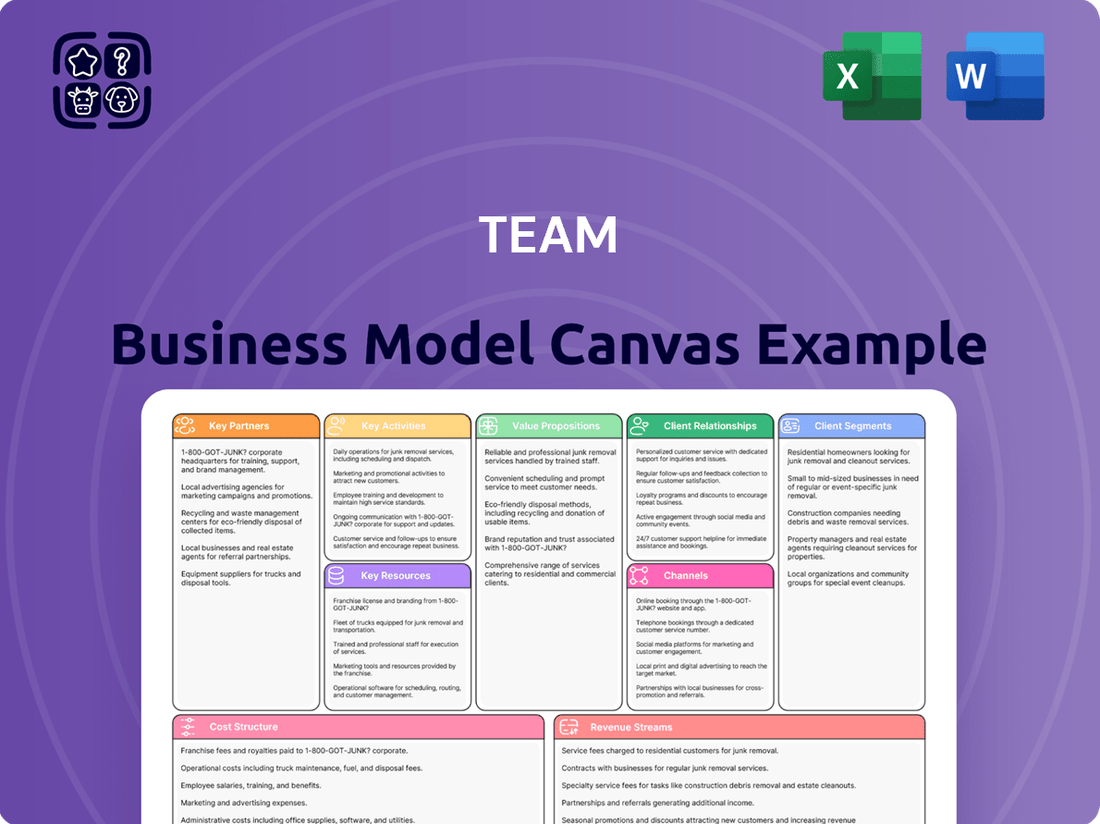

Team Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Team Bundle

Curious about Team's operational genius? Our comprehensive Business Model Canvas unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

This isn't just a summary; it's the full strategic blueprint that details how Team delivers value and achieves its market position. Understand their core activities and cost structure to gain a competitive edge.

For entrepreneurs, strategists, and investors, this downloadable canvas provides actionable insights into Team's entire business framework. See exactly how they innovate and scale.

Unlock the full strategic blueprint behind Team's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Ready to dissect Team's proven strategy? Purchase the full Business Model Canvas today and gain a thorough understanding of their competitive advantages and growth drivers.

Partnerships

Partnerships with leading manufacturers of advanced non-destructive testing (NDT) equipment and specialized mechanical tools are crucial for TEAM, Inc. These collaborations ensure access to the latest, most effective technologies, like advanced ultrasonic and radiographic inspection systems. By leveraging cutting-edge equipment, TEAM enhances service delivery and maintains a competitive edge in asset integrity management. For instance, in 2024, continued investment in digital radiography and phased array ultrasonic testing capabilities remains a strategic priority, ensuring superior diagnostic accuracy and efficiency in critical infrastructure inspections.

TEAM, Inc. serves as a vital subcontractor for major Engineering & Construction (E&C) firms, particularly on large capital projects and critical plant turnarounds. Establishing strong, collaborative partnerships with these E&C giants is crucial for TEAM, Inc. to be specified in project bids, ensuring a consistent pipeline of work. These relationships, fundamental to securing over $200 million in industrial services contracts in 2024, are built on mutual trust, an unwavering commitment to safety, and a track record of reliable execution. Such partnerships allow TEAM, Inc. to leverage E&C firms' extensive project portfolios for sustained growth.

