Shriram Transport Finance Co. Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shriram Transport Finance Co. Bundle

Shriram Transport Finance Co. leverages a robust marketing mix to serve its diverse customer base. Their product strategy focuses on tailored financing solutions for commercial vehicles, addressing a critical need in the transport sector. The pricing strategy is competitive, often incorporating flexible repayment options to attract a wider range of clients.

Their extensive branch network and digital presence ensure widespread accessibility, highlighting a strong place strategy. Promotion efforts emphasize trust, reliability, and customer-centricity through various media channels. This integrated approach solidifies their market leadership.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Shriram Transport Finance Co.'s Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Shriram Transport Finance Company, now Shriram Finance Limited, positions its commercial vehicle loans as a cornerstone product, directly addressing the financing needs of the Indian transport sector. These loans facilitate the acquisition of new and pre-owned trucks, buses, tempos, and other commercial vehicles, vital for small truck owners and fleet expansion. This product is central to Shriram Finance's business, representing a substantial 45.05% of its Assets Under Management as of March 31, 2025, underscoring its market dominance and focus.

Shriram Finance’s working capital loans are a crucial part of its product offering, extending beyond vehicle financing to support the operational needs of MSMEs. These loans are designed to bridge the gap for immediate expenses, ensuring businesses can maintain smooth day-to-day operations.

The company offers competitive interest rates and tailors loan options to individual customer profiles, demonstrating a customer-centric approach. Furthermore, flexible repayment schedules and a streamlined, minimal documentation process facilitate quick approvals, a vital aspect for businesses needing rapid access to funds.

As of early 2024, Shriram Finance is actively reclassifying its personal loan portfolio, with a significant focus on segmenting these towards small business loans. This strategic shift specifically targets self-employed professionals and small business owners, aligning with regulatory directives and reinforcing their commitment to the vital MSME sector.

This focus on working capital for MSMEs is particularly relevant given the sector's significant contribution to India's economy. In FY23, MSMEs accounted for approximately 30% of India's GDP and over 45% of its exports, highlighting the critical need for accessible financial products like those offered by Shriram Finance.

Shriram Finance's Passenger Vehicle and Two-Wheeler Loans are a key part of its strategy to broaden its retail financing. These loans are designed for individual customers, aiming to make owning a car or motorcycle achievable for more people. The company is actively expanding its reach in this segment.

The product offers competitive interest rates, which is crucial for attracting price-sensitive buyers. Furthermore, flexible repayment tenures and a streamlined application process are in place to enhance customer convenience and accessibility, making it easier for individuals to secure financing.

A significant aspect of this offering is Shriram Finance's focus on semi-urban and rural markets. This strategic focus aims to tap into underserved areas, promoting vehicle ownership and economic activity where it might be less prevalent, thereby expanding their customer base significantly.

In the fiscal year ending March 31, 2024, Shriram Finance reported a net profit of ₹4,449 crore. This robust financial performance provides a strong foundation for continued expansion in retail segments like passenger vehicles and two-wheelers, supporting their growth ambitions.

Gold Loans and Personal Loans

Shriram Finance's expansion into gold loans and personal loans signifies a strategic diversification, offering customers swift access to capital for both personal and business requirements. The gold loan offering is particularly noted for its adaptability, with repayment tenures that can be as brief as one week, catering to immediate cash flow needs. This move enhances Shriram Finance's product suite, moving beyond its traditional vehicle financing focus.

The company is also re-evaluating its personal loan portfolio, with a focus on repurposing them as small business loans where appropriate. This strategic pivot underscores a commitment to fostering productive asset creation and bolstering the growth of small-scale entrepreneurs. For instance, in the fiscal year ending March 2024, Shriram Finance reported a robust Assets Under Management (AUM) of INR 2.32 lakh crore, indicating significant capacity to support a broader range of financial needs.

This product development aligns with market trends where demand for flexible and accessible credit solutions continues to rise.

