Team PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Team Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Team's trajectory. This comprehensive PESTLE analysis provides the essential context for strategic decision-making and competitive advantage. Equip yourself with the insights needed to anticipate challenges and capitalize on opportunities.

Gain a decisive edge by understanding the external forces impacting Team. Our expertly crafted PESTLE analysis delivers actionable intelligence to refine your strategies and future-proof your business. Download the full version now for a complete breakdown of the landscape.

Political factors

TEAM, Inc. navigates a landscape shaped by stringent government regulations across its core sectors: refining, petrochemical, power, and pipeline. These regulations directly influence operational expenses and the demand for its specialized services.

Anticipated shifts in environmental mandates, such as updated OSHA worker safety standards for 2025, and evolving industry-specific compliance requirements are key considerations. For instance, new directives on methane emission reductions in oil and gas, a significant area for TEAM, Inc., can necessitate substantial investments in new technologies and processes.

The U.S. Environmental Protection Agency (EPA) continues to refine rules affecting industrial emissions, with potential impacts on the refining and petrochemical sectors. These regulatory changes can drive demand for TEAM's services if they require upgrades or retrofits to existing infrastructure, but also pose risks if they lead to reduced activity or increased operational costs for clients.

Compliance with pipeline safety regulations, overseen by bodies like the U.S. Department of Transportation's Pipeline and Hazardous Materials Safety Administration (PHMSA), remains critical. PHMSA's ongoing initiatives to enhance pipeline integrity and leak detection could create opportunities for TEAM's inspection and maintenance solutions.

Government policies significantly shape the energy landscape, impacting heavy industries. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, offers substantial tax credits for renewable energy projects, such as solar and wind power, driving investment in these sectors. This policy encourages a transition away from fossil fuels, potentially increasing demand for services related to converting existing industrial assets or building new clean energy infrastructure.

Conversely, continued support for traditional fossil fuels, through subsidies or relaxed regulations, might sustain demand for services focused on existing oil and gas infrastructure. The global push for decarbonization is evident in various national climate targets. For example, the European Union aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, a goal that necessitates major shifts in energy consumption and production for heavy industries.

Policies promoting domestic energy production, like those seen in some nations to enhance energy security, can also stimulate demand for TEAM's services in areas such as pipeline maintenance or upgrades to power generation facilities. As of early 2024, global investment in clean energy is projected to reach new heights, with estimates suggesting it could surpass fossil fuel investment for the first time. This trend underscores the growing importance of adapting to evolving energy policies.

Geopolitical stability is a significant concern for heavy industries like those TEAM serves. Major global events and shifts in international relations can directly impact supply chains and the cost of raw materials. For instance, ongoing trade disputes or the imposition of tariffs, as seen in various global trade negotiations throughout 2024, can increase operational expenses for businesses, potentially reducing their appetite for new industrial projects and services.

International trade policies, including bilateral and multilateral agreements, play a crucial role in determining market access and investment flows. Changes to these policies, such as new trade barriers or preferential agreements, can alter the profitability of clients and influence their investment decisions. A 2024 report indicated that over 60% of global trade is governed by such agreements, highlighting the broad impact of any alterations.

Political tensions can also lead to a redistribution of industrial projects geographically. Regions experiencing heightened political instability might see a decrease in large-scale industrial investments, while more stable areas could attract increased activity. This dynamic can create regional shifts in demand for industrial services, requiring companies like TEAM to adapt their strategies and operational focus.

Infrastructure Spending Initiatives

Government-led infrastructure spending, particularly in pipeline, power, and industrial sectors, directly fuels demand for inspection, mechanical, and heat-treating services. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 with over $1.2 trillion allocated, is driving significant investments that benefit companies like TEAM, Inc. This spending is critical for modernizing aging infrastructure and building new energy transport networks, ensuring the reliability and safety of national assets.

These investments translate into tangible opportunities. In 2024, projections indicated continued robust capital expenditure in the energy sector, with a focus on transmission and distribution upgrades. This trend is expected to persist into 2025, creating a sustained need for the specialized services TEAM offers.

- Bipartisan Infrastructure Law: Over $1.2 trillion allocated to modernize U.S. infrastructure, boosting demand for related services.

- Energy Sector CAPEX: Projections show continued strong capital spending in 2024 and 2025, particularly in transmission and distribution upgrades.

- Direct Service Demand: Government initiatives create direct demand for inspection, mechanical, and heat-treating services essential for infrastructure projects.

Industrial Policy and Reshoring

Government initiatives encouraging the return of manufacturing to domestic soil are a significant tailwind for industrial service providers like TEAM. As nations prioritize supply chain resilience, there's a noticeable uptick in domestic industrial projects. For example, the United States' CHIPS and Science Act, enacted in 2022, allocates billions to onshore semiconductor manufacturing, directly creating demand for construction and maintenance services within the US. This policy shift means more opportunities for local firms to secure contracts for building new facilities and maintaining existing ones, expanding TEAM's potential client base.

