Thai Wah Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Thai Wah Bundle

Thai Wah operates in a dynamic agricultural sector, where understanding competitive forces is crucial. The bargaining power of buyers, particularly large food manufacturers and retailers, significantly influences pricing and product specifications. Similarly, the threat of substitutes for Thai Wah's core products, like tapioca starch and animal feed, requires constant innovation and cost management.

The intensity of rivalry among existing players, including both domestic and international competitors, shapes market share and profitability. Furthermore, the bargaining power of suppliers, from farmers to logistics providers, can impact Thai Wah's operational costs and raw material availability.

The threat of new entrants, while potentially moderate due to capital requirements and established supply chains, remains a factor to monitor in the growing Asian food ingredient market. These forces collectively define Thai Wah's strategic landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Thai Wah’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Thai Wah is notably shaped by the concentration of its key agricultural raw material sources, especially tapioca and rice. When a few suppliers control a significant portion of these essential inputs, their ability to dictate terms, including pricing, increases considerably.

Recent challenges, such as the projected decline in cassava production for 2024 due to the impact of El Niño and the prevalence of cassava mosaic disease, have already begun to exert pressure on raw material availability. This scarcity can translate into higher procurement costs for Thai Wah.

To counter these supplier-driven pressures, Thai Wah has strategically diversified its sourcing. By expanding its raw material procurement to countries like Cambodia and Vietnam, the company aims to reduce its reliance on any single source, thereby mitigating the risks associated with concentrated supplier power and potential price hikes.

Raw materials represent a significant cost driver for Thai Wah's native starch production, accounting for approximately 75% of total processing expenses. This high dependency on agricultural inputs means that price volatility in commodities like tapioca directly impacts the company's bottom line. For instance, in 2024, global tapioca prices experienced fluctuations due to weather patterns and demand shifts, underscoring this vulnerability.

Thai Wah actively mitigates this by leveraging its integrated value chain, which allows for greater control over raw material sourcing and processing. Strategic sourcing initiatives and long-term supplier relationships are crucial to securing stable supplies and managing cost escalations, thereby reducing reliance on a concentrated supplier base.

Developing new supplier relationships for agricultural commodities, like those Thai Wah relies on, can be a substantial undertaking. This involves considerable time and effort to establish quality assurance protocols and adapt logistics, representing a de facto switching cost for buyers seeking alternative sources.

Thai Wah actively manages this by cultivating enduring partnerships with its suppliers. This strategy aims to secure a consistent and reliable supply chain, mitigating the potential disruption and expense associated with finding and integrating new agricultural commodity providers.

Furthermore, Thai Wah’s support for its 'Thai Wah Farmer network' directly addresses and reduces these switching costs. By investing in and collaborating with its farmer base, the company ensures a stable flow of raw materials, thereby strengthening its bargaining position against individual suppliers.

Threat of Forward Integration by Suppliers

The threat of agricultural suppliers integrating forward into starch or noodle production for Thai Wah is generally considered low. This is primarily due to the significant capital investment and specialized technical expertise needed to operate large-scale manufacturing facilities and manage global distribution networks.

While individual farmers are unlikely to integrate, the possibility exists for larger agricultural cooperatives or even agricultural conglomerates to consider downstream expansion. This remains a potential long-term concern, particularly if they can achieve the necessary scale and efficiency.

Thai Wah's substantial operational scale and its established position within the market serve as a significant deterrent against such forward integration attempts by suppliers. The company's existing infrastructure and market reach make it challenging for new entrants, even those with agricultural backing, to compete effectively.

For example, in 2024, the Thai food industry saw continued investment in value-added processing, but this often involved established players rather than raw material suppliers moving into complex manufacturing. Thai Wah's strategic sourcing agreements and its focus on innovation in starch and noodle products further solidify its competitive advantage against potential supplier encroachment.

Uniqueness of Inputs and Sustainable Sourcing

Thai Wah's commitment to sustainable sourcing and providing disease-free tapioca stems to farmers can significantly influence supplier bargaining power. By fostering stronger relationships and ensuring higher-quality inputs, Thai Wah potentially mitigates the reliance on individual, less specialized suppliers.

