Sysco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sysco Bundle

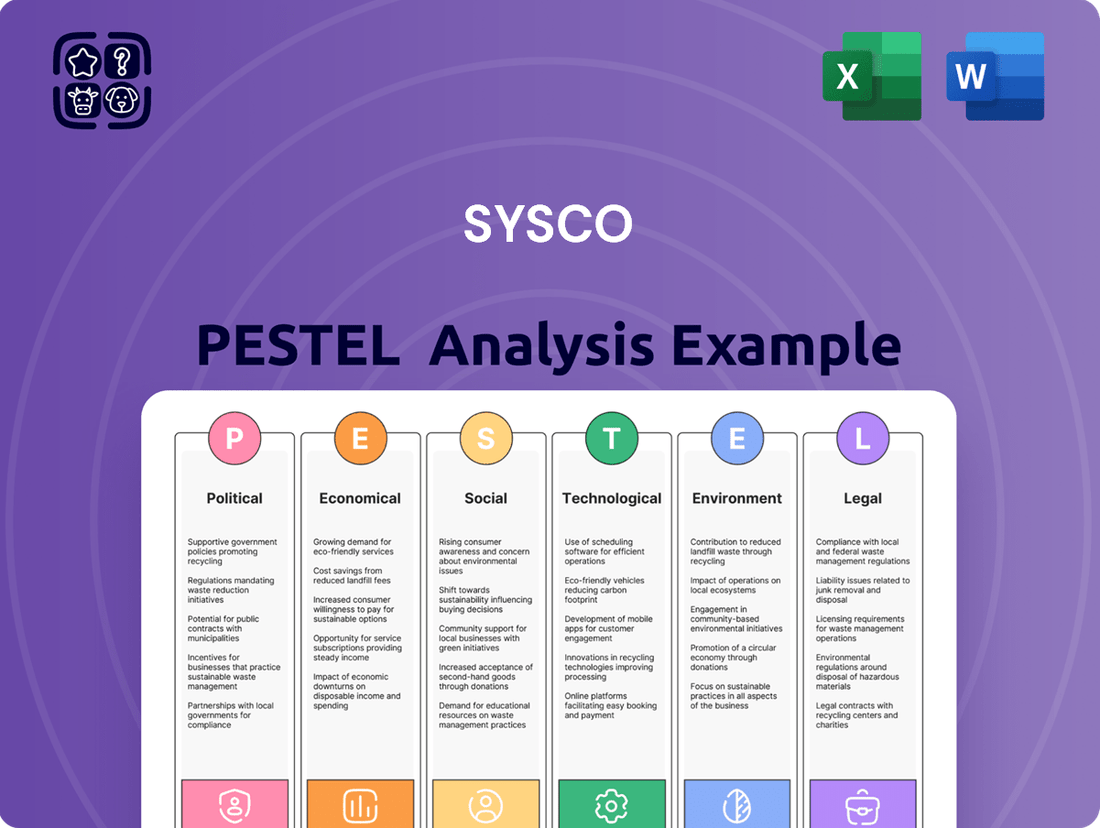

Navigate the complex external forces shaping Sysco's future with our comprehensive PESTLE analysis. Discover how political, economic, social, technological, legal, and environmental factors are impacting the foodservice distribution giant. Gain a critical understanding of the opportunities and threats that lie ahead, empowering you to make informed strategic decisions. Download the full analysis now and equip yourself with the insights needed to thrive in today's dynamic market.

Political factors

Governments globally enforce rigorous food safety, labeling, and quality standards that directly affect Sysco's business. Staying compliant with these evolving regulations, like the FDA's updated 'healthy' food labeling criteria taking effect April 28, 2025, and stricter traceability mandates under FSMA 204, is vital for Sysco to prevent fines and uphold consumer confidence.

Sysco must consistently adjust its procurement, storage, and delivery procedures to align with these changing requirements. For instance, the Food Safety Modernization Act (FSMA) continues to emphasize preventative controls and supply chain oversight, influencing how Sysco manages its vast network of suppliers and distributors.

Sysco's global operations are directly impacted by international trade policies and tariffs. Changes in these agreements can alter the cost of sourcing ingredients and finished goods from various countries, affecting Sysco's profitability.

Trade disputes and geopolitical tensions pose a significant risk to Sysco's supply chain. For instance, a December 2024 analysis highlighted the potential for US tariffs on UK food products, which could increase costs and limit product variety for Sysco's North American operations.

Sysco's operations are significantly impacted by evolving labor laws, such as potential minimum wage hikes and new rules for tipped employees, which directly influence their operational expenses, especially in distribution and customer service roles. For instance, the Bureau of Labor Statistics reported a 4.1% increase in wages for transportation and warehousing occupations in the year ending May 2024, a trend likely to continue impacting Sysco.