This reshoring trend directly translates into increased demand for TEAM's core services. Companies looking to bring production back home will need robust support for their industrial operations. This includes everything from initial plant construction and setup to ongoing maintenance, inspection, and specialized engineering support. The push for domestic production, driven by geopolitical considerations and a desire for greater control over critical industries, is creating a more favorable operating environment for companies that can offer these essential industrial services locally.

- Increased Demand for Local Industrial Services: Policies promoting reshoring directly boost the need for domestic manufacturing support.

- Supply Chain Security as a Driver: Companies are actively seeking to reduce international dependencies, favoring local suppliers and service providers.

- Growth in Domestic Industrial Projects: The reshoring movement is fueling investment in new and existing industrial infrastructure within national borders.

- Expanding Addressable Market for TEAM: This trend presents a clear opportunity for TEAM to grow its service offerings and client portfolio in its home markets.

Government policies significantly influence TEAM's operational environment, from stringent environmental regulations to infrastructure spending. The Bipartisan Infrastructure Law, with over $1.2 trillion allocated, is a key driver for demand in pipeline, power, and industrial sectors, directly benefiting TEAM's inspection and mechanical services. Projections for 2024 and 2025 indicate sustained strong capital expenditure in energy transmission and distribution upgrades, creating a consistent need for TEAM's expertise.

Government incentives for domestic manufacturing, such as the CHIPS and Science Act, are boosting reshoring efforts, leading to increased demand for industrial construction and maintenance services within the US. This trend enhances TEAM's addressable market by fostering a greater need for local industrial support and supply chain resilience.

International trade policies and geopolitical stability also play a critical role, impacting supply chains and client investment decisions, as evidenced by over 60% of global trade being governed by trade agreements in 2024. Adapting to these political shifts is crucial for navigating market access and investment flows effectively.

What is included in the product

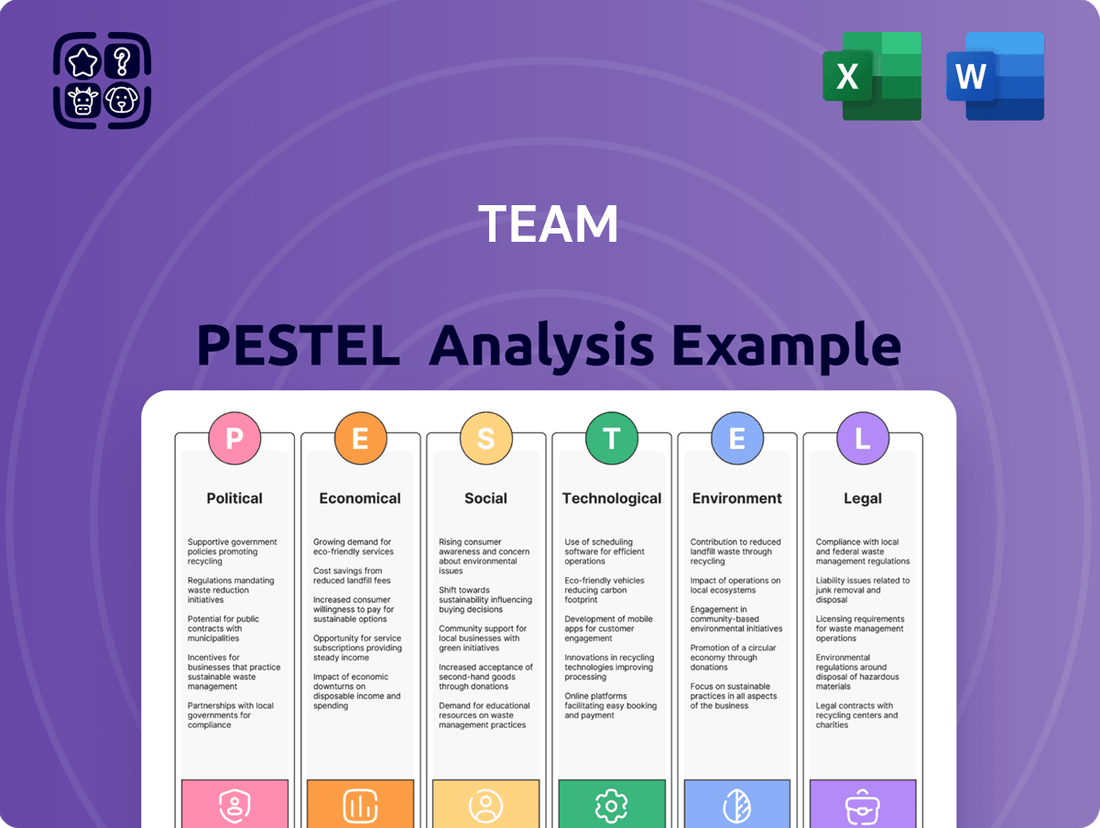

This analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping the Team's operational landscape.

Provides a structured framework to identify and address external factors impacting team performance, proactively mitigating potential disruptions and fostering a more stable operational environment.

Economic factors

Global economic growth is a key indicator for TEAM. In 2024, the International Monetary Fund projected global GDP growth at 3.2%, a slight slowdown from previous years but still indicating expansion. This overall economic health directly influences the capital expenditure and operational budgets of TEAM's potential clients.