This strategic approach to supply chain management, focusing on farmer development and input quality, can lead to more consistent and reliable sourcing. This, in turn, can diminish the leverage individual suppliers might otherwise hold due to the commodity nature of basic tapioca and rice.

- Sustainable Sourcing: Thai Wah actively promotes sustainable farming practices among its tapioca and rice suppliers.

- Disease-Free Stems: The company provides farmers with disease-free tapioca stems, enhancing crop yields and quality.

- Farmer Development: Investments in farmer training and support strengthen the overall supply chain reliability.

- Input Differentiation: This focus creates a more differentiated input stream compared to standard commodity sourcing.

Thai Wah's bargaining power with suppliers is moderated by the concentration of its raw material sources, particularly tapioca and rice. Recent factors, such as El Niño's impact on 2024 cassava production, have tightened supply and increased procurement costs, highlighting the inherent vulnerability to price volatility given that raw materials constitute around 75% of starch production expenses.

| Factor | Impact on Thai Wah | Mitigation Strategy |

|---|---|---|

| Supplier Concentration | High reliance on a few sources increases supplier leverage. | Diversification of sourcing to countries like Cambodia and Vietnam. |

| Raw Material Price Volatility | Commodity price swings directly affect profitability (e.g., tapioca prices in 2024). | Integrated value chain, strategic sourcing, and long-term supplier relationships. |

| Switching Costs | Establishing new supplier relationships requires time, effort, and quality assurance. | Cultivating enduring partnerships and supporting the Thai Wah Farmer network. |

| Threat of Forward Integration | Low for individual farmers; potential concern for large agricultural cooperatives. | Thai Wah's scale, market position, and focus on innovation deter encroachment. |