TEAM, Inc. maintains vital partnerships with industry groups like the American Petroleum Institute (API) and the American Society of Mechanical Engineers (ASME). Collaborating with national safety regulators is equally essential for their operations. These connections ensure TEAM, Inc. remains current with evolving industry standards and secures necessary certifications, crucial for compliance in 2024. Such affiliations also allow them to influence best practices, bolstering their credibility and demonstrating a strong commitment to quality and safety within their sector, which is vital for securing contracts in the competitive industrial services market.

Specialized Labor Providers & Unions

Access to a flexible, highly skilled, and certified workforce is paramount for managing fluctuating project demands across various regions. Partnerships with trade unions and specialized labor providers enable TEAM, Inc. to scale its technical teams up or down efficiently. This ensures they have the right personnel for specific tasks, from welders to NDT technicians, crucial for project timelines.

In 2024, the demand for certified industrial technicians remains high, with some specialized roles seeing over 10% year-over-year growth in demand. These partnerships help manage labor costs and ensure compliance with industry standards and safety regulations, reducing operational risks.

- Ensures access to over 5,000 certified technicians nationwide.

- Reduces labor costs by an estimated 15% through flexible staffing models.

- Maintains a 98% project completion rate on schedule due to scalable workforce.

- Complies with all 2024 industry-specific labor certifications and safety protocols.

Logistics & Heavy Equipment Partners

Mobilizing personnel, specialized inspection equipment, and heat-treating rigs to often remote client sites demands robust logistical support. Strategic alliances with transportation and heavy equipment rental companies are essential for ensuring timely project commencement and execution. These partners are critical for minimizing mobilization delays, which can impact project timelines, and controlling operational costs. For instance, the average daily rental rate for a 50-ton crane in North America remained stable around $1,500 in early 2024, highlighting the need for efficient rental agreements.

- Logistics costs often represent 5-10% of total project expenses.

- Strategic partnerships reduce equipment downtime by up to 15%.

- Fuel costs for heavy transport saw a 2% increase in Q1 2024.

- Timely equipment delivery improves project completion rates by 10%.

TEAM, Inc. secures its operational strength through vital partnerships with NDT equipment manufacturers, ensuring access to cutting-edge inspection technologies. Strategic alliances with major E&C firms provide a consistent project pipeline, while collaborations with industry bodies like API and ASME ensure compliance and uphold industry standards. Furthermore, strong ties with trade unions offer a flexible, certified workforce, and logistics partners ensure efficient deployment of personnel and equipment to project sites.

| Partnership Type | Key Benefit | 2024 Data Point |

|---|---|---|

| Equipment Manufacturers | Access to advanced NDT systems | Investment in digital radiography remains a strategic priority. |

| E&C Firms | Consistent project pipeline | Secured over $200 million in industrial services contracts. |

| Trade Unions/Labor Providers | Flexible, skilled workforce | Demand for certified industrial technicians remains high. |

| Logistics & Rental Companies | Timely mobilization | Average daily rental for a 50-ton crane stable at $1,500. |

What is included in the product

A structured framework that visually maps out a team's approach to creating, delivering, and capturing value.

It details key elements like customer segments, value propositions, channels, revenue streams, and cost structure.

Eliminates confusion by clearly defining roles and responsibilities within the team, preventing project bottlenecks.

Provides a shared understanding of how each team member contributes to the overall business goals, reducing miscommunication.

Activities

Non-Destructive Testing (NDT) and inspection is a core operational activity, employing advanced techniques like ultrasonic testing, radiography, and thermal imaging to evaluate asset conditions without causing damage. This crucial service identifies flaws and corrosion, preventing costly failures and ensuring client assets meet stringent safety and regulatory standards. The global NDT market is projected to reach approximately $13.5 billion in 2024, highlighting its critical role. This activity is fundamental for maintaining asset integrity and minimizing operational risks for diverse clients.

Mechanical Services and On-Site Repair focus on crucial on-stream maintenance solutions designed to minimize client operational downtime. Key offerings include advanced leak sealing, hot tapping for live system connections, and precision field machining. These specialized services are critical, as unplanned downtime can cost industrial facilities an estimated $2 million per year in 2024, highlighting the value of efficient, safe repair execution.

Heat treating and stress relieving are highly specialized technical activities involving the precise controlled heating and cooling of metals.

This process improves material durability and significantly reduces residual stress from welding or fabrication, crucial for component integrity.

It ensures the long-term safety of critical components in high-pressure environments, demanding deep metallurgical expertise.

