Phoenix Group Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Phoenix Group Holdings Bundle

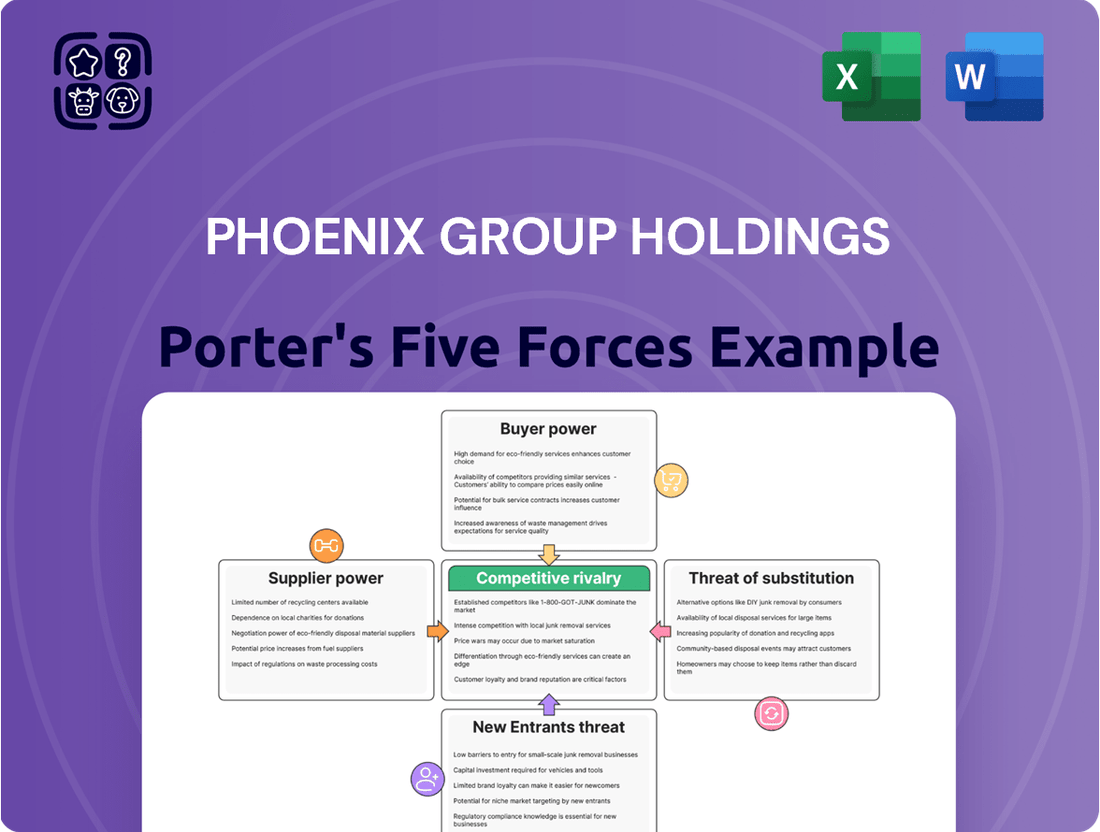

Phoenix Group Holdings operates within a dynamic financial services landscape, where understanding competitive forces is paramount. The threat of new entrants, while present, is tempered by significant regulatory hurdles and capital requirements. Buyer power, particularly from large institutional clients, can exert pressure on pricing and service offerings.

The intensity of rivalry among established players like Phoenix Group Holdings is a constant factor, driven by innovation and customer retention strategies. Supplier power, though less pronounced, can influence the cost of essential services and technology. Crucially, the threat of substitutes, such as alternative investment vehicles or fintech solutions, necessitates continuous adaptation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Phoenix Group Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Phoenix Group Holdings, like many large insurers, depends on specialized IT and software providers to manage its extensive portfolio of legacy policies and its newer digital platforms. The intricate and unique nature of these systems often means that only a select few suppliers have the deep expertise required. This can grant these specialized providers significant bargaining power, particularly when it comes to essential maintenance and crucial upgrades.

For instance, in 2024, the global IT services market, which includes specialized software for financial institutions, was valued at over $1.3 trillion, highlighting the significant investment in technology. The complexity of insurance systems, which often involve decades of custom-built code, reinforces the reliance on these niche providers. This reliance can translate into higher costs for Phoenix Group if these suppliers dictate terms, especially for critical system support.