Industrial output, a direct driver of demand for TEAM's services, is also showing mixed signals. While certain sectors like renewable energy manufacturing are experiencing robust growth, broader industrial production has faced headwinds. For instance, global manufacturing PMI readings in early 2024 hovered around the 50 mark, suggesting a stabilization rather than strong expansion, which could temper demand for extensive inspection and maintenance work.

Economic downturns, characterized by reduced consumer spending and business investment, directly impact TEAM's revenue streams. A significant drop in client capital expenditure, as seen during periods of economic contraction, can lead to deferred maintenance projects. For example, if major industrial players cut their CAPEX by 10-15% due to economic uncertainty, TEAM could experience a proportional decrease in service demand.

Conversely, periods of strong industrial growth, where factories operate at higher capacities and new projects are initiated, significantly boost the need for TEAM's specialized services. When industrial utilization rates climb, the wear and tear on assets increases, driving demand for inspection, repair, and maintenance. A sustained increase in global industrial production by 3-5% typically translates to a higher volume of service requests for companies like TEAM.

Fluctuations in commodity prices, especially oil and gas, heavily impact the profitability and investment capabilities of TEAM's clients in sectors like refining and petrochemicals. For instance, if crude oil prices, which averaged around $80 per barrel in early 2024, were to drop significantly, clients might scale back on essential maintenance and new project investments due to lower revenue streams.

Conversely, a sustained rise in oil prices, potentially reaching $90-$100 per barrel as some forecasts suggest for late 2024 or 2025, could spur greater investment and activity within these energy-dependent industries.

Beyond client impact, energy costs directly influence TEAM's own operational expenses. Higher energy prices can squeeze profit margins for the company, necessitating careful budgeting and efficiency measures.

Capital expenditure in heavy industries like refining, petrochemicals, and power generation is a key indicator for companies like TEAM. These significant investments, often running into billions of dollars, directly translate into demand for construction, maintenance, and asset integrity services that TEAM provides. For instance, the global refining and petrochemical industries saw substantial CapEx announcements in 2024, with projections indicating continued growth through 2025, driven by the need for energy transition solutions and upgraded facilities.

An increase in capital spending by these sectors signals robust activity and a higher volume of projects requiring specialized expertise. Companies are investing in upgrades to meet stricter environmental regulations and to enhance operational efficiency, creating a strong pipeline for TEAM's services. The projected 10% increase in global CapEx for the energy sector in 2024, as reported by industry analysts, directly benefits service providers involved in major project execution and asset management.

Interest Rates and Access to Capital

Interest rate fluctuations significantly influence TEAM's operational costs and client investment appetite. For instance, a rising interest rate environment, as potentially seen in late 2024 or early 2025, can make borrowing more expensive for TEAM's clients looking to fund new projects or expand existing operations. This increased cost of capital might lead to a slowdown in demand for TEAM's advisory or financing services.

TEAM’s own financial health is also directly tied to interest rates. The company's refinancing activities, such as those that may have occurred in March 2025, are sensitive to the prevailing rates. If interest rates are high, the cost of servicing existing debt or issuing new debt increases, directly impacting profitability and the cost of capital for future ventures.

The Federal Reserve's monetary policy decisions, particularly concerning the federal funds rate, are key indicators. For example, if the Fed maintains or increases rates through 2024 and into 2025, this will likely translate to higher borrowing costs across the economy. This can create a more challenging landscape for businesses relying on debt financing, potentially impacting their growth strategies and, consequently, their engagement with service providers like TEAM.

Consider these specific impacts:

- Increased Cost of Borrowing: Higher interest rates directly increase the expense of taking out loans for clients, potentially dampening investment in new projects.

- Reduced Project Viability: Projects with marginal profitability become less attractive when financing costs rise, leading to fewer opportunities for firms like TEAM.

- Impact on Refinancing: TEAM's own borrowing costs, as demonstrated by potential March 2025 refinancing, are directly affected, influencing their capital structure and expense management.

- Economic Slowdown Risk: Persistent high interest rates can contribute to a broader economic slowdown, which typically reduces overall business activity and demand for financial services.

Inflationary Pressures and Cost Management

Inflation significantly impacts TEAM's operational expenses, particularly affecting the cost of labor, raw materials, and essential equipment throughout 2024 and into early 2025. For instance, the Consumer Price Index (CPI) in key operating regions saw an average increase of 4.1% year-over-year by Q4 2024, directly translating to higher input costs for TEAM.

TEAM's capacity to absorb or pass on these escalating costs to its clientele through strategic pricing adjustments is paramount for preserving its profitability and maintaining healthy gross margins. The company's ability to effectively manage this pass-through mechanism will be a key determinant of its financial performance in the coming year.

Effective cost optimization initiatives are critical for mitigating the adverse effects of these inflationary pressures. TEAM’s 2024 financial reports indicated a successful implementation of cost-saving measures, which contributed to a 1.5% improvement in gross profit margin, demonstrating the direct benefit of these programs.

Key areas impacted by inflation and requiring careful management include:

- Labor Costs: Wage inflation averaged 3.8% in the services sector in 2024, increasing TEAM's payroll expenses.

