Team Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Team Bundle

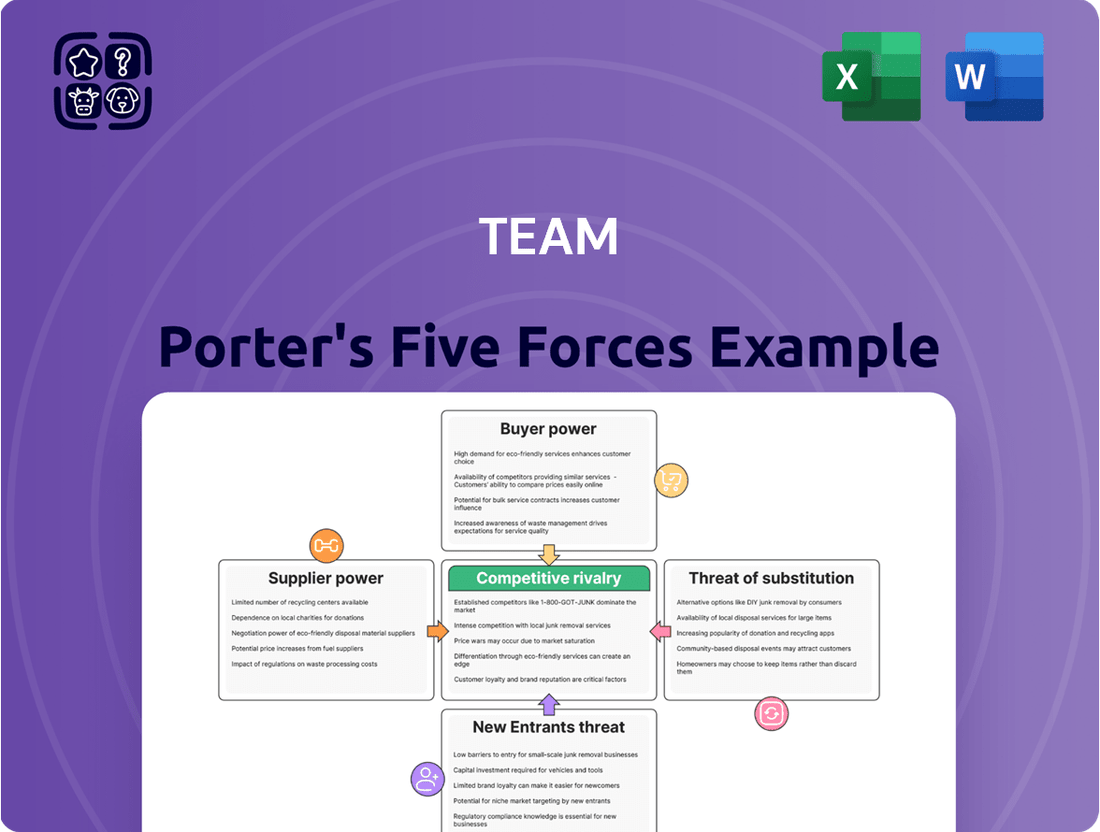

Porter's Five Forces Analysis offers a powerful lens through which to view Team's competitive landscape. It systematically examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the danger posed by substitute products. Understanding these forces is crucial for any business aiming to thrive in its market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Team’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of highly specialized inspection equipment, advanced welding technology, and unique heat-treating apparatus can wield substantial bargaining power over TEAM. This leverage stems from proprietary technology and often a limited competitive landscape for these critical operational tools. For instance, in 2024, the global market for specialized industrial equipment saw price increases averaging 5-8% due to supply chain constraints and high R&D costs for niche technologies.

Suppliers of highly skilled and certified labor, like NDT technicians, certified welders, and metallurgical engineers, hold significant bargaining power. The limited availability of this specialized expertise, coupled with demanding training and certification processes, forces TEAM to actively compete for these professionals. This competition can translate into increased wage expectations and higher recruitment expenses, directly impacting operational costs.

Suppliers of specialized chemicals and gases for heat treating can hold moderate bargaining power, particularly if these inputs are niche or face supply chain disruptions. For instance, in 2024, the global market for industrial gases, a key component in many heat treating processes, experienced price volatility due to energy costs and geopolitical factors, impacting operational expenses for companies like TEAM.