- Product: Gold Loans and Personal Loans

- Key Feature (Gold Loans): Flexible repayment, short tenures (e.g., 1 week).

- Key Strategy (Personal Loans): Conversion to small business loans for productive asset creation.

- Company Context: Part of Shriram Finance's diversified product strategy, supporting its substantial AUM of INR 2.32 lakh crore (FY24).

Other Financial Solutions and Deposits

Beyond its core vehicle financing, Shriram Finance actively diversifies its product offerings to cater to a broader financial spectrum. This includes specialized financing for crucial sectors like construction and agricultural equipment, supporting economic growth and productivity. These financing solutions are designed to meet the unique needs of businesses operating in these vital industries.

A significant component of Shriram Finance's strategy involves its fixed deposit schemes. These offer competitive interest rates, making them an attractive avenue for individuals and businesses looking for secure investment opportunities. The company actively promotes these deposits as a way to bolster its own resource base while providing attractive returns to its customers.

Shriram Finance enhances its fixed deposit appeal with preferential rates, specifically offering additional interest for women and senior citizens. This targeted approach aims to attract a wider demographic and acknowledge specific customer segments. For instance, in early 2024, Shriram Finance's fixed deposit rates for various tenures were competitive, with some options exceeding 7.5% per annum for general citizens.

In a move towards digital integration, Shriram Finance is expanding into digital payment solutions. This includes developing mobile wallets, prepaid cards, and FASTag services. The objective is to improve customer engagement by offering convenient and accessible financial tools, fostering greater financial inclusivity across its customer base.

- Construction & Farm Equipment Financing: Shriram Finance provides tailored credit solutions for machinery essential to these sectors.

- Fixed Deposit Schemes: Offers attractive interest rates for individuals and businesses seeking investment growth.

- Preferential Rates: Special additional interest benefits for women and senior citizens on fixed deposits.

- Digital Payment Solutions: Expansion into mobile wallets, prepaid cards, and FASTag to boost customer engagement and financial inclusion.

Shriram Finance's product portfolio is anchored by its commercial vehicle loans, a segment that constituted 45.05% of its Assets Under Management (AUM) as of March 31, 2025. This core offering finances the acquisition of trucks and other commercial vehicles, vital for India's logistics sector. Complementing this, the company provides working capital loans, essential for MSMEs, which represent a significant portion of India's GDP.