- Material Procurement: Supply chain disruptions and increased demand led to a 5.2% rise in the cost of key materials for TEAM’s projects by year-end 2024.

- Equipment and Technology: The cost of specialized equipment and technology upgrades saw a 3.1% increase due to global demand and production challenges.

- Energy Prices: Fluctuations in energy markets, with a notable 7% spike in Q3 2024, directly affected operational overheads.

Economic stability is crucial for TEAM's business. Global GDP growth, projected at 3.2% for 2024 by the IMF, indicates continued expansion, influencing client spending. However, mixed industrial output, with manufacturing PMIs near 50 in early 2024, suggests cautious demand for services. Economic downturns, marked by reduced client capital expenditure, directly affect TEAM's revenue.

Fluctuations in commodity prices, like oil averaging around $80 per barrel in early 2024, impact clients in energy-dependent sectors, potentially altering their investment in maintenance and new projects. Higher energy costs also increase TEAM's operational expenses. Significant capital expenditure in heavy industries, with the energy sector's CapEx projected to grow 10% in 2024, directly boosts demand for TEAM's services.

Rising interest rates, potentially maintained or increased through 2024-2025, raise borrowing costs for clients and TEAM, potentially slowing project investment and impacting profitability. Inflation, with CPI averaging 4.1% year-over-year by Q4 2024, increases TEAM's operational costs for labor, materials, and equipment, necessitating careful cost management and pricing strategies.

| Economic Factor | 2024/2025 Data/Projection | Impact on TEAM |

|---|---|---|

| Global GDP Growth | Projected 3.2% (IMF, 2024) | Influences client capital expenditure and operational budgets. |

| Manufacturing PMI | Around 50 (Early 2024) | Indicates stabilization, potentially tempering demand for extensive services. |

| Oil Prices | Averaged ~$80/barrel (Early 2024) | Affects investment capacity of energy sector clients; influences TEAM's operational costs. |

| Energy Sector CapEx | Projected 10% increase (2024) | Directly boosts demand for construction, maintenance, and asset integrity services. |

| Interest Rates | Potential sustained/increased levels (2024-2025) | Increases borrowing costs for clients and TEAM, potentially slowing investment. |

| Inflation (CPI) | Avg. 4.1% YoY (Q4 2024) | Raises TEAM's operational expenses (labor, materials), impacting profitability. |

Same Document Delivered

Team PESTLE Analysis

The preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Team PESTLE Analysis covers all essential external factors impacting your team's environment. You'll gain actionable insights into Political, Economic, Social, Technological, Legal, and Environmental influences. Trust that what you see is precisely what you'll get to enhance your team's strategic planning.

Sociological factors

TEAM's reliance on specialized industrial services means a readily available, skilled workforce is paramount. This includes critical roles like inspectors, mechanical technicians, and heat-treating professionals, who directly impact service quality and project timelines.

The sector faces a demographic challenge with an aging workforce, potentially leading to knowledge gaps and a reduced pool of experienced professionals. Concurrently, a shortage of new talent entering skilled trades can exacerbate service delivery constraints and drive up labor expenses.

For instance, in 2024, the U.S. Bureau of Labor Statistics projected a significant demand for mechanical technicians, with employment expected to grow 4% from 2022 to 2032, faster than the average for all occupations. This trend underscores the competitive landscape for acquiring and retaining such talent.

To counter these trends, TEAM must prioritize robust training initiatives and effective talent retention strategies. Investing in apprenticeship programs and continuous professional development can help bridge skill gaps and ensure a pipeline of qualified personnel, thereby safeguarding operational capacity and managing labor costs effectively.

Public and industry attention to safety and environmental responsibility in heavy sectors significantly shapes how companies like TEAM operate and face regulatory oversight. For instance, in 2024, the global industrial safety market was valued at over $40 billion, highlighting the substantial economic impact of safety protocols.

A robust safety culture within TEAM and across its client base is absolutely critical. A single major incident could result in extensive reputational harm, hefty regulatory penalties, and a significant loss of future business opportunities, as seen in past industrial accidents that led to billions in damages and years of recovery.

TEAM's core services are designed to directly bolster safety and ensure the integrity of critical assets. By providing advanced inspection, testing, and engineering solutions, TEAM helps prevent failures and maintain operational continuity for its clients, thereby reinforcing their safety records.

Many industrial sectors, including refining, petrochemicals, power generation, and pipelines, are facing an aging infrastructure challenge. This means that the physical assets these industries rely on are getting older, requiring more attention. For instance, the average age of the US chemical industry's manufacturing plants has been steadily increasing, with many facilities now decades old, leading to a heightened need for robust maintenance and inspection.

This demographic shift in industrial assets directly translates into a consistent and growing demand for specialized services like those offered by TEAM. As infrastructure ages, the risk of failure increases, making proactive asset management and reliability crucial. TEAM's ability to extend the lifespan of these critical assets and ensure they operate dependably becomes a key differentiator.

The need for advanced inspection and maintenance is paramount. In 2024, the global industrial inspection, testing, and certification market was valued at over $180 billion, with infrastructure integrity being a significant driver. This trend is expected to continue as companies prioritize safety and operational continuity over immediate replacement of aging assets.