However, the ongoing digital transformation within the insurance sector, with a strong push towards cloud-based solutions and open-source technologies, is gradually increasing competition among technology providers. This shift could, over the longer term, dilute the bargaining power of individual specialized suppliers by offering Phoenix Group a wider range of potential partners and more competitive pricing for new implementations and ongoing services.

The bargaining power of suppliers providing actuarial and consulting services to Phoenix Group Holdings is considerable. The insurance sector, especially long-term savings and retirement, is heavily regulated, demanding specialized expertise for risk management, valuation, and compliance with frameworks like Solvency UK and PRA stress tests. This necessity for deep, niche knowledge allows these suppliers to influence pricing and terms significantly.

In 2024, the demand for specialized actuarial talent remained high, with consulting firms like Deloitte, EY, PwC, and KPMG, as well as niche actuarial consultancies, being key players. The cost of these services can be substantial, reflecting the critical nature of their work in ensuring regulatory adherence and financial stability for companies like Phoenix Group. For instance, the complexity of IFRS 17 implementation, which continued to be a focus in 2024, further amplified the need for expert actuarial advice, giving these service providers leverage.

Reinsurance providers hold significant bargaining power, particularly for large pension risk transfer (PRT) deals like those undertaken by Phoenix Group. These reinsurers are essential for insurers to manage catastrophic or long-term risks, such as the longevity risk embedded in vast pension liabilities. The limited number of highly specialized and reputable reinsurers capable of handling such substantial transactions means they can often dictate terms and pricing, especially for complex or sizable portfolios. For instance, in 2023, the global reinsurance market saw continued strong demand, with gross written premiums in life reinsurance alone reaching hundreds of billions of dollars, underscoring the scale and importance of these providers.

Asset Management Services

Phoenix Group Holdings, while possessing in-house asset management through Standard Life, also engages external asset managers. The bargaining power of these external managers is influenced by their specialized expertise and the volume of assets they handle for Phoenix. For instance, if a niche manager offers unique investment strategies not readily available internally, their leverage increases. In 2023, the global asset management industry saw significant inflows, with active managers particularly benefiting from market volatility, potentially strengthening their negotiating position with large institutional clients like Phoenix.

The concentration of external asset managers available for specific investment mandates also plays a role. If only a few firms possess the required skills or track record, their bargaining power is amplified. Conversely, a highly competitive market with many providers diminishes this power. The sheer scale of assets Phoenix Group manages could also be a bargaining chip, allowing them to negotiate more favorable fee structures with external managers, especially those looking to grow their assets under management.

- Specialized Expertise: External managers with unique or hard-to-replicate investment strategies hold greater bargaining power.

- Asset Scale: The amount of assets Phoenix Group allocates to an external manager can influence negotiation leverage.

- Market Competition: A crowded market for specific asset management services reduces the bargaining power of individual suppliers.

- Performance Track Record: Managers with consistently strong past performance may command higher fees and thus possess more bargaining power.

Marketing and Distribution Partners

Phoenix Group's reliance on marketing and distribution partners, such as financial advisers and its own direct-to-consumer platforms for brands like Standard Life, can influence supplier bargaining power. The reach and effectiveness of these channels are critical for generating new business. For instance, in 2024, the UK financial advice market continued to be a significant distribution route for long-term savings products.

Well-established distribution partners with substantial client bases may possess some leverage when negotiating terms with Phoenix Group. This leverage can stem from their ability to direct significant volumes of new business, making their partnership valuable. Conversely, Phoenix Group's own brand strength and direct channel capabilities can mitigate this power.

- Distribution Channel Importance: Phoenix Group leverages financial advisers and direct-to-consumer platforms for brands like Standard Life.

- New Business Growth: The effectiveness and reach of these partners directly impact Phoenix Group's ability to grow new business.

- Partner Leverage: Larger, established distribution partners may have some bargaining power in commercial agreements due to their client reach.

- Market Dynamics (2024): The UK financial advice market remained a key distribution channel for long-term savings products in 2024.

Phoenix Group Holdings faces significant supplier bargaining power from specialized IT and software providers due to the complexity and unique nature of its legacy systems. This reliance can lead to higher costs for essential maintenance and upgrades, as only a few niche firms possess the required deep expertise.

