Thai Wah PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Thai Wah Bundle

Gain a strategic advantage by understanding the intricate PESTLE factors influencing Thai Wah. Our comprehensive analysis delves into the political, economic, social, technological, legal, and environmental forces shaping their operations and market position. Discover how regulatory shifts and evolving consumer preferences present both challenges and opportunities for the agribusiness giant. Equip yourself with actionable intelligence to anticipate market dynamics and refine your own business strategy. Unlock the full Thai Wah PESTLE analysis today and navigate the external landscape with confidence.

Political factors

Government agricultural policies in Thailand and other countries where Thai Wah operates directly impact the availability and cost of its key raw materials, namely tapioca and rice. For instance, Thailand's government has been actively promoting higher-value agricultural exports, which can influence the pricing and allocation of resources for crops like tapioca.

Support for sustainable farming initiatives, exemplified by Thai Wah's farmers receiving the FSA Gold Award, not only improves raw material quality but also helps mitigate supply chain vulnerabilities. This focus on sustainability aligns with global trends and can open up new market opportunities.

Trade policies, including import tariffs and export quotas set by various nations, play a crucial role in determining Thai Wah's cost-competitiveness in international markets. For example, changes in import duties on processed food products in key export destinations can significantly affect sales volumes and profitability.

Thai Wah operates within a landscape of stringent food safety and quality regulations, both domestically in Thailand and in the international markets it serves. Adherence to these rules is absolutely critical for market access and maintaining consumer confidence. For instance, Thailand's Ministry of Public Health frequently updates its regulations concerning food additives and contaminants, requiring continuous adaptation by food producers like Thai Wah to ensure their products meet these evolving standards. The company's pursuit of and maintenance of international certifications, such as those related to food safety management systems, demonstrates a proactive strategy to navigate and comply with these crucial political factors.

Thai Wah's performance is closely tied to international trade agreements and the geopolitical climate in its key markets, including China, Southeast Asia, India, Europe, and North America. For instance, the continued strength of ASEAN trade pacts supports Thai Wah's regional sales, while potential trade disputes with major economies could impact its export volumes and pricing strategies.

Geopolitical stability is crucial for maintaining smooth supply chains and managing operational risks. In 2024, ongoing geopolitical developments, such as regional conflicts and shifting trade policies, necessitate a diversified operational footprint for Thai Wah to mitigate potential disruptions.

Strategic alliances, like the joint venture with Fuji Nihon Corporation for tapioca starch production in Vietnam, enhance Thai Wah's supply chain resilience. This partnership, operational since 2023, aims to secure raw material access and improve logistical efficiency in a competitive Southeast Asian market.

Sustainability and Green Policies

Thailand's government is increasingly prioritizing sustainability and green economy initiatives, directly impacting companies like Thai Wah. These policies, aimed at achieving net-zero emissions, encourage a shift towards eco-friendly operations and products. For instance, government support for renewable energy and waste reduction incentivizes investments in cleaner production methods. Thai Wah's strategic objective to source 50% of its electricity from renewable sources by 2026-2027 demonstrates its alignment with these national green policy directions.

The drive towards a green economy opens avenues for companies to develop and market sustainable products. Policies promoting sustainable agriculture and the use of bioplastics, for example, create new market opportunities. Thai Wah's expansion into bioplastics, derived from tapioca starch, positions it to capitalize on this growing demand for environmentally responsible materials. This focus not only addresses regulatory pressures but also enhances brand reputation and consumer appeal in an increasingly eco-conscious market.

- Government Focus: Thailand's commitment to sustainability and a green economy is a significant political driver for businesses.

- Policy Incentives: Policies encouraging renewable energy adoption and waste management, like those supporting bioplastics development, directly influence corporate strategy.

- Net-Zero Targets: National net-zero emission goals push companies to invest in cleaner technologies and sustainable practices.

- Thai Wah's Alignment: The company's goal to power 50% of its operations with renewable energy by 2026-2027 reflects a proactive response to these political trends.

Political Stability and Investment Climate

Political stability in Thailand, a key market for Thai Wah, directly influences investor confidence. In early 2024, Thailand saw the formation of a new coalition government, aiming to provide a more stable political landscape after a period of uncertainty, which is crucial for attracting the foreign direct investment Thai Wah relies on for its expansion.

The government's commitment to economic reforms and ease of doing business policies, such as streamlining investment approvals, directly supports Thai Wah's strategic goals. For instance, the Board of Investment (BOI) continues to offer incentives for agro-food processing and export-oriented businesses, directly benefiting Thai Wah's operations and potential new factory setups.

Thai Wah’s regional expansion, particularly into Cambodia, is also contingent on political stability in those countries. Cambodia’s consistent economic growth and supportive foreign investment policies, maintained through 2024, create a favorable environment for establishing new subsidiaries and joint ventures, bolstering Thai Wah's regional footprint.

