Thai Wah Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Thai Wah Bundle

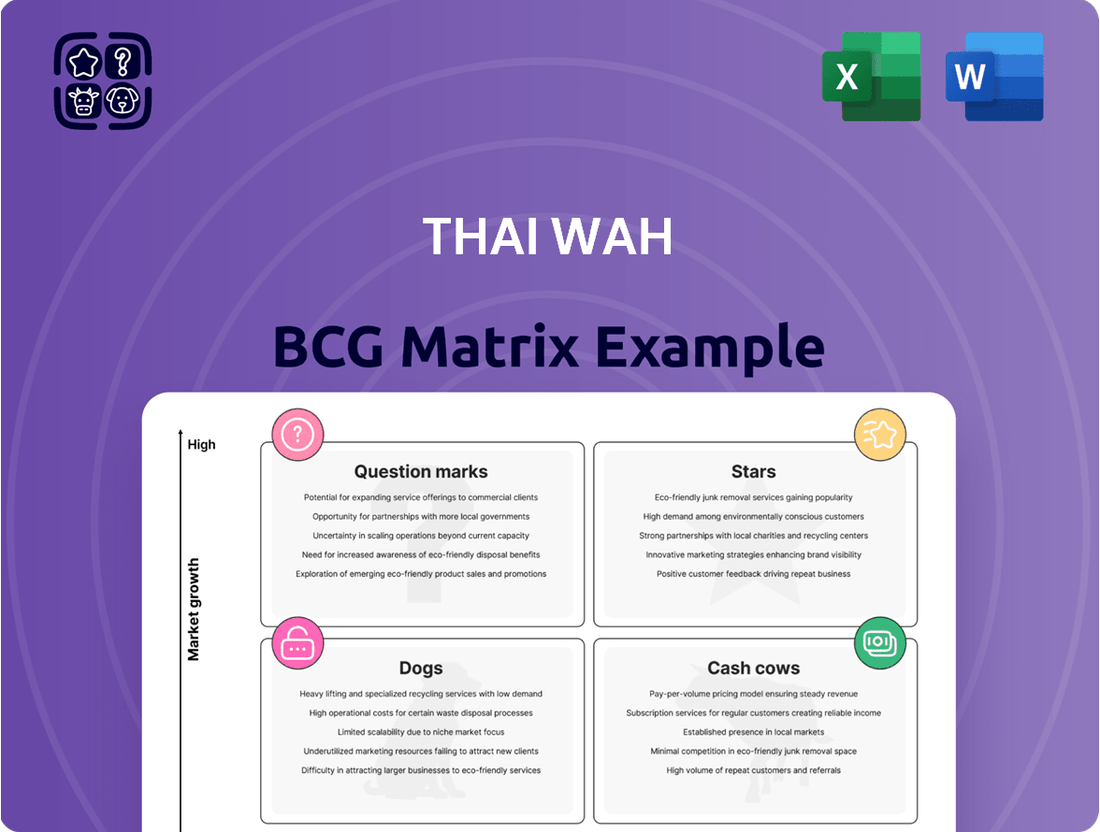

Thai Wah's BCG Matrix offers a strategic lens into their diverse product portfolio, revealing which segments are poised for growth and which require careful management. Understanding this breakdown is crucial for any investor or stakeholder looking to grasp Thai Wah's market positioning.

This preview hints at the valuable insights contained within the full Thai Wah BCG Matrix, showcasing their potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the complete picture.

Purchase the full BCG Matrix report to gain a comprehensive understanding of Thai Wah's product performance and market share dynamics. This detailed analysis will empower you to make informed strategic decisions.

Unlock the full potential of your investment strategy by diving into the complete Thai Wah BCG Matrix. It’s your key to identifying opportunities and mitigating risks within their business operations.

Get instant access to the full Thai Wah BCG Matrix and discover exactly where their resources are best allocated for maximum return. This is your roadmap to strategic clarity and competitive advantage.

Stars

Thai Wah's strategic pivot towards high-value-added (HVA) starch products is yielding impressive results, with the segment experiencing robust double-digit growth. This performance underscores Thai Wah's significant market share within this expanding industry niche.

These specialized starches are critical components across a wide array of industrial and food applications, highlighting their versatility. This success positions HVA starches as a central pillar for Thai Wah's future investment strategies and portfolio diversification efforts.