What is included in the product

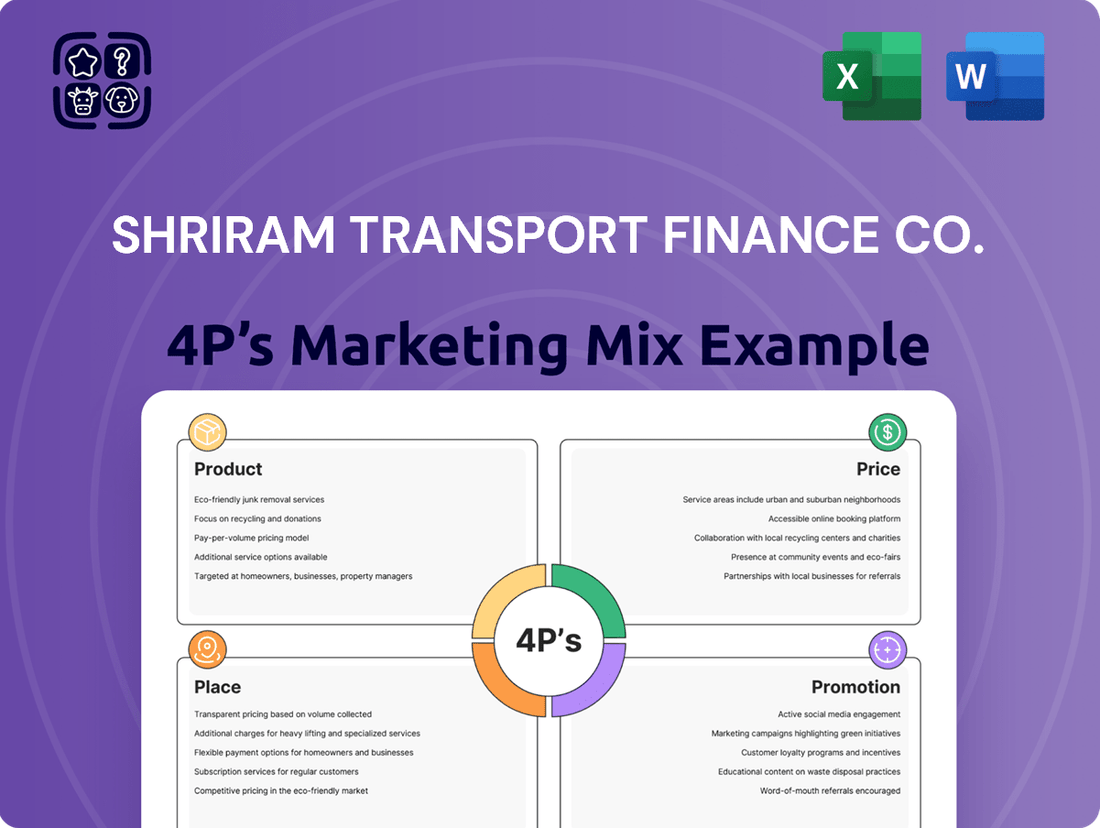

This analysis delves into Shriram Transport Finance Co.'s marketing mix, examining its tailored financial products for commercial vehicle owners, competitive pricing strategies, extensive rural and semi-urban distribution network, and targeted promotional campaigns focused on trust and accessibility.

Shriram Transport Finance's 4Ps marketing mix analysis acts as a pain point reliever by clearly outlining how their product (tailored finance solutions), price (competitive and transparent), place (widespread accessibility), and promotion (targeted outreach) address the specific financial challenges faced by commercial vehicle operators, simplifying complex financial decisions.

Place

Shriram Finance boasts an impressive physical footprint, a cornerstone of its marketing strategy. As of March 31, 2025, the company operates a substantial network comprising 3,220 branches and an additional 681 rural centers spread across India. This vast physical presence is crucial for reaching a broad spectrum of customers, especially those in underserved rural and semi-urban markets.

This extensive branch network is not just about scale; it's about accessibility and trust. The physical locations serve as vital touchpoints for direct customer engagement, enabling personalized service and fostering strong relationships. This direct interaction is key for efficient loan origination and processing, making financial services more convenient for a diverse clientele.

Shriram Transport Finance Company (now Shriram Finance) has embraced digital platforms and mobile applications to bolster its customer reach and service delivery. The Shriram One Super App is a prime example, acting as a central hub for a comprehensive suite of financial services. This includes seamless loan application processes, convenient repayment options, investment management, insurance services, and utility bill payments, all designed to maximize customer convenience.

This digital push is more than just an app; it’s a strategic move to enhance accessibility and customer engagement. By offering these services through a digital interface, Shriram Finance is catering to the evolving preferences of its diverse customer base, many of whom rely on mobile technology for their daily financial needs. The platform also serves as a vital channel for disseminating valuable financial content and fostering stronger customer relationships.

Shriram Transport Finance Company (STFC) leverages a robust direct sales force alongside an extensive network of deposit and insurance agents to connect with its customer base. This dual strategy is vital for distributing its diverse financial offerings, particularly to small business owners and individual borrowers who often require personalized service.

The direct sales teams enable STFC to offer tailored financial solutions, fostering deeper client relationships and providing immediate support. This hands-on approach is instrumental in understanding the unique requirements of its target market.

As of the fiscal year 2024, STFC's agent network plays a significant role, with thousands of agents actively promoting its products. This widespread presence ensures broad market penetration, especially in semi-urban and rural areas where traditional banking channels may be less accessible.

