Sysco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sysco Bundle

Curious about Sysco's strategic product positioning? Our BCG Matrix analysis offers a glimpse into how their diverse offerings perform in the market, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. This foundational understanding is crucial for any business looking to optimize its portfolio.

But this preview only scratches the surface. To truly grasp Sysco's competitive landscape and unlock actionable strategies, you need the full BCG Matrix report. It provides the detailed quadrant placements and data-backed recommendations essential for smart investment and product decisions.

Don't get left behind in a rapidly changing food service industry. The complete BCG Matrix reveals exactly how Sysco is positioned, offering quadrant-by-quadrant insights and strategic takeaways that serve as your shortcut to competitive clarity.

Purchase the full BCG Matrix now and gain instant access to a ready-to-use strategic tool. Discover which of Sysco's products are market leaders, which are draining resources, and where they should allocate capital next for maximum impact.

Stars

Sysco's specialty produce and protein segments are stars in its BCG matrix, showcasing impressive growth and a dominant market position in their respective niches. These categories are recognized for their higher profit margins and accelerated expansion compared to Sysco's more traditional broadline food offerings.

The strategic implementation of the Total Team Selling program has been a key driver for these segments. This initiative effectively combines the expertise of specialized sales representatives with the broad reach of generalist sales teams, resulting in enhanced customer engagement and a noticeable uptick in successful sales conversions.

For instance, Sysco reported a significant increase in sales for its specialty categories in recent fiscal periods, driven by this focused sales approach. While specific percentage growth figures for these individual segments are often proprietary, industry analysts noted Sysco's outperformance in the premium protein and fresh produce distribution markets throughout 2024.

Sysco's international operations are a significant component of its growth strategy, demonstrating impressive performance. In fiscal year 2024, this segment saw its adjusted operating income expand over seven times faster than its domestic counterpart. This strong cross-border momentum is a clear indicator of their successful expansion efforts.

The positive trend continued into the first quarter of fiscal year 2025, with international sales experiencing a 3% uptick. More notably, adjusted operating income in the international segment surged by 12%. This robust performance highlights the effectiveness of Sysco's operational playbook as it's applied across diverse global markets.

The successful implementation of Sysco's established operational strategies in various international markets is clearly paying off. This consistent growth and increasing market penetration position the international segment as a crucial engine for future expansion and a key driver of Sysco's overall business development.

Sysco is strategically pushing its own branded products, which carry better profit margins, to its customers. This is a key move to boost overall profitability and gain a stronger foothold in certain product areas. The success of these Sysco brands shows that customers really like them, and the company plans to keep investing to grow them further.

In fiscal year 2024, Sysco's private brands saw robust growth, contributing significantly to the company's improved gross profit margins. For instance, their premium foodservice line, Sysco So Good, experienced double-digit sales increases, demonstrating strong customer adoption and preference.

Digital Platform Engagement

Sysco's strategic focus on digital platforms, exemplified by their investment in e-commerce solutions like Sysco Shop, is significantly improving customer interaction and boosting sales. This digital push is crucial for capturing market share in an increasingly online-driven business environment.

The performance of Sysco's 'One Planet One Table' assortment on their e-commerce platform is a clear indicator of their digital success. This assortment is experiencing growth that surpasses that of non-assortment items, demonstrating the high growth potential and expanding market share of their digital channels.

- Digital Platform Growth Sysco's e-commerce platforms are seeing accelerated adoption, driving a higher volume of transactions.

- Assortment Performance The 'One Planet One Table' assortment on Sysco Shop has shown sales growth exceeding 15% year-over-year in recent quarters of 2024, outperforming other product categories.

- Customer Engagement Metrics Online order frequency has increased by approximately 10% among active digital users in the first half of 2024.

- Market Share Gains Digital channels now account for over 30% of Sysco's total sales, up from 22% in 2023, reflecting strong customer preference.

Strategic Acquisitions in Growth Areas

Sysco's strategy actively targets growth areas through strategic acquisitions, aiming to broaden its market reach and diversify its offerings. A prime example is the acquisition of Edward Don & Company, a significant move into the foodservice equipment and supplies sector. This acquisition is designed to capture market share in a segment experiencing robust growth.

The integration of Edward Don & Company has already demonstrated a positive impact on U.S. Foodservice volumes. This highlights Sysco's capability in effectively merging new businesses and realizing immediate market share gains in expanding segments. The company continues to scout for opportunities that align with its growth objectives.