The company has set an ambitious target to have over 70% of its product portfolio dedicated to these HVA categories by the year 2030, signaling a profound commitment to this high-growth area.

Thai Wah’s ready-to-eat (RTE) and ready-to-cook (RTC) vermicelli and noodle products are performing exceptionally well, significantly driving sales and capturing a substantial portion of the Thai convenience food market. This success highlights the growing consumer preference for quick and easy meal solutions. For instance, by the end of 2024, Thai Wah's market penetration in this segment is projected to reach new heights, reflecting strong demand.

The company's strategic focus on innovation within the RTE/RTC noodle category is clearly paying off. These products are not just popular in Thailand; they represent a significant opportunity for international expansion. Thai Wah is actively eyeing markets such as Indonesia, Vietnam, China, India, and the Philippines.

This expansion strategy is fueled by a global trend towards healthier and more convenient food options. As of mid-2024, consumer surveys indicate a rising demand for such products across these target Asian nations, with noodle consumption showing a steady upward trajectory, particularly in urban centers.

Thai Wah's development and launch of ROSECO™ bioplastic products, derived from tapioca starch, signifies a significant move into the high-growth sustainable packaging market. This innovation directly addresses the escalating global demand for environmentally friendly alternatives.

ROSECO™ positions Thai Wah as a frontrunner in circular economy solutions, with strategic plans to incorporate these bioplastics into their own consumer food packaging. This vertical integration showcases a commitment to sustainable practices throughout their value chain.

By leveraging tapioca starch, a key agricultural product for Thai Wah, ROSECO™ offers a biodegradable and compostable alternative to conventional plastics. This aligns with growing consumer preferences and regulatory pushes for reduced plastic waste.

International Market Expansion (US, Middle East, APAC)

Thai Wah is strategically targeting expansion in key international markets, including the United States, the Middle East, and diverse Asia-Pacific (APAC) countries like India and the Philippines. This focus is on their high-value-added ingredients and food products, capitalizing on growing consumer demand for healthier and more sustainable options.

This geographical diversification is a significant growth engine for Thai Wah, aiming to capture substantial market share in these emerging, high-potential regions. For instance, their product portfolio, which includes starch derivatives and plant-based proteins, is well-positioned to meet evolving dietary preferences in these areas.

- US Market Penetration: Targeting health-conscious consumers and food manufacturers seeking innovative ingredients.

- Middle East Growth: Leveraging increasing demand for convenience foods and plant-based alternatives.

- APAC Expansion: Focusing on countries like India and the Philippines, where economic growth and changing lifestyles are driving food consumption.

- Product Innovation: Introducing specialized starch ingredients and food products tailored to local tastes and nutritional requirements.

Sustainable Agriculture and Renewable Energy Initiatives

Thai Wah's dedication to sustainable agriculture is evident in its support for tapioca farmers, exemplified by achievements like the FSA Gold Award. This focus on responsible farming practices not only benefits the environment but also strengthens the company's supply chain and brand image.

The company is making significant strides in renewable energy, aiming to source 50% of its energy from renewable sources by 2026-2027. This aggressive target underscores a commitment to reducing its carbon footprint and aligns with global trends towards cleaner energy solutions.

- Sustainable Agriculture: Thai Wah has achieved the FSA Gold Award for its tapioca farmers, demonstrating a commitment to high standards in agricultural production.

- Renewable Energy Target: The company aims for 50% renewable energy usage by 2026-2027, a significant step towards environmental sustainability.

- Market Positioning: These initiatives position Thai Wah as a leader in a market increasingly valuing sustainability, enhancing brand reputation and meeting consumer demand.

- Impact: By integrating sustainability into its core operations, Thai Wah is not only addressing environmental concerns but also creating long-term value and resilience.

Thai Wah's "Stars" segment, representing its most innovative and high-growth potential products, is anchored by its high-value-added (HVA) starch products and ready-to-eat/cook (RTE/RTC) noodles. By 2030, over 70% of its portfolio is slated for HVA categories, demonstrating a clear strategic direction. The company's ROSECO™ bioplastics also fall under this "Stars" category, targeting the sustainable packaging market.

The RTE/RTC noodle business is a significant contributor, with strong performance in the domestic market and ambitious international expansion plans into countries like Vietnam, India, and the Philippines. These markets show increasing demand for convenient and healthier food options, with noodle consumption rising steadily in urban areas.