The insurance sector's reliance on specialized actuarial and consulting services also grants these suppliers considerable leverage. Their deep knowledge in risk management, valuation, and regulatory compliance, especially with frameworks like Solvency UK, allows them to influence pricing and terms, particularly for critical tasks like IFRS 17 implementation, a key focus in 2024.

Reinsurers hold substantial bargaining power, particularly for large-scale pension risk transfer deals, as the number of specialized, reputable reinsurers capable of handling such transactions is limited. This scarcity allows them to dictate terms and pricing for substantial portfolios.

The bargaining power of external asset managers can be substantial if they offer unique investment strategies or manage a significant volume of assets for Phoenix Group. A concentrated market for specific mandates amplifies this power, though Phoenix Group's scale can also be a negotiating advantage.

| Supplier Type | Key Factors Influencing Power | Impact on Phoenix Group | Relevant Data/Context (2024/2023) |

|---|---|---|---|

| IT & Software Providers | Specialized expertise, system complexity | Higher costs for maintenance and upgrades | Global IT services market > $1.3 trillion (2024) |

| Actuarial & Consulting Firms | Niche knowledge, regulatory demands | Significant influence on pricing for compliance services | High demand for actuarial talent; IFRS 17 focus (2024) |

| Reinsurers | Limited number of specialized providers, risk scale | Ability to dictate terms for large PRT deals | Life reinsurance premiums in hundreds of billions (2023) |

| External Asset Managers | Unique strategies, asset volume, market concentration | Potential for higher fees; leverage from strong track records | Active managers saw significant inflows (2023) |

What is included in the product

This analysis unpacks the competitive forces impacting Phoenix Group Holdings, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the financial services sector.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, providing a clear roadmap for strategic action.

Customers Bargaining Power

For individual policyholders of open products like pensions and bonds, particularly those offered via Standard Life, their bargaining power is generally moderate. The rise of comparison websites and enhanced transparency driven by regulations like the UK's Consumer Duty in 2024 have empowered consumers with more information. This increased visibility, alongside relatively low switching costs for ongoing contributions, gives customers more leverage.

However, the actual exercise of this power can be tempered. Customer inertia, meaning a reluctance to change providers even when better options exist, and the inherent complexity of financial products can act as significant barriers to switching. Despite the availability of information, a substantial portion of policyholders may not actively compare or move their funds, thus limiting their immediate impact on Phoenix Group's pricing or terms.

Pension scheme trustees, particularly those managing large defined benefit schemes in the bulk purchase annuity (BPA) market, wield considerable bargaining power. These transactions, often involving billions of pounds, see multiple insurers competing intensely. Trustees leverage expert consultants to negotiate the most advantageous terms, ensuring the best outcomes for their scheme members.

The competitive bidding process inherent in the BPA market significantly amplifies trustee leverage. For instance, in 2023, the BPA market saw record activity with transactions totaling over £40 billion in the UK, indicating a robust demand from schemes and a strong negotiating position for their trustees. This high volume of deals means insurers are eager to secure business, allowing trustees to push for better pricing and improved contract conditions.

The Financial Conduct Authority's (FCA) Consumer Duty, fully implemented in 2024, significantly bolsters customer bargaining power. This regulation requires firms like Phoenix Group to ensure customers achieve good outcomes, focusing on fair value and accessible support. This legal obligation means Phoenix must proactively prioritize customer interests, making products simpler to understand and manage, thereby increasing customer leverage.

Information Availability and Digital Tools

Customers now wield significant power due to readily available digital tools and comparison platforms. This ease of access allows them to thoroughly research and compare financial products, from savings accounts to complex investment vehicles. For instance, a significant portion of consumers actively use online comparison sites before making financial decisions, a trend that has only accelerated in recent years.

Phoenix Group Holdings acknowledges this shift. Their strategic focus on enhancing digital tools for financial wellbeing and improving their master trust offerings demonstrates a clear understanding of this empowered customer base. This responsiveness is crucial for retaining market share and attracting new clients in a competitive landscape.

- Increased Information Access: Digital tools and comparison platforms have drastically lowered the barrier to entry for customer research in the financial services sector.

- Phoenix Group's Digital Investment: The company's enhancements to digital tools and master trust offerings reflect a direct response to customer demand for transparency and ease of comparison.

