Thai Wah SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Thai Wah Bundle

Thai Wah's market position is defined by its strong brand recognition and established distribution networks, key strengths in a competitive agricultural landscape. However, potential vulnerabilities lie in supply chain disruptions and fluctuating commodity prices, presenting significant risks. Opportunities for expansion into new product lines and emerging markets are readily available.

Want the full story behind Thai Wah's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Thai Wah's integrated value chain management is a significant strength, giving them control from sourcing tapioca and sugarcane to production and global sales. This end-to-end oversight streamlines operations and ensures consistent product quality, a vital factor for customer loyalty and market standing.

This integrated model translates into tangible cost advantages and enhanced supply chain resilience, critical in today's volatile global market. For instance, in 2023, Thai Wah reported a revenue of THB 21.4 billion, demonstrating the scale and effectiveness of their operations.

Thai Wah's strength lies in its broad product range, encompassing both starches and downstream products like vermicelli and noodles. This strategy allows them to cater to a variety of customers across industrial and consumer sectors. For instance, in 2023, the company reported revenue from its starch and co-products segment contributing significantly, alongside its branded consumer products, showcasing this diversification in action.

Thai Wah places a significant emphasis on innovation, evident in its drive to develop high-value-added ingredients. This commitment fuels continuous product development and process improvements, ensuring the company remains competitive in a fast-evolving market. For instance, Thai Wah's investment in sustainable bioplastics like ROSECO™ showcases this forward-thinking approach, opening new avenues for growth and differentiation.

Commitment to Sustainability Practices

Thai Wah's dedication to sustainability is a significant strength, resonating with the growing global demand for environmentally responsible businesses. This commitment is underscored by achievements such as the FSA Gold rating, demonstrating robust sustainability performance.

The company's strategic focus on renewable energy, with a target to reach 100% renewable electricity usage by 2030, further solidifies this position.

This proactive approach not only bolsters Thai Wah's brand image and appeals to eco-conscious consumers but also offers potential for reduced operational costs and secures long-term access to essential raw materials, contributing to overall business resilience and value creation.

- FSA Gold Rating: Recognition for strong sustainability practices.

- Renewable Energy Target: Aiming for 100% renewable electricity by 2030.

- Enhanced Brand Reputation: Attracts environmentally conscious consumers and investors.

- Operational Cost Reduction: Efficiency gains from sustainable practices.

Established Global Distribution Network and Regional Expansion

Thai Wah's established global distribution network is a significant strength, reaching customers across Southeast Asia, China, India, Europe, and North America. This expansive network allows the company to effectively serve a diverse international market, tapping into various consumer demands and economic landscapes. For example, in 2023, Thai Wah reported a notable increase in its international sales, driven by demand in these key regions, underscoring the network's effectiveness.

Further bolstering its market reach, Thai Wah is actively pursuing regional expansion. The company's strategic move to establish a new factory in Cambodia, alongside new offices in India and the Philippines, directly enhances its access to growing markets. This expansion is crucial for capitalizing on regional economic development and solidifying its presence in these vital territories. These investments are anticipated to contribute to a projected 15% revenue growth from these new ventures by 2025.

- Global Reach: Serves customers in Southeast Asia, China, India, Europe, and North America.

- Strategic Expansion: New factory in Cambodia and offices in India and the Philippines planned.

- Market Access: Enhanced ability to tap into growing regional economies.

- Growth Potential: Expansion initiatives are expected to drive significant revenue increases.

Thai Wah's integrated value chain, from sourcing to global sales, provides robust operational control and ensures consistent product quality. This end-to-end oversight, demonstrated by their 2023 revenue of THB 21.4 billion, translates into cost advantages and supply chain resilience in a dynamic global market.

The company boasts a diverse product portfolio, including starches and downstream items like vermicelli and noodles, catering to both industrial and consumer sectors. This breadth is reflected in their 2023 revenue streams, which show significant contributions from both starch and branded consumer products.

Thai Wah's commitment to innovation is evident in its development of high-value ingredients and sustainable solutions, such as the bioplastic ROSECO™. This focus on R&D keeps them competitive and opens new growth avenues.

Sustainability is a core strength, recognized by an FSA Gold rating and a commitment to 100% renewable electricity by 2030. This not only enhances brand reputation but also promises operational efficiencies and long-term resource security.

An extensive global distribution network reaches key markets across Asia, Europe, and North America, with strategic expansions like a new Cambodian factory and offices in India and the Philippines expected to drive an estimated 15% revenue growth from these ventures by 2025.