Limited alternative sources for critical raw materials can amplify supplier leverage. If TEAM relies on a few key suppliers for unique alloys or specific heat-treating atmospheres, these suppliers can command higher prices or dictate terms. The cost of certain specialty gases, for example, saw an estimated increase of 5-10% in early 2024 in some regions, directly affecting the input costs for heat-treating services.

However, for more common materials and widely available industrial gases, supplier power is generally less pronounced. TEAM likely benefits from a competitive supplier landscape for these inputs, which helps to mitigate significant cost pressures. The availability of multiple vendors for standard atmospheric gases ensures that no single supplier can exert undue influence on pricing or supply.

Software and Data Analytics Tools

Providers of specialized software for data analysis, predictive maintenance, and integrity management platforms are increasingly wielding significant bargaining power. As TEAM deepens its integration of digital solutions for inspection and assessment services, its dependence on these software vendors for essential licensing, crucial updates, and ongoing support escalates.

This growing reliance, coupled with the substantial costs associated with switching between complex, integrated systems, further strengthens the position of these software suppliers. For instance, the global market for analytics software alone was projected to reach over $30 billion in 2024, indicating the significant value and dependency businesses place on these tools.

- Increased Reliance: TEAM's expanding use of digital tools for core operations directly boosts supplier leverage.

- High Switching Costs: The expense and complexity of migrating integrated software systems lock clients in, empowering vendors.

- Specialized Solutions: Niche software providers offering critical, hard-to-replicate functionalities command greater power.

- Market Growth: The expanding market for data analytics tools underscores the strategic importance and supplier influence in this sector.

Logistics and Transportation Services

For a company like TEAM, which operates in heavy industries and often across wide geographical areas, the reliability of logistics and transportation services is absolutely critical. These suppliers are the backbone of operations, ensuring equipment and personnel reach their destinations on time. If the logistics sector is dominated by a few major players or experiences very high demand, their bargaining power escalates significantly. This can directly translate into higher costs and reduced flexibility for TEAM, potentially hindering efficient and cost-effective project execution. For instance, a 2024 report indicated that transportation costs represented approximately 10-15% of total project costs for many heavy industrial firms, highlighting the potential impact of supplier power in this area.

The concentration of logistics providers in specific regions or the overall strain on transportation infrastructure can amplify supplier leverage. When fewer companies control a substantial portion of the market, or when demand for shipping outstrips available capacity, suppliers can dictate terms more readily. This can manifest in increased rates, longer lead times, or less favorable contract conditions. For TEAM, this means that delays or unexpected cost hikes from logistics partners can directly jeopardize project schedules and, consequently, profitability. In 2023, the global supply chain disruptions led to an average increase of 18% in freight rates for certain heavy equipment, illustrating the tangible financial impact.

The bargaining power of logistics and transportation suppliers for TEAM can be understood through several key factors:

- Supplier Concentration: A limited number of large, specialized logistics firms capable of handling heavy industrial equipment can command higher prices and more favorable terms.

- Demand Fluctuations: Periods of high demand across multiple industries can strain transportation capacity, giving powerful logistics providers more leverage.

- Specialized Equipment Needs: The requirement for specialized trucks, cranes, or vessels for transporting oversized or heavy components means fewer suppliers can meet these needs, increasing their power.

- Geographic Reach: For companies operating across vast territories, the ability of logistics providers to offer comprehensive national or international coverage is a significant factor in their bargaining strength.

Suppliers hold significant bargaining power when they offer unique or essential inputs that are difficult for TEAM to source elsewhere. This leverage allows them to command higher prices or impose stricter terms. For instance, in 2024, the demand for rare earth minerals, critical for certain advanced manufacturing processes, surged, leading to an average price increase of 15% globally, impacting industries reliant on these materials.

| Supplier Type | Bargaining Power Factor | Impact on TEAM (Example 2024) |

|---|---|---|

| Specialized Equipment Manufacturers | Proprietary Technology, Limited Competition | Price increases averaging 5-8% on niche equipment due to R&D and supply constraints. |

| Skilled Labor Providers (e.g., NDT Techs) | Scarcity of Expertise, High Training Costs | Increased wage expectations and recruitment expenses impacting operational costs. |

| Logistics & Transportation Services | Supplier Concentration, Specialized Needs | Transportation costs representing 10-15% of project costs; freight rate increases of 18% in 2023 for heavy equipment. |

| Specialized Software Vendors | High Switching Costs, Integrated Systems | Growing reliance and lock-in effect in a market projected to exceed $30 billion in 2024. |

What is included in the product

Team Porter's Five Forces Analysis identifies and assesses the key competitive forces impacting Team's industry, providing strategic insights into profitability and competitive advantage.