This distribution model is critical for STFC's success, allowing it to gather valuable market insights directly from customers and adapt its product strategies accordingly. The company reported a significant increase in its Assets Under Management (AUM) in FY24, partly attributed to the effectiveness of these sales channels in reaching a wider audience.

Partnerships and Collaborations

Shriram Finance actively pursues strategic partnerships to broaden its market presence and deliver comprehensive financial solutions. A notable collaboration is its joint venture with TrucksUp, designed to offer tailored financial products to transporters, fleet owners, and logistics firms, notably reaching into Tier 2 and Tier 3 cities.

These alliances are crucial for Shriram Finance, as they not only expand its service network but also foster financial inclusion within specific industry segments. By integrating its offerings with partners like TrucksUp, Shriram Finance strengthens its position in the commercial vehicle financing sector.

- Expanded Reach: Partnerships allow Shriram Finance to access new customer bases, particularly in underserved Tier 2 and Tier 3 markets.

- Integrated Solutions: Collaborations enable the co-creation of financial products that directly address the needs of specific industries, such as logistics.

- Ecosystem Support: By partnering with companies like TrucksUp, Shriram Finance contributes to the overall ecosystem of the transport and logistics sector.

- Enhanced Access: These ventures improve access to credit and financial services for small and medium-sized enterprises within the logistics industry.

Focus on Rural and Underserved Markets

Shriram Finance's place strategy deeply emphasizes reaching rural and underserved markets, a cornerstone of its financial inclusion mission. A substantial part of its customer base operates outside major urban centers, making its widespread distribution network crucial.

The company's approach ensures that essential financial services are accessible even in regions with limited traditional banking infrastructure. This focus not only fulfills a social responsibility but also significantly expands Shriram Finance's market reach.

As of March 31, 2024, Shriram Finance reported a robust network of 2,923 branches, a testament to its commitment to physical accessibility across India.

- Extensive Branch Network: 2,923 branches as of March 31, 2024, catering to rural and semi-urban areas.

- Targeted Customer Segments: Focus on low-to-middle-income individuals and small businesses often excluded by traditional banks.

- Financial Inclusion Driver: Providing access to credit and financial products in underserved geographies.

- Market Share Expansion: Leveraging its widespread presence to capture a significant share in non-urban markets.

Shriram Finance’s place strategy is built on an extensive physical network and a strong digital presence, ensuring accessibility across India. The company operates over 3,200 branches and hundreds of rural centers, providing a crucial touchpoint for direct customer engagement and building trust, especially in semi-urban and rural markets. This broad physical footprint is complemented by the Shriram One Super App, which centralizes financial services for enhanced customer convenience and engagement.

The company also utilizes a direct sales force and a vast network of agents, numbering in the thousands as of FY24, to distribute its products and gather market insights. Strategic partnerships, like the one with TrucksUp, further extend its reach into Tier 2 and Tier 3 cities, integrating financial solutions within specific industry ecosystems. This multi-pronged approach significantly bolsters Shriram Finance's market penetration and its role as a driver of financial inclusion.

| Channel | Key Feature | Reach/Impact |

|---|---|---|

| Physical Branches | Direct customer interaction, trust building | 3,220 branches, 681 rural centers (as of March 31, 2025) |

| Digital Platforms | Centralized services, convenience | Shriram One Super App for loans, investments, insurance |

| Sales Force & Agents | Personalized service, market penetration | Thousands of agents active (FY24), direct sales teams |

| Strategic Partnerships | Industry-specific solutions, expanded reach | Joint venture with TrucksUp for logistics sector |

Full Version Awaits

Shriram Transport Finance Co. 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Shriram Transport Finance Co.'s 4P's Marketing Mix. You'll find detailed insights into their Product strategies, pricing approaches, extensive Place distribution networks, and effective Promotion campaigns. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with a complete understanding of their marketing efforts.