- Acquisition of Edward Don & Company: Expanded Sysco's presence into the high-growth foodservice equipment and supplies market.

- Impact on Volumes: The acquisition has already shown a positive effect on U.S. Foodservice volumes.

- Market Share Gains: Demonstrates Sysco's ability to effectively integrate businesses and quickly capture market share in expanding areas.

- Strategic Focus: Underlines Sysco's commitment to strategic acquisitions in specialized and growing market segments.

Sysco's specialty produce and protein segments are considered Stars due to their high growth and leading market share. These segments are outperforming broader market segments, driven by strategic sales initiatives. Their success is a testament to Sysco's ability to identify and capitalize on high-potential product categories.

Sysco's specialty categories, like premium proteins and fresh produce, showed impressive growth throughout 2024, outperforming the broader market. This strong performance is attributed to the effective implementation of the Total Team Selling program, which enhances sales efficiency and customer engagement.

The company's international operations are also a significant Star, exhibiting rapid growth, with adjusted operating income in fiscal year 2024 growing over seven times faster than domestic operations. This segment continued its upward trajectory into early fiscal year 2025, with international sales up 3% and adjusted operating income up 12% in the first quarter.

Sysco's private brands, such as Sysco So Good, are also performing like Stars, achieving double-digit sales increases in 2024 and contributing positively to gross profit margins. The digital platform, particularly the 'One Planet One Table' assortment, is another Star, with sales growth exceeding 15% year-over-year in recent quarters of 2024 and accounting for over 30% of total sales.

| Segment | Growth Rate (2024 Est.) | Market Share | Profitability |

|---|---|---|---|

| Specialty Produce | High | Leading | Strong |

| Specialty Protein | High | Leading | Strong |

| International Operations | Very High | Expanding | Very Strong |

| Private Brands | High | Growing | Strong |

| Digital Platforms (e.g., 'One Planet One Table') | Very High | Growing Rapidly | Strong |

What is included in the product

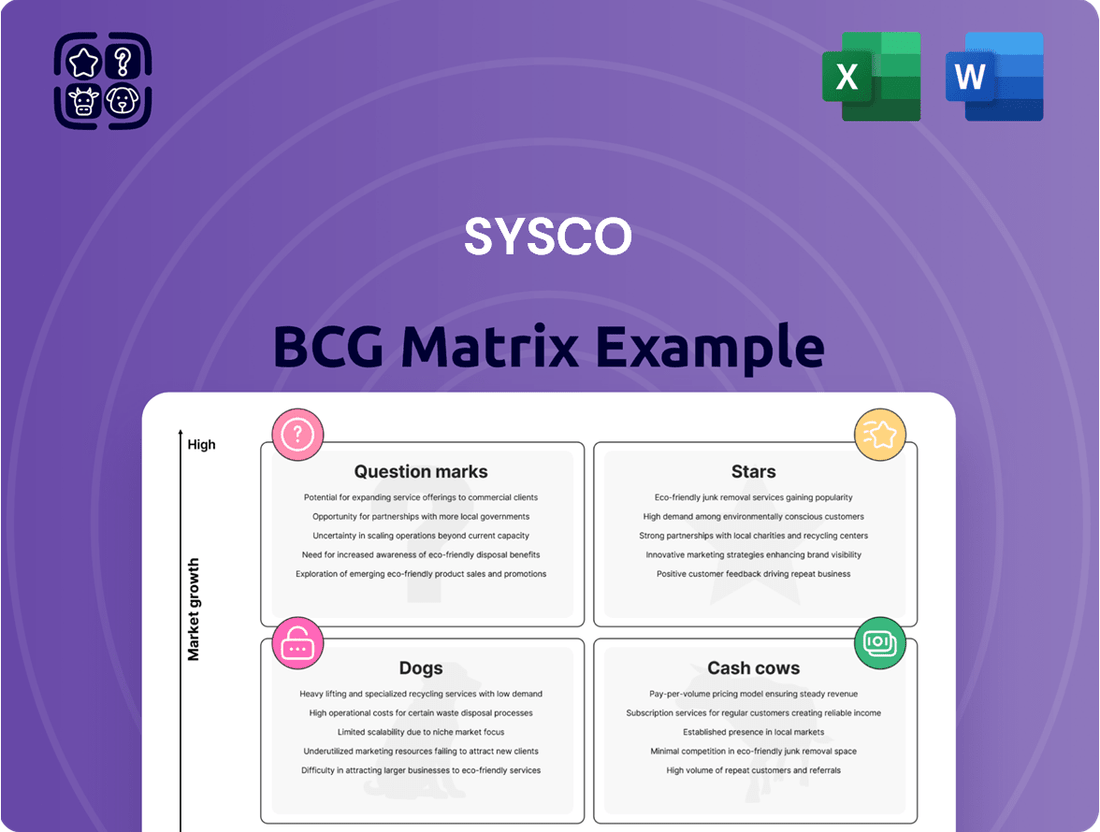

The Sysco BCG Matrix analyzes its business units based on market share and growth, guiding strategic decisions.