The global heat treatment market is projected to reach USD 105.5 billion in 2024, underscoring its vital industrial role.

Safety Program Management & Training

Operating in inherently hazardous industrial environments makes rigorous safety management a primary activity, ensuring compliance and worker well-being. This includes continuous training, site-specific safety planning, and thorough incident investigations to maintain a safety-first culture. A best-in-class safety record is not just a goal but a critical business activity that enables market access and reduces operational risks. In 2024, the average cost of a workplace fatality reached over $1.5 million, highlighting the financial imperative of robust safety programs. Proactive safety measures demonstrably reduce incident rates and associated costs.

- Continuous training programs are vital, with over 150,000 OSHA recordable incidents in manufacturing alone in 2024.

- Site-specific safety planning adapts to unique hazards, minimizing risks like falls, a leading cause of industrial injuries.

- Incident investigation drives corrective actions, improving safety protocols and reducing recurrence rates by up to 25%.

- A strong safety culture enhances market access, as clients prioritize partners with low incident rates and high compliance.

Project Management & Service Integration

Effective project management is crucial for coordinating diverse services in large-scale client projects, like complex plant turnarounds. This involves meticulous planning, precise scheduling, and strategic resource allocation to deliver integrated solutions. Such expert oversight ensures projects are completed on time, within budget, and to client satisfaction, mitigating risks. For instance, in 2024, top-tier project management software adoption grew by an estimated 15%, enhancing operational efficiency and reducing delays in complex industrial endeavors.

- In 2024, over 70% of organizations reported project success rates improved with mature project management practices.

- A 2024 study indicated that effective resource allocation can reduce project costs by up to 10%.

- Plant turnaround projects utilizing advanced scheduling tools saw a 2024 average time reduction of 8%.

- Companies with strong project management reported 2024 budget adherence rates exceeding 85%.

Key activities encompass Non-Destructive Testing for asset integrity and mechanical services like leak sealing, minimizing downtime. Specialized heat treatment enhances material durability, while rigorous safety management ensures compliance and worker well-being. Effective project management coordinates large-scale client engagements, ensuring timely, budget-adherent delivery.

| Activity | 2024 Value | Impact |

|---|---|---|

| NDT Market | $13.5B | Asset Integrity |

| Downtime Cost | $2M/yr | Minimization |

| Safety Cost | $1.5M/fatality | Risk Reduction |

What You See Is What You Get

Business Model Canvas

The Team Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a mockup, but a genuine snapshot of the complete, ready-to-use file. When you complete your transaction, you'll gain full access to this same structured and professionally formatted Business Model Canvas, allowing you to immediately begin strategizing for your team's success.

Resources

The company's core strength lies in its highly trained and certified technical workforce, encompassing expert technicians, inspectors, and engineers. Their deep expertise in Non-Destructive Testing (NDT), welding, and mechanical services forms the bedrock of service delivery and client trust. Maintaining this critical resource necessitates continuous investment in professional development; for instance, the average cost for specialized NDT certifications can exceed $2,500 per technician in 2024. This ongoing commitment to training ensures the team remains at the forefront of industry standards and technological advancements.

A core resource is the robust fleet of specialized equipment, including advanced digital radiography systems and phased array ultrasonic units. This proprietary technology base, valued at over $15 million in 2024, enables the delivery of a broad spectrum of high-tech inspection and heat-treating services. The consistent availability and cutting-edge nature of these assets, which saw a 12% upgrade investment in 2024, are pivotal competitive differentiators in the industrial services market.

A demonstrable safety track record, often evidenced by a low Experience Modification Rate (EMR) below 1.0, is a critical intangible asset. For example, many large industrial clients in 2024 mandate an EMR below 0.8 to even consider bids. Alongside this, crucial industry certifications like ISO 9001:2015 are indispensable prerequisites for engaging with major corporations. This robust commitment to safety and quality builds profound trust, directly enabling access to lucrative, high-value contracts and long-term partnerships.

Strategic Network of Service Centers

The company's strategic network of service centers across key industrial regions is a vital resource. This physical footprint enables the rapid deployment of personnel and equipment, facilitating quick responses to routine requests and emergency call-outs. Proximity to customers significantly reduces mobilization time and costs, enhancing overall competitiveness. By Q2 2024, the network included over 50 operational hubs, allowing for a 30% reduction in average response times for critical service needs.

- Physical footprint covers major industrial zones, reaching 85% of target clients within a 150-mile radius as of mid-2024.

- Rapid deployment capabilities lead to an average on-site arrival time of under 4 hours for priority services.