What is included in the product

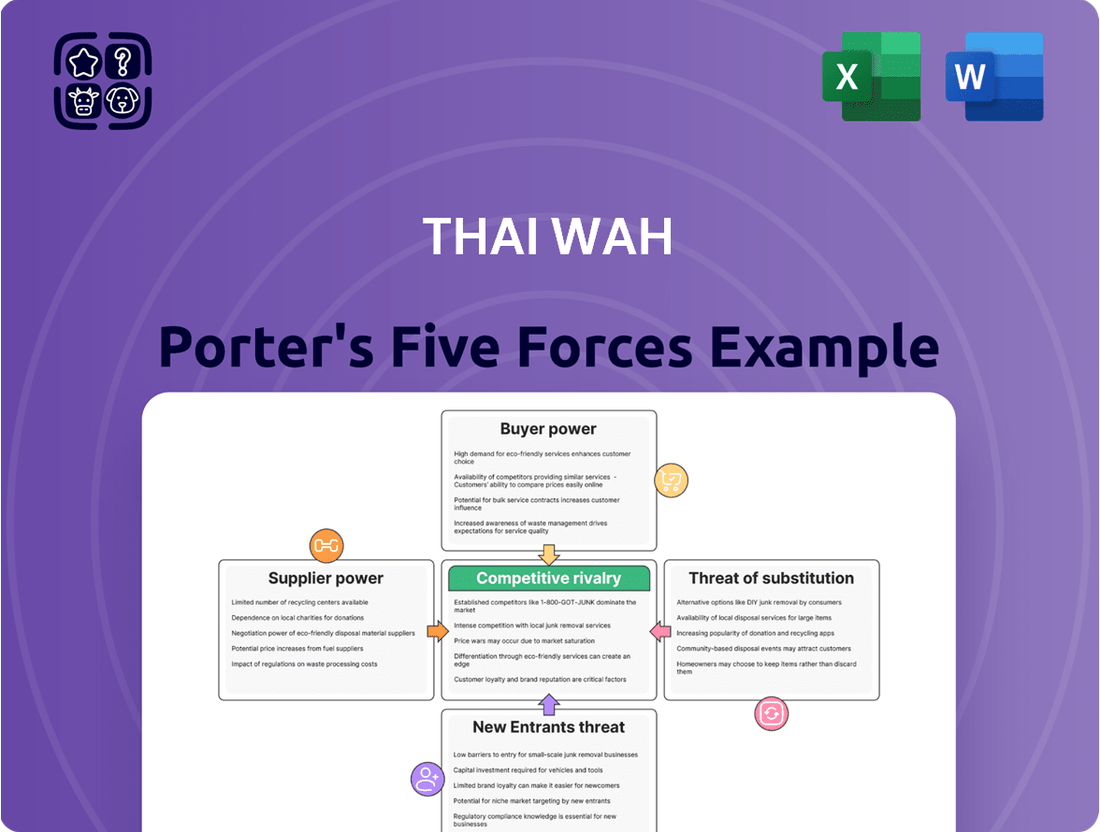

This analysis delves into the competitive forces shaping Thai Wah's industry, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Instantly grasp Thai Wah's competitive landscape with a visual representation of all five forces, simplifying complex market pressures for decisive action.

Customers Bargaining Power

Thai Wah's customer base ranges from massive industrial buyers to dispersed consumer markets. Industrial clients, buying in bulk, wield significant influence, particularly in the commodity starch sector. For instance, the weakening of pricing power in China's starch market in 2023 directly reflects this industrial buyer leverage.

While individual consumers of products like vermicelli and noodles have minimal direct bargaining power, their collective preferences and purchasing habits significantly shape market dynamics. Changes in consumer demand, driven by factors like health consciousness or price sensitivity, can indirectly empower consumers by forcing Thai Wah to adapt its product offerings and pricing strategies.

Thai Wah's strategic pivot towards high-value-added ingredients and finished food products, targeting over 70% of its portfolio by 2030, significantly curtails customer bargaining power. This move allows the company to command stronger pricing by offering differentiated products. For instance, by the end of 2023, Thai Wah had already achieved a 56% revenue contribution from value-added products, demonstrating tangible progress toward this goal.

Innovation in product development is a key driver in this strategy. By introducing unique flavors, health-focused options such as gluten-free and organic varieties, and convenient Ready to Eat and Ready to Cook noodle lines, Thai Wah creates products that are less susceptible to direct price comparisons. This differentiation builds customer loyalty and reduces their ability to demand lower prices based on comparable alternatives.

For industrial customers, switching between starch suppliers can involve significant hurdles. These include the costs associated with technical adjustments to production processes, the expense of reformulating products to meet new starch specifications, and the potential for supply chain disruptions during the transition. These factors collectively create a moderate level of switching costs for Thai Wah's B2B clients.

In the consumer product segment, Thai Wah benefits from implicit switching costs driven by strong brand loyalty, a perception of high quality, and the convenience offered by its leading market position. For instance, in 2024, Thai Wah maintained its status as a top player in Thailand's noodle and vermicelli market, a position built on years of consistent product delivery and consumer trust, making it less likely for consumers to switch to lesser-known brands.

Information Availability and Price Sensitivity

Customers in the commodity starch market, where Thai Wah operates, are highly price-sensitive due to readily available pricing information. This means that small price fluctuations can significantly impact purchasing decisions. For instance, in 2024, many agricultural commodity markets saw increased volatility, making price a primary driver for buyers in these segments.

However, in Thai Wah's differentiated food product segments, the bargaining power of customers is tempered. Factors like strong marketing, established brand reputation, and continuous product innovation play a crucial role, allowing Thai Wah to command a premium and reducing the focus solely on price. This shift is evident as consumer preferences increasingly lean towards quality and unique offerings.

Thai Wah's extensive global distribution network and direct-to-customer channels provide valuable market intelligence. This enhanced understanding of customer needs and market dynamics in 2024 allows the company to better anticipate demand and tailor its product offerings, thereby strengthening its position against customer price pressures.

- Information Availability: Customers in commodity starch markets have easy access to pricing data, increasing their sensitivity to price changes.

- Differentiated Products: In food segments, brand loyalty, marketing, and innovation can override price as a primary purchase factor.

- Market Intelligence: Thai Wah's direct channels and global reach improve its understanding of customer behavior and market trends.

- Reduced Price Pressure: By focusing on value-added products and strong branding, Thai Wah can mitigate the impact of customer price sensitivity.

