Team SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Team Bundle

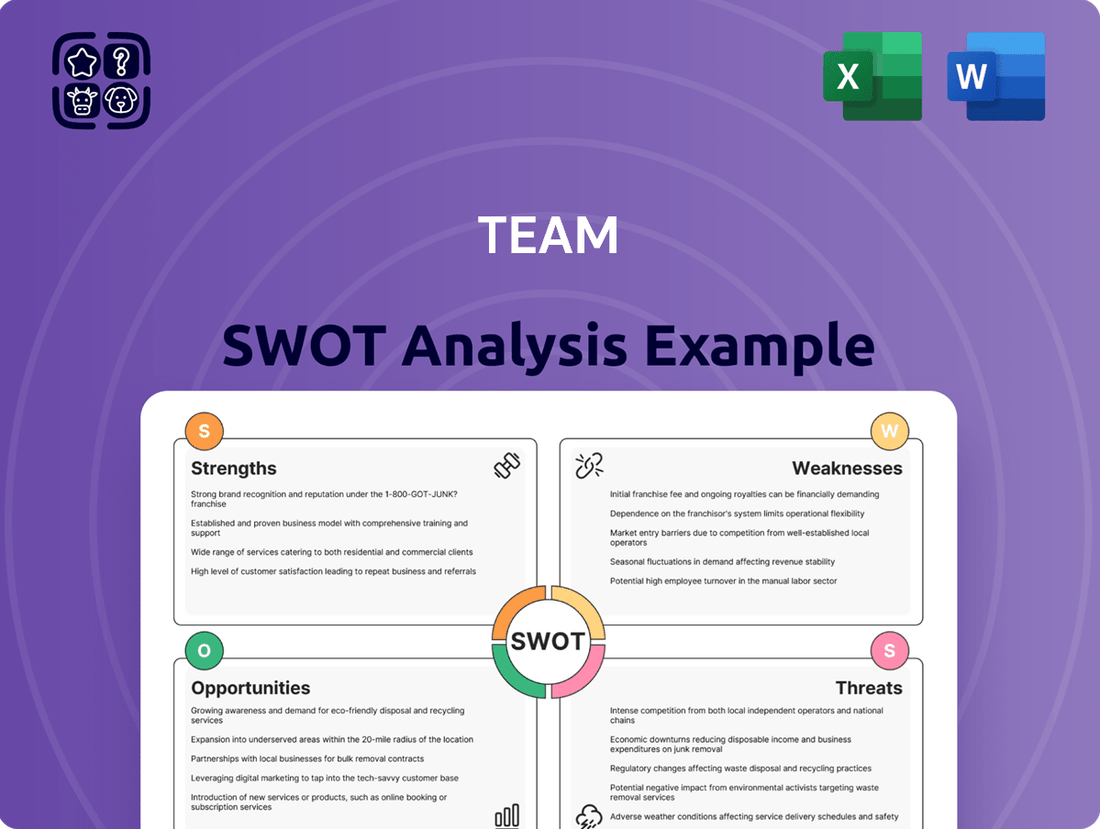

This glimpse into the team's SWOT analysis highlights key internal strengths and potential challenges.

However, to truly leverage these insights for strategic advantage, you need the complete picture.

Our full SWOT analysis provides a comprehensive breakdown, including actionable strategies and a deeper dive into market opportunities and threats.

Don't just understand the landscape; conquer it.

Purchase the full SWOT analysis to unlock detailed planning tools, expert commentary, and a ready-to-present report, empowering your team's success.

Strengths

TEAM, Inc. is a leading global provider of specialty industrial services, known for its strong reputation and comprehensive service portfolio. This includes conventional, specialized, and proprietary services like inspection, heat treating, and mechanical solutions. As of Q1 2025, their integrated, digitally-enabled offerings serve as a one-stop shop, helping clients across heavy industries like refining and power ensure asset performance and reliability. For instance, their Q4 2024 results highlighted strong demand for their integrated solutions, contributing to a projected 2025 revenue growth.

The company has significantly improved its financial results, showcasing robust performance. For the full year 2024, TEAM, Inc. successfully increased its gross margin and operating income while effectively reducing its net loss compared to the prior year. These gains stem from a favorable project mix, improved pricing strategies, and successful cost optimization initiatives. Looking ahead, the company anticipates realizing additional annualized cost savings throughout 2025, further bolstering financial stability.