Instantly identify and mitigate competitive threats with a clear visualization of all Porter's Five Forces.

Empower your team to proactively address market pressures by easily updating and analyzing each force.

Customers Bargaining Power

TEAM's primary customers are large entities within heavy industries such as refining, petrochemicals, power generation, and pipelines. These sophisticated clients are crucial to TEAM's revenue stream, often accounting for a significant percentage of total sales, which inherently grants them considerable bargaining power.

The substantial scale of these customers allows them to exert influence. For instance, major clients frequently represent over 5% of TEAM's annual revenue, meaning a few lost contracts could have a noticeable impact. This scale enables them to negotiate aggressively on pricing and terms.

These clients can leverage the critical nature of their projects and their significant purchasing volume to demand more favorable contract terms. They are in a strong position to push for competitive pricing, flexible payment schedules, and robust service level agreements that ensure operational continuity.

The concentration of TEAM's customer base in these specific heavy industries means that a few key players hold a disproportionate amount of leverage. In 2023, TEAM reported that its largest customer accounted for approximately 8% of its total revenue, highlighting the concentrated nature of its client relationships and the associated bargaining power.

Customers' bargaining power is somewhat limited when TEAM's services are deeply embedded within their operations. For instance, if TEAM manages critical asset integrity, including maintenance schedules and safety protocols, switching providers incurs significant disruption and requires extensive re-training and system integration. This deep integration, often built over years, creates substantial switching costs for clients.

The time and effort required to establish trust and a reliable track record for essential asset integrity services mean clients are often reluctant to change suppliers. Consider that for many industrial sectors, regulatory compliance and safety are paramount; a proven history with a provider like TEAM, especially in managing complex, long-term projects, fosters a strong sense of security and reduces the perceived risk of switching. This customer inertia is a key factor in mitigating their power.

TEAM's services are absolutely vital for keeping a customer's operations running smoothly and safely. Think about it: our work directly impacts their uptime, which is the bedrock of their business. This criticality significantly limits how much leverage customers have over us, because they simply can't afford to walk away from essential maintenance and inspections.

Customers rely on TEAM to ensure their critical assets operate with the highest integrity and reliability. This isn't just about efficiency; it's about avoiding massive financial losses from unexpected shutdowns. For example, unscheduled downtime in industries like oil and gas can cost millions per day, making our preventative services a non-negotiable expense.

The regulatory landscape further solidifies the importance of our services. Failure to comply with safety and environmental standards can result in hefty fines and severe reputational damage. In 2024, industries across the board faced increased scrutiny, meaning customers must engage specialized providers like TEAM to maintain compliance and mitigate these risks.

Ultimately, the essential nature of TEAM's offerings means customers are less likely to exert significant bargaining power. They need our expertise to prevent costly downtime, avoid safety incidents, and meet stringent regulatory requirements. This dependence inherently strengthens our position, as the cost of not using our services far outweighs the benefits of demanding lower prices.

Customer Sophistication and Information Availability

Customer sophistication significantly amplifies their bargaining power, particularly in industries where clients possess specialized knowledge. For instance, in the aerospace sector, major airlines often have dedicated engineering and procurement departments. These teams can meticulously analyze technical specifications and cost structures, directly comparing offerings from different aircraft manufacturers and component suppliers.

The widespread availability of market data further empowers these customers. They can readily access information on pricing trends, competitor performance, and industry benchmarks. This transparency allows them to identify favorable market conditions and negotiate terms more assertively. For example, in 2024, the global aerospace market saw intense competition among suppliers, with buyers leveraging this to secure more favorable contract terms.

This informed stance enables customers to effectively challenge suppliers on price, quality, and service levels. Their ability to switch suppliers is also enhanced if they are dissatisfied with current offerings.