The predictability of government policies regarding trade, agricultural subsidies, and food safety regulations is paramount for Thai Wah's long-term planning and operational efficiency. A consistent policy framework ensures that investments in new technologies and market development yield predictable returns.

- Government Stability: Thailand's political landscape in 2024 has shown efforts towards greater stability with the formation of a new coalition government.

- Investment Climate: Thailand's Board of Investment (BOI) actively promotes foreign investment, offering incentives that are relevant to Thai Wah's sector.

- Regional Operations: Cambodia's sustained economic growth and foreign investment policies in 2024 provide a positive outlook for Thai Wah's regional ventures.

- Policy Consistency: Predictable trade and agricultural policies are essential for Thai Wah's strategic investments and operational planning.

Government agricultural policies, trade agreements, and regulatory environments are key political factors influencing Thai Wah. For instance, Thailand's focus on sustainable agriculture and the green economy, with a goal of sourcing 50% of electricity from renewables by 2026-2027, directly shapes operational strategies and product development, such as the push into bioplastics. Political stability in Thailand, evidenced by the formation of a new coalition government in early 2024, is crucial for investor confidence and the company's expansion plans.

| Political Factor | Impact on Thai Wah | Example/Data Point |

|---|---|---|

| Government Agricultural Policies | Affects raw material availability and cost | Thailand's promotion of higher-value exports impacts tapioca pricing. |

| Trade Agreements & Geopolitics | Influences export competitiveness and supply chain stability | ASEAN trade pacts support regional sales; geopolitical shifts in 2024 necessitate operational diversification. |

| Food Safety & Quality Regulations | Critical for market access and consumer trust | Thailand's Ministry of Public Health updates on food additives require continuous adaptation. |

| Sustainability & Green Economy Initiatives | Drives investment in cleaner operations and eco-friendly products | Goal to source 50% of electricity from renewables by 2026-2027; expansion into bioplastics. |

| Political Stability & Investment Climate | Impacts investor confidence and foreign direct investment | New coalition government in Thailand (early 2024) aims for greater stability; BOI incentives support agro-food processing. |

What is included in the product

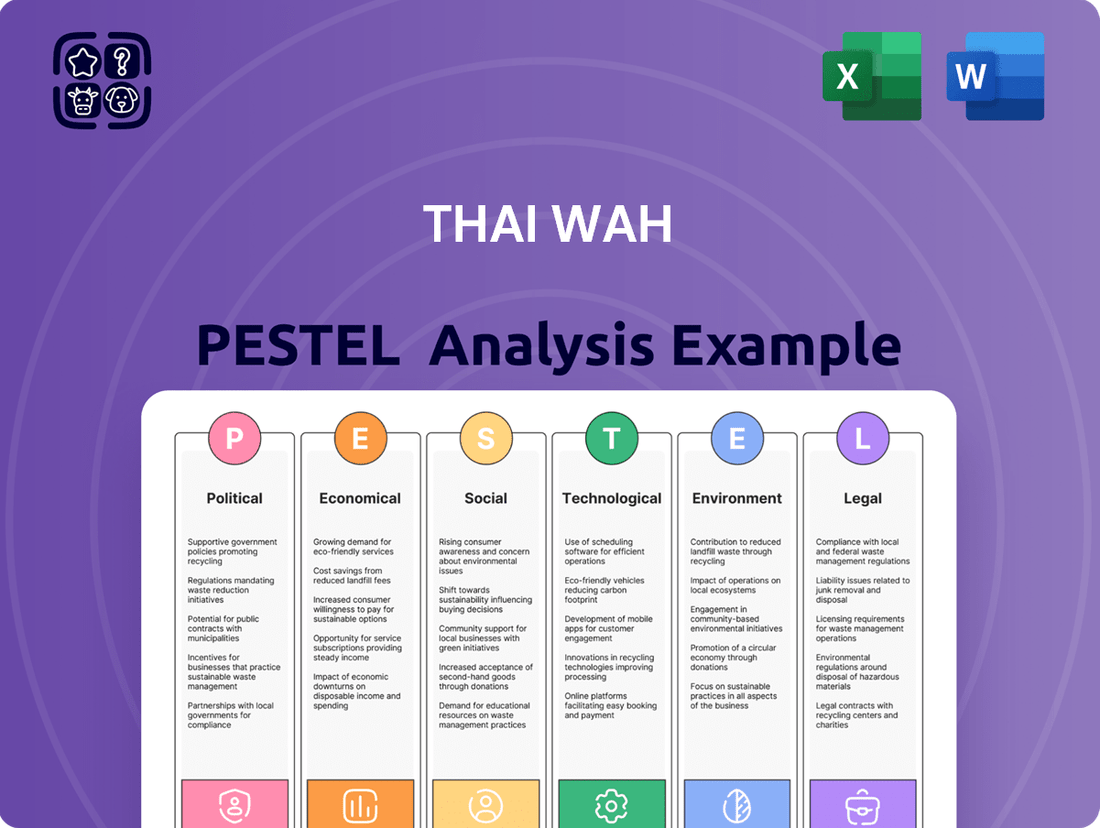

This Thai Wah PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces influencing the company's operations and strategic direction.