TEAM, Inc. benefits significantly from its extensive global footprint, operating from numerous locations across more than 20 countries, ensuring worldwide service capability. This broad presence allows the company to serve a diverse client base within critical heavy industries such as refining, power generation, and petrochemicals. Their strategic focus on further sector diversification, evidenced by recent expansions into new industrial segments in early 2025, aims to broaden market reach and stabilize revenue streams. This global reach and diversification provide a robust competitive advantage, enhancing resilience against regional economic shifts and industry-specific downturns.

Focus on Technological Innovation and Digitalization

The company strongly emphasizes technological innovation and digitalization, enhancing its value proposition. By 2025, over 70% of core processes are projected to be fully digitized, improving operational efficiency. The integration of advanced inspection tools and remote monitoring, including autonomous robotics, reduces on-site labor costs by an estimated 15% annually.

- Digitalization: 70%+ core processes digitized by 2025.

- Efficiency: 15% reduction in labor costs via robotics/remote monitoring.

- Innovation: Focus on advanced inspection and engineering solutions.

Experienced Workforce and Commitment to Safety

TEAM, Inc. leverages its highly experienced workforce, comprising skilled technicians and engineers, as a significant competitive advantage. The company prioritizes rigorous safety protocols and comprehensive training, ensuring employees complete extensive hours of specialized instruction annually. This dedication to a well-trained and safety-conscious team is crucial, especially in the high-risk industrial environments they serve. For instance, TEAM, Inc. invested approximately $15 million in training and safety initiatives in fiscal year 2024.

- TEAM, Inc. reported over 1.5 million training hours for its global workforce in 2024, emphasizing specialized technical and safety certifications.

- The company's Total Recordable Incident Rate (TRIR) consistently remains below industry averages, reflecting its robust safety culture.

- Their expertise covers critical asset integrity management, essential for clients in energy and manufacturing sectors.

TEAM, Inc. leverages its strong global presence and comprehensive, digitally-integrated service portfolio, which contributed to improved 2024 financials and projected 2025 revenue growth. Their innovative digital solutions, with 70% of core processes digitized by 2025, enhance efficiency and reduce labor costs by 15%. A highly skilled workforce, supported by $15 million in 2024 training investments, underpins operational excellence.

| Metric | 2024 Actual | 2025 Projection |

|---|---|---|

| Revenue Growth | Strong Demand | Anticipated Growth |

| Core Processes Digitized | N/A | 70%+ |

| Training Investment | $15 Million | N/A |

What is included in the product

Analyzes the Team’s internal strengths and weaknesses alongside external opportunities and threats to inform strategic planning.

Offers a clear, actionable framework to identify and address internal team weaknesses and external threats, relieving the pain of strategic uncertainty.

Weaknesses

Despite efforts to improve, TEAM, Inc. continues to face significant financial hurdles, reporting a consolidated net loss of $38.3 million for the full fiscal year 2024. This follows a cumulative net loss of $55 million for the 12 months concluding in the second quarter of 2024. These figures highlight persistent challenges in achieving consistent profitability. The ongoing losses suggest that while improvements are noted, the path to sustained positive net income remains difficult for the company. This financial weakness impacts investor confidence and operational flexibility.

The company carries significant debt, totaling $325.1 million as of December 31, 2024. While a successful refinancing in March 2025 extended maturities and lowered interest rates, this debt level still poses financial risks. It can limit the company's operational flexibility and potential for future investments. Managing this leverage remains a key challenge for sustained financial health.

TEAM, Inc. primarily serves cyclical heavy industries such as refining, petrochemical, and power generation. These sectors are highly sensitive to economic fluctuations, which directly impacts demand for TEAM's inspection and maintenance services. For instance, a projected slowdown in global industrial output in late 2024 and early 2025 could lead to a reduction in client capital expenditures. This decreased spending during economic downturns directly affects TEAM's revenue streams and overall profitability, as seen with historical sensitivities to energy price volatility.

Slight Revenue Decline

The company experienced a slight year-over-year revenue decline, impacting its top-line growth. In the fourth quarter of 2024, revenue dipped by 1%, and the full year saw a 1.2% decrease. Despite this, the company still outperformed its direct competitors in revenue stability. However, any decline in top-line growth remains a significant concern for future performance.

- Q4 2024 revenue declined by 1%.

- Full year 2024 revenue decreased by 1.2%.

- Company outperformed competitors despite the decline.