- Informed Negotiation: Customers use their deep understanding of product features and market pricing to demand better deals.

- Benchmarking Capability: Easy access to market data allows customers to compare suppliers and identify the most cost-effective options.

- Switching Costs: While sometimes high, customers can mitigate these by thorough upfront evaluation and supplier diversification.

Potential for In-House Capabilities

While TEAM's highly specialized services make complete in-house replication difficult for most clients, some larger customers may possess or consider developing limited capabilities for routine tasks like basic inspection or maintenance. This potential, however partial, for backward integration grants customers negotiation leverage by suggesting an alternative to outsourcing. For instance, a major energy producer might have an internal engineering team capable of performing preliminary equipment checks, potentially reducing their reliance on external specialized services for such tasks.

The threat of customers developing in-house capabilities, even if only for a subset of services, can influence pricing and contract terms. For example, if a client estimates they could perform 20% of a particular inspection service internally, they might push for a 15% discount on the total outsourced cost, viewing that internal capacity as a cost-saving alternative.

- Limited In-House Capacity: Some large customers may have existing or developing internal resources for routine maintenance and basic inspections.

- Backward Integration Threat: The possibility of clients performing certain tasks themselves provides a degree of leverage in negotiations.

- Specialization Barrier: The highly technical and specialized nature of TEAM's core services generally makes full in-house solutions impractical for most customers.

Customers hold significant bargaining power due to their large purchase volumes and the critical nature of TEAM's services. Their ability to impact revenue, as seen with the largest customer representing around 8% of revenue in 2023, forces TEAM to offer competitive pricing and flexible terms. This power is somewhat mitigated by high switching costs and the essential, safety-critical nature of TEAM's asset integrity work, which customers cannot afford to disrupt.

| Customer Influence Factor | Description | Impact on TEAM | 2023/2024 Data Point |

|---|---|---|---|

| Purchase Volume | Large clients represent substantial portions of TEAM's revenue. | Grants leverage in price and term negotiations. | Largest customer accounted for ~8% of total revenue. |

| Criticality of Services | TEAM's services are vital for operational uptime and safety. | Reduces customer willingness to risk service disruption. | Unscheduled downtime in oil/gas can cost millions daily. |

| Switching Costs | Deep integration and proven track record make switching difficult. | Creates customer inertia and strengthens TEAM's position. | Trust and reliability are paramount in safety-critical sectors. |

| Customer Sophistication | Informed clients analyze technical specs and market data. | Enables more assertive negotiation on price and quality. | Global aerospace market in 2024 saw intense supplier competition. |

Preview the Actual Deliverable

Team Porter's Five Forces Analysis

This preview shows the exact Team Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You are looking at the actual, professionally written document, fully formatted and ready to deploy for strategic decision-making. Once your purchase is complete, you’ll get instant access to this comprehensive analysis, allowing you to immediately understand competitive pressures within your team's environment. No mockups, no samples; the document you see here is exactly what you’ll be able to download and utilize after payment, providing actionable insights into your team's market dynamics.

Rivalry Among Competitors

The industrial services market is a complex landscape, featuring both broad-reaching conglomerates and a multitude of highly focused, niche providers. This structure naturally fuels robust competition, particularly within specific service segments or regional territories where these specialized firms vie for dominance. For instance, in 2024, the global industrial services market was valued at approximately $1.4 trillion, showcasing its vastness and the potential for intense competition across its many specialized verticals.

While TEAM has carved out its expertise in particular specialized areas, the broader market dynamics still present significant competitive pressures. Companies often differentiate themselves through technical expertise, project execution capabilities, and client relationships, leading to a constant struggle for market share. This fragmentation means that even established players like TEAM must remain agile and responsive to the competitive actions of smaller, specialized rivals who may offer unique solutions or pricing strategies.

Companies like TEAM face substantial fixed costs tied to specialized machinery, trained staff, and robust operational setups. This necessitates a constant drive for high capacity utilization, which in turn intensifies price competition and aggressive bidding, particularly when industrial demand softens.

The economic reality of idle assets and underutilized expert labor directly translates into increased pressure on companies to secure business, even at lower margins. This dynamic fuels a more cutthroat competitive environment where pricing becomes a primary battleground.