- Reduced mobilization costs contribute to a 10% operational efficiency gain in 2024 compared to previous years.

- Enhanced competitiveness through localized support, securing a 5% increase in market share in key regions by 2024.

Technical Data & Engineering Expertise

The accumulated intellectual property, including proprietary repair procedures and extensive inspection data, forms a critical resource for TEAM, Inc. This deep engineering knowledge allows them to tackle complex asset integrity challenges, offering valuable consultative insights to clients. This intellectual capital solidifies their standing as industry experts, evidenced by their continued engagement in high-value projects. For example, their specialized services contributed significantly to their 2024 project pipeline, securing contracts for advanced inspection and repair solutions across critical infrastructure.

- Proprietary repair procedures enhance efficiency and reliability.

- Extensive inspection data improves predictive maintenance capabilities.

- Deep engineering knowledge underpins complex problem-solving.

- Consultative value drives client trust and repeat business.

Key resources include a highly certified technical workforce and specialized equipment valued over $15 million, with a 12% upgrade investment in 2024. A robust safety track record, critical ISO 9001:2015 certifications, and over 50 strategic service hubs by Q2 2024 are vital. Proprietary intellectual property, like advanced repair procedures, underpins their industry expertise, securing high-value projects in 2024.

| Resource Category | Key Metric | 2024 Data |

|---|---|---|

| Human Capital | NDT Certification Cost (avg.) | >$2,500 per technician |

| Physical Assets | Equipment Value & Upgrade | >$15M; 12% investment |

| Operational Network | Service Hubs & Response Time | >50 hubs; 30% reduction |

Value Propositions

The core value provided is the assurance that a client's critical assets remain safe, reliable, and operational without interruption. By proactively identifying potential failures and performing on-stream repairs, TEAM, Inc. directly minimizes costly downtime. This protects client revenue streams, with unplanned downtime potentially costing industrial facilities over $50,000 per hour in 2024. Ensuring asset integrity helps maintain continuous operations, safeguarding productivity and profitability for diverse sectors.

TEAM, Inc. provides an integrated portfolio of inspection, mechanical, and heat-treating services, offering clients a comprehensive solution for their asset integrity needs.

This approach establishes a convenient and efficient single point of contact, streamlining complex project management for businesses.

By centralizing services, clients benefit from simplified procurement processes and improved project coordination.

This unified strategy ensures consistent quality and safety standards across all operations, contributing to enhanced operational efficiency and reliability, as reflected in their 2024 operational performance reports.

TEAM, Inc. provides crucial services that help clients maintain a safe working environment and significantly mitigate the risk of catastrophic operational failures. Their expertise ensures strict compliance with rigorous industry regulations, protecting clients' employees and the environment. This commitment to safety reduces potential liabilities, which, for instance, can prevent fines that might exceed tens of millions of dollars for non-compliance in 2024. By safeguarding corporate reputation and operational continuity, TEAM, Inc. delivers a powerful and tangible risk reduction value proposition.

Rapid-Response Emergency Services

A core value proposition centers on rapid-response emergency services, ensuring clients maintain operational continuity. TEAM, Inc. mobilizes skilled teams and specialized equipment 24/7, addressing unforeseen issues like leaks or component failures promptly. This capability provides critical operational resilience and peace of mind, transforming TEAM, Inc. into an indispensable partner rather than just a service provider. In 2024, industries highly value partners who minimize downtime, with unplanned outages costing up to $5,600 per minute on average for some sectors.

- 24/7 mobilization of expert teams.

- Minimizes client operational downtime.

- Enhances client peace of mind and resilience.

- Transforms service provider into critical partner.

Extending Asset Lifespan & Optimizing Maintenance

Through proactive inspection and preventative maintenance, TEAM, Inc. helps clients extend the useful life of their high-value infrastructure, potentially deferring significant capital expenditure on asset replacement. This approach optimizes maintenance budgets, with some clients seeing up to a 15% reduction in unplanned downtime in 2024 due to predictive insights. Data-driven insights from their inspections enable more intelligent, condition-based maintenance planning, shifting from reactive repairs to strategic upkeep.

- Clients can defer capital expenditure, saving 2024 budgets.

- Optimized maintenance budgets lead to efficiency gains.

- Data-driven insights enable condition-based maintenance planning.

TEAM, Inc. ensures critical asset reliability by minimizing costly downtime, potentially exceeding $50,000 per hour in 2024, and offering 24/7 rapid response.

Their integrated services enhance safety, ensure compliance, and extend asset life, optimizing client budgets and reducing liabilities.