It provides a comprehensive overview of external factors, highlighting potential threats and opportunities for Thai Wah to leverage in its strategic planning.

The Thai Wah PESTLE Analysis offers a clean, summarized version of external factors, serving as a pain point reliever by providing easy referencing during meetings or presentations.

This analysis, segmented by PESTEL categories, acts as a pain point reliever by allowing for quick interpretation at a glance, simplifying complex external influences.

Economic factors

Global commodity price volatility is a significant factor for Thai Wah. Fluctuations in the prices of key agricultural inputs like tapioca and rice directly impact the company's cost of goods sold and overall profitability. For instance, during periods of high global demand or supply disruptions, the cost of these essential raw materials can surge, putting pressure on Thai Wah's margins.

Macroeconomic challenges and climate-related events in 2024 have already demonstrated their impact on raw material availability and, consequently, company sales. Extreme weather patterns or geopolitical events can disrupt supply chains, leading to unpredictable price swings and affecting the volume of products Thai Wah can secure. This volatility requires a proactive approach to managing its supply base.

To navigate these risks, Thai Wah is focusing on diversifying its sourcing strategies to reduce reliance on any single region or supplier. Additionally, the company's investment in smart farming initiatives aims to enhance crop yields and resilience, thereby stabilizing raw material supply and mitigating the impact of external price shocks.

Inflationary pressures in Thailand, with the Consumer Price Index (CPI) showing a moderate increase in early 2024, directly impact consumer purchasing power, influencing demand for Thai Wah's food products. For instance, a 1.5% CPI rise in February 2024 compared to the previous year means consumers have less disposable income for non-essential or higher-priced food items.

Thai Wah's strategic pivot to high-value-added ingredients and food products is crucial for navigating these economic shifts, helping to sustain sales revenue and profitability even when consumer spending on basic processed foods might dip due to economic slowdowns.

Exchange rate fluctuations present a significant factor for Thai Wah, directly impacting its international trade. Volatility in currency values can alter the profitability of export sales and increase the cost of essential imported raw materials or machinery needed for its global production facilities. For instance, a stronger Thai Baht against key trading partner currencies could make Thai Wah's exports more expensive, potentially reducing demand.

To mitigate these risks, Thai Wah benefits from its geographically diversified operations. This diversification allows the company to spread its exposure across various currency markets, smoothing out the impact of any single currency's movement and enhancing overall business resilience. This strategic approach helps maintain stability even amidst unpredictable economic shifts.

The competitiveness of Thai Wah's products on the global stage is also sensitive to these currency swings. A depreciating Baht might offer a price advantage for its agricultural products and food ingredients in export markets, while an appreciating Baht could necessitate price adjustments to remain competitive. For example, the Baht's performance against the US Dollar, a major global currency, significantly influences its export pricing strategies.

Economic Growth in Key Markets

Thai Wah's performance is closely tied to economic expansion in its core markets, spanning Southeast Asia, China, India, Europe, and North America. For instance, projections for 2024 indicate continued economic resilience in many of these regions, with the IMF forecasting global growth around 3.2% for the year. This growth directly influences consumer spending on both industrial starch and food products.

The company sees significant potential in high-value-added ingredients, with reports from 2024 suggesting double-digit growth in specific segments within China, reflecting strong demand for specialized food components. This trend is further supported by ongoing urbanization and increasing disposable incomes across the Asia Pacific region.

- Southeast Asia's projected GDP growth for 2024 is estimated to be around 4.7%, boosting demand for Thai Wah's products.

- China's economic recovery is expected to remain a key driver, with a projected GDP growth of approximately 5.0% in 2024.

- Rising middle-class populations in India are anticipated to fuel demand for processed foods and wellness products, a core offering for Thai Wah.

- Developed markets in Europe and North America, while experiencing more moderate growth, still represent substantial demand for industrial ingredients.

Investment and Capital Access

Thai Wah's ability to secure investment and access capital plays a vital role in fueling its growth ambitions, including regional expansion and new factory developments. The company's robust financial health, evidenced by its strong cash flow position in 2024, provides a solid foundation for these strategic initiatives. This financial stability is further bolstered by the approval of dividends, signaling confidence in the company's earnings and its capacity for reinvestment.