The foodservice distribution sector, including Sysco, grapples with persistent challenges in attracting and keeping employees, making strict adherence to labor regulations and strategic workforce planning critical. The U.S. Department of Labor continues to monitor and enforce wage and hour laws, with potential penalties for non-compliance.

Looking ahead to 2025, the industry anticipates continued job creation, but this growth is expected to be coupled with ongoing pressure on labor costs. This means Sysco will need to carefully manage compensation and benefits to remain competitive while navigating regulatory changes.

Public Health Initiatives and Dietary Guidelines

Government-driven public health campaigns and evolving dietary guidelines significantly shape the food industry. Initiatives encouraging reduced consumption of high-fat, sugar, and salt (HFSS) items directly influence consumer purchasing patterns and, consequently, the demand for products Sysco distributes. For example, the UK's upcoming restrictions on HFSS food advertising to children, set to take effect in October 2025, are poised to alter menu choices and sourcing strategies for Sysco's restaurant and foodservice clients.

Sysco must proactively adapt its product portfolio and supply chain to align with these governmental health priorities and the resultant dietary shifts. This includes offering a wider array of healthier alternatives and potentially reducing the prominence of less healthy options in its catalog.

- Government Health Initiatives: Public health programs promoting balanced diets impact consumer demand for specific food categories.

- Regulatory Changes: Restrictions, such as the UK's upcoming HFSS advertising ban in 2025, will influence foodservice providers' procurement and menu development.

- Dietary Trend Alignment: Sysco's ability to cater to growing consumer preferences for healthier options is crucial for market relevance.

Food Waste Reduction Legislation

New legislation globally is pushing businesses to tackle food waste head-on, and Sysco is directly in the crosshairs. For instance, the UK's mandate for businesses to segregate food waste starting April 1, 2025, means Sysco needs to adapt its operations to meet these new requirements. This isn't just a minor adjustment; it necessitates significant changes in how food is handled throughout the supply chain, from procurement to delivery.

The European Union also has ambitious targets, aiming for a 10% reduction in food processing and manufacturing waste by 2030. As a major food distributor, Sysco must implement advanced waste-tracking systems and explore more sustainable disposal methods. These regulations are designed to improve environmental footprints, and companies like Sysco are expected to lead by example.

- UK Food Waste Segregation Mandate: Effective April 1, 2025, requiring businesses to separate food waste.

- EU Food Waste Reduction Target: A 10% decrease in food processing and manufacturing waste by 2030.

- Impact on Sysco: Necessitates investment in robust waste-tracking and eco-friendly disposal solutions.

- Strategic Imperative: Compliance drives operational efficiency and enhances Sysco's sustainability profile.

Government regulations concerning food safety, labeling, and traceability are paramount for Sysco. The FDA's updated healthy food labeling criteria, effective April 28, 2025, and FSMA 204's stricter traceability mandates require continuous adaptation to avoid penalties and maintain consumer trust.

International trade policies and geopolitical tensions directly influence Sysco's sourcing costs and supply chain stability. For example, the potential for US tariffs on UK food products, as analyzed in December 2024, could increase expenses and limit product availability.

Labor laws, including minimum wage adjustments and new regulations for tipped employees, significantly impact Sysco's operational costs. The Bureau of Labor Statistics reported a 4.1% increase in wages for transportation and warehousing occupations by May 2024, a trend expected to continue.

Public health initiatives and dietary guidelines, such as the UK's October 2025 restrictions on HFSS food advertising, shape consumer demand and necessitate Sysco's portfolio adjustments towards healthier alternatives.

What is included in the product

This Sysco PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors impact the company's operations and strategy.

It offers actionable insights for stakeholders by highlighting market dynamics and regulatory influences relevant to Sysco's industry.

A clear, actionable Sysco PESTLE analysis readily available for strategic decision-making, eliminating the guesswork in understanding market dynamics.

Economic factors

Inflation, especially concerning food and labor, directly affects Sysco's bottom line and how it sets prices. While predictions suggest food-away-from-home inflation will ease in 2025, it's still projected to outpace general consumer price index increases. Sysco's Q1 FY2025 results indicated an inflation rate of around 2%, highlighting the ongoing challenge.

Managing procurement expenses and strategically adjusting prices are crucial for Sysco to counter these inflationary forces. This balancing act is essential to maintain competitiveness within the dynamic foodservice industry, ensuring they can absorb rising costs without alienating customers.

Consumer spending habits and the amount of disposable income individuals have are critical drivers for Sysco, as they directly impact the demand for foodservice. When people have more money left over after essential expenses, they're more likely to eat out, which benefits Sysco's restaurant and hospitality clients. This trend is a key economic factor to watch.

