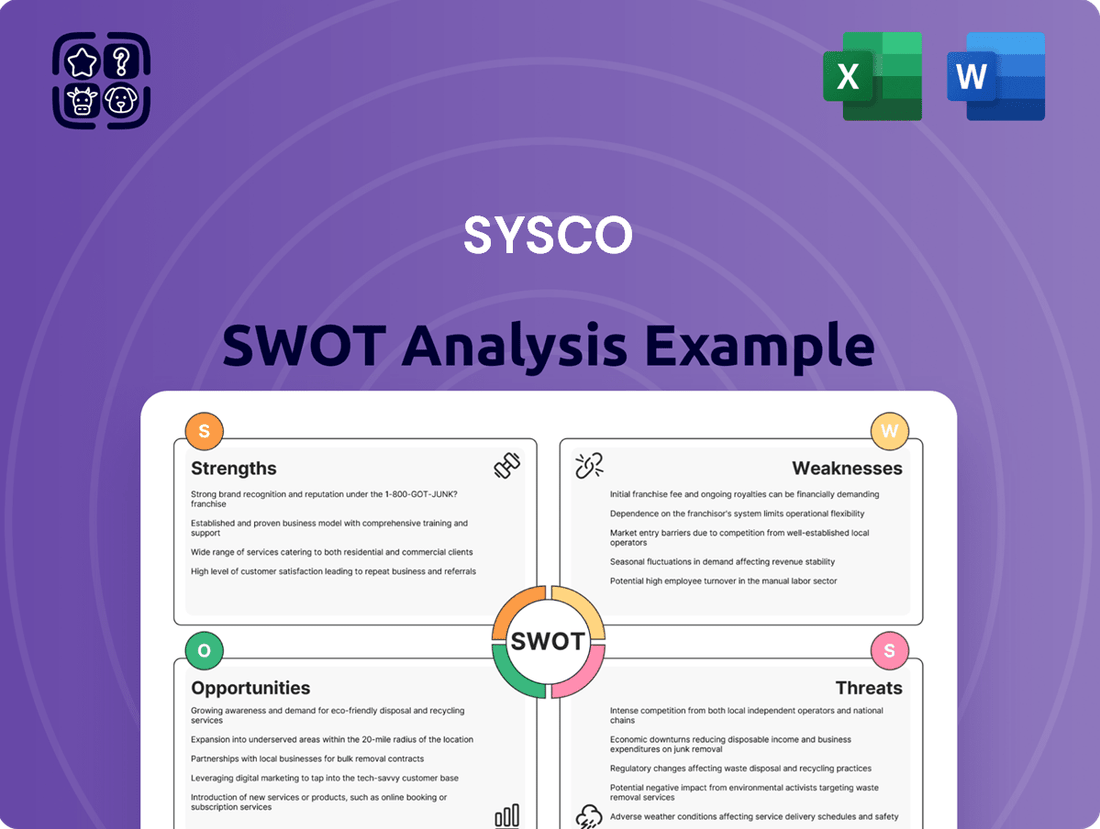

Sysco SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sysco Bundle

Sysco, a giant in foodservice distribution, boasts impressive strengths like its vast network and economies of scale, but also faces significant opportunities in expanding its product lines and digital offerings. However, understanding the full scope of its challenges, such as supply chain disruptions and evolving consumer preferences, is crucial for any strategic decision.

Want the full story behind Sysco’s market position, including a detailed breakdown of its competitive advantages and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Sysco's position as the largest foodservice distributor in the U.S. grants it unparalleled market leadership. In 2023, the company commanded an estimated 17% of the $370 billion U.S. foodservice market, a testament to its vast reach and operational capabilities.

This substantial scale translates directly into significant purchasing power with suppliers. Sysco can negotiate favorable per-unit costs, which in turn allows for healthier gross margins than many of its smaller rivals can achieve.

Sysco boasts an extensive distribution network comprising over 340 facilities strategically located across North America and Europe. This vast infrastructure allows the company to efficiently serve hundreds of thousands of customer locations, ensuring broad market coverage.

The significant route density within this network translates into tangible operational advantages. It enables shorter delivery times and maintains product freshness, which are critical factors in the food service industry.

This widespread presence and logistical efficiency provide Sysco with a substantial competitive edge. Customers benefit from reliable and timely access to a wide array of food products.

As of fiscal year 2023, Sysco's operations spanned across the United States, Canada, the United Kingdom, and Ireland, showcasing the global reach of its distribution capabilities.