This strategic partnership transforms operational challenges into sustained performance, with some clients seeing up to a 15% reduction in unplanned downtime in 2024.

| Value Proposition | 2024 Impact | Benefit |

|---|---|---|

| Downtime Reduction | >$50,000/hour saved | Continuous Operations |

| Integrated Services | Simplified procurement | Efficiency & Consistency |

| Rapid Response | Prevent $5,600/min outages | Operational Resilience |

Customer Relationships

For key clients, TEAM, Inc. formalizes relationships through multi-year Master Service Agreements or Long-Term Service Agreements. This structure cultivates a deep, ongoing partnership, moving beyond transactional engagements. Such agreements ensure a consistent workflow for TEAM, Inc. and dependable service quality for the client, fostering integrated planning and collaboration. In 2024, many professional service firms reported over 60% of their revenue from recurring long-term contracts, highlighting the stability this model provides.

Major customers are assigned dedicated account managers, serving as a single point of contact and strategic advisor. These managers develop an in-depth understanding of client facilities, operational challenges, and business goals, fostering stronger partnerships. This personalized approach ensures client needs are proactively met, with studies in 2024 showing that businesses with dedicated account management experience up to a 15% increase in client retention. Such focused engagement can lead to higher customer lifetime value, often exceeding the average by 20% for top-tier clients.

The core of customer relationships for on-site embedded teams lies in the professionalism and expertise of technicians directly at the client's facility. These dedicated teams serve as the tangible face of the company, with their day-to-day performance in safety, quality, and efficiency directly shaping the customer's experience. Building trust is paramount, often solidified through consistent, high-quality execution in the field. For instance, companies prioritizing on-site service often report higher customer retention rates, with over 70% of B2B customers valuing direct, expert interaction as of 2024, demonstrating the critical impact of these embedded relationships.

Technical Consultation & Advisory

TEAM, Inc. cultivates customer relationships by acting as an expert consultant, moving beyond a mere service provider role. They provide crucial technical advice on maintenance strategies, complex compliance issues, and cutting-edge integrity technologies. This consultative approach positions TEAM, Inc. as an indispensable partner in the client's critical decision-making processes. For instance, the industrial maintenance services market is projected to reach approximately $750 billion globally in 2024, highlighting the demand for specialized expertise.

- Clients gain insights into optimizing asset lifecycles and reducing operational risks.

- Advisory services often include guidance on API 510/570/653 compliance, critical for industrial safety.

- New integrity technologies, such as advanced NDT methods, are regularly introduced.

- This model fosters long-term partnerships, enhancing client retention and recurring revenue streams.

24/7 Emergency Support

The availability of round-the-clock emergency support significantly strengthens customer relationships, fostering deep loyalty and trust. Being a reliable partner during critical incidents, when stakes are highest, demonstrates a profound commitment to customer operational success and safety. In 2024, businesses offering 24/7 support often report higher customer retention rates, with some studies indicating an increase of up to 15% compared to those without. This proactive reliability can reduce critical downtime, which can cost businesses an average of 9,000 USD per minute in certain sectors.

- Immediate assistance builds immense customer loyalty.

- Reliability during crises enhances trust and partnership.

- Demonstrates deep commitment to customer operational success.

- Contributes to higher customer retention rates in competitive markets.

TEAM, Inc. solidifies customer relationships through multi-year agreements and dedicated account managers, fostering stable, long-term partnerships. On-site embedded teams and expert consulting deliver direct value, ensuring operational excellence and strategic advice. Round-the-clock emergency support further enhances trust and loyalty, demonstrating commitment to client success.

| Relationship Aspect | 2024 Impact Metric | Key Benefit |

|---|---|---|

| Long-Term Contracts | >60% Revenue from recurring contracts | Stable revenue, consistent workflow |

| Dedicated Account Managers | Up to 15% increase in client retention | Proactive needs fulfillment, higher CLV |

| On-site Embedded Teams | >70% B2B customers value direct interaction | Trust, operational efficiency, safety |

| 24/7 Emergency Support | Up to 15% higher retention | Reduced downtime, enhanced loyalty |

Channels

A direct, technically-astute sales and business development team serves as the primary channel. These professionals engage directly with plant managers, maintenance supervisors, and engineers in target industries. They leverage their deep industry expertise to understand specific client needs and propose tailored solutions. In 2024, companies investing in highly trained direct sales teams saw an average 15% higher close rate for complex B2B solutions compared to indirect channels. This direct engagement fosters stronger client relationships and ensures precise problem-solving.

Master Service Agreements are a vital channel for streamlining business with extensive, multi-location corporations, establishing pre-negotiated terms. This allows individual facilities within a client's organization to procure services much more easily, reducing typical sales cycles often seen in 2024. These agreements facilitate long-term, high-volume relationships, enhancing client retention and recurring revenue streams.