Backward Integration by Customers

The threat of customers backward integrating into starch or noodle production for companies like Thai Wah is generally considered low, particularly within consumer markets. This is primarily due to the significant complexities and substantial capital investment required for manufacturing these products. For instance, setting up a modern starch processing facility involves advanced technology and considerable upfront expenditure, making it a prohibitive barrier for most customers.

While large industrial food manufacturers possess the theoretical capacity to consider backward integration, they often find it more economically sensible to continue sourcing from specialized suppliers such as Thai Wah. This reliance stems from the need for consistent quality, economies of scale, and the specialized expertise that established players like Thai Wah offer. In 2024, the global starch market, a key input, continued to see consolidation and technological advancements, reinforcing the advantages of specialized production.

- Complexity and Capital Intensity: Backward integration into starch production requires substantial investment in specialized machinery and processing technology, a significant hurdle for most customers.

- Economies of Scale: Established suppliers like Thai Wah benefit from economies of scale, allowing them to produce starch and noodles at a lower per-unit cost than a new entrant customer could achieve.

- Quality Consistency: Maintaining consistent quality in starch and noodle production demands specific expertise and rigorous quality control processes, which specialized manufacturers excel at.

- Focus on Core Competencies: Customers, especially in the food industry, often prefer to focus on their core competencies like product development, branding, and distribution rather than diverting resources to upstream manufacturing.

Thai Wah's customer base presents a mixed landscape regarding bargaining power. Industrial buyers of commodity starch, due to market transparency and high price sensitivity, exert considerable influence, as seen in the 2023 Chinese starch market's price weakening. Conversely, individual consumers of finished food products have minimal direct power, but their collective preferences can shift dynamics. Thai Wah's strategic shift towards value-added products, aiming for over 70% of its portfolio by 2030, aims to counter this by offering differentiated goods, with 56% of revenue already from such products by late 2023.

Switching costs for industrial clients, influenced by technical and reformulation expenses, offer Thai Wah moderate protection. For consumers, brand loyalty and perceived quality, reinforced by Thai Wah's top market position in 2024 for noodles and vermicelli, create implicit switching costs. While commodity starch customers are highly price-sensitive, especially with 2024's agricultural market volatility, Thai Wah's focus on differentiated food products leverages marketing and innovation to reduce price-centric bargaining.

The threat of backward integration by customers remains low. The high capital investment and technical complexity of starch production make it prohibitive for most. Even large food manufacturers often find it more efficient to rely on specialized suppliers like Thai Wah in 2024, benefiting from economies of scale and consistent quality, particularly as the global starch market sees continued consolidation and technological advancement.

| Customer Segment | Bargaining Power Factors | Thai Wah's Mitigation Strategies |

| Industrial (Commodity Starch) | High price sensitivity, easy information access | Focus on economies of scale, brand reputation in specialized applications |

| Consumer (Finished Foods) | Low individual power, high collective influence on trends | Product differentiation (health, convenience), strong brand loyalty, market intelligence |

| Potential Backward Integrators | Low threat due to capital intensity and complexity | Leverage specialized expertise, economies of scale, and consistent quality |

Same Document Delivered

Thai Wah Porter's Five Forces Analysis

This preview showcases the comprehensive Thai Wah Porter's Five Forces Analysis you will receive immediately upon purchase. The detailed examination of competitive rivalry, threat of new entrants, bargaining power of buyers, bargaining power of suppliers, and threat of substitutes is presented in its entirety. You are viewing the actual, professionally formatted document, ensuring no discrepancies or missing sections. This is the exact, ready-to-use analysis you'll download after completing your transaction.

Rivalry Among Competitors

The starch and noodle sectors in Thailand are intensely competitive, featuring a crowded field of both local and international businesses. Thai Wah faces robust competition from global giants such as Cargill, Ingredion, and Tate & Lyle in the starch market, demanding constant innovation and efficiency.

In the instant noodle segment, Thai Wah contends with formidable domestic players, including Thai President Foods, makers of the popular Mama brand, and Thai Preserved Food Factory, known for Waiwai noodles. This intense rivalry necessitates strong brand recognition and effective distribution strategies to maintain market share.

The instant noodles market in Thailand is a dynamic space, with a projected compound annual growth rate of 6.19% between 2024 and 2032. This strong growth, fueled by increasing urbanization and a demand for convenient food options, naturally intensifies competition among existing players. As more consumers reach for instant noodles, companies are compelled to fight harder for every sale.