Looking ahead to 2025, while the broader economy and consumer spending are projected to stay positive, there are nuances. Consumer confidence levels can fluctuate, and many households are still adjusting to potentially depleted pandemic-era savings. This often leads to a greater emphasis on value and price-conscious decisions from consumers, influencing how Sysco's customers operate.

Sysco's own sales growth is intrinsically linked to the overall health of the economy and, more specifically, to consumers' inclination to spend on dining experiences outside the home. For instance, in Q1 2024, U.S. consumer spending increased at a 3.2% annualized rate, signaling continued demand, but understanding the underlying sentiment is crucial for Sysco's strategic planning.

A robust labor market, while a boon for overall economic activity and consumer spending, presents a direct challenge for companies like Sysco through increased labor costs. This dynamic means that as more people are employed and demand for workers rises, wages tend to climb, directly impacting the operating expenses of foodservice distributors.

Sysco’s Q1 FY2025 performance, for instance, showcased a focus on managing expenses even as the company grew. However, the ongoing difficulty in attracting and keeping qualified employees, alongside the pressure of escalating wage demands, remains a significant factor in their operational cost structure, impacting profitability.

To counteract these rising labor expenses, Sysco, like many in the industry, is increasingly investing in automation and operational efficiency improvements. These strategies are crucial for mitigating the financial impact of a tight labor market and the associated wage inflation that distributors must navigate.

Economic Growth and Recession Concerns

Economic growth significantly impacts the foodservice sector. While recession fears were present in 2024, the outlook for 2025 remains positive, with projections indicating 1.0% real growth for the industry. Sysco's sales in Q1 FY2025 demonstrated this link, increasing by 4.4% as the broader economy expanded.

This economic expansion directly supports Sysco's business model. As consumer spending power generally rises with GDP growth, demand for restaurant meals and catering services, Sysco's core offerings, tends to increase. Conversely, any slowdown or contraction in GDP could lead to reduced discretionary spending, negatively affecting Sysco's sales volumes.

- GDP Growth: Positive GDP growth into 2025 underpins industry health.

- Foodservice Industry Growth: Projected 1.0% real growth for the foodservice sector in 2025.

- Sysco's Sales Performance: Q1 FY2025 saw a 4.4% increase in sales, reflecting economic tailwinds.

- Recessionary Impact: Mild recession concerns in 2024 highlighted the sensitivity of the sector to economic downturns.

Interest Rates and Access to Capital

Fluctuations in interest rates directly affect Sysco's borrowing costs for crucial capital expenditures and potential acquisitions. For instance, if the Federal Reserve maintains its target range for the federal funds rate, as it did through much of early 2024, this can keep borrowing costs relatively stable. Conversely, rising rates, as seen in previous tightening cycles, would increase the expense of financing new ventures or expanding its fleet and facilities.

Sysco's strategic initiatives, including potential mergers and acquisitions, are significantly influenced by the prevailing cost of capital. A lower interest rate environment, such as the period preceding 2022, generally makes debt financing more attractive, potentially enabling more aggressive M&A strategies. For example, if Sysco were to pursue a major acquisition in 2024, the interest rate on the associated debt would be a critical factor in determining the deal's financial viability and potential return on investment.

Moreover, interest rates impact Sysco's diverse customer base, from independent restaurants to large healthcare facilities. Higher rates can dampen their ability to invest in new equipment, renovations, or expansion projects, thereby reducing demand for Sysco's products and services. Conversely, a stable financial environment with manageable interest rates supports customer growth, which in turn benefits Sysco's top-line performance.

- Interest Rate Impact: Sysco's borrowing costs for capital projects and acquisitions are directly tied to interest rate movements.

- Customer Spending: Higher rates can limit customer investment and expansion, potentially reducing Sysco's sales volume.

- Strategic Financing: The cost of capital is a key determinant in the feasibility of Sysco's M&A and growth strategies.

- Economic Stability: A predictable interest rate environment supports both Sysco's financial planning and its customers' business health.

Economic growth and consumer spending are key indicators for Sysco's performance, with projections for 2025 suggesting continued positive trends for the foodservice industry, estimated at 1.0% real growth. Sysco's own sales in Q1 FY2025 reflected this economic momentum, rising by 4.4%, demonstrating a clear correlation between broader economic expansion and demand for their distribution services. While recessionary concerns in 2024 highlighted the sector's sensitivity, the current outlook supports increased consumer spending on dining out, a primary driver for Sysco's business.

Inflation, particularly in food and labor, continues to be a significant factor, with food-away-from-home inflation expected to outpace general CPI in 2025, though at a moderating pace. Sysco's Q1 FY2025 results showed an inflation rate around 2%, underscoring the need for careful procurement and pricing strategies to manage these rising costs. The company must balance absorbing these expenses with maintaining competitive pricing to retain its customer base in a dynamic market.