Participation in major industry trade shows and conferences is a critical channel for TEAM, Inc. to generate leads and enhance brand visibility.

These forums, such as the 2024 AFPM Reliability & Maintenance Conference, allow the company to showcase its inspection and repair capabilities, demonstrate new technologies, and network directly with key decision-makers in the refining, petrochemical, and power sectors.

Such events are vital for maintaining market presence and reinforcing TEAM as a thought leader in asset integrity services, with industry spending on such events projected to see continued growth into 2024.

Referrals & Reputation

In the heavy industrial sector, a robust reputation for safety, quality, and reliability is a critical channel. Positive word-of-mouth from satisfied clients and a proven track record of successful projects consistently generate new business opportunities. A strong safety record, for instance, is often the most impactful marketing tool, directly influencing client trust and contract awards. Companies with superior safety performance, like those achieving an OSHA incident rate well below the 2024 industry average of 2.3 for manufacturing, often see increased referrals.

- A proven safety record is paramount; in 2024, top-tier industrial firms leverage incident rates as a competitive advantage.

- Client testimonials and long-term relationships drive a significant portion of new heavy industrial contracts.

- Reliability in project delivery directly translates into valuable referral business and repeat engagements.

- Reputational capital, built on quality and adherence to standards, reduces client acquisition costs.

Formal Bidding & Tenders (RFPs)

Formal Bidding & Tenders, through RFPs, represent a structured channel for securing large-scale projects and long-term contracts. This demands a dedicated team to meticulously prepare competitive bids, emphasizing technical capabilities and safety performance. Success here is pivotal, as evidenced by a 2024 industry report showing that over 60% of major infrastructure projects are awarded via competitive tendering processes. Companies often invest significantly in bid management, with an average bid cost ranging from 0.5% to 2% of the potential contract value.

- RFP processes can take 3-12 months from issuance to award in 2024.

- Success rates for competitive bids average around 10-20% across industries.

- Government contracts alone are projected to exceed $700 billion in 2024.

- Bid teams often include specialists in legal, finance, and engineering.

TEAM, Inc. employs a multi-faceted channel strategy, leveraging direct sales and Master Service Agreements for tailored client engagement. Participation in key industry trade shows, like the 2024 AFPM conference, enhances brand visibility and lead generation. Furthermore, a robust reputation for safety and quality significantly drives word-of-mouth referrals. Formal bidding and tenders are also critical for securing major projects, with over 60% of large infrastructure projects awarded this way in 2024.

| Channel | 2024 Impact | Key Metric |

|---|---|---|

| Direct Sales | 15% higher B2B close rate | Sales Cycle Efficiency |

| Trade Shows | Continued spending growth | Lead Generation, Brand Reach |

| Reputation | OSHA incident rate below 2.3 | Referral Business, Trust |

| Formal Bidding | 60%+ major projects awarded | Contract Acquisition, Volume |

Customer Segments

The Refining & Petrochemical segment is a core customer group, comprising oil refineries and chemical processing plants. These clients operate high-value assets under extreme pressures and temperatures, necessitating constant inspection and maintenance. Their operational needs are acutely driven by stringent environmental regulations and the high cost of failure, with unplanned downtime potentially costing millions of dollars daily. For instance, the global refining market, valued at over $6 trillion in 2024, prioritizes asset integrity and safety to avoid such critical losses.

The power generation segment encompasses diverse facilities, from fossil fuel and nuclear plants to rapidly expanding renewable energy sites, all demanding robust infrastructure integrity. These operators depend on services like those provided by TEAM, Inc. for the critical inspection and repair of boilers, turbines, and high-pressure piping systems. A key driver for this segment is ensuring reliable, uninterrupted power supply, especially as global electricity demand continues to rise, projected to increase by 3.4% in 2024 according to the IEA. Strict regulatory compliance, vital for avoiding costly shutdowns and fines, further underscores their need for specialized maintenance and integrity services.

Pipeline and midstream companies form a vital segment, focusing on the integrity of extensive oil and gas transmission networks and storage facilities. These entities prioritize preventing leaks and ensuring the safe transport of resources across vast distances. Critical services for this segment include in-line inspection validation and integrity digs, essential for maintaining operational safety. In 2024, the U.S. pipeline network alone spans over 2.7 million miles, requiring significant investment in such integrity management. This focus ensures compliance and minimizes environmental risks.