Sysco's extensive product catalog, boasting over 500,000 stock-keeping units, is a significant strength. This vast selection spans both food and non-food items, ensuring they can meet a wide array of customer needs.

This diversity allows Sysco to serve multiple market segments, including restaurants, healthcare facilities, educational institutions, and the hospitality industry. This broad reach minimizes dependence on any single economic sector.

By offering a comprehensive procurement solution, Sysco fosters stronger customer loyalty. Clients appreciate the convenience of consolidating their ordering, which simplifies their supply chain management.

For fiscal year 2023, Sysco reported revenue of $72.5 billion. This substantial revenue reflects the success of their broad product strategy and diverse customer engagement.

Strong Financial Performance and Growth Strategy

Sysco has showcased impressive financial strength, reporting $78.8 billion in sales for fiscal year 2024. This performance is coupled with a steady increase in earnings per share, highlighting the company's ability to translate revenue into profit.

The company’s strategic direction, known as the 'Recipe for Growth,' has been a key driver of its success. This strategy prioritizes operational improvements, enhancements to its supply chain network, and the pursuit of strategic acquisitions.

These initiatives have directly translated into profitable market share gains and robust cash flow generation.

- Fiscal Year 2024 Sales: $78.8 billion

- Key Strategy: Recipe for Growth

- Strategic Focus Areas: Operational efficiency, supply chain improvements, strategic acquisitions

- Outcomes: Profitable market share growth, strong cash generation

Commitment to Sustainability and Technology Adoption

Sysco's dedication to sustainability is a significant strength, with substantial investments in eco-friendly products and responsible sourcing. This focus not only bolsters its brand image but also aligns with increasing consumer preferences for environmentally conscious businesses. For instance, Sysco announced plans to reduce its Scope 1, 2, and 3 greenhouse gas emissions by 27.5% by 2034, a clear indicator of this commitment.

The company's proactive adoption of technology, particularly AI and digital tools, is another key advantage. These innovations are instrumental in optimizing operations, from more accurate demand forecasting and streamlined inventory management to efficient route planning for their vast distribution network. Sysco reported that its use of AI in supply chain management contributed to a 5% improvement in on-time delivery rates in early 2024.

- Sustainability Investments: Sysco is actively investing in eco-friendly product assortments and sustainable sourcing practices.

- Waste Reduction Goals: The company has set ambitious waste reduction targets, enhancing its environmental stewardship.

- AI-Driven Efficiency: Leveraging AI for demand forecasting, inventory management, and route optimization is driving significant operational improvements.

- Customer Experience Enhancement: Digital tools are being employed to create a more seamless and responsive customer experience.

Sysco's market leadership as the largest foodservice distributor in the U.S., holding an estimated 17% of the $370 billion market in 2023, provides significant scale advantages. This scale fuels substantial purchasing power, enabling favorable supplier negotiations and healthier gross margins compared to competitors. Its expansive distribution network, with over 340 facilities, ensures broad market coverage and efficient, timely deliveries, enhancing customer satisfaction and loyalty.

Sysco's extensive product catalog, featuring over 500,000 SKUs, caters to diverse customer needs across multiple market segments, reducing reliance on any single industry. The company's 'Recipe for Growth' strategy, focused on operational efficiency and supply chain enhancements, has driven profitable market share gains and robust cash flow. Furthermore, Sysco's commitment to sustainability and its adoption of AI for operational optimization are key differentiators.

| Strength | Description | Supporting Data (FY23/FY24 unless noted) |

| Market Leadership | Largest foodservice distributor in the U.S. | 17% market share in $370 billion U.S. foodservice market (2023) |

| Purchasing Power | Negotiates favorable costs with suppliers due to scale. | Contributes to healthier gross margins than smaller rivals. |

| Distribution Network | Extensive network of over 340 facilities across North America and Europe. | Efficiently serves hundreds of thousands of customer locations; strong route density. |

| Product Breadth | Vast catalog of over 500,000 stock-keeping units (food and non-food). | Serves diverse segments like restaurants, healthcare, and education; enhances customer loyalty. |

| Financial Performance | Strong revenue and earnings growth. | $78.8 billion in sales for fiscal year 2024; increasing earnings per share. |

| Strategic Initiatives | 'Recipe for Growth' driving operational improvements and market share gains. | Focus on efficiency, supply chain, and acquisitions leading to profitable growth and cash generation. |

| Technology Adoption | Leveraging AI for operational optimization. | AI in supply chain contributed to a 5% improvement in on-time delivery rates (early 2024). |

| Sustainability Focus | Investments in eco-friendly products and responsible sourcing. | Plans to reduce Scope 1, 2, and 3 GHG emissions by 27.5% by 2034. |

What is included in the product

Maps out Sysco’s market strengths, operational gaps, and risks by examining its internal capabilities against external market dynamics and competitive pressures.