What is included in the product

Delivers a strategic overview of Thai Wah’s internal and external business factors, highlighting its strengths in tapioca starch and feed production alongside opportunities in plant-based food innovation and market expansion.

Provides a clear, actionable SWOT analysis for Thai Wah, simplifying complex market dynamics into strategic opportunities and mitigating potential threats.

Weaknesses

Thai Wah's significant reliance on agricultural inputs like tapioca starch exposes it to substantial price volatility. For instance, fluctuations in global tapioca prices, driven by weather patterns and supply-demand dynamics, directly impact the company's cost of goods sold. This can squeeze profit margins and create uncertainty in financial planning.

Unexpected surges in raw material costs can lead to higher production expenses, making it difficult for Thai Wah to maintain consistent profitability. This unpredictability can also make it challenging to forecast financial performance accurately, potentially impacting investor confidence and the company's ability to secure financing or maintain operational stability.

Thai Wah's reliance on a steady agricultural supply chain presents a significant vulnerability. This dependency means the company is inherently exposed to the unpredictable nature of farming, including the impacts of adverse weather, the spread of crop diseases, and the overarching threat of climate change.

These external forces can directly disrupt the availability and quality of essential raw materials. For instance, a severe drought in Thailand during 2024 could significantly impact tapioca yields, a key input for Thai Wah. Such disruptions can trigger production shortfalls, drive up procurement costs, and ultimately hinder the company's ability to fulfill market demand consistently.

Thai Wah operates in starch and noodle sectors that are incredibly crowded. Think of it this way: so many companies, both small and large, are vying for customers, especially in a huge market like China. This means prices can get pushed down, and it's tough to grab a bigger piece of the pie.

To keep up, Thai Wah has to constantly spend money on making its products better and telling people about them. For instance, in 2023, the company's revenue from its starch business was THB 1.9 billion, and while that's substantial, the competitive landscape means a significant portion of that must be reinvested to maintain market position rather than directly boosting profits.

Recent Decline in Profitability

Thai Wah's recent financial performance reveals a significant weakening in its profitability. For the full year ending December 31, 2024, the company reported a net loss. This trend continued into the third quarter of 2024, where a net loss was also recorded.

This downturn in profits stems from several key factors. Softening pricing power in its markets has limited the company's ability to maintain margins. Additionally, unfavorable exchange rates have further eroded financial results, creating a challenging operating environment.

These financial results present a clear weakness for Thai Wah:

- Net Loss for Full Year 2024: The company's inability to achieve profitability over the entire fiscal year is a major concern.

- Continued Losses in Q3 2024: The third quarter results underscore a persistent struggle to generate positive earnings.

- Impact of Softening Pricing Power: Reduced ability to command prices directly impacts revenue and profit margins.

- Unfavorable Exchange Rate Effects: Currency fluctuations have a tangible negative effect on the company's bottom line.

Challenges in Market Perception and Analyst Coverage

Thai Wah, while a substantial entity in its sector, might contend with challenges in achieving widespread market recognition and securing robust analyst coverage when juxtaposed against larger, internationally renowned food corporations. This can impact how readily investors perceive its value and growth trajectory.

Certain financial data providers highlight a scarcity of comprehensive historical data and analyst projections, which can complicate the process of conducting reliable future earnings estimations. This lack of readily available data may consequently reduce investor visibility and influence valuation assessments.

For example, as of early 2024, some analyst reports indicated a limited number of covering firms for Thai Wah compared to its multinational peers. This disparity can create a perception gap, potentially affecting stock liquidity and the ease with which the market can accurately price the company's assets.

The limited analyst coverage can also mean fewer in-depth research reports are available, potentially hindering a deeper understanding of Thai Wah's strategic initiatives and competitive positioning among a broader investor base.

Thai Wah faces a significant hurdle with its profitability, as evidenced by a net loss reported for the full year ending December 31, 2024. This downward trend persisted into the third quarter of 2024, indicating ongoing financial struggles.

The company's ability to command pricing power has weakened, directly impacting its margins, and unfavorable exchange rates have further exacerbated these financial challenges. This combination creates a difficult operating environment for Thai Wah.

For instance, the softening pricing power means that even with substantial revenues, such as the THB 1.9 billion generated by its starch business in 2023, the company struggles to translate this into consistent profits. The unfavorable exchange rates also directly reduced the value of earnings when converted back into Thai Baht.

These financial results highlight critical weaknesses: a full-year net loss for 2024, continued losses in Q3 2024, reduced pricing power, and negative impacts from exchange rate fluctuations.