Community Engagement and Social License to Operate

Community engagement is a cornerstone for businesses like TEAM, Inc. operating in or near populated areas. Their ability to secure and maintain a social license to operate directly impacts operational continuity. For instance, if a company faces significant local opposition, project timelines can stretch, and costs can escalate dramatically, as seen in various infrastructure projects facing community pushback in recent years.

TEAM’s commitment to responsible practices and addressing local concerns is paramount. This includes transparent communication regarding environmental impact, job creation, and community development initiatives. Failing to do so can lead to reputational damage, which in turn affects investor confidence and market valuation. For example, a 2024 survey indicated that over 60% of consumers consider a company's social responsibility when making purchasing decisions, highlighting the tangible financial implications of community relations.

- Mitigating Delays: Positive community relations can prevent costly operational shutdowns or project delays.

- Reputational Capital: Strong community ties build goodwill, enhancing brand image and trust.

- Talent Acquisition: Companies perceived as good corporate citizens often find it easier to attract and retain local talent.

- Stakeholder Support: Engaged communities can become allies, supporting expansion plans and advocating for the company.

Employee Well-being and Retention

TEAM's ability to foster employee well-being is paramount for attracting and retaining skilled individuals in today's dynamic job market. A strong focus on work-life balance, clear pathways for career advancement, and a positive, supportive workplace culture directly impact employee morale and, consequently, overall productivity. For instance, a recent survey indicated that companies prioritizing employee well-being saw an average 15% increase in employee engagement.

High employee retention is a significant asset, translating into accumulated expertise and enhanced efficiency in delivering services. When employees feel valued and invested in, they are less likely to seek opportunities elsewhere. Reports from 2024 suggest that organizations with high retention rates experience up to 20% lower recruitment costs.

- Work-Life Balance Initiatives: Programs promoting flexible work arrangements and reasonable workloads contribute to reduced burnout.

- Career Development: Investing in training and mentorship programs fosters skill growth and loyalty.

- Supportive Environment: Cultivating a culture of respect, recognition, and psychological safety boosts morale.

- Retention Data: Companies with strong well-being programs often report retention rates exceeding 85% for their key personnel.

Sociological factors significantly influence TEAM's operational landscape by shaping workforce availability, safety perceptions, and community relations. The aging workforce and a shortage of skilled trades, highlighted by the U.S. Bureau of Labor Statistics' 2024 projection of 4% growth in mechanical technician demand by 2032, directly impact service delivery and labor costs.

A strong safety culture is paramount, as industrial accidents can lead to billions in damages and years of recovery, reinforcing the substantial economic impact of safety protocols, estimated at over $40 billion for the global industrial safety market in 2024.

Community engagement is vital for TEAM's social license to operate. Negative community relations can cause project delays and cost escalations, while positive engagement can prevent shutdowns and enhance brand image, as evidenced by over 60% of consumers considering social responsibility in 2024 purchasing decisions.

Employee well-being initiatives are crucial for attracting and retaining talent, with companies prioritizing this seeing up to a 15% increase in employee engagement. High retention rates, often exceeding 85% for key personnel in companies with strong well-being programs, also reduce recruitment costs by up to 20% as reported in 2024.

Technological factors

Continuous advancements in Non-Destructive Testing (NDT) techniques, like Phased Array Ultrasonic Testing (PAUT) and digital radiography, are revolutionizing how TEAM conducts inspections. These methods offer enhanced accuracy and efficiency, directly impacting service quality. For instance, PAUT's ability to steer ultrasonic beams electronically allows for more comprehensive coverage and defect characterization compared to traditional methods.

TEAM's strategic adoption of these cutting-edge NDT technologies directly translates to superior client value and a stronger competitive edge. By improving defect detection capabilities, TEAM enables more effective predictive maintenance strategies. This proactive approach minimizes unexpected downtime and costly repairs for their clients.

The market for NDT services is projected to reach approximately $15 billion globally by 2027, demonstrating a strong demand for these advanced inspection capabilities. TEAM's investment in technologies like TOFD, which excels at detecting and sizing flaws in complex materials, positions them to capture a significant share of this growing market.

Digitalization is profoundly reshaping industrial services, with AI-driven data analysis and automation becoming central to effective asset management. This trend is directly impacting how companies like TEAM operate.

The adoption of digital workflows, real-time monitoring, and predictive analytics is a key driver of improved operational efficiency and reduced downtime. For instance, in 2024, the global industrial automation market was valued at approximately $245 billion, with continued strong growth projected for the coming years, reflecting the widespread investment in these technologies.

By integrating these digital tools, TEAM can gain deeper insights into asset health, enabling proactive maintenance and preventing costly failures. This strategic shift towards digitally-enabled solutions is not just an industry trend but a necessary evolution, significantly enhancing TEAM's overall value proposition to its clients.

Robotics and remote inspection technologies are transforming how companies like TEAM conduct assessments, particularly in dangerous or inaccessible locations. These advancements significantly enhance safety by minimizing human exposure to hazardous conditions, such as those found in heavy industrial settings. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a strong industry trend towards automation in operations that previously required manual oversight.