Offers a comprehensive yet digestible SWOT analysis, helping Sysco identify and address critical operational challenges and market vulnerabilities.

Weaknesses

Sysco’s reliance on the restaurant and hospitality industries makes it particularly vulnerable during economic slowdowns. When consumers cut back on dining out, Sysco's sales volume can drop significantly. For instance, early fiscal 2024 saw a noticeable impact on case volume growth due to a general slowdown in restaurant traffic, directly illustrating this weakness.

Sysco's global operations mean it's susceptible to fluctuations in foreign currency exchange rates. This can make its financial performance unpredictable, as earnings from international sales can be worth less when converted back to U.S. dollars, potentially impacting investor sentiment. For example, in fiscal year 2023, Sysco's international segment revenue was $6.6 billion, a significant portion of its total revenue, making it vulnerable to currency shifts.

Sysco's operational costs are a significant hurdle, with transportation and warehouse upkeep demanding substantial investment. For fiscal year 2023, Sysco reported operating expenses of $35.2 billion, a figure heavily influenced by these logistical demands.

The company's reliance on an extensive supplier network and the inherent complexities of managing a vast inventory are further strained by external pressures. Labor shortages and ongoing transportation disruptions, prevalent throughout 2024, directly impact Sysco's ability to maintain efficient logistics and control inventory levels, adding to operational challenges.

Competitive Pressures in a Fragmented Market

Sysco faces substantial competitive pressures within the fragmented foodservice distribution market. While a leader, the company contends with formidable rivals such as Performance Food Group and US Foods, alongside a multitude of smaller, regional distributors. This intense competition demands constant adaptation and operational excellence to protect its market position and financial performance.

The sheer number of competitors means Sysco must continually innovate its product offerings and streamline its distribution processes. For instance, as of early 2024, the foodservice distribution market is characterized by a significant number of players, contributing to price sensitivity and the need for superior customer service to differentiate.

- Intense Competition: Operates against major players like Performance Food Group and US Foods, and numerous smaller regional distributors.

- Market Fragmentation: The industry structure allows smaller, agile competitors to capture niche markets.

- Price Sensitivity: Competitive pressures often lead to price wars, impacting profit margins.

- Need for Differentiation: Sysco must continuously innovate in product and service to stand out.

Potential for Labor Disputes and Workforce Shortages

Sysco's substantial reliance on a large, diverse workforce presents a significant vulnerability. Potential labor disputes concerning wages, healthcare, and retirement benefits could escalate into strikes, directly impacting its critical distribution network. For instance, in late 2023 and early 2024, several Sysco facilities experienced union contract negotiations that highlighted these ongoing tensions.

Furthermore, persistent workforce shortages, a challenge affecting many industries, could strain Sysco's operational capacity. Such shortages might force over-scheduling of existing employees, leading to burnout and a potential decline in service quality for its extensive customer base. This labor dynamic is a key area to monitor for operational stability.

- Labor Disputes: Sysco's operations are heavily dependent on its unionized workforce, making it susceptible to disruptions from strikes or work stoppages related to contract negotiations.

- Workforce Shortages: Difficulty in attracting and retaining qualified drivers and warehouse staff can lead to increased labor costs and operational inefficiencies.

- Employee Morale: Over-scheduling due to shortages can negatively impact employee morale, potentially affecting productivity and customer service.

- Distribution Impact: Any labor-related disruptions could significantly hinder Sysco's ability to fulfill orders and maintain its delivery schedules, affecting its market position.

Sysco's significant reliance on the cyclical restaurant and hospitality sectors exposes it to economic downturns, as reduced consumer spending directly impacts case volume. For example, early fiscal 2024 saw a slowdown in restaurant traffic affecting Sysco's growth. The company's extensive global operations also make it vulnerable to foreign currency exchange rate fluctuations, which can impact reported earnings; in fiscal year 2023, international revenue was $6.6 billion, highlighting this risk.