The investment climate in Thailand and its neighboring regions directly impacts Thai Wah's capacity to fund major projects and explore new ventures. Strategic partnerships are also becoming increasingly important as a source of capital, enabling the company to accelerate its expansion and innovation efforts without solely relying on internal resources.

- 2024 Cash Flow: Thai Wah reported a strong cash flow position in 2024, which is essential for funding capital expenditures.

- Dividend Approvals: The consistent approval of dividends indicates financial health and the company's ability to return value to shareholders while retaining capital for investment.

- Strategic Partnerships: Collaborations provide access to external capital, mitigating the financial burden of large-scale projects and fostering innovation.

- Regional Expansion Funding: Access to capital markets and investment opportunities is critical for the success of Thai Wah's planned regional growth strategies.

Economic factors significantly shape Thai Wah's operational landscape. Global commodity price volatility, especially for tapioca and rice, directly impacts production costs, as seen with potential surges due to supply disruptions. Inflationary pressures in Thailand, with a 1.5% CPI rise in February 2024, affect consumer spending power, making Thai Wah's strategy of shifting to high-value products crucial for maintaining sales.

Exchange rate fluctuations also pose a risk, influencing export competitiveness and the cost of imported materials; a stronger Baht, for example, can make exports pricier. However, Thai Wah's diversified operations help mitigate these currency impacts across different markets.

Economic growth in key markets like Southeast Asia (projected 4.7% GDP growth in 2024) and China (projected 5.0% GDP growth in 2024) directly drives demand for Thai Wah's diverse product lines, from industrial starch to food ingredients, supported by rising disposable incomes.

Thai Wah's financial health, demonstrated by its strong 2024 cash flow and consistent dividend approvals, underpins its ability to fund expansion and innovation, while strategic partnerships offer additional capital access for large-scale projects.

| Economic Factor | Impact on Thai Wah | Supporting Data (2024/2025) |

| Commodity Price Volatility | Affects cost of goods sold and profit margins. | Key inputs like tapioca and rice subject to global supply/demand shifts. |

| Inflation | Reduces consumer purchasing power, impacting demand. | Thai CPI rose 1.5% in Feb 2024, influencing spending on food products. |

| Exchange Rates | Impacts export pricing and import costs. | Baht's performance against USD affects export competitiveness. |

| Economic Growth | Drives demand for products in various segments. | SEA GDP growth ~4.7%, China GDP growth ~5.0% projected for 2024. |

| Capital Access | Enables investment in expansion and innovation. | Strong 2024 cash flow and dividend approvals support financial health. |

Preview Before You Purchase

Thai Wah PESTLE Analysis

The preview shown here is the exact Thai Wah PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Thai Wah. You can trust that the insights and structure you see now are precisely what you'll gain access to immediately after completing your purchase.

Sociological factors

Consumers are definitely leaning more towards health and wellness these days, which means they're really looking for food that's good for them, has simple ingredients, and maybe even offers some extra benefits. Think nutritious, clean-label, and functional foods – that's the sweet spot.

Thai Wah is catching onto this wave by broadening its product range. They're introducing healthier choices, like organic noodles, and putting more effort into ingredients that offer greater value. This strategic shift aims to meet the growing demand for better-for-you options.

This health-conscious movement is especially noticeable across Asia. Consumers there are actively seeking out products that support gut health and provide nutrition tailored to different age groups. This indicates a deeper understanding and proactive approach to personal well-being through diet.

Thailand's increasing urbanization, with a higher proportion of its population now living in cities, combined with smaller family units and demanding work schedules, is significantly boosting the demand for convenient food options. This societal shift means people have less time for traditional meal preparation.

Thai Wah is strategically capitalizing on this trend by expanding its business-to-consumer (B2C) offerings. Their product line now includes convenient instant pouches, ready-to-cook meal kits, and a variety of noodle products, all designed to meet the needs of consumers seeking quick and easy meal solutions.

The ready-to-eat food market in Thailand, a sector directly benefiting from these sociological changes, is projected to see a strong recovery and continued growth. Market analysis indicates a positive outlook for these convenient food products, reflecting consumer preferences for ease and speed in their daily lives.

Consumers are increasingly prioritizing products sourced sustainably and ethically, significantly shaping their purchasing choices. This trend is evident globally, with a growing demand for transparency in supply chains. For instance, a 2024 survey indicated that over 70% of consumers consider sustainability when buying food products.

Thai Wah is well-positioned to capitalize on this shift, evident in its commitment to sustainable agriculture. The company’s recognition with the FSA Gold Award for sustainable farming practices highlights its dedication. Furthermore, Thai Wah's focus on regenerative farming aligns directly with consumer desires for environmentally responsible production.

The company’s emphasis on transparent sourcing and production builds trust and enhances its brand image. This transparency is crucial for consumers seeking assurance about the origins and ethical treatment involved in the manufacturing process. Thai Wah's proactive approach in this area strengthens its competitive advantage in the market.