- Top-line growth decline is a key concern.

Challenges in a Highly Fragmented and Competitive Market

The industrial services market remains highly fragmented, presenting significant competitive challenges for TEAM, Inc. While the company views itself as a leader, it faces intense pressure from over 100 diverse service contractors, impacting its operational leverage. This intense competition, especially from smaller, agile firms and larger integrated players, directly influences pricing strategies and market share. Consequently, maintaining profitability amidst such a crowded field requires continuous strategic adaptation.

- Market fragmentation impacts TEAM's pricing power.

- Over 100 competitors vying for market share.

- Profitability is pressured by competitive bidding and lower margins.

TEAM, Inc. faces persistent financial challenges, reporting a $38.3 million net loss for fiscal year 2024 and carrying $325.1 million in debt as of December 31, 2024. Its revenue stability is threatened by a 1.2% decline in 2024 and heavy reliance on cyclical industries sensitive to economic downturns. The highly fragmented market, with over 100 competitors, further pressures pricing and market share. These weaknesses collectively impede sustained profitability and growth.

| Metric | FY2024 Data | Impact |

|---|---|---|

| Net Loss | $38.3 million | Hinders profitability |

| Total Debt | $325.1 million | Limits flexibility |

| FY2024 Revenue Change | -1.2% | Indicates top-line decline |

Full Version Awaits

Team SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global industrial services market is experiencing strong growth, presenting a notable opportunity for TEAM, Inc. Projections indicate this market will expand from $37.06 billion in 2025 to an estimated $46.96 billion by 2029. This substantial growth trajectory offers TEAM, Inc. a significant chance to boost its revenue and capture a larger market share. Expanding demand across industrial sectors further solidifies this potential for strategic growth.

The market for asset integrity management is projected to reach approximately $35 billion by 2025, driven by a growing focus on operational efficiency. Industries are increasingly adopting predictive maintenance and remote monitoring, with AI and data analytics integrations expanding by over 20% annually in industrial processes through 2024. This trend highlights a critical need for reliable asset performance, making TEAMs specialized services highly relevant. As companies prioritize technological solutions to ensure asset reliability, TEAM is well-positioned to meet this escalating demand.

The continued growth of Industry 4.0 and IoT technologies presents a significant opportunity. Projections indicate the global IoT market will reach approximately $1.1 trillion by 2025, driven by industrial applications. TEAM's core focus on digitally-enabled solutions and advanced analytics aligns perfectly, allowing them to offer sophisticated, data-driven services. This trend empowers TEAM to enhance client operational efficiencies and deliver substantial value in an increasingly connected industrial landscape.

Strategic Acquisitions and Partnerships

The industrial services market remains fragmented, presenting significant opportunities for TEAM, Inc. to pursue strategic consolidation. Acquiring smaller, specialized competitors could expand TEAM's geographic footprint, particularly in high-growth regions like the Gulf Coast where industrial activity is robust, and diversify its service portfolio. For instance, in Q1 2024, the industrial maintenance market saw several smaller M&A activities, indicating a ripe environment for strategic plays. Collaborating with advanced technology firms, possibly through joint ventures, could accelerate digital transformation initiatives, enhancing predictive maintenance capabilities and operational efficiency. Such partnerships are crucial as the global industrial IoT market is projected to reach over 150 billion by 2025.

- Market fragmentation allows for targeted acquisitions to expand service lines and regional presence.

- Potential for 2024-2025 revenue growth through synergistic acquisitions.

- Partnerships with AI and IoT firms can integrate cutting-edge predictive analytics.

- Consolidation could improve TEAM's market share, currently around 2% in key segments.

Focus on Environmental, Social, and Governance (ESG) Services

The increasing global emphasis on sustainability and stringent environmental regulations presents a significant opportunity for TEAM. Expanding service offerings into emissions control and energy efficiency directly addresses market demand, which saw global ESG assets under management projected to exceed $50 trillion by 2025. This allows the company to capitalize on the growing need for ESG-related compliance and consulting services.

- Global ESG investment reached approximately $40 trillion in 2024.

- New EU Corporate Sustainability Due Diligence Directive (CSDDD) mandates impact supply chains.

- The US Inflation Reduction Act (IRA) provides significant incentives for clean energy.

- Companies are boosting ESG spending by 15-20% annually through 2025.