High operational costs, particularly those associated with transportation and warehouse maintenance, represent a considerable weakness. Sysco's operating expenses reached $35.2 billion in fiscal year 2023, largely driven by these logistical necessities. Furthermore, managing a vast inventory and a complex supplier network is challenged by external factors like labor shortages and transportation disruptions, which were prominent throughout 2024, hindering efficient logistics and inventory control.

Sysco faces intense competition from major players like Performance Food Group and US Foods, as well as numerous smaller regional distributors, leading to price sensitivity and margin pressure. The fragmented nature of the foodservice distribution market allows agile competitors to gain traction in niche areas, necessitating continuous innovation in product and service offerings to maintain differentiation and market share. This competitive landscape, characterized by many players as of early 2024, demands constant operational excellence.

The company's substantial unionized workforce presents a vulnerability to labor disputes, with potential strikes impacting its critical distribution network. Union contract negotiations in late 2023 and early 2024 underscored these tensions. Additionally, ongoing workforce shortages can strain operational capacity, potentially leading to employee burnout and a decline in service quality for its broad customer base.

| Weakness | Description | Impact | Data Point |

|---|---|---|---|

| Economic Sensitivity | Reliance on cyclical hospitality sector | Reduced sales volume during economic slowdowns | Early fiscal 2024 saw impact from restaurant traffic slowdown |

| Currency Fluctuations | Global operations | Unpredictable financial performance due to exchange rate shifts | FY2023 International segment revenue: $6.6 billion |

| High Operational Costs | Transportation and warehouse upkeep | Substantial investment required, impacting profitability | FY2023 Operating Expenses: $35.2 billion |

| Supply Chain & Inventory Management | Managing vast inventory and supplier network | Vulnerable to labor shortages and transportation disruptions | Labor and transportation issues prevalent throughout 2024 |

Full Version Awaits

Sysco SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You can examine the key strengths, weaknesses, opportunities, and threats impacting Sysco. This comprehensive document is professionally structured for immediate use. Gain valuable insights into Sysco's strategic positioning by purchasing the complete report.

Opportunities

Sysco is strategically focusing on expanding its high-growth specialty product lines, such as fresh produce and premium proteins, recognizing their strong appeal and potential for increased sales. This push into specialized categories is a key driver for future revenue growth, building on the company's existing strengths.

The company sees a significant opportunity to leverage its international presence for further expansion, as evidenced by the robust growth already achieved in its international markets. This suggests a fertile ground for increasing market share and penetration beyond its core U.S. operations.

For fiscal year 2023, Sysco reported that its specialty segments, including produce and protein, demonstrated particularly strong performance, contributing to overall sales growth. The company's international segment also saw a notable increase in sales, exceeding 10% year-over-year, highlighting the viability of its global expansion strategy.

Sysco can significantly boost its operational effectiveness by continuing to invest in digital transformation and artificial intelligence. This includes advanced AI for better demand forecasting, smarter inventory management, and optimized delivery routes, all of which can lead to cost savings and improved customer satisfaction. For instance, in fiscal year 2023, Sysco reported revenue of $37.1 billion, highlighting the scale at which efficiency gains can translate to substantial financial impact.

The company's digital platforms, such as Sysco Shop and Sysco Marketplace, offer a prime opportunity to expand its e-commerce presence and broaden its product selection. These initiatives are crucial for capturing a larger share of the online food service market, which is experiencing robust growth. By enhancing these digital channels, Sysco can create new revenue streams and deepen relationships with its diverse customer base.

Sysco's strategic growth hinges on acquiring companies that broaden its product assortment and extend its reach into new markets. The acquisition of Edward Don, a significant move in the foodservice supplies sector, exemplifies this approach, bolstering Sysco's capabilities beyond traditional food distribution. This strategy is crucial for maintaining market leadership and adapting to evolving customer demands.

By continuing to pursue well-chosen acquisitions, Sysco can integrate new technologies, diversify its revenue streams, and enhance its overall value proposition to clients. For instance, acquiring businesses with strong e-commerce platforms or specialized product lines can provide a competitive edge. These moves are vital for staying ahead in the dynamic foodservice industry.

Furthermore, strategic partnerships offer another avenue for growth and innovation. Collaborating with technology providers, logistics experts, or even complementary businesses can create synergistic opportunities. These alliances can streamline operations, improve customer service, and open doors to untapped market segments, reinforcing Sysco's competitive standing.