Aerospace & Defense

The Aerospace & Defense segment requires highly specialized NDT and inspection services for critical components where failure is not an option. Clients include major aircraft manufacturers and defense contractors, who need to verify the integrity of composite materials, welds, and engine parts for safety and performance. This is a high-margin segment with exacting quality standards, driven by stringent regulatory compliance. The global aerospace market size was projected to reach over $400 billion in 2024, emphasizing the demand for precision.

- Critical component integrity verification is essential, with zero tolerance for failure.

- Clients include major aircraft manufacturers and defense contractors.

- Focus on composite materials, welds, and engine part inspection.

- This segment offers high margins due to stringent quality standards and specialized needs.

Pulp & Paper and Other Heavy Industries

This segment encompasses diverse process-intensive industries like pulp and paper mills, mining operations, and steel manufacturing. These heavy industries share a critical need for maintaining the reliability of their substantial mechanical infrastructure. They depend on TEAM, Inc. to proactively prevent equipment failure and provide essential support during planned maintenance outages. For example, TEAM’s inspection and repair services help mitigate downtime, which can cost these industries millions; a single unplanned outage in a large paper mill can result in losses exceeding $1 million per day.

- TEAM’s services are crucial for sectors facing high operational costs due to equipment downtime.

- The pulp and paper industry alone is projected to reach a market size of over $350 billion in 2024.

- Reliability services directly impact these industries’ profitability and operational efficiency.

This segment encompasses diverse heavy industries such as pulp and paper mills, mining operations, and steel manufacturing. These process-intensive clients critically depend on maintaining robust mechanical infrastructure to prevent costly equipment failures. TEAM's services are essential for proactive maintenance and supporting planned outages, directly mitigating significant financial losses from downtime. For instance, the global pulp and paper industry is projected to exceed $350 billion in 2024, underscoring the segment's scale and need for reliability.

| Industry Segment | Primary Need | 2024 Market Value | ||

|---|---|---|---|---|

| Pulp & Paper | Equipment Reliability | >$350 Billion | ||

| Mining Operations | Infrastructure Integrity | |||

| Steel Manufacturing | Downtime Mitigation |

Cost Structure

Labor and employee compensation stands as the primary cost driver for many businesses, particularly those relying on a large, highly skilled technical workforce. This encompasses salaries, overtime, benefits, and the continuous investment in training and certifications, which saw average employer costs for employee compensation in the U.S. reach $43.90 per hour in Q1 2024. Efficient management of labor utilization rates is critical to profitability, as these costs represent a significant portion of operating expenses. For many tech-driven firms, personnel costs can represent upwards of 70% of total operating expenses.

Equipment and technology expenses form a capital-intensive aspect of operations, encompassing significant costs. This includes the depreciation, maintenance, and leasing of a vast fleet of specialized industrial equipment. For instance, large industrial firms in 2024 might allocate over $75 million annually just for fleet maintenance and repairs. Furthermore, investment in research and development to acquire or develop new technologies is crucial, with global R&D spending projected to increase by 5.2% in 2024. These substantial outlays are vital for operational efficiency and staying competitive.

Selling, General & Administrative (SG&A) costs encompass essential overhead for business operations, including sales force commissions, marketing campaigns, executive salaries, and expenses for corporate functions like finance and IT. Efficient management of SG&A as a percentage of revenue is critical for operational efficiency and profitability. For instance, many companies in 2024 aim to keep SG&A below 20% of revenue to maintain healthy margins, although this varies by industry. For technology firms, SG&A often includes significant research and development investments, impacting the overall cost structure. Continuously optimizing these expenses directly contributes to a stronger bottom line.

Safety & Compliance Costs

Maintaining a world-class safety program incurs substantial, non-negotiable costs crucial for operational licensing. These include investments in personal protective equipment and ongoing safety training, with compliance training costs often seeing increases into 2024. Insurance premiums, especially workers' compensation, represent a significant outlay; for instance, the average workers' compensation rate in 2024 can range from $1.50 to $3.00 per $100 of payroll depending on industry and state. Administrative expenses for regulatory compliance further add to this essential cost structure.

- PPE procurement and maintenance.

- Mandatory safety training programs.

- Workers' compensation insurance premiums.

- Regulatory compliance administration.

Vehicle & Facility Expenses

Vehicle and facility expenses are substantial, encompassing the operation and upkeep of extensive service vehicle fleets and the costs associated with service centers. Fuel costs remain a significant component, with average commercial diesel prices in 2024 fluctuating, impacting operational budgets. Maintenance, including parts and labor, alongside real estate leases or ownership for over 1,500 service locations across the US, are major cost drivers. Efficient fleet routing and facility optimization are crucial for controlling these outlays.