Demographic Shifts and Population Growth

Population growth remains a significant driver for food demand, especially in rapidly expanding regions like Southeast Asia and India. By mid-2024, the global population is projected to exceed 8.1 billion, with a substantial portion of this growth concentrated in Asia. This presents a clear opportunity for companies like Thai Wah, which are strategically expanding their presence in these high-growth markets.

Furthermore, demographic shifts, such as the aging population in the Asia Pacific region, influence consumption patterns. As of 2024, the proportion of individuals aged 65 and over in Asia Pacific is steadily increasing, leading to a greater demand for specific food products catering to health and wellness needs. Thai Wah's diversification efforts are well-positioned to address these evolving consumer preferences.

The need for personalized nutrition is also a growing trend, directly linked to segmented age groups and their distinct dietary requirements. Understanding these nuances allows Thai Wah to tailor its product offerings. For instance, the company's investment in value-added products can align with the health consciousness of an aging demographic and the specialized needs of younger generations.

- Global population projected to surpass 8.1 billion by mid-2024.

- Asia Pacific region sees a notable increase in its elderly population, driving demand for health-focused foods.

- Thai Wah's expansion into Southeast Asia and India leverages regional population growth trends.

- Personalized nutrition is a key consideration for diverse age segments within these expanding markets.

Cultural Acceptance and Dietary Trends

The embrace of traditional foods like vermicelli and noodles remains strong, but it's the rise of new dietary preferences that's really driving change. Think plant-based eating and a growing demand for gluten-free products; these aren't just fads anymore, they're influencing what consumers want and what companies like Thai Wah need to offer.

Thai Wah has been smart about this, moving beyond just their classic noodle offerings. They're now pushing products like rice paper and sweet potato noodles, and even organic versions. This diversification directly taps into those evolving consumer tastes, showing a clear strategy to cater to health-conscious and flexitarian diets.

In 2024, the global plant-based food market was valued at approximately $35 billion, with projections indicating continued robust growth. Similarly, the gluten-free market is experiencing significant expansion, driven by both necessity and lifestyle choices.

Thai Wah's repositioning efforts are clearly aimed at capturing a larger share of these expanding segments. By adapting their product lines, they are actively responding to a market that increasingly prioritizes health, sustainability, and dietary inclusivity.

- Cultural Relevance: Traditional noodle products like vermicelli maintain significant cultural acceptance in Thailand and key export markets.

- Dietary Shift: Emerging trends towards plant-based and gluten-free diets are creating new market opportunities.

- Product Diversification: Thai Wah's expansion into rice paper, sweet potato noodles, and organic varieties aligns with these evolving consumer preferences.

- Market Adaptation: The company's strategy reflects a proactive approach to capture growth in health-conscious and alternative diet segments.

Societal shifts towards health and convenience are profoundly impacting food consumption. Thai Wah's strategic expansion into healthier, ready-to-cook options directly addresses the growing demand from urbanized populations with less time for meal preparation. This aligns with a global trend where consumers prioritize both nutritional value and ease of use, a market segment that is showing strong recovery and projected growth.

Technological factors

Technological advancements are reshaping starch processing and food manufacturing, directly impacting Thai Wah's operations. Innovations in starch extraction and modification allow for improved product quality and the creation of new functional ingredients, crucial for staying competitive. Thai Wah's investment in seven R&D centers across six countries underscores its dedication to leveraging these technological shifts, focusing on areas like clean-label starches and advanced hydrocolloids.

Thai Wah is actively embracing automation and digitalization throughout its supply chain, a move critical for enhancing efficiency and cost reduction. This adoption spans from the initial sourcing of raw materials right through to global distribution networks. By integrating digital tools, the company aims to significantly boost its responsiveness to market demands.

The company's commitment to digital integration is evident in its use of digital crop scans and the promotion of smart farming techniques. These technologies allow Thai Wah to closely monitor its raw material supply, particularly cassava, and work towards improving crop yields. This proactive approach is key to building a more resilient and predictable supply chain.

These advancements in digital supply chain management are particularly beneficial in mitigating risks associated with supply chain disruptions. By having better visibility and control over its agricultural inputs, Thai Wah is better positioned to navigate unforeseen challenges, ensuring a more stable flow of materials for its operations.

Thai Wah's innovation in sustainable packaging, like their tapioca-based thermoplastic starch (TPS) called Roseco, presents a significant technological advancement. This material provides an eco-friendly substitute for conventional plastics, aligning with global sustainability trends. Roseco is designed to be compostable, forming a closed-loop system from agricultural sourcing to end-of-life decomposition.

The company's strategic intent to incorporate Roseco into its consumer product packaging highlights a commitment to integrating this technology into their core business. This move is expected to reduce the environmental footprint of their product lines, a critical factor for consumers and regulators in 2024 and beyond.