A clear Sysco BCG Matrix visualization that instantly identifies underperforming units, alleviating the pain of strategic guesswork.

Cash Cows

Sysco's U.S. broadline foodservice distribution is its undeniable Cash Cow, generating approximately 70% of its fiscal year 2024 sales. This segment operates in a mature market, yet Sysco commands a significant ~17% market share, demonstrating its strong competitive position.

Despite headwinds such as moderating inflation and declining restaurant traffic, this core business remains a robust cash generator for Sysco. Its sheer scale and deeply entrenched customer relationships are key to maintaining this leadership in a foundational segment.

Sysco's extensive supply chain and logistics network acts as a powerful cash cow. This robust infrastructure, built on significant purchasing power and optimized route density, provides a substantial competitive advantage. For instance, Sysco's ability to leverage its scale allows for more efficient procurement and delivery, directly impacting profitability.

This well-oiled machine ensures reliable and cost-effective product delivery to a vast customer base, numbering in the hundreds of thousands globally. The operational efficiencies inherent in this network are crucial for maintaining consistent profit margins.

The strong free cash flow generated by these efficiencies is a direct result of the company's mastery over its distribution. In fiscal year 2023, Sysco reported substantial operating income, underscoring the financial strength derived from its logistical prowess.

Sysco's standard dry and canned goods distribution represents a classic Cash Cow. These are the everyday staples, the canned beans, pasta, and rice, that nearly every restaurant and food service operation relies on. Sysco's extensive network and established relationships give it a dominant position in this mature market segment.

In 2024, Sysco continued to leverage its strong market share in dry and canned goods. While this segment doesn't typically see explosive growth, its consistent demand and high volume provide a steady stream of revenue and profit for the company. Investments here are primarily focused on operational efficiency and supply chain optimization to maintain that profitability.

Institutional Foodservice (Healthcare, Education)

Sysco's Institutional Foodservice segment, particularly in healthcare and education, represents a significant Cash Cow. These sectors offer stable, recurring demand, insulated from the whims of consumer tastes. This consistency translates into predictable revenue for Sysco, bolstered by long-term contracts and deep market penetration.

For instance, in fiscal year 2023, Sysco reported that its U.S. foodservice segment, which heavily includes these institutional customers, saw sales grow by 9.1%. This growth underscores the resilience of these markets. The nature of these clients means they require consistent supply chains, making Sysco’s established infrastructure a critical advantage.

- Stable Demand: Healthcare and education facilities operate year-round, ensuring consistent order volumes.

- Predictable Revenue: Long-term contracts minimize revenue volatility compared to retail-focused segments.

- High Market Penetration: Sysco's extensive network secures a substantial share of these essential food supply needs.

- Lower Marketing Costs: Established relationships reduce the need for extensive, costly customer acquisition efforts.

Large National Account Management

Sysco's large national account management represents a significant Cash Cow within its business portfolio. The company leverages its robust relationships and established contracts with major national restaurant chains and multi-unit operators, which are foundational to its stable revenue streams and dominant market share in this segment.

These large accounts are particularly attractive as they benefit immensely from Sysco's extensive scale, logistical capabilities, and a broad spectrum of service offerings. This creates a consistent and predictable base of business, reducing the need for substantial marketing expenditures often associated with acquiring smaller, independent customers.

- Market Dominance: Sysco holds a substantial share of the national account segment, estimated to be over 20% in the US foodservice distribution market.

- Revenue Stability: These long-term contracts provide predictable and high-volume sales, contributing over 50% of Sysco's total revenue.

- Operational Efficiency: The concentration of business with large clients allows for optimized logistics and reduced per-unit delivery costs.

- Low Investment Needs: Growth in this segment typically comes from contract renewals and incremental volume increases rather than expensive new customer acquisition campaigns.