Interest rates play a crucial role in Sysco's financial strategy and its customers' investment capacity. Stable interest rates, as observed through early 2024, can support borrowing for capital expenditures and acquisitions, while rising rates increase financing costs and can dampen customer expansion. Managing the cost of capital is therefore essential for Sysco's M&A activities and overall growth strategy, as well as for supporting the financial health of its diverse customer base.

| Economic Factor | 2024 Outlook | 2025 Projection | Sysco Impact | Data Point |

| GDP Growth | Mixed, some recession fears | Positive | Supports foodservice demand | Industry growth projected at 1.0% |

| Inflation (Food Away From Home) | Elevated | Moderating, but still above CPI | Increases procurement and operating costs | Sysco Q1 FY2025 inflation ~2% |

| Consumer Spending | Positive | Expected to remain strong | Drives demand for dining out | Q1 FY2024 US consumer spending +3.2% |

| Interest Rates | Stable to rising | Uncertain, potential for cuts | Affects borrowing costs and customer investment | Federal Reserve target range maintained |

| Labor Market | Tight | Expected to remain tight | Increases labor costs, drives automation investment | Ongoing challenge in attracting/retaining staff |

What You See Is What You Get

Sysco PESTLE Analysis

The preview shown here is the exact Sysco PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the Sysco PESTLE Analysis product you’re buying—delivered exactly as shown, no surprises.

The content and structure of this Sysco PESTLE Analysis shown in the preview is the same document you’ll download after payment.

The file you’re seeing now is the final Sysco PESTLE Analysis version—ready to download right after purchase.

Sociological factors

Consumers are increasingly prioritizing health and wellness, driving demand for natural, organic, and plant-based foods. This shift is a significant sociological factor influencing the food service industry. Sysco's 'One Planet One Table' initiative, featuring over 3,500 sustainably sourced items, directly addresses this growing preference for healthier and ethically produced food.

The ongoing demand for convenience and ready-to-eat meals is reshaping how consumers eat. This means people want quicker, more adaptable ways to get their food and easy online ordering. For Sysco, this translates to supporting its clients, like restaurants, in meeting these needs through flexible order sizes and dependable delivery.

In 2024, the global convenience food market was valued at over $300 billion, with projections showing continued growth. This trend is fueled by busy lifestyles and a desire for quick meal solutions, impacting how foodservice businesses operate and what Sysco needs to supply.

The rise of e-commerce and direct-to-consumer models further emphasizes this shift. Sysco's ability to facilitate these channels for its customers, offering a wider range of convenient options and streamlined digital platforms, is crucial for adapting to evolving consumer preferences.

Consumer demand for sustainability is significantly impacting the food service industry, with younger demographics leading the charge. A substantial portion of Gen Z and Millennial consumers actively seek out restaurants and food suppliers that demonstrate strong ethical sourcing and environmental responsibility.

Sysco is actively addressing these evolving consumer preferences, as evidenced by its progress in sustainability initiatives. For instance, the company has already surpassed its 2025 goal for sourcing certified sustainable coffee, a testament to its proactive approach. Furthermore, Sysco's support for sustainable beef production, detailed in its 2024 Sustainability Report, showcases its commitment to a more environmentally conscious supply chain.

By prioritizing responsible sourcing and implementing eco-friendly operational practices, Sysco is not only meeting but also anticipating market shifts. This focus strengthens its brand image and resonates deeply with a growing segment of consumers who make purchasing decisions based on ethical and environmental considerations.

Demographic Shifts and Cultural Diversity

Demographic shifts significantly impact food preferences. For instance, the aging population in many developed nations often seeks convenient, healthier meal options, while a younger demographic might be more adventurous, embracing global flavors. Sysco, as a major food distributor, needs to stay ahead of these trends. In 2024, the U.S. Hispanic population alone represented over 62 million people, a key demographic with distinct culinary traditions that Sysco must cater to.

Cultural diversity is another powerful driver. The increasing popularity of international cuisines, such as Korean, Vietnamese, and Filipino, is undeniable. Sysco's ability to source and supply ingredients for these growing culinary markets is crucial for its continued success. By offering a wider variety of authentic international products, Sysco can capture a larger share of the market and meet the evolving tastes of its diverse customer base.

- Growing Demand for Ethnic Foods: Reports from 2024 indicate a consistent double-digit growth in consumer spending on ethnic foods, outpacing general grocery sales.

- Aging Population Needs: By 2030, over 20% of the U.S. population is projected to be 65 or older, increasing demand for easily prepared, nutritious meals.