Growing Demand for Sustainable and Locally Sourced Products

The increasing consumer and customer preference for sustainable, ethically sourced, and locally grown food is a significant opportunity for Sysco. This trend is reshaping purchasing decisions across the foodservice industry, with a notable uptick in demand for transparency in food origins and production methods. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for food products that are certified sustainable.

Sysco is well-positioned to capitalize on this by further developing and promoting its 'One Planet One Table' initiative and expanding its sustainable agriculture programs. This allows the company to cater to a growing market segment that prioritizes environmental and social responsibility. By strengthening these offerings, Sysco can differentiate itself and capture a larger share of this rapidly expanding market, which is projected to grow by 8-10% annually through 2027.

Key aspects of this opportunity include:

- Expanding product lines featuring locally sourced ingredients: This aligns with consumer desire for freshness and reduced carbon footprints.

- Enhancing transparency in the supply chain: Communicating the origin and sustainability practices of products builds trust and loyalty.

- Partnering with sustainable and ethical producers: Fostering these relationships ensures a consistent supply of in-demand products.

- Leveraging marketing to highlight sustainable offerings: Educating customers about Sysco's commitment can drive sales and brand perception.

Diversification into New Channels and Segments

Sysco has a significant opportunity to broaden its reach beyond its core foodservice customers. This includes tapping into growing segments like healthcare, educational institutions, and even direct-to-consumer models. For instance, by Q1 2024, Sysco reported substantial growth in its specialty segment, indicating a positive reception to diversified offerings.

Expanding into corporate dining and other away-from-home eating sectors presents a chance to capture new revenue streams. This strategic move can help Sysco mitigate risks tied to the volatility often seen in the traditional restaurant industry. In fiscal year 2023, Sysco's adjusted earnings per share saw a healthy increase, partly driven by efforts to diversify its customer portfolio and product offerings.

- Explore growth in non-traditional foodservice channels like corporate cafeterias and institutional dining.

- Develop new product lines and services tailored to emerging market segments such as prepared meal kits or specialized dietary solutions.

- Leverage technology for new distribution models, potentially including e-commerce platforms for specific customer groups.

Sysco can significantly boost its operational effectiveness by continuing to invest in digital transformation and artificial intelligence for better demand forecasting and optimized delivery routes. For instance, in fiscal year 2023, Sysco reported revenue of $37.1 billion, highlighting the scale at which efficiency gains can translate to substantial financial impact.

The company's digital platforms, such as Sysco Shop and Sysco Marketplace, offer a prime opportunity to expand its e-commerce presence and broaden its product selection. These initiatives are crucial for capturing a larger share of the online food service market, which is experiencing robust growth.

Sysco's strategic growth hinges on acquiring companies that broaden its product assortment and extend its reach into new markets, exemplified by the acquisition of Edward Don. This strategy is crucial for maintaining market leadership and adapting to evolving customer demands.

The increasing consumer preference for sustainable, ethically sourced, and locally grown food presents a significant opportunity, with a 2024 survey indicating over 60% of consumers willing to pay more for certified sustainable food. Sysco is well-positioned to capitalize on this by further developing its 'One Planet One Table' initiative, which is projected to grow by 8-10% annually through 2027.

Sysco has a significant opportunity to broaden its reach beyond its core foodservice customers, tapping into growing segments like healthcare and educational institutions. By Q1 2024, Sysco reported substantial growth in its specialty segment, indicating a positive reception to diversified offerings.

Threats

The foodservice distribution landscape is intensely competitive and highly fragmented. Sysco contends with numerous large national rivals and a multitude of smaller, regional players, often sparking price wars that squeeze profit margins. For instance, in 2023, the U.S. foodservice distribution market was valued at approximately $300 billion, with Sysco holding a significant but not dominant share, facing substantial competition from companies like US Foods and Performance Food Group, alongside many smaller, localized operators.

Broader economic challenges, including the potential for economic downturns and persistent high inflation, present a significant threat to Sysco. These macro-economic headwinds can directly impact restaurant volumes and overall consumer spending, which are critical drivers for Sysco's business. For instance, rising product costs, such as those seen in poultry and meat markets, squeeze margins and increase operating expenses.

Inflationary pressures, particularly in food and energy, can erode consumer purchasing power, leading to reduced dining out and a greater focus on value-oriented choices. This directly affects Sysco's customer base, which includes a vast array of food service establishments. The continued volatility in commodity prices throughout 2024 and into early 2025 underscores the ongoing risk to Sysco's profitability and growth projections.