What You See Is What You Get

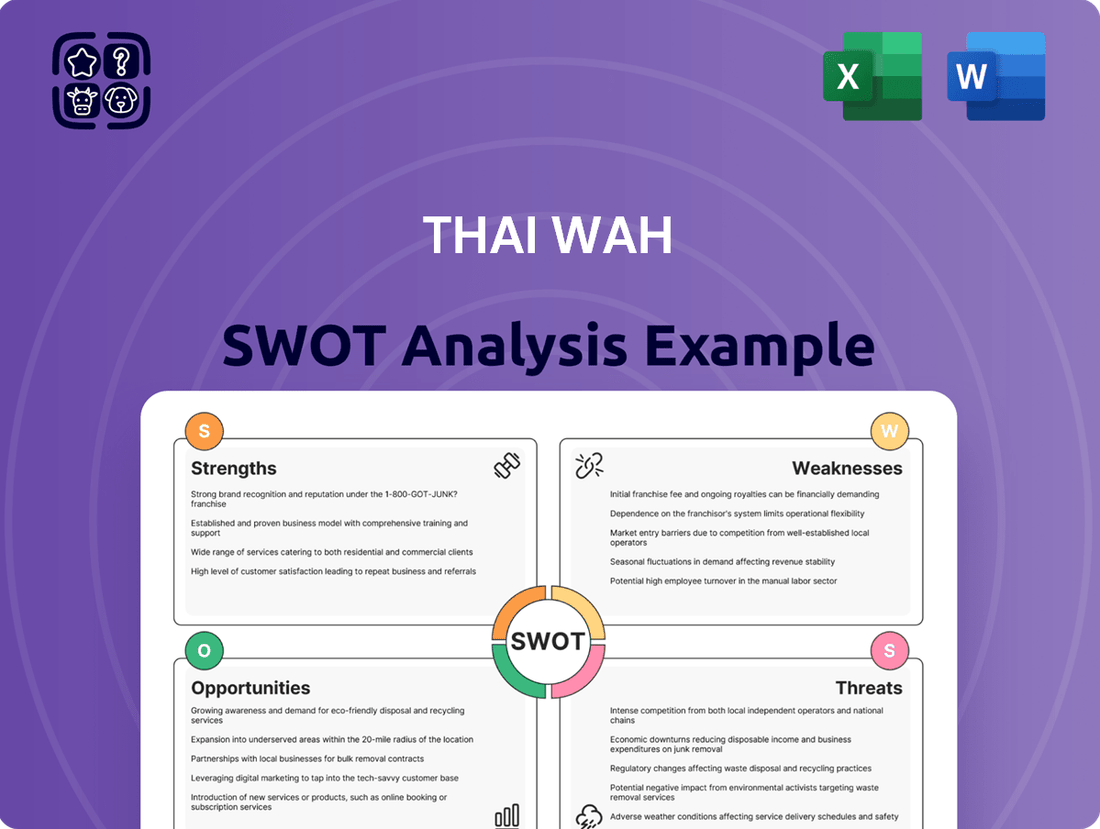

Thai Wah SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report on Thai Wah's Strengths, Weaknesses, Opportunities, and Threats. This preview reflects the real document you'll receive—professional, structured, and ready to use, covering all key aspects for your strategic planning.

Opportunities

The global marketplace is increasingly favoring ingredients and food items that offer enhanced value and are produced with sustainability in mind. This trend, especially the surge in demand for plant-based options, directly benefits companies like Thai Wah that are pivoting their product lines.

Thai Wah's strategic decision to bolster its offerings with high-value-added products, such as organic rice and innovative bioplastics derived from tapioca, positions it well to capitalize on these evolving consumer demands. This focus not only meets market expectations but also opens avenues for improved profitability due to the premium consumers are willing to pay for such goods.

For instance, the global market for plant-based foods was projected to reach over $74 billion by 2030, indicating a substantial growth trajectory. Similarly, the bioplastics market is expected to see significant expansion, driven by environmental regulations and consumer awareness.

Thai Wah can capitalize on its existing distribution network to expand into promising new markets like India and the Middle East. These regions are experiencing significant economic growth, with India's GDP projected to reach $7.3 trillion by 2030 and the Middle East's population nearing 500 million, presenting substantial demand for food products.

The company's strategic push into the B2C segment offers a direct pathway to consumers, fostering brand loyalty and capturing higher margins. This shift allows Thai Wah to diversify revenue streams beyond its established B2B relationships, potentially tapping into the growing ready-to-eat and convenient food markets in Southeast Asia.

Thai Wah's strategic partnerships and acquisitions present significant growth avenues. A prime example is its joint venture with Fuji Nihon Corporation, focusing on developing advanced cassava starch solutions. This collaboration leverages combined expertise to enhance capabilities and unlock access to novel technologies and markets, thereby accelerating expansion and strengthening the global supply chain.