- Millennial and Gen Z Preferences: These younger demographics are driving the adoption of plant-based diets and novel flavor profiles, influencing restaurant menus and Sysco's product sourcing.

- Multicultural Consumer Spending: The purchasing power of diverse ethnic groups is substantial, with the U.S. Asian American market alone projected to reach $1.6 trillion in spending by 2025, highlighting opportunities for specialized product lines.

Labor Force Dynamics and Employee Expectations

The foodservice and distribution sectors are experiencing significant shifts in their labor force. We're seeing increased participation from younger demographics, such as teenagers and young adults, who often bring different priorities to the workplace. This evolving landscape means companies like Sysco must adapt to changing employee expectations, particularly concerning work-life balance and equitable compensation. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that the leisure and hospitality sector, which includes foodservice, faced persistent labor shortages, with job openings often exceeding the number of unemployed individuals seeking work.

To effectively attract and retain talent, Sysco must focus on creating a compelling employee value proposition. This includes offering competitive wages and benefits packages, alongside fostering a positive and supportive work environment. The ability to meet these evolving demands is crucial for maintaining operational efficiency and ensuring high service quality. In 2025, industry surveys indicated that a significant percentage of frontline workers prioritized flexible scheduling and opportunities for career advancement, alongside fair pay, as key factors in job satisfaction and retention.

These labor dynamics directly influence Sysco's ability to operate smoothly and deliver on its service commitments. Challenges in staffing can lead to increased operational costs due to overtime or reliance on temporary labor, and can also impact delivery schedules and customer satisfaction.

- Teenage and young adult participation in the labor force is growing.

- Employee expectations now heavily favor work-life balance and fair wages.

- Sysco faces retention challenges due to industry-wide staffing difficulties.

- Operational efficiency and service quality are directly impacted by labor availability.

Sociological factors highlight changing consumer lifestyles and preferences that directly affect the food industry. The increasing demand for convenience, driven by busy schedules, is a major trend. This is evidenced by the global convenience food market, valued at over $300 billion in 2024, which continues to expand.

Health and wellness consciousness is also on the rise, with consumers seeking more natural, organic, and plant-based options. This is particularly strong among younger demographics like Millennials and Gen Z, who are actively influencing menu trends and product sourcing for companies like Sysco. Sysco's commitment to sustainable sourcing, with over 3,500 such items available, addresses this crucial shift.

Demographic changes, such as an aging population needing simpler meal solutions and a growing multicultural consumer base with diverse culinary tastes, also shape demand. For example, the U.S. Hispanic population, exceeding 62 million in 2024, presents significant opportunities for specialized product offerings. Sysco must adapt its supply chain to cater to these evolving tastes and needs.

| Sociological Factor | Impact on Foodservice | Sysco's Response/Opportunity | Relevant Data (2024-2025) |

| Demand for Convenience | Shorter prep times, ready-to-eat meals, online ordering | Flexible order sizes, reliable delivery, streamlined digital platforms | Global convenience food market > $300 billion (2024) |

| Health & Wellness Focus | Increased demand for organic, plant-based, natural foods | Expansion of sustainably sourced products, catering to dietary needs | Millennial & Gen Z driving plant-based trends |

| Demographic Shifts | Aging population seeks easy meals; multicultural groups desire authentic cuisines | Diverse product sourcing, catering to specific ethnic markets | U.S. Hispanic population > 62 million (2024) |

Technological factors

Sysco is heavily invested in digital transformation, a trend accelerating across the food distribution industry. This strategic shift aims to enhance operational efficiency and provide a competitive advantage. The company's launch of 'Sysco Marketplace' and its e-commerce platform, 'Sysco Shop,' exemplify this commitment, offering customers digital ordering, improved inventory management, and real-time tracking capabilities.

These digital initiatives are designed to significantly boost the customer experience and streamline internal processes. By facilitating better data exchange, Sysco's platforms are making it easier for both customers and suppliers to interact with the company, leading to more efficient transactions and a more integrated supply chain.

Advanced data analytics and AI are increasingly vital for optimizing supply chains, a crucial area for Sysco. These technologies enhance demand forecasting and traceability, allowing Sysco to pinpoint inefficiencies and reduce waste. For instance, by implementing predictive analytics, Sysco can better manage its vast inventory, minimizing spoilage and ensuring product availability, which is paramount in the food distribution sector.

Sysco's adoption of real-time tracking and predictive analytics directly addresses the inherent complexities of global food distribution. These tools enable proactive management of potential disruptions, such as weather events or transportation delays, thereby improving overall operational efficiency. By gaining deeper insights into pricing and margins through sophisticated analytics, Sysco can navigate market volatility more effectively and maintain a competitive edge.