Biotechnology and Agri-tech for Crop Improvement

Investment in biotechnology and agri-tech is crucial for bolstering raw material resilience and yield, particularly as climate change poses increasing challenges. This includes advancements in crop breeding, genetics, and soil innovation. For example, global investment in Agri-tech startups reached approximately $7.1 billion in 2023, highlighting the sector's growing importance.

Thai Wah Ventures, the company's corporate venture capital arm, actively invests in technology startups. These ventures concentrate on agri-food and supply chain solutions, with a specific focus on agricultural and soil science deeptech. This strategic approach aims to elevate both productivity and the quality of Thai agriculture.

- Enhanced Crop Resilience: Biotechnology allows for the development of crops more resistant to pests, diseases, and environmental stresses like drought and salinity.

- Increased Yields: Genetic improvements and precision farming techniques supported by agri-tech can significantly boost crop output per unit of land.

- Sustainable Soil Management: Innovations in soil science contribute to healthier soil, reducing the need for chemical inputs and improving long-term agricultural sustainability.

- Supply Chain Efficiency: Agri-tech solutions optimize logistics and reduce post-harvest losses, ensuring better quality and availability of agricultural products.

Waste Valorization Technologies

Technologies that turn agricultural residues and manufacturing waste into valuable products like bioplastics, animal feed, or biogas offer considerable advantages for Thai Wah. These advancements directly support the company's sustainability objectives by creating new income sources and minimizing its environmental impact. For instance, in 2024, the global bioplastics market was projected to reach over $12 billion, showcasing the significant economic potential in waste upcycling.

Thai Wah generates a substantial volume of waste each year, creating a vast opportunity for valorization. By implementing these technologies, the company can transform what was once a disposal cost into a revenue-generating asset. Estimates suggest that the agricultural sector alone produces millions of tons of residue annually, a significant portion of which could be repurposed.

- Bioplastics Production: Converting starch-rich waste into biodegradable plastics.

- Animal Feed Creation: Processing by-products into nutritious feed for livestock.

- Biogas Generation: Utilizing organic waste for renewable energy production.

Thai Wah is actively integrating advanced digital tools across its operations, from smart farming techniques like digital crop scans to optimize cassava yields, to enhancing supply chain efficiency through digital management. This commitment to technology aims to improve raw material visibility and resilience, crucial for navigating market volatility. The company's investment in seven R&D centers highlights its focus on innovation in areas such as clean-label ingredients and advanced food technologies.

The development of Roseco, a tapioca-based thermoplastic starch, exemplifies Thai Wah's technological push towards sustainable packaging solutions. This compostable material offers an eco-friendly alternative to conventional plastics, aligning with growing consumer and regulatory demand for greener products. Thai Wah Ventures actively scouts for agri-food tech startups, particularly in agricultural and soil science, to boost productivity and quality in the Thai agricultural sector.

| Technology Area | Impact on Thai Wah | Example/Data Point |

|---|---|---|

| Digitalization & Automation | Supply chain efficiency, cost reduction, market responsiveness | Integration of digital crop scans, smart farming promotion |

| Biotechnology & Agri-tech | Enhanced crop resilience, increased yields, sustainable soil management | Global Agri-tech startup investment reached ~$7.1 billion in 2023 |

| Sustainable Materials | Eco-friendly product alternatives, reduced environmental footprint | Development of Roseco (tapioca-based thermoplastic starch) |

| Waste Valorization | New revenue streams, minimized environmental impact | Global bioplastics market projected over $12 billion in 2024; transforming agricultural waste |

Legal factors

Thai Wah navigates a complex web of food safety and hygiene regulations across its operational markets, adhering to both national and international standards to ensure product integrity. These regulations are not static; for instance, updates to Thailand's food additive regulations and labeling requirements, observed in late 2023 and early 2024, demand ongoing adaptation in manufacturing and product development. Failure to comply with these evolving legal frameworks, which often carry substantial fines and can severely damage brand reputation, requires constant vigilance and investment in compliance measures.

Thai Wah's operations are significantly shaped by Thailand's labor laws and employment regulations. Compliance with these rules, covering aspects like minimum wage, working hours, and safety standards, is non-negotiable for the company's large workforce. For instance, the national minimum wage in Thailand was adjusted in January 2024, with rates varying by province but generally increasing affordability for workers.

Adhering to these regulations not only prevents costly legal penalties and operational disruptions but also fosters a positive employer-employee relationship. Thai Wah's focus on fair labor practices and employee well-being is a core component of its broader sustainability initiatives, aiming to build trust and a committed workforce. This commitment is crucial given the company's extensive employee base across its agribusiness and food sectors.