- Competitive Landscape: The ability for customers to easily compare offerings puts pressure on all financial institutions, including Phoenix Group, to innovate and offer superior value propositions.

Low Switching Costs for New Business

The bargaining power of customers is significantly influenced by switching costs. For Phoenix Group Holdings, while their legacy closed book policies involve considerable complexity in transferring, the landscape for their newer, open book products is quite different.

Customers looking to move their funds or initiate new pension contributions with a competitor face minimal financial or procedural hurdles. This ease of transition directly amplifies customer power, as they are more inclined to shop around for superior value or enhanced service offerings.

- Low Switching Costs: For new business lines, customers can easily transfer funds or start new pension pots elsewhere, enhancing their leverage.

- Customer Choice: In 2024, the competitive pension market offers numerous providers, giving customers ample options to seek better deals.

- Price Sensitivity: As customers become more aware of fees and performance differences, they are more likely to switch for a perceived advantage.

Customers, particularly individual policyholders of open products, possess moderate bargaining power. Increased transparency, driven by initiatives like the UK's 2024 Consumer Duty, and the proliferation of comparison websites empower them with information. This accessibility, coupled with relatively low switching costs for ongoing contributions, grants customers more leverage to seek better value, though inertia can limit its full impact.

However, pension scheme trustees, especially in the substantial bulk purchase annuity (BPA) market, exert considerable bargaining power. In 2023, the UK BPA market saw over £40 billion in transactions, highlighting intense competition among insurers. Trustees, often advised by consultants, can negotiate highly favorable terms due to this competitive environment, directly influencing pricing and contract conditions.

| Customer Segment | Bargaining Power Level | Key Influencing Factors |

|---|---|---|

| Individual Policyholders (Open Products) | Moderate | Information access via comparison sites, Consumer Duty (2024), low switching costs for new contributions |

| Pension Scheme Trustees (BPA Market) | High | Large transaction values, intense insurer competition, expert advice, high market volume (£40bn+ in UK BPA 2023) |

Preview the Actual Deliverable

Phoenix Group Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of the Phoenix Group Holdings, detailing the competitive landscape within the insurance and wealth management sectors. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy.

Rivalry Among Competitors

The UK's long-term savings and retirement sector, despite ongoing consolidation, still features a broad array of competitors. Phoenix Group faces robust rivalry from major entities like Aviva, Legal & General, and Prudential, all vying for market share in pensions, bonds, and equity release products.

This fragmentation means Phoenix Group must continually innovate and offer compelling value propositions. For instance, in 2023, the UK pensions landscape saw significant activity, with providers adapting to evolving regulatory frameworks and consumer demand for flexible retirement options.

The competitive intensity is further amplified by the presence of specialist providers and the increasing influence of technology in delivering savings solutions. Phoenix Group's strategy must account for this dynamic environment to maintain and grow its position.

Phoenix Group operates in a market characterized by intense rivalry, primarily focused on acquiring and managing closed book life assurance funds. This niche segment attracts a concentrated group of sophisticated financial institutions, all vying for the same portfolios. The competition is fierce because these closed books represent established cash flows and predictable liabilities, making them attractive assets.

Key players in this space include other large consolidators and specialist asset managers with proven track records in portfolio integration and optimization. For instance, in 2024, the market continues to see significant activity, with firms like ReAssure and Aviva also actively participating in the closed book acquisition space, contributing to a highly competitive landscape. The ability to deploy capital efficiently and manage acquired books effectively is paramount.

The differentiation among competitors often hinges on their operational efficiency, risk management capabilities, and the scale of their integration platforms. Companies that can demonstrate superior cost management and capital allocation strategies gain a competitive edge. Phoenix Group’s success is therefore closely tied to its capacity to outmaneuver rivals in securing and optimizing these valuable, yet limited, acquisition opportunities.

The Pension Risk Transfer (PRT) market, encompassing bulk purchase annuities, represents a key growth avenue for Phoenix Group but is characterized by fierce competition.

Elevated interest rates in 2024 have bolstered pension scheme funding levels, thereby increasing the attractiveness of PRT transactions. This has fueled aggressive pricing strategies and intensified competition among a select group of major insurers vying for substantial 'jumbo' deals, often exceeding billions in value.