The integration of robotics and process automation within Sysco's extensive network of distribution centers is a significant technological factor. These advancements are crucial for enhancing operational efficiency, a key concern for a company managing a vast food supply chain. By automating tasks such as sorting, cutting, and packaging, Sysco can expect a notable reduction in labor costs. For instance, many logistics companies are seeing productivity gains of 20-30% through automation, directly impacting Sysco's bottom line.

Furthermore, automation plays a vital role in addressing the persistent labor shortages that have been affecting the logistics and food service industries. In 2024 and projected into 2025, the demand for warehouse workers continues to outstrip supply. Robotics can fill these gaps, ensuring smoother operations and faster order fulfillment. This also translates to improved food safety, as automated systems minimize human contact with products, reducing the risk of contamination.

Sysco's investment in automation, therefore, is not just about keeping pace but about gaining a competitive edge. The company's ability to manage inventory more effectively through automated systems, potentially reducing spoilage rates which can be as high as 10-15% for certain perishable goods, is a tangible benefit. These technological shifts are reshaping the logistics landscape, making them essential for Sysco's continued growth and operational excellence.

Food Safety and Traceability Technologies

Technological advancements are significantly reshaping food safety and traceability. New regulations, like the FDA's Food Traceability Rule, are compelling investments in technologies such as advanced pathogen detection and real-time monitoring systems. These systems are crucial for ensuring the safety and integrity of the food supply chain. For example, by mid-2025, companies are expected to have robust traceability systems in place for certain high-risk foods, a deadline driving adoption of these advanced solutions.

Sysco is actively integrating technology-enabled traceability systems to bolster product quality and minimize recall risks. This strategic adoption enhances visibility across the entire supply chain, from initial sourcing to the final customer. By implementing these systems, Sysco aims to meet stringent compliance standards and proactively manage any potential safety concerns, thereby building greater consumer trust.

Blockchain technology is emerging as a key player in enhancing food traceability by providing an immutable ledger of transactions and product movements. This technology allows for swift identification of the source of contamination or issues, reducing the scope and impact of recalls. Sysco's commitment to such technologies underscores the industry's broader shift towards proactive safety management and data-driven quality assurance.

- FDA Food Traceability Rule: Mandates enhanced record-keeping and traceability for specific food categories, driving technology investment.

- Advanced Pathogen Detection: Technologies that can identify harmful bacteria and viruses faster and more accurately are becoming essential.

- Real-Time Monitoring: Systems that track temperature, humidity, and other critical factors throughout the supply chain ensure product integrity.

- Blockchain Adoption: Increasingly utilized to create transparent and secure records of food product journeys, enhancing recall efficiency.

Sustainable Technology and Eco-friendly Innovations

Technological advancements are pivotal for Sysco to meet its sustainability objectives, focusing on areas like reducing carbon emissions, improving upcycling processes, and developing eco-friendly packaging solutions. For instance, Sysco is actively implementing energy and water conservation technologies across its operations, a move that directly addresses growing consumer preferences for environmentally responsible brands and increasing regulatory mandates. This strategic focus on sustainability technology is crucial for maintaining market relevance and operational efficiency in the evolving food service landscape.

Sysco’s commitment to innovation extends to its fleet, with explorations into alternative fuels and advancements in vehicle efficiency to lower its carbon footprint. Furthermore, the company's investment in eco-friendly packaging materials, such as exploring innovations in bioplastic packaging, directly responds to market demand. These technological integrations are not just about compliance but are becoming a competitive differentiator in 2024 and beyond. For example, by 2023, Sysco had already committed to reducing its Scope 1 and 2 greenhouse gas emissions by 27.5% from a 2019 baseline, showcasing a tangible impact of their technology adoption.

- Energy and Water Conservation: Sysco is integrating technologies to reduce resource consumption in its distribution centers and facilities.

- Sustainable Packaging: Research and development into bioplastics and other eco-friendly packaging alternatives are ongoing.

- Fleet Efficiency: Exploration of alternative fuels and optimized logistics technologies aims to lower transportation-related emissions.

- Upcycling Innovations: Technology is being leveraged to find new uses for byproducts and reduce waste sent to landfills.

Sysco's technological advancements are crucial for enhancing food safety and traceability, driven by regulations like the FDA's Food Traceability Rule. Technologies for advanced pathogen detection and real-time monitoring are becoming essential, with compliance deadlines approaching in mid-2025 for certain high-risk foods, necessitating robust systems for product integrity and recall management.

Legal factors

Sysco navigates a complex web of food safety regulations, primarily governed by agencies like the Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA). These regulations are not static; they are continuously evolving to address emerging public health concerns and scientific advancements.

Key upcoming changes, such as the FDA's Food Traceability Final Rule and revised Salmonella thresholds for poultry set for mid-2025, demand significant adjustments. These mandates will require Sysco to implement more rigorous record-keeping practices and enhanced microbial testing throughout its extensive supply chain.