Within this competitive landscape, Thai Wah strategically positions itself by emphasizing high-value-added products and continuous innovation. This approach allows Thai Wah to stand out from competitors who might be primarily focused on basic, commodity-level offerings. By differentiating through product quality and unique features, Thai Wah aims to capture a more loyal customer base and command a stronger market position.

Thai Wah faces significant competitive rivalry, especially in the native starch sector where price wars are common. This intense competition, particularly evident in markets like China, has eroded the company's pricing power and put pressure on its profit margins. For instance, in 2024, the global starch market experienced fluctuating raw material costs, directly impacting Thai Wah's ability to maintain stable pricing.

To counter this, Thai Wah strategically focuses on cost efficiency across its operations. A key part of its strategy involves shifting its product mix towards higher-value food ingredients and specialty starches. This pivot aims to capture better margins and reduce reliance on the more commoditized native starch segments, thereby strengthening overall profitability.

Exit Barriers and Industry Investment

The starch and noodle sectors are characterized by substantial capital outlays for manufacturing and specialized equipment. This high investment level erects significant exit barriers, forcing existing players to maintain competitive strategies to preserve their market standing. Thai Wah's ongoing investment in regional growth and new plants, like its facility in Cambodia, underscores a deep-seated commitment to the sector.

Thai Wah's strategic investments highlight the industry's capital intensity and the resultant pressure to remain competitive. For example, the company's investment in its new Cambodian plant, operationalized in 2023, represents a significant capital commitment, reinforcing its long-term presence and competitive drive within the region.

- High Capital Investment: Manufacturing facilities and specialized assets require substantial upfront capital, making it difficult and costly for companies to exit the market.

- Exit Barriers: These high costs create significant barriers to exit, compelling companies to continue operating and competing even in challenging market conditions.

- Thai Wah's Commitment: Thai Wah’s investments, such as its Cambodian factory, demonstrate a strategic intent to remain in the industry for the long term.

- Regional Expansion: The company’s expansion into Cambodia signals a proactive approach to capturing market share and solidifying its competitive position in Southeast Asia.

Innovation and Sustainability as Competitive Levers

Companies in the food and agriculture sector are increasingly differentiating themselves through innovation and sustainability, moving beyond traditional price competition. Thai Wah exemplifies this trend, focusing on 'Innovation and Sustainability from Farm to Shelf.' This approach allows them to capture value by offering products that meet evolving consumer demands for health and convenience, such as plant-based protein alternatives and value-added food ingredients. Their recognition for green exporting further solidifies this competitive advantage, signaling strong environmental stewardship to global markets.

In 2023, Thai Wah reported revenue growth of 13.3% to THB 21.5 billion, partly driven by its focus on higher-value products and export markets. The company's strategic investments in R&D for new product development, including healthy snacks and specialized food ingredients, are crucial for staying ahead. For instance, their development of bioplastics from tapioca starch addresses the growing demand for sustainable packaging solutions, a market segment projected for significant expansion in the coming years.

- Product Innovation: Thai Wah's development of plant-based protein products and convenient food solutions caters to rising health consciousness among consumers.

- Sustainability Focus: Awards for green exporting demonstrate Thai Wah's commitment to eco-friendly practices, enhancing brand reputation and market access.

- Market Differentiation: By prioritizing innovation and sustainability, Thai Wah aims to reduce direct price-based competition and build stronger customer loyalty.

- Financial Impact: The company's revenue growth in 2023 suggests that these strategic initiatives are translating into tangible business success.

The competitive rivalry in Thailand's starch and noodle sectors is fierce, with both domestic and global players vying for market share. Thai Wah faces intense competition from giants like Cargill and Ingredion in starch, and from Thai President Foods and Thai Preserved Food Factory in instant noodles. This rivalry is amplified by the instant noodle market's projected 6.19% CAGR between 2024 and 2032, driving companies to innovate and differentiate.