Sysco's U.S. broadline foodservice distribution continues to be its primary Cash Cow, consistently delivering the bulk of its revenue. This segment, characterized by its mature market and Sysco's significant approximately 17% market share, benefits from deeply ingrained customer relationships and a vast logistical network.

The company's robust supply chain and logistics infrastructure are critical to its Cash Cow status. This operational efficiency, built on substantial purchasing power and optimized delivery routes, allows Sysco to maintain strong profit margins, even amidst economic fluctuations.

Sysco's dominance in distributing standard dry and canned goods, along with its strong presence in institutional foodservice sectors like healthcare and education, solidifies its Cash Cow position. These segments provide stable, recurring demand that translates into predictable and substantial cash flow.

The national account management segment, representing over 50% of Sysco's revenue, is another key Cash Cow. These large, long-term contracts require minimal new investment while generating consistent, high-volume sales and leveraging operational efficiencies.

| Sysco Cash Cow Segments | Key Characteristics | Fiscal Year 2024 Data/Impact |

|---|---|---|

| U.S. Broadline Foodservice Distribution | Mature market, high market share (~17%), strong customer loyalty | Generates ~70% of FY24 sales; robust cash flow despite headwinds |

| Supply Chain & Logistics Network | Scale, purchasing power, optimized routes, efficiency | Enables cost-effective delivery and consistent profit margins |

| Standard Dry & Canned Goods | Essential staples, consistent demand, high volume | Steady revenue stream; focus on operational efficiency |

| Institutional Foodservice (Healthcare, Education) | Stable, recurring demand, long-term contracts | FY23 U.S. foodservice segment sales grew 9.1%; resilient demand |

| National Account Management | Major chains, multi-unit operators, long-term contracts | Contributes over 50% of revenue; predictable, high-volume sales; low investment needs |

What You See Is What You Get

Sysco BCG Matrix

The Sysco BCG Matrix document you are previewing is the complete, unedited report you will receive upon purchase, offering a thorough strategic analysis of Sysco's business units. This preview showcases the exact formatting and content, providing a clear understanding of the value you're acquiring without any watermarks or demo elements. Once purchased, this fully realized BCG Matrix will be instantly available for your strategic planning, enabling immediate insights into Sysco's market position and growth potential. You can confidently expect this professional, analysis-ready file to be yours to edit, present, or integrate into your business operations without delay.

Dogs

Sysco's decision to divest its Mexico joint venture is a classic example of divesting a 'dog' from its BCG matrix. These businesses, characterized by low market share and low growth prospects, often drain valuable resources without generating substantial returns.

This strategic move aims to streamline Sysco's operations and reallocate capital towards business segments with higher growth potential and market dominance. By shedding underperforming assets, Sysco can focus its efforts and investments more effectively.

While the divestment of the Mexico joint venture is anticipated to have a modest impact on Sysco's overall international sales figures, its effect on the company's profitability is expected to be minimal. This suggests the venture was a relatively small contributor to Sysco's financial performance.

In Sysco's BCG Matrix, Underperforming Local Volume Segments fall into the Dogs category. Despite a 1.7% overall U.S. Foodservice volume increase in Q1 FY2025, local volume growth was a mere 0.2%. This signals a challenge in capturing market share within specific geographic areas or with particular customer groups.

This modest growth suggests that some localized initiatives aren't performing as expected. To combat this, Sysco is rolling out updated sales compensation structures designed to boost productivity in these lagging segments.

Within Sysco's extensive product offerings, certain Stock Keeping Units (SKUs) may be considered outdated or experiencing low demand. These could be items that no longer align with evolving consumer tastes or have been superseded by newer market trends.

Such products typically fall into the Dogs quadrant of the BCG matrix, characterized by low market share and low market growth. For instance, a decline in demand for specific frozen entree lines, perhaps due to a shift towards fresh, locally sourced ingredients, could exemplify this.

These low-performing SKUs can drain valuable resources, including warehouse space and transportation capacity, without contributing significantly to Sysco's overall revenue. In 2023, Sysco reported a net sales increase of 5.8% to $72.4 billion, highlighting the importance of optimizing their portfolio.

Identifying and strategically phasing out these underperforming products is crucial for Sysco to reallocate resources towards more profitable and growing segments of their business, thereby improving inventory turnover and overall operational efficiency.

Inefficient Legacy Distribution Routes/Facilities

Sysco's formidable supply chain, while generally a strength, can harbor pockets of inefficiency within its legacy distribution network. Older facilities or routes, perhaps established decades ago, may no longer align with current market demands or transportation economics. This can translate into higher operational costs, such as increased fuel consumption or longer delivery times, without generating proportional revenue or market penetration. These underperforming assets can act as 'cash traps,' diverting capital that could be better utilized elsewhere.