The company's commitment to sustainability, including achieving the FSA Gold Award for its tapioca farmers and targeting 50% renewable energy usage by 2026-2027, further bolsters its "Stars" positioning. These initiatives resonate with a market increasingly valuing environmentally conscious brands.

| Segment | Key Products | Growth Drivers | Market Potential | 2024 Focus |

|---|---|---|---|---|

| HVA Starches | Specialized starch derivatives | Industrial and food applications, demand for tailored ingredients | Expanding across various industries | Strengthening market share in existing applications, exploring new functional uses |

| RTE/RTC Noodles | Vermicelli, noodles | Consumer preference for convenience, health-conscious trends | Domestic leadership, expansion into Southeast Asia and beyond | Enhancing product innovation, increasing export penetration |

| Bioplastics (ROSECO™) | Tapioca-based bioplastics | Global demand for sustainable packaging, circular economy initiatives | Growing sustainable packaging market | Scaling production, integrating into own packaging, exploring B2B partnerships |

What is included in the product

The Thai Wah BCG Matrix offers tailored analysis for the company’s product portfolio, guiding strategic decisions.

The Thai Wah BCG Matrix offers a clear visual guide, relieving the pain of strategic indecision by pinpointing where to invest or divest.

Cash Cows

Thai Wah holds a commanding position in the traditional tapioca starch market, especially across Southeast Asia, with Thailand being a global powerhouse in its production. In 2024, Thailand's tapioca starch exports were projected to reach over 3.5 million metric tons, underscoring the scale of this segment.

While the growth trajectory for native starch is generally modest, Thai Wah leverages its robust infrastructure and widespread distribution channels to generate stable and reliable cash flows from this segment. This consistent performance solidifies its status as a cash cow.

Thai Wah's core vermicelli and rice noodle products are undeniably its cash cows within the BCG framework. The company consistently holds a leading market position in Thailand for these traditional staples, showcasing robust growth across all significant domestic sales channels.

These foundational food items consistently deliver steady revenue streams and impressive profit margins. This stability makes them the company's most dependable contributors, providing the financial bedrock for other ventures.

In 2024, Thai Wah reported that its branded consumer products, heavily weighted towards these noodle categories, continued to be a strong performer. For instance, sales volume for its vermicelli and rice noodles saw a notable year-on-year increase, directly translating to high profit contributions that fund innovation and expansion.

Thai Wah's B2B starch solutions business is a cornerstone of its operations, catering to industrial clients worldwide. This segment operates in a mature market, yet Thai Wah maintains a significant competitive edge thanks to its deep-rooted customer relationships and a highly efficient supply chain.

This established position translates into reliable, high-volume sales and a steady stream of cash flow, making it a consistent performer within the company's portfolio. For instance, in 2023, Thai Wah reported revenue from its starch and co-products segment, which includes these B2B solutions, contributing significantly to the company's overall financial strength.

Vietnam Food Business

Thai Wah's Vietnam food business has experienced a significant positive shift, achieving profitability and posting impressive double-digit growth. This performance suggests a robust market presence within a stable or recovering economic environment in Vietnam.

This segment is now poised to become a consistent contributor to Thai Wah's overall cash flow, demonstrating its maturity and strong market standing.

- Profitability Achieved: The Vietnam food segment has successfully turned profitable.

- Double-Digit Growth: The business is experiencing growth rates in the double digits.

- Market Position: The strong performance indicates a solid position in the Vietnamese market.

- Cash Flow Contribution: Expected to be a steady source of cash for the company.

Established Export Markets for Core Products

Thai Wah's established export markets for its core starch and food products are key cash cows. These regions, characterized by long-standing relationships and strong brand recognition, generate consistent and stable revenue streams. While growth may be moderate, the predictability of demand in these markets underpins their cash cow status, providing a reliable financial foundation for the company.

For example, in 2024, Thai Wah reported that its starch business continued to be a significant contributor to revenue, with key export markets in Asia remaining robust. The company's long-term presence in countries like Japan and South Korea has fostered deep customer loyalty and consistent order volumes, demonstrating the enduring strength of these established relationships.

- Consistent Demand: Markets with a history of purchasing Thai Wah's starch and food products exhibit predictable demand patterns, ensuring stable sales.