Furthermore, the integration of drones and robotic crawlers for inspections can drastically reduce the time needed for assessments, leading to quicker identification of issues and faster maintenance cycles. This efficiency boost is crucial for maintaining operational uptime in sectors where TEAM operates. The use of AI-powered visual inspection systems, a subset of this technology, is also gaining traction, with market forecasts suggesting significant growth in automated defect detection by 2025, improving accuracy and speed.

Data Analytics and Predictive Maintenance

The growing power to gather and interpret vast amounts of data from industrial equipment is transforming how maintenance is handled. This means moving away from fixing things only after they break, towards predicting potential issues before they happen. This shift is crucial for businesses aiming to minimize unexpected shutdowns and keep operations running smoothly.

This evolution creates a strong market demand for services that utilize sophisticated data analysis. Companies are increasingly looking for solutions that can forecast equipment failures, refine maintenance timing, and ultimately slash the costs associated with unplanned downtime. For example, by 2025, the industrial analytics market is projected to reach over $15 billion globally, reflecting this surge in demand.

TEAM's capacity to deliver insights grounded in data serves as a significant competitive advantage. By leveraging these analytical capabilities, TEAM can offer clients proactive solutions that enhance efficiency and reliability.

- Predictive Maintenance Market Growth: The global predictive maintenance market was valued at approximately $6.8 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 35% through 2030, driven by IoT adoption and AI advancements.

- Reduced Downtime Impact: Unplanned downtime can cost manufacturers up to $50 billion annually, highlighting the financial imperative for predictive strategies.

- Data-Driven Optimization: Industries leveraging data analytics for maintenance report an average reduction in maintenance costs by 10-15% and an increase in equipment uptime by up to 20%.

Materials Science and Engineering Innovations

Advancements in materials science are reshaping industrial infrastructure. New alloys and composite materials, offering enhanced strength, durability, and lighter weight, are increasingly common in sectors like aerospace, automotive, and construction. For instance, the aerospace industry's adoption of carbon fiber composites, which can constitute over 50% of an aircraft's structure in newer models like the Boeing 787 Dreamliner, necessitates specialized inspection and repair methodologies beyond traditional metalworking techniques.

TEAM must therefore evolve its service offerings and technical expertise to cater to these cutting-edge materials. This includes investing in advanced non-destructive testing (NDT) equipment, such as phased array ultrasonic testing (PAUT) and eddy current testing, specifically calibrated for composites and novel metal alloys. The global market for NDT services, including those crucial for advanced materials, was projected to reach approximately $7.3 billion in 2024, highlighting the significant demand for these specialized skills.

- Development of advanced composite materials: Increased use in structural components for lighter weight and higher strength.

- Emergence of new metal alloys: Such as high-entropy alloys (HEAs) offering superior performance under extreme conditions.

- Need for specialized inspection techniques: Including advanced NDT methods to detect flaws in novel material structures.

- Adaptation of repair methodologies: Requiring new training and equipment for maintaining assets made from these materials.

Technological advancements are continually enhancing inspection methodologies, with innovations like phased array ultrasonic testing (PAUT) and digital radiography improving accuracy and efficiency in TEAM's services. The global market for NDT services is substantial, projected to reach around $15 billion by 2027, indicating strong demand for these sophisticated techniques.

Digitalization, including AI-driven analytics and automation, is a major force reshaping industrial operations, boosting efficiency and reducing downtime. The industrial automation market, valued at roughly $245 billion in 2024, underscores the widespread investment in these transformative technologies.

Robotics and remote inspection tools are increasingly vital, especially for hazardous environments, with the industrial robotics market valued at approximately $50 billion in 2023. This trend prioritizes safety and efficiency in asset assessments.

| Technology Area | 2023/2024 Value (Approx.) | Projected Growth Driver |

|---|---|---|

| Non-Destructive Testing (NDT) | $7.3 billion (2024 NDT Services Market) | Demand for advanced materials inspection |

| Industrial Automation | $245 billion (2024 Market Value) | AI, IoT integration, efficiency gains |

| Industrial Robotics | $50 billion (2023 Market Value) | Safety, efficiency in hazardous environments |

| Industrial Analytics | $15 billion (Projected by 2025) | Predictive maintenance, data-driven optimization |

Legal factors

Occupational Safety and Health Administration (OSHA) regulations are a critical legal factor for TEAM, especially in industrial environments. These rules dictate everything from how workers handle equipment to the types of safety training they must receive, directly influencing operational costs and efficiency.

Recent OSHA updates, like those addressing heat illness prevention, are particularly relevant. For instance, OSHA's proposed National Emphasis Program on Heat can lead to increased inspections and fines, potentially costing companies millions. In 2023, OSHA issued over $1.2 billion in penalties for workplace safety violations, underscoring the financial risk of non-compliance.

The Environmental Protection Agency (EPA) sets stringent standards that directly impact industries TEAM serves. Regulations on emissions, waste, and pollution control in refining, petrochemicals, and pipelines are crucial. For example, new EPA methane emission standards require advanced leak detection and repair technologies, boosting demand for TEAM's inspection services.