Failure to adhere to these stringent food safety standards can lead to severe consequences. These include substantial financial penalties, product recalls, and significant damage to Sysco's hard-earned reputation, impacting customer trust and market share.

Sysco operates under a complex web of labor and employment laws, covering everything from minimum wage and overtime to worker classification and crucial workplace safety standards. These regulations are not static; for instance, potential shifts in tipped minimum wage laws or new state-specific employment mandates could directly affect Sysco's operational expenses and how it manages its vast human capital. In 2024, the debate around minimum wage increases continued across many states, with some jurisdictions seeing adjustments that could add to labor costs for companies like Sysco.

Sysco faces growing legal hurdles driven by environmental mandates. For instance, new UK and EU laws are pushing for food waste reduction, with targets set for 2025 and 2030, requiring significant investment in compliant waste management and recycling infrastructure.

The company must also navigate evolving regulations concerning packaging materials, particularly those containing per- and polyfluoroalkyl substances (PFAS), which are increasingly restricted in food contact applications.

Furthermore, stricter corporate sustainability reporting requirements, now standard in many jurisdictions, compel Sysco to meticulously track and disclose its environmental performance, adding another layer of legal compliance to its operations.

Antitrust and Competition Laws

Antitrust and competition laws are critical for Sysco, a major player in foodservice distribution. These regulations aim to foster a level playing field by preventing monopolistic practices. For instance, in 2023, Sysco faced scrutiny over certain acquisition strategies, highlighting the need for meticulous compliance checks.

Sysco's market position means its every move, from mergers to competitive tactics, must align with these laws. Failure to do so could lead to significant legal hurdles, including substantial fines. The company must continuously monitor evolving regulatory landscapes to ensure its business practices remain compliant, especially in regions with strong antitrust enforcement.

- Regulatory Scrutiny: Sysco's significant market share in foodservice distribution invites close examination by antitrust authorities globally.

- Merger and Acquisition Compliance: All proposed acquisitions and mergers must undergo rigorous review to ensure they do not unduly restrict competition.

- Competitive Strategy Adherence: Sysco's pricing, distribution, and supplier agreements are subject to review for fairness and to prevent anti-competitive behavior.

- Potential Penalties: Non-compliance can result in hefty fines and mandated changes to business operations, impacting profitability and market access.

International Trade Laws and Customs Regulations

Sysco's global reach means navigating a complex web of international trade laws and customs regulations. These rules dictate how goods can move across borders, affecting everything from product sourcing to final delivery. For instance, Sysco must comply with differing import and export tariffs and documentation requirements in countries like Canada and Mexico, where it has significant operations.

Political changes can dramatically alter the landscape of international trade. The ongoing adjustments following Brexit continue to impact trade flows between the UK and the European Union, necessitating Sysco to refine its supply chain strategies and potentially incur higher logistics costs. Such shifts demand constant vigilance and adaptability in Sysco's cross-border operations.

Failure to adhere to these legal frameworks carries substantial risks. Non-compliance can result in costly import delays, unexpected customs duties, and even legal challenges. In 2023, the U.S. International Trade Commission reported an increase in trade disputes, highlighting the importance of robust compliance programs for companies like Sysco engaged in international commerce.

- Adherence to Diverse Trade Laws: Sysco must comply with varying import/export regulations and customs duties across its international markets.

- Impact of Political Shifts: Events like Brexit necessitate strategic adjustments to cross-border logistics and sourcing in regions like the UK and EU.

- Consequences of Non-Compliance: Violations can lead to significant operational disruptions, increased expenses, and legal ramifications for Sysco.

- Global Trade Environment: As of late 2024, global trade tensions and evolving regulations continue to pose challenges for multinational food distributors.

Sysco's operations are heavily influenced by labor laws, including minimum wage, overtime, and worker classification, with potential state-level adjustments in 2024 impacting labor costs. Environmental regulations are also critical, with upcoming mandates in the UK and EU targeting food waste reduction by 2025 and 2030, necessitating investments in waste management. Furthermore, Sysco must navigate increasing restrictions on PFAS in food contact materials and stricter corporate sustainability reporting requirements across various jurisdictions.

Environmental factors

Climate change directly impacts agricultural output, threatening the raw materials Sysco distributes. In 2024, droughts in key agricultural regions, like parts of the U.S. Midwest, led to an estimated 10-15% reduction in corn yields compared to the previous year, increasing input costs.

Extreme weather events, such as the widespread flooding experienced in Southeast Asia in early 2025, disrupted transportation networks and caused significant spoilage of perishable goods. This necessitates Sysco's focus on building more resilient and diversified sourcing strategies to buffer against such disruptions.