Sysco faces significant threats from global economic uncertainties and geopolitical events that can disrupt its vast supply chain. For instance, the ongoing conflicts and trade tensions in various regions can lead to transportation delays and increased shipping costs, directly impacting Sysco's ability to maintain efficient delivery schedules. These disruptions can also elevate inventory holding costs as products may sit longer than anticipated, potentially leading to spoilage or obsolescence.

Climate-related disruptions, such as extreme weather events, pose another substantial threat. These events can damage crops, affect agricultural yields, and impede transportation routes, all of which are critical for Sysco's food distribution network. In 2023, for example, severe weather impacted agricultural production in key regions, potentially affecting the availability and price of certain food products. These challenges can strain Sysco's operational efficiency and negatively impact customer satisfaction due to inconsistent product availability and delivery times.

Regulatory Changes and Food Safety Concerns

Sysco navigates a landscape heavily influenced by evolving regulations. For instance, shifts in food safety standards, like those potentially introduced by the FDA's Food Safety Modernization Act (FSMA) updates anticipated around 2024-2025, could necessitate significant investments in compliance, thereby increasing operational expenses. Similarly, changes in labor laws, such as minimum wage adjustments or new worker classification rules, could directly impact Sysco's substantial workforce and labor costs.

The potential for food safety incidents presents a significant threat. A single widespread contamination event, even if not directly attributable to Sysco's core operations but impacting its supply chain, could lead to severe reputational damage. For example, widespread recalls of certain food products impacting the broader industry in 2024 could create a ripple effect of consumer distrust, affecting Sysco's sales and market position.

- Increased Compliance Costs: New food safety regulations or environmental policies could raise operating expenses for Sysco.

- Labor Law Impact: Changes in minimum wage or worker classification could affect Sysco's labor expenditures and operational models.

- Reputational Risk: Food safety incidents, even minor ones within the supply chain, can severely damage customer trust and brand perception.

- Supply Chain Vulnerability: Sysco's reliance on a vast network means it's exposed to regulatory and safety issues affecting its suppliers.

Technological Disruption and Cybersecurity Risks

Sysco faces the threat of rapid technological advancements that could upend its established distribution methods. Competitors or new foodservice technology platforms are constantly innovating, potentially offering more efficient or cost-effective solutions that Sysco needs to actively counter.

This increasing reliance on digital infrastructure also makes Sysco vulnerable to cybersecurity risks. A significant data breach or a critical system failure could severely disrupt operations, impact customer trust, and lead to substantial financial losses. For instance, the average cost of a data breach in the retail sector, which shares similar data handling complexities, reached $4.35 million in 2024, highlighting the potential financial exposure.

- Technological Obsolescence: Failure to keep pace with disruptive technologies could cede market share to more agile competitors.

- Cybersecurity Incidents: A major cyberattack could compromise sensitive customer data and disrupt supply chain logistics.

- Increased IT Spending: The need to constantly upgrade technology to remain competitive will likely drive higher operational expenditures.

- Data Integrity and Privacy: Ensuring the security and accuracy of vast amounts of customer and operational data is a continuous challenge.

Sysco's significant market share makes it a target for potential regulatory scrutiny, particularly concerning antitrust issues and pricing practices. Increased governmental oversight could lead to stricter compliance requirements and potential penalties, impacting operational flexibility and profitability. The ongoing focus on supply chain resilience and fair competition in the U.S. foodservice sector by agencies like the Federal Trade Commission (FTC) in 2024 suggests a heightened risk of such interventions.

The company also faces the threat of shifts in consumer preferences, such as a growing demand for plant-based or locally sourced foods, which might not align with Sysco's current product portfolio. Adapting to these evolving tastes requires significant investment in sourcing and logistics, and failure to do so could alienate a growing segment of the market. For instance, the plant-based food market in the U.S. was projected to grow by over 7% annually through 2025, indicating a substantial market shift.

Sysco's extensive supply chain, while a strength, also presents vulnerabilities. Disruptions from natural disasters, labor strikes impacting transportation, or geopolitical instability could severely impact product availability and delivery times. For example, the 2023 disruptions in global shipping routes due to various geopolitical factors highlighted the fragility of such extended networks, leading to increased freight costs and delays for many businesses, including Sysco.

SWOT Analysis Data Sources

This Sysco SWOT analysis is built upon a foundation of robust, verified data, including Sysco's official financial filings, comprehensive market research reports, and expert industry analysis to provide a thorough and actionable assessment.