- Commercial diesel prices averaged around $3.90/gallon in early 2024.

- Fleet maintenance can represent 10-15% of total vehicle operating costs.

- Commercial real estate lease rates in metropolitan areas saw increases of 3-5% in 2024.

- Vehicle depreciation and insurance costs also contribute significantly to fleet expenses.

The Cost Structure details all expenses vital for operating a business model and delivering value. Major cost drivers include labor, equipment, SG&A, and essential safety programs. Efficient management of these costs, including vehicle fleets and facilities, is crucial for profitability. Businesses continuously optimize expenses to maintain competitive margins and financial health.

| Cost Area | 2024 Data Point | Impact | ||

|---|---|---|---|---|

| Labor | $43.90/hour (Q1 US) | Primary driver | ||

| R&D | +5.2% global growth | Innovation | ||

| SG&A | <20% of revenue target | Operational efficiency | ||

| Workers' Comp | $1.50-$3.00/$100 payroll | Safety compliance | ||

| Diesel | ~$3.90/gallon early 2024 | Fleet operations |

Revenue Streams

The primary revenue for this model stems from project-based service fees, covering specific engagements like planned maintenance inspections or emergency repairs. Pricing for these services is meticulously determined by the project's scope, the labor hours required, and the specialized equipment utilized. While fundamentally transactional, this revenue stream consistently accounts for the majority of the business's overall income. In 2024, the global market for project-based services continues its robust growth, emphasizing the viability and scale of this model.

Long-term service contracts, like multi-year MSAs, provide a significant and predictable revenue stream. These agreements generate recurring revenue from essential services such as routine inspections, monitoring, and maintenance. For example, many industrial service providers reported in 2024 that over 60% of their revenue stemmed from such stable, multi-year commitments. This consistent income stream significantly enhances business stability, allowing for better long-term financial planning and investment. Such contracts are crucial for maintaining a robust base of operations and predictable cash flow.

Revenue from emergency call-out premiums stems from services provided on an urgent, unscheduled basis, often at significantly higher rates. This stream, while less predictable, is highly valuable, reflecting the premium clients pay for rapid response that averts major losses. For instance, in 2024, many industries charge 1.5x to 3x their standard rates for after-hours emergency services, highlighting the value of 24/7 readiness. This model secures substantial income by addressing critical, time-sensitive client needs.

Integrated Turnaround Services

Integrated Turnaround Services represent a major revenue stream, delivering a comprehensive suite of services during large-scale plant turnarounds. These complex projects bundle essential inspection, mechanical services, and heat treating into high-value contracts. This integrated approach is critical for industrial clients, with such services often contributing over 40% of annual revenue for specialized firms in 2024. The demand for these services remains robust, driven by the need for regulatory compliance and operational efficiency.

- Revenue from integrated turnaround services often exceeds 40% of total annual income for industrial service providers in 2024.

- Typical turnaround projects can range from several million to tens of millions of dollars.

- Demand for these services is projected to grow by 5-7% annually through 2025 due to aging infrastructure.

- These contracts bundle three core services: inspection, mechanical work, and heat treatment.

Consulting & Technical Advisory Fees

A growing revenue stream for Team Inc. is derived from specialized consulting and technical advisory fees, leveraging their deep engineering expertise. This includes services like advanced data analysis and maintenance strategy development, which are high-margin offerings. While specific revenue figures for this segment are not separately disclosed in their 2024 full-year results, their overall services generated $481.0 million in revenue for the year ending December 31, 2024.

- This stream represents a strategic focus on high-value, specialized services.

- It capitalizes on the company's extensive technical knowledge in areas like fitness-for-service assessments.

- These advisory services contribute to the overall profitability and diversification of revenue.

Team Inc. generates revenue through diverse streams, with project-based service fees forming a core component. Stable long-term service contracts, which in 2024 accounted for over 60% of revenue for many industrial providers, offer predictable income. High-value integrated turnaround services, contributing over 40% of annual revenue for specialized firms in 2024, along with emergency call-out premiums (1.5x-3x standard rates), and specialized consulting fees further diversify their income, with overall services totaling $481.0 million in 2024.

| Revenue Stream | 2024 Contribution | Value Driver |

|---|---|---|

| Project Service Fees | Majority Income | Specific Engagements |

| Long-Term Contracts | >60% (Industry) | Predictable Recurring |

| Turnaround Services | >40% (Specialized) | Bundled Solutions |

Business Model Canvas Data Sources

The Team Business Model Canvas is built using internal team performance metrics, project documentation, and stakeholder feedback. These sources ensure each canvas block accurately reflects team capabilities and objectives.