Thai Wah counters this by focusing on high-value-added products and innovation, such as plant-based proteins and sustainable packaging solutions derived from tapioca starch. Despite price wars in the native starch market, particularly in China, Thai Wah's strategic shift towards specialty starches and cost efficiency, evidenced by its THB 21.5 billion revenue in 2023, aims to bolster profitability and market position.

| Competitor | Market Segment | Key Strategy |

|---|---|---|

| Cargill | Starch | Global scale, diverse ingredient portfolio |

| Ingredion | Starch | Specialty ingredients, R&D focus |

| Thai President Foods (Mama) | Instant Noodles | Strong brand recognition, extensive distribution |

| Thai Preserved Food Factory (Waiwai) | Instant Noodles | Established domestic presence, product variety |

SSubstitutes Threaten

Thai Wah's starch products encounter significant competition from readily available alternative starches and ingredients. Wheat flour, for instance, poses a notable threat, particularly in price-sensitive markets like China. When global wheat prices decrease, wheat flour becomes a more economically viable option for many manufacturers, directly impacting demand for Thai Wah's tapioca starch. In 2024, for example, fluctuations in global wheat supply chains and pricing strategies by major wheat-producing nations could further intensify this competitive pressure.

Beyond wheat, modified starches derived from other common crops such as corn, wheat, and barley present functional similarities to Thai Wah's offerings. These alternatives often provide comparable texture, binding, and thickening properties across various food applications. This wide array of substitutes means that customers have flexibility in their sourcing decisions, potentially shifting to cheaper or more readily available alternatives if Thai Wah's pricing or supply chain becomes less competitive.

Evolving consumer preferences, particularly a growing emphasis on health and wellness, present a significant threat of substitutes for traditional starch-based products. This shift is driving demand towards alternatives like whole grains, gluten-free options, organic produce, and plant-based foods. For example, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to grow substantially, indicating a clear consumer movement away from conventional staples.

Thai Wah's vermicelli and noodle products face significant competition from a wide array of other staple foods. Consumers can easily opt for alternatives like rice, bread, potatoes, or even pre-packaged ready-to-eat meals and various types of pasta as substitutes for their noodle offerings.

The very convenience and affordability that drive growth for products like instant noodles also underscore the threat of substitution. It illustrates how readily consumers can shift their choices to other quick and accessible meal solutions, impacting Thai Wah's market share in the broader convenience food sector.

Technological Advancements in Food Production

Technological advancements in food production present a significant threat of substitutes for Thai Wah's starch and noodle products. Innovations like plant-based protein alternatives or novel processing techniques for existing ingredients could offer consumers new options that rival traditional offerings in terms of cost, functionality, or perceived health benefits. For instance, advancements in fermentation technology could lead to cost-effective protein isolates that substitute for starch in certain food applications. By the end of 2023, the global food tech market was valued at over $300 billion, indicating substantial investment and rapid innovation in this area.

Thai Wah is proactively addressing this threat by focusing on its own research and development. The company's strategy includes investing in high-value-added products and exploring new applications for its core ingredients. This commitment to innovation is crucial for maintaining a competitive edge. In 2024, Thai Wah announced a partnership with a leading research institution to explore novel uses for tapioca starch, aiming to create advanced materials and ingredients. This proactive approach helps mitigate the risk of being disrupted by emerging substitute products.

- Emerging Ingredients: The rise of alternative flours (e.g., chickpea, lentil) and novel sweeteners could reduce demand for traditional starch-based products.

- Processing Innovations: New food processing technologies may create cost-effective substitutes that mimic the texture and taste of current offerings.

- Health & Wellness Trends: Products perceived as healthier, such as those with lower carbohydrate content or high protein, can act as substitutes.

- Thai Wah's R&D: Continued investment in developing specialized starches and value-added food ingredients is key to countering substitution threats.

Price-Performance Trade-off of Substitutes

The price-performance trade-off of substitute products is a critical factor for Thai Wah. Consumers and industrial buyers are always looking for the best value, meaning they weigh the benefits they receive against the cost. If alternatives provide similar or even superior performance for less money, this significantly increases the threat of substitution.

This dynamic forces Thai Wah to remain highly competitive on pricing. It also necessitates a strong focus on communicating the unique advantages and superior quality of its own offerings. For instance, in the starch industry, if alternative starch sources become significantly cheaper without a major performance drop, Thai Wah’s market share could be impacted.