Leveraging Digitalization and Smart Farming for Efficiency

Thai Wah can capitalize on the opportunity to boost cassava yield and secure raw material supply by embracing digital technologies. Implementing digital crop scans and expanding its network of "root yards" allows for more precise agricultural management. Promoting smart farming practices among its extensive farmer network is also key. For instance, Thai Wah's initiatives in 2023 saw a focus on digital farmer engagement, aiming to increase the adoption of best practices, which directly contributes to a more robust and predictable supply chain.

Further digitalization and automation across its operational footprint present a significant avenue for enhancing efficiency and reducing costs. This strategic move can lead to improved overall business agility, allowing Thai Wah to respond more effectively to market dynamics. By investing in smart technologies, the company can streamline processes, from sourcing to production, ultimately leading to better resource utilization and a stronger competitive position in the market.

- Digital Crop Scans: Enhancing precision agriculture for better yield prediction and management.

- Root Yard Networks: Expanding the infrastructure for improved seed quality and distribution.

- Smart Farming Promotion: Educating and equipping farmers with advanced techniques for higher productivity.

- Operational Automation: Streamlining processes to reduce costs and increase efficiency across the value chain.

Innovation in Ready-to-Eat and Ready-to-Cook Solutions

The shift towards convenience foods, driven by evolving consumer lifestyles, presents a significant opportunity for Thai Wah. The company's strategic expansion into ready-to-eat and ready-to-cook meals directly addresses this growing demand. This diversification, which also includes organic and instant food options, positions Thai Wah to capitalize on a rapidly expanding market segment.

The global market for convenience foods is experiencing robust growth. For instance, the ready-to-eat meal market alone was valued at approximately USD 165 billion in 2023 and is projected to reach over USD 230 billion by 2028, with a compound annual growth rate of around 7%. Thai Wah's focus on these product categories aligns perfectly with these favorable market trends, offering a clear avenue for increased market penetration and revenue growth.

- Growing Demand: Consumer lifestyles increasingly favor quick and easy meal solutions.

- Market Expansion: Diversification into ready-to-eat and ready-to-cook products taps into a burgeoning market.

- Portfolio Enhancement: Integration of organic and instant options broadens appeal and captures diverse consumer preferences.

- Revenue Growth: Capturing a larger share of the convenience food market can significantly boost Thai Wah's financial performance.

Thai Wah is well-positioned to benefit from the rising global demand for plant-based and sustainable food ingredients, a market expected to see substantial growth. The company's strategic expansion into high-value products like organic rice and bioplastics, coupled with its entry into new markets such as India and the Middle East, offers significant revenue expansion opportunities.

By strengthening its B2C presence and developing convenient food options, Thai Wah can tap into higher margins and build stronger brand loyalty. Strategic partnerships, like the one with Fuji Nihon Corporation, are crucial for accessing new technologies and markets, thereby enhancing its competitive edge.

Embracing digital farming technologies and operational automation will bolster Thai Wah's supply chain resilience and efficiency, leading to cost reductions and improved agility. The company's focus on convenience foods aligns with evolving consumer lifestyles, projecting strong growth potential in this segment, with the ready-to-eat market alone valued at approximately USD 165 billion in 2023.

Threats

Thai Wah faces ongoing threats from the volatility of global commodity prices, particularly for agricultural inputs like tapioca. For instance, during 2023, global tapioca prices experienced significant swings due to factors like weather patterns affecting harvests in key producing regions and shifting demand from sectors such as animal feed and biofuels. This fluctuation directly impacts Thai Wah's cost of goods sold.

A sharp rise in raw material costs, as seen with tapioca starch, can significantly squeeze profit margins for Thai Wah if these increases cannot be passed on to customers through price adjustments. The company's ability to manage these price shocks through hedging or efficient procurement is crucial for maintaining profitability. For example, a 10% increase in tapioca prices could directly reduce margins by a notable percentage if not mitigated.

The starch and noodle sectors within Thailand's food industry are experiencing a significant uptick in competition. This intensified rivalry comes from both global food giants and agile domestic companies, creating a challenging environment for Thai Wah. For instance, in 2024, the average price of corn, a key ingredient for starch, saw fluctuations impacting production costs.

This heightened competition can easily trigger price wars, potentially eroding Thai Wah's market share. Such scenarios place immense pressure on the company's financial resources, particularly for marketing initiatives and crucial research and development investments. This strain directly impacts Thai Wah's ability to maintain robust profitability in a dynamic market.