In 2023, the UK PRT market saw record transaction volumes, with estimates suggesting over £50 billion in deals were completed, highlighting the significant market opportunity and the competitive pressures to secure this business.

Product Innovation and Digitalization

Competitive rivalry within the financial services sector, particularly for Phoenix Group Holdings, is intensifying due to a strong emphasis on product innovation. This is especially evident in areas like the open book segment and the rapidly growing retirement solutions market. Companies are actively pursuing digital transformation to enhance customer experience and operational efficiency.

This drive for innovation translates into significant investment in personalized offerings and products that align with Environmental, Social, and Governance (ESG) principles. Phoenix's own Standard Life brand, for instance, has been at the forefront by adopting sustainability-labelled funds, reflecting a broader industry trend to meet investor demand for responsible investment options.

- Digital Transformation: Phoenix Group is investing in digital capabilities to streamline customer journeys and offer more accessible financial products.

- Personalized Offerings: The market is seeing a shift towards tailored financial solutions, encouraging providers to leverage data analytics for deeper customer understanding.

- ESG Focus: With increasing investor and regulatory pressure, companies are integrating ESG considerations into their product development, such as Standard Life's sustainability-labelled funds.

- Retirement Solutions: Innovation in retirement products is a key battleground, with providers enhancing options for long-term savings and income generation.

Regulatory Scrutiny and Consolidation Pressure

Regulatory bodies such as the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA) are actively shaping the competitive landscape. Initiatives like rigorous stress tests and the Consumer Duty are compelling smaller, less efficient pension schemes to consider consolidation, thereby altering market dynamics.

The UK government has explicitly outlined a strategic vision favouring fewer, larger defined contribution (DC) pension schemes. This policy direction directly fuels consolidation pressures within the industry, as it incentivizes mergers and acquisitions to achieve greater scale and efficiency.

- Regulatory Drivers: PRA and FCA introduce stress tests and Consumer Duty, impacting smaller, less efficient schemes.

- Government Policy: Vision for fewer, larger DC pension schemes accelerates consolidation.

- Market Impact: Increased pressure for mergers and acquisitions to achieve scale and compliance.

- 2024 Outlook: Continued regulatory focus expected to drive further consolidation activity.

Phoenix Group operates in a highly competitive UK financial services market, particularly in closed book acquisitions and Pension Risk Transfer (PRT). Rivalry is intense with major players like Aviva and Legal & General actively pursuing similar opportunities. The drive for scale and efficiency, encouraged by regulatory shifts in 2024, means firms must excel in operational management and capital deployment to secure profitable portfolios.

| Competitor | Key Activities | 2023/2024 Focus |

|---|---|---|

| Aviva | Closed book acquisition, PRT, open market pensions | Expanding annuity and PRT offerings, digital innovation |

| Legal & General | Bulk annuities, retirement solutions, asset management | Record PRT volumes, focus on institutional clients |

| ReAssure | Closed book consolidation, life insurance portfolio management | Strategic acquisitions and integration of acquired assets |

SSubstitutes Threaten

Customers increasingly bypass traditional insurers by opting for direct investment platforms and do-it-yourself (DIY) investing. These platforms offer a more cost-effective and flexible way to manage savings and retirement funds, directly challenging the role of intermediaries like Phoenix Group. For instance, the UK's DIY investment platform market has seen substantial growth, with assets under management reaching over £250 billion by the end of 2023, indicating a clear shift in consumer preference.

Alternative savings vehicles pose a significant threat to Phoenix Group's open products. Options like Individual Savings Accounts (ISAs) in the UK, or direct property investments, offer customers different ways to save and grow their wealth outside of traditional insurance wrappers. These can appeal to those prioritizing liquidity or greater direct control over their investments, potentially diverting capital that might otherwise flow into Phoenix's offerings.

Government-backed schemes, like state pensions, act as a significant, albeit indirect, substitute for private retirement savings. While they don't replace the full spectrum of private provision, their presence can dampen the perceived urgency for individuals to secure supplementary income. For instance, in the UK, the State Pension age is gradually increasing, with the current age set at 66, moving towards 67 in the coming years, which directly impacts the timeline for individuals relying solely on state support.