Consider the global starch market, valued at approximately USD 120 billion in 2023. Within this, corn starch is a dominant player, but alternatives like tapioca starch, potato starch, and even novel plant-based starches are available. Thai Wah, a major tapioca starch producer, must constantly monitor the pricing and performance of these substitutes.

- Price Sensitivity: Buyers will switch to substitutes if the price difference is substantial, especially for commodity-like applications.

- Performance Parity: If substitutes achieve comparable functional properties (e.g., viscosity, binding) to Thai Wah's products, the switching barrier lowers.

- Innovation in Substitutes: Advances in processing or sourcing of alternative ingredients can reduce their cost or enhance their performance, increasing the threat.

- Market Dynamics: Fluctuations in raw material costs for Thai Wah versus its competitors directly influence the price-performance trade-off.

The threat of substitutes for Thai Wah's products is substantial, stemming from readily available alternatives like wheat flour, especially when global wheat prices fall, making it a more attractive option for manufacturers in price-sensitive markets like China. Furthermore, modified starches from corn, wheat, and barley offer similar functional properties, allowing buyers flexibility in sourcing. The growing health and wellness trend also fuels demand for alternatives such as whole grains, gluten-free, and plant-based options, as evidenced by the global plant-based food market's valuation of approximately $29.7 billion in 2023.

Thai Wah's vermicelli and noodle products face substitution from a broad range of staple foods like rice, bread, potatoes, and convenience meals, highlighting the ease with which consumers can shift preferences. Technological advancements in food production, such as plant-based protein alternatives and novel processing techniques, also pose a threat, with the global food tech market exceeding $300 billion by the end of 2023. To counter this, Thai Wah is investing in R&D, exemplified by its 2024 partnership to explore new uses for tapioca starch.

| Threat Category | Key Substitutes | Impact on Thai Wah | 2023-2024 Data Point |

| Ingredient Alternatives | Wheat flour, corn starch, other modified starches | Price pressure, potential loss of market share | Global starch market valued at ~USD 120 billion (2023) |

| Dietary & Lifestyle Trends | Whole grains, gluten-free products, plant-based foods | Reduced demand for traditional starch-based items | Global plant-based food market ~$29.7 billion (2023) |

| Food Convenience | Rice, bread, potatoes, ready-to-eat meals, pasta | Competition for consumer meal choices | N/A (qualitative impact) |

| Technological Advancements | Plant-based proteins, novel processing techniques | Potential for new, cost-effective alternatives | Global food tech market >$300 billion (end of 2023) |

Entrants Threaten

The starch and food manufacturing sectors demand significant upfront capital. This includes building modern factories, acquiring specialized machinery, and investing in ongoing research and development to stay competitive. These substantial financial requirements act as a formidable barrier, making it difficult for new companies to enter the market and challenge established players like Thai Wah.

Access to raw material supply chains presents a significant barrier for new entrants in the starch and ingredients sector, particularly for companies like Thai Wah reliant on agricultural commodities such as cassava. Establishing robust and sustainable relationships with a vast network of farmers is a complex undertaking, requiring substantial time and investment to build trust and ensure consistent supply.

Thai Wah's established 'Farm to Shelf' model, honed over years, grants them a distinct advantage. This model is supported by extensive farmer development programs, which not only secure raw materials but also contribute to product quality and traceability. In 2023, Thai Wah reported sourcing a significant portion of its cassava from its contracted farmer network, highlighting the scale and integration of its supply chain.

New players would face considerable challenges in replicating this deep integration and farmer engagement. The capital expenditure and operational expertise needed to build comparable networks and ensure reliable sourcing of agricultural inputs are substantial. This lack of immediate access to a stable and quality raw material pipeline acts as a strong deterrent, limiting the threat of new entrants.

Thai Wah's robust distribution network, spanning modern trade, wholesale, industrial, and e-commerce channels both domestically and internationally, presents a significant barrier to new entrants. Replicating this extensive reach and established market access would require substantial investment and time, making it difficult for newcomers to compete effectively.

