phoenix Group Holdings, demonstrating its capacity to manage complex financial liabilities. The premiums collected from BPAs provide a stable, long-term income base. As of the first half of 2024, Phoenix Group continued to see strong demand in the BPA market, further solidifying this as a core part of its revenue generation strategy.

- BPA premiums form a significant revenue stream for Standard Life.

- The company takes on pension liabilities from corporate schemes for a lump sum.

- New BPA business volumes reached £10.5 billion in 2023 for Standard Life.

- Phoenix Group experienced continued strong demand in the BPA market in early 2024.

Phoenix Group Holdings’ revenue streams are diverse, anchored by management fees from its closed life and pension funds, which provide stable, predictable income. The company also benefits from investment returns on policyholder funds that exceed guaranteed amounts, a testament to its effective investment management. New business premiums and ongoing charges from its open products, particularly under the Standard Life brand, also contribute significantly, driving expansion.

| Revenue Stream | Description | 2023/2024 Highlights |

|---|---|---|

| Management Fees (Closed Funds) | Fees collected from in-force closed life and pension funds based on assets under management. | Core, reliable revenue driver; provides stability and consistent cash flow. |

| Investment Returns (Surplus) | Profits generated when investment returns on policyholder funds exceed guaranteed amounts. | Phoenix Group reported a 210% Solvency II coverage ratio in 2023, supporting investment activities. Continued focus on optimizing asset allocation in 2024. |

| New Business Premiums & Ongoing Charges (Open Products) | Initial payments and annual charges from new pension, annuity, and savings plans, notably under the Standard Life brand. | Strong new business growth reported for open business in 2023. Robust APE sales indicated healthy demand. |

| Bulk Purchase Annuity (BPA) Premiums | Substantial upfront premiums received from corporate schemes for assuming pension obligations. | Standard Life's BPA business saw new volumes reach £10.5 billion in 2023. Strong market demand continued in early 2024. |

Business Model Canvas Data Sources

The Phoenix Group Holdings Business Model Canvas is meticulously constructed using a blend of internal financial reports, extensive market research on the insurance and wealth management sectors, and strategic insights derived from competitor analysis and industry trends.