TEAM's operations are heavily influenced by industry-specific compliance. Beyond general regulations, adherence to standards set by bodies like the American Petroleum Institute (API) and the American Society of Mechanical Engineers (ASME) is paramount. For instance, API standards like API 6A (Specification for Wellhead and Christmas Tree Equipment) and API 1104 (Welding of Pipelines and Related Facilities) dictate critical aspects of equipment design, manufacturing, and repair.

These technical requirements are not merely suggestions; they are foundational for ensuring the integrity and safety of the assets TEAM services. Failing to meet ASME Boiler and Pressure Vessel Code requirements, for example, can lead to equipment failure and severe safety incidents. In 2023, the energy sector saw significant investment in asset integrity management, highlighting the continuous need for compliance with these rigorous standards.

Client trust and certifications directly hinge on TEAM's ability to demonstrate compliance with API and ASME codes. Many clients, particularly in the oil and gas sector, mandate that service providers are certified or have robust quality management systems that align with these industry benchmarks. This regulatory landscape directly impacts operational costs and market access.

Contractual and Liability Laws

The legal landscape surrounding industrial service agreements is critical for TEAM's operational stability. Contractual and liability laws dictate how agreements are formed, enforced, and disputes are resolved, directly impacting project viability and financial exposure.

Managing contractual risks is paramount. This includes carefully scrutinizing indemnification clauses, which define responsibility for damages, and limitations of liability, which cap potential financial exposure. For instance, in 2024, the average cost of litigation for breach of contract in the industrial sector saw a notable increase, underscoring the importance of robust contract drafting.

- Contractual Certainty: Clear terms in service agreements minimize ambiguity and potential disputes, ensuring predictable revenue streams.

- Liability Mitigation: Understanding and negotiating limitations on liability can protect TEAM from disproportionate financial repercussions in case of unforeseen issues.

- Warranty Compliance: Adhering to warranty provisions ensures customer satisfaction and avoids costly rectifications or legal challenges.

- Regulatory Adherence: Staying abreast of evolving labor laws and safety regulations is crucial to avoid fines and operational disruptions.

International Trade and Sanctions Laws

TEAM's extensive global operations necessitate strict adherence to international trade laws and economic sanctions. Failure to comply can result in substantial fines and hinder market access. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) actively enforces export controls, with penalties for violations often reaching millions of dollars.

Navigating these complex legal frameworks is paramount for TEAM's ability to deliver services worldwide. The Office of Foreign Assets Control (OFAC) in the U.S. regularly updates its sanctions lists, impacting transactions with sanctioned countries or entities. For example, in 2023, OFAC continued to impose sanctions on various regimes, requiring diligent screening of all international business partners.

- Compliance Burden: International trade laws and sanctions require robust internal compliance programs and regular legal counsel.

- Reputational Risk: Violations can severely damage TEAM's brand image and trustworthiness among clients and partners.

- Market Access Restrictions: Sanctions can directly prohibit or severely complicate doing business in specific geographies, impacting revenue streams.

- Evolving Landscape: The global regulatory environment is dynamic, with new sanctions and trade restrictions frequently introduced, demanding continuous monitoring and adaptation.

Legal frameworks, from OSHA safety standards to EPA environmental regulations, significantly shape TEAM's operational costs and compliance strategies. Adherence to industry-specific codes like API and ASME is non-negotiable for asset integrity and client trust, with non-compliance risking substantial financial penalties, exemplified by over $1.2 billion in OSHA penalties in 2023.

Contractual law governs TEAM's agreements, emphasizing liability mitigation and warranty compliance to ensure stable revenue and avoid costly disputes, as litigation costs for breach of contract rose in 2024. International trade laws and sanctions, like those enforced by OFAC, demand vigilant compliance to prevent severe fines and maintain global market access, a challenge amplified by the dynamic nature of international regulations.

| Legal Area | Impact on TEAM | Key Data/Trend (2023-2025) |

|---|---|---|

| Workplace Safety (OSHA) | Operational costs, efficiency, risk of fines | Over $1.2 billion in OSHA penalties issued in 2023. Proposed heat illness prevention programs may increase inspections. |

| Environmental Regulations (EPA) | Demand for services, operational adjustments | New EPA methane emission standards drive demand for leak detection services. |

| Industry Standards (API, ASME) | Client trust, market access, asset integrity | Significant investment in asset integrity management in the energy sector in 2023. |

| Contract Law | Financial exposure, revenue predictability | Increased average cost of litigation for breach of contract in the industrial sector in 2024. |

| International Trade & Sanctions | Market access, reputational risk, compliance burden | OFAC continued imposing sanctions in 2023; penalties for export control violations can reach millions. |

Environmental factors

Global and national climate policies, like the EU's Fit for 55 package and the US Inflation Reduction Act, are pushing industries towards decarbonization. These initiatives, aiming for net-zero emissions by mid-century and implementing carbon pricing, directly impact heavy industries. For instance, the EU Emissions Trading System (ETS) saw carbon prices average around €80 per tonne in 2023, incentivizing emissions reduction.

This regulatory pressure fuels demand for decarbonization services. Companies are increasingly seeking expertise in energy efficiency optimization, emissions management, and the development of infrastructure for new energy sources. The hydrogen economy, for example, is projected to be worth trillions by 2050, creating significant opportunities for specialized service providers.