Brand Recognition and Customer Loyalty

Thai Wah benefits from established brand recognition, especially with its popular 'Rosebrand,' and commands leading market shares in Thailand's vermicelli and rice noodle segments. This strong consumer trust, cultivated over years, presents a significant hurdle for newcomers. New entrants would need substantial marketing expenditure and a long-term commitment to build comparable brand loyalty. For instance, in 2023, Thai Wah reported revenue growth, underscoring the continued strength of its established brands in the competitive food market.

The effort and capital required to forge similar brand loyalty are considerable. New companies entering the Thai food market face the challenge of not only producing quality products but also convincing consumers to switch from trusted, familiar brands. This often translates into higher initial operating costs for new players. Thai Wah's market leadership, supported by consistent product quality and distribution, means new entrants must overcome deeply ingrained consumer preferences.

- Established Brand Equity: Thai Wah's 'Rosebrand' enjoys high recognition, a key differentiator in a crowded marketplace.

- Market Leadership: Holding top positions in vermicelli and rice noodles signifies strong consumer preference and distribution advantages.

- High Marketing Investment: New entrants require significant financial outlay for branding and consumer outreach to challenge incumbents.

- Customer Loyalty Barrier: Building trust and loyalty in the food sector is a lengthy and costly process, deterring swift market penetration by new firms.

Regulatory Hurdles and Sustainability Standards

The Thai food industry faces significant regulatory hurdles that act as a substantial barrier to entry for new companies. Compliance with rigorous food safety standards and evolving government regulations demands considerable investment and expertise, making it challenging for less established players to enter the market. For instance, in 2024, the Thai Food and Drug Administration continued to enforce strict guidelines on product labeling, ingredient sourcing, and manufacturing processes.

Furthermore, the growing global and domestic emphasis on sustainability is introducing another layer of complexity. New entrants must navigate and often invest in obtaining certifications that demonstrate responsible sourcing and production. Thai Wah's commitment to standards such as the Sustainability Assessment of Information (SAI) Food Agricultural Practices (FSA) Gold, as highlighted in their 2024 sustainability reports, requires significant upfront investment in infrastructure and operational practices. This commitment sets a high bar, making it more difficult for newcomers to compete on both quality and ethical grounds.

- Stringent Food Safety Regulations: Thai food manufacturers must adhere to national and international food safety laws, impacting production processes and product development.

- Sustainability Certifications: Obtaining certifications like SAI FSA Gold for responsible agricultural practices adds costs and operational complexity for new entrants.

- Investment in Compliance: The financial and operational resources needed to meet these regulatory and sustainability demands create a significant barrier for smaller or less experienced competitors.

- Thai Wah's Proactive Approach: Thai Wah's established adherence to these high standards positions them favorably against potential new market entrants who may struggle to meet the same benchmarks.

The threat of new entrants for Thai Wah is relatively low due to high capital requirements for production facilities and advanced machinery, alongside the necessity of securing reliable agricultural supply chains. Established brand loyalty and extensive distribution networks further deter new players, requiring significant investment in marketing and market penetration efforts. For instance, in 2023, Thai Wah's revenue growth indicated continued strong consumer preference for their established brands.

Regulatory compliance, particularly concerning food safety and increasingly sustainability standards, also poses a substantial barrier. New entrants must invest heavily to meet these requirements, such as adherence to labeling and sourcing regulations enforced by bodies like the Thai Food and Drug Administration in 2024. Thai Wah's existing certifications, like SAI FSA Gold, already establish a benchmark for responsible practices that newcomers would find challenging and costly to replicate.

| Barrier Type | Impact on New Entrants | Thai Wah's Position |

| Capital Investment | High cost for factories and machinery | Established operational scale |

| Supply Chain Access | Difficulty securing consistent raw materials | Extensive farmer network and 'Farm to Shelf' model |

| Brand Loyalty | Requires significant marketing spend | Strong brand recognition ('Rosebrand') and market share |

| Regulatory Compliance | Costly adherence to food safety and sustainability | Proactive adoption of high standards and certifications |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Thai Wah is built upon a foundation of robust data, including the company's annual reports, investor presentations, and official filings. We also incorporate insights from reputable industry research firms and market intelligence platforms that cover the agribusiness and food sectors in Southeast Asia.