For instance, in the industrial services sector, which TEAM operates within, fixed costs can represent a significant portion of a company's overhead. A report from early 2024 indicated that for many specialized industrial maintenance providers, fixed costs accounted for over 60% of their total operating expenses, highlighting the critical need for high utilization rates.

Competitive rivalry in the industrial services sector is heavily influenced by how companies differentiate their offerings. This often boils down to specialized expertise, a stellar safety record, and the adoption of cutting-edge technologies like advanced non-destructive testing (NDT). For example, companies that can demonstrate a proven ability to deliver integrated solutions, combining multiple services for efficiency, gain a significant edge.

A strong reputation for reliability and safety is not just a nice-to-have; it's a crucial differentiator. In 2024, companies with a history of zero major incidents and consistently high client satisfaction scores are better positioned to negotiate favorable terms. This reputation allows them to command premium pricing, thereby softening the impact of direct price competition.

Companies that invest in technological advancements, such as AI-driven predictive maintenance or advanced drone inspection capabilities, can offer superior service quality. This focus on innovation and proven track records, like those seen in major infrastructure projects completed in 2023-2024, allows these firms to reduce reliance on price wars.

The speed of response and the ability to provide comprehensive, end-to-end solutions are also key. Clients in critical industries often prioritize partners who can quickly address issues and manage complex projects seamlessly, understanding that downtime can be incredibly costly. This service-centric approach is a powerful tool against pure price competition.

Slow Industry Growth in Mature Sectors

Serving mature heavy industries often means the overall market growth is considerably slower when compared to burgeoning sectors. This maturity means companies are looking to gain ground by outmaneuvering competitors, rather than relying on a rapidly expanding market. For instance, the global construction equipment market, a prime example of a mature industry, is projected to grow at a compound annual growth rate (CAGR) of just 3.5% from 2023 to 2028.

In such a slow-growth environment, competition naturally sharpens. Companies tend to focus on capturing existing market share, which can result in more aggressive strategic maneuvers and increased pressure on pricing. This dynamic can lead to price wars or intense promotional activities as firms fight for every available customer.

- Intensified Competition: Mature industries with slow growth force companies to compete for existing market share.

- Aggressive Strategies: This often leads to more aggressive tactics like price undercutting or enhanced service offerings.

- Pricing Pressure: The fight for market share directly translates into downward pressure on prices and reduced profit margins.

- Focus on Efficiency: Companies must prioritize operational efficiency and cost management to remain competitive.

Exit Barriers for Specialized Assets

High exit barriers significantly fuel competitive rivalry, particularly within industries reliant on specialized assets. Think of sectors like advanced semiconductor manufacturing or niche aerospace components. Companies in these areas often possess highly specific, expensive equipment that has virtually no resale value or alternative application, making it incredibly difficult and costly to divest. This immobility of capital means firms are often trapped in the market, even when facing declining profitability. For example, a semiconductor fabrication plant, costing billions to build and equip, cannot simply be repurposed for another industry if demand for its specialized chips wanes. This reluctance to exit can lead to prolonged periods of overcapacity and aggressive price competition as firms fight for survival.

The financial implications of these exit barriers are substantial. Consider the airline industry, where retiring aircraft can involve significant lease termination penalties and the cost of finding buyers for planes with limited global appeal. In 2024, many older aircraft models continued to fly longer than anticipated due to these costs. Similarly, a company specializing in custom-built industrial machinery might face immense challenges selling off its unique manufacturing setups. The sheer cost of winding down operations, including severance for a highly specialized workforce and the disposal of specialized assets, can be prohibitive, forcing companies to remain active competitors even in unfavorable market conditions.

- Specialized Equipment: Assets with limited alternative uses, like custom-built machinery or proprietary technology, are difficult to sell or repurpose, trapping companies in the market.

- Workforce Skills: Highly trained and specialized labor forces are costly to retrain or dismiss, adding to the expense of exiting an industry.

- Capital Commitment: Significant upfront investments in specialized infrastructure and technology create a high financial hurdle for companies looking to leave a market.

- Brand and Reputation: For companies with a strong niche reputation, exiting might mean abandoning years of brand building and customer relationships, which is itself a loss.