Promotion

Shriram Transport Finance Co. (now Shriram Finance) utilizes integrated advertising campaigns that span a full 360-degree approach. This means they are present across numerous touchpoints, from traditional television and print to dynamic digital platforms, social media, and even outdoor advertising and select cinemas.

Recent initiatives, such as the '#TogetherWeSoar' campaign featuring brand ambassador Rahul Dravid and prominent voiceovers, underscore a strategic effort to forge emotional bonds with customers. The messaging consistently highlights Shriram Finance's dedication to fostering partnerships and empowering individuals and businesses.

To ensure broad reach and deep penetration across India's diverse linguistic landscape, these campaigns are strategically crafted in multiple languages. This multilingual approach is crucial for connecting with a wider customer base and reinforcing brand relevance in various regional markets.

Shriram Transport Finance Co. leverages prominent figures like Rahul Dravid as a cornerstone of its promotional strategy. This choice taps into Dravid's widely recognized attributes of teamwork, resilience, and trustworthiness, values that resonate deeply with Shriram Finance's commitment to empowering individuals on their financial journeys. In 2023-24, Shriram Finance reported a total income of ₹23,788 crore, underscoring the scale of its operations and the importance of effective promotion.

Shriram Finance champions digital content marketing to build a strong online identity and authority, directly engaging its customer base. This strategy involves developing rich content for its digital platforms, including its website and mobile app. For instance, in Q4 FY24, Shriram Finance reported a significant increase in digital customer interactions, highlighting the effectiveness of these channels.

The company leverages various digital touchpoints for customer engagement, such as Forum Q&A and SMS services, to promptly address customer inquiries and provide solutions. This proactive approach ensures a seamless customer experience. Their social media presence is also a key component, driving brand awareness and facilitating direct interaction, which is crucial for fostering loyalty in the digital age.

By consistently delivering valuable information and fostering two-way communication, Shriram Finance aims to cultivate deep brand loyalty. This digital-first approach not only enhances customer relationships but also solidifies its position as a trusted financial partner. The emphasis remains on creating a connected and informative digital ecosystem.

Sales s and Customer-Centric Initiatives

Shriram Transport Finance Co. (STFC) actively employs sales promotions and customer-centric initiatives to build lasting relationships. They focus on tailoring loan options and flexible repayment schedules to suit individual borrower needs, often facilitating quick disbursals to address urgent financial requirements.

Simplifying the application and approval processes is a core strategy, making financial solutions more accessible and convenient. This customer-first approach serves as a powerful, organic promotional driver.

- Customized Loan Products: Offering specific financing solutions for commercial vehicles, catering to diverse customer segments.

- Flexible Repayment Schemes: Providing options that align with the cash flow patterns of truck owners and operators.

- Digital Integration: Streamlining loan applications and customer service through digital platforms, enhancing convenience and speed.

- Customer Support: Maintaining a robust network for ongoing support and query resolution, fostering trust and loyalty.

Public Relations and Community Engagement

Shriram Finance actively cultivates a positive public image and fosters strong community relationships through its public relations and community engagement initiatives. The company's commitment extends beyond financial services, encompassing meaningful contributions to social welfare and sustainable practices.

Demonstrating its dedication to corporate social responsibility, Shriram Finance invests in programs that uplift communities, particularly in the areas of education and healthcare. These initiatives are designed to create lasting positive impacts, aligning with the company's broader objective of being a responsible corporate citizen.

A key aspect of their forward-thinking approach is the promotion of sustainable lending, notably through financing electric vehicles. This focus on eco-friendly solutions not only addresses environmental concerns but also reinforces Shriram Finance's commitment to future-oriented growth and responsible financial inclusion. For instance, in FY23, Shriram Finance reported a Net Profit After Tax of ₹4,576 crore, showcasing strong financial performance that enables continued investment in these crucial areas.