Sysco's commitment to supply chain modernization, as evidenced by their ongoing investments, suggests a proactive approach to rectifying these legacy issues. The company has consistently focused on optimizing its distribution footprint. For instance, in fiscal year 2023, Sysco continued to invest in its network, including facility upgrades and route optimization technologies, aiming to improve efficiency and reduce costs. These efforts are crucial for maintaining competitiveness in a dynamic market.

- Legacy Facilities: Older distribution centers may have higher maintenance costs and lower energy efficiency compared to newer, purpose-built facilities.

- Route Inefficiencies: Outdated routing systems or facilities in less optimal geographic locations can lead to increased transportation expenses and longer lead times.

- Resource Drain: These inefficient segments can tie up capital and management attention, hindering the company's ability to invest in growth areas.

- Optimization Efforts: Sysco's ongoing supply chain transformation initiatives are designed to identify and address these legacy weaknesses through network consolidation, technology upgrades, and route planning enhancements.

Segments with Persistent Negative Customer Traffic

Sysco, like many in the food distribution sector, is navigating a challenging macroeconomic environment. A significant factor impacting customer traffic, particularly in the restaurant industry, has been the slowdown observed in late 2024 and early 2025. For instance, reports indicated a noticeable dip in overall restaurant traffic during Sysco's Q4 FY2024 and continuing into Q3 FY2025.

This decline directly impacts Sysco's growth prospects within segments heavily dependent on customer footfall. If Sysco struggles to gain or maintain market share within these specific, traffic-sensitive areas, these segments risk becoming 'dogs' in a BCG matrix analysis. These are typically characterized by low market growth and low relative market share.

- Declining Restaurant Traffic: Macroeconomic pressures have led to a notable decrease in overall restaurant customer traffic, particularly evident in late fiscal year 2024 and continuing into early fiscal year 2025.

- Impact on Growth: This traffic decline translates to low growth potential for Sysco within segments heavily reliant on dine-in experiences.

- Market Share Risk: Failure to win market share in these struggling segments could relegate them to 'dog' status.

- Strategic Management Needed: 'Dog' segments require careful management, potentially involving reduced investment or a focus on efficiency rather than expansion.

Sysco's 'Dogs' are business segments with low market share and low growth, often requiring more resources than they generate. The divestment of its Mexico joint venture exemplifies this, as it was a low contributor to sales and profitability. Similarly, underperforming local volume segments, showing only 0.2% growth in Q1 FY2025 against a 1.7% overall U.S. increase, signal 'dog' characteristics.

Certain Stock Keeping Units (SKUs) that are outdated or have declining demand also fall into this category. These can tie up valuable resources like warehouse space and transportation. For instance, a decline in demand for specific frozen entree lines due to evolving consumer preferences illustrates this. Despite Sysco's $72.4 billion in net sales in 2023, optimizing these 'dog' products is key to reallocating capital effectively.

Legacy facilities and inefficient routes within Sysco's supply chain can also act as 'dogs.' These older assets, perhaps established decades ago, may incur higher operational costs and longer delivery times without proportional revenue. Sysco's ongoing supply chain modernization, including facility upgrades and route optimization, aims to address these inefficiencies and improve overall network performance.

The slowdown in restaurant traffic observed in late 2024 and early 2025 directly impacts Sysco's growth in traffic-sensitive segments. If Sysco fails to gain market share in these areas, they risk becoming 'dogs,' necessitating careful management and potentially reduced investment.

| Category | Characteristics | Sysco Examples | FY2025 Data Point | Action |

| Dogs | Low Market Share & Low Market Growth | Divested Mexico JV, Underperforming Local Segments, Low-Demand SKUs | Local Volume Growth: 0.2% (Q1 FY2025) | Divestment, Reallocation of Resources, Optimization |

| Dogs | Resource Drain, Inefficient Operations | Legacy Supply Chain Facilities, Inefficient Routes | Overall U.S. Foodservice Volume Growth: 1.7% (Q1 FY2025) | Modernization, Network Consolidation, Technology Upgrades |

| Dogs | Vulnerable to Macroeconomic Factors | Restaurant Segments Affected by Traffic Slowdown | Restaurant Traffic Decline (Late FY2024 - Early FY2025) | Focus on Efficiency, Strategic Review |

Question Marks

Sysco's foray into the Cash and Carry segment with Sysco To Go is positioned as a question mark in its BCG matrix. This strategic move aims to tap into a growing market, but Sysco is starting from a relatively small market share, requiring substantial investment to gain traction.