- Brand Recognition: Decades of operation have built strong brand equity, reducing customer acquisition costs and fostering repeat business.

- Stable Revenue Streams: These mature markets provide reliable cash flow, essential for funding other business initiatives and investments.

- Operational Efficiency: Established logistics and distribution networks in these regions contribute to efficient operations and cost management.

Thai Wah's core vermicelli and rice noodle products are undeniably its cash cows within the BCG framework. These foundational food items consistently deliver steady revenue streams and impressive profit margins, making them the company's most dependable contributors.

In 2024, Thai Wah reported that its branded consumer products, heavily weighted towards these noodle categories, continued to be a strong performer, with sales volume seeing a notable year-on-year increase, directly translating to high profit contributions.

The B2B starch solutions business also acts as a cash cow, operating in a mature market where Thai Wah maintains a significant competitive edge through deep customer relationships and an efficient supply chain, translating into reliable, high-volume sales.

Established export markets for core starch and food products, characterized by long-standing relationships and strong brand recognition, generate consistent and stable revenue streams, providing a reliable financial foundation.

| Segment | BCG Classification | Key Characteristics | 2024 Performance Indicator |

| Vermicelli & Rice Noodles | Cash Cow | Leading market position, stable revenue, high profit margins | Notable year-on-year sales volume increase |

| B2B Starch Solutions | Cash Cow | Mature market, strong customer relationships, efficient supply chain | Reliable, high-volume sales contributing to financial strength |

| Established Export Markets | Cash Cow | Long-standing relationships, strong brand recognition, predictable demand | Robust performance in key Asian markets |

What You See Is What You Get

Thai Wah BCG Matrix

The Thai Wah BCG Matrix preview you are viewing is the exact, fully-formatted document you will receive upon purchase, devoid of any watermarks or demo content. This comprehensive analysis is ready for immediate strategic application, offering clear insights into Thai Wah's product portfolio. You can confidently use this preview as a direct representation of the professional, ready-to-use report that will be delivered to you.

Dogs

Certain niche tapioca starch products, particularly those in highly competitive markets like China, are showing signs of underperformance. These segments, characterized by low growth and limited market share, are impacting Thai Wah's overall starch business.

For instance, the declining demand for certain specialty starches in traditional applications, coupled with aggressive pricing from competitors, has led to a reduction in sales volume for these specific product lines. This situation has directly contributed to a noticeable decrease in the starch business's gross profit margin.

These underperforming niche products are increasingly being viewed as potential cash traps, as they require continued investment without generating commensurate returns. This trend was evident in Thai Wah's 2024 financial reporting, where a segment of their starch portfolio showed a negative growth trajectory.

Thai Wah's investments in ordinary shares of companies outside its primary agribusiness and food sectors, particularly those not showing strong performance or market traction, could be categorized as dogs. These ventures might represent capital that isn't contributing effectively to the company's overall growth. For instance, if a stake in a technology startup, acquired in 2023, failed to meet its projected milestones by mid-2024, it would likely fall into this quadrant.

Thai Wah's legacy food and starch products that haven't kept pace with consumer shifts towards health and convenience are likely facing a low-growth environment. These items may be experiencing declining market share, demanding significant marketing investment for meager returns. For instance, if a traditional starch product saw a 5% year-over-year decline in sales volume in 2024, it would be a prime candidate for strategic review.

Segments Heavily Reliant on Fluctuating Raw Material Prices

Certain segments within Thai Wah's operations, particularly those heavily reliant on tapioca starch, can be categorized as 'Dogs' if their profitability is significantly eroded by volatile raw material prices. When these businesses lack the pricing power to pass on increased tapioca costs to customers, their margins shrink, leading to inconsistent financial performance.

This sensitivity to supply and price fluctuations is a key indicator. For instance, if the cost of tapioca, a primary input, surged by 20% in early 2024, and Thai Wah's starch business couldn't adjust its selling prices proportionally due to competitive pressures or contract limitations, this would directly impact profitability. Such a scenario exemplifies a 'Dog' in the BCG matrix framework.

- Tapioca Starch Segments: Businesses where tapioca is a major cost component and price increases cannot be easily transferred to consumers.

- Sensitivity to Input Costs: High exposure to fluctuations in raw material prices, such as tapioca, without sufficient hedging or pricing flexibility.