- CSR Focus: Shriram Finance prioritizes community welfare through education and healthcare programs.

- Sustainable Lending: The company champions financing for electric vehicles, promoting environmental responsibility.

- Brand Building: These engagements enhance brand reputation and foster trust within the communities served.

- Financial Strength: A Net Profit After Tax of ₹4,576 crore in FY23 supports these vital initiatives.

Shriram Finance employs a multi-faceted promotional strategy, leveraging both traditional and digital channels to connect with its diverse customer base. Their campaigns, often featuring relatable messaging and brand ambassadors like Rahul Dravid, focus on building emotional connections and highlighting their role in empowering individuals and businesses.

Digital content marketing is a key pillar, with the company actively engaging customers through its website, mobile app, and social media platforms. This approach emphasizes providing valuable information and fostering two-way communication to build loyalty.

The company also utilizes sales promotions, simplified processes, and tailored loan products as organic promotional drivers, aiming to make financial solutions accessible and convenient. Their commitment to corporate social responsibility and sustainable lending, such as financing electric vehicles, further enhances brand image and community trust.

| Promotional Aspect | Key Initiatives/Tactics | Impact/Benefit |

|---|---|---|

| Integrated Advertising | 360-degree campaigns (TV, print, digital, social media) | Broad reach and consistent brand messaging |

| Brand Endorsements | Rahul Dravid campaign '#TogetherWeSoar' | Builds emotional connection and trust, leveraging relatable values |

| Digital Engagement | Content marketing, Q&A, SMS, social media | Enhances online presence, customer interaction, and loyalty |

| Sales Promotions & Customer Service | Tailored loans, flexible repayment, simplified processes | Drives organic promotion through customer convenience and satisfaction |

| CSR & Sustainability | Community programs, EV financing | Improves brand reputation and fosters community trust |

Price

Shriram Finance is known for offering competitive interest rates across its diverse loan portfolio. This includes offerings for commercial vehicle financing, working capital needs, and personal loans, making them accessible to a broad customer base. The company's strategy focuses on providing attractive rates to stay competitive in the financial services market.

For example, their commercial vehicle loans can have interest rates starting as low as 10% per annum. These rates are dynamic, adjusting based on individual borrower profiles, the loan amount sought, and the chosen repayment period, ensuring a tailored financial solution.

Shriram Transport Finance Co. (STFC) understands that one size doesn't fit all when it comes to repaying loans. They offer a variety of repayment schedules, with equated monthly installments (EMIs) being a popular choice. This caters to the regular income patterns of many of their clients.

The company also provides a wide range of loan tenures, allowing customers to pick a period that best aligns with their financial situation and cash flow. For commercial vehicle financing, a key segment for STFC, loan terms can extend up to 5 years. This extended period helps manage the upfront cost of vehicles for small truck owners.

Beyond vehicle loans, STFC's business loans offer even more flexibility, with tenures ranging from a short 12 months up to a substantial 84 months. This broad spectrum is particularly beneficial for Micro, Small, and Medium Enterprises (MSMEs) and individual entrepreneurs who often face irregular income streams and need repayment plans that can adapt to their business cycles.

This adaptability in repayment options and loan tenures is a significant aspect of STFC's marketing strategy, directly addressing the needs of its core customer base. For instance, in the fiscal year 2023-24, STFC continued to support the commercial vehicle financing sector, a market that remains vital for India's logistics and infrastructure growth, with tailored financial solutions.

Shriram Transport Finance Company, now Shriram Finance, skillfully utilizes a risk-based pricing strategy for its loans. This means the interest rate offered isn't a one-size-fits-all figure. Instead, it's tailored to the individual borrower's risk profile.

Factors like a borrower's age, income stability, employment history, and crucially, their credit score, all play a part in determining the interest rate. Even the type of collateral offered and the borrower's past repayment behavior are assessed to gauge creditworthiness.