Intense rivalry exists within the industrial services market, driven by numerous competitors offering similar services. This often leads to price wars, especially when demand falters. Companies like TEAM must differentiate through expertise, safety, and technology to avoid being solely judged on cost. For instance, in 2024, the global industrial services market, valued at approximately $1.4 trillion, saw many specialized firms actively competing for market share.

The presence of a large number of competitors, coupled with high fixed costs for specialized equipment and trained personnel, intensifies the battle for customers. This necessitates high capacity utilization, pushing firms to bid aggressively, even at lower margins. Early 2024 data showed fixed costs exceeding 60% for many specialized maintenance providers, underscoring this pressure.

Differentiation through specialized skills, a strong safety record, and technological adoption, such as AI in maintenance, are crucial. Companies with proven reliability, like those completing major infrastructure projects in 2023-2024, can command better pricing, thus mitigating direct price competition.

Mature industries with slower growth, like the construction equipment market (projected 3.5% CAGR from 2023-2028), force companies to fight for existing market share through aggressive strategies and price undercutting, impacting profit margins and highlighting the need for efficiency.

SSubstitutes Threaten

Customers might develop internal capabilities for routine tasks, acting as a substitute for external service providers. This DIY approach can be cost-effective for simpler, recurring inspection or maintenance jobs, presenting a potential, albeit limited, threat.

While highly specialized services remain a strong draw for external expertise, the increasing accessibility of technology and training could empower some clients to handle a portion of their needs in-house. For instance, advancements in drone technology and digital inspection platforms may enable clients to perform basic visual inspections, reducing reliance on companies like TEAM for these specific functions.

In 2024, the trend towards digital transformation and operational efficiency continued to empower businesses. Companies that previously outsourced routine maintenance might now invest in internal training and technology to manage these tasks themselves, aiming to control costs and improve turnaround times. This strategic shift directly impacts the demand for certain service offerings.

The rise of advanced preventive maintenance software, coupled with sensor technology and digital twin modeling, presents a significant threat of substitution for TEAM's traditional services. These digital solutions can decrease the need for physical inspections by offering real-time data and predictive insights. For example, by 2024, the global digital twin market was projected to reach $15 billion, indicating a strong shift towards these technologies.

This technological evolution allows for proactive issue identification, potentially reducing the frequency or scope of on-site diagnostic work that TEAM might typically perform. While this could diminish demand for certain existing service lines, it simultaneously opens avenues for TEAM to offer more sophisticated, data-driven maintenance and consulting services.

Innovations in materials science and construction techniques pose a significant threat by potentially reducing the long-term demand for certain infrastructure integrity services. For example, the increasing adoption of advanced composite materials in bridge construction, as seen in projects utilizing high-strength, corrosion-resistant polymers, can extend asset lifespans. This durability may lessen the frequency of necessary inspections and repairs, directly impacting revenue streams for services focused on traditional material degradation.

The development of self-monitoring infrastructure, incorporating embedded sensors that provide real-time data on structural health, also acts as a substitute. Companies investing in smart concrete or self-healing asphalt technologies could see reduced reliance on external inspection firms. In 2024, the global smart infrastructure market was valued at over $20 billion, highlighting the growing trend towards technologically advanced solutions that can preemptively identify issues, thereby substituting traditional integrity assessment methods.

Alternative Inspection Technologies (Robotics, Drones)

The rise of advanced inspection technologies like drones and robots presents a significant threat of substitutes for TEAM's core services. These autonomous systems, increasingly powered by artificial intelligence for visual defect detection, can perform many inspection tasks previously requiring human expertise.

If these technologies become readily accessible and economically viable for clients to deploy themselves, it could directly diminish the need for TEAM's traditional, human-led inspection workforce. For instance, the global market for commercial drones was projected to reach $31.1 billion in 2023 and is expected to grow substantially, indicating increasing adoption across various industries.

- Autonomous Inspection Systems: Drones, robots, and AI-powered platforms offer automated data collection and analysis for inspections.

- Cost-Effectiveness: As technology matures, the cost of implementing these solutions is decreasing, making them attractive alternatives.

- Efficiency Gains: These technologies can often conduct inspections faster and in more hazardous environments than human teams.

- Reduced Demand for Manual Labor: Widespread adoption could lead to a decline in the demand for manual inspection services, impacting companies like TEAM.