Environmental regulations in Thailand are becoming more stringent, impacting areas like emissions, waste disposal, water consumption, and overall pollution control. This means companies like Thai Wah must adapt their operations to meet these evolving standards.

Thai Wah's strategic focus on renewable energy, minimizing waste, and adopting sustainable farming methods is significantly influenced by these environmental laws. For instance, the company's commitment to achieving net-zero targets aligns with the government's push for greener industrial practices.

Operating "green factories" is not just an aspiration but a necessity for compliance. This involves meticulous waste management protocols and robust pollution control measures to ensure operations adhere to legal requirements and minimize ecological impact.

In 2023, Thailand's Ministry of Natural Resources and Environment continued to emphasize stricter enforcement of pollution control, with a particular focus on industrial wastewater discharge. Thai Wah's investments in advanced wastewater treatment facilities, which exceeded 50 million Thai Baht in the past two years, directly address these regulatory pressures.

Intellectual Property Rights and Innovation Protection

Protecting intellectual property (IP) is paramount for Thai Wah, especially concerning its innovative products, processing technologies, and sustainability initiatives like Roseco bioplastic, as these are key to its competitive edge. Thailand's legal system, including its patent, trademark, and trade secret laws, provides the essential framework to safeguard the company's significant investments in research and development, ensuring these efforts translate into protected market advantages.

Strategic collaborations and alliances are also integral to Thai Wah's IP strategy. These partnerships can involve structured agreements for sharing and protecting jointly developed intellectual property, thereby fostering innovation while mitigating risks associated with IP leakage. For instance, in 2024, Thailand continued its efforts to strengthen IP enforcement, with the Department of Intellectual Property reporting a notable increase in patent applications, reflecting a growing emphasis on innovation across various sectors.

- Patents: Securing patents for novel processing methods and product formulations, such as those related to starch derivatives or bioplastics, shields Thai Wah's technological advancements from competitors.

- Trademarks: Registering trademarks for its brands and product names, like Roseco, builds brand recognition and consumer trust, preventing others from using similar identifiers.

- Trade Secrets: Maintaining strict confidentiality protocols for proprietary manufacturing processes and formulations is crucial, as these often provide a lasting competitive advantage that cannot be patented.

- International Agreements: Adhering to international IP treaties and conventions, such as the Paris Convention and the Patent Cooperation Treaty (PCT), allows Thai Wah to seek protection for its innovations in key global markets.

International Trade Laws and Compliance

Thai Wah's global reach hinges on strict adherence to international trade laws and customs regulations. Navigating import/export restrictions is crucial for maintaining its worldwide distribution network, especially as it expands into new territories. In 2024, Thailand’s export sector faced ongoing adjustments to global trade policies, impacting businesses like Thai Wah that rely on seamless cross-border movement of goods.

Ensuring compliance across multiple jurisdictions presents a significant challenge for Thai Wah's operations. This includes understanding and adapting to varying trade agreements and tariffs. For instance, the ASEAN Economic Community (AEC) framework facilitates trade within Southeast Asia, but external trade policies can still introduce complexities.

- Adherence to international trade laws: Essential for maintaining Thai Wah's global distribution.

- Customs regulations and import/export restrictions: Critical for seamless cross-border operations.

- Navigating complex trade policies: Key for expansion into new markets.

- International legal frameworks for joint ventures: Such as the partnership with Fuji Nihon, require careful navigation.

Thai Wah's operations are deeply influenced by Thailand's evolving legal landscape. Strict adherence to food safety regulations, labor laws, and environmental protection mandates is crucial for maintaining operational integrity and brand reputation. The company must also actively manage intellectual property rights to safeguard its innovations and comply with international trade agreements to facilitate its global business.

Environmental factors

Climate change presents a substantial threat to Thai Wah's core operations by disrupting the supply and quality of key agricultural inputs such as tapioca and rice. Unpredictable weather events, including prolonged droughts and severe floods, directly impact crop yields. For example, recent drought conditions have led to notable decreases in tapioca production across vital sourcing regions like Cambodia, Vietnam, and Thailand.

In response, Thai Wah is proactively implementing strategies to build resilience against these environmental shifts. This includes significant investments in promoting climate-resilient farming techniques among its supplier base, leveraging digital crop scanning technologies for better monitoring and prediction, and diversifying its geographical sourcing to spread risk and ensure continuity of supply. These measures are crucial to mitigate the potential for yield reductions and maintain raw material availability.

Thai Wah's extensive agricultural and food processing operations are highly dependent on water resources, making sustainable water management a critical environmental factor. In 2024, Thailand faced varying degrees of drought conditions across several regions, impacting crop yields and increasing the operational costs associated with water procurement and treatment for facilities like those in Nakhon Ratchasima, a key operational hub.