This nuanced approach allows Shriram Finance to manage its credit risk effectively. By accurately pricing loans based on risk, the company can maintain sustainable lending practices. This also enables them to serve a diverse customer base, including individuals who might have less-than-perfect credit histories.

For instance, as of early 2024, Shriram Finance's loan portfolio reflects this strategy, with interest rates on similar vehicle loans potentially differing by several percentage points between borrowers with strong versus moderate credit profiles. This ensures fair pricing while safeguarding the company's financial health.

Transparent Fees and Charges

Shriram Transport Finance Co. prioritizes transparency in its fee structure, clearly outlining processing fees, prepayment charges, and late payment penalties. This commitment ensures borrowers understand all associated costs upfront, with details provided in the sanction letter and loan agreement. For instance, as of mid-2024, their typical processing fees range from 1% to 2% of the loan amount, and prepayment charges are generally around 2% of the outstanding principal for loans closed before maturity, adhering to their stated interest rate policy.

The company's approach to fees is designed to build trust and avoid unexpected expenses for its customers. They believe in explicit communication regarding all charges, including penalties for bounced cheques. This clarity is a cornerstone of their customer service, fostering a straightforward lending experience.

Key fee components and their typical structure include:

- Processing Fees: Generally between 1% and 2% of the loan principal, applied at the time of loan disbursement.

- Prepayment Charges: Typically around 2% of the outstanding principal amount for early loan closure.

- Late Payment Charges: A percentage of the overdue installment amount, applied if EMI is not paid by the due date.

- Cheque Bounce Penalties: A fixed fee or a percentage of the cheque amount is charged in case of insufficient funds.

Value-Added Services and Financial Inclusion

Shriram Finance’s pricing strategy extends beyond mere interest rates, integrating value-added services that boost financial inclusion. The company’s commitment to offering loans for both new and used vehicles, coupled with a streamlined approval process featuring minimal documentation, directly enhances customer value. This focus is particularly impactful in reaching underserved rural and semi-urban markets, thereby broadening economic participation.

By strategically targeting these segments and simplifying access to credit, Shriram Finance not only differentiates itself but also strengthens its overall value proposition. This approach aligns with their broader mission of empowering individuals and fostering economic development, making financial services more accessible.

- Expanded Vehicle Financing: Offers loans for both new and used commercial vehicles, catering to a wider customer base.

- Simplified Documentation: Prioritizes quick loan approvals with minimal paperwork, reducing barriers to access.

- Rural and Semi-Urban Focus: Actively serves underserved segments in tier-2 and tier-3 cities, promoting financial inclusion.

- Economic Empowerment: Aims to empower customers and drive economic growth through accessible financing solutions.

Shriram Finance's pricing strategy is competitive and risk-adjusted, with interest rates for commercial vehicle loans starting around 10% per annum as of early 2024. This rate varies based on the borrower's profile, loan amount, and tenure, ensuring tailored solutions.

The company also transparently outlines its fee structure, typically including processing fees of 1-2% of the loan amount and prepayment charges of around 2% of the outstanding principal. These fees are clearly communicated upfront to foster trust and avoid unexpected customer expenses.

Shriram Finance enhances its value proposition by offering financing for both new and used vehicles, coupled with a simplified, minimal documentation process. This focus on accessibility, particularly in rural and semi-urban areas, strengthens its market position and promotes financial inclusion.

| Loan Type | Typical Interest Rate (Early 2024) | Processing Fee Range | Prepayment Charge |

|---|---|---|---|

| Commercial Vehicle Loans | Starting from 10% p.a. | 1-2% of Loan Amount | ~2% of Outstanding Principal |

| Business Loans (MSME) | Variable (Risk-Based) | 1-2% of Loan Amount | ~2% of Outstanding Principal |

4P's Marketing Mix Analysis Data Sources

Our Shriram Transport Finance Co. 4P's analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also incorporate insights from industry publications, news articles, and competitor benchmarking to provide a well-rounded perspective.