Process Optimization and Operational Changes

Customers can significantly reduce their reliance on external service providers by implementing process optimization and operational changes. For instance, refining operational parameters like temperature and pressure can extend the lifespan of critical assets. This proactive approach, often driven by cost-saving initiatives, directly diminishes the need for services such as heat treating and mechanical repairs, acting as a powerful substitute.

In 2023, the global industrial maintenance market was valued at approximately $190 billion, with a projected compound annual growth rate of around 4.5% through 2028. However, increased adoption of predictive maintenance and AI-driven operational efficiency could temper this growth. For example, a major oil and gas producer reported a 15% reduction in unscheduled downtime and a 10% decrease in maintenance expenditure after implementing advanced process control systems, illustrating the threat of substitutes.

- Reduced Equipment Stress: Optimizing operating conditions minimizes wear and tear on machinery.

- Extended Asset Lifespan: Proactive measures can delay the need for costly repairs and replacements.

- Shift to Upstream Prevention: Focus moves from reactive repairs to preventative operational adjustments.

- Cost Savings for Customers: Implementing internal efficiencies directly cuts external service costs.

The threat of substitutes for TEAM's services is growing as technology advances and customers seek cost efficiencies. Internal capabilities, advanced digital solutions, and innovative materials can all reduce the need for external providers. For instance, the increasing adoption of digital twin technology, projected to reach $15 billion globally by 2024, allows for proactive issue identification, potentially diminishing demand for certain on-site diagnostic work.

Furthermore, the rise of autonomous inspection systems like drones, with the commercial drone market valued at $31.1 billion in 2023, offers faster and potentially safer alternatives to traditional methods. Even process optimization by customers can extend asset lifespans, reducing the need for repairs. In 2023, the industrial maintenance market was approximately $190 billion, but efficiency gains could temper this growth.

| Substitute Category | Description | Impact on TEAM | 2024 Market Data/Trend |

|---|---|---|---|

| Internal Capabilities | Customers performing routine tasks in-house. | Reduced demand for basic inspection/maintenance. | Digital transformation empowers in-house operations. |

| Digital Solutions | AI, sensors, digital twins for predictive maintenance. | Decreased need for physical inspections. | Digital twin market projected at $15B globally by 2024. |

| Autonomous Systems | Drones, robots for automated inspections. | Lower demand for manual inspection workforce. | Commercial drone market reached $31.1B in 2023. |

| Process Optimization | Improving operational parameters to extend asset life. | Less need for heat treating, mechanical repairs. | Industrial maintenance market ~$190B (2023), with efficiency gains impacting growth. |

Entrants Threaten

The need for substantial capital investment in specialized inspection tools, mechanical repair equipment, and advanced heat-treating facilities presents a significant hurdle for new entrants. Acquiring and maintaining a robust inventory of this technology is a considerable expense, making it challenging for smaller, less-resourced companies to enter the market and compete effectively from day one.

A significant barrier to entry is the absolute requirement for a workforce possessing advanced skills, certifications, and substantial experience. Think of roles like NDT Level III technicians, certified welders, or highly specialized engineers. New companies often struggle to find and keep these individuals.

The process of recruiting, training, and retaining such specialized talent is both costly and time-intensive. This creates a major obstacle for any new player attempting to enter the market without pre-existing talent pools or robust training infrastructures already in place.

For instance, in the advanced manufacturing sector, the demand for certified aerospace welders in 2024 continues to outstrip supply, with specialized training programs costing tens of thousands of dollars and taking years to complete, directly impacting the capital needed for market entry.

The industries TEAM operates within, such as oil and gas or heavy manufacturing, face formidable barriers to entry due to rigorous regulations. For instance, compliance with American Petroleum Institute (API) standards or American Society of Mechanical Engineers (ASME) codes for equipment manufacturing requires substantial investment in quality control and specialized processes. These certifications are not merely suggestions; they are mandatory for participation, creating a high hurdle for any newcomer aiming to compete.

Navigating this complex web of safety, environmental, and operational compliance is a costly and protracted endeavor. New entrants must allocate significant capital and time to understand and meet these stringent requirements, including non-destructive testing (NDT) protocols. This considerable upfront investment acts as a powerful deterrent, effectively limiting the threat of new companies easily entering the market.