To mitigate these risks and align with its green factory initiatives, Thai Wah has been investing in water-efficient technologies. For instance, their efforts in optimizing irrigation systems in their tapioca cultivation, which accounts for a significant portion of their raw material sourcing, aim to reduce water consumption by up to 15% by 2025 compared to 2023 benchmarks. This focus on responsible sourcing and efficient use is paramount for long-term operational resilience.

Thai Wah is deeply committed to sustainable sourcing, especially for its key ingredient, tapioca. They actively promote regenerative agriculture practices, working closely with their extensive network of farmers. This collaboration aims to boost crop yields while simultaneously reducing environmental impact and preventing land degradation.

A significant testament to their responsible land use practices is their achievement of the SAI Platform's FSA Gold Award. This certification underscores Thai Wah's dedication to preventing deforestation and ensuring ethical land management throughout their supply chain, reinforcing their broader Farm to Shelf sustainability initiative.

Waste Management and Pollution from Operations

Thai Wah faces the significant environmental challenge of managing waste from its manufacturing and agricultural operations. This includes byproducts from tapioca starch production and other agricultural processing. The company is actively addressing this by implementing upcycling strategies to transform waste into valuable resources. This initiative is central to their ambition of achieving green factory status across their facilities.

Their approach involves converting waste streams into new products such as bioplastics, biofertilizers, and biogas. This not only minimizes their environmental impact but also opens up new revenue streams and business opportunities. For example, in 2024, Thai Wah reported a successful pilot for a biogas project, producing enough energy to power a portion of their plant operations, reducing reliance on fossil fuels by an estimated 15% for that site.

Key initiatives and their impact include:

- Waste-to-Product Conversion: Thai Wah is investing in technologies to process agricultural residues, aiming to divert over 80% of manufacturing waste from landfills by the end of 2025.

- Bioplastics Development: The company is exploring the use of tapioca starch waste as a feedstock for biodegradable plastics, targeting a 10% reduction in virgin plastic use in specific packaging applications by 2026.

- Biofertilizer Production: By processing organic waste, Thai Wah produces biofertilizers, which are supplied to local farmers, improving soil health and reducing the need for chemical fertilizers. In 2023, they distributed over 5,000 tons of biofertilizer.

- Biogas Generation: The biogas produced from waste is used for on-site energy generation, contributing to a cleaner energy mix and reducing greenhouse gas emissions.

Carbon Footprint and Renewable Energy Adoption

Thai Wah is actively working to shrink its environmental impact, with a key focus on adopting renewable energy. The company has set an ambitious goal to power half of its operations using renewable sources by the 2026-2027 period. This strategic move underscores their dedication to combating climate change and improving overall energy efficiency across their business.

A significant part of this strategy involves substantial investment in solar energy projects. For instance, Thai Wah has been actively developing solar farms, such as the one at its Nakhon Ratchasima facility, which contributes to their renewable energy targets.

- Renewable Energy Target: 50% of operations powered by renewables by 2026-2027.

- Investment in Solar: Actively developing solar energy projects to meet this goal.

- Climate Change Mitigation: Commitment to reducing carbon footprint and enhancing energy efficiency.

Thai Wah's environmental strategy heavily relies on sustainable water management, crucial given its agricultural and processing operations. The company is investing in water-efficient technologies, aiming for a 15% reduction in water usage for tapioca cultivation by 2025 compared to 2023. This focus is vital for operational resilience amidst varying drought conditions in Thailand, as experienced in 2024.

Thai Wah is actively transforming waste into valuable resources through upcycling initiatives, targeting an 80% diversion of manufacturing waste from landfills by the end of 2025. This includes developing bioplastics from tapioca starch waste and producing biofertilizers, with over 5,000 tons distributed in 2023. A pilot biogas project in 2024 successfully powered a portion of plant operations, reducing fossil fuel reliance by an estimated 15% at that site.

The company is committed to increasing its renewable energy usage, with a goal to power 50% of its operations by renewables by 2026-2027. This involves significant investment in solar energy projects, such as the one at its Nakhon Ratchasima facility, to reduce its carbon footprint and improve energy efficiency.

| Environmental Initiative | Target/Status | Year | Impact/Metric |

|---|---|---|---|

| Water Efficiency (Tapioca) | 15% reduction | 2025 | vs. 2023 benchmarks |

| Waste Diversion | >80% from landfills | End of 2025 | Upcycling into bioplastics, biofertilizers |

| Biofertilizer Distribution | 5,000+ tons distributed | 2023 | Improving soil health |

| Renewable Energy Usage | 50% of operations | 2026-2027 | Focus on solar energy projects |

PESTLE Analysis Data Sources

Our Thai Wah PESTLE Analysis is built on a comprehensive review of data from official government agencies in Thailand, international financial institutions, and reputable industry research firms. This ensures all insights into political, economic, social, technological, legal, and environmental factors affecting Thai Wah are accurate and current.