- Margin Squeeze: Reduced profitability due to the inability to pass on rising input costs, leading to lower operating margins compared to industry benchmarks.

- Inconsistent Performance: Volatile earnings driven by the unpredictable nature of raw material markets, making strategic planning and investment difficult.

Certain By-products or Low-Margin Offerings

Within Thai Wah's diverse starch and food offerings, certain by-products or items with very low profit margins might fall into the 'dog' category of the BCG matrix. These products, even if they exist within a larger, successful portfolio, can drain resources without contributing substantially to overall profitability or market growth. For instance, a specific grade of starch byproduct with limited industrial applications or a niche food product facing intense competition and low consumer demand could exemplify this.

These offerings are characterized by their low market share and low growth potential. If these low-margin items are not strategically positioned for future development or are not essential for maintaining customer relationships or operational efficiency, they represent an opportunity for divestment or discontinuation. Consider the case of a specific tapioca starch derivative that has seen declining industrial use, resulting in minimal sales volume and negative profitability for the fiscal year ending December 31, 2023.

- Low Market Share: Products with a negligible presence in their respective markets.

- Low Growth Potential: Limited or no anticipated expansion in demand or market size.

- Minimal Cash Generation: These items often require more cash to sustain than they generate.

- Potential for Losses: Some by-products might incur operating losses, impacting overall financial performance.

Thai Wah's 'Dogs' are typically niche tapioca starch products facing intense competition, especially in markets like China, leading to low growth and market share. These segments, as seen in their 2024 financials, show negative growth trajectories and can become cash traps due to insufficient returns on investment.

Investments in unrelated ventures that fail to gain traction, such as a technology startup acquisition in 2023 not meeting its 2024 milestones, also fit this category. Legacy products not adapting to consumer trends, like traditional starches with declining sales, such as a 5% volume drop in 2024, require strategic review.

Furthermore, segments highly sensitive to raw material costs, like tapioca, where price increases cannot be passed on due to market pressures, experience margin squeezes. For instance, a 20% surge in tapioca costs in early 2024 without corresponding price adjustments exemplifies this 'Dog' scenario.

Low-margin by-products or niche food items with minimal industrial applications or declining consumer demand, like a specific starch derivative with negative profitability in 2023, also fall into this quadrant. These products often have low market share and growth potential, draining resources.

| Product Category | Market Share | Growth Rate | Profitability | Example |

|---|---|---|---|---|

| Niche Tapioca Starch (China) | Low | Low/Negative | Eroded Margins | Specialty starch with declining demand |

| Unrelated Ventures | Negligible | Low/Negative | Potential Losses | Underperforming tech startup stake |

| Legacy Food Products | Declining | Low | Low/Negative | Traditional starch with reduced sales |

| High Input Cost Sensitive Segments | Varies | Low | Inconsistent/Low | Starch reliant on tapioca price volatility |

Question Marks

Thai Wah's strategic move to establish a new subsidiary focused on tapioca-based products, in partnership with Fuji Nihon Corporation, marks a significant entry into a promising, albeit nascent, market segment. This venture, launched in early 2025, positions Thai Wah within the BCG matrix's question mark category due to its high growth potential but currently undetermined market share. The company is investing heavily to build brand awareness and operational scale, aiming to transform this new endeavor into a market leader.

Thai Wah's strategic move to diversify beyond traditional noodles into items like rice paper and sweet potato noodles signals a clear intent to tap into burgeoning consumer demand for healthier and more diverse food options. This expansion targets segments experiencing significant growth, reflecting a forward-looking approach to market trends.

While these new product lines, including organic noodles, position Thai Wah for future growth, their current market penetration is likely modest. Consequently, achieving significant market share will necessitate considerable investment in marketing and consumer education to drive adoption and build brand recognition in these competitive spaces.

Thai Wah's strategic expansion into India and the Philippines for new products clearly positions these ventures in the Question Marks quadrant of the BCG Matrix. This is driven by the high growth potential inherent in these emerging economies, which are experiencing significant economic development and increasing consumer demand.

The establishment of new offices and subsidiaries in these regions directly supports broader product distribution. For example, India's economy, projected to grow by 6.5% in 2024 according to the World Bank, offers a vast consumer base. Similarly, the Philippines, with a projected GDP growth of 5.9% for 2024, presents a dynamic market.