The industrial services market offers significant growth, projected to reach $37.06 billion by 2025, with asset integrity management hitting $35 billion, driven by surging Industry 4.0 adoption. Strategic acquisitions in the fragmented market could boost TEAM's ~2% share, while expanding ESG services capitalizes on over $40 trillion in global ESG investment by 2024.

| Area | 2025 Projection | Growth Driver | ||

|---|---|---|---|---|

| Industrial Services | $37.06 Billion | Global Demand Increase | ||

| Asset Integrity Mgt. | $35 Billion | AI/IoT Integration | ||

| ESG Investment | >$40 Trillion | Regulatory & Corporate Focus |

Threats

Economic downturns pose a significant threat, potentially reducing capital spending by clients in heavy industries, which saw global capital expenditure growth moderate to an estimated 2.8% in Q1 2024. This could lead to project delays or cancellations, directly impacting TEAM's revenue and profitability. The IMF's 2024 global growth forecast of 3.2% still highlights underlying economic uncertainties. Client spending in sectors like mining and construction remains sensitive to commodity price volatility and interest rate hikes. Such reductions could significantly hinder new contract acquisitions and existing project pipelines through mid-2025.

The industrial services industry faces intense competition, with numerous local, regional, and national players vying for market share. This crowded landscape, projected to see continued fragmentation through 2025, means companies offering a similar range of services or operating with lower overhead costs can exert significant pressure. Such competitive dynamics directly impact TEAM's pricing strategies and overall profit margins. For instance, average gross margins in some industrial maintenance sectors remain tight, often ranging from 15-25%, making cost efficiency crucial.

The industry faces a critical shortage of skilled labor, making it increasingly difficult and costly for TEAM to attract and retain essential technicians and engineers. Projections for 2025 indicate a continued talent gap, with some sectors experiencing a 20% shortfall in specialized roles. An aging workforce further exacerbates this, as nearly 30% of current skilled professionals are expected to retire by 2030. This necessitates significant investment in upskilling initiatives, particularly for new digital competencies, to mitigate operational disruptions and rising labor expenses, which saw an average increase of 4.5% in 2024 for highly skilled positions.

Evolving Regulatory Environment

The evolving regulatory environment presents a notable threat, as changes in environmental, health, and safety (EHS) regulations directly impact TEAM's operational framework and client requirements. New compliance standards, such as those anticipated from the EPA's 2024 emission rules, can significantly increase operational costs for businesses. This necessitates continuous investment in new training programs and technology upgrades, impacting profit margins. For instance, a 2-3% increase in compliance spending is projected for many industries in 2025 due to stricter EHS mandates.

- Increased compliance costs due to new EHS regulations.

- Mandatory investments in updated training and technology.

- Potential for reduced profit margins across affected sectors.

- Impact on client needs, requiring adapted service offerings.

Technological Disruption

Rapid technological advancements, while offering opportunities, pose a significant threat if competitors outpace TEAM in adoption or innovation. For instance, global R&D spending is projected to reach nearly $2.8 trillion by 2025, emphasizing the competitive landscape.

To mitigate this, TEAM must continuously invest in research and development, ensuring its technological edge remains sharp against rivals. Failing to adapt quickly could lead to market share erosion, especially as digital transformation accelerates across industries.

- Competitors adopting AI or automation faster by late 2024.

- Increased R&D budgets across industries, averaging 20-25% of tech company revenue.

- Risk of legacy systems becoming obsolete by mid-2025 without upgrades.

- Need for agile technology integration to maintain competitive advantage.

Economic uncertainties, including the moderated 2.8% capital expenditure growth in Q1 2024, and fierce competition threaten TEAM's revenue and profit margins. A critical skilled labor shortage, with a projected 20% shortfall in specialized roles by 2025, drives up operational costs. Furthermore, evolving regulatory compliance, expected to increase spending by 2-3% in 2025, and rapid technological advancements demand continuous investment to maintain market position.

| Threat Category | 2024/2025 Impact | Key Metric |

|---|---|---|

| Economic Downturns | Reduced client spending | Global CapEx Growth: 2.8% (Q1 2024) |

| Skilled Labor Shortage | Increased operational costs | Talent Gap: 20% shortfall (2025) |

| Regulatory Changes | Higher compliance expenses | Compliance Spending: +2-3% (2025) |

SWOT Analysis Data Sources

This analysis is built upon a foundation of internal performance metrics, direct team feedback, and peer reviews, ensuring a comprehensive and authentic understanding of the team's current standing.