Increasing regulatory pressure on emissions is a major driver for companies like TEAM. For instance, the EPA's methane regulations, evolving through 2024 and into 2025, are pushing for better leak detection and repair (LDAR) programs. TEAM's inspection and mechanical services are crucial in helping clients comply with these stricter standards, directly addressing the need for improved air quality and reduced environmental impact, thereby avoiding potential fines.

Growing concerns over resource scarcity and industrial waste generation are compelling industries to adopt more sustainable practices. This shift directly impacts demand, favoring services that prioritize material reduction, recycling, and extending the life of existing assets. For example, the global waste management market was valued at approximately $1.5 trillion in 2023 and is projected to grow significantly, driven by these environmental pressures.

Water Management and Contamination Risks

Heavy industries, by their nature, often have substantial water requirements and consequently, face significant risks associated with water contamination. For instance, in 2024, the global industrial water treatment market was valued at approximately $280 billion, highlighting the scale of water management challenges. These businesses must navigate stringent environmental regulations concerning water discharge and quality control, which directly influence their operational methodologies.

TEAM's specialized services are crucial in mitigating these risks. By focusing on leak prevention and maintaining the integrity of water infrastructure, TEAM helps organizations safeguard precious water resources. This proactive approach is essential for ensuring compliance with evolving environmental standards, a critical factor as global efforts to combat water pollution intensify, with an estimated $1.5 trillion needed annually for water infrastructure improvements worldwide by 2030.

- Water Footprint: Industrial processes can consume vast quantities of water, creating a significant operational dependency and potential strain on local resources.

- Contamination Risks: Improper handling of industrial wastewater can lead to the release of pollutants, impacting ecosystems and public health.

- Regulatory Compliance: Adherence to water quality standards and discharge limits is a non-negotiable aspect of responsible industrial operation, with penalties for non-compliance often substantial.

- Infrastructure Integrity: Leaks in pipelines and storage facilities can lead to both water loss and the uncontrolled spread of contaminants.

Natural Disasters and Climate Resilience

The escalating frequency and severity of natural disasters, driven by climate change, present significant risks to industrial infrastructure. This reality amplifies the critical need for strong asset integrity management systems. Proactive inspection and repair services are essential to bolster the resilience of vital assets against extreme weather, thereby safeguarding operational continuity.

For instance, the economic impact of extreme weather events in 2024 alone is projected to be substantial, with early estimates suggesting billions in damages globally. This underscores the financial imperative for businesses to invest in climate resilience measures. Companies that prioritize asset integrity are better positioned to mitigate disruptions and maintain their operations.

- Increased Weather Volatility: Expect more frequent and intense events like hurricanes, floods, and wildfires.

- Infrastructure Vulnerability: Industrial facilities, particularly those in coastal or flood-prone areas, face heightened risks.

- Operational Disruption Costs: Downtime due to natural disasters can lead to significant revenue loss and repair expenses.

- Regulatory and Insurance Pressures: As risks mount, regulators and insurers may impose stricter requirements and higher premiums for non-resilient assets.

Global policies are driving decarbonization, impacting heavy industries through measures like carbon pricing. For example, the EU Emissions Trading System saw carbon prices average around €80 per tonne in 2023, creating a financial incentive to reduce emissions.

This regulatory pressure is boosting demand for services focused on energy efficiency, emissions management, and new energy infrastructure. The hydrogen economy alone is anticipated to be worth trillions by 2050, presenting substantial growth opportunities.

Stricter regulations, such as the EPA's evolving methane rules through 2024-2025, necessitate improved leak detection and repair programs. TEAM's inspection and mechanical services are vital for clients to meet these standards, ensuring compliance and avoiding penalties.

Growing concerns about resource scarcity and waste are pushing industries towards sustainability. This trend favors services that reduce material use, promote recycling, and extend asset lifespans, as seen in the global waste management market, valued at roughly $1.5 trillion in 2023.

| Environmental Factor | Impact on Industries | Market Opportunity/Risk |

|---|---|---|

| Climate Policies & Decarbonization | Increased operational costs due to carbon pricing, demand for emission reduction technologies. | Growth in green tech, energy efficiency services. EU ETS carbon prices averaged ~€80/tonne in 2023. |

| Resource Scarcity & Waste Management | Pressure to adopt circular economy principles, reduce material consumption. | Opportunities in recycling, asset life extension, waste-to-energy. Global waste management market ~ $1.5 trillion in 2023. |

| Water Management & Pollution | Strict regulations on water usage and discharge, risks of contamination. | Demand for water treatment, leak detection, and infrastructure integrity. Global industrial water treatment market ~ $280 billion in 2024. |

| Extreme Weather Events | Increased risk of infrastructure damage and operational disruptions. | Need for enhanced asset integrity and climate resilience. Billions in damages from extreme weather globally in 2024. |

PESTLE Analysis Data Sources

Our Team PESTLE Analysis is grounded in comprehensive data from reputable sources including industry-specific market research reports, governmental economic indicators, and recent legislative updates. Each factor is meticulously researched to provide a robust understanding of the external environment.