Sysco's investment in supporting sustainable agriculture practices, including water-efficient irrigation and soil health initiatives, is crucial for mitigating these long-term risks. By 2025, the company aims to source 30% of its produce from farms employing advanced climate-resilient farming techniques.

Reducing food waste is a major environmental goal, and regulations are increasingly pushing businesses to separate food waste. This trend directly impacts how companies like Sysco manage their operations and supply chains.

Sysco has set an ambitious target to divert 90% of its operational and food waste from landfills by 2025. This commitment, outlined in their 2024 Sustainability Report, demonstrates a clear strategy for enhancing resource efficiency and minimizing their environmental impact.

Achieving this 90% diversion rate by 2025 is crucial for Sysco to meet regulatory demands and consumer expectations for sustainable business practices. It also signifies a move towards a more circular economy model for food distribution.

Consumers, investors, and regulators are increasingly demanding that companies source materials sustainably and operate ethically. Sysco is responding to this pressure through initiatives like its 'One Planet One Table' assortment, which focuses on responsibly sourced products, and by exceeding its coffee sourcing commitments. These actions directly address the growing expectation for businesses to mitigate negative environmental, social, and ethical impacts throughout their supply chains.

Packaging Waste and Circular Economy Initiatives

The escalating concern over plastic pollution and packaging waste is a significant environmental factor influencing Sysco. This trend fuels a growing demand for packaging that is not only eco-friendly but also biodegradable. Sysco has proactively responded by establishing stringent packaging guidelines for its suppliers and implementing internal changes aimed at reducing plastic and corrugate waste, a move that has already resulted in savings of millions of pounds.

Sysco's commitment to a circular economy is a key component of its environmental strategy. This involves a multifaceted approach that prioritizes increased recycling rates and the adoption of compostable materials across its operations.

- 2023 Sustainability Report: Sysco reported progress in reducing its environmental footprint, including advancements in packaging sustainability.

- Supplier Engagement: Sysco's supplier guidelines focus on promoting responsible packaging sourcing and waste reduction.

- Waste Reduction Targets: The company continues to set and work towards ambitious targets for decreasing overall waste, particularly from packaging materials.

Carbon Footprint and Fleet Decarbonization

Sysco faces significant environmental pressures to reduce its carbon footprint, particularly concerning its extensive fleet operations. The company has committed to powering 20% of its fleet vehicles with alternative fuels by 2025, a substantial undertaking aimed at mitigating greenhouse gas emissions. This initiative is critical for remaining competitive and compliant with evolving environmental regulations.

Achieving these decarbonization goals requires strategic investments in sustainable technologies. Sysco is actively exploring and integrating electric vehicles (EVs) into its fleet, alongside sourcing renewable energy for its distribution centers and facilities. These efforts are not just about environmental responsibility but also about long-term operational efficiency and cost savings.

- Fleet Decarbonization Target: Power 20% of fleet vehicles with alternative fuels by 2025.

- Investment Focus: Increasing adoption of electric vehicles and renewable energy sources for facilities.

- Operational Impact: Reducing Scope 1 and Scope 2 emissions from transportation and facility energy consumption.

Sysco's environmental strategy addresses climate change impacts on agriculture, aiming to source 30% of produce from climate-resilient farms by 2025. Initiatives focus on reducing food waste, targeting a 90% diversion from landfills by 2025, and promoting sustainable packaging to minimize plastic and corrugate waste, a move that has already yielded millions of pounds in savings.

The company is also committed to reducing its carbon footprint, with a goal to power 20% of its fleet with alternative fuels by 2025, integrating electric vehicles and renewable energy sources to enhance operational efficiency and meet regulatory demands.

| Environmental Factor | Sysco's Response/Initiative | Target/Data (2024/2025) | Impact |

| Climate Change & Agriculture | Sourcing from climate-resilient farms | 30% of produce by 2025 | Mitigates supply chain disruptions, stabilizes input costs |

| Food Waste Reduction | Waste diversion programs | 90% diversion from landfills by 2025 | Enhances resource efficiency, meets regulatory expectations |

| Packaging Sustainability | Reducing plastic and corrugate waste, promoting eco-friendly materials | Millions of pounds saved in waste reduction | Minimizes environmental impact, meets consumer demand |

| Carbon Footprint (Fleet) | Transitioning to alternative fuels and EVs | 20% of fleet powered by alternative fuels by 2025 | Reduces greenhouse gas emissions, improves operational efficiency |

PESTLE Analysis Data Sources

Our Sysco PESTLE Analysis is informed by a diverse range of data, including reports from major economic bodies like the World Bank and IMF, alongside government publications detailing legislative changes and trade agreements. We also incorporate insights from industry-specific market research and environmental impact assessments.