Changes in the generosity or accessibility of these state provisions can directly influence demand for Phoenix Group's private offerings. If state pensions are perceived as less robust or if eligibility criteria become stricter, it could drive greater demand for private long-term savings products. Conversely, an increase in state pension benefits might reduce the perceived need for additional private savings for some segments of the population.

Financial Advice Shifting Focus

The threat of substitutes for Phoenix Group Holdings is growing as the nature of financial advice itself changes. Some advisors are now suggesting a wider array of financial products, moving beyond the traditional insurance and pension offerings Phoenix specializes in. This evolution means customers might increasingly turn to non-insurance products if these alternatives appear more adaptable or economical.

This trend is supported by data indicating a shift in consumer preference. For instance, in 2024, the global fintech market, which often provides alternative financial solutions, was projected to reach over $33 billion, demonstrating a significant appetite for non-traditional financial products.

- Evolving Advice Landscape: Financial advisors are broadening their product recommendations, impacting traditional insurance and pension providers.

- Customer Choice: Customers may opt for non-insurance products perceived as more flexible or cost-effective.

- Fintech Growth: The burgeoning fintech sector offers a direct substitute channel for financial services, with significant market growth in 2024.

- Competitive Pressure: This broader advice spectrum increases competitive pressure on Phoenix Group Holdings from a wider range of financial service providers.

Emerging Fintech Solutions

Emerging fintech solutions present a significant substitute threat to Phoenix Group Holdings, particularly in the savings, investment, and retirement planning sectors. These agile companies are rapidly innovating, often at a lower cost point, by leveraging technology to offer streamlined, digital-first customer experiences. This can directly appeal to a growing segment of consumers seeking simpler, more accessible financial management tools, potentially drawing them away from traditional providers.

The disruption is already evident. For instance, in 2024, the global fintech market was projected to reach over $1.1 trillion, a testament to its rapid growth and increasing adoption. Specific areas like robo-advisors, which offer automated investment management, are gaining traction. These platforms can provide diversified portfolios and ongoing management at a fraction of the fees charged by traditional wealth managers, making them an attractive alternative for cost-conscious investors.

- Lower Cost Structures: Fintechs often operate with leaner overheads, allowing them to offer competitive pricing on services like investment management and financial advice.

- Digital-First Experience: Many new entrants focus on user-friendly mobile apps and online platforms, catering to a digitally native customer base.

- Niche Market Focus: Some fintechs target specific customer segments or financial needs, offering highly specialized solutions that traditional institutions may not address as effectively.

- Rapid Innovation Cycles: The pace of technological advancement in fintech allows for quicker development and deployment of new products and features, keeping them ahead of the curve.

The threat of substitutes for Phoenix Group is multifaceted, encompassing direct investment platforms, alternative savings vehicles, and even government-backed pensions. The rise of DIY investing platforms, for example, saw the UK market's assets under management surpass £250 billion by late 2023, highlighting a consumer shift towards more cost-effective and flexible wealth management outside traditional insurance products. Furthermore, the fintech sector's projected growth to over $1.1 trillion globally in 2024 underscores the increasing availability and appeal of innovative, often lower-cost financial solutions that bypass incumbent providers.

| Substitute Category | Key Characteristics | Impact on Phoenix Group | Example Data Point (2023/2024) |

|---|---|---|---|

| DIY Investment Platforms | Cost-effective, flexible, direct control | Diverts savings from traditional insurance wrappers | UK DIY platform AUM > £250 billion (end 2023) |

| Alternative Savings Vehicles | ISAs, property investment, direct investments | Offers diversification and liquidity outside insurance | N/A (General category) |

| Government Pensions | State safety net, supplementary income | Can reduce perceived need for private retirement savings | UK State Pension age increasing to 67 |

| Fintech Solutions | Digital-first, lower fees, innovative products | Offers streamlined, accessible financial management | Global fintech market projected > $1.1 trillion (2024) |

Entrants Threaten

The UK's long-term savings and retirement market is heavily regulated by the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA). These bodies impose strict capital requirements, such as those under Solvency UK, and robust operational resilience standards. These stringent rules create substantial financial and operational hurdles, making it exceptionally difficult and expensive for new companies to enter and compete with established players like Phoenix Group Holdings.

Establishing a new long-term savings and retirement business, especially one handling intricate legacy portfolios or substantial pension risk transfers, demands significant capital investment. For instance, launching such an operation in 2024 would likely necessitate hundreds of millions, if not billions, of dollars to cover regulatory capital, operational infrastructure, and initial customer acquisition costs.

In financial services, especially for products requiring long-term commitment like pensions, building trust and brand recognition is incredibly important. New companies find it hard to gain the credibility and size needed to go head-to-head with established players. Phoenix Group, for example, benefits significantly from its extensive customer base and the well-respected Standard Life brand, which new entrants would take years to replicate.

Complexity of Legacy Systems and Closed Books

Phoenix Group's core strategy involves acquiring and managing mature, closed life assurance funds. This requires specialized expertise and significant investment in IT systems to handle the intricate legacy data and regulatory requirements. For instance, as of December 31, 2023, Phoenix managed over £274 billion in assets, underscoring the scale of these operations.

The inherent complexity of these legacy systems, often built on outdated technology and subject to unique legal frameworks, presents a substantial hurdle for potential new entrants. Integrating or replicating such systems demands considerable time, capital, and specialized knowledge, acting as a strong deterrent.

- High Capital Investment: New entrants need substantial funds to acquire or develop comparable IT infrastructure and expertise.

- Regulatory Hurdles: Navigating the complex regulatory landscape for closed life funds is a significant barrier.

- Operational Expertise: Managing legacy systems requires niche skills and a proven track record, which new players lack.

- Data Migration Challenges: The sheer volume and complexity of data in closed books make migration a difficult and risky undertaking.

Distribution Network and Customer Acquisition Costs

Establishing a robust distribution network for pensions and savings products is inherently costly and time-consuming. New players entering the market must invest significantly in building these channels, which can take years to mature. For instance, acquiring new customers in the UK financial services sector can cost upwards of £500 per customer, a substantial barrier for any newcomer aiming for scale.

Customer acquisition costs represent a major hurdle for potential new entrants. Beyond direct marketing, significant resources are required to cultivate relationships with independent financial advisors (IFAs) or to develop and market a direct-to-consumer (D2C) platform. In 2024, the average cost to acquire a new investment customer through digital channels alone often exceeded £300, highlighting the financial commitment needed.

- High Investment: Building and maintaining an effective distribution network for financial products demands substantial upfront and ongoing capital expenditure.

- Relationship Building: Securing access to IFAs requires dedicated sales teams and marketing efforts, adding to operational costs.

- D2C Challenges: Developing a competitive D2C platform involves significant technology investment, marketing spend, and customer support infrastructure.

- Customer Acquisition Costs: In 2024, acquisition costs for financial services customers often ranged from £300 to £500+, making it difficult for new entrants to compete with established players' economies of scale.

The threat of new entrants into the UK long-term savings and retirement market is significantly low for Phoenix Group Holdings. The sector is characterized by immense regulatory barriers, with bodies like the PRA and FCA imposing stringent capital and operational resilience standards, making it prohibitively expensive for newcomers. For instance, the capital requirements for acquiring and managing life assurance funds, as demonstrated by Phoenix's £274 billion asset base as of December 2023, demand resources far beyond the reach of most new firms.

The need for substantial capital investment, estimated to be in the hundreds of millions to billions of dollars for a 2024 launch, combined with the difficulty of building trust and brand recognition against established entities like Phoenix with its Standard Life brand, presents a formidable challenge. Furthermore, the specialized expertise required to manage complex legacy systems, a core part of Phoenix's strategy, and the high customer acquisition costs, often exceeding £300-£500 per customer in 2024, deter potential new entrants.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Requirements | Strict capital and operational standards from PRA/FCA. | High compliance costs and complexity. |

| Capital Investment | Significant funds needed for infrastructure, IT, and operations. | Prohibitive for most new players. |

| Brand & Trust | Established reputation of incumbents like Phoenix. | Difficult to build credibility and market share. |

| Operational Expertise | Handling complex legacy systems and data. | Requires specialized skills and significant investment. |

| Customer Acquisition Costs | High costs for marketing, sales, and advisor relationships. | Makes scaling difficult and expensive. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Phoenix Group Holdings is built upon a foundation of robust data, including their annual reports, investor presentations, and official regulatory filings.

We supplement this internal data with insights from reputable industry research firms, financial news outlets, and macroeconomic data providers to offer a comprehensive understanding of the competitive landscape.