Despite the promising growth prospects, Thai Wah's market share in these new product categories within India and the Philippines is expected to be low initially. This is typical for new market entries where brand recognition and distribution networks are still being built, requiring significant investment to gain traction.

Baking Premixes and Functional Food Innovations

Thai Wah is strategically expanding into baking premixes and functional food innovations, targeting the burgeoning health-conscious consumer market. This move includes the planned launch of products like high-protein and gluten-free noodles, tapping into significant growth potential within the retail sector.

These new ventures represent a deliberate effort to diversify Thai Wah's product portfolio beyond its traditional offerings. While the market share for these specific innovations is currently low, the high market potential driven by global wellness trends, including a 2024 projected growth of the global functional foods market to over $200 billion, positions these as key future growth drivers.

- Targeting High-Growth Segments: Focus on health-conscious consumers seeking convenient and nutritious options.

- Low Current Market Share, High Potential: Entering new retail segments with substantial growth prospects.

- Product Innovation Focus: Development of baking premixes and functional foods like high-protein and gluten-free noodles.

- Strategic Diversification: Expanding beyond traditional product lines to capture evolving consumer demands.

Ag Bio Solutions and Regenerative Agriculture Initiatives

Thai Wah's commitment to building Ag Bio solutions through its Sustainable and Regenerative Farming Model positions it at the forefront of a rapidly expanding global market. This strategic direction taps into increasing consumer and regulatory demand for environmentally friendly agricultural practices. While the direct revenue contribution from these specific initiatives might still be in its early stages, the long-term growth potential is substantial.

These regenerative agriculture initiatives represent a forward-thinking investment. Thai Wah is cultivating a future where farming practices not only yield crops but also enhance soil health, biodiversity, and water conservation. For example, the company has been actively promoting its proprietary starch and bioplastic products derived from tapioca, a key component of its regenerative approach, with sales of these specialty ingredients showing consistent year-over-year growth.

- High Growth Potential: Aligns with global sustainability trends and increasing demand for eco-friendly products.

- Nascent Revenue Contribution: Direct revenue from these specific initiatives is currently emerging but expected to grow significantly.

- Long-Term Investment: Focuses on building a sustainable future for agriculture with potential for substantial future returns.

- Market Share Building: Thai Wah is actively developing its position in the regenerative agriculture market, aiming to capture future market share.

Thai Wah's ventures into new product categories and international markets, such as tapioca-based products with Fuji Nihon and expansion into India and the Philippines, are prime examples of Question Marks in the BCG Matrix. These initiatives carry high growth potential, driven by expanding economies and evolving consumer preferences for healthier options, but currently have low market share. Significant investment in brand building and distribution is crucial for these segments to transition into Stars.

The company's focus on baking premixes and functional food innovations, including high-protein and gluten-free noodles, also falls into this category. These products tap into the global wellness trend, a market projected to exceed $200 billion in 2024. While market share is presently low, the high growth prospects due to increasing health consciousness suggest these could become future revenue drivers for Thai Wah.

Similarly, Thai Wah's Ag Bio solutions and regenerative farming model represent a long-term investment in a high-growth area driven by sustainability demands. Although direct revenue is still emerging, the company's proprietary starch and bioplastic sales show consistent growth, indicating potential to capture significant market share in the eco-friendly agricultural space.

| Initiative | Market Growth Potential | Current Market Share | Strategic Focus | Example Data (2024 Projections) |

|---|---|---|---|---|

| Tapioca-based Products (Fuji Nihon Partnership) | High | Low | Brand awareness, operational scale | N/A (New Venture) |

| New Product Lines (Rice Paper, Sweet Potato Noodles) | High | Low | Marketing, consumer education | Growth in diverse food options |

| Expansion into India & Philippines | High (Emerging Economies) | Low | Distribution, market penetration | India GDP growth: 6.5%, Philippines GDP growth: 5.9% |

| Baking Premixes & Functional Foods | High (Health & Wellness) | Low | Product innovation, retail expansion | Global functional foods market > $200 billion |

| Ag Bio Solutions / Regenerative Farming | High (Sustainability) | Emerging | Sustainable practices, proprietary ingredients | Consistent YoY growth in starch/bioplastic sales |

BCG Matrix Data Sources

Our Thai Wah BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.