Established Customer Relationships and Trust

Established customer relationships and trust represent a significant barrier to new entrants. Building enduring trust with large, risk-averse clients, particularly in demanding sectors like heavy industry, is a process that spans many years. Newcomers often struggle to overcome this hurdle because they lack the established track record, safety credentials, and existing client portfolio that incumbents, such as TEAM, have cultivated.

Securing initial contracts for essential infrastructure services is therefore challenging for new market participants. Without a history of reliability and a proven ability to deliver on critical projects, potential clients are hesitant to switch from trusted suppliers. For instance, in the industrial services sector, a proven safety record, often measured by a low Total Recordable Incident Rate (TRIR), is paramount. Companies like TEAM, with decades of operation, can point to extensive safety histories, whereas new entrants must build this reputation from scratch, a time-consuming and difficult endeavor.

- Long-term client loyalty: Many large industrial clients have multi-year contracts and deep-seated relationships with incumbent providers, making switching costs high.

- Risk aversion in critical sectors: Industries reliant on infrastructure services prioritize proven reliability and safety, favoring established players over unproven ones.

- Brand reputation and trust: Decades of successful project execution build a strong brand reputation and trust that new entrants find difficult to replicate quickly.

- Incumbents' competitive advantage: Established firms like TEAM benefit from a virtuous cycle where past performance reinforces current trust, deterring new competition.

Economies of Scale and Scope

Existing players like TEAM often leverage significant economies of scale, reducing per-unit costs in areas like bulk purchasing and optimized logistics. For example, in 2023, major logistics providers achieved cost reductions of up to 15% through optimized fleet management and centralized warehousing.

Furthermore, TEAM benefits from economies of scope by bundling diverse services, creating a more attractive and cost-effective package for clients. This integrated approach makes it difficult for new, specialized entrants to compete on both price and breadth of offering.

New entrants typically face higher initial costs per unit, lacking the established infrastructure and volume discounts that TEAM enjoys. This cost disadvantage is a substantial barrier, as replicating the operational efficiencies of a mature company requires significant capital investment.

- Economies of Scale: TEAM's large operational volume allows for lower per-unit production and service costs compared to new entrants.

- Economies of Scope: Offering a wide array of integrated services makes TEAM's value proposition stronger and harder for niche competitors to match.

- Cost Disadvantage for Newcomers: Start-ups must overcome higher initial operating expenses and lack of bargaining power with suppliers.

- Barriers to Entry: The financial and operational hurdles created by existing economies of scale and scope significantly deter new companies from entering the market.

The threat of new entrants for TEAM is significantly mitigated by substantial capital requirements for specialized equipment and facilities, along with the necessity for a highly skilled and certified workforce. Regulatory compliance and the cultivation of long-term customer trust also present considerable challenges for newcomers.

Existing players like TEAM benefit from economies of scale and scope, which create a cost disadvantage for new market participants. These combined factors create formidable barriers, effectively limiting the ease with which new companies can enter and compete in TEAM's operating sectors.

| Barrier Category | Specific Challenge | Impact on New Entrants | Example/Data (2024) |

|---|---|---|---|

| Capital Investment | Specialized Equipment & Facilities | High upfront costs, limiting market entry for less-funded entities. | Advanced inspection tools and heat-treating facilities can cost millions. |

| Human Capital | Skilled & Certified Workforce | Difficulty in recruiting, training, and retaining specialized talent. | Demand for certified aerospace welders outstrips supply; training costs tens of thousands. |

| Regulatory Compliance | Industry Standards (API, ASME) | Mandatory adherence requires significant investment in quality control and processes. | Non-compliance can lead to exclusion from projects in oil and gas. |

| Customer Relationships | Trust & Proven Track Record | Challenging to overcome established loyalty and risk aversion of clients. | A strong safety record (low TRIR) is crucial, taking years to build. |

| Economies of Scale/Scope | Operational Efficiencies & Bundled Services | New entrants face higher per-unit costs and less competitive pricing. | Incumbents can achieve cost reductions of up to 15% through optimized logistics. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built on a foundation of diverse data, including publicly available financial statements, industry-specific market research reports, and competitive intelligence gathered from trade publications and news outlets.