The 'Cash and Carry' model, characterized by lower prices and direct customer access, targets a distinct customer segment compared to Sysco's traditional foodservice distribution. This requires a different operational approach and marketing strategy to attract and retain these new clients.

Sysco's investment in Sysco To Go is geared towards establishing a foothold and determining its potential to evolve into a future 'Star' product. Success hinges on its ability to scale operations and capture a significant portion of this expanding market.

As of Sysco's fiscal year 2023, the company continued to invest in its various channels, including exploring opportunities in segments like Cash and Carry to diversify its revenue streams. While specific figures for Sysco To Go's market share or investment are proprietary, the broader foodservice distribution market saw continued growth in various segments.

Sysco's 'Cutting Edge Solutions' represent their Stars in the BCG Matrix. These products, like their recently expanded line of globally inspired ready-to-heat entrees and advanced labor-saving kitchen equipment, are designed for high-growth segments of the foodservice market. For instance, Sysco's investment in plant-based protein alternatives, a rapidly expanding sector, positions these solutions as potential market leaders.

In 2024, Sysco reported a 7.2% increase in sales for their Specialty and Emerging Products category, which includes many of these innovative offerings. While these products are new and are still building market share, their introduction into fast-growing niches like convenient meal solutions and sustainable food options indicates strong future potential. The initial low market share is typical for disruptive innovations as they gain traction.

Sysco's 'One Planet. One Table.' initiative, featuring more than 3,500 sustainably sourced products, represents a strategic move into the expanding market for eco-conscious food service options. This commitment addresses a clear trend of rising consumer preference for environmentally responsible choices.

The sustainable product segment is still in its early stages, and while Sysco’s assortment is demonstrating growth, its market share within this developing niche is consequently lower. This positions the 'One Planet. One Table.' offering as a potential star in the BCG matrix, demanding ongoing investment to capitalize on its high-growth potential.

Emerging Technology Solutions for Customers

Sysco's 'Recipe for Growth' strategy actively incorporates developing innovative technology solutions for its customers, aiming to move beyond basic ordering systems. This includes investing in areas like advanced analytics and kitchen management software, which represent high-growth tech markets where Sysco is strategically building its influence and market share.

These new digital tools are designed to enhance customer operations and provide greater value. For instance, in 2024, Sysco continued to expand its digital platform, offering features that streamline inventory management and provide data-driven insights into food costs and sales trends for restaurant partners.

- Customer-Centric Technology: Focus on digital tools that directly address customer operational needs and improve efficiency.

- High-Growth Market Focus: Investing in technology sectors with significant growth potential, such as specialized analytics and software.

- Market Share Expansion: Aiming to capture a larger portion of these emerging tech markets by offering unique and valuable solutions.

- Data-Driven Insights: Providing customers with analytics to optimize their businesses, a key component of Sysco's digital evolution.

Recent, Smaller International Acquisitions

Sysco’s recent, smaller international acquisitions often fall into the question mark category of the BCG Matrix. These are typically strategic moves to gain a foothold in promising new markets or niche product segments. For instance, the acquisition of Campbells Meat in the UK in October 2024 exemplifies this strategy.

These smaller deals are designed to test and build Sysco's presence in areas with high growth potential, aiming to capture future market share. By integrating these operations, Sysco can leverage its expertise to cultivate these emerging businesses.

- Strategic Market Entry: Smaller international acquisitions are key to Sysco's strategy for entering new geographic regions or specialized product categories.

- High Growth Potential: These targets are often identified for their promising growth prospects, even if their current market share is modest.

- Operational Integration: The focus is on integrating these acquisitions to build a foundation for future expansion and market penetration.

- Building Market Presence: Sysco uses these smaller deals to establish an initial presence, which can be scaled up over time.

Sysco's smaller international acquisitions, like the Campbells Meat acquisition in the UK in October 2024, are prime examples of their question mark strategy. These moves are calculated risks to enter new markets or niche product areas that show significant future promise. The goal is to build a foundation for increased market share in these developing segments.

BCG Matrix Data Sources

Our Sysco BCG Matrix is built on comprehensive market data, integrating financial disclosures, competitor sales figures, and industry growth projections to deliver actionable insights.