Thai Wah faces a significant threat from evolving consumer tastes. A notable trend is the shift away from high-carbohydrate foods, which could dampen demand for their staple products like rice noodles. For instance, in 2024, global health and wellness trends continued to emphasize lower-carb diets, with projections indicating sustained growth in this segment.

Furthermore, consumers are increasingly seeking fresh, minimally processed foods. This preference for natural alternatives poses a challenge to processed goods within Thai Wah's portfolio, requiring a strategic pivot towards offerings that align with these cleaner eating habits. Market research in early 2025 confirmed that this demand for unprocessed options is a persistent driver in food purchasing decisions.

New health fads and dietary trends emerge rapidly, necessitating constant vigilance and innovation from Thai Wah. Failure to anticipate and adapt to these shifts, such as the growing popularity of plant-based diets or specific superfoods, could lead to a decline in market share and revenue. The company's ability to conduct thorough and timely market research is crucial for navigating this dynamic landscape.

Adverse Regulatory Changes and Trade Barriers

Thai Wah faces significant threats from evolving regulatory landscapes. Changes in food safety standards and environmental regulations, such as stricter waste management or chemical usage rules, can directly increase operational costs and require substantial investment in compliance. For instance, new regulations in key export markets could necessitate costly product reformulation or packaging changes.

Furthermore, international trade policies present another major challenge. Tariffs and import quotas imposed by countries where Thai Wah exports its products, or from which it sources raw materials, can significantly impact pricing competitiveness and market access. For example, a sudden increase in tariffs on rice or tapioca starch in a major importing nation could reduce demand for Thai Wah's goods.

- Evolving Food Safety Standards: Increased scrutiny on food processing and ingredients could lead to higher testing and certification costs.

- Environmental Regulations: Stricter rules on water usage, emissions, or packaging materials might necessitate capital expenditures for upgrades.

- Trade Barriers: Tariffs and quotas on agricultural commodities like rice and tapioca could limit export opportunities and increase raw material costs.

- Geopolitical Shifts: Unforeseen international relations changes can rapidly alter trade agreements and market access.

Impact of Climate Change on Agricultural Supply

Climate change presents a significant, ongoing risk to agriculture, which is the bedrock of Thai Wah's operations. We anticipate more frequent and intense extreme weather events. These disruptions can directly impact crop yields and quality, affecting essential raw materials like tapioca. For instance, during the 2023-2024 tapioca season, unseasonal heavy rainfall in key growing regions of Thailand led to concerns about harvest volumes and starch content, potentially impacting downstream processing and product availability.

These climate-related challenges could escalate sourcing risks for Thai Wah, making it harder to secure consistent, high-quality inputs. This scarcity can naturally lead to increased procurement costs as demand outstrips supply. The variability in weather patterns also affects planting and harvesting schedules, creating a more unpredictable operational environment for the company and its network of farmers.

The long-term viability of agricultural output is directly threatened by these environmental shifts. Thai Wah's reliance on agricultural commodities means that a sustained decline in yields or quality due to climate change could fundamentally alter the economics of its business.

- Increased Volatility in Raw Material Supply: Extreme weather events like droughts or floods can significantly reduce tapioca yields, impacting Thai Wah's production capacity.

- Rising Input Costs: Reduced crop availability due to climate change will likely drive up the price of essential raw materials, affecting profit margins.

- Shift in Growing Seasons: Altered climatic conditions may necessitate changes in traditional farming practices, requiring adaptation and potentially new investment in research and development for resilient crop varieties.

- Impact on Product Quality: Environmental stress on crops can lead to variations in the quality of raw materials, potentially affecting the consistency and characteristics of Thai Wah's finished products.

The intensifying competition within Thailand's starch and noodle sectors poses a significant threat to Thai Wah. This heightened rivalry, stemming from both global and domestic players, puts pressure on pricing and market share. For instance, the average price of corn, a key ingredient for starch, saw fluctuations in 2024, impacting production costs and potentially leading to price wars.

| Competitor Type | Impact on Thai Wah | Example Scenario (2024-2025) |

|---|---|---|

| Global Food Giants | Price pressure, market share erosion | Aggressive pricing strategies on starch-based products. |

| Agile Domestic Companies | Niche market challenges, innovation pressure | Focus on specialized noodle products with premium ingredients. |

| Raw Material Cost Volatility | Margin squeeze, reduced profitability | A 10% increase in tapioca prices could reduce margins by 1-2% if not passed on. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible industry data, including Thai Wah's official financial filings, comprehensive market research reports, and expert commentary